Putin & Trump in Alaska: The Hidden China Angle

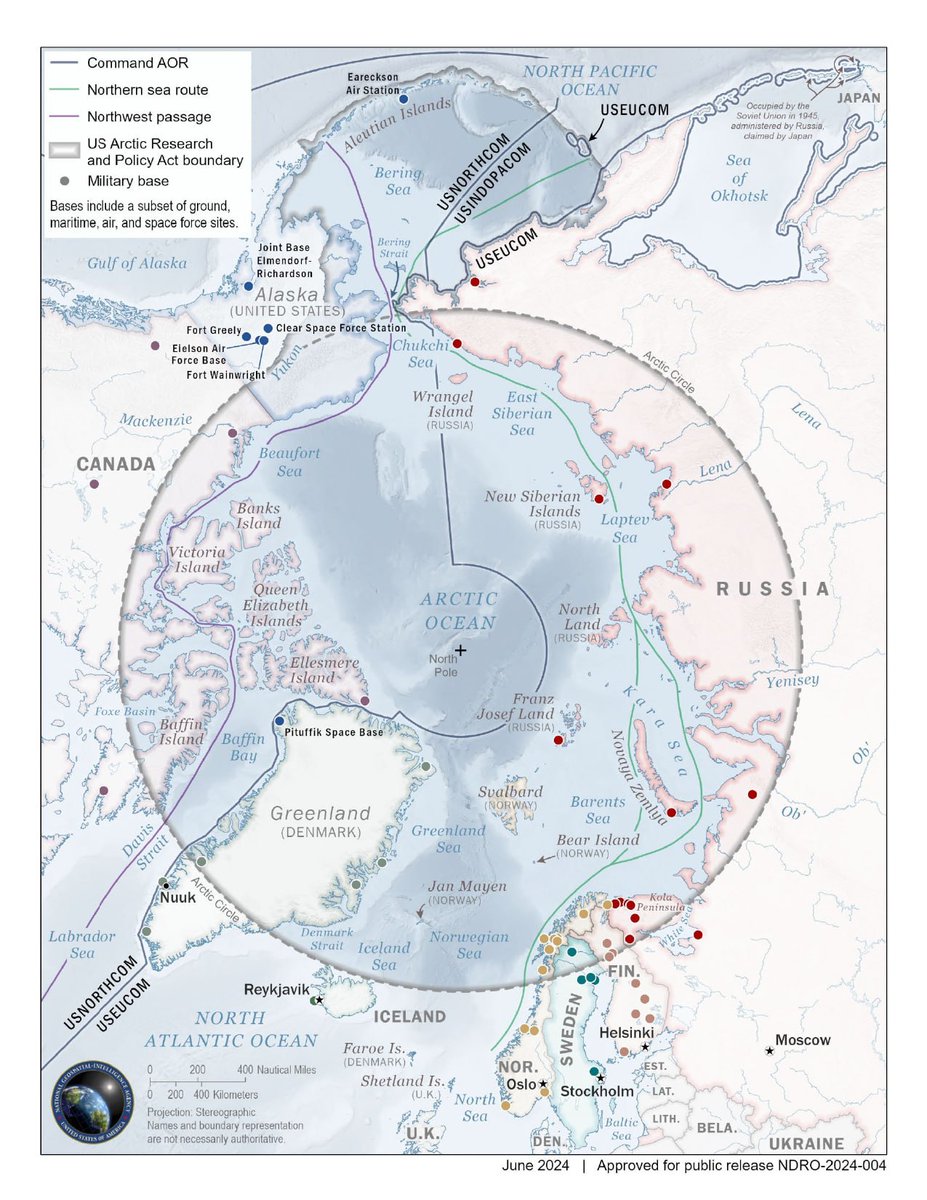

The meeting at Joint Base Elmendorf-Richardson focuses primarily on ending the Ukraine war, but lurking in the background is the battle for the Arctic's future

🧵 Let's dive in

The meeting at Joint Base Elmendorf-Richardson focuses primarily on ending the Ukraine war, but lurking in the background is the battle for the Arctic's future

🧵 Let's dive in

Arctic's geopolitical future

With tensions around the Middle East and military threats for maritime trade via the Suez Canal, the region is opening up for shipping, resources, and military ops.

Russia and China are racing ahead, leaving the US scrambling.

With tensions around the Middle East and military threats for maritime trade via the Suez Canal, the region is opening up for shipping, resources, and military ops.

Russia and China are racing ahead, leaving the US scrambling.

Russia and China are WORKING TOGETHER to develop the Arctic.

Joint naval drills, economic projects like the Northern Sea Route, and military cooperation are ramping up.

Joint naval drills, economic projects like the Northern Sea Route, and military cooperation are ramping up.

In 2025 alone, we've seen deepened ties, including a fourth working group meeting and accelerated reality from rhetoric.

China eyes it for trade routes; Russia for resources and security.

China eyes it for trade routes; Russia for resources and security.

The US is deeply concerned.

Melting ice means new strategic flashpoints—Russia-China partnerships challenge the Arctic order.

DOD's 2024 strategy calls for more presence, but America lags.

Melting ice means new strategic flashpoints—Russia-China partnerships challenge the Arctic order.

DOD's 2024 strategy calls for more presence, but America lags.

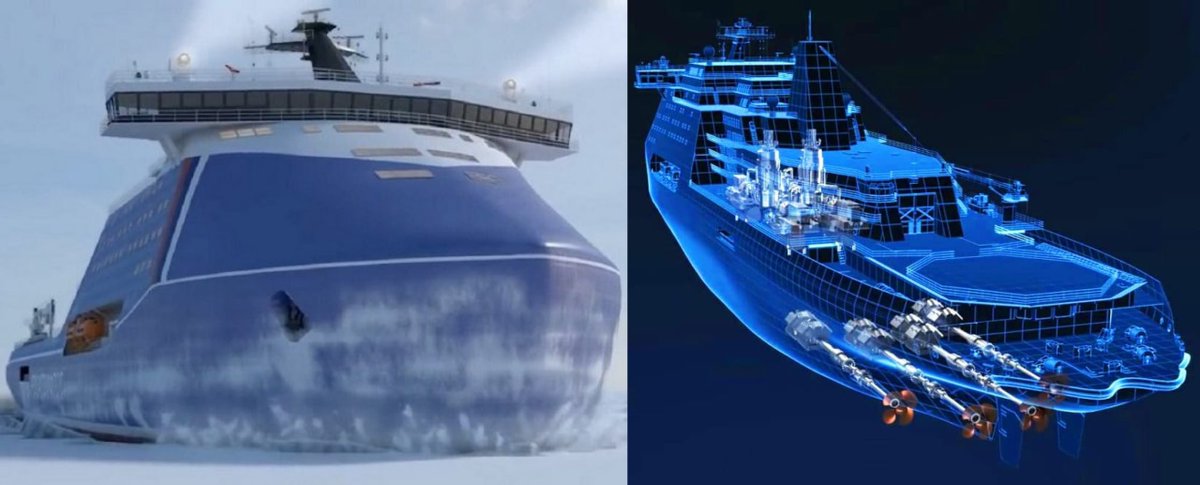

Russia's leadership in Arctic development is unmatched.

They boast the world's largest nuclear icebreaker fleet—over 40 vessels, including the massive Project 10510 "Leader" class.

They boast the world's largest nuclear icebreaker fleet—over 40 vessels, including the massive Project 10510 "Leader" class.

Nuclear-powered icebreakers with 160,923-horsepower engines made to ensure year-round navigation will become operational in 2027.

The US? Just a handful, prompting alliances like ICE Pact to catch up.

The US? Just a handful, prompting alliances like ICE Pact to catch up.

Trump's play: Pull Russia closer to the US

With economic interests overlapping in Alaska and the Arctic, he might pitch joint exploration or resource deals to counter China.

He's hinted at US-Russia partnerships in the region, aiming to weaken Moscow-Beijing alignment.

With economic interests overlapping in Alaska and the Arctic, he might pitch joint exploration or resource deals to counter China.

He's hinted at US-Russia partnerships in the region, aiming to weaken Moscow-Beijing alignment.

Reality check: Russia won't ditch China for the US.

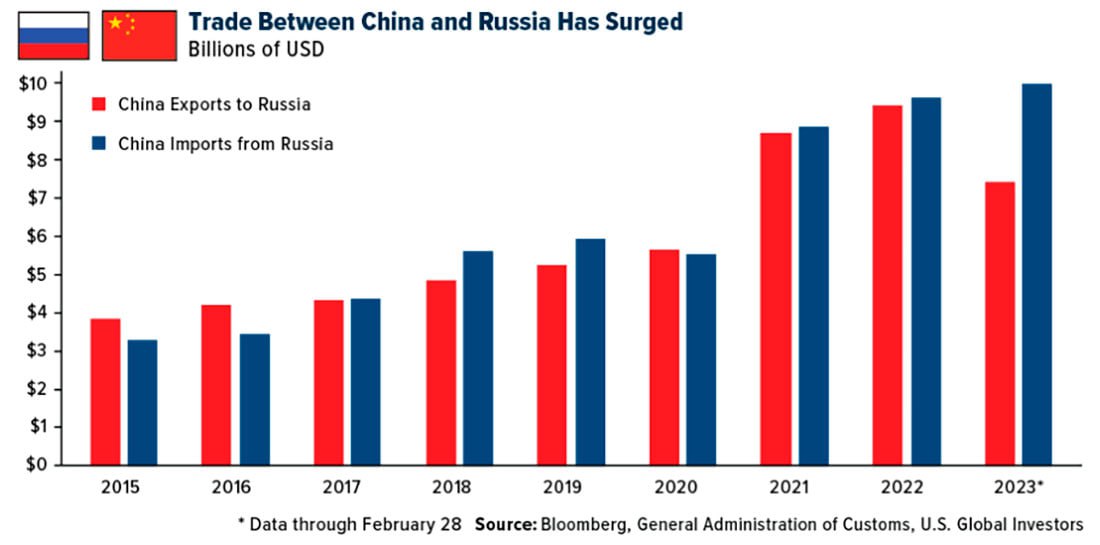

Why? China is Russia's top trade partner by far.

No sanctions or proxy wars killing Russians.

Bilateral trade booms, with Arctic projects like LNG and shipping benefiting both.

Why? China is Russia's top trade partner by far.

No sanctions or proxy wars killing Russians.

Bilateral trade booms, with Arctic projects like LNG and shipping benefiting both.

Deeper ties

China and Russia share a "no limits" partnership, including military-tech coop in the Arctic.

Distrust exists, but systemic pressures push them together.

China never sanctioned Russia over Ukraine—unlike the West—and supports Moscow's concerns about NATO expansion.

China and Russia share a "no limits" partnership, including military-tech coop in the Arctic.

Distrust exists, but systemic pressures push them together.

China never sanctioned Russia over Ukraine—unlike the West—and supports Moscow's concerns about NATO expansion.

Strategically, cooperating with a rising China makes sense for Russia.

As the US weakens (deindustrialization, ballooning debt, political dysfunction), China's economy strengthens—offering reliable markets for Russian energy and resources.

Why risk that for a volatile US alliance?

As the US weakens (deindustrialization, ballooning debt, political dysfunction), China's economy strengthens—offering reliable markets for Russian energy and resources.

Why risk that for a volatile US alliance?

To sum things up:

While Trump might dangle Arctic deals to lure Russia away, his pitch is likely to fall flat.

Russia has absolutely no incentive to join the US in an anti-China alliance in the Arctic, or anywhere else for that matter.

While Trump might dangle Arctic deals to lure Russia away, his pitch is likely to fall flat.

Russia has absolutely no incentive to join the US in an anti-China alliance in the Arctic, or anywhere else for that matter.

• • •

Missing some Tweet in this thread? You can try to

force a refresh