The people wanted a covered calls / option selling mega-thread, a one-click response to all the charlatans out there trying to farm retail investors.

Systematically, blindly selling options is a BAD IDEA. Underperforms owning equities by a lot. Let's go through why and how.

Systematically, blindly selling options is a BAD IDEA. Underperforms owning equities by a lot. Let's go through why and how.

Okay. The starting point here is flows. Before 2010 or so, options markets were sort of a backwater. Risk premium was relatively high, so if you backtested simple option selling strategies like covered calls or cash-secured puts, they looked pretty good (see PUT INDEX, BXM INDEX)

Then pension fund consultants started to write white papers and pitch "equity like returns with lower risk via option selling" to their massive clients. And by 2012, tens of billions of dollars of institutional money started to flow into benchmark-oriented option selling...

... run by managers like Neuberger Berman, Parametric and the like. Meanwhile, retail investors started to catch the bug as well, with the rise of TastyTrade for do-it-yourselfers and various asset management industry products sold to private wealth managers.

Remember that derivatives markets are relatively small, they're not whole asset classes that you're supposed to be able to invest tens or hundreds of billions of dollars in without moving prices around. So this moved prices!

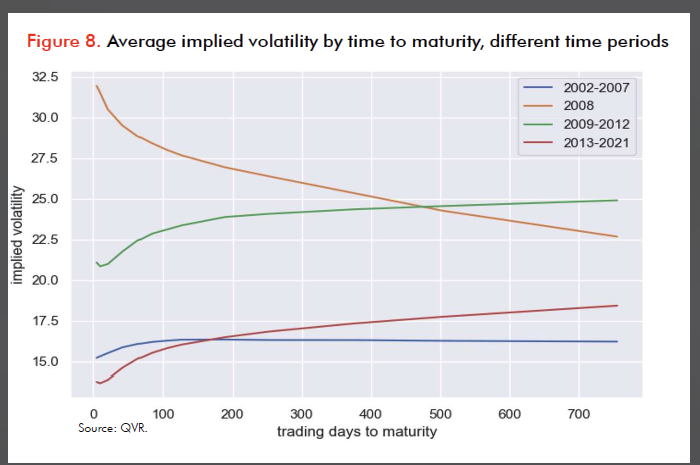

The typical S&P volatility term structure went from mildly upward sloping and elevated, to highly depressed in front and extremely steeply upward sloping, as by the late-2010's there were only sellers of benchmark 1-month relatively near the money options

And after 2012, there was a structural change in the relative performance of option selling versus just owning equities -- the latter strongly dominated the former in both absolute and risk adjusted terms

https://x.com/bennpeifert/status/1882684157345857742

Here's a cute little table with pre- and post-2012. Think of it like the in sample and out of sample period for the backtest

https://x.com/bennpeifert/status/1887758068882219149

So how does this work mechanically? Covered calls -- even though people love to describe them to you in terms of entry points, getting paid to sell a stock at a price you want to anyway -- are just a short volatility, short delta trade

https://x.com/bennpeifert/status/1393931064180043778

If you own a stock, and you're considering selling a call against it: selling that call is just a trade. You're going to lose money on that trade if the stock goes up enough. And if the stock is volatile -- goes up a lot and then down a lot -- you're going to get hosed

Because when it goes down a lot, you just collect a small premium, but when it goes up a lot, you get your face ripped off. This is the precise nature of a short volatility trade.

The charlatans will tell you about their "income" in terms of either the premium sold or the theta collected, but that's only half of the story -- what about all the LOSSES on options you've sold!

https://x.com/bennpeifert/status/1572019785797603328

"Oh but I only sell the 10 delta calls so I barely ever get assigned" -- yeah, and you get way less premium to do it, markets aren't stupid, why on earth do you think they are?

"But I own the underlying!", you say -- we're comparing owning the underlying to running a CC strategy, the difference between those two things is just selling a call, and this is exactly how it works. It's just a trade with short delta and a negatively asymmetric return profile

"Well what about in a sideways, choppy market?", you say. Work through this example please.

https://x.com/bennpeifert/status/1403729788255145987

"Well, but isn't it like hedging, don't covered calls and cash-secured puts work better in a declining market?" Read this please.

https://x.com/bennpeifert/status/1252045566793547777

Safe, unleveraged, risk-contained option selling in iron condor format has been flat for 15 years (the out of sample period)

The final cope you hear a lot from charlatans is that all of this systematic evidence is irrelevant because they don't trade systematically, they pick their names and they pick their entry points and vol levels and actually their returns are spectacular. Look, it's a nice idea!

If this was true, surely there would be hedge fund or mutual fund managers with great track records tactically selling options, right? Why would the smartest people in the world not do this and get paid huge incentive fees for it? There are literally zero audited track records

Nothing here says don't sell options, can't sell options (either RV or outright). But don't blindly sell the same options that everyone else is selling, because YouTube and Instagram influencers are telling you to and pasting MS Paint screenshots of fake PNL

There are tons of YieldMax ETFs doing covered calls on singlenames now. Look at every single one of them and compare it to owning the underlying. You're just losing money.

https://x.com/bennpeifert/status/1883143589213188430

Why do retail option influencoooors want you to sell options? Because they want you to buy a course for $99 a month, or want you to subscribe to their YouTube channel, so that they don't have to get a real job (because they sure as hell aren't paying their rent selling options)

Why does TastyTrade want you to sell options? Because they're a brokerage. They get paid on commissions and payment for order flow. They get paid when you TRADE, not when you make money. That's why they want you to do four-legged option trades that you roll every two weeks

And if you sell them instead of buy them, you're likely to grind along for a few years making a small amount of money and stick with it, until you get wiped out

Versus if they tell you to buy them you'll more likely burn out faster - it's hard and nuanced to manage risk

Versus if they tell you to buy them you'll more likely burn out faster - it's hard and nuanced to manage risk

all right if you appreciate this then help me get cool jobs for my friends please

https://x.com/bennpeifert/status/1954545903064228251

oh another one "we just sell vol when vol spikes" or "we just sell vol on high vol names"

https://x.com/bennpeifert/status/1878956686167417104

Finally, why is Benn out here telling you this?

Derivatives hedge funds make money by taking the other side of dislocations in derivatives markets. More people herding into the same dumb trades is good for us.

I don't care. I don't want people falling for scams.

Derivatives hedge funds make money by taking the other side of dislocations in derivatives markets. More people herding into the same dumb trades is good for us.

I don't care. I don't want people falling for scams.

If you're still wondering why you can't also make 40% a year with little risk selling options

noahpinion.blog/p/on-bullshit-…

noahpinion.blog/p/on-bullshit-…

@RedactedAeon optically sounds great ("oh wow, income of 20% a year") or whatever -- most of it just paid out of initial capital, for optics

• • •

Missing some Tweet in this thread? You can try to

force a refresh