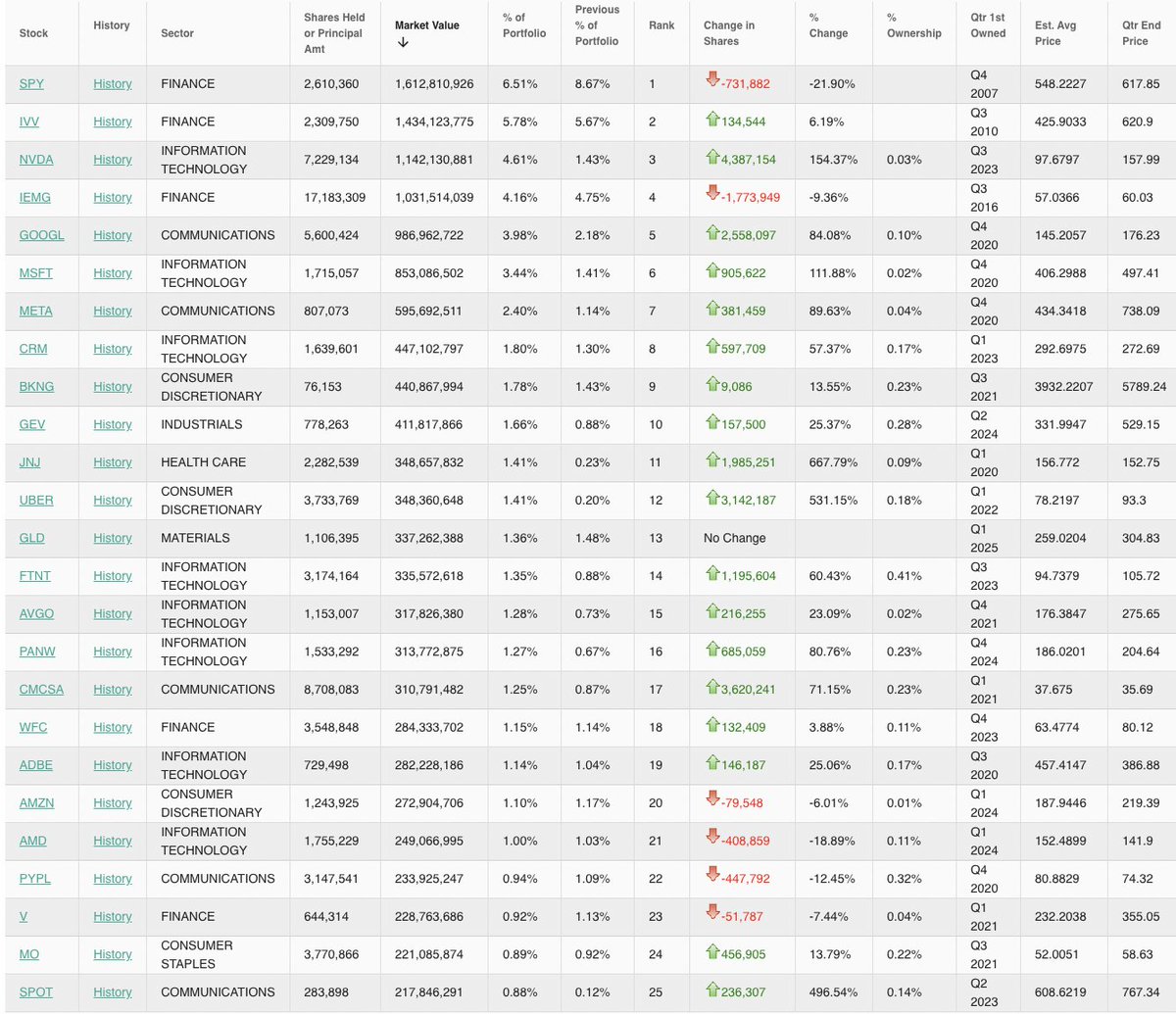

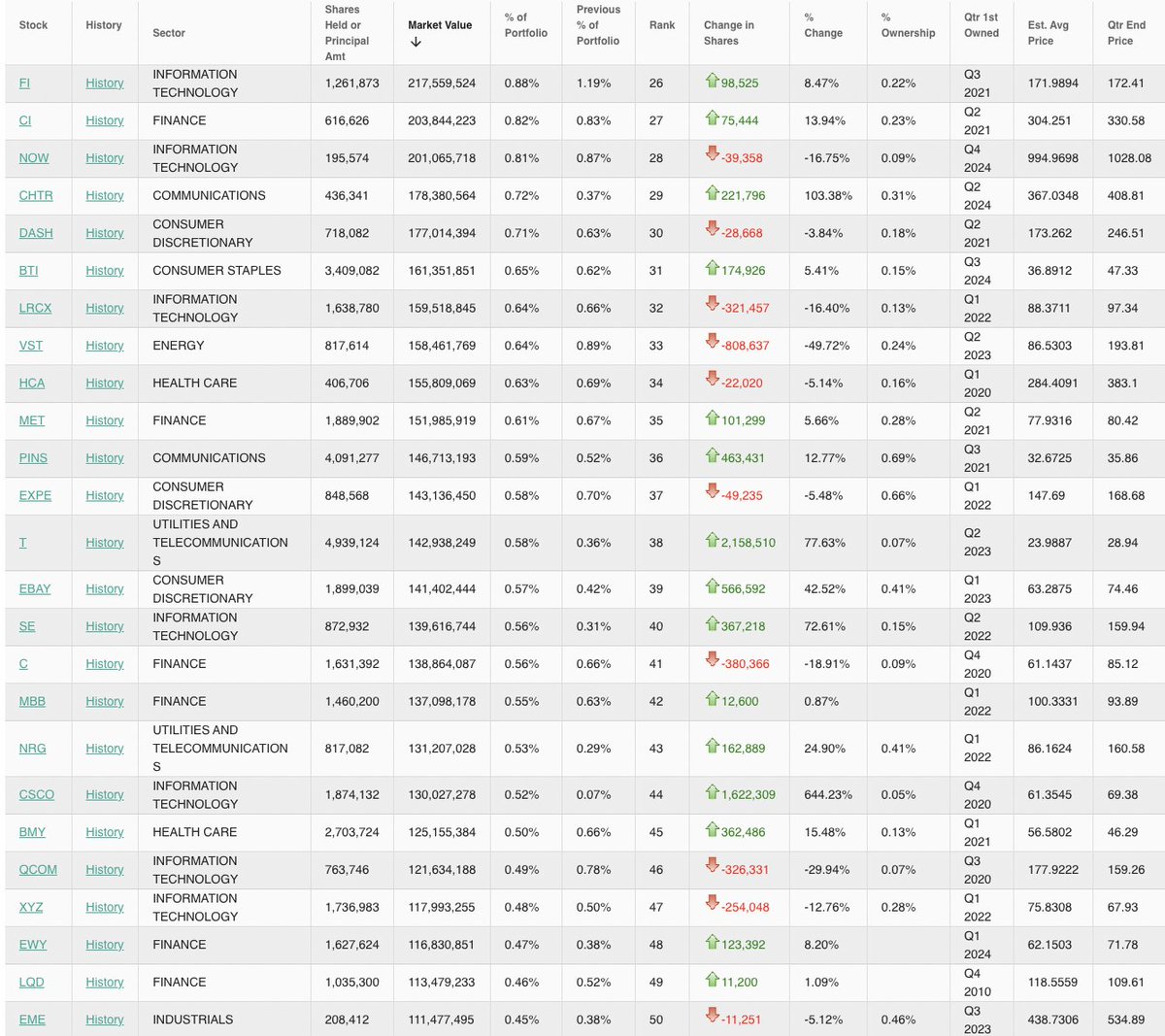

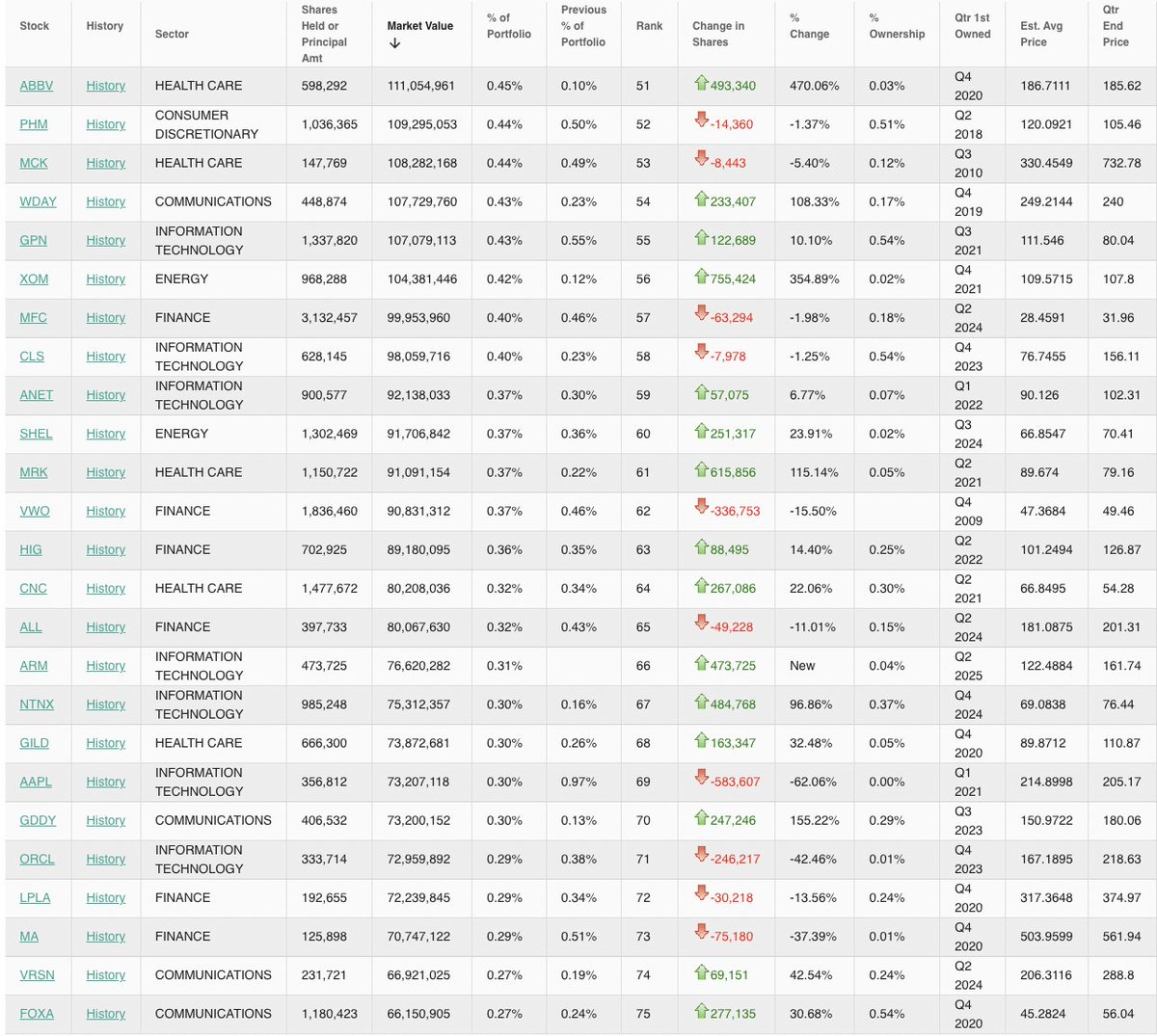

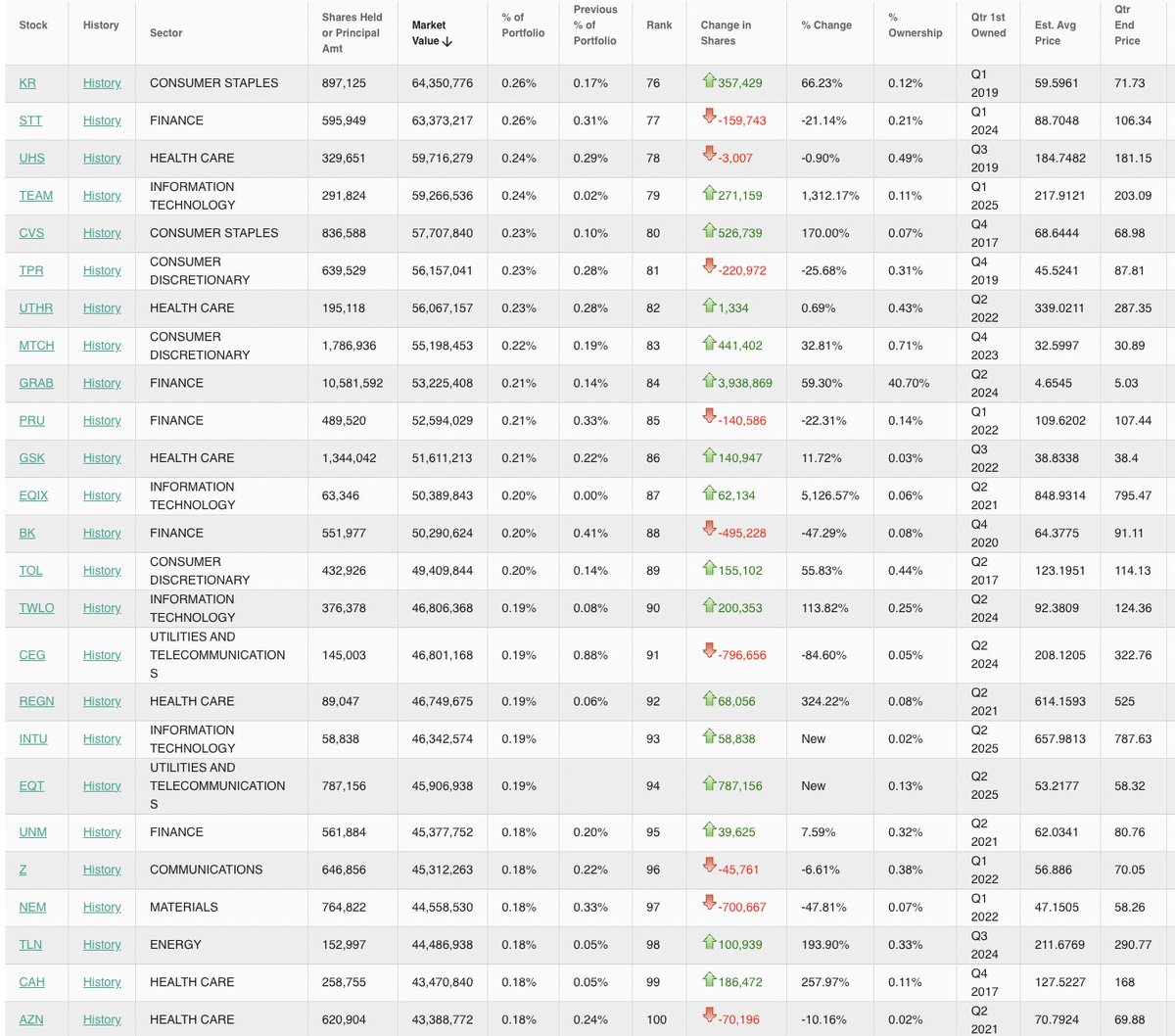

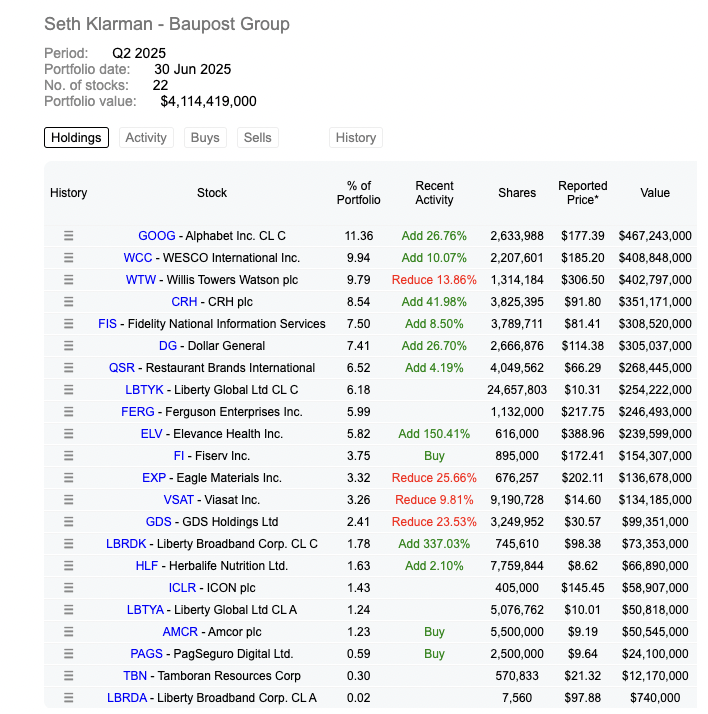

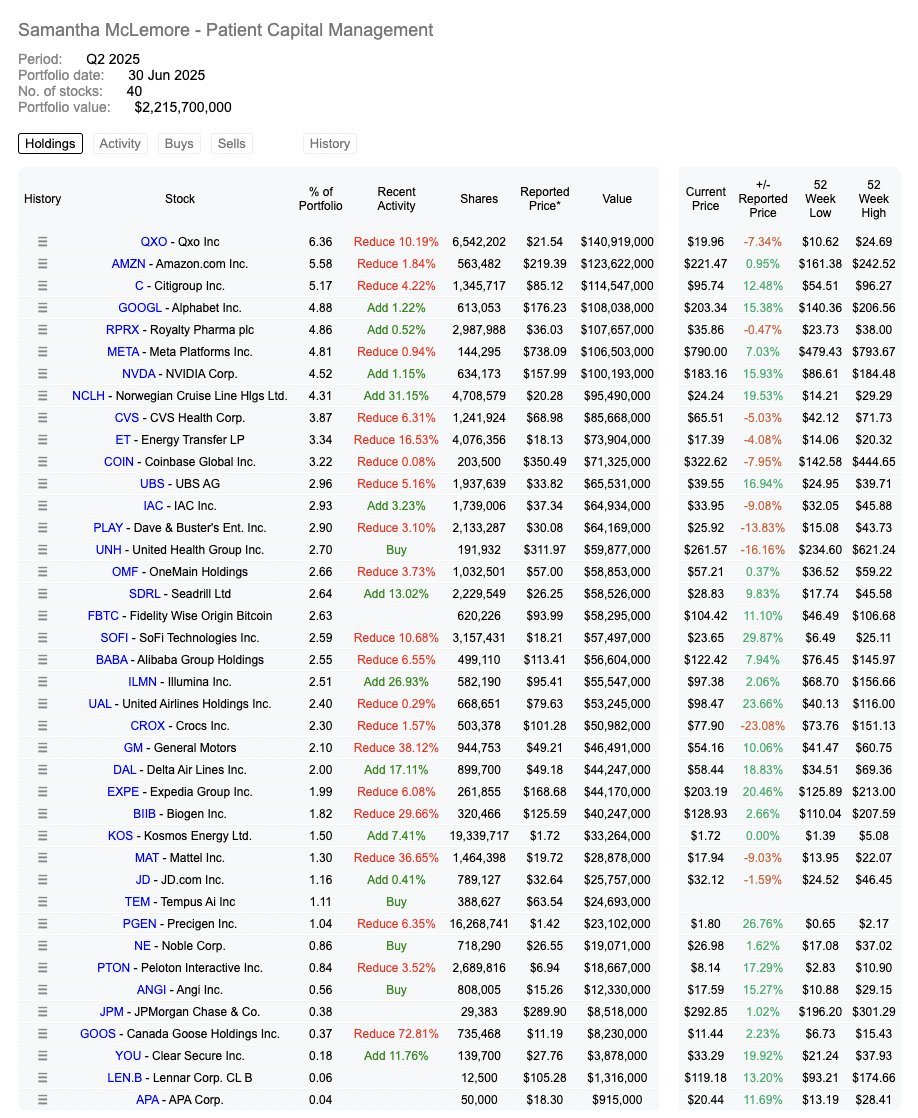

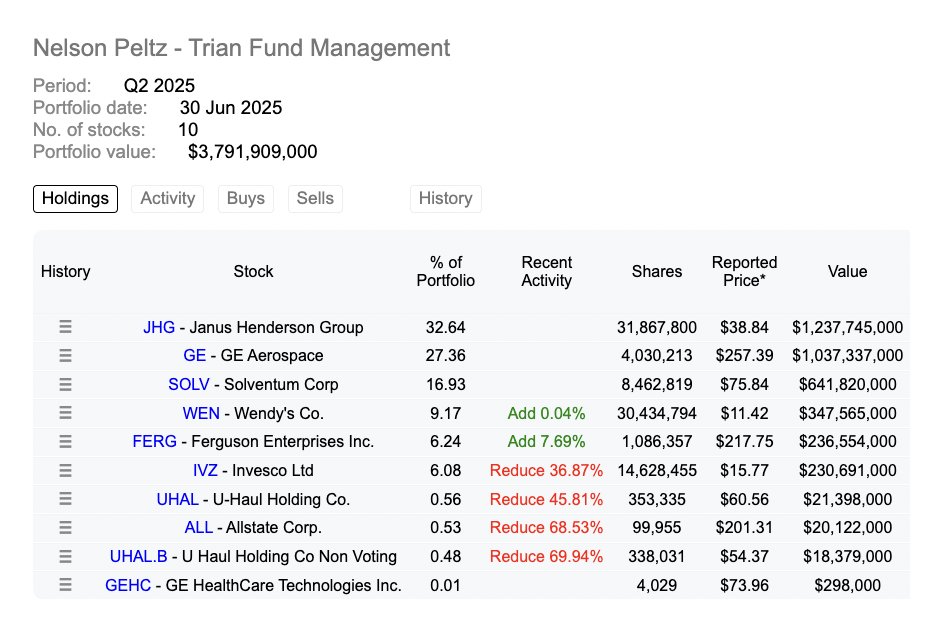

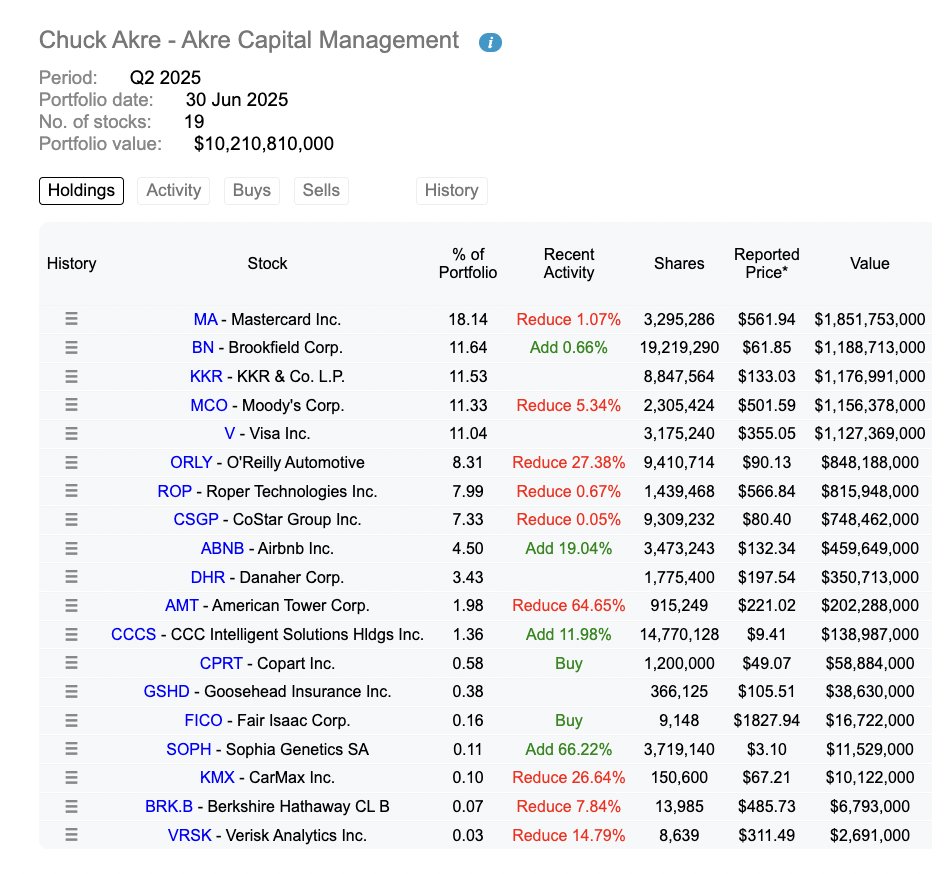

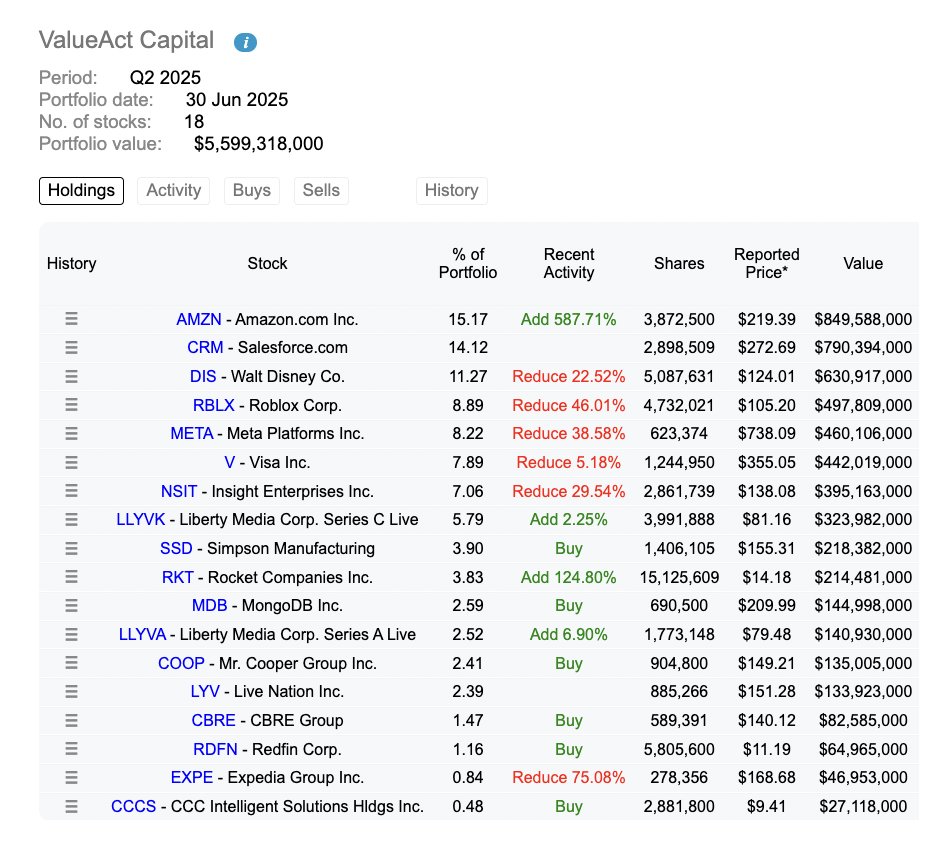

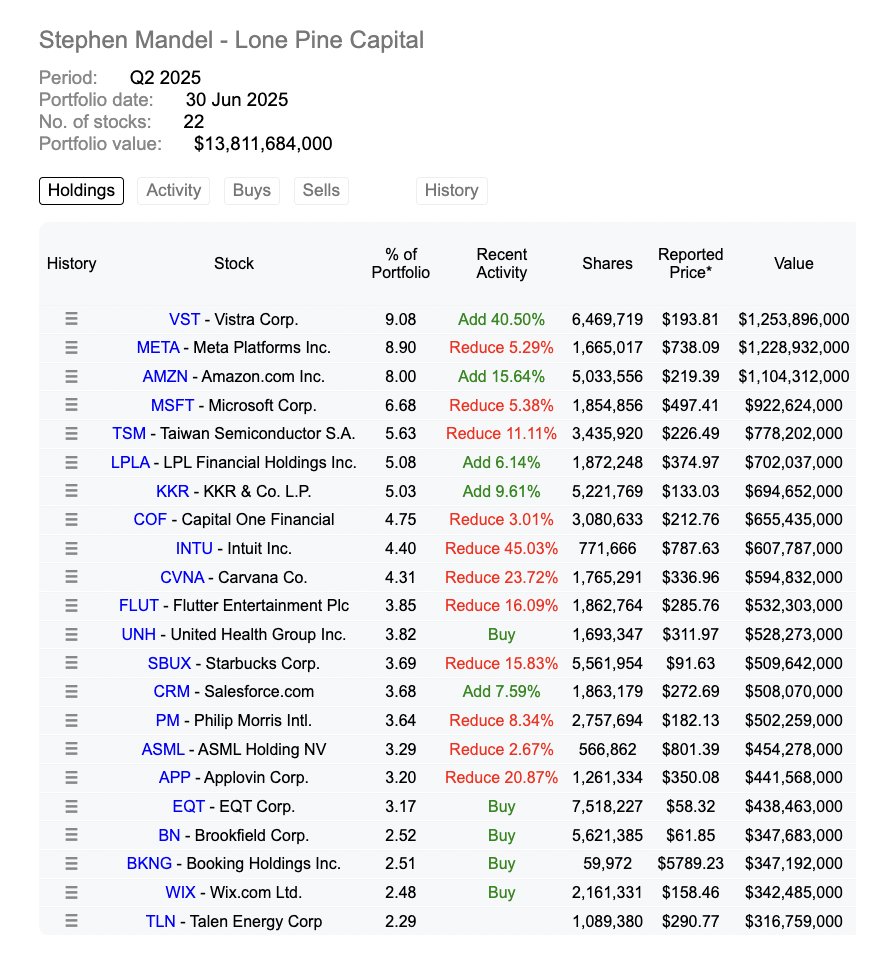

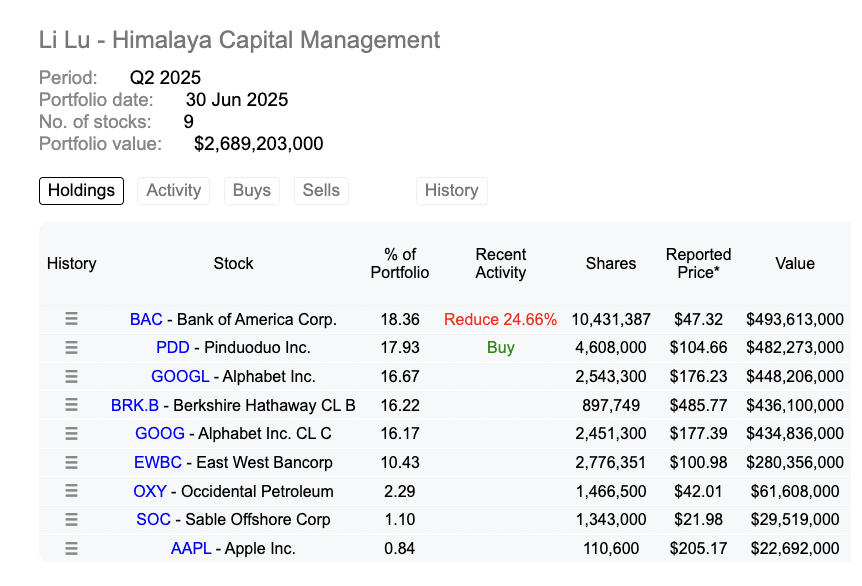

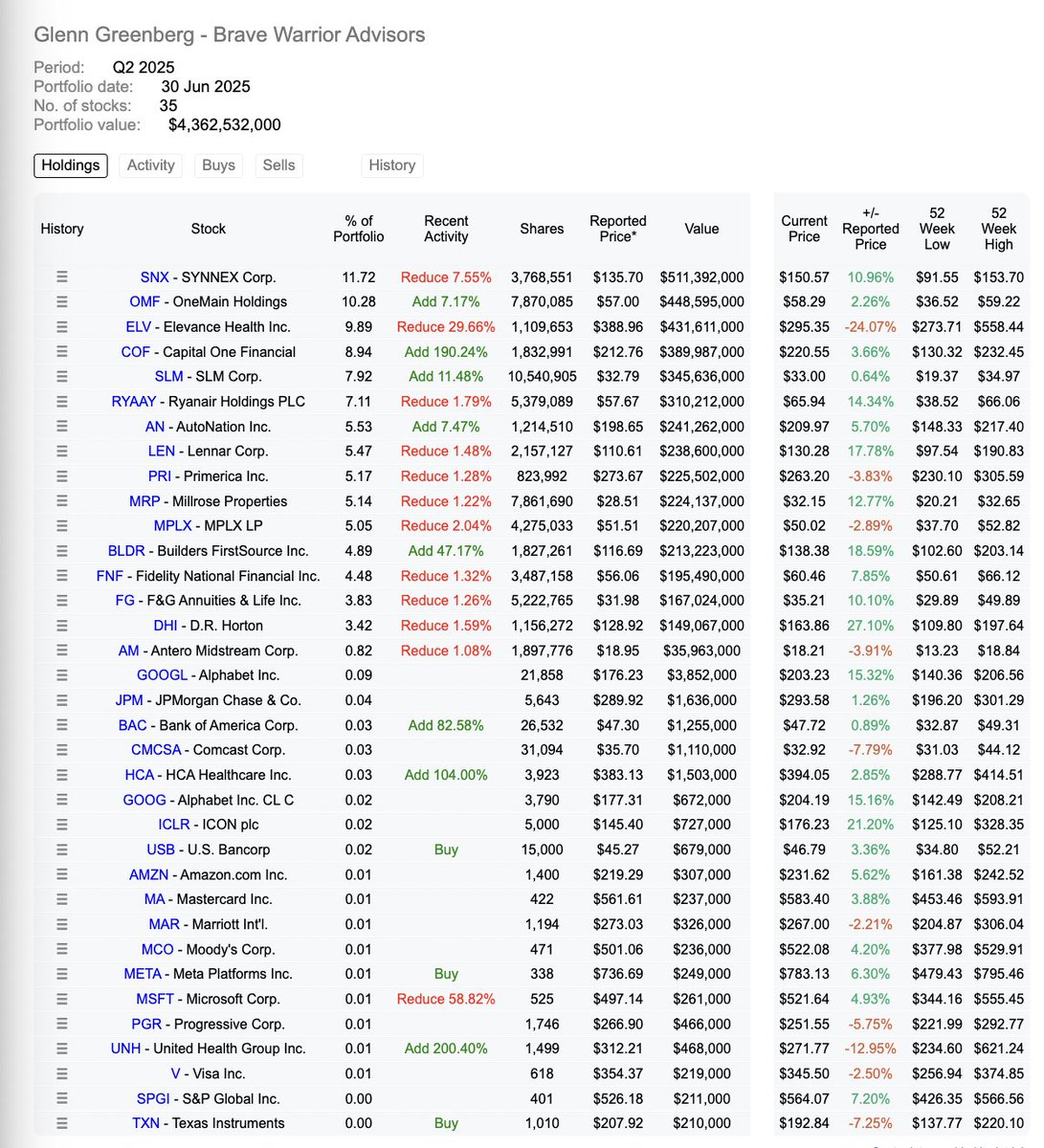

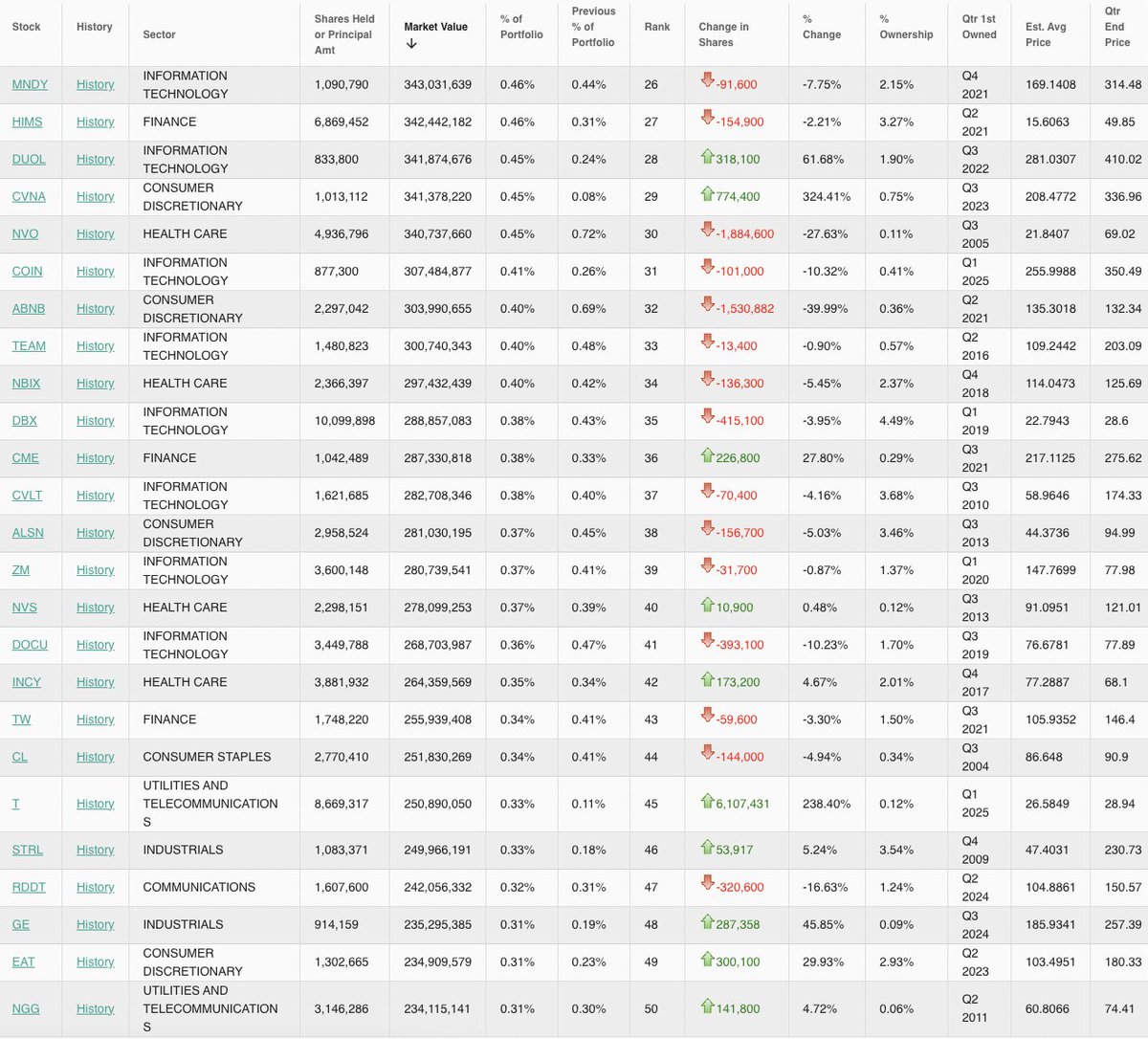

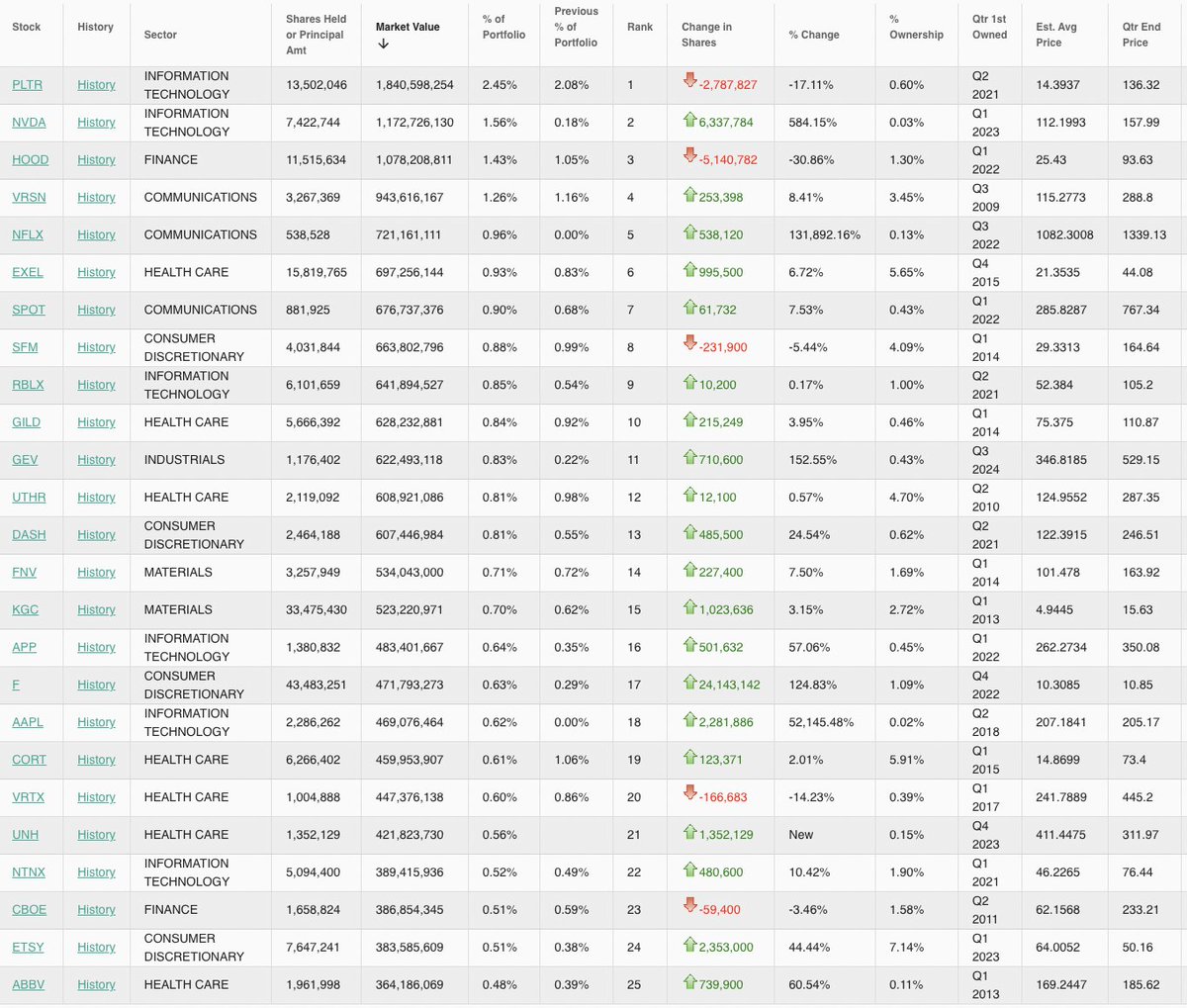

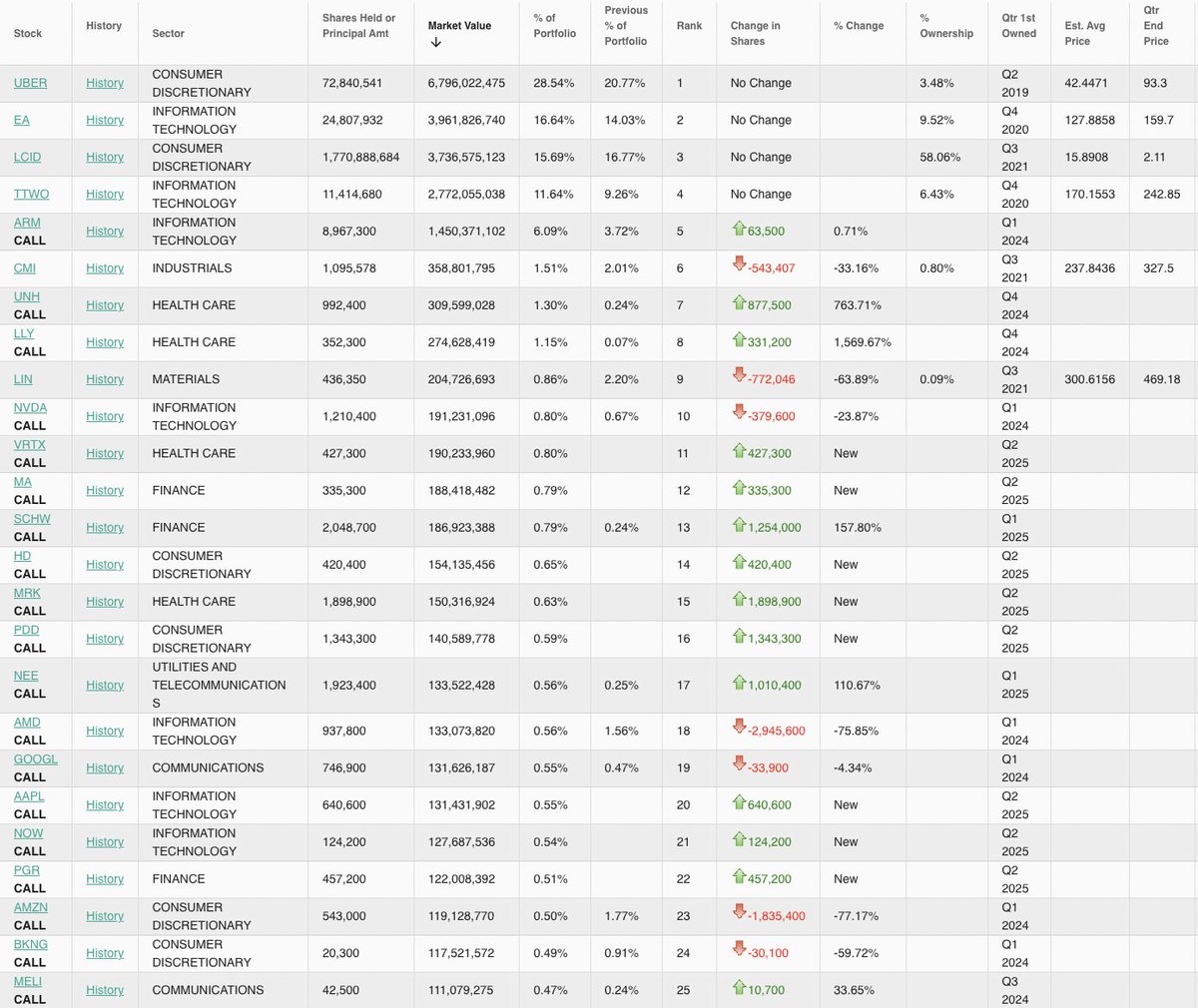

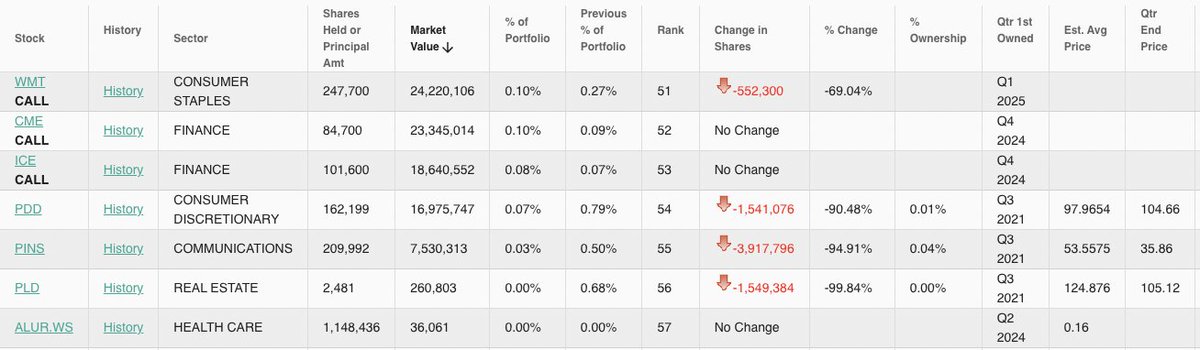

Many famous investors including Warren Buffett, Bill Ackman and a bunch more just updated their portfolios

Here's what their portfolios looked like as of the end of Q2 (A thread🧵⬇️)

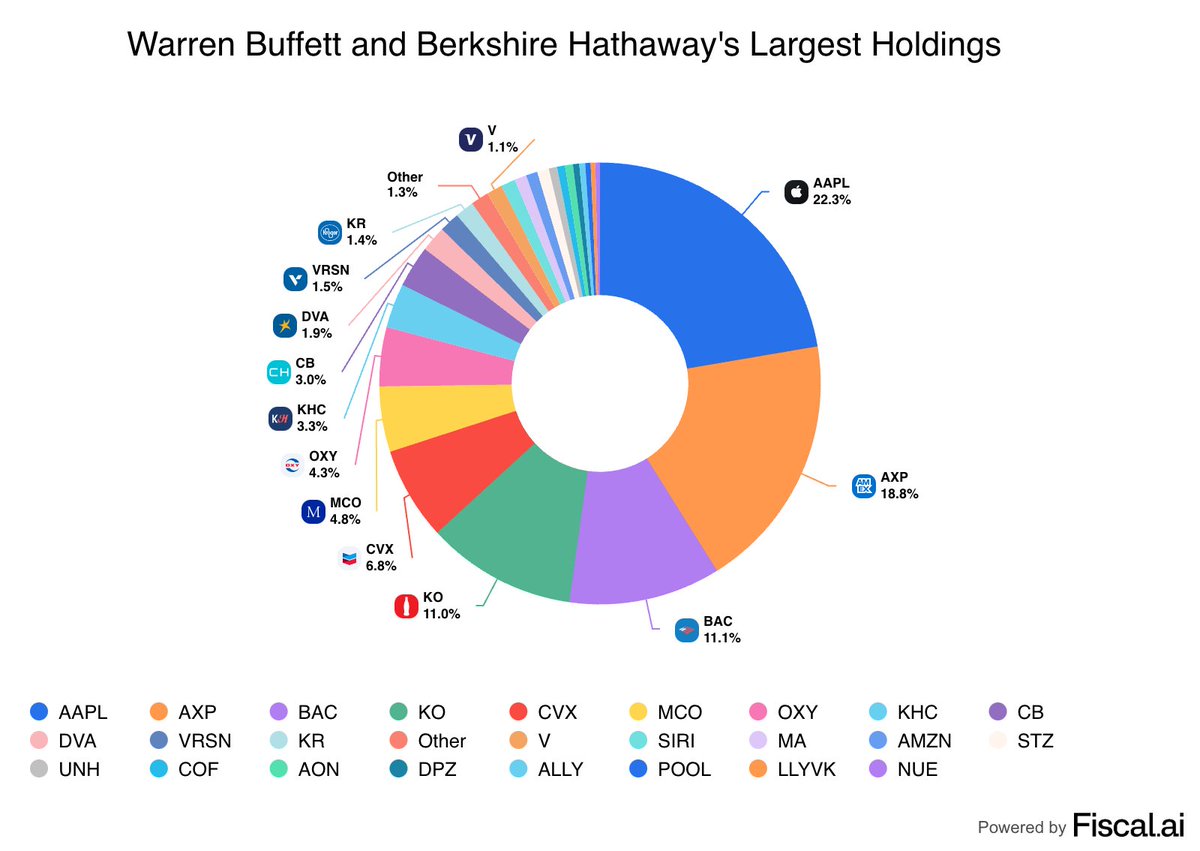

Warren Buffett: 🐐

Here's what their portfolios looked like as of the end of Q2 (A thread🧵⬇️)

Warren Buffett: 🐐

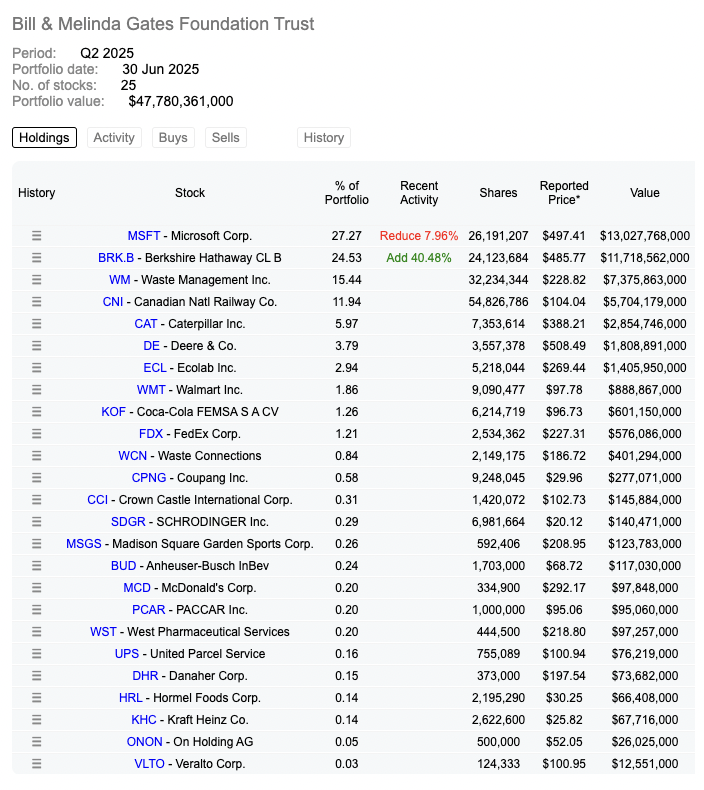

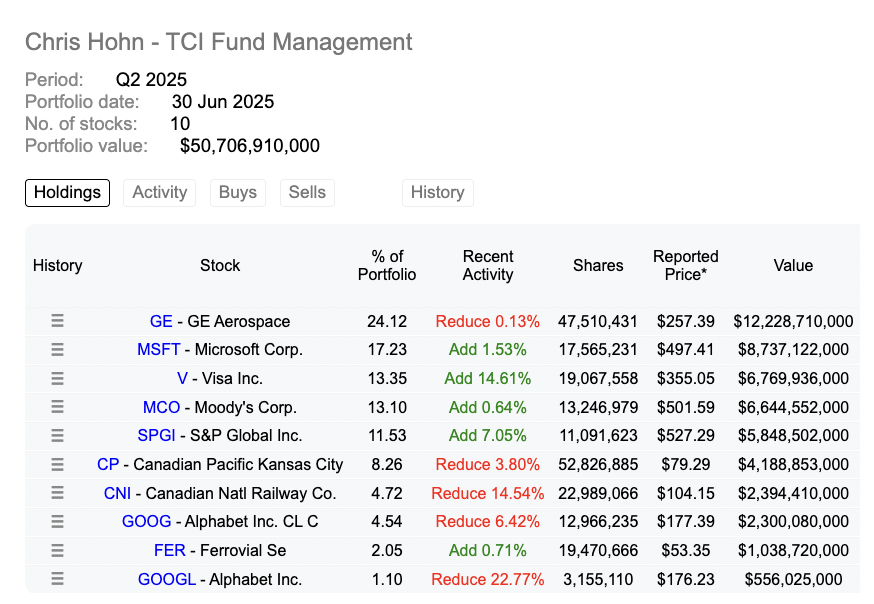

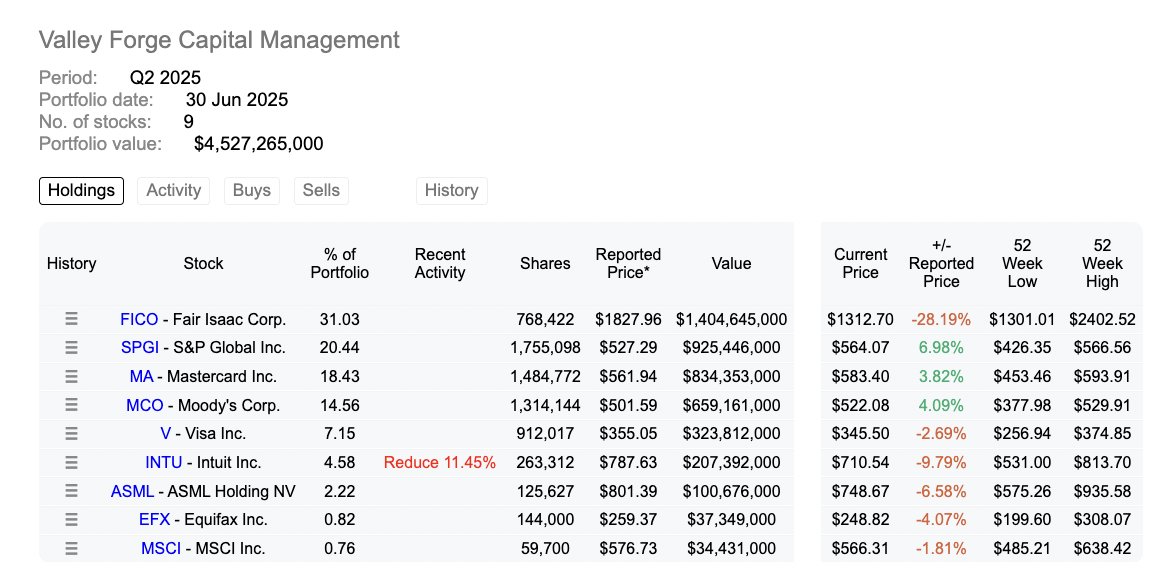

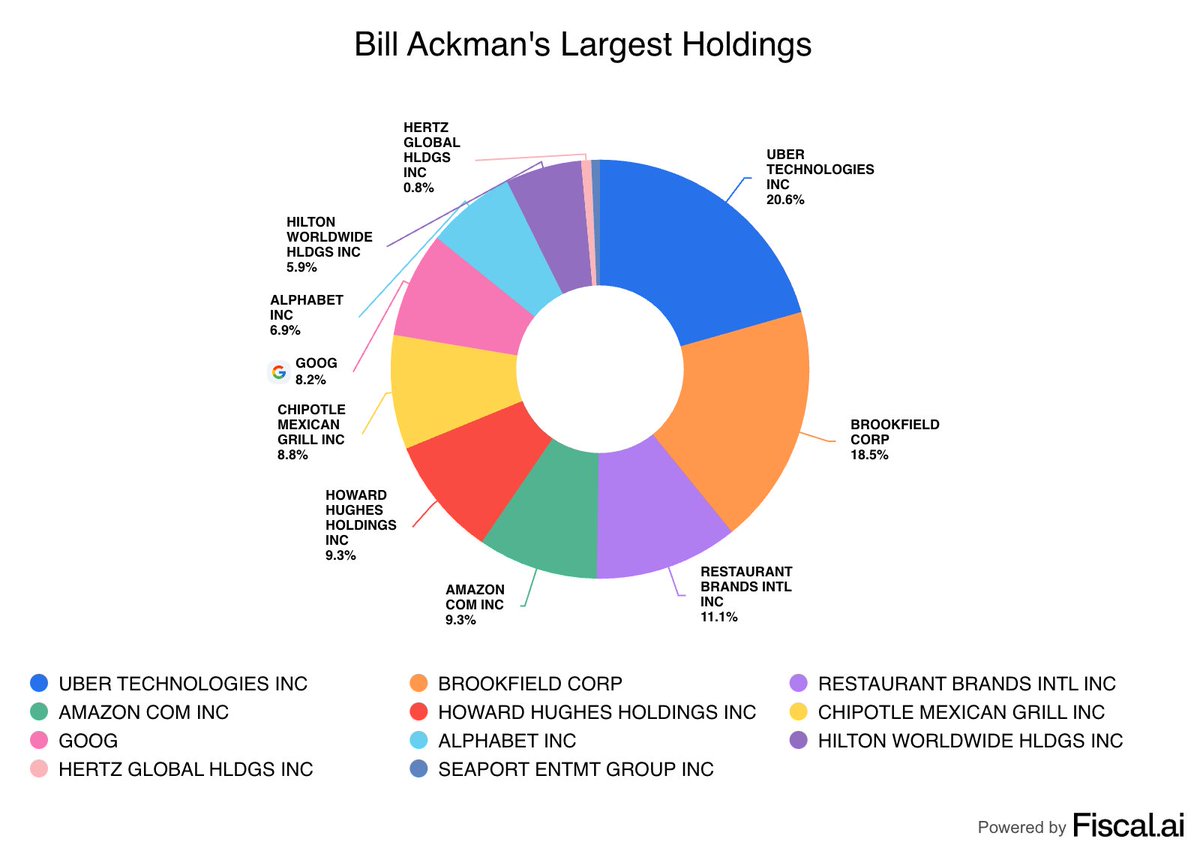

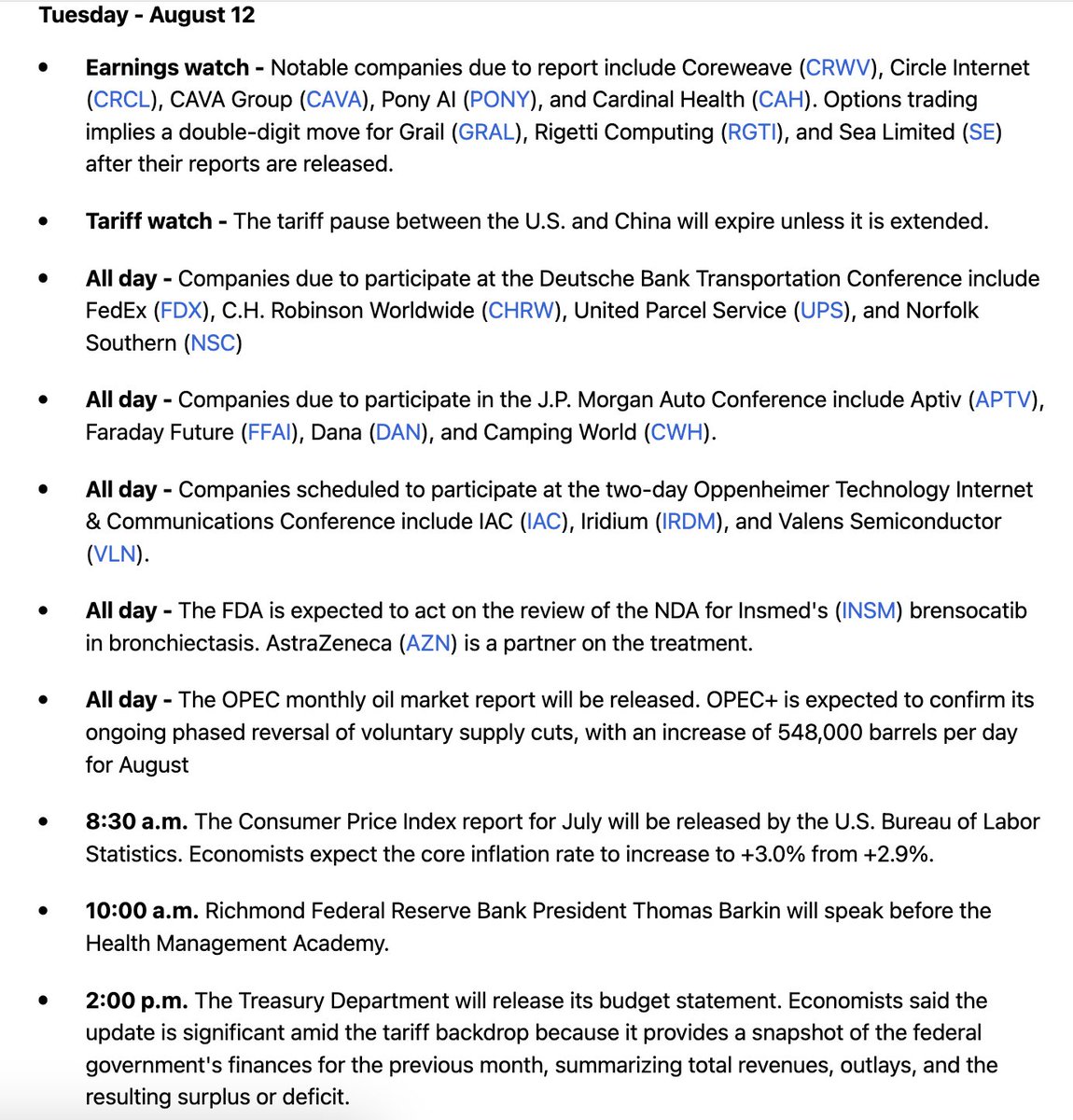

Bill Ackman:

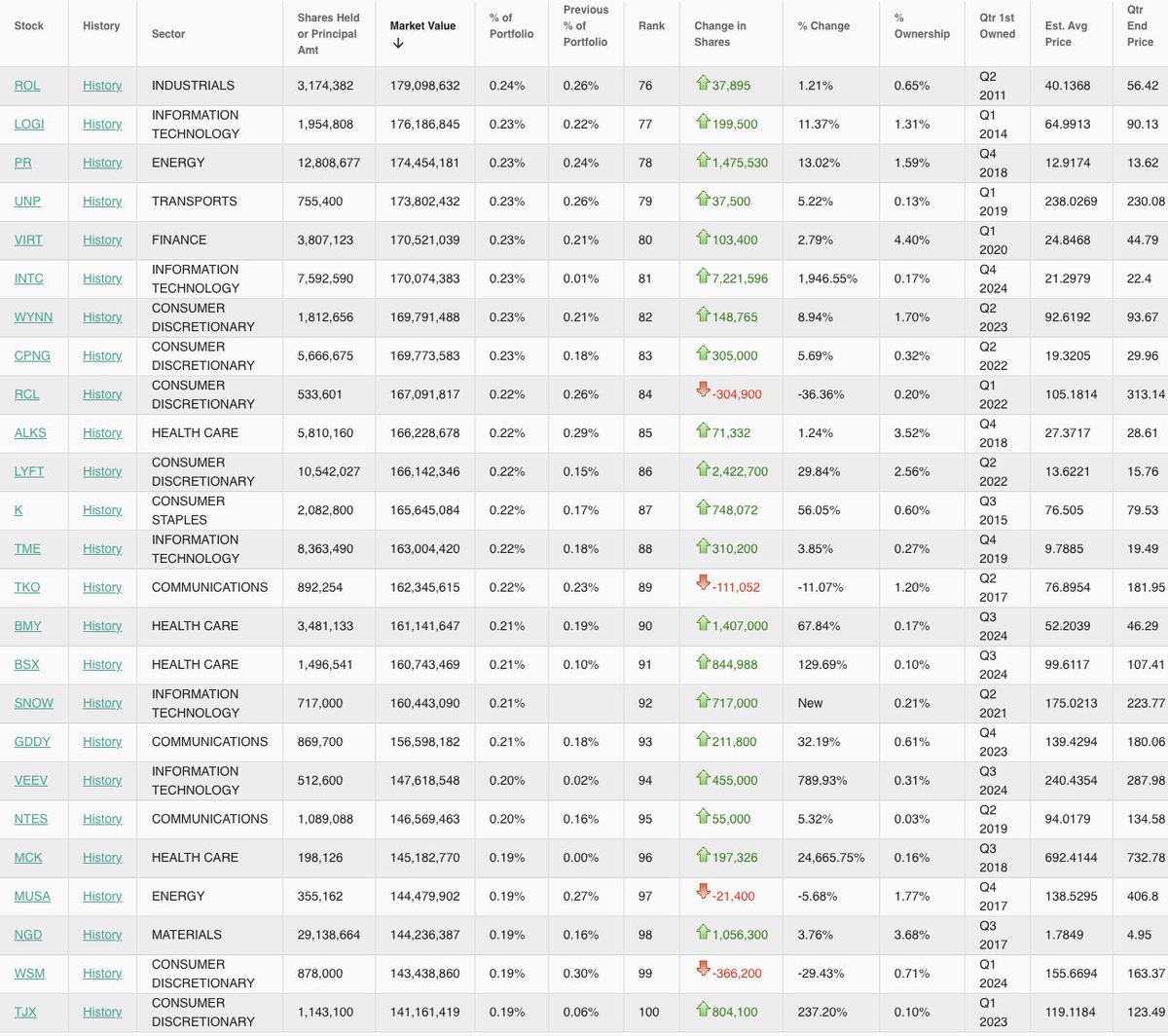

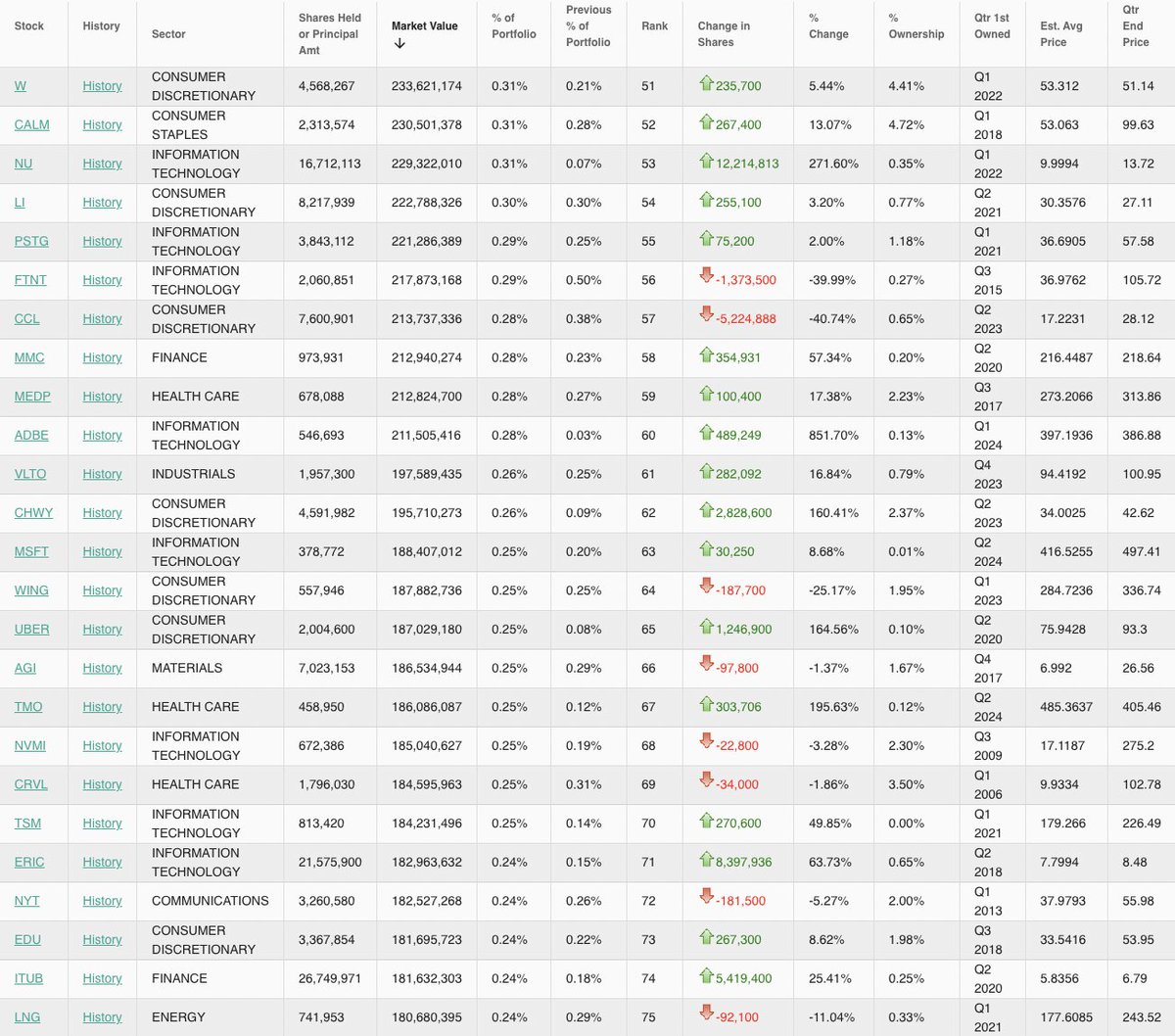

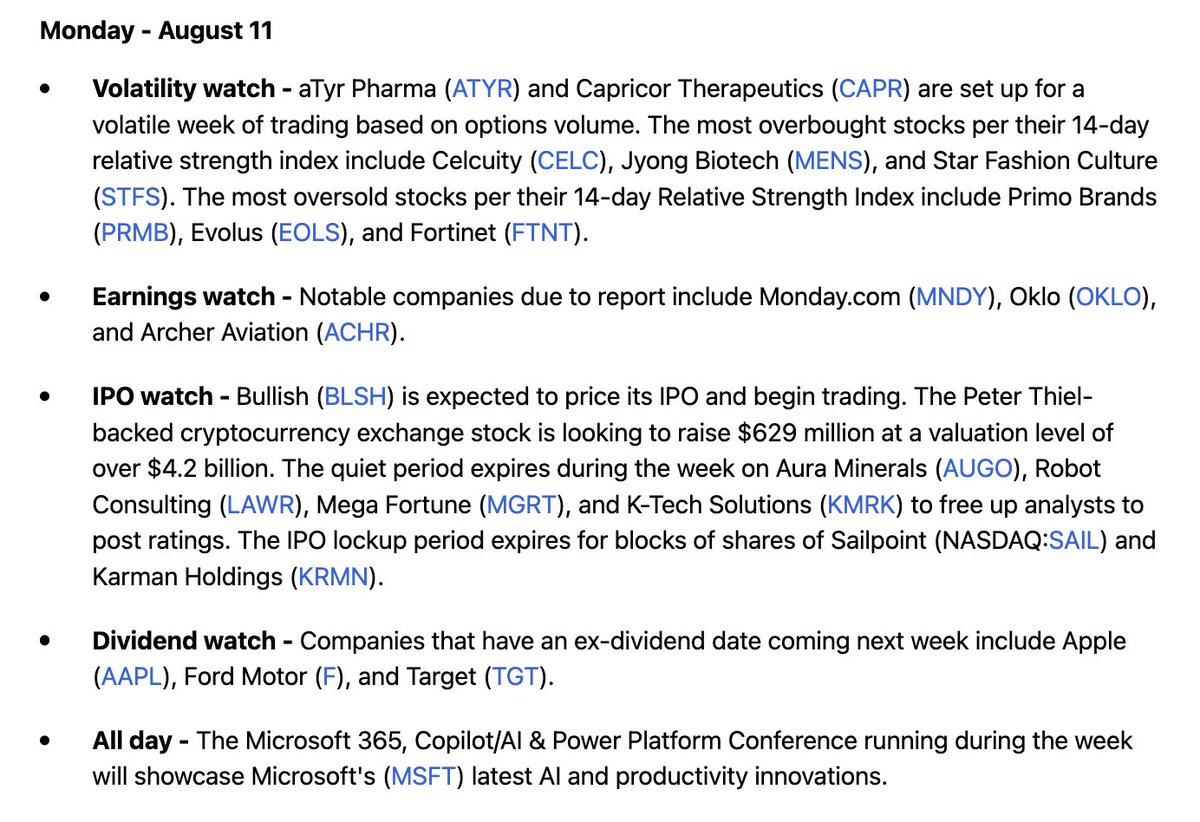

Important info:

All the portfolios are their holdings as of the end of Q4 … all of the info was taken from 13F forms filed with the SEC and the photos are from DataRoma

Important info:

All the portfolios are their holdings as of the end of Q4 … all of the info was taken from 13F forms filed with the SEC and the photos are from DataRoma

• • •

Missing some Tweet in this thread? You can try to

force a refresh