2020 FED rate cut cycle breakdown🧵

In March 2020, FED made 2 ‘emergency rate cuts’ to control the economic downturn fuelled by the COVID-19:

1. March 3, 2020: FED cut by 50 bp. This was the first ‘emergency rate’ cut since the 2008 GFC.

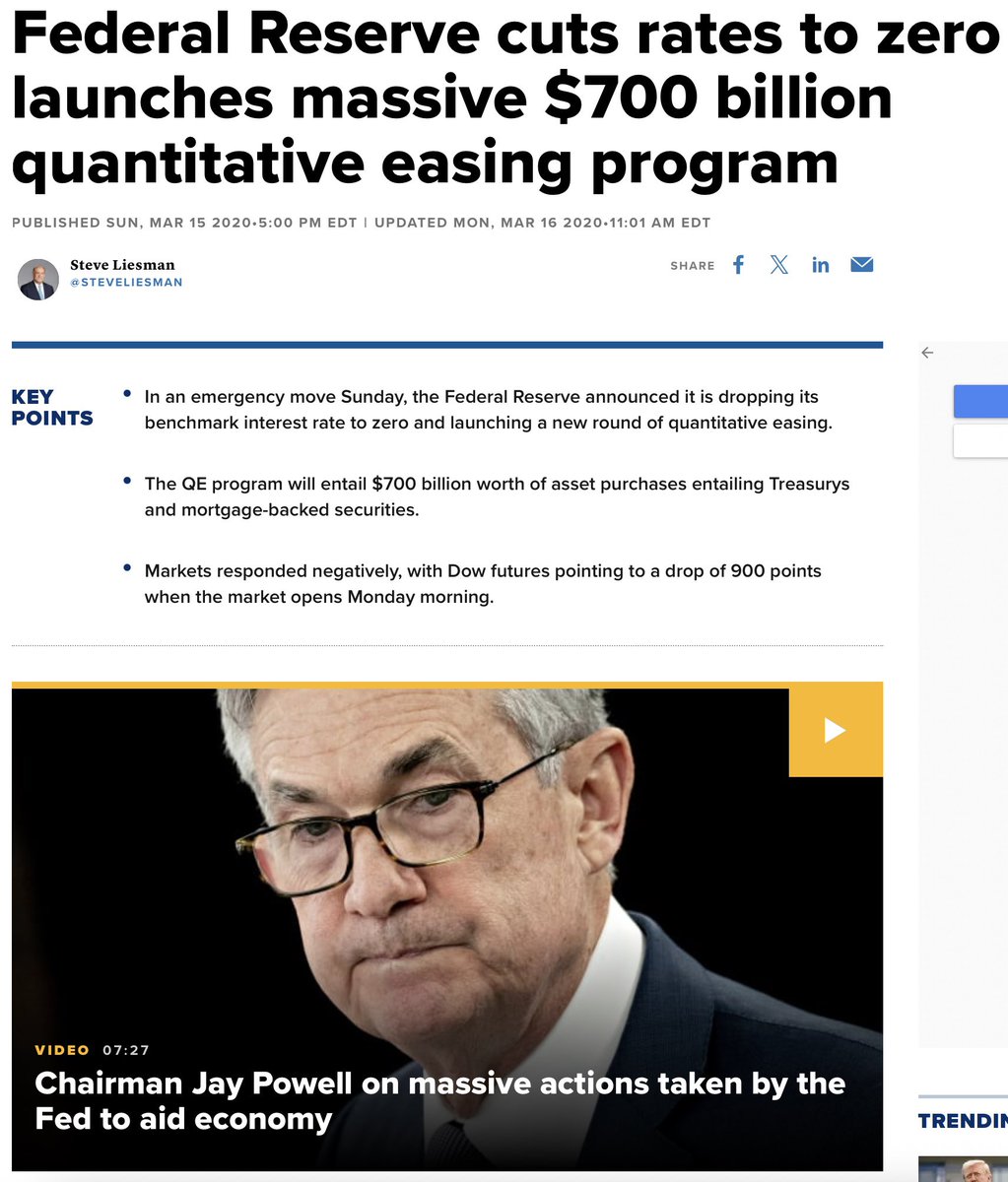

2. March 15, 2020: FED cut rates to near 0%. With this cut they started QE with a $700 billion >quantitative easing< program!!

In March 2020, FED made 2 ‘emergency rate cuts’ to control the economic downturn fuelled by the COVID-19:

1. March 3, 2020: FED cut by 50 bp. This was the first ‘emergency rate’ cut since the 2008 GFC.

2. March 15, 2020: FED cut rates to near 0%. With this cut they started QE with a $700 billion >quantitative easing< program!!

From March to December 2020, The Fed’s balance sheet had expanded almost by 2X, to ~$8 trillion from ~$4.2 trillion pre-COVID. Meaning, the Bond market sold off almost 4 trillion and the FED was the only buyer and was forced to buy it all or face a complete collapse of the system.

What happened to the markets after launching QE?

Inflation worldwide went to double digits.

Bitcoin went from $4K to 69K

Etherium went from $159 to $4.666

Nasdaq went from $7K to 14K

S&P went from $2.3K to 4.8K

What happened to the markets after launching QE?

Inflation worldwide went to double digits.

Bitcoin went from $4K to 69K

Etherium went from $159 to $4.666

Nasdaq went from $7K to 14K

S&P went from $2.3K to 4.8K

Who bought all those bonds in the end and saved the system? We, all of us by paying higher prices for everything.

Is this time is different? Yes, we don’t have Covid and so far gradually lowering bond yields indicate no signs of failing bond auctions and any other signs.

We shouldn’t have that big crash on September 15th as it was on March 2020.

But the next QE will be so big and so destructive with it’s inflationary impact that not owning any assets will be a financial suicide. And again we will all pay the the next QE (~$10-20 trillion) with inflation.

Take care.

$BTC $SPX $DJI $ETH $QQQ $GLD

Is this time is different? Yes, we don’t have Covid and so far gradually lowering bond yields indicate no signs of failing bond auctions and any other signs.

We shouldn’t have that big crash on September 15th as it was on March 2020.

But the next QE will be so big and so destructive with it’s inflationary impact that not owning any assets will be a financial suicide. And again we will all pay the the next QE (~$10-20 trillion) with inflation.

Take care.

$BTC $SPX $DJI $ETH $QQQ $GLD

• • •

Missing some Tweet in this thread? You can try to

force a refresh