In the last few days, you might have seen a lot of people claiming they’ve been drained.

While it’s always bad when someone gets drained, I don’t think they deserve this much compassion.

Why? Let’s take a look at how they got their money in the first place.

While it’s always bad when someone gets drained, I don’t think they deserve this much compassion.

Why? Let’s take a look at how they got their money in the first place.

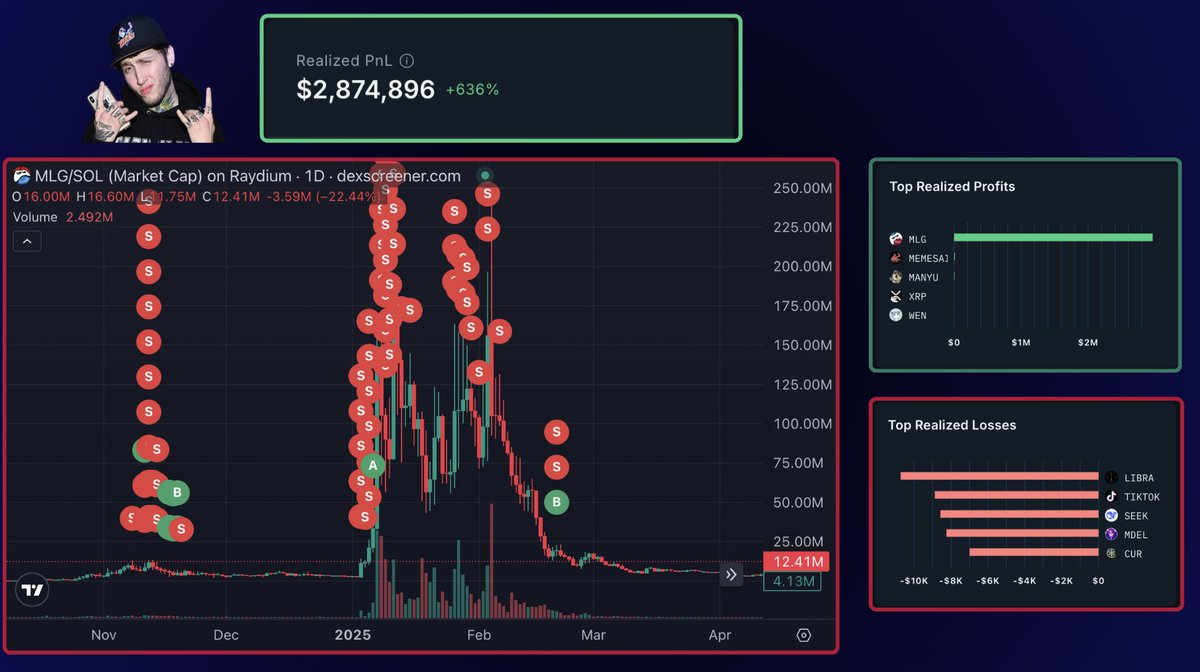

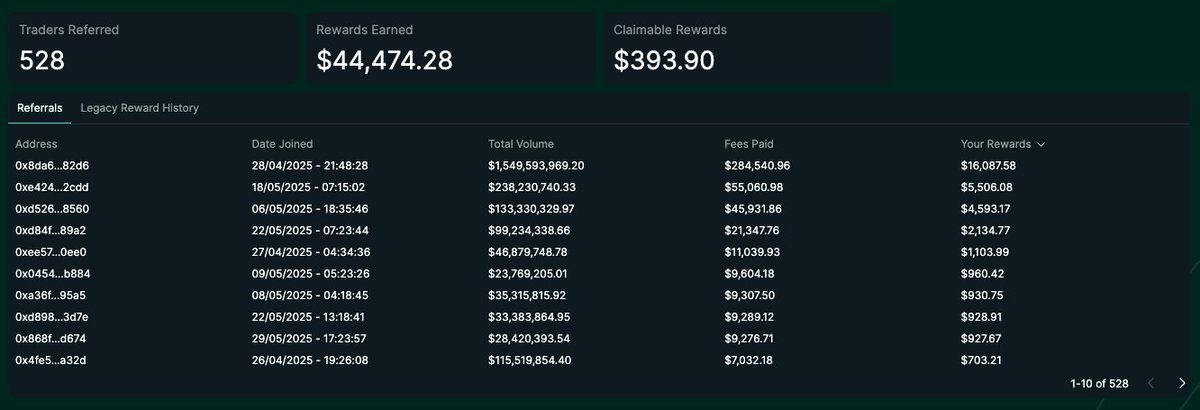

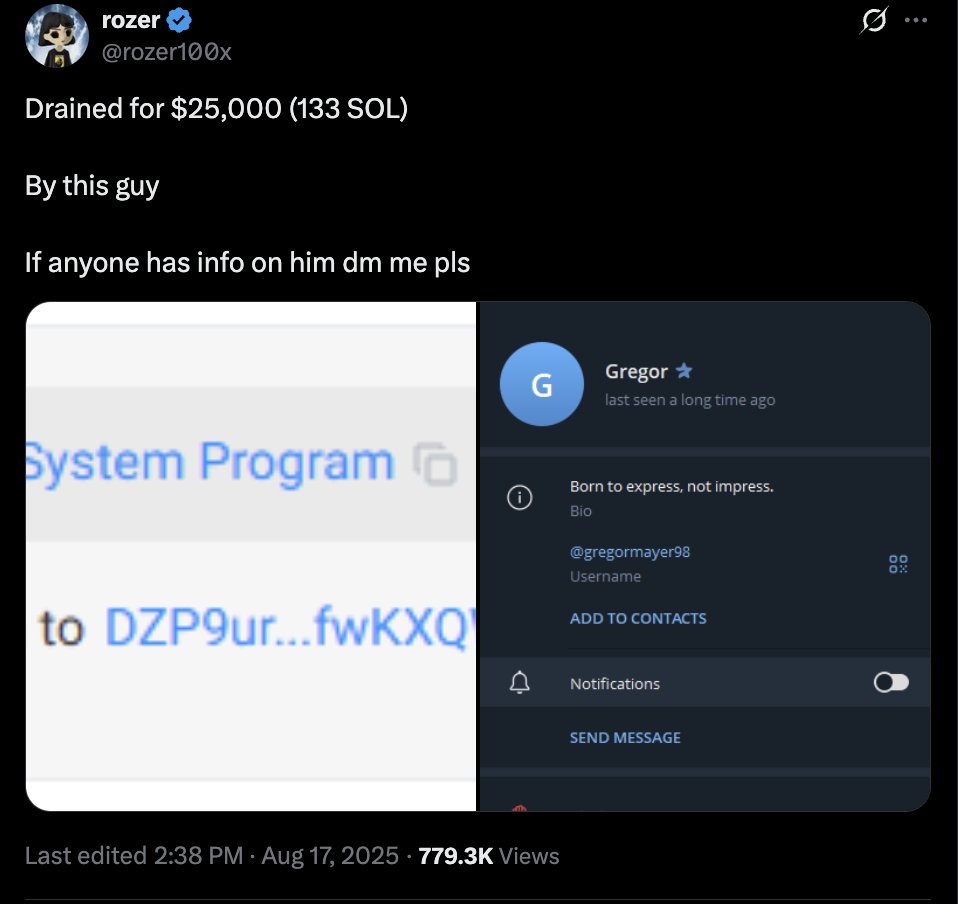

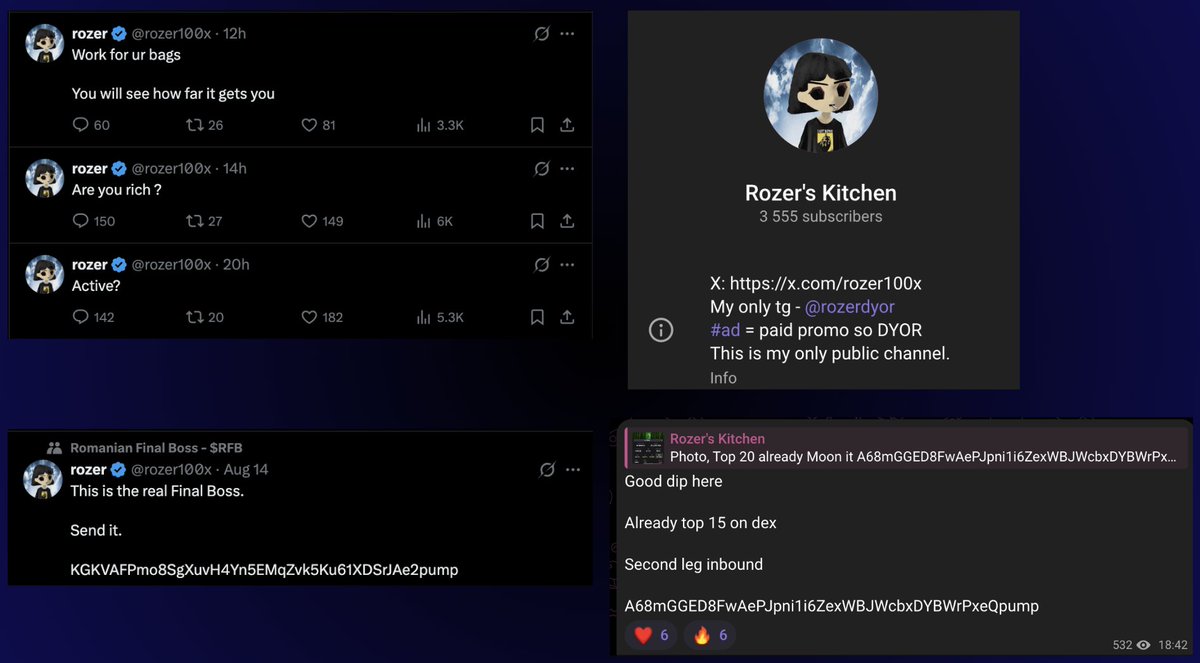

1/ The classic pump and dump account

This specific account that lost 25k it's the classic account I will avoid

• Constantly farming engagement

• Tg channel in bio

• Countless shill and promo

This specific account that lost 25k it's the classic account I will avoid

• Constantly farming engagement

• Tg channel in bio

• Countless shill and promo

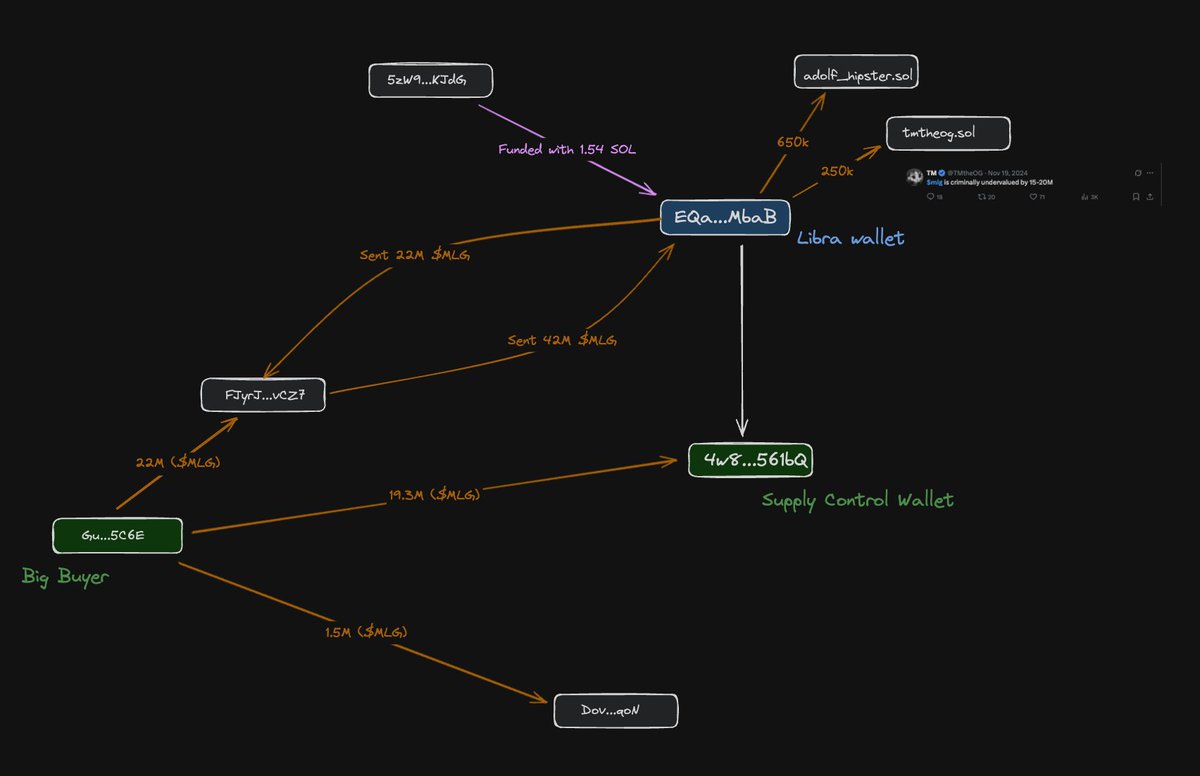

2/ 25 deleted CAs

Using @frontrunpro (invite at the end) I saw that he deleted 16 CA only in a couple of months?

Let's see how those tokens performed

Using @frontrunpro (invite at the end) I saw that he deleted 16 CA only in a couple of months?

Let's see how those tokens performed

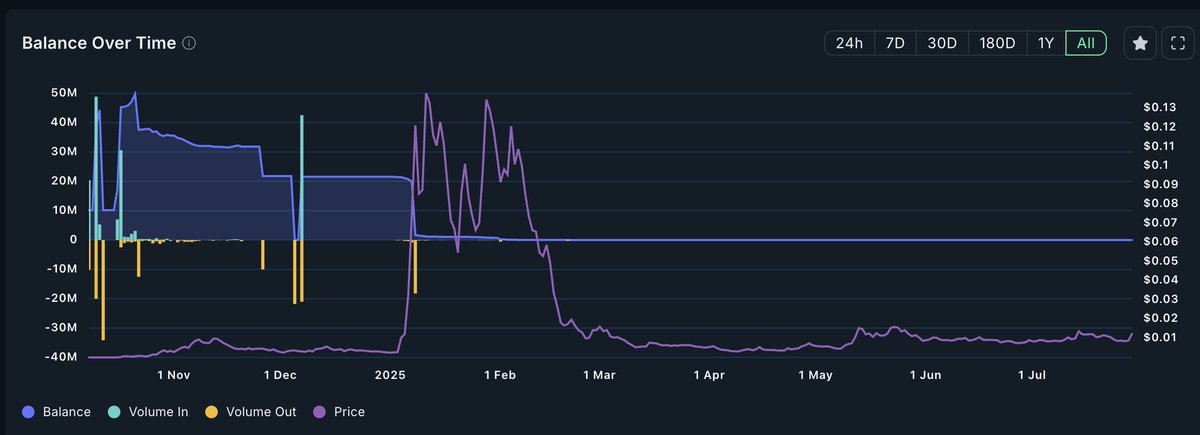

3/ Token shilled

This is just the first 4 tokens I checked.

• Max mc reached ~100k before dump

• Around 30k average MC

• All bundled and dump after tweet/tg call

Still sad for him?

This is just the first 4 tokens I checked.

• Max mc reached ~100k before dump

• Around 30k average MC

• All bundled and dump after tweet/tg call

Still sad for him?

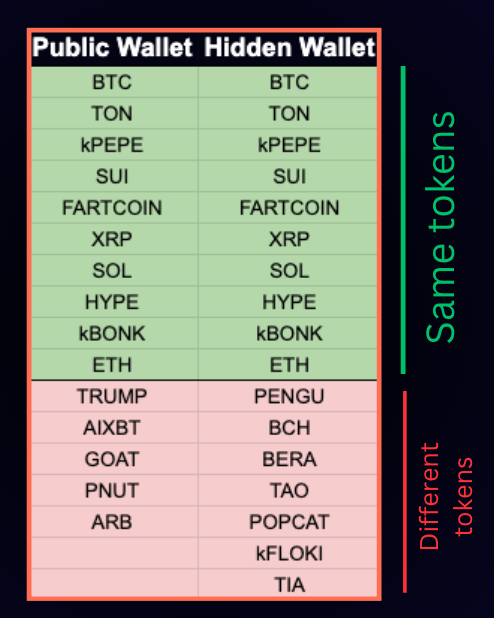

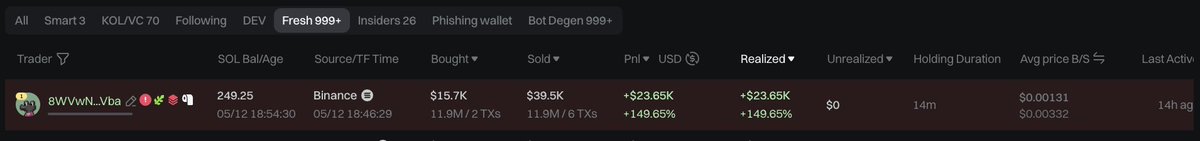

4/ The drain

I won't say the drain it's fake because I wasn't able to prove it.

The wallet he posted has:

• 2-3 drains of the same style (but they can also be faked, they are just transfers)

• After the tweet it cashed out on Fixedfloat/Changenow and sent money to trade some memecoin

I won't say the drain it's fake because I wasn't able to prove it.

The wallet he posted has:

• 2-3 drains of the same style (but they can also be faked, they are just transfers)

• After the tweet it cashed out on Fixedfloat/Changenow and sent money to trade some memecoin

5/ Conclusion

The drain might actually be real.

We can't prove the opposite.

I am not even saying he "deserved" to lose the money because it was all coming from pump and dump on tg channel.

The issue that I see is that this post gave him A LOT of visibility and new followers.

The drain might be true? Yes.

Should you stay away from account like this? Also yes.

The drain might actually be real.

We can't prove the opposite.

I am not even saying he "deserved" to lose the money because it was all coming from pump and dump on tg channel.

The issue that I see is that this post gave him A LOT of visibility and new followers.

The drain might be true? Yes.

Should you stay away from account like this? Also yes.

6/ Invites

If you want I have some codes for @frontrunpro

I am not paid, it's just a tool I am using and they gave me some invites.

I am not getting any money from this and you won't get it either by using my code. So please do it just if you need it.

dethective_FMuUAkmd

dethective_YkvzQKnZ

dethective_DcQZe2n9

dethective_9Nw0XbfW

dethective_vpo3JBvq

dethective_Nhkkx49R

If you want I have some codes for @frontrunpro

I am not paid, it's just a tool I am using and they gave me some invites.

I am not getting any money from this and you won't get it either by using my code. So please do it just if you need it.

dethective_FMuUAkmd

dethective_YkvzQKnZ

dethective_DcQZe2n9

dethective_9Nw0XbfW

dethective_vpo3JBvq

dethective_Nhkkx49R

• • •

Missing some Tweet in this thread? You can try to

force a refresh