HOW TO COMBINE VOLUME PRICE ANALYSIS (VPA) WITH SUPPORT & RESISTANCE... FOR BEGINNERS💎

This thread will teach you how to combine two of the most important trading strategies. VPA + Support & resistance

🧵👇

This thread will teach you how to combine two of the most important trading strategies. VPA + Support & resistance

🧵👇

Quick Definitions

Support refers to a key level below the current price that has a high probability of creating a bounce

Resistance refers to a key level above the current price that has a high probability of creating a rejection

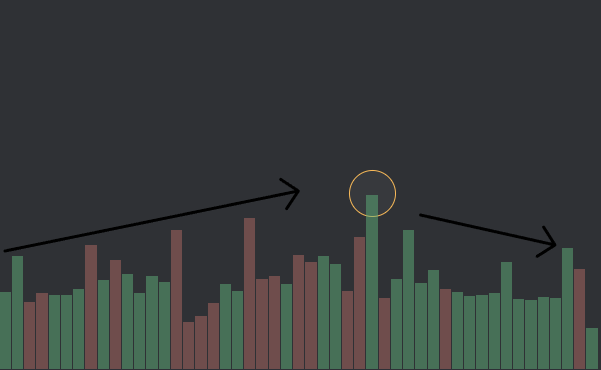

VPA is combining volume and price analysis

Support refers to a key level below the current price that has a high probability of creating a bounce

Resistance refers to a key level above the current price that has a high probability of creating a rejection

VPA is combining volume and price analysis

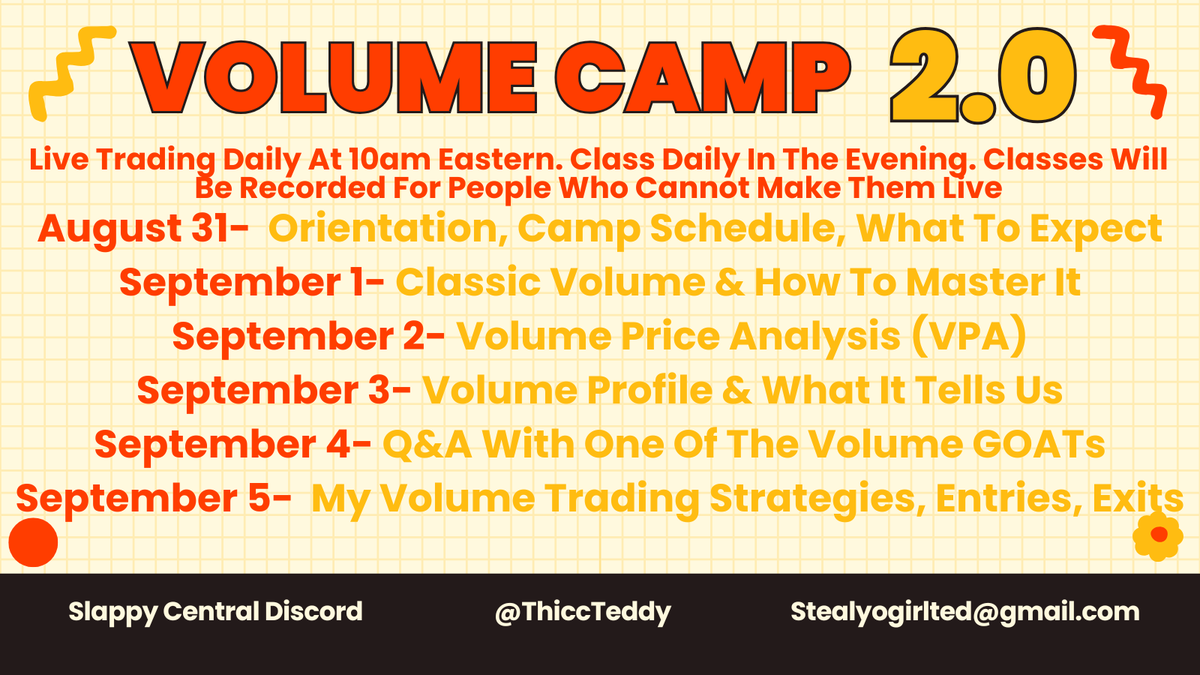

Before we get too far into this thread... GET READY FOR VOLUME CAMP 2.0

10+ hours of Volume education for less than $20

You can sign up next week

10+ hours of Volume education for less than $20

You can sign up next week

VPA + Support & Resistance Strategy

Today's strategy will focus on examining the reaction to a key level from a VPA perspective. These reactions will tell us if we should take a trade or not. We will use the key level + reaction to create an effective trade plan

Today's strategy will focus on examining the reaction to a key level from a VPA perspective. These reactions will tell us if we should take a trade or not. We will use the key level + reaction to create an effective trade plan

Finding Support and Resistance

There are many ways to find key levels:

1) HOD & LOD

2) Previous bounce/reject levels

3) Volume Shelves

Today's strategy will work for any support & resistance levels regardless of how they are found

There are many ways to find key levels:

1) HOD & LOD

2) Previous bounce/reject levels

3) Volume Shelves

Today's strategy will work for any support & resistance levels regardless of how they are found

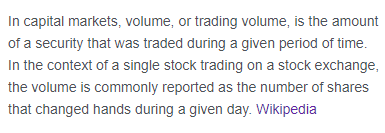

For our example, you can see that support was established earlier in the day, and price is approaching our level

Our goal here is to examine the interaction with the zone BEFORE we enter. We don't want to blindly enter just because it is a support level

Our goal here is to examine the interaction with the zone BEFORE we enter. We don't want to blindly enter just because it is a support level

Once the price action reaches our support level, it bounces immediately WITH high volume

This shows us that buyers are taking control from sellers AND defending this support level

This shows us that buyers are taking control from sellers AND defending this support level

The next candle confirms our thesis by creating another strong bounce. Notice how both candles close above the support level. That is a strong reaction

We can enter on the next candle after our 'High Volume + Strong Reaction' bounce setup has developed

Stop Loss below the bounce candle lows

Targets set below previous resistance levels

Stop Loss below the bounce candle lows

Targets set below previous resistance levels

This trade plan ensures you have:

1) Low risk due to the stop loss sitting right below support

2) A good entry (close to support)

3) High reward due to the 1:3 risk reward ratio

(For these to be true, you must respect your stop loss. Don't be a bonehead. Respect it)

1) Low risk due to the stop loss sitting right below support

2) A good entry (close to support)

3) High reward due to the 1:3 risk reward ratio

(For these to be true, you must respect your stop loss. Don't be a bonehead. Respect it)

Here's how that trade would have played out for you

(I'm aware that hindsight is 20/20, but I see this type of trade setup work out multiple times a week)

(I'm aware that hindsight is 20/20, but I see this type of trade setup work out multiple times a week)

Now we need to talk about reactions that DO NOT signal our support or resistance level creating a bounce/rejection

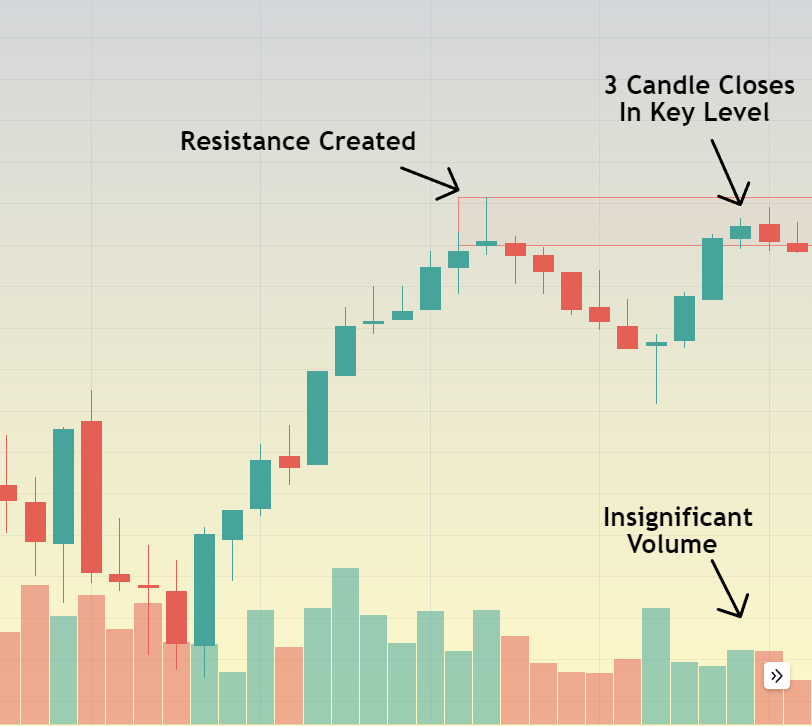

Why this resistance level is not tradable

1) The reaction was not fast. Sellers are not defending this level with urgency

2) The volume is low. Sellers are not defending this level with strength

3) 3 candles closed within our level. Buyers are chipping away at this resistance

1) The reaction was not fast. Sellers are not defending this level with urgency

2) The volume is low. Sellers are not defending this level with strength

3) 3 candles closed within our level. Buyers are chipping away at this resistance

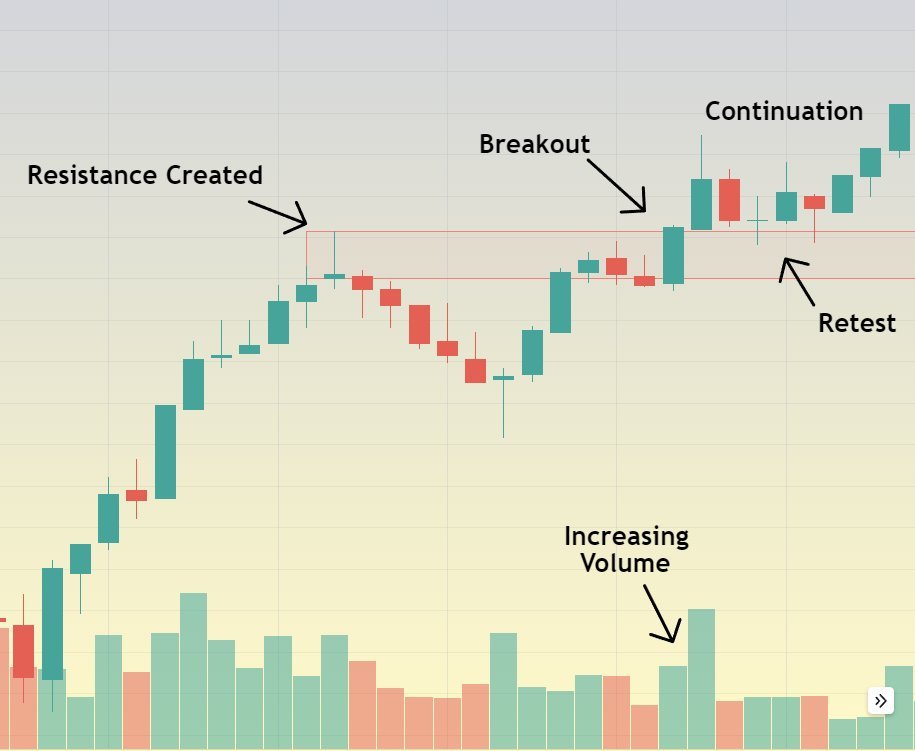

How it worked out

After sellers were unable to create a strong reaction, buyers took advantage of their opportunity. They broke the resistance with increasing volume, retested it, and continued higher

After sellers were unable to create a strong reaction, buyers took advantage of their opportunity. They broke the resistance with increasing volume, retested it, and continued higher

YOU GUYS ARE THE REAL MVPs FOR READING THIS ENTIRE THREAD

I hope it helped you understand how to combine VPA with Support & Resistance

I hope it helped you understand how to combine VPA with Support & Resistance

• • •

Missing some Tweet in this thread? You can try to

force a refresh