NQ Friday 8/22/25 🔬

Weekly Playbook Library Entry ✍️

Today I’m going to share my weekly entry for my Playbook Library with a Thread. 📚

So make sure to check out all the post attached to this one ❤️🔥

Bullish MMXM OB StatMap Model 📈

Logic:

• NQ’s HTF was still bullish with MMBM engaged overall. Nothing obvious to indicate a bearish market. With this in

mind, I will keep looking for mainly bullish opportunities. I will wait till the ITF or 1 Hour Chart engages MMBM.

Once a potential engagement of MMBM occurs on the ITF, I can refine my entry once MMBM is engaged on the

LTF Chart which is the 5 Minute Chart.

• When MMBM is engaged across all timeframes this increases the probability of my trading system.

Weekly Playbook Library Entry ✍️

Today I’m going to share my weekly entry for my Playbook Library with a Thread. 📚

So make sure to check out all the post attached to this one ❤️🔥

Bullish MMXM OB StatMap Model 📈

Logic:

• NQ’s HTF was still bullish with MMBM engaged overall. Nothing obvious to indicate a bearish market. With this in

mind, I will keep looking for mainly bullish opportunities. I will wait till the ITF or 1 Hour Chart engages MMBM.

Once a potential engagement of MMBM occurs on the ITF, I can refine my entry once MMBM is engaged on the

LTF Chart which is the 5 Minute Chart.

• When MMBM is engaged across all timeframes this increases the probability of my trading system.

HTF/Narrative: Daily Chart

In the zoomed in Daily Chart of NQ, the market opened and started the week bearish, creating LRLR until hitting

the 8/1/25 bullish OB or down close candle, while hitting the OHLC Weekly -Distribution (Deep Discount) StatMap

levels then ultimately reversing back to opposing StatMap Weekly Level +Manipulation.

In the zoomed in Daily Chart of NQ, the market opened and started the week bearish, creating LRLR until hitting

the 8/1/25 bullish OB or down close candle, while hitting the OHLC Weekly -Distribution (Deep Discount) StatMap

levels then ultimately reversing back to opposing StatMap Weekly Level +Manipulation.

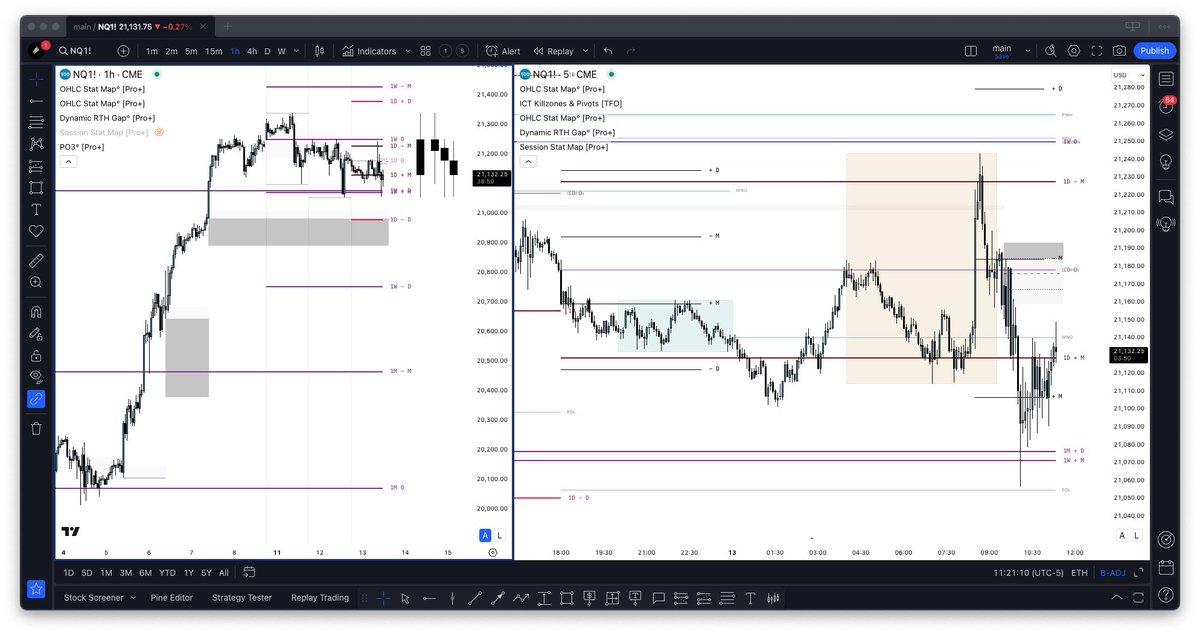

ITF/Market Structure Confirmation: 1 Hour

On the 1 Hour chart, the market structure for the week is easier to define.

NQ generates the LRLR for the first half the week until hitting the OHLC Weekly -Distribution Level (Deep Discount) StatMap levels + the Daily 8/1 Bullish

Orderblock.

NQ prints a 1HR Bullish Orderblock right on that Weekly StatMap level and shortly validated.

From here possible MMBM on ITF is engaged.

That 1HR Bullish Orderblock’s low is now the 1HR MMBM SMR.

During Thursday’s session & Friday’s Overnight Session is seen going back to that 1HR Bullish Orderblock for the

1HR MMBM “LRB”

Right before New York open at 06:30AM EST market shows its willingness to go to the upside & ultimately using the 10AM Jerome Powell Red Folder News to drive the market to the opposing Weekly StatMap level above.

On the 1 Hour chart, the market structure for the week is easier to define.

NQ generates the LRLR for the first half the week until hitting the OHLC Weekly -Distribution Level (Deep Discount) StatMap levels + the Daily 8/1 Bullish

Orderblock.

NQ prints a 1HR Bullish Orderblock right on that Weekly StatMap level and shortly validated.

From here possible MMBM on ITF is engaged.

That 1HR Bullish Orderblock’s low is now the 1HR MMBM SMR.

During Thursday’s session & Friday’s Overnight Session is seen going back to that 1HR Bullish Orderblock for the

1HR MMBM “LRB”

Right before New York open at 06:30AM EST market shows its willingness to go to the upside & ultimately using the 10AM Jerome Powell Red Folder News to drive the market to the opposing Weekly StatMap level above.

LTF/5M Chart:

On the 5M Chart, we can see the Overnight Session more refined and can see where the SMR and LRB confirmed via 5M OB StatMap Model

Market hit the following levels to engage the 5M OB StatMap Model during London session:

1. OHLC Weekly -Distribution

2. OHLC Daily +Manipulation

3. Overnight Session -D

From here market delivers and created the 5M MMBM 1st Stage Accumulation occur prior to New York Session.

At New York Session, another 5M Orderblock StatMap Model is created confirmed and used for the delivery to

upside utilizing the 10AM Jerome Powell Red Folder News to reach the OHLC Weekly +Manipulation level.

The 0930 5M Candle creates the 5M Orderblock, and is shortly validated.

Market hit the following levels to engage the 5M OB StatMap Model during New York AM session:

1. OHLC Daily Open

2. New York AM Session -M

One can trust the possible 1 stage accumulation and play it to the upside.

Why?

Market has HTF-ITF-LTF MMBM alignment.

Market is seen creating a SMR & LRB via Bullish 5M Orderblock StatMap Model.

From here the anticipation or expectation is a 1st stage accumulation being created and used for delivery to

upside utilizing red folder news as volatility injection.

One understands that it may not play out as even A+ Setups can immediately fail.

My job as a trader is to find high probability opportunities, apply my risk management & let the probabilities play

out.

On the 5M Chart, we can see the Overnight Session more refined and can see where the SMR and LRB confirmed via 5M OB StatMap Model

Market hit the following levels to engage the 5M OB StatMap Model during London session:

1. OHLC Weekly -Distribution

2. OHLC Daily +Manipulation

3. Overnight Session -D

From here market delivers and created the 5M MMBM 1st Stage Accumulation occur prior to New York Session.

At New York Session, another 5M Orderblock StatMap Model is created confirmed and used for the delivery to

upside utilizing the 10AM Jerome Powell Red Folder News to reach the OHLC Weekly +Manipulation level.

The 0930 5M Candle creates the 5M Orderblock, and is shortly validated.

Market hit the following levels to engage the 5M OB StatMap Model during New York AM session:

1. OHLC Daily Open

2. New York AM Session -M

One can trust the possible 1 stage accumulation and play it to the upside.

Why?

Market has HTF-ITF-LTF MMBM alignment.

Market is seen creating a SMR & LRB via Bullish 5M Orderblock StatMap Model.

From here the anticipation or expectation is a 1st stage accumulation being created and used for delivery to

upside utilizing red folder news as volatility injection.

One understands that it may not play out as even A+ Setups can immediately fail.

My job as a trader is to find high probability opportunities, apply my risk management & let the probabilities play

out.

Key Notes:

• Note how market generates LRLR on the ITF Chart.

Daily chart was just retracing into Daily OB

During this time reeling in bearish market participants cause them to generate said LRLR or Low Resistance

Liquidity Run for the upside.

• Note how the market better the opportunities flow when the HTF - ITF - LTF are all in the same MMXM delivery.

• While the above statement regarding MMXM delivery, there will be times it may fail.

That’s where it’s my job or

duty to see what went wrong and what lessons and change I can bring to the following weeks ahead.

This can

easy be done by reviewing my trading system.

Seeing where or what went wrong or what was missed.

• Note how market generates LRLR on the ITF Chart.

Daily chart was just retracing into Daily OB

During this time reeling in bearish market participants cause them to generate said LRLR or Low Resistance

Liquidity Run for the upside.

• Note how the market better the opportunities flow when the HTF - ITF - LTF are all in the same MMXM delivery.

• While the above statement regarding MMXM delivery, there will be times it may fail.

That’s where it’s my job or

duty to see what went wrong and what lessons and change I can bring to the following weeks ahead.

This can

easy be done by reviewing my trading system.

Seeing where or what went wrong or what was missed.

• • •

Missing some Tweet in this thread? You can try to

force a refresh