🚨 How the US is turning the EU into a peripheral vassal

The US is systematically turning the EU into a subordinate periphery, stripping it of sovereignty to weaponize it against BRICS nations like Russia and China

Let's dive into the hard facts 🧵👇

The US is systematically turning the EU into a subordinate periphery, stripping it of sovereignty to weaponize it against BRICS nations like Russia and China

Let's dive into the hard facts 🧵👇

Tariffs

In July 2025, the US forced the EU into a "trade deal" imposing a 15% baseline tariff on most EU goods entering the US, higher than previous rates.

Steel, aluminum, and copper tariffs remain at 50% squeeizing EU economies while protecting US markets.

In July 2025, the US forced the EU into a "trade deal" imposing a 15% baseline tariff on most EU goods entering the US, higher than previous rates.

Steel, aluminum, and copper tariffs remain at 50% squeeizing EU economies while protecting US markets.

The US Inflation Reduction Act (IRA) is poaching European businesses

High energy prices and economic instability in Europe have driven manufacturers to relocate to the US

For instance, Volkswagen announced expansions in the US at the expense of Europe.

High energy prices and economic instability in Europe have driven manufacturers to relocate to the US

For instance, Volkswagen announced expansions in the US at the expense of Europe.

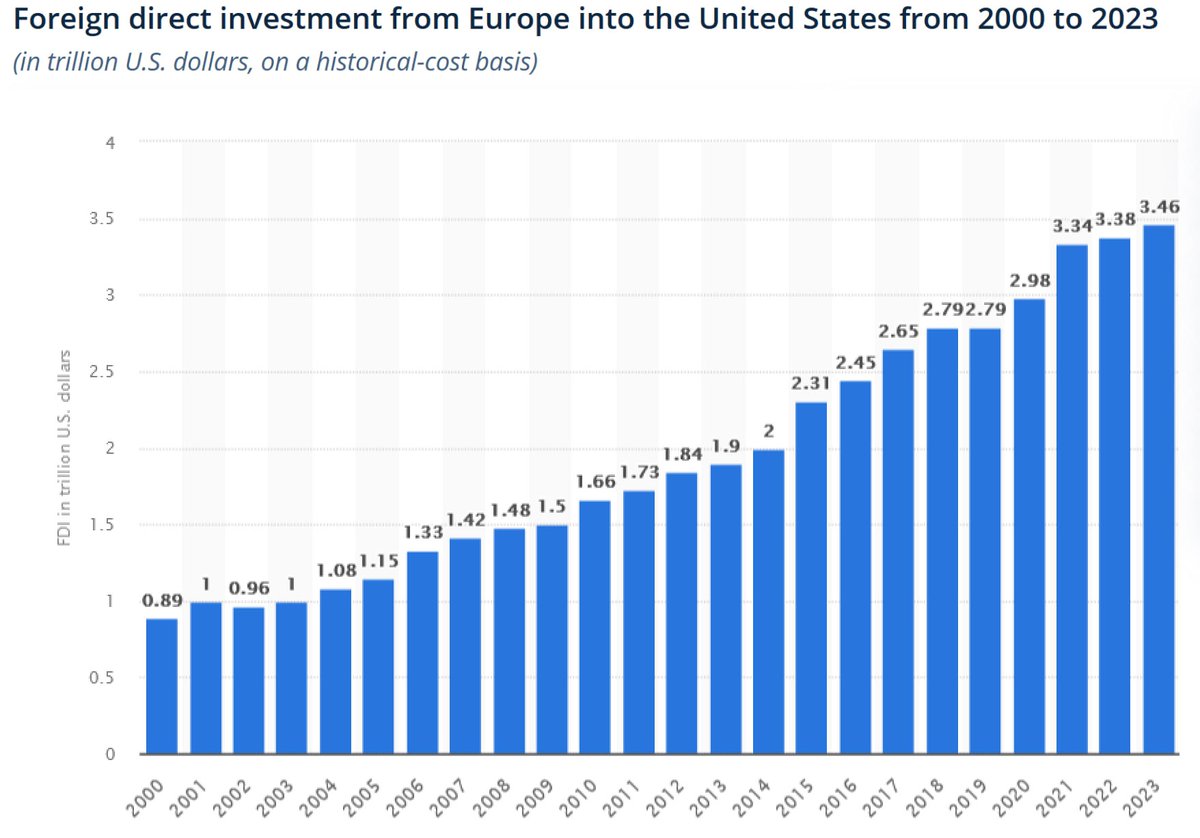

Stat

European FDI into the US surged due to IRA subsidies

In 2023-2025, numerous EU firms shifted investments, with concerns that production and resources are flowing to the US, leaving the EU hollowed out

European FDI into the US surged due to IRA subsidies

In 2023-2025, numerous EU firms shifted investments, with concerns that production and resources are flowing to the US, leaving the EU hollowed out

Militarily US dominates via NATO

At the June 2025 Summit, NATO raised the defense spending target to 5% of GDP by 2035—up from 2%

European NATO members' spending rose from 1.66% in 2022 to 2.02% in 2024, projected at 5.9% growth in 2025, draining EU budgets for US-led agendas

At the June 2025 Summit, NATO raised the defense spending target to 5% of GDP by 2035—up from 2%

European NATO members' spending rose from 1.66% in 2022 to 2.02% in 2024, projected at 5.9% growth in 2025, draining EU budgets for US-led agendas

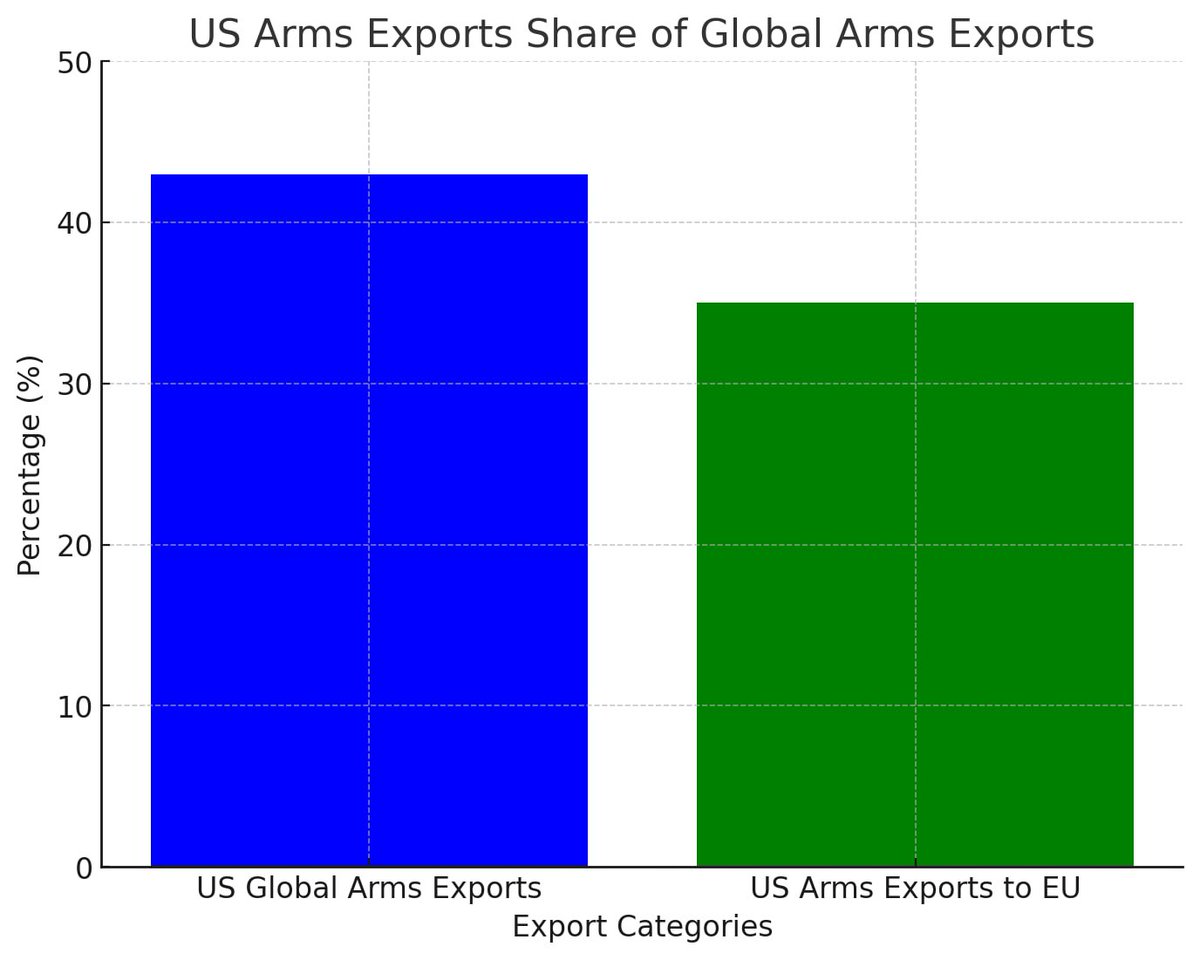

Arms sales

From 2020-2024, US weapons exports to 🇪🇺 tripled compared to 2015-2019, boosted by demands to arm 🇺🇦

🇺🇸 holds 43% of global arms exports, with 35% going to 🇪🇺 in that period

FY2024 US arms transfers hit $117.9B via Foreign Military Sales alone—a 45.7% increase

From 2020-2024, US weapons exports to 🇪🇺 tripled compared to 2015-2019, boosted by demands to arm 🇺🇦

🇺🇸 holds 43% of global arms exports, with 35% going to 🇪🇺 in that period

FY2024 US arms transfers hit $117.9B via Foreign Military Sales alone—a 45.7% increase

Europe sends its weapons to Ukraine, then buys overpriced US replacements

SIPRI data shows US dominance: $318.7B in total arms trade value in FY2024

This cycle enriches American defense firms while depleting European stockpiles and independence

SIPRI data shows US dominance: $318.7B in total arms trade value in FY2024

This cycle enriches American defense firms while depleting European stockpiles and independence

Brain drain

In tech, EU startups are battling a "brain drain" to the US, with founders uniting in "Project Europe" to stem the tide

Stats show the US attracting EU AI and STEM talent, exacerbating Europe's shortages

In tech, EU startups are battling a "brain drain" to the US, with founders uniting in "Project Europe" to stem the tide

Stats show the US attracting EU AI and STEM talent, exacerbating Europe's shortages

Biden's interference in Romania

In 2024 Biden’s admin highlighted Russian TikTok interference, leading to the annulment of Romania’s presidential runoff

Critics called it a US-backed coup to block anti-EU and anti-NATO candidate Călin Georgescu, with suspiciously timed intel leaks

In 2024 Biden’s admin highlighted Russian TikTok interference, leading to the annulment of Romania’s presidential runoff

Critics called it a US-backed coup to block anti-EU and anti-NATO candidate Călin Georgescu, with suspiciously timed intel leaks

Meddling in France & Germany

In France’s 2024 snap elections, US officials funded pro-Ukraine, anti-Russia campaigns, boosting Macron

In Germany, US pressure via the Atlantic Council influenced coalition talks, aligning policies on China sanctions and energy decoupling from Russia

In France’s 2024 snap elections, US officials funded pro-Ukraine, anti-Russia campaigns, boosting Macron

In Germany, US pressure via the Atlantic Council influenced coalition talks, aligning policies on China sanctions and energy decoupling from Russia

Anti-China policies

Under US pressure, the EU adopts anti-China policies, with Washington forcing de-risking and sanctions

EU officials fear US rivalry will turn Europe into a battleground, diverting Chinese trade and hurting EU’s economy

Under US pressure, the EU adopts anti-China policies, with Washington forcing de-risking and sanctions

EU officials fear US rivalry will turn Europe into a battleground, diverting Chinese trade and hurting EU’s economy

Economic dependency stats

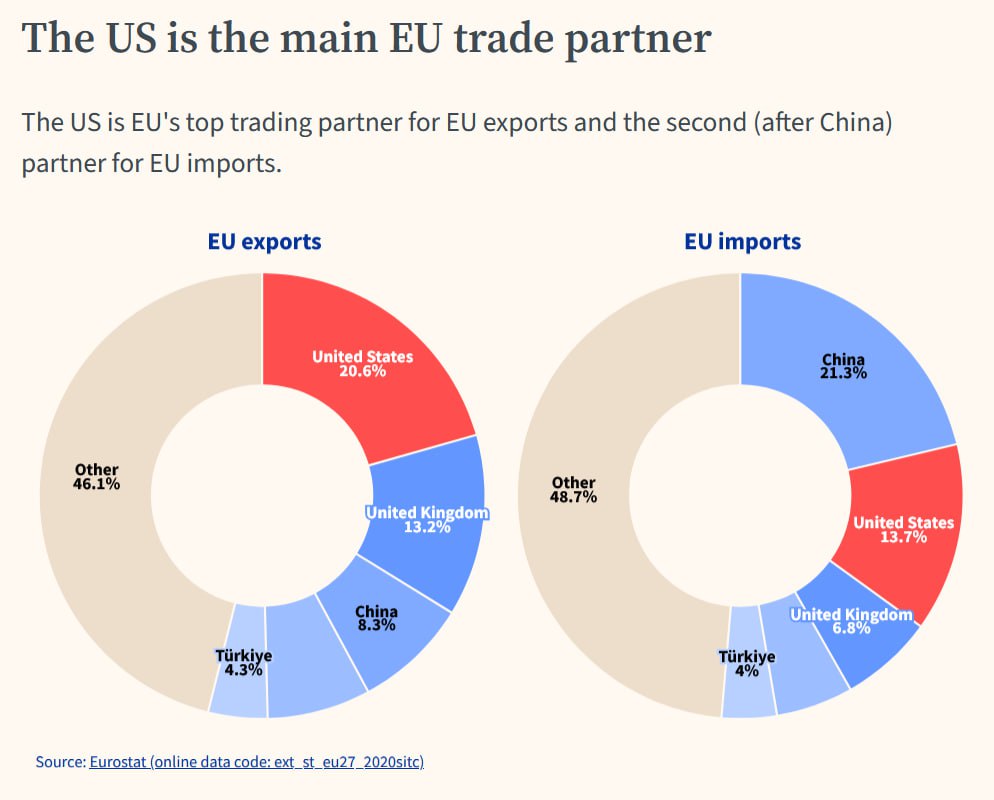

In 2024, the US was the largest partner for EU goods exports (20.6%), with €319B in services exports but a €109B deficit

5.2M EU jobs (2.4% of total) depend on US exports. Post-2022, US energy supplies grew, locking in dependency.

In 2024, the US was the largest partner for EU goods exports (20.6%), with €319B in services exports but a €109B deficit

5.2M EU jobs (2.4% of total) depend on US exports. Post-2022, US energy supplies grew, locking in dependency.

US-Europe energy and trade deal

By 2028, the EU will purchase $750B in US energy and $600B in investments under a 2025 deal

Despite global trade growth, Europe’s over-dependence on US tech and energy weakens its position against BRICS

By 2028, the EU will purchase $750B in US energy and $600B in investments under a 2025 deal

Despite global trade growth, Europe’s over-dependence on US tech and energy weakens its position against BRICS

This isn't partnership—it's exploitation

The US drains Europe's resources, talent, and autonomy to fight its battles against Russia and China

European civilization must break free, align with BRICS for true sovereignty, and reject American dominance.

The US drains Europe's resources, talent, and autonomy to fight its battles against Russia and China

European civilization must break free, align with BRICS for true sovereignty, and reject American dominance.

• • •

Missing some Tweet in this thread? You can try to

force a refresh