Tokenomics update!

$PTB is the utility token of Portal to Bitcoin, powering our network of validators, litenodes, and liquidity providers while driving sustainable cross-chain swaps.

And we have significantly increased the Community incentives along with some other!

Now, let’s explore the updates👇

$PTB is the utility token of Portal to Bitcoin, powering our network of validators, litenodes, and liquidity providers while driving sustainable cross-chain swaps.

And we have significantly increased the Community incentives along with some other!

Now, let’s explore the updates👇

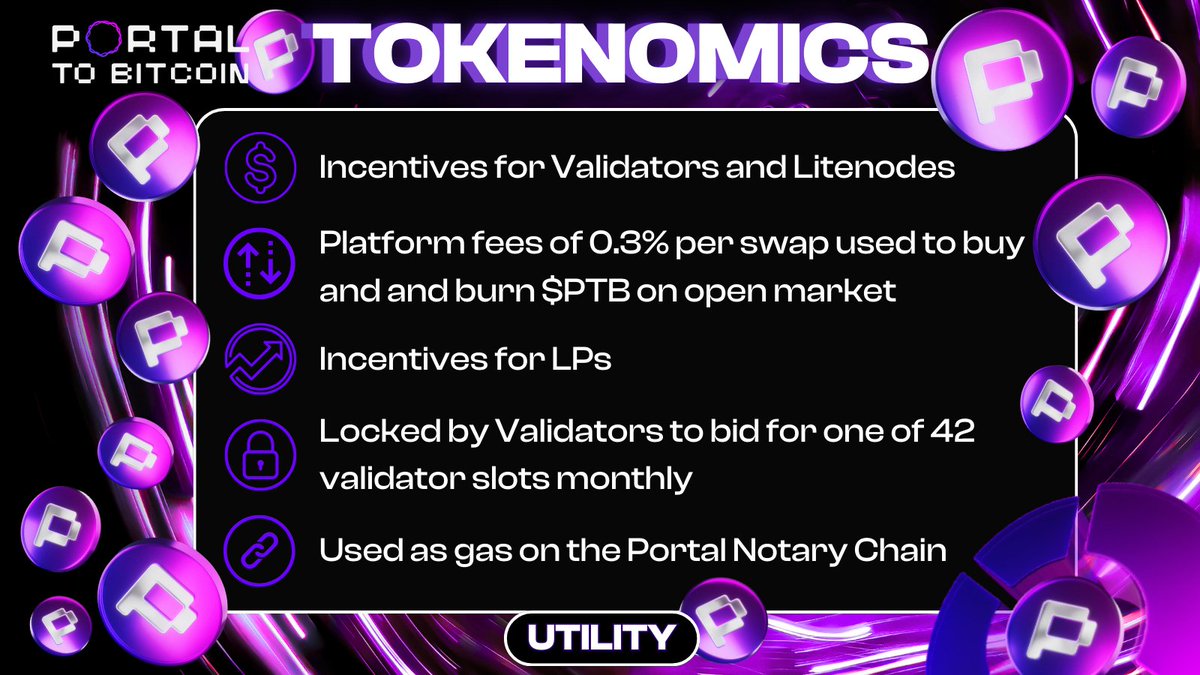

Firstly lets do a quick refersh on the demand drivers, rewards and utility of $PTB!

Our incentives, rewards and emissions for LPs, Validators and Litenodes remain the same.

Demand Drivers

Portal’s model balances emissions with built-in demand:

- Validator bidding wars keep $PTB in active use monthly

- Buyback & Burn: 100% of swap fees are used to purchase $PTB on the open market and burn it.

- $PTB used as gas on the Portal Notary Chain

The goal: burn more than we emit as network usage grows.

1/9

Our incentives, rewards and emissions for LPs, Validators and Litenodes remain the same.

Demand Drivers

Portal’s model balances emissions with built-in demand:

- Validator bidding wars keep $PTB in active use monthly

- Buyback & Burn: 100% of swap fees are used to purchase $PTB on the open market and burn it.

- $PTB used as gas on the Portal Notary Chain

The goal: burn more than we emit as network usage grows.

1/9

Now lets cover the updates!

Airdrop is now part of the Community tranche and will be done at original vesting with 33% of the airdrop at TGE.

This does not mean the entire community tranche will be an airdrop.

But we can say the final airdrop amount will be a pleasant surprise!

2/9

Airdrop is now part of the Community tranche and will be done at original vesting with 33% of the airdrop at TGE.

This does not mean the entire community tranche will be an airdrop.

But we can say the final airdrop amount will be a pleasant surprise!

2/9

The idea of increasing this will allow us to provide a number of incentives for the community to fuel our growth post launch.

Trading competitions like you have never seen before! Refferal programs, rewards for high volume users and a community LP program are ideas we are exploring for our post launch phase!

3/9

Trading competitions like you have never seen before! Refferal programs, rewards for high volume users and a community LP program are ideas we are exploring for our post launch phase!

3/9

These tokens as well as the Ecosystem Development tranche are technically unlocked but will only be sold as top tier opportunites present themselves that can help us to accelerate the growth of Portal and $PTB

They are to be distibuted over a 10 year period.

In terms of the difference between Ecosystem and Community tranches you can think of it like this.....

4/9

They are to be distibuted over a 10 year period.

In terms of the difference between Ecosystem and Community tranches you can think of it like this.....

4/9

Community tokens are of a more growth focus with regards to incentivising those who can support growing traction and usage.

Ecosystem Development is to incentivising building on Bitscaler as a whole so think of things like developers adding things like perps, tokenised stocks and other RWAs as examples.

And we now have over 21% of our supply as a war chest we can use to drive Portal forward!

5/9

Ecosystem Development is to incentivising building on Bitscaler as a whole so think of things like developers adding things like perps, tokenised stocks and other RWAs as examples.

And we now have over 21% of our supply as a war chest we can use to drive Portal forward!

5/9

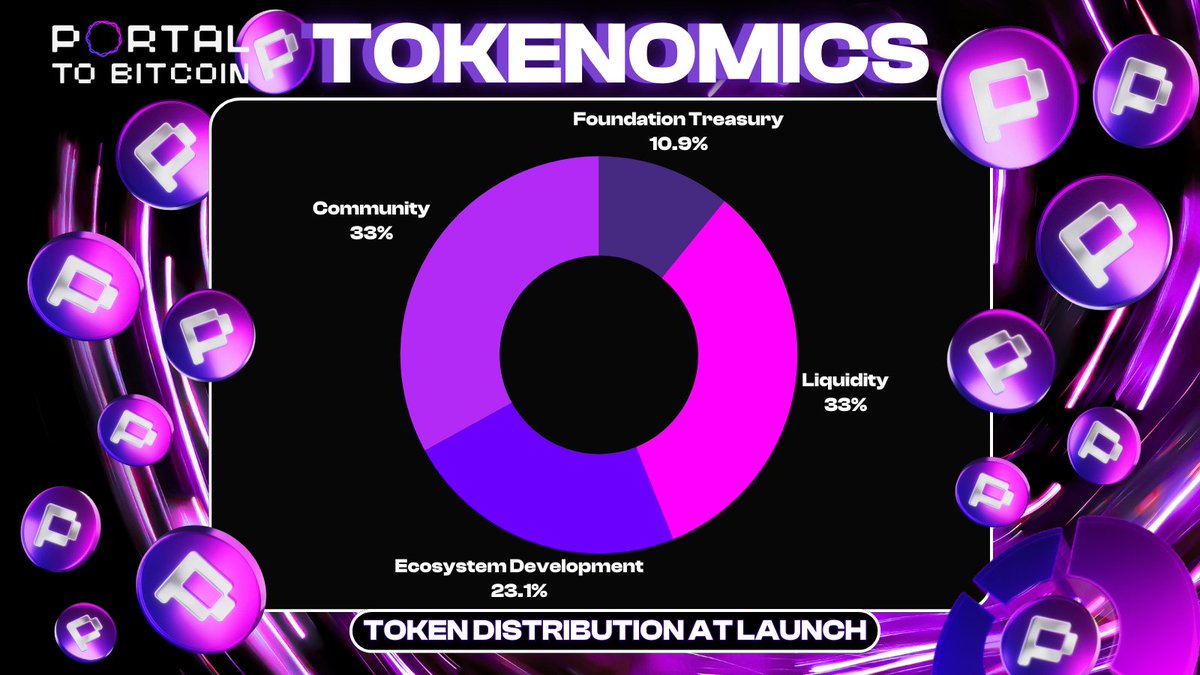

📊 Token Distribution of circulating supply at TGE

- Community: 33%

- Liquidity: 33%

- Ecosystem Development: 23.1%

- Foundation Treasury: 10.9%

This ensures immediate market liquidity and strong community alignment from day one.

It is important to highlight that we will always be transparent with our community and holders when it comes to how we deploy the Ecosystem and Community tranches.

No nasty surprises.

6/9

- Community: 33%

- Liquidity: 33%

- Ecosystem Development: 23.1%

- Foundation Treasury: 10.9%

This ensures immediate market liquidity and strong community alignment from day one.

It is important to highlight that we will always be transparent with our community and holders when it comes to how we deploy the Ecosystem and Community tranches.

No nasty surprises.

6/9

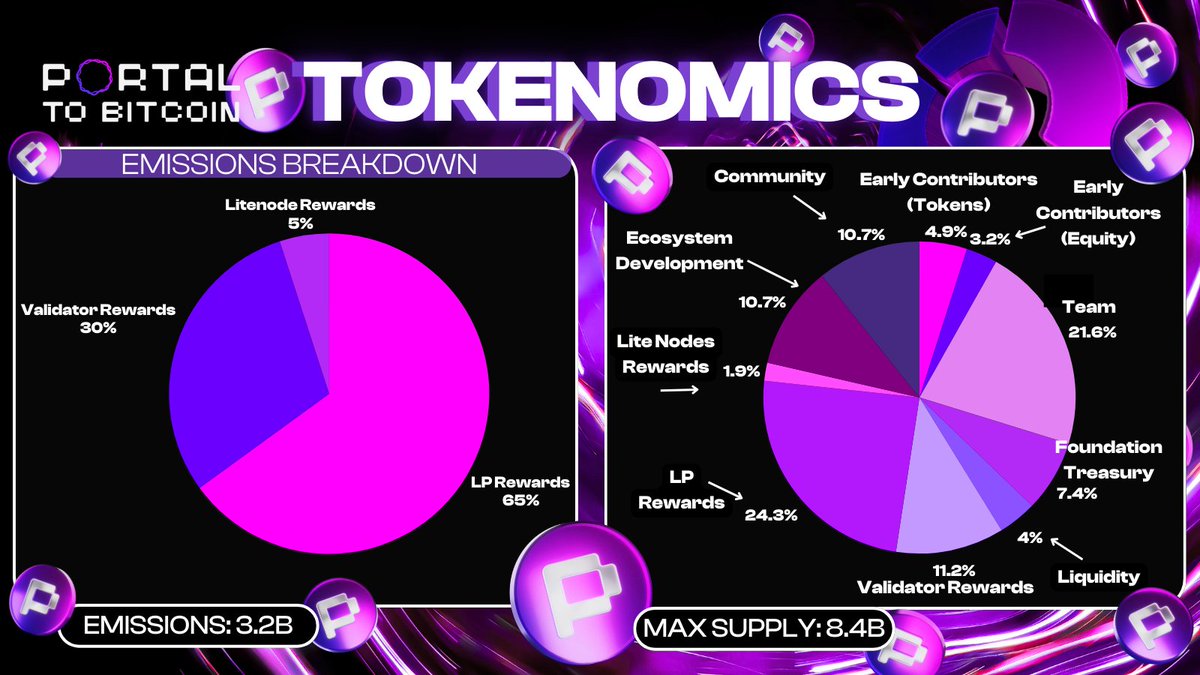

Overall Token Distribution

On the left we have the emissions separately and on the right the entire breakdown with all tranches included.

7/9

On the left we have the emissions separately and on the right the entire breakdown with all tranches included.

7/9

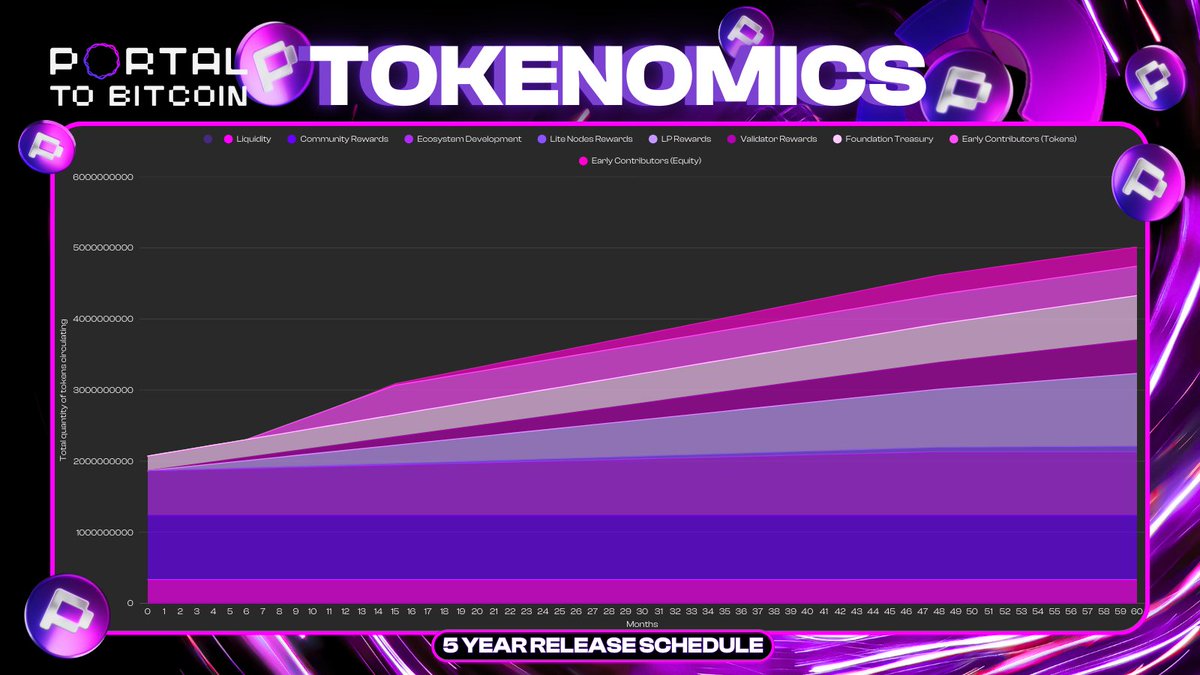

Release Schedule

This is the emissions schedule for the first 5 years.

As you can seen its been designed in a way to ensure no sudden supply shocks that can be detimental to any project.

8/9

This is the emissions schedule for the first 5 years.

As you can seen its been designed in a way to ensure no sudden supply shocks that can be detimental to any project.

8/9

Portal’s tokenomics are designed for long-term sustainability — rewarding contributors, fueling liquidity, and creating deflationary pressure as usage scales.

By aligning incentives across all stakeholders, $PTB underpins a truly decentralized cross-chain swap network.

We will be exploring the updates in more detail in an article coming soon!

9/9

By aligning incentives across all stakeholders, $PTB underpins a truly decentralized cross-chain swap network.

We will be exploring the updates in more detail in an article coming soon!

9/9

• • •

Missing some Tweet in this thread? You can try to

force a refresh