regardless of where the ai cycle ends, it is inevitable that the number of investable assets pre-ipo is going to go from 1000s to dozens pretty quickly

most of the market has intuited this, but very few are taking it deadly seriously.

my view of what’s going on here;

most of the market has intuited this, but very few are taking it deadly seriously.

my view of what’s going on here;

I’ve written about the causes of this shift elsewhere, but the story is very simple,

even if all model progress plateaus tmrw (or already has months prior) we already have a world where the marginal cost of the inputs that make up a company are orders of magnitude cheaper

even if all model progress plateaus tmrw (or already has months prior) we already have a world where the marginal cost of the inputs that make up a company are orders of magnitude cheaper

this means, counterintuitively, the cost of building anything consequential is much more expensive

things that used to be cheap as a result of good software— distribution, attention, install base— are now order of magnitude more expensive and the returns they drive much greater

things that used to be cheap as a result of good software— distribution, attention, install base— are now order of magnitude more expensive and the returns they drive much greater

achieving distribution, attention, or meaningful scale will mean overcoming a nearly endless army of vibe coded enterprise widgets that are competing for the same CIO attention that you are.

we explored this idea at length in “software as a variable cost business” last year

we explored this idea at length in “software as a variable cost business” last year

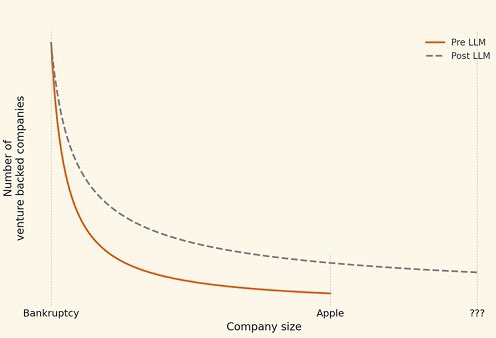

visually, this will look like a smushing of the return curve. bottom quartile assets will be able to stay alive longer due to reduced cogs in niches, middle 50% assets suddenly can be run for cash but are not venture outcomes, and the winners will be orders of magnitude bigger

this means the nature of risk capital necessary to fund the next generation of internet companies will need to be totally different.

the foot race model of venture where dozens of identical firms line up to compete to issue brain dead identical term sheets is over.

the foot race model of venture where dozens of identical firms line up to compete to issue brain dead identical term sheets is over.

this model will be killed by both supply and demand

on the demand side: the nature of capital needs for emergent businesses will be meaningfully different. a early stage venture may need to strip a pubco for distribution, buy a team, or gut a services company

on the demand side: the nature of capital needs for emergent businesses will be meaningfully different. a early stage venture may need to strip a pubco for distribution, buy a team, or gut a services company

on the supply side: I recently had a conversation with a (very good) early stage investor who described his job as being a truffle hunter

but wondered if there’s still truffles to be found after all the fields had already been turned over by heavy machinery (large platforms)

but wondered if there’s still truffles to be found after all the fields had already been turned over by heavy machinery (large platforms)

if there’s two ways to be good in the venture business: be early (and therefore cheap) or be contrarian

both of these are being competed out by either increased capital needs earlier in the lifecycle or platforms that can pay up on okay/good assets early for option value

both of these are being competed out by either increased capital needs earlier in the lifecycle or platforms that can pay up on okay/good assets early for option value

you have basically two options:

1. do everything you can do, cross product, to accumulate dollars behind companies at the far end of the return curve (early primary, secondary, credit, receivables, underwriting m&a)

2. be ruthless and play a private equity game in the middle

1. do everything you can do, cross product, to accumulate dollars behind companies at the far end of the return curve (early primary, secondary, credit, receivables, underwriting m&a)

2. be ruthless and play a private equity game in the middle

very few firms are prepared to prosecute either side of this market presently.

even fewer can imagine a world where 70-80-90 of their peers and downstream capital providers die off or consolidate as the rush to multi manager platforms continue

even fewer can imagine a world where 70-80-90 of their peers and downstream capital providers die off or consolidate as the rush to multi manager platforms continue

the timeline has been filled this week with venture capitalists reaching a consensus that they all are, in fact, in the business of being non conscious

this is a fine strategy when a non consensus asset can become consensus with $2m, but what happens when it needs $200m?

this is a fine strategy when a non consensus asset can become consensus with $2m, but what happens when it needs $200m?

playing the game on the field may be the path of least resistance for most managers, but it’s also the path of least returns.

the fundamental activity of venture is no longer “40 companies, 10% each, every 5 years”. you need to understand how to get 10x dollars in 100x fewer cos

the fundamental activity of venture is no longer “40 companies, 10% each, every 5 years”. you need to understand how to get 10x dollars in 100x fewer cos

• • •

Missing some Tweet in this thread? You can try to

force a refresh