🧵 THREAD: The Hidden Truth Behind the UK’s Immigration Explosion – It’s a Billionaire’s Bonanza Fueled by Taxpayer Cash and Corruption

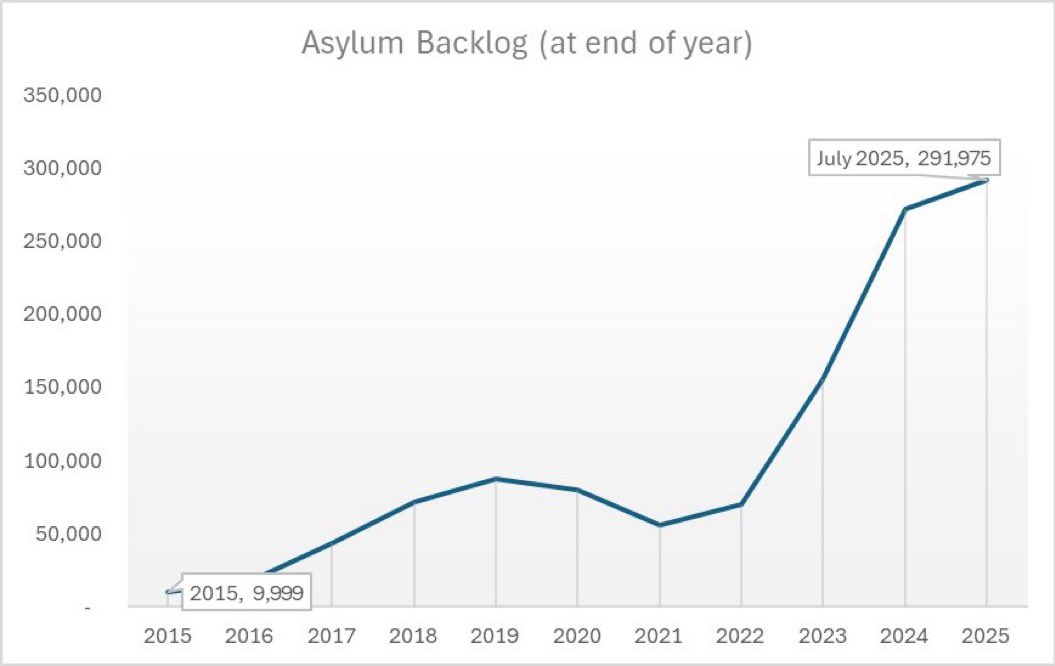

For years, we’ve seen immigration numbers skyrocket in the UK, with asylum claims surging and backlogs piling up.

But why?

It’s not just policy failure, it’s a rigged system where a handful of insiders are making BILLIONS off housing asylum seekers.

This isn’t charity, it’s profiteering on an industrial scale, incentivizing delays and influxes to keep the money flowing.

Let’s expose the key players and how they’ve turned human desperation into a goldmine. @DataRepublican @elonmusk

For years, we’ve seen immigration numbers skyrocket in the UK, with asylum claims surging and backlogs piling up.

But why?

It’s not just policy failure, it’s a rigged system where a handful of insiders are making BILLIONS off housing asylum seekers.

This isn’t charity, it’s profiteering on an industrial scale, incentivizing delays and influxes to keep the money flowing.

Let’s expose the key players and how they’ve turned human desperation into a goldmine. @DataRepublican @elonmusk

Meet Graham King, the “Asylum King.” He started with holiday parks but switched to asylum housing years ago.

His company, Clearsprings, landed a massive 10-year Home Office deal, initially worth £1bn but now ballooned to £7.3bn due to “demand.”

King owns nearly all the shares, pocketing £90m in dividends last year, roughly £4.8m a DAY from public funds.

He’s on track to be a billionaire, built on asylum contracts.

His company, Clearsprings, landed a massive 10-year Home Office deal, initially worth £1bn but now ballooned to £7.3bn due to “demand.”

King owns nearly all the shares, pocketing £90m in dividends last year, roughly £4.8m a DAY from public funds.

He’s on track to be a billionaire, built on asylum contracts.

Serco, a global outsourcing giant, also rakes it in, managing housing in northern and central England with £148m yearly profits.

Big investors like BlackRock and Vanguard hold stakes, funneling taxpayer money to global funds.

Serco locks landlords into long-term deals, driving up costs as backlogs grow.

Big investors like BlackRock and Vanguard hold stakes, funneling taxpayer money to global funds.

Serco locks landlords into long-term deals, driving up costs as backlogs grow.

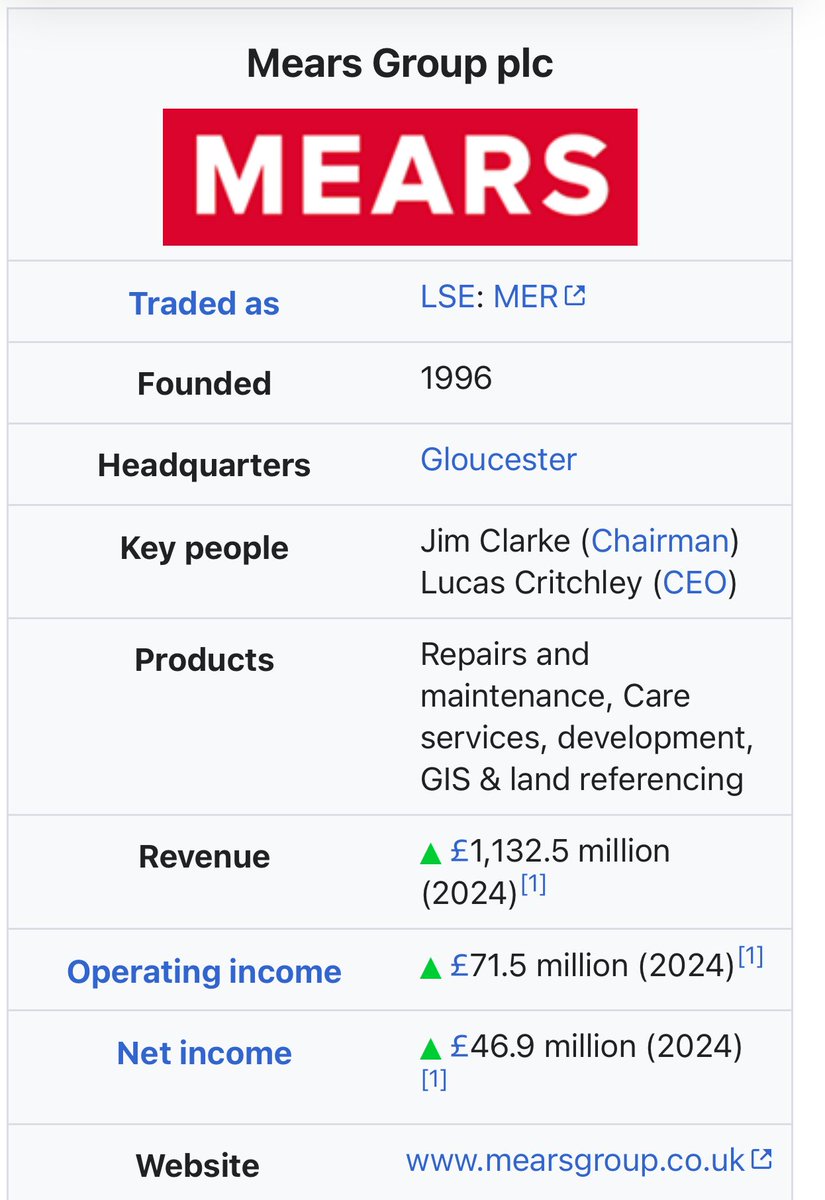

Mears Group snagged £1.15bn in 2019 contracts for Scotland, Northern Ireland, and parts of England.

They’ve repaid £13.8m in excess profits but still operate with slim margins that explode with volume.

Vanguard holds significant shares here too.

They’ve repaid £13.8m in excess profits but still operate with slim margins that explode with volume.

Vanguard holds significant shares here too.

Don’t forget subcontractors like Britannia Hotels, owned by Alex Langsam, which has pocketed £150m since 2020 by turning 17+ hotels into asylum accommodations.

And Bibby Stockholm’s contractor recently replaced an underperforming hotel provider, showing the revolving door of failures, but profits keep rolling.

And Bibby Stockholm’s contractor recently replaced an underperforming hotel provider, showing the revolving door of failures, but profits keep rolling.

The smoking gun?

The UK’s asylum spending has exploded from £500m to £4.3bn annually, with hotel costs alone accounting for 76% of expenses but only 35% of housing.

The National Audit Office (NAO) May 2025 report reveals these three firms (Serco, Mears, Clearsprings) made £383m in profits from 2019-2024/25, with total costs projected to hit £15bn over a decade, triple original estimates.

Oversight? Dismantled after the DfID merger in 2020, echoing Covid-era scandals where £15bn in contracts raised red flags for corruption.

nao.org.uk/wp-content/upl…

The UK’s asylum spending has exploded from £500m to £4.3bn annually, with hotel costs alone accounting for 76% of expenses but only 35% of housing.

The National Audit Office (NAO) May 2025 report reveals these three firms (Serco, Mears, Clearsprings) made £383m in profits from 2019-2024/25, with total costs projected to hit £15bn over a decade, triple original estimates.

Oversight? Dismantled after the DfID merger in 2020, echoing Covid-era scandals where £15bn in contracts raised red flags for corruption.

nao.org.uk/wp-content/upl…

Why does immigration explode?

The system REWARDS inefficiency.

Profits tie to prolonged hotel use and backlogs, delays mean more bodies, more billing.

No incentive to process claims quickly or deter arrivals.

Anomalies abound: Offshore payments by Clearsprings to UAE entities under HMRC probe, subcontractor records missing, and penalties recouping <1% of costs.

High risk of fraud, as warned by ex-DfID head Sir Mark Lowcock: “Scam and scandal” due to zero monitoring.

The system REWARDS inefficiency.

Profits tie to prolonged hotel use and backlogs, delays mean more bodies, more billing.

No incentive to process claims quickly or deter arrivals.

Anomalies abound: Offshore payments by Clearsprings to UAE entities under HMRC probe, subcontractor records missing, and penalties recouping <1% of costs.

High risk of fraud, as warned by ex-DfID head Sir Mark Lowcock: “Scam and scandal” due to zero monitoring.

Connections run deep: Contracts from 2012 privatization (COMPASS) renewed in 2019 (AASC) under Boris Johnson.

Profits flow to Tory donors?

King and others have ties, with public money siphoned to friends.

Protests erupt over hotels, but the real outrage is this: While communities suffer, billionaires laugh to the bank.

Immigration explodes because it’s profitable, for them, not citizens.

Profits flow to Tory donors?

King and others have ties, with public money siphoned to friends.

Protests erupt over hotels, but the real outrage is this: While communities suffer, billionaires laugh to the bank.

Immigration explodes because it’s profitable, for them, not citizens.

• • •

Missing some Tweet in this thread? You can try to

force a refresh