🧵

1/5

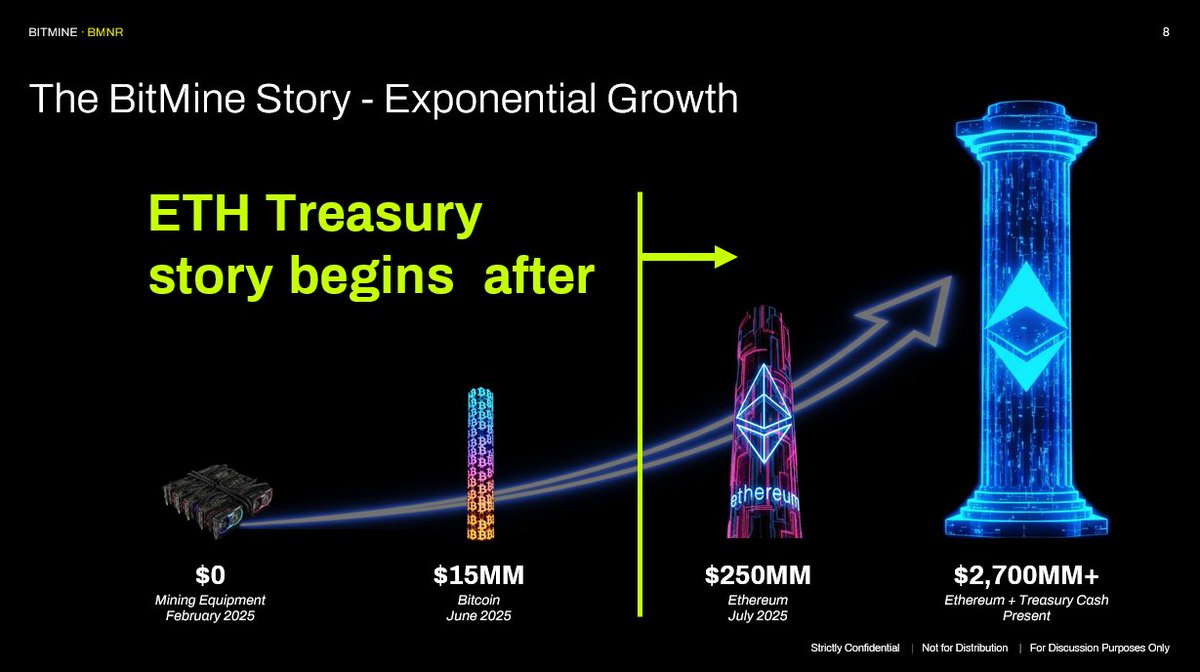

BitMine disclosed latest crypto holdings. As of August 24th at 5:30pm ET:

- 1,713,899 $ETH,

- 192 Bitcoin ($BTC) and

- unencumbered cash of $562 million

- fully diluted shares outstanding 221,515,180

= BMNR NAV per share $39.84

Total NAV $8.8 billion.

BitMine is #2 largest crypto treasury behind @MicroStrategy $MSTR

Chairman: Thomas "Tom" Lee @fundstrat

Ticker: $BMNR

1/5

BitMine disclosed latest crypto holdings. As of August 24th at 5:30pm ET:

- 1,713,899 $ETH,

- 192 Bitcoin ($BTC) and

- unencumbered cash of $562 million

- fully diluted shares outstanding 221,515,180

= BMNR NAV per share $39.84

Total NAV $8.8 billion.

BitMine is #2 largest crypto treasury behind @MicroStrategy $MSTR

Chairman: Thomas "Tom" Lee @fundstrat

Ticker: $BMNR

2/5

BitMine's Crypto NAV (net asset value) is $39.84 per $BMNR share:

- ETH $8.24 billion (1.7mm $ETH tokens)

- BTC $22 million (192 $BTC coins)

- treasury cash (unencumbered) $562 million

= NAV $8.82 billion

- fully diluted shares outstanding 221,515,180

= NAV per share $39.84 per $BMNR share

Chairman: Thomas "Tom" Lee @fundstrat

Ticker: $BMNR

BitMine's Crypto NAV (net asset value) is $39.84 per $BMNR share:

- ETH $8.24 billion (1.7mm $ETH tokens)

- BTC $22 million (192 $BTC coins)

- treasury cash (unencumbered) $562 million

= NAV $8.82 billion

- fully diluted shares outstanding 221,515,180

= NAV per share $39.84 per $BMNR share

Chairman: Thomas "Tom" Lee @fundstrat

Ticker: $BMNR

3/5

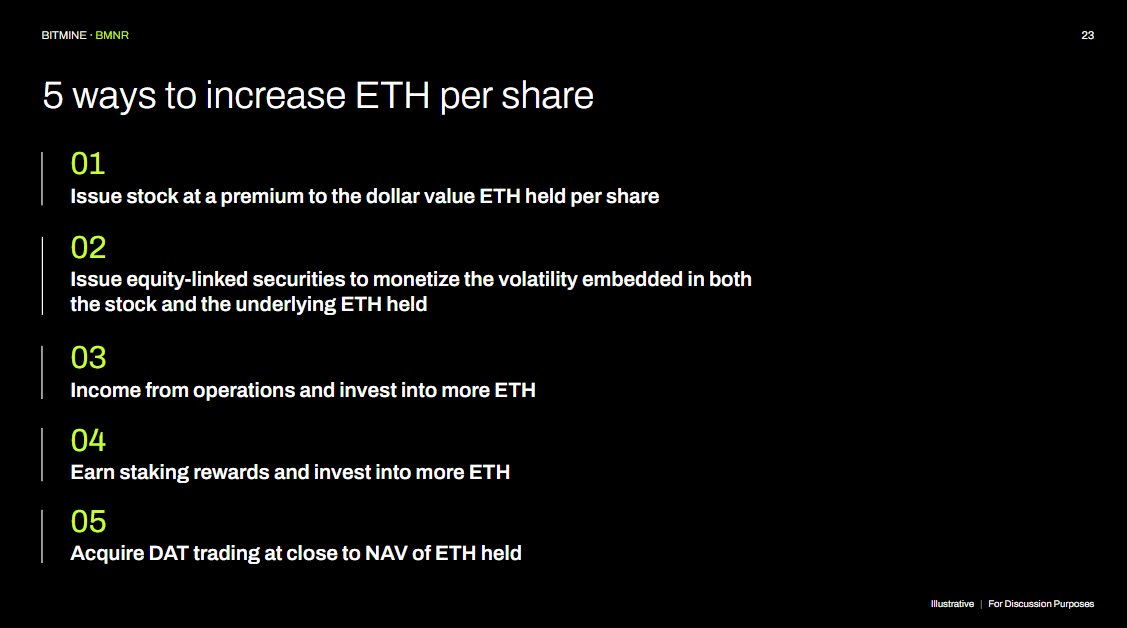

BitMine has multiple ways to increase $ETH per share:

- issue common stock at a premium to ETH per share

- issue equity-linked securities to monetize volatility

- use income from operations to buy ETH

- earn staking rewards to invest into more ETH

Chairman: Thomas "Tom" Lee @fundstrat

Ticker: $BMNR

BitMine has multiple ways to increase $ETH per share:

- issue common stock at a premium to ETH per share

- issue equity-linked securities to monetize volatility

- use income from operations to buy ETH

- earn staking rewards to invest into more ETH

Chairman: Thomas "Tom" Lee @fundstrat

Ticker: $BMNR

4/5

As we stated in our July 27th presentation and Chairman's message, ETH Treasuries are crypto infrastructure:

- $ETH is proof of stake, so $BMNR secures network

- ETH generates a staking yield, which is revs for BMNR

- staking and validating is a security operation

- any entity tokenizing stablecoins, stocks, or any RWA (real world assets) will ultimately want to stake ETH

Chairman: Thomas "Tom" Lee @fundstrat

Ticker: $BMNR

Presentation link: bitminetech.io/investor-relat…

As we stated in our July 27th presentation and Chairman's message, ETH Treasuries are crypto infrastructure:

- $ETH is proof of stake, so $BMNR secures network

- ETH generates a staking yield, which is revs for BMNR

- staking and validating is a security operation

- any entity tokenizing stablecoins, stocks, or any RWA (real world assets) will ultimately want to stake ETH

Chairman: Thomas "Tom" Lee @fundstrat

Ticker: $BMNR

Presentation link: bitminetech.io/investor-relat…

5/5

Press release 📰🗞️dated August 25, 2025 is here

👇

Chairman: Thomas "Tom" Lee @fundstrat

Ticker: $BMNR

prnewswire.com/news-releases/…

Press release 📰🗞️dated August 25, 2025 is here

👇

Chairman: Thomas "Tom" Lee @fundstrat

Ticker: $BMNR

prnewswire.com/news-releases/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh