🧵 The Hidden Power of $XRP: How It’s Used Even When You Don’t See It

You may think XRP is only used when you explicitly send it…

But behind the scenes, XRP is quietly routing liquidity across the XRPL and targeting a Trillions of Dollars Industry.

Let’s break it down 🧵👇

You may think XRP is only used when you explicitly send it…

But behind the scenes, XRP is quietly routing liquidity across the XRPL and targeting a Trillions of Dollars Industry.

Let’s break it down 🧵👇

1/ What Is Auto-Bridging on XRPL?

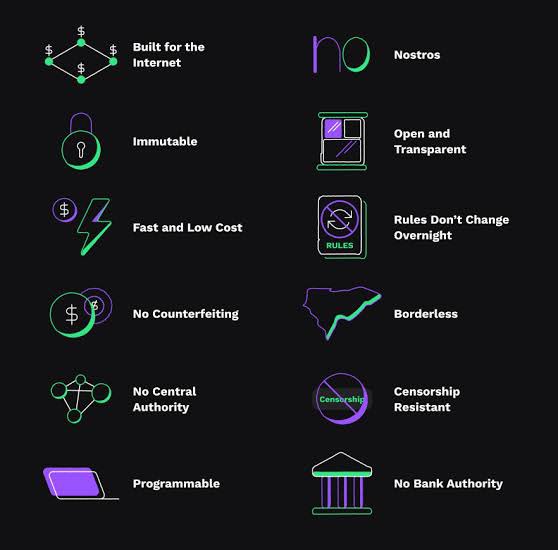

The XRP Ledger (XRPL) is one of the fastest, most efficient blockchains for moving value, not just XRP, but any asset tokenized on it (stablecoins, fiat IOUs, even CBDCs).

To enable this, XRPL uses a unique feature called Auto-Bridging.

The XRP Ledger (XRPL) is one of the fastest, most efficient blockchains for moving value, not just XRP, but any asset tokenized on it (stablecoins, fiat IOUs, even CBDCs).

To enable this, XRPL uses a unique feature called Auto-Bridging.

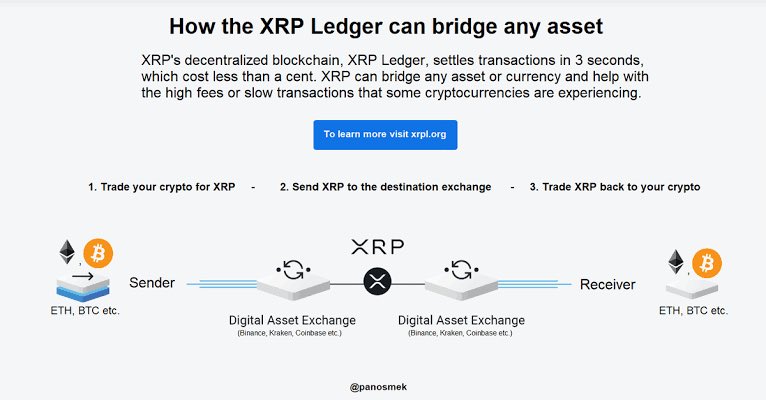

2/ Auto-bridging allows XRPL to route payments between two assets even if there’s no direct market between them, by using $XRP as an invisible bridge.

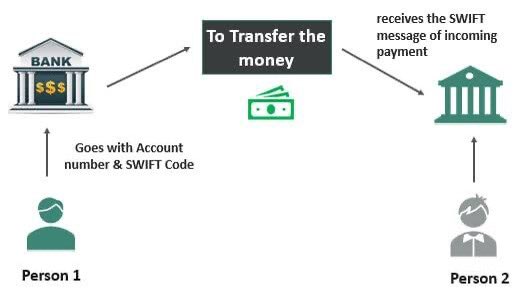

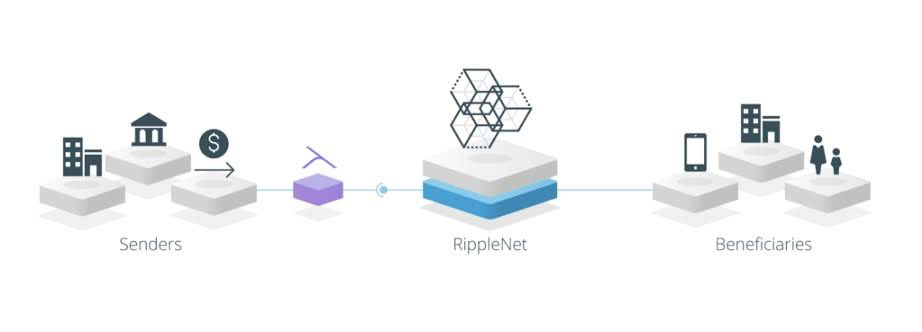

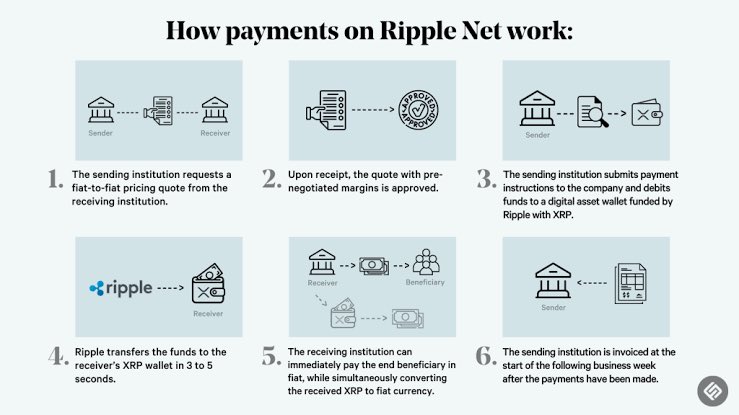

$XRP is used as a bridge asset to facilitate faster, cheaper, and more efficient cross-border payments through Ripple's payment network, RippleNet.

$XRP is used as a bridge asset to facilitate faster, cheaper, and more efficient cross-border payments through Ripple's payment network, RippleNet.

3/ Here’s a Simple Example 🧠

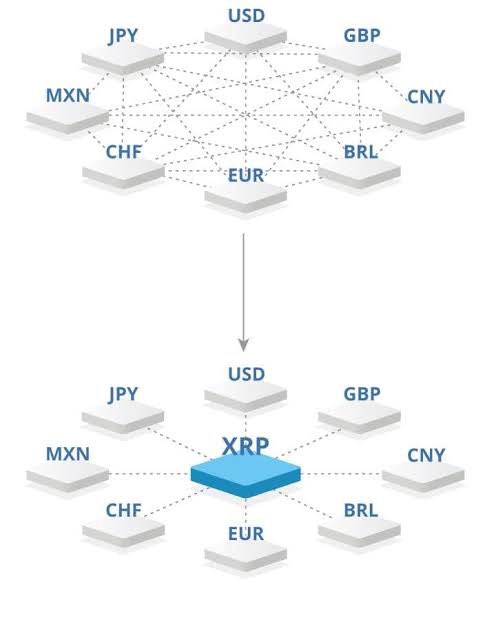

Anita wants to trade $GBP for $BRL, but the direct market lacks enough liquidity.

Since both $GBP and $BRL have active markets with XRP, the XRP Ledger auto-bridging kicks in.

First swapping $GBP to $XRP, then $XRP to $BRL, giving Anita the best possible rate by combining offers across multiple markets.

Anita wants to trade $GBP for $BRL, but the direct market lacks enough liquidity.

Since both $GBP and $BRL have active markets with XRP, the XRP Ledger auto-bridging kicks in.

First swapping $GBP to $XRP, then $XRP to $BRL, giving Anita the best possible rate by combining offers across multiple markets.

4/ Why XRP Is Perfect for This

Auto-bridging only works if there’s a liquid, fast, and neutral asset that:

•Exists natively on the XRPL

•Can be traded with many other tokens

•Has low fees and fast settlement

That’s exactly what XRP is.

It’s the default bridge asset on the XRP Ledger.

Auto-bridging only works if there’s a liquid, fast, and neutral asset that:

•Exists natively on the XRPL

•Can be traded with many other tokens

•Has low fees and fast settlement

That’s exactly what XRP is.

It’s the default bridge asset on the XRP Ledger.

5/ Auto-Bridging: Trillion Dollars Industry?

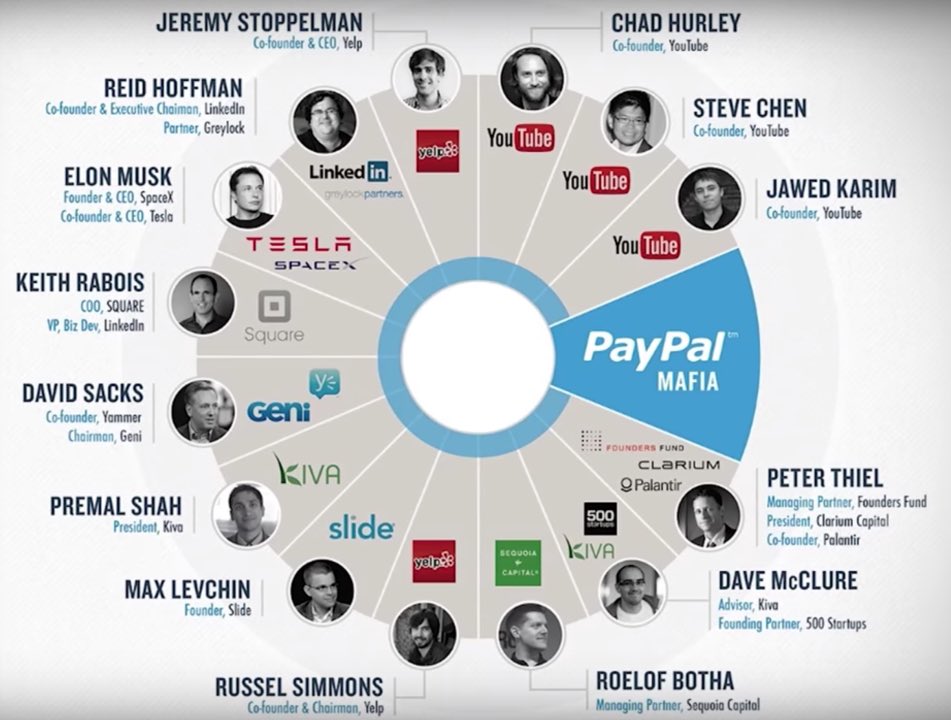

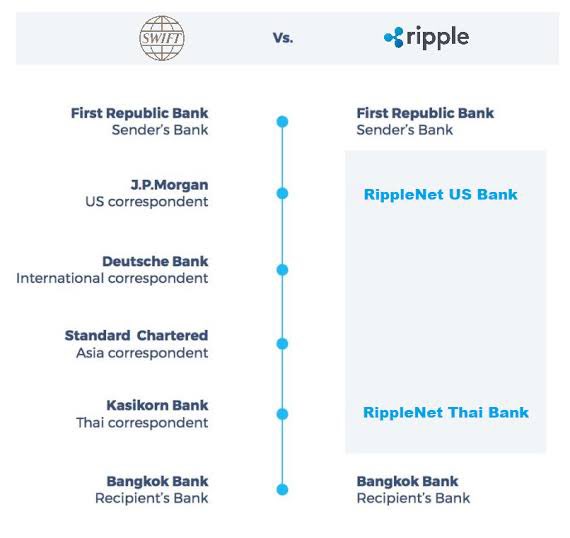

Brad Garlinghouse has numerous times mentioned that through XRP and XRPL, they are solving a key issue that banks and institutions face worldwide while transferring money — Prefunding.

And this industry is worth Trillions of Dollars.

Brad Garlinghouse has numerous times mentioned that through XRP and XRPL, they are solving a key issue that banks and institutions face worldwide while transferring money — Prefunding.

And this industry is worth Trillions of Dollars.

6/ Why It Matters: Utility Without Visibility.

Most people measure utility by “how often XRP is sent.”

But auto-bridging means XRP can be used thousands of times per day without being seen directly.

Imagine doing what SWIFT does, but not just in the U.S. — it’s worldwide and at scale.

Most people measure utility by “how often XRP is sent.”

But auto-bridging means XRP can be used thousands of times per day without being seen directly.

Imagine doing what SWIFT does, but not just in the U.S. — it’s worldwide and at scale.

7/ What Does It Mean for $XRP?

Every transaction on the XRP Ledger whether it’s sending stablecoins, swapping CBDCs, or trading tokenized assets, routes through XRP when needed

This means:

✅ More volume

✅ More liquidity demand

✅ More usage of XRP in decentralized markets

✅ All happening passively, beneath user interfaces

Every transaction on the XRP Ledger whether it’s sending stablecoins, swapping CBDCs, or trading tokenized assets, routes through XRP when needed

This means:

✅ More volume

✅ More liquidity demand

✅ More usage of XRP in decentralized markets

✅ All happening passively, beneath user interfaces

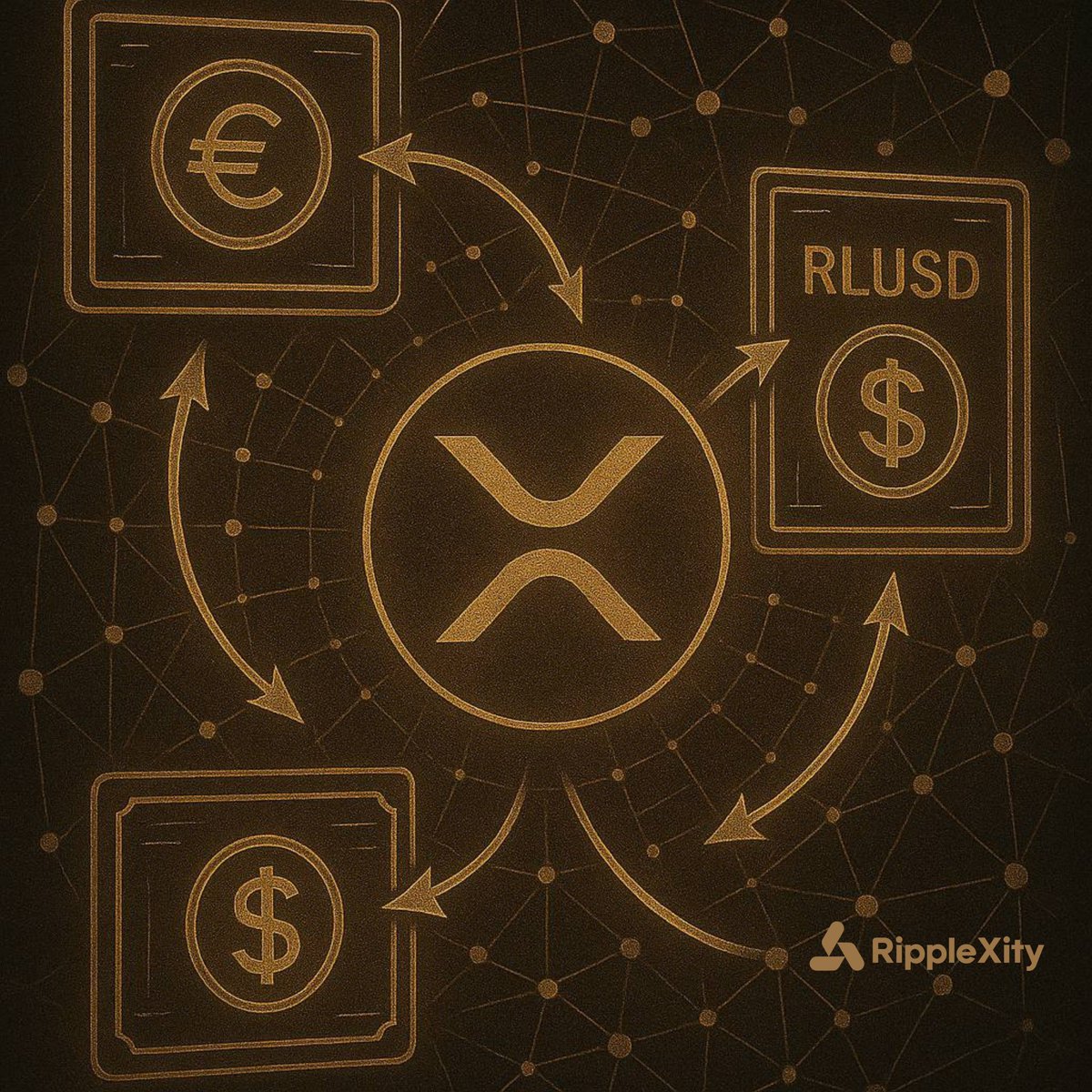

8/ RLUSD, CBDCs, and XRP’s Core Role.

Ripple has built RLUSD, a U.S. dollar stablecoin.

It’s also piloting CBDCs for countries like Palau, Bhutan, and Colombia.

When these fiat tokens move across the XRPL, auto-bridging kicks in and $XRP is the engine that connects them.

Even if users are transacting in digital dollars or local stablecoins, XRP is often the asset doing the work under the hood.

Ripple has built RLUSD, a U.S. dollar stablecoin.

It’s also piloting CBDCs for countries like Palau, Bhutan, and Colombia.

When these fiat tokens move across the XRPL, auto-bridging kicks in and $XRP is the engine that connects them.

Even if users are transacting in digital dollars or local stablecoins, XRP is often the asset doing the work under the hood.

9/ So what’s the takeaway?

$XRP doesn’t have to be sent, traded, or hyped to be valuable.

It’s the default liquidity layer in a growing ecosystem of:

• Stablecoins

• CBDCs

• Tokenized assets

• Financial institutions

• DeFi use cases

As these grow, so does XRP’s demand, invisibly, automatically, continuously.

$XRP doesn’t have to be sent, traded, or hyped to be valuable.

It’s the default liquidity layer in a growing ecosystem of:

• Stablecoins

• CBDCs

• Tokenized assets

• Financial institutions

• DeFi use cases

As these grow, so does XRP’s demand, invisibly, automatically, continuously.

10/ To Conclude:

Auto-bridging is one of XRPL’s most underrated features.

It shows that XRP is not just a token, it’s a utility layer, silently connecting global assets across borders, 24/7.

The future of finance might run through XRP… even if you never see it.

Auto-bridging is one of XRPL’s most underrated features.

It shows that XRP is not just a token, it’s a utility layer, silently connecting global assets across borders, 24/7.

The future of finance might run through XRP… even if you never see it.

[11/11] 🔁 Retweet this to help others understand XRP’s real-world role.

📌 Follow @RippleXity and turn on notifications for real-time verified updates about Ripple, XRP, and blockchain infrastructure.

📌 Follow @RippleXity and turn on notifications for real-time verified updates about Ripple, XRP, and blockchain infrastructure.

• • •

Missing some Tweet in this thread? You can try to

force a refresh