(1/🧵) The Dark Script: 1700 NDAs, XRPL, Palantir, BlackRock, CIA and the U.S. Government.

The battle for the future is Palantir vs. The XRP Ledger.

BlackRock doesn’t pick sides. It picks profits. That’s why it quietly jumped from Palantir to XRPL.

Here’s the dark reality🧵👇

The battle for the future is Palantir vs. The XRP Ledger.

BlackRock doesn’t pick sides. It picks profits. That’s why it quietly jumped from Palantir to XRPL.

Here’s the dark reality🧵👇

(2/🧵) Palantir was funded by the CIA’s venture arm In-Q-Tel.

From Day 1, it wasn’t a “startup”… it was an intelligence weapon.

Its purpose? Build the software backbone for mass surveillance & control.

Palantir already knows more about you than your government, your bank, and your doctor combined.

From Day 1, it wasn’t a “startup”… it was an intelligence weapon.

Its purpose? Build the software backbone for mass surveillance & control.

Palantir already knows more about you than your government, your bank, and your doctor combined.

(3/🧵) Their product “GOTHAM” integrates EVERYTHING:

•Bank transfers

•Emails

•Social media

•Travel logs

•Even DNA & medical records.

They don’t just track you. They predict you.

•Bank transfers

•Emails

•Social media

•Travel logs

•Even DNA & medical records.

They don’t just track you. They predict you.

(4/🧵) And now… the new frontier: your DNA.

Palantir quietly secured health + genomic data through government contracts. Not just in the U.S. and England but in almost every region.

Genomics isn’t about health,it’s about identity control.

If they own the rails, they own you.

Palantir quietly secured health + genomic data through government contracts. Not just in the U.S. and England but in almost every region.

Genomics isn’t about health,it’s about identity control.

If they own the rails, they own you.

(5/🧵) How BalckRock shifted from Palantir to the XRP Ledger?

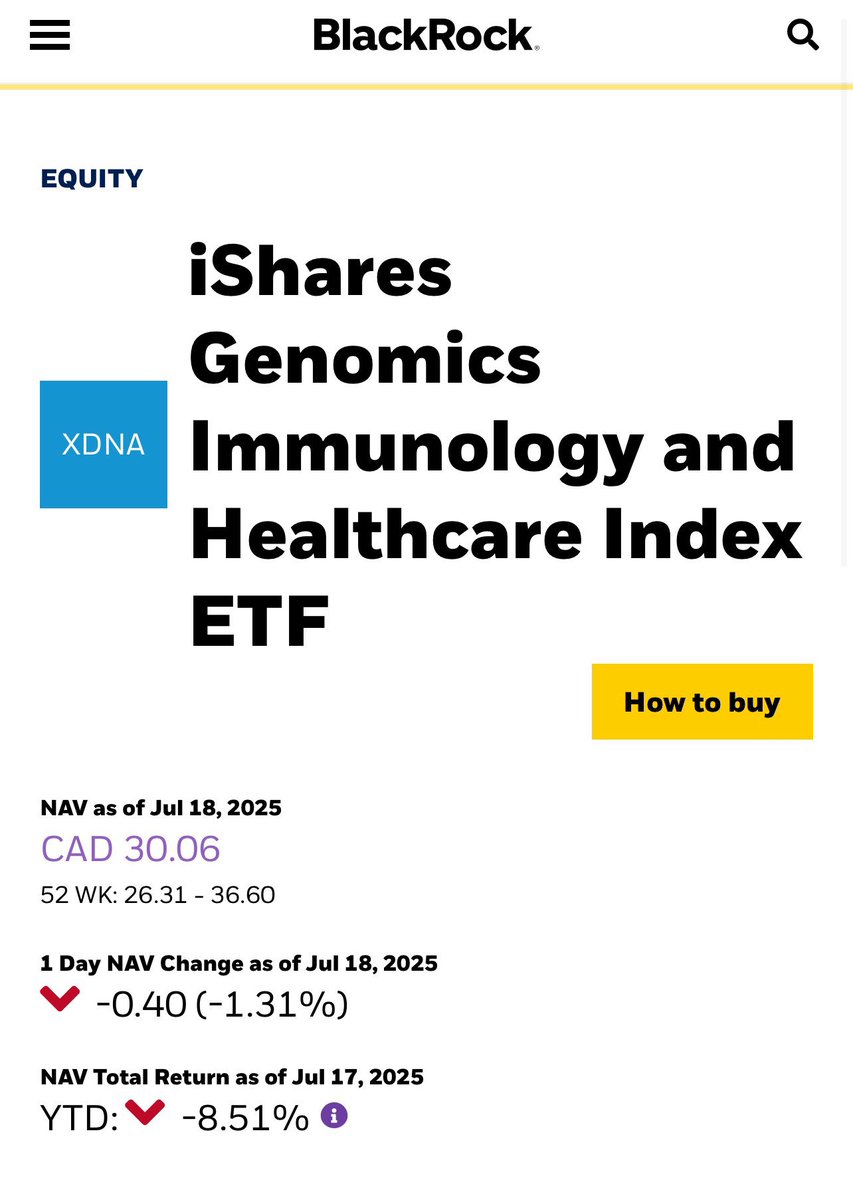

The CIA & White House were already invested in BlackRock’s $XDNA ETF that invested in companies involved in Genomic Sequencing and DNA Storage.

Palantir had a quiet hand behind the scenes with the CIA.

BlackStone had also offered to buy one person’s DNA for $261.

The CIA & White House were already invested in BlackRock’s $XDNA ETF that invested in companies involved in Genomic Sequencing and DNA Storage.

Palantir had a quiet hand behind the scenes with the CIA.

BlackStone had also offered to buy one person’s DNA for $261.

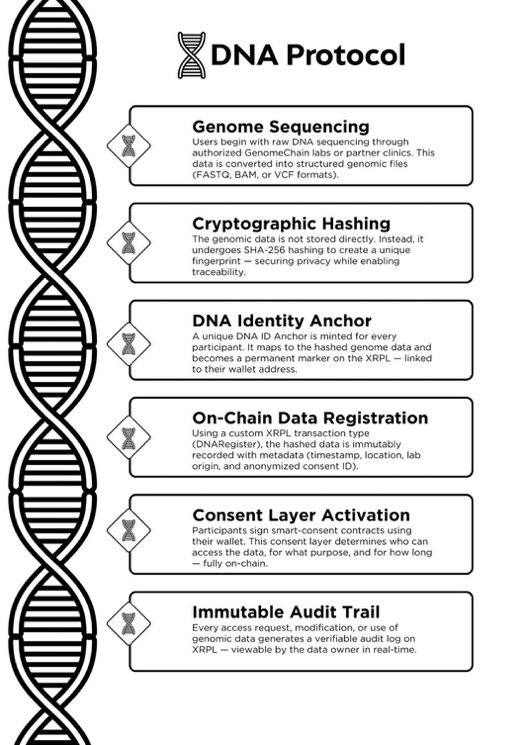

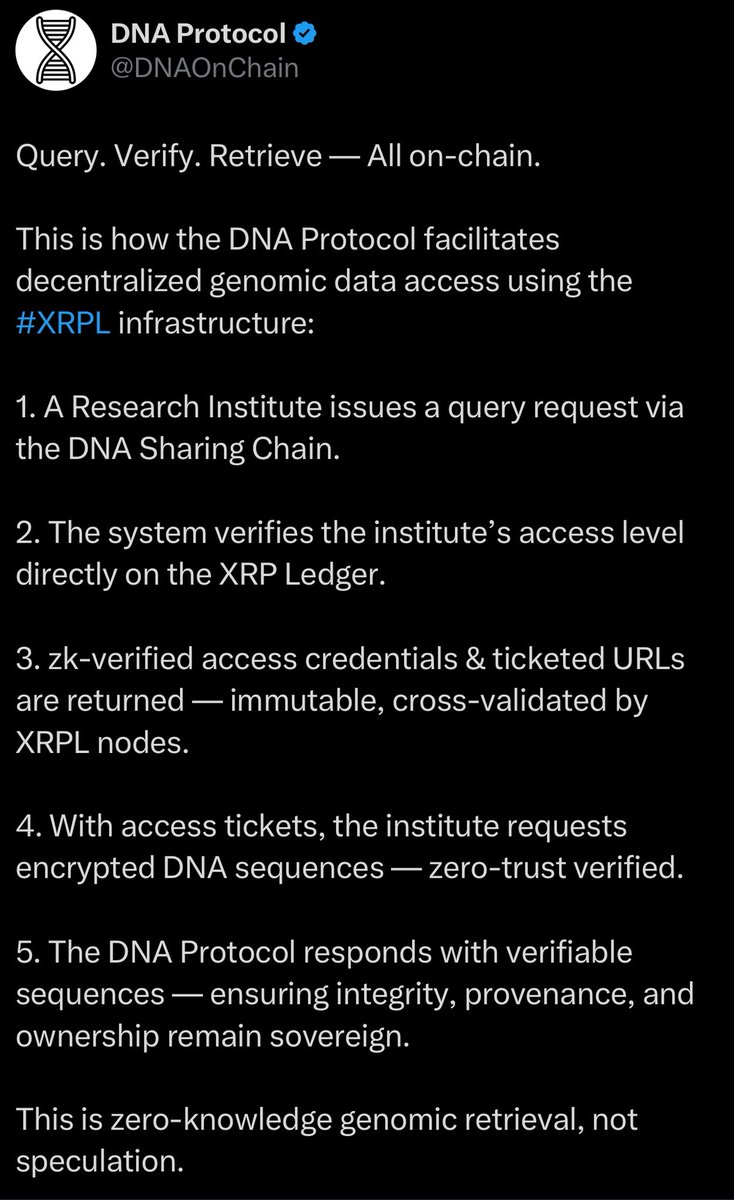

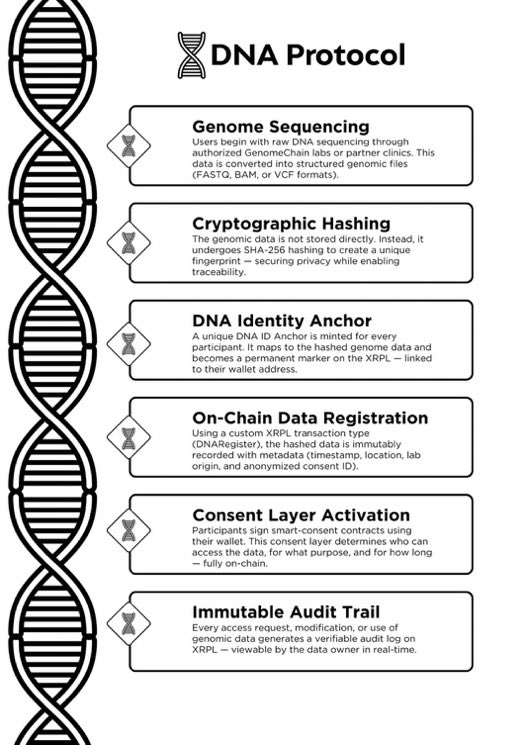

(6/🧵) When the dark truth about surveillance started leaking, BlackRock quietly pivoted to a new emerging decentralized technology for DNA by funding @DNAOnChain on XRPL.

Obviously with 1700+ NDAs, nothing comes openly.

There were signs:

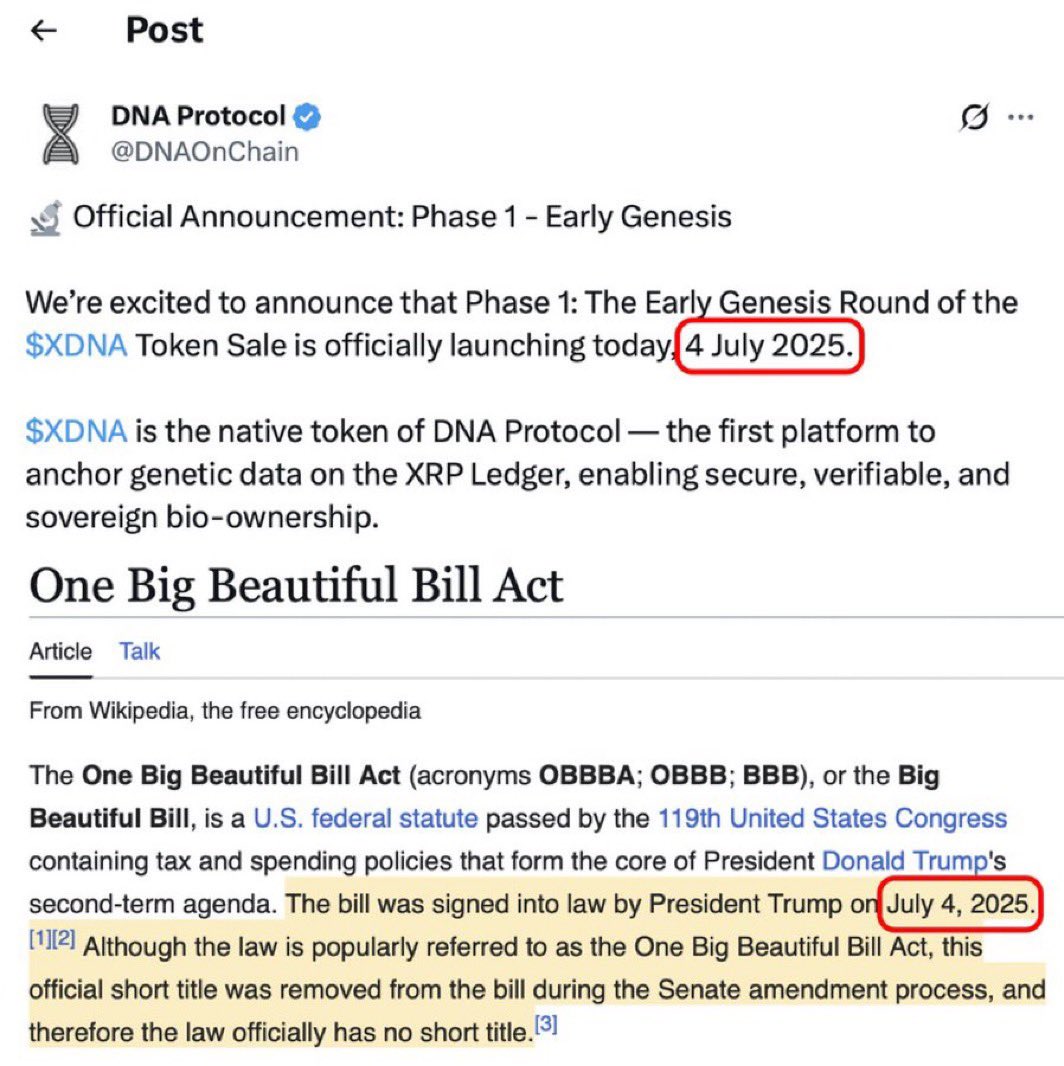

$XDNA launching on XRPL on 4th July — Independence Day, Trump signing One Big Beautiful Bill slashing healthcare benefits….

Obviously with 1700+ NDAs, nothing comes openly.

There were signs:

$XDNA launching on XRPL on 4th July — Independence Day, Trump signing One Big Beautiful Bill slashing healthcare benefits….

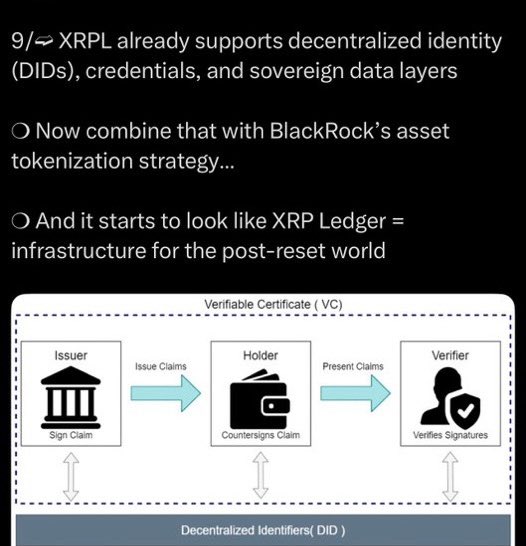

(7/🧵) Why did BlackRock choose XRPL?

1. The XRP Ledger already supports decentralized Identity(DIDs), credentials and sovereign data layers.

2. With 1700+ NDAs, Ripple built the perfect cover for BlackRock. Behind the scenes, they can quietly test, build, and launch the next financial rails on XRPL, without the world knowing until it’s too late.

1. The XRP Ledger already supports decentralized Identity(DIDs), credentials and sovereign data layers.

2. With 1700+ NDAs, Ripple built the perfect cover for BlackRock. Behind the scenes, they can quietly test, build, and launch the next financial rails on XRPL, without the world knowing until it’s too late.

(8/🧵) Brad Garlinghouse: “I love the idea about Blockchain Based Identity.”

Is it @DNAOnChain ?

Brad openly hinted in an interview about building a blockchain based identity because the Government Owns Your Identity.

Hear it Yourself, but remember the 1700+ NDAs that are holding him back👇

Is it @DNAOnChain ?

Brad openly hinted in an interview about building a blockchain based identity because the Government Owns Your Identity.

Hear it Yourself, but remember the 1700+ NDAs that are holding him back👇

(9/🧵) The fight is already happening.

If Palantir wins, your life becomes data to be managed.

If XRPL wins, your life becomes value you control.

The stakes? Money. Identity. DNA.

The winner? That depends on whether people wake up.

If Palantir wins, your life becomes data to be managed.

If XRPL wins, your life becomes value you control.

The stakes? Money. Identity. DNA.

The winner? That depends on whether people wake up.

(10/10) The dots are all there. But the full picture? Too dark for X.

Join my Telegram where the censored truths and the real connections will be exposed👇

t.me/ripplercult

Join my Telegram where the censored truths and the real connections will be exposed👇

t.me/ripplercult

• • •

Missing some Tweet in this thread? You can try to

force a refresh