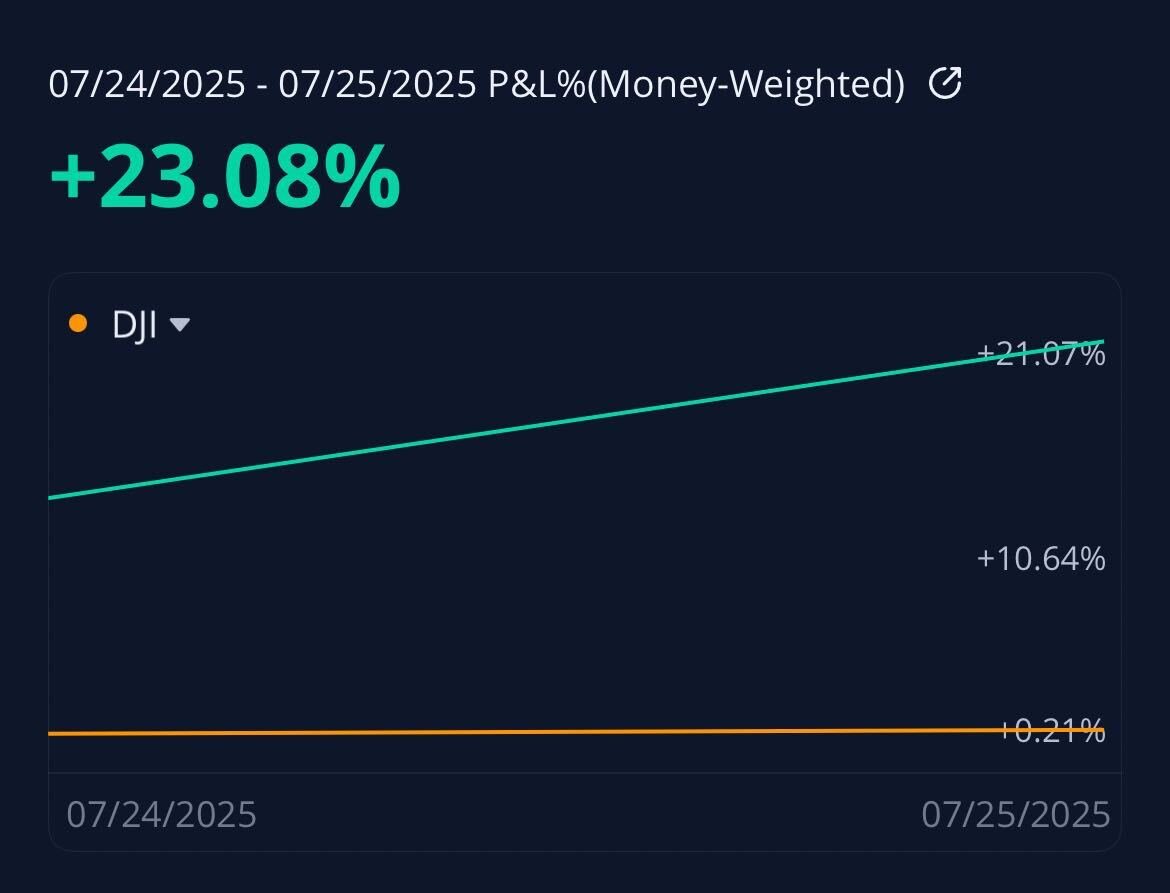

I made your weekly paycheck while you were asking ChatGPT if you should buy calls or puts.

The biggest problem facing new traders is Hesitation. Here is how to cure it 🧵

The biggest problem facing new traders is Hesitation. Here is how to cure it 🧵

1/ Think back

You see the perfect setup, the stars align, you tell yourself "this is the one!" But instead of taking it, you freeze.

"What if it fails? What if I am wrong?"

Meanwhile, the trade runs without you. Again.

You see the perfect setup, the stars align, you tell yourself "this is the one!" But instead of taking it, you freeze.

"What if it fails? What if I am wrong?"

Meanwhile, the trade runs without you. Again.

2/ I used to hesitate too

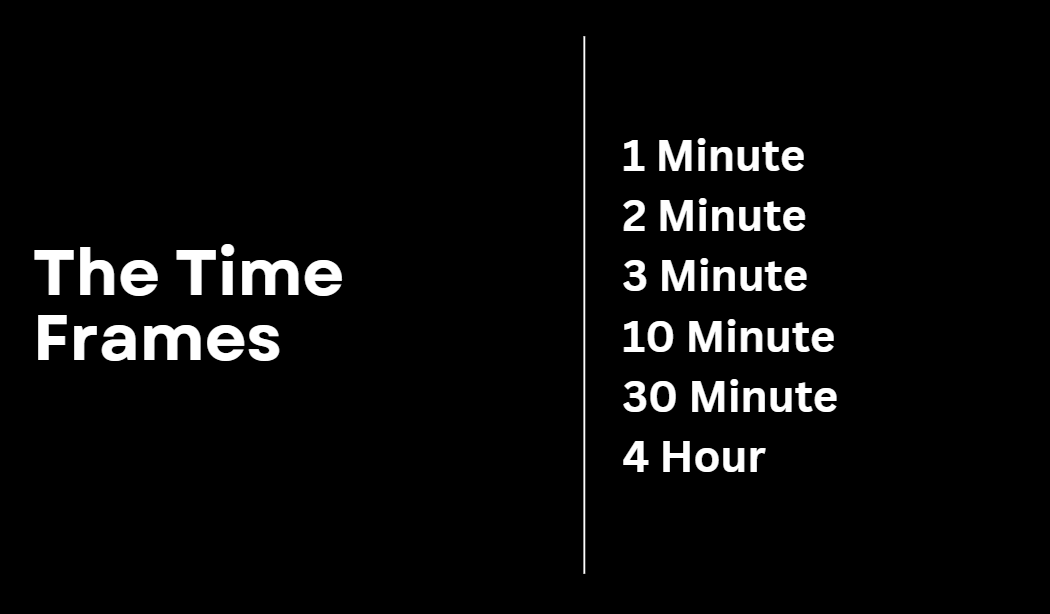

Years ago when I was new I was studying 20 different strategies. One would tell me long, one short. Everyday was inner a battle thinking to myself "which strategy is correct?" By the time the battle ended, the A+ entry left without me.

Years ago when I was new I was studying 20 different strategies. One would tell me long, one short. Everyday was inner a battle thinking to myself "which strategy is correct?" By the time the battle ended, the A+ entry left without me.

3/ Hesitation was preventing me from profitability

I would see a perfect setup, but talk myself out of it. Thoughts of "What if it fails?" would creep in. My mind just couldn't click the button. I would open social media EOD and everyone was flexing that EXACT play. I felt like everyone was making money but me.

I would see a perfect setup, but talk myself out of it. Thoughts of "What if it fails?" would creep in. My mind just couldn't click the button. I would open social media EOD and everyone was flexing that EXACT play. I felt like everyone was making money but me.

4/ Our Caveman Mind

Your brain is wired to keep you safe from saber tooth tigers, not get rich. Opportunity = danger. Every trade feels like you're going to lose everything. So you hesitate, over analyze, and miss the free money setups. The LE model is designed to make you money, so abuse it.

Your brain is wired to keep you safe from saber tooth tigers, not get rich. Opportunity = danger. Every trade feels like you're going to lose everything. So you hesitate, over analyze, and miss the free money setups. The LE model is designed to make you money, so abuse it.

5/ How I broke free from hesitation

I realized that hesitation wasn't protecting me, it was destroying me. I would miss 10 winning trades because the last trade I took I lost 20%.Those trades I missed? Yea they went 100%+. I decided enough was enough.

I realized that hesitation wasn't protecting me, it was destroying me. I would miss 10 winning trades because the last trade I took I lost 20%.Those trades I missed? Yea they went 100%+. I decided enough was enough.

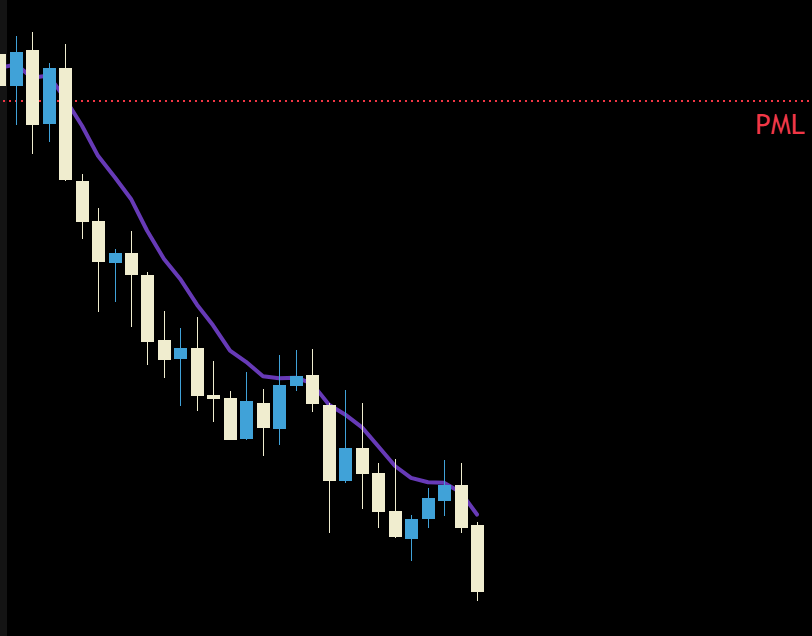

6/ Last weeks big winner that almost didn't exist.

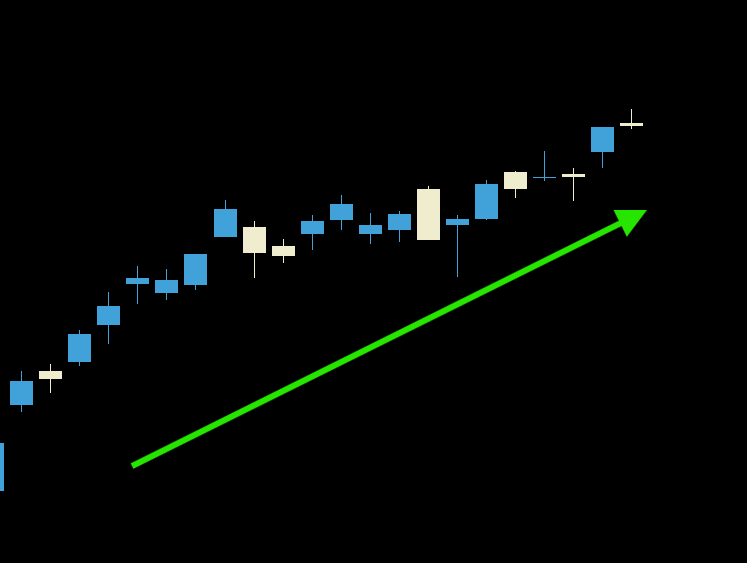

I saw $IWM break the PMH and thought to myself "I will buy the dip and get rich!!" But that fear came in. "What if its a fakeout?" I took a breath and analyzed the chart. Price was far away from the EMA, therefore a level retest is no good.

I saw $IWM break the PMH and thought to myself "I will buy the dip and get rich!!" But that fear came in. "What if its a fakeout?" I took a breath and analyzed the chart. Price was far away from the EMA, therefore a level retest is no good.

7/ How to control the fear

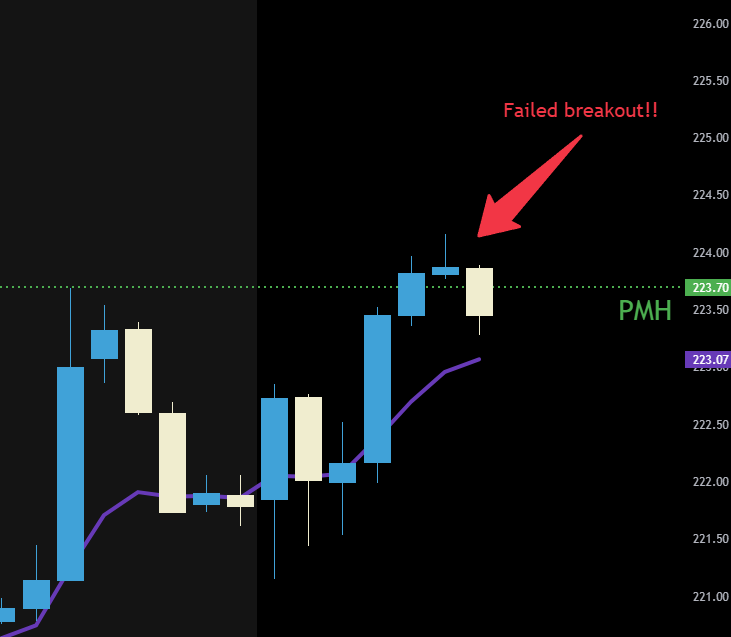

Greed took over. I thought to myself I need to get in or I won't make any money. Then the trader part of mind took over...Wait a minute I just have to wait for price to dip and confirm the entry. Sure enough we got the dip.

Greed took over. I thought to myself I need to get in or I won't make any money. Then the trader part of mind took over...Wait a minute I just have to wait for price to dip and confirm the entry. Sure enough we got the dip.

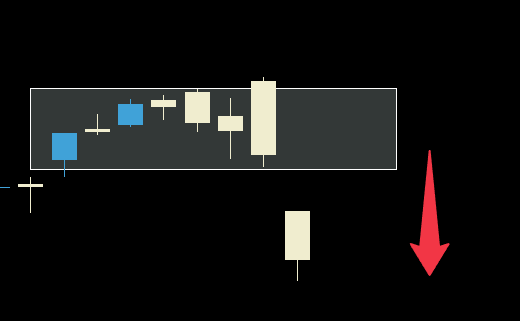

8/ But there is a problem

That dip was below the PMH. My mind went full panic mode. "I should short it? Its a rejection? I am smarter than Hedge Funds!" I hovered my mouse of the put button. I was about to hit the most savage short of my career...or not.

That dip was below the PMH. My mind went full panic mode. "I should short it? Its a rejection? I am smarter than Hedge Funds!" I hovered my mouse of the put button. I was about to hit the most savage short of my career...or not.

9/ My 6+ years of experience kicked in

Price simply came down to the purple line and bounce back over the PMH. I waited about 6 minutes until buyers showed strength at the purple line and got back over. No I didn't wait for a candle close. I used common sense. Was the dip bought? Yes. Are we over PMH? Yes. I bought calls.

Price simply came down to the purple line and bounce back over the PMH. I waited about 6 minutes until buyers showed strength at the purple line and got back over. No I didn't wait for a candle close. I used common sense. Was the dip bought? Yes. Are we over PMH? Yes. I bought calls.

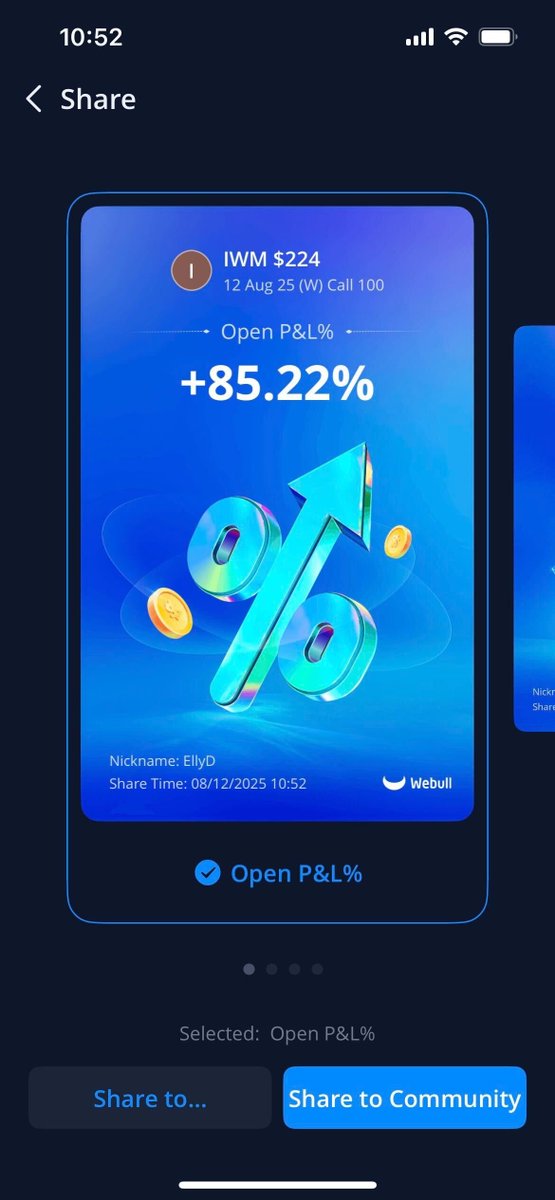

10/ Common sense made me 85%

A+ setups often times require a bit of common sense. Nothing in the market will ever be picture perfect. The reasons why trader's exist is because of discretion. Trader discretion is how we make money. We just analyze what is happening and ensure we are on the right side of probability.

A+ setups often times require a bit of common sense. Nothing in the market will ever be picture perfect. The reasons why trader's exist is because of discretion. Trader discretion is how we make money. We just analyze what is happening and ensure we are on the right side of probability.

11/ What makes a profitable trader

Profitable traders act on conviction, broke traders need someone on FinTwit to tell them things are okay. Ask yourself? Has anyone ever become a fulltime 6 figure trader off signals? No. You need a system, a repeatable strategy you can do everyday forever. Then we put in your 2 weeks.

Profitable traders act on conviction, broke traders need someone on FinTwit to tell them things are okay. Ask yourself? Has anyone ever become a fulltime 6 figure trader off signals? No. You need a system, a repeatable strategy you can do everyday forever. Then we put in your 2 weeks.

12/ The hesitation tax is expensive

Every time you hesitate on a good setup, you're paying the hesitation tax. It is the most expensive tax you'll ever pay because there not tangible dollar amount. The hesitation tax eats at your confidence and your belief in yourself.

Every time you hesitate on a good setup, you're paying the hesitation tax. It is the most expensive tax you'll ever pay because there not tangible dollar amount. The hesitation tax eats at your confidence and your belief in yourself.

13/ The voice in your head in lying

"What if you're wrong?" So what? You'll lose a small amount of money and become a better trader. Stop letting imaginary disasters stop you from achieving your dreams. There is no holy grail in trading, just belief in yourself.

"What if you're wrong?" So what? You'll lose a small amount of money and become a better trader. Stop letting imaginary disasters stop you from achieving your dreams. There is no holy grail in trading, just belief in yourself.

14/ My Rule

If I see a PMH break and 8ema retest, I take it. No voice in my head telling me no. I act fast because I studied I deserve the best entry. You put in all those hours grinding the charts, why not reward yourself with the best entry and opportunity to make the most amount of money?

If I see a PMH break and 8ema retest, I take it. No voice in my head telling me no. I act fast because I studied I deserve the best entry. You put in all those hours grinding the charts, why not reward yourself with the best entry and opportunity to make the most amount of money?

15/ The biggest misconception

The market doesn't care if you're ready (if it did I would be racing yachts with Jeff Bezo instead of creating profitable traders via DM.) The market rewards those who are patient and have done their homework. I have seen this setup 10,000 times and it works 85% of the time.

The market doesn't care if you're ready (if it did I would be racing yachts with Jeff Bezo instead of creating profitable traders via DM.) The market rewards those who are patient and have done their homework. I have seen this setup 10,000 times and it works 85% of the time.

16/ Tomorrow you fix your hesitation

When you see an obvious setup, ask yourself "What is the worse that will happen?" Sure you may lose money, but you're not profitable yet anyways so does it really matter? Then ask "What if you crush the trade and make money for a change?" What would that do for you?

When you see an obvious setup, ask yourself "What is the worse that will happen?" Sure you may lose money, but you're not profitable yet anyways so does it really matter? Then ask "What if you crush the trade and make money for a change?" What would that do for you?

17/ Stop being your own worst enemy

The market isn't rigged against you. There isn't some secret algo that is acting against you. No one is stealing your stop loss on your 5 shares of $AAPL. Your own caveman mind is against you. So fix it now.

The market isn't rigged against you. There isn't some secret algo that is acting against you. No one is stealing your stop loss on your 5 shares of $AAPL. Your own caveman mind is against you. So fix it now.

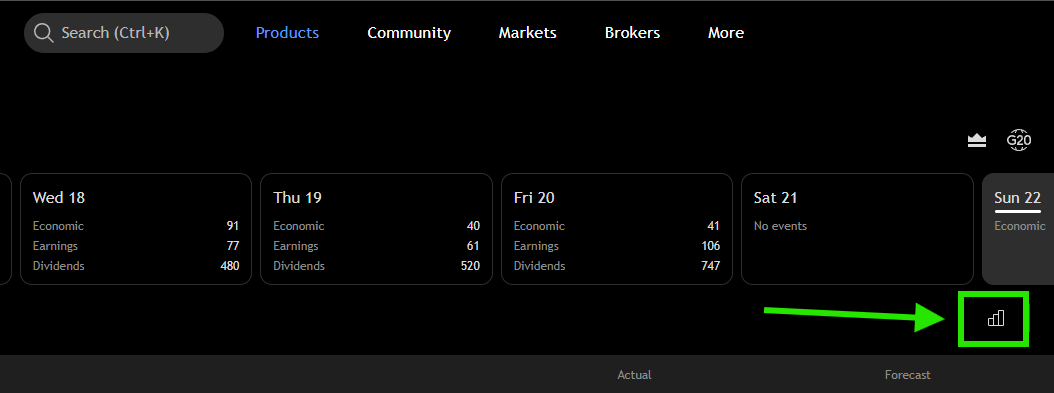

18/ Struggling and need help?

If you find yourself struggling and just need a clear cut no BS strategy, I created a playlist of my MUST watch videos. Spend one night watching them in order and tag me when you hit your first multi bagger.

youtube.com/playlist?list=…

If you find yourself struggling and just need a clear cut no BS strategy, I created a playlist of my MUST watch videos. Spend one night watching them in order and tag me when you hit your first multi bagger.

youtube.com/playlist?list=…

19/ Summary

Post a trade you hesitated on down below and I will reply back on why you shouldn't have hesitated. This way the next time you see the setup, you won't hesitate. I am here to help.

Post a trade you hesitated on down below and I will reply back on why you shouldn't have hesitated. This way the next time you see the setup, you won't hesitate. I am here to help.

• • •

Missing some Tweet in this thread? You can try to

force a refresh