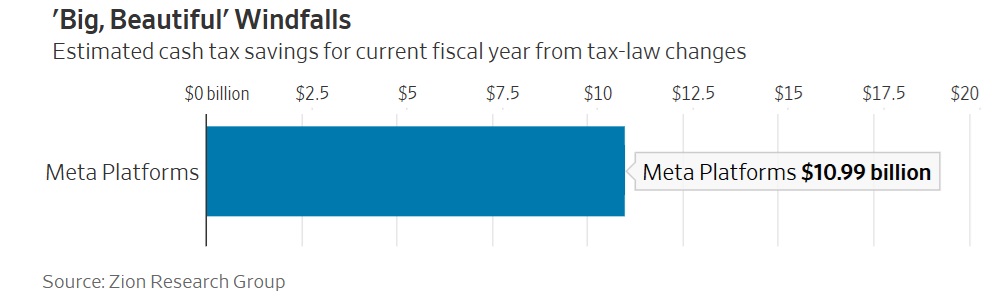

Wall Street’s favorite measure of equity valuation, the Buffett Indicator, sits above 200%, a level never seen before.

Yet Fed Chair Powell is signaling a rate cut in September.

That has never happened before.

So what does it mean for you, your job, your business?

Yet Fed Chair Powell is signaling a rate cut in September.

That has never happened before.

So what does it mean for you, your job, your business?

The Buffett Indicator compares the total U.S. stock market cap to GDP, a gauge Buffett once called “the best single measure” of valuations.

Historically, 70–80% meant undervalued, 100% fair, 150%+ bubble.

Today it sits near 200%, a level never seen before in history.

Historically, 70–80% meant undervalued, 100% fair, 150%+ bubble.

Today it sits near 200%, a level never seen before in history.

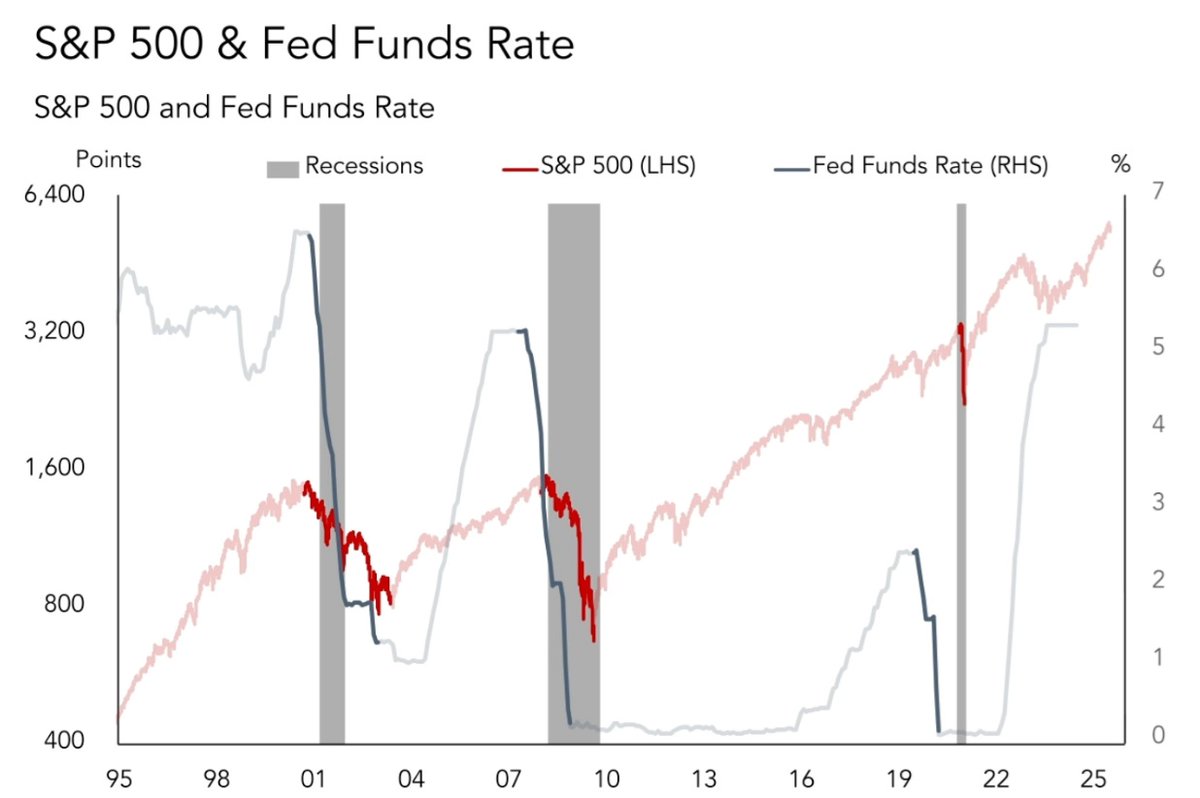

Normally, the Fed cuts after a market crash, dot-com (2001), housing (2008), pandemic (2020).

This time, it’s cutting into record valuations. Why?

Because the economy faces systemic shocks: AI job losses, tariffs, and slowing growth.

This time, it’s cutting into record valuations. Why?

Because the economy faces systemic shocks: AI job losses, tariffs, and slowing growth.

Start with AI (deflationary).

Large swaths of coding, analytics, support, and back-office work are now AI-assistable.

Unlike past cycles, this isn’t just cost-cutting.

Companies can do the same or better output with fewer staff.

Large swaths of coding, analytics, support, and back-office work are now AI-assistable.

Unlike past cycles, this isn’t just cost-cutting.

Companies can do the same or better output with fewer staff.

Result: highly educated engineers are moving into blue-collar jobs: trades, trucking, manufacturing.

When white-collar workers flood the manual labor pool, that’s a labor market reset.

When white-collar workers flood the manual labor pool, that’s a labor market reset.

Layer on tariffs (inflationary).

Broad tariffs raise costs for raw materials, semis, autos, and consumer goods.

Walmart’s recent call: “Even at the reduced levels, the higher tariffs will result in higher prices.”

Ford Q2: $800M tariff hit, $2B FY headwind.

Broad tariffs raise costs for raw materials, semis, autos, and consumer goods.

Walmart’s recent call: “Even at the reduced levels, the higher tariffs will result in higher prices.”

Ford Q2: $800M tariff hit, $2B FY headwind.

This traps the Fed.

AI is hollowing out jobs (deflationary).

Tariffs are raising prices (inflationary).

So Powell is cutting rates into a market that’s both overvalued and distorted by trade policy.

AI is hollowing out jobs (deflationary).

Tariffs are raising prices (inflationary).

So Powell is cutting rates into a market that’s both overvalued and distorted by trade policy.

For workers, this matters: AI makes white-collar careers less secure (automates routine tasks, slows hiring).

Tariffs make goods more expensive (higher import costs).

Together, real pay is squeezed, so upskilling into AI-literate, less-automatable roles is essential.

Tariffs make goods more expensive (higher import costs).

Together, real pay is squeezed, so upskilling into AI-literate, less-automatable roles is essential.

For businesses, cheap credit helps cover tariff-driven costs and fund operations.

But customer demand depends on how well the workforce transitions in the AI era.

But customer demand depends on how well the workforce transitions in the AI era.

For investors, the policy mix is unusual: protectionist tariffs + rate cuts.

Tariffs weigh on trade and profits. Cuts push liquidity into markets and lower discount rates.

Short-term bullish, long-term uncertain.

Tariffs weigh on trade and profits. Cuts push liquidity into markets and lower discount rates.

Short-term bullish, long-term uncertain.

Jackson Hole, Aug 22, 2025: Fed Chair Powell said policy is still “restrictive,” the “balance of risks” is shifting toward jobs, and the Fed is now “100 bps closer to neutral” than a year ago, so the outlook may “warrant adjusting our policy stance.”

If Powell cuts in September, remember:

It’s not confidence, it’s triage.

A panic button to buy time against AI labor disruption + tariff squeeze.

It’s not confidence, it’s triage.

A panic button to buy time against AI labor disruption + tariff squeeze.

Written by @jasoniswifi

• • •

Missing some Tweet in this thread? You can try to

force a refresh