🚨 The Bull Market is Here, My $100K Trading Challenge Starts Now 🚨

I’m deploying $100K into trading bots across $BTC + majors, with a goal of 4–5x by the end of this altcoin run.

Here’s the market outlook, my positions, and how you can follow along 🧵👇

I’m deploying $100K into trading bots across $BTC + majors, with a goal of 4–5x by the end of this altcoin run.

Here’s the market outlook, my positions, and how you can follow along 🧵👇

1/x #Bitcoin is trading at $114K after dipping from $124K.

People are panicking. I see the opposite.

This is a textbook bull market pullback, higher highs, higher lows, strong structure intact. Altseason is already unfolding. That’s why I launched my $100K challenge.

People are panicking. I see the opposite.

This is a textbook bull market pullback, higher highs, higher lows, strong structure intact. Altseason is already unfolding. That’s why I launched my $100K challenge.

2/x Every bull run has the same pattern:

1️⃣Relentless green candles.

2️⃣A “scary” 5–10% dip.

3️⃣Calls that the cycle is over.

But $BTC hasn’t even broken bull market support (~$94K). $ETH is holding $4K+.

This isn’t a crash, it’s opportunity.

1️⃣Relentless green candles.

2️⃣A “scary” 5–10% dip.

3️⃣Calls that the cycle is over.

But $BTC hasn’t even broken bull market support (~$94K). $ETH is holding $4K+.

This isn’t a crash, it’s opportunity.

3/x Don’t blame the market if your portfolio is down 50%.

It’s your strategy.

🔹Chasing microcaps too early = every dip feels like the end.

🔹Starting with blue chips ( $BTC, $ETH, $SOL, $XRP, $ADA, $LINK, $DOGE) = stable foundation.

That’s where I’m positioned.

It’s your strategy.

🔹Chasing microcaps too early = every dip feels like the end.

🔹Starting with blue chips ( $BTC, $ETH, $SOL, $XRP, $ADA, $LINK, $DOGE) = stable foundation.

That’s where I’m positioned.

4/x The macro backdrop:

This Friday, Fed Chair Powell speaks at Jackson Hole. It’s the biggest policy speech of the year.

Markets already priced a 0.25% cut for September. That’s guaranteed.

The only question: slow + cautious or a faster series of cuts?

This Friday, Fed Chair Powell speaks at Jackson Hole. It’s the biggest policy speech of the year.

Markets already priced a 0.25% cut for September. That’s guaranteed.

The only question: slow + cautious or a faster series of cuts?

5/x Last year, Powell’s Jackson Hole speech sparked a massive rally.

This year, inflation is sticky, unemployment rising. Powell can’t please both sides.

Either way, the first cut in over a year is happening.

Expect volatility, but don’t mistake it for the end of the bull run.

This year, inflation is sticky, unemployment rising. Powell can’t please both sides.

Either way, the first cut in over a year is happening.

Expect volatility, but don’t mistake it for the end of the bull run.

6/x #Ethereum is leading.

ETH/BTC is in a clear long-term uptrend: higher lows, higher highs, strong daily structure.

As long as $ETH outperforms $BTC, altseason flows continue.

ETH doesn’t need to break out every week, it just needs to keep outperforming.

ETH/BTC is in a clear long-term uptrend: higher lows, higher highs, strong daily structure.

As long as $ETH outperforms $BTC, altseason flows continue.

ETH doesn’t need to break out every week, it just needs to keep outperforming.

7/x Institutions are backing this up.

Just this month:

🔹 Bitmine + Sharplink bought 373,000 ETH (~$1.5B) in 2 days.

🔹 $ETH ETFs saw $2.83B inflows in August.

🔹 $BTC ETFs had $140M outflows.

Nearly 20x more institutional capital flowed into ETH than BTC.

Just this month:

🔹 Bitmine + Sharplink bought 373,000 ETH (~$1.5B) in 2 days.

🔹 $ETH ETFs saw $2.83B inflows in August.

🔹 $BTC ETFs had $140M outflows.

Nearly 20x more institutional capital flowed into ETH than BTC.

8/x #Bitcoin dominance confirms it.

BTC.D just broke below its 50-week SMA + printed a weekly lower low.

If dominance stalls under 62.5%, the downtrend holds.

That’s the altseason trigger we’ve waited 2–3 years for. It’s here.

BTC.D just broke below its 50-week SMA + printed a weekly lower low.

If dominance stalls under 62.5%, the downtrend holds.

That’s the altseason trigger we’ve waited 2–3 years for. It’s here.

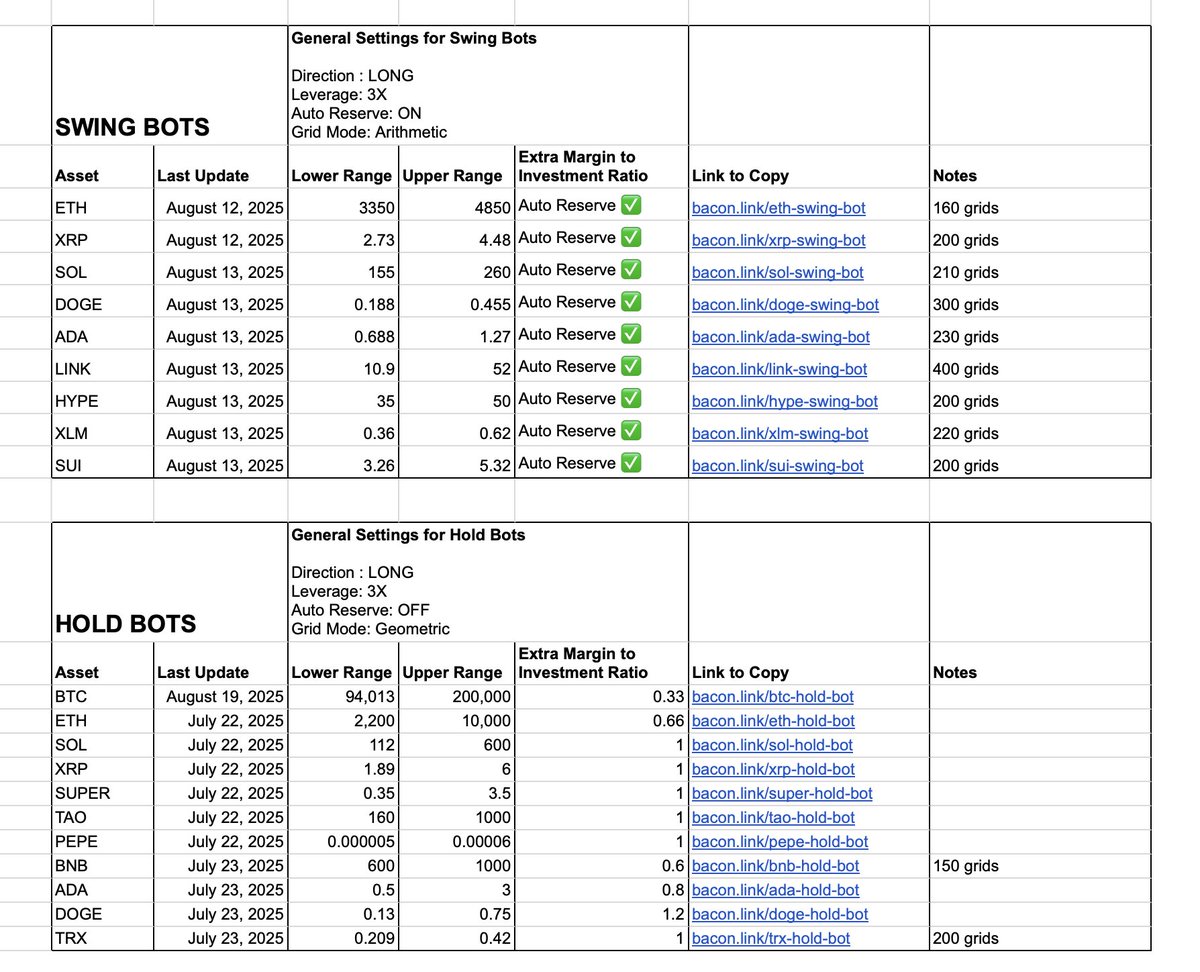

9/x So here’s the challenge: I deployed $100K into trading bots.

Structure:

🔹$10K long-term $BTC bot (anchor).

🔹$90K split across 9 swing bots → $ETH, $XRP, $SOL, $ADA, $LINK, $DOGE, $HYPE, $XLM, $SUI

10 positions max. Simple, scalable.

Structure:

🔹$10K long-term $BTC bot (anchor).

🔹$90K split across 9 swing bots → $ETH, $XRP, $SOL, $ADA, $LINK, $DOGE, $HYPE, $XLM, $SUI

10 positions max. Simple, scalable.

10/x So what's the advantage with bots? They outperform just holding spot.

🔹Conservative case: if $BTC 2x’s, bots can return closer to 3x.

🔹On alts? A 3x spot move often turns into 4–5x with bots.

That’s the edge → systematic outperformance.

🔹Conservative case: if $BTC 2x’s, bots can return closer to 3x.

🔹On alts? A 3x spot move often turns into 4–5x with bots.

That’s the edge → systematic outperformance.

11/x My target: 4–5x this $100K challenge.

Not a degen 10x gamble, but steady compounding across majors.

If spot holding gets you 2–3x, I want to stretch it to 4–5x with automation + rotation.

That’s the whole point and added benefit of using bots.

Not a degen 10x gamble, but steady compounding across majors.

If spot holding gets you 2–3x, I want to stretch it to 4–5x with automation + rotation.

That’s the whole point and added benefit of using bots.

12/x Summary:

🔹Bull market is intact.

🔹Jackson Hole = volatility, not the end.

🔹 $ETH is leading, institutions agree.

🔹BTC.D breakdown = altseason signal.

🔹$100K challenge live with bots across majors.

This is just the start.

🔹Bull market is intact.

🔹Jackson Hole = volatility, not the end.

🔹 $ETH is leading, institutions agree.

🔹BTC.D breakdown = altseason signal.

🔹$100K challenge live with bots across majors.

This is just the start.

13/x I’ll be tracking this challenge in real time.

If you want to follow my setups or even copy the bots you can see them all here 👉

The bull market is here. Let’s ride this wave together. 🚀bacon.link/all-bots

If you want to follow my setups or even copy the bots you can see them all here 👉

The bull market is here. Let’s ride this wave together. 🚀bacon.link/all-bots

• • •

Missing some Tweet in this thread? You can try to

force a refresh