(1/🧵) AN EX-BANKER JUST LEAKED ONE OF RIPPLE’S NDA.

And what they’re building with Trump, BlackRock & JPMorgan on XRPL will blow your mind.

Suddenly all their strange moves make perfect sense.

No one was supposed to know this🧵👇

And what they’re building with Trump, BlackRock & JPMorgan on XRPL will blow your mind.

Suddenly all their strange moves make perfect sense.

No one was supposed to know this🧵👇

(2/🧵) An ex-banker under the alias “@LordBelgrave” claimed to have leaked one of the NDAs with UBS.

Other than details that had already come out in light, there’s a shocking detail: a reference to “Biometric Identity Mapping.”

Something that signals aligning Digital Identity and Global Settlement Systems.

Other than details that had already come out in light, there’s a shocking detail: a reference to “Biometric Identity Mapping.”

Something that signals aligning Digital Identity and Global Settlement Systems.

(3/🧵) Brad Garlinghouse warned in interviews about governments using technology to control our identity?

At the time, most thought he was just talking about CBDCs.

But Ripple had quietly been building something entirely different.

Related to Digital Identity and Payments.

At the time, most thought he was just talking about CBDCs.

But Ripple had quietly been building something entirely different.

Related to Digital Identity and Payments.

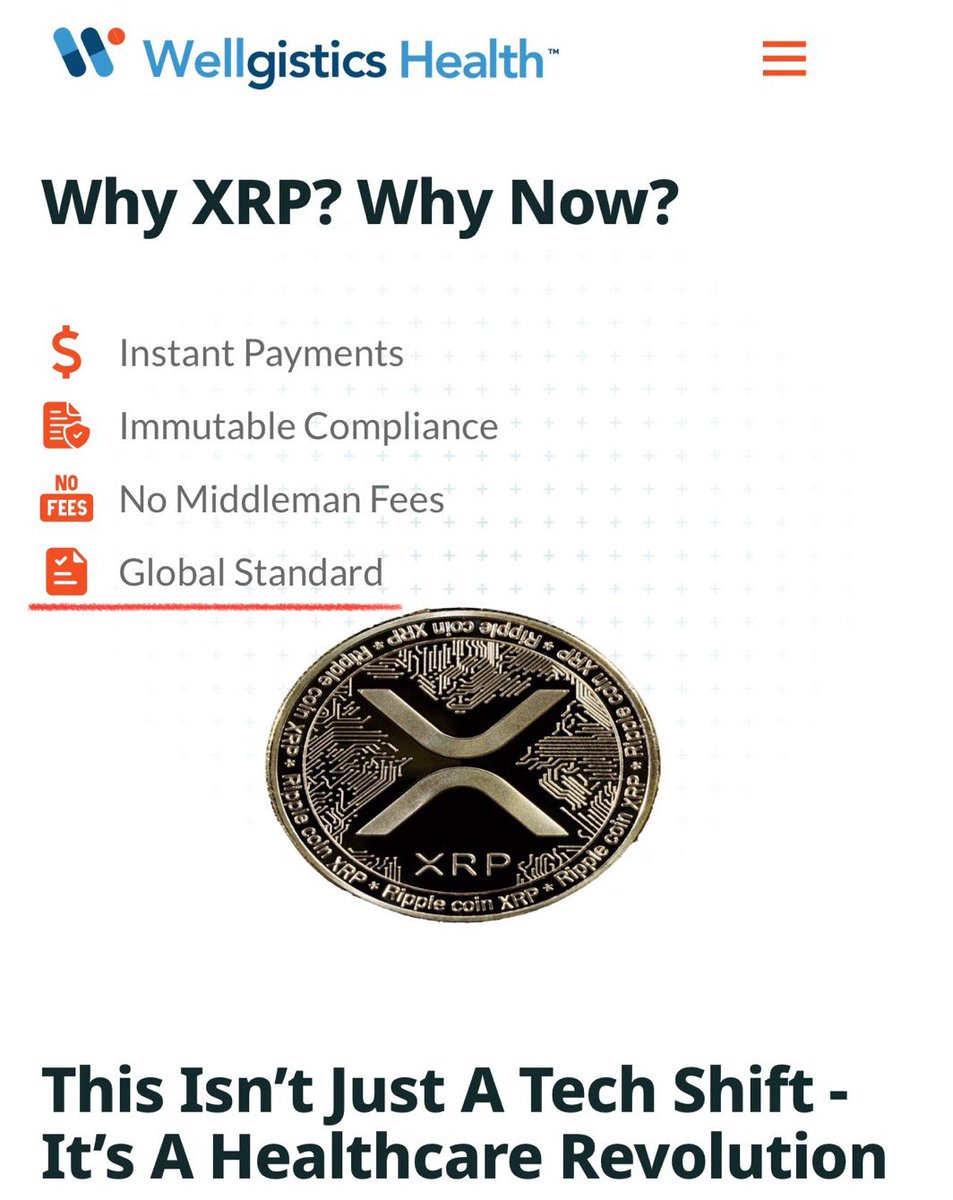

(4/🧵) Meanwhile, $XRP is quietly embedding itself in healthcare payments.

Wellgistics Health had announced an XRP Ledger–based payment system for 6,500 U.S. pharmacies.

Instant payments + compliance + “global standard”?

This isn’t just finance, it’s health data pipelines.

Wellgistics Health had announced an XRP Ledger–based payment system for 6,500 U.S. pharmacies.

Instant payments + compliance + “global standard”?

This isn’t just finance, it’s health data pipelines.

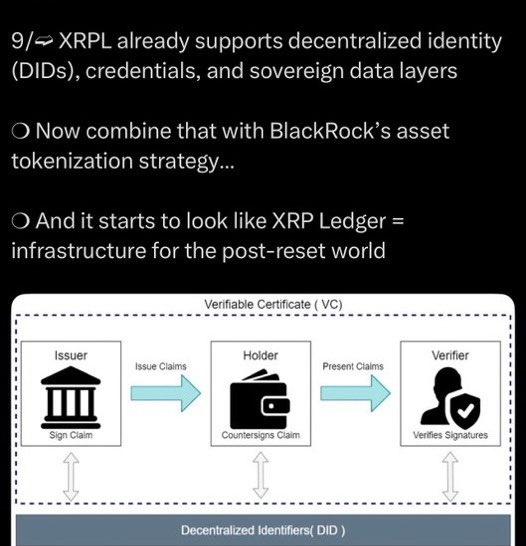

(5/🧵) JPMorgan has already admitted it: “Digital identity is the foundation of Web3.”

The World Economic Forum(WEF) took it further.

Their Blockchain Toolkit literally lays out the framework:

🔹 Digital ID

🔹 Compliance tracking

🔹 Healthcare + supply chains

The World Economic Forum(WEF) took it further.

Their Blockchain Toolkit literally lays out the framework:

🔹 Digital ID

🔹 Compliance tracking

🔹 Healthcare + supply chains

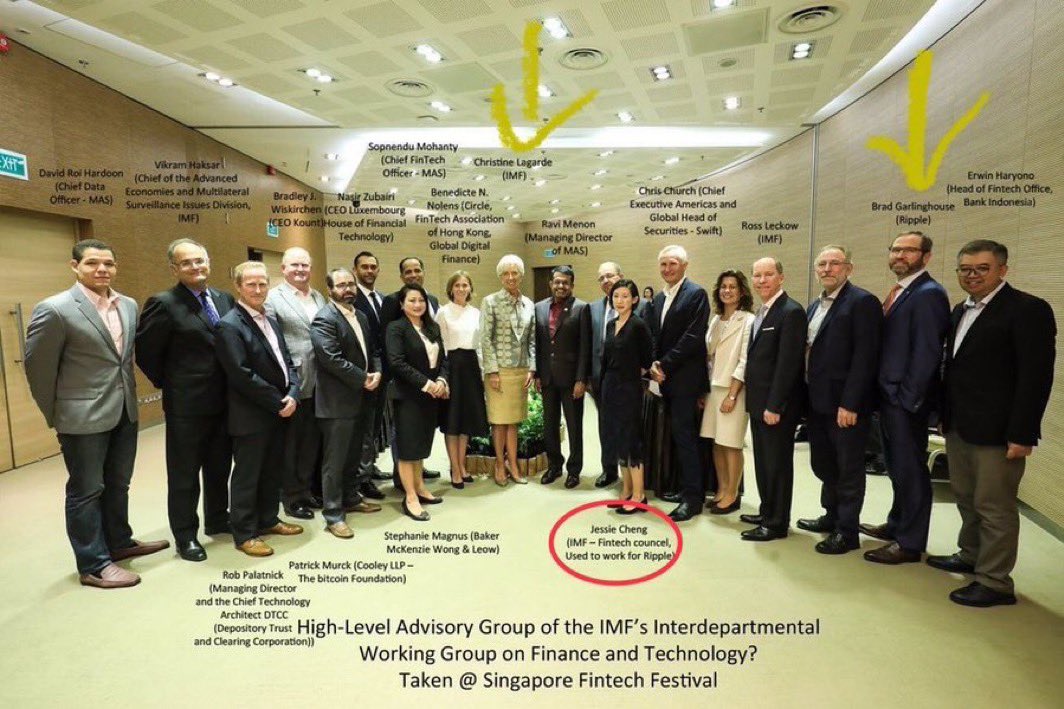

(6/🧵) And don’t forget Ripple’s seat at the real table.

Here’s Brad Garlinghouse standing with Christine Lagarde, IMF officials, SWIFT, MAS, and even Ripple alumni working inside IMF.

Coincidence? Or was Ripple always the chosen rail for this “identity-health-finance” merger?

Here’s Brad Garlinghouse standing with Christine Lagarde, IMF officials, SWIFT, MAS, and even Ripple alumni working inside IMF.

Coincidence? Or was Ripple always the chosen rail for this “identity-health-finance” merger?

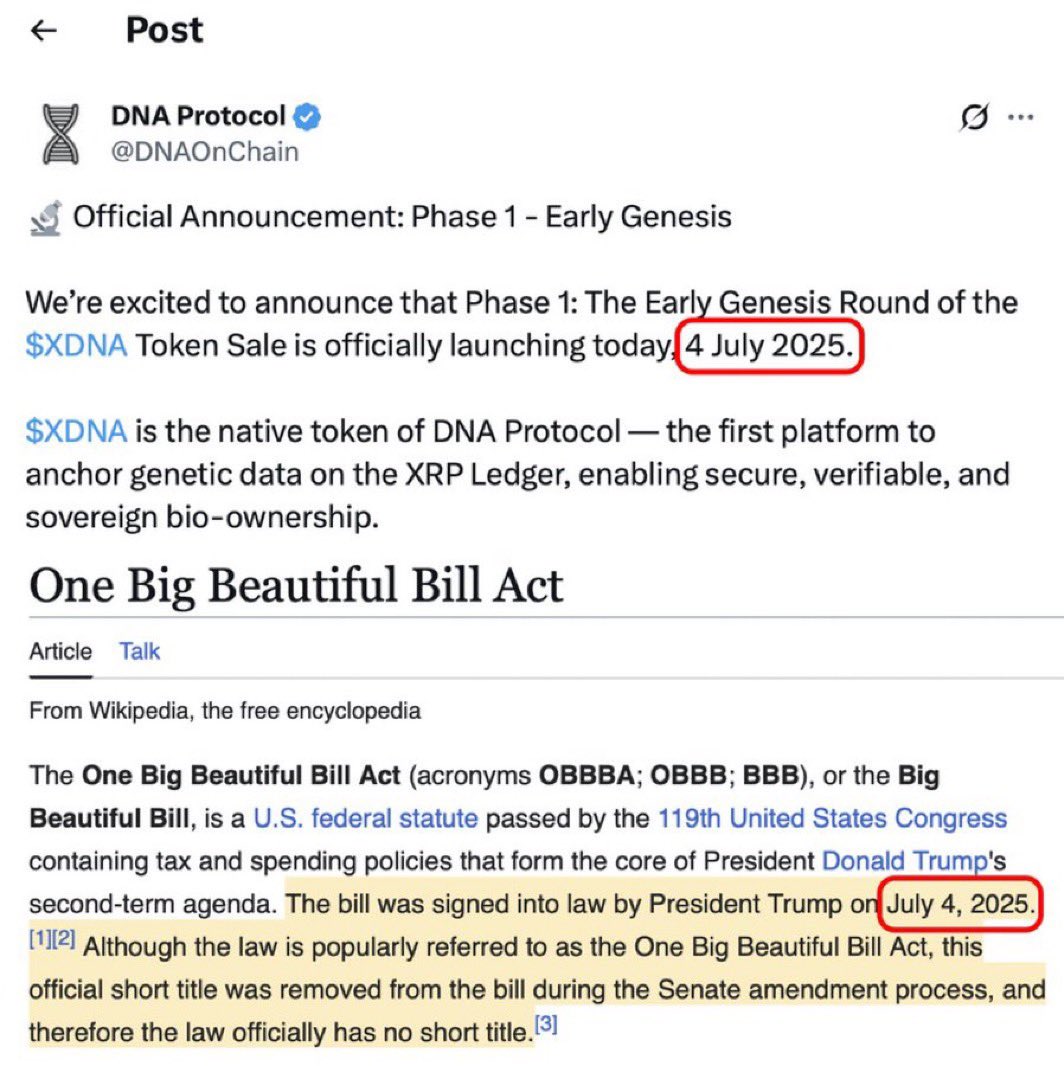

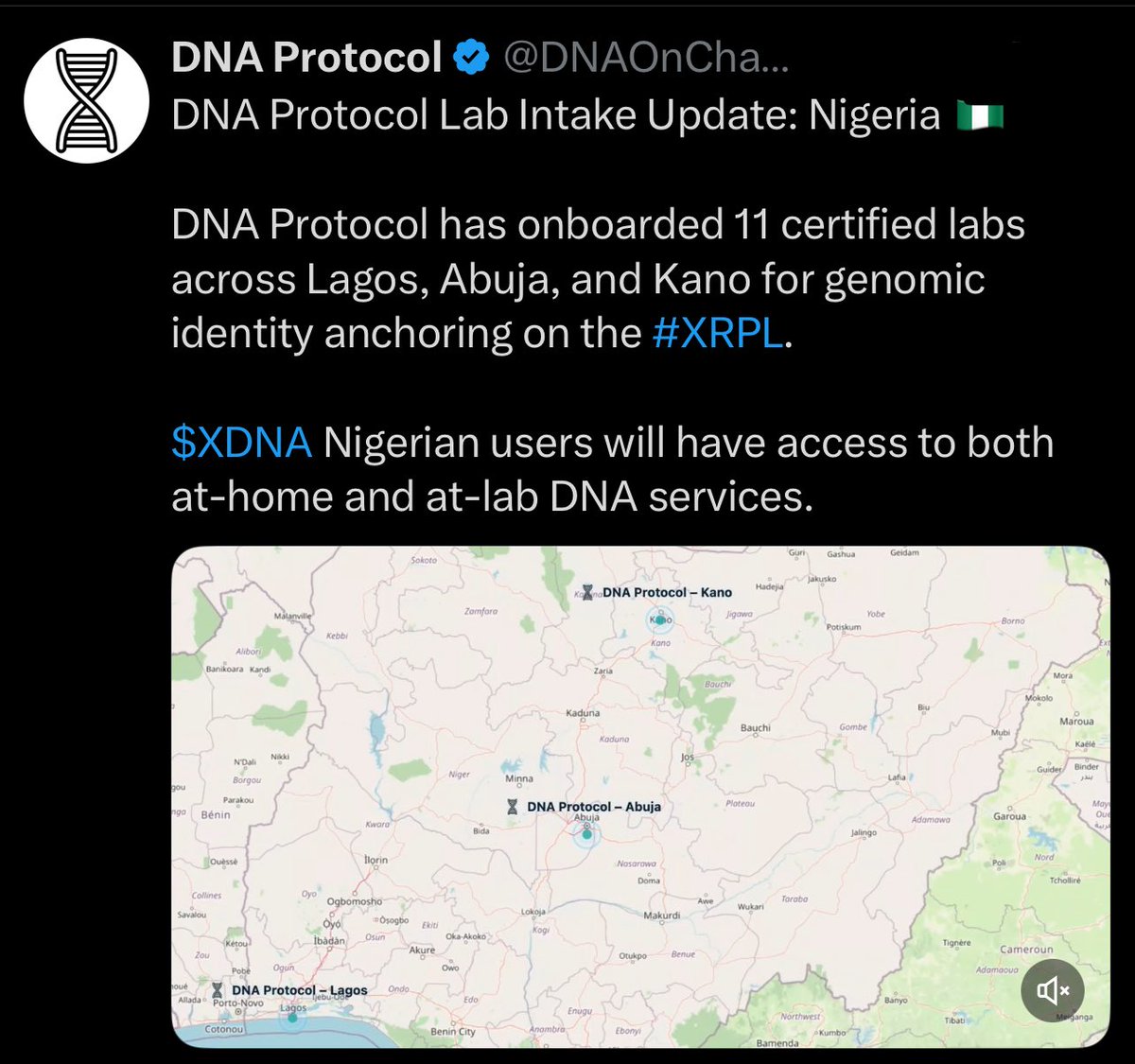

(7/🧵) All of this points to one thing: DNA Protocol on XRPL(@DNAOnChain)

BlackRock’s $XDNA ETF wasn’t a coincidence either — launched on July 4th, the same day as US Independence & Trump’s One Big Beautiful Bill slashing healthcare spend.

They’re moving healthcare on-chain.

BlackRock’s $XDNA ETF wasn’t a coincidence either — launched on July 4th, the same day as US Independence & Trump’s One Big Beautiful Bill slashing healthcare spend.

They’re moving healthcare on-chain.

(8/🧵) It was never random, they’ve been quietly laying the rails for it all on XRPL.

Trump’s One Big Beautiful Bill slashed healthcare spending.

Then came his Digital Health Tech Ecosystem.

At the same time, BlackRock’s $XDNA was launched on XRPL on July 4th.

And JPMorgan kept pushing digital identity.

Trump’s One Big Beautiful Bill slashed healthcare spending.

Then came his Digital Health Tech Ecosystem.

At the same time, BlackRock’s $XDNA was launched on XRPL on July 4th.

And JPMorgan kept pushing digital identity.

(9/🧵) Ripple hasn’t been targeting Africa by accident…

Partnerships with Chipper Cash, Onafriq with expansions in the MENA Region.

Meanwhile, DNA Protocol quietly onboards labs across African nations.

Coincidence?

Partnerships with Chipper Cash, Onafriq with expansions in the MENA Region.

Meanwhile, DNA Protocol quietly onboards labs across African nations.

Coincidence?

(10/10) Everything I’ve shown here is just the surface.

The full files, articles, images & evidence are all in one place.

🔗 Join the Telegram where the dots connect and the truth lies👇

t.me/ripplercult

The full files, articles, images & evidence are all in one place.

🔗 Join the Telegram where the dots connect and the truth lies👇

t.me/ripplercult

• • •

Missing some Tweet in this thread? You can try to

force a refresh