I am giving the exact strategy that saved my trading career, for free of course.

The strategy that made me a profitable trader 🧵

The strategy that made me a profitable trader 🧵

1/ New traders have it completely backwards

FIntwit teaches you to "buy the breakout" and "short the breakdown." What does this mean in reality? It means new traders are buying the tops and shorting the bottoms. Then they wonder why their portfolio is getting bent over.

FIntwit teaches you to "buy the breakout" and "short the breakdown." What does this mean in reality? It means new traders are buying the tops and shorting the bottoms. Then they wonder why their portfolio is getting bent over.

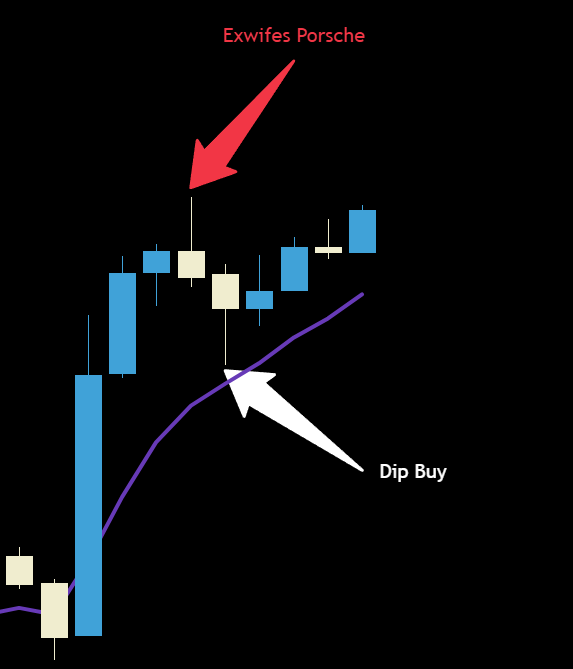

2/ The brutal truth about chasing

When you buy the highs, just imagine a greedy wall street banker counting his money. His 3rd ex wife needs a Porsche and you just provided the down payment. All because you couldn't resist buying the High of the Day.

When you buy the highs, just imagine a greedy wall street banker counting his money. His 3rd ex wife needs a Porsche and you just provided the down payment. All because you couldn't resist buying the High of the Day.

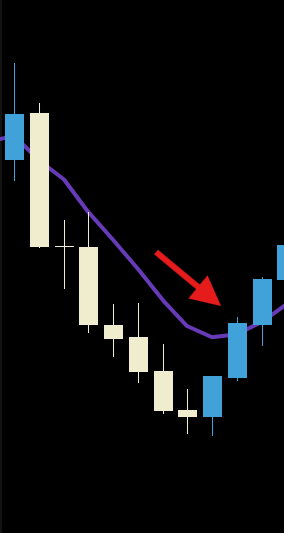

3/ What changed everything for me

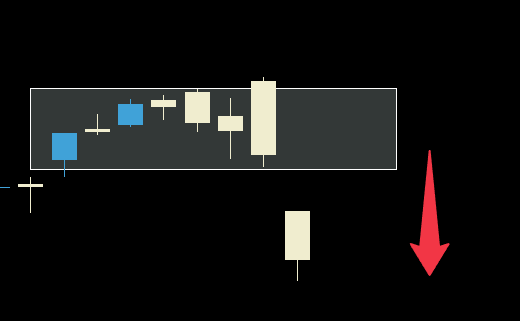

Instead of funding some bankers ex wife's new car (red arrow), I started buying dips on breakouts (white arrow), and shorting pops on breakdowns. Suddenly it felt like I was on the right side of the trade. I was experiencing less and less draw down.

Instead of funding some bankers ex wife's new car (red arrow), I started buying dips on breakouts (white arrow), and shorting pops on breakdowns. Suddenly it felt like I was on the right side of the trade. I was experiencing less and less draw down.

4/ But how do I know when to buy dips?

I was lost and confused. Stocks were at all time highs and I couldn't find a level of support to buy the dip. I thought to myself what do I do?!? What can I use to know its a dip not a reversal. I thought to myself, what line moves with the candle a level off support based on the candles forming? EMAs.

I was lost and confused. Stocks were at all time highs and I couldn't find a level of support to buy the dip. I thought to myself what do I do?!? What can I use to know its a dip not a reversal. I thought to myself, what line moves with the candle a level off support based on the candles forming? EMAs.

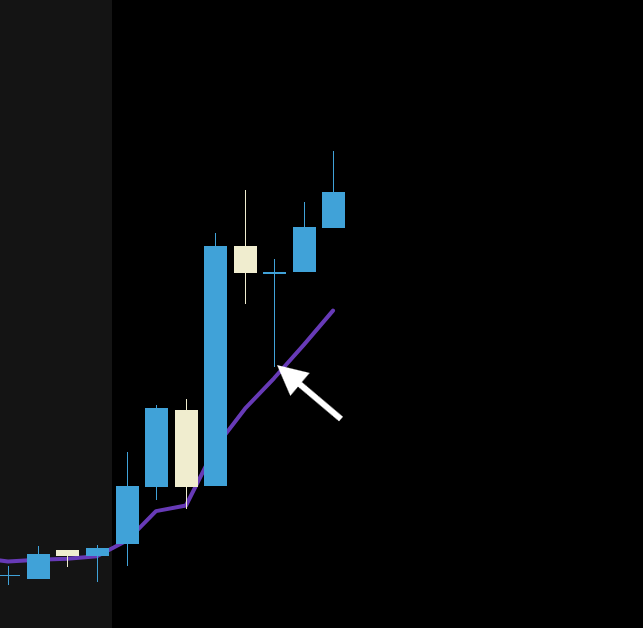

5/ The answer I was looking for

I went on ChatGPT and typed in my problem like any modern person in 2025. "How do I know when to buy the dip?" It told me its not a financial advisor. Great, I thought back to square one. I started scrolling, I saw something called the LE Model. In this model the trader uses the 8ema or the magic purple line.

I went on ChatGPT and typed in my problem like any modern person in 2025. "How do I know when to buy the dip?" It told me its not a financial advisor. Great, I thought back to square one. I started scrolling, I saw something called the LE Model. In this model the trader uses the 8ema or the magic purple line.

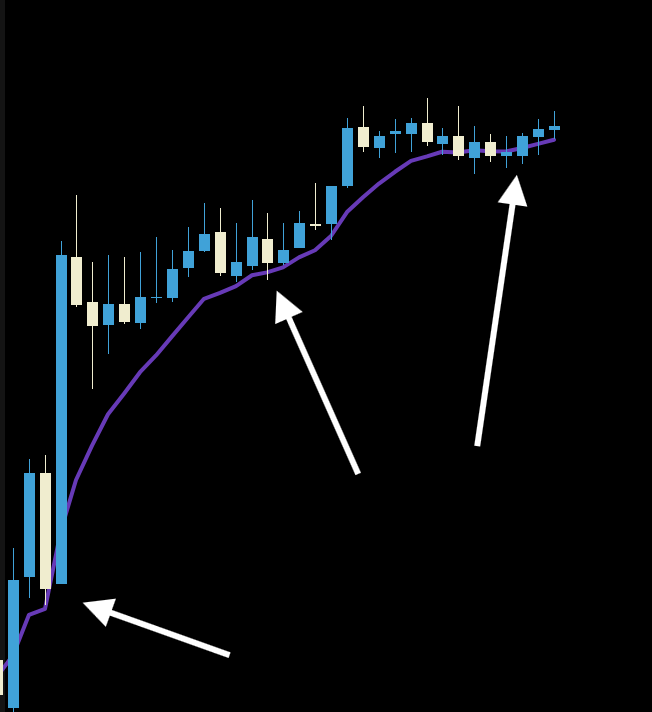

6/ I figured I would give it a try

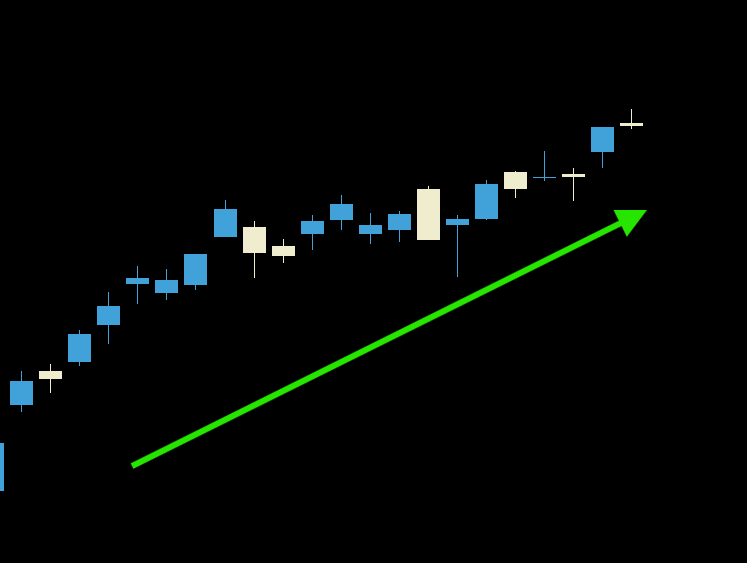

I noticed when a stock would break the range (PMH/L) it would form a trend. If it was above the purple line I would buy calls, if below buy puts. My portfolio started to grow.

I noticed when a stock would break the range (PMH/L) it would form a trend. If it was above the purple line I would buy calls, if below buy puts. My portfolio started to grow.

7/ Why buying the dip to the 8ema works

When a stock breaks out and starts trending, the 8ema acts as dynamic support. Notice its still a level of support just not a horizontal level. While most traders panic, algos are sitting at the EMA ready to gobble up the dips. The EMAs are magnets price gets pulled to them and bounces off.

When a stock breaks out and starts trending, the 8ema acts as dynamic support. Notice its still a level of support just not a horizontal level. While most traders panic, algos are sitting at the EMA ready to gobble up the dips. The EMAs are magnets price gets pulled to them and bounces off.

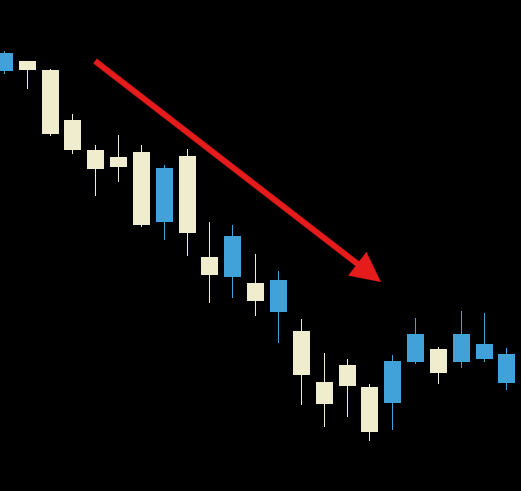

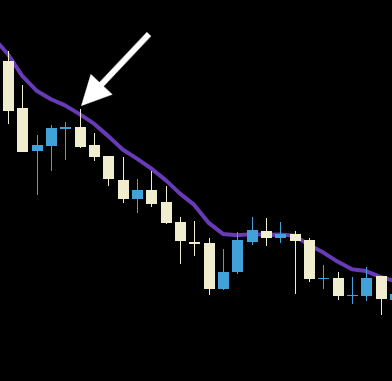

8/ Why shorting the pops to the 8ema works

When a stock breaks down and starts falling, the 8ema becomes dynamic resistance. This resistance adjusts real time as the price falls. Every bounce to the line is just an excuse for hedgefunds to dump more and more shared. The 8ema acts a ceiling on the days price action.

When a stock breaks down and starts falling, the 8ema becomes dynamic resistance. This resistance adjusts real time as the price falls. Every bounce to the line is just an excuse for hedgefunds to dump more and more shared. The 8ema acts a ceiling on the days price action.

9/ Look I have been there

I have been trapped at the HOD more times than I care to admit. Your mind will scream at you "BUY NOW OR YOU WON'T MAKE ANY MONEY!" So you listen to it, because when has your mind steered you wrong before? It tells you when you're hungry and tired. Hedge Funds know this and exploit your weakness like a casino.

I have been trapped at the HOD more times than I care to admit. Your mind will scream at you "BUY NOW OR YOU WON'T MAKE ANY MONEY!" So you listen to it, because when has your mind steered you wrong before? It tells you when you're hungry and tired. Hedge Funds know this and exploit your weakness like a casino.

10/ How I learned to trust the 🟣 line

I reviewed 1000s of setups and wrote down the number of times a stock will bounce off the 8ema. The number is greater than 80%, based off math alone I knew there was edge. If there is edge, there is money to be made. You're probably wondering, what happens if it doesn't bounce?

I reviewed 1000s of setups and wrote down the number of times a stock will bounce off the 8ema. The number is greater than 80%, based off math alone I knew there was edge. If there is edge, there is money to be made. You're probably wondering, what happens if it doesn't bounce?

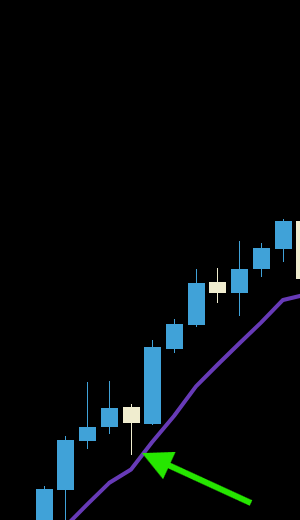

11/ The difference between a dip and reversal

A dip will slowly come down and bounce off the 8ema (green arrow). Reversals slice through the line with a vengeance (red arrow). The rule is simple the 8ema either holds or it doesn't and I cut it for a small loss.

A dip will slowly come down and bounce off the 8ema (green arrow). Reversals slice through the line with a vengeance (red arrow). The rule is simple the 8ema either holds or it doesn't and I cut it for a small loss.

12/ Why I like the 8ema over traditional levels

Levels get old and stale and rarely change. There is so much money to be made in the in-between that often gets overlooked. The 8ema is alive, its almost like its trading with me, watching the same candles I am watching. It's like having a little support and resistance buddy standing next to me while I trade.

Levels get old and stale and rarely change. There is so much money to be made in the in-between that often gets overlooked. The 8ema is alive, its almost like its trading with me, watching the same candles I am watching. It's like having a little support and resistance buddy standing next to me while I trade.

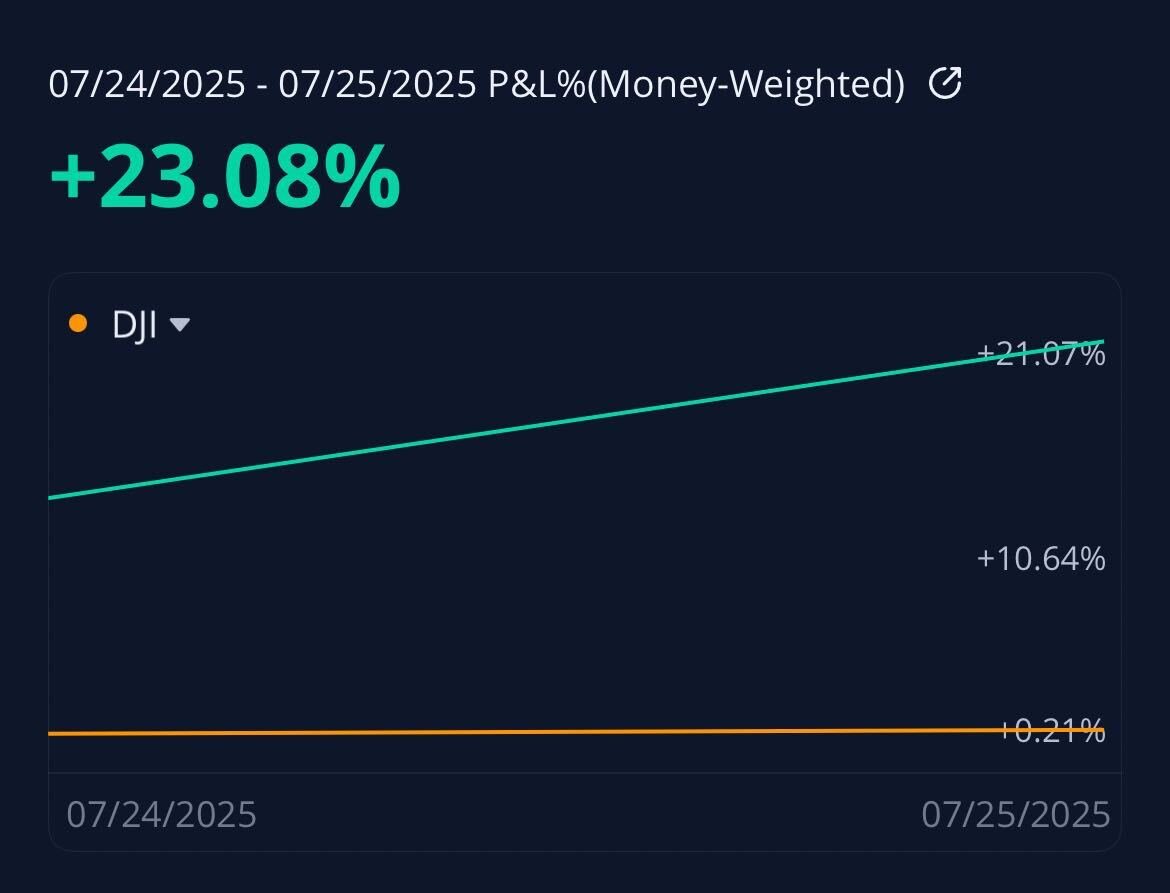

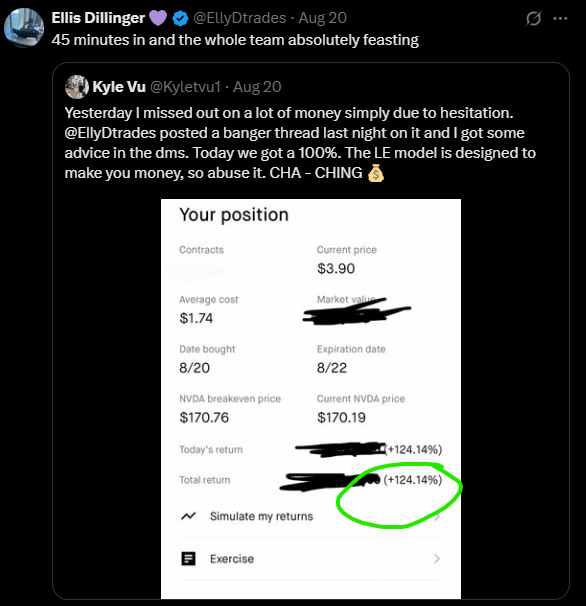

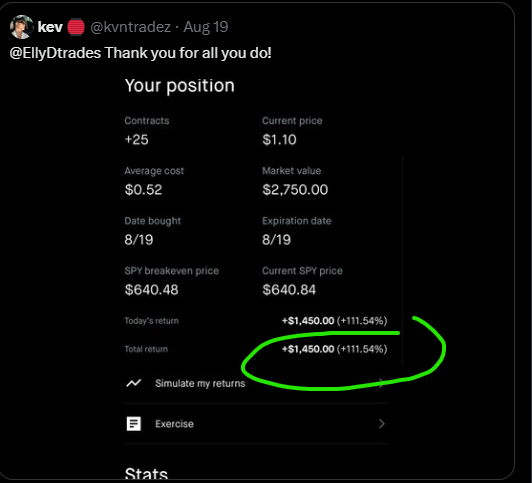

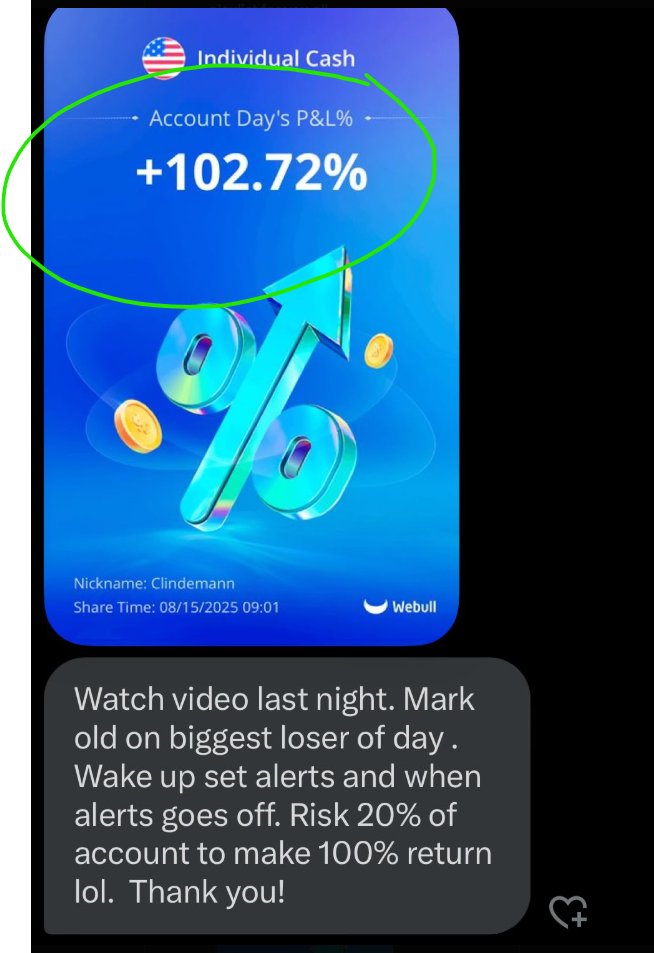

13/ The results speak for themselves

Since I have began teaching this for free, I get tagged almost daily from my my followers hitting 100%ers. We have a rule no retweets until it goes 100%+, which happens often....

Since I have began teaching this for free, I get tagged almost daily from my my followers hitting 100%ers. We have a rule no retweets until it goes 100%+, which happens often....

14/ Your homework

Review your last 10 losing trades, I'd be willing to bet it was because you chased a breakout, instead of waiting the 8ema. Fix just this one thing and your trading career will be saved. Christmas will look different this year, just trust.

Review your last 10 losing trades, I'd be willing to bet it was because you chased a breakout, instead of waiting the 8ema. Fix just this one thing and your trading career will be saved. Christmas will look different this year, just trust.

15/ The best part

You can learn my strategy for 100% free, I don't even need your email. Just click the link below and spend a night watching every video and your trading will change forever. youtube.com/playlist?list=…

You can learn my strategy for 100% free, I don't even need your email. Just click the link below and spend a night watching every video and your trading will change forever. youtube.com/playlist?list=…

16/ If you found this FREE strategy just changed how you think about trading repost it and let your friends know who will be shopping for a new car soon. I have been keeping eyes on who is taking trading seriously 👀

https://x.com/EllyDtrades/status/1960493992526729359

• • •

Missing some Tweet in this thread? You can try to

force a refresh