An activist investor just released a turnaround plan for Cracker Barrel. It's incredible reading.

Sardar Biglari, who fixed Steak 'n Shake after 2008, has owned $CBRL shares for 14 years. And he's not happy with how his investment has gone.

Let's dive into the 120-page plan 👇

Sardar Biglari, who fixed Steak 'n Shake after 2008, has owned $CBRL shares for 14 years. And he's not happy with how his investment has gone.

Let's dive into the 120-page plan 👇

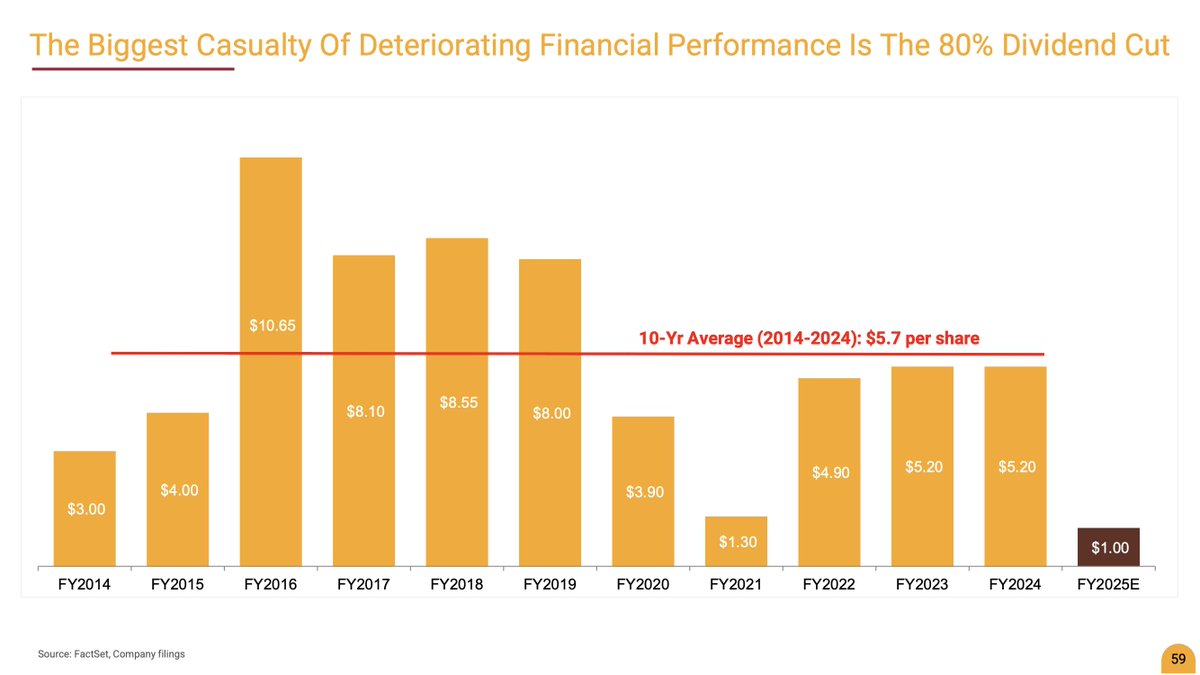

Cracker Barrel stock is down nearly 50% over the last year, compared to a 28% gain in the S&P 500.

Over the last five years, the stock is down 70%, compared to a gain of 108% in the index.

Over the last five years, the stock is down 70%, compared to a gain of 108% in the index.

Even prior to Covid, guest traffic was decreasing 1-2% per year. Over the past two years, it's down 3.5% and 5.0% (these are *massive* declines for a restaurant chain).

Operating income has decreased 84%(!) since FY19.

Operating income has decreased 84%(!) since FY19.

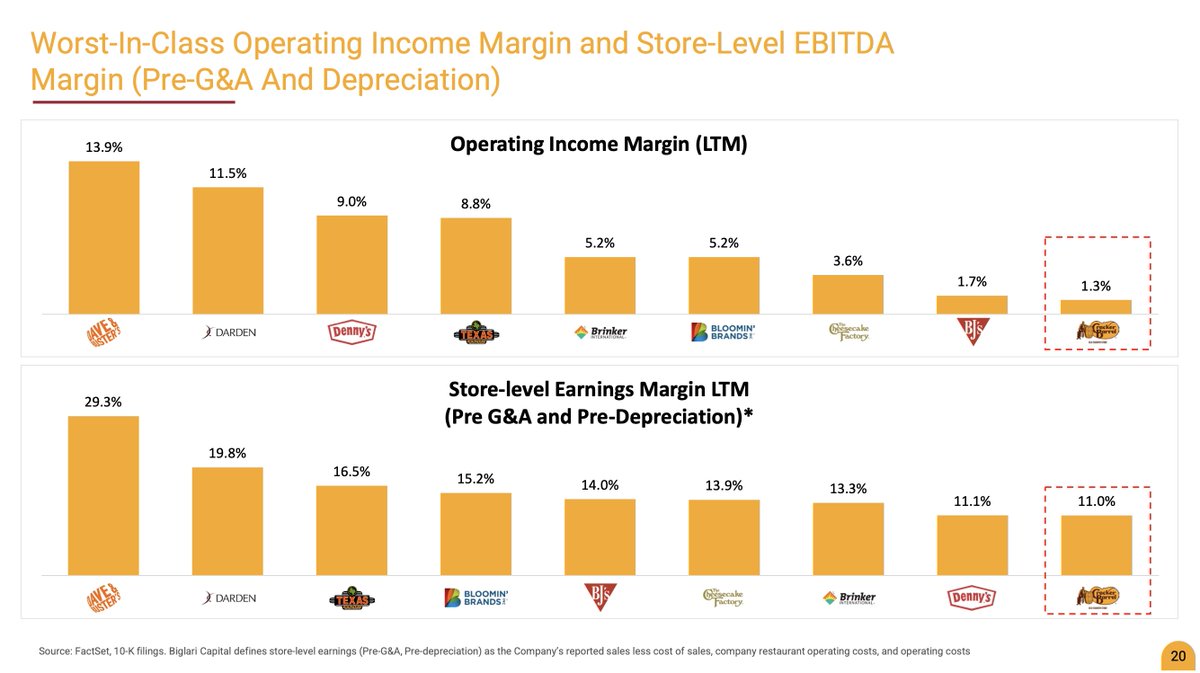

Cracker Barrel has the worst margins in the industry.

Operating margins are just 1.3%, compared to 11.5% for Darden (owner of Olive Garden and Cheddar's).

Even excluding overhead and depreciation, margins are 11.0%, compared to nearly 20% for Darden.

Operating margins are just 1.3%, compared to 11.5% for Darden (owner of Olive Garden and Cheddar's).

Even excluding overhead and depreciation, margins are 11.0%, compared to nearly 20% for Darden.

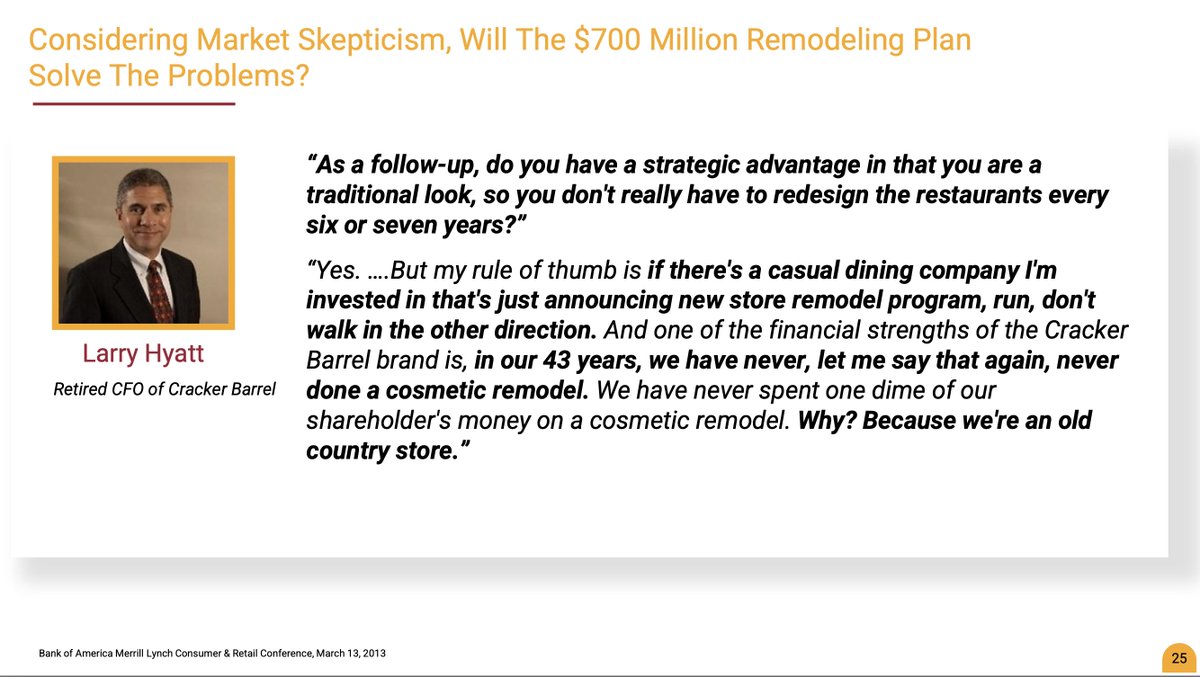

One of Cracker Barrel's advantages used to be that its down home, "old country" style didn't require renovations every 6-7 years.

In the words of their former CFO, if a casual dining company announces a remodel program, "run, don't walk in the other direction."

In the words of their former CFO, if a casual dining company announces a remodel program, "run, don't walk in the other direction."

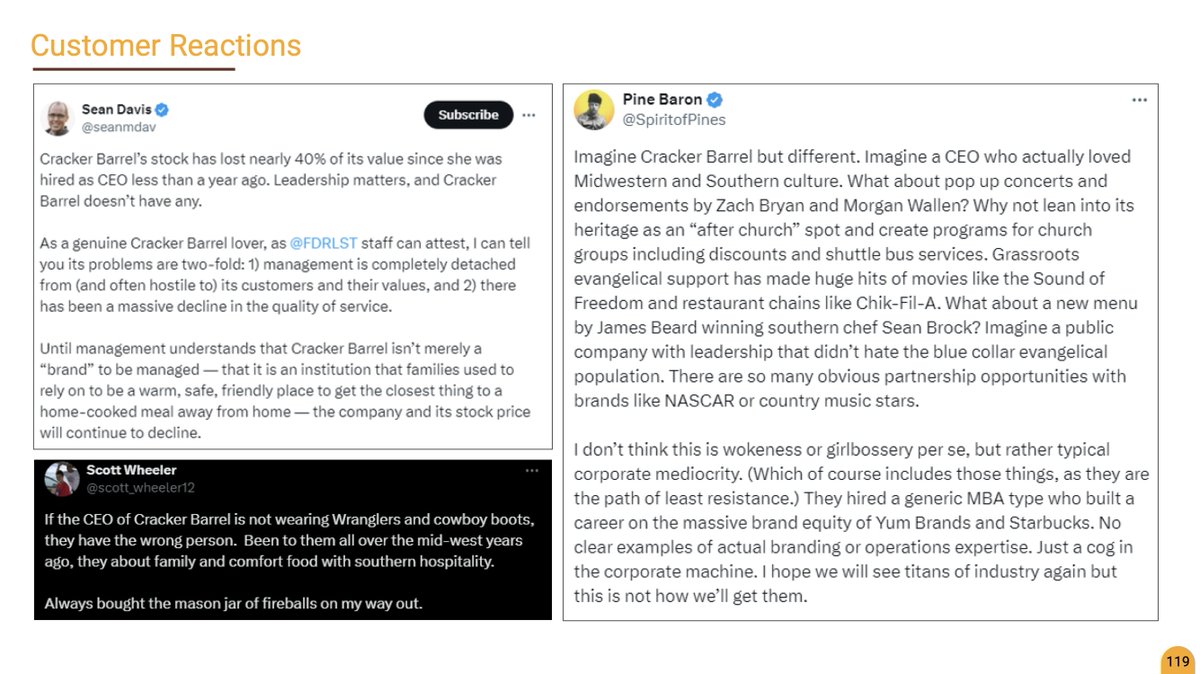

Customer complaints center on reduced quality and smaller portion sizes. Store remodels don't fix this.

(Note: I'm sure the company is in a bind here. Its elderly customers are likely price-sensitive, and rising ingredient prices don't leave them much room to maintain margins.)

(Note: I'm sure the company is in a bind here. Its elderly customers are likely price-sensitive, and rising ingredient prices don't leave them much room to maintain margins.)

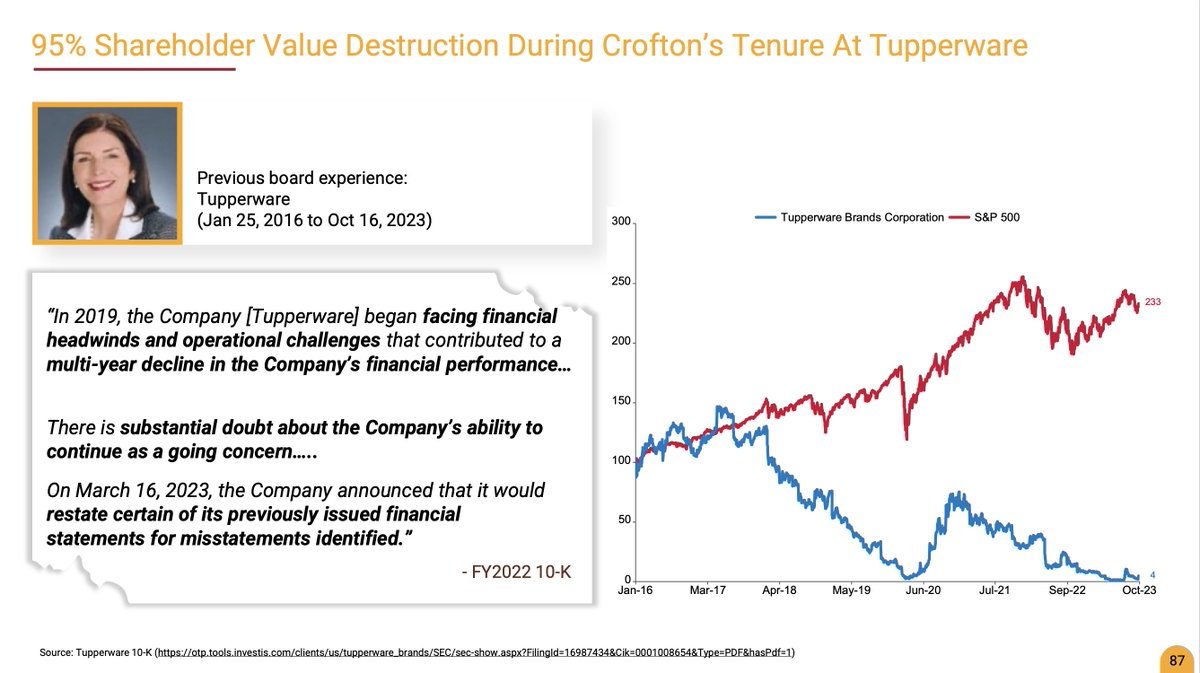

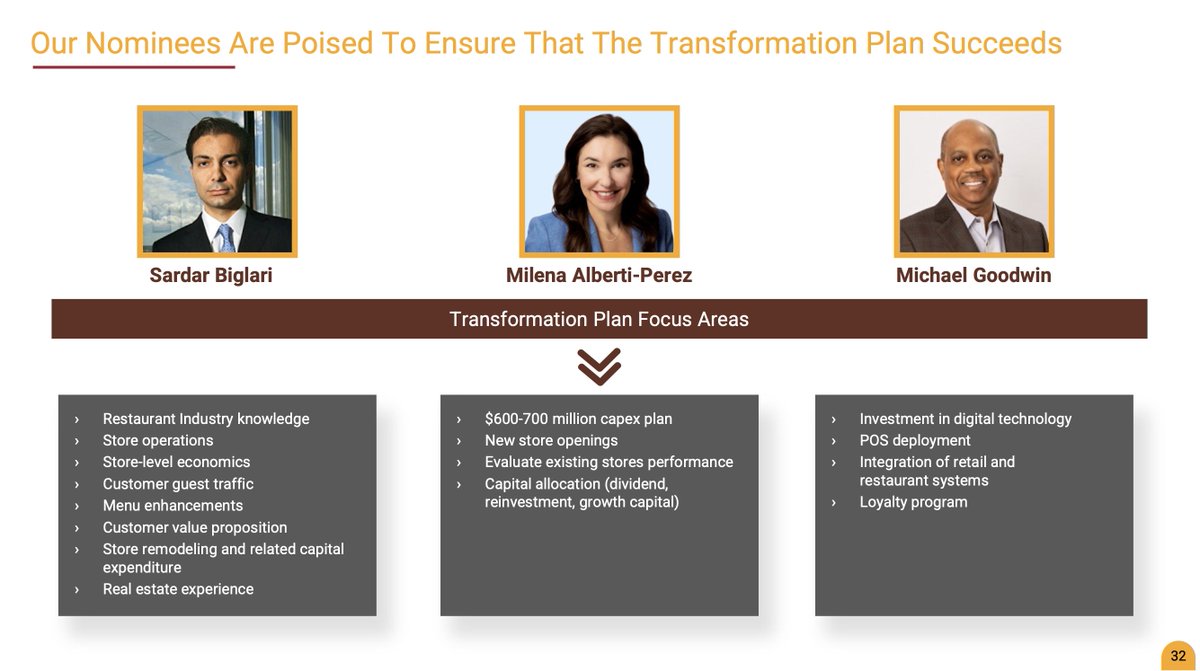

Biglari is nominating three directors—including himself—with strong experience in casual restaurants.

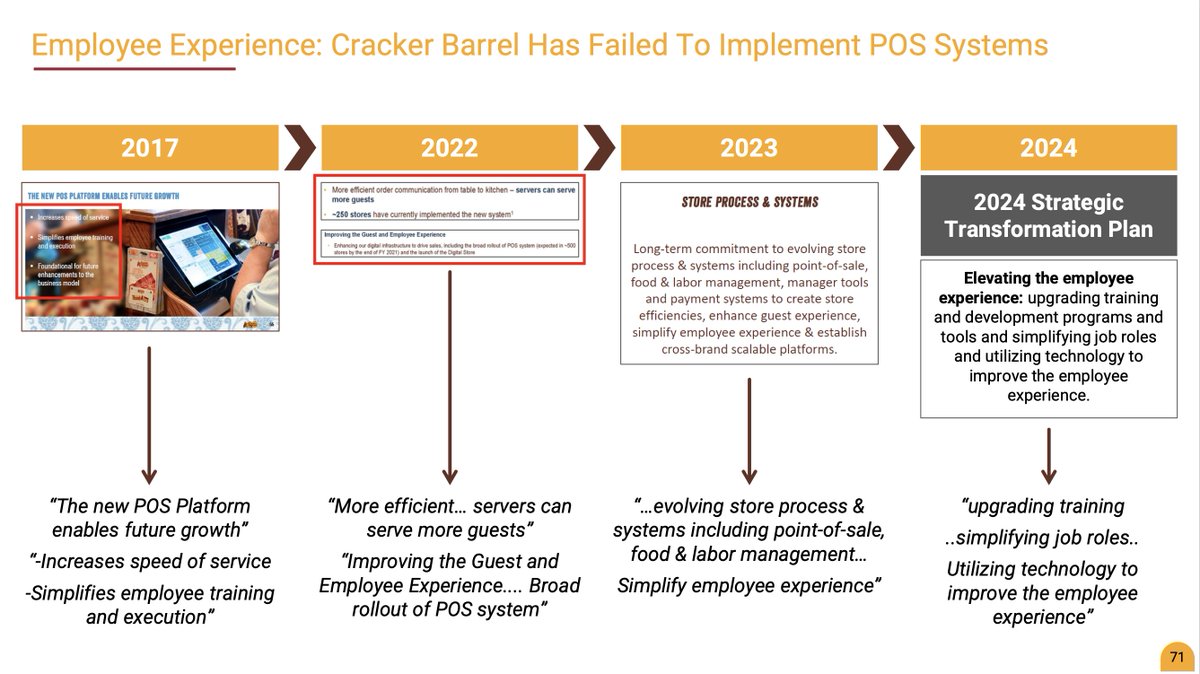

Focus areas: More store openings, better customer value prop, high-ROIC growth, customer loyalty program, addressing technology challenges.

Focus areas: More store openings, better customer value prop, high-ROIC growth, customer loyalty program, addressing technology challenges.

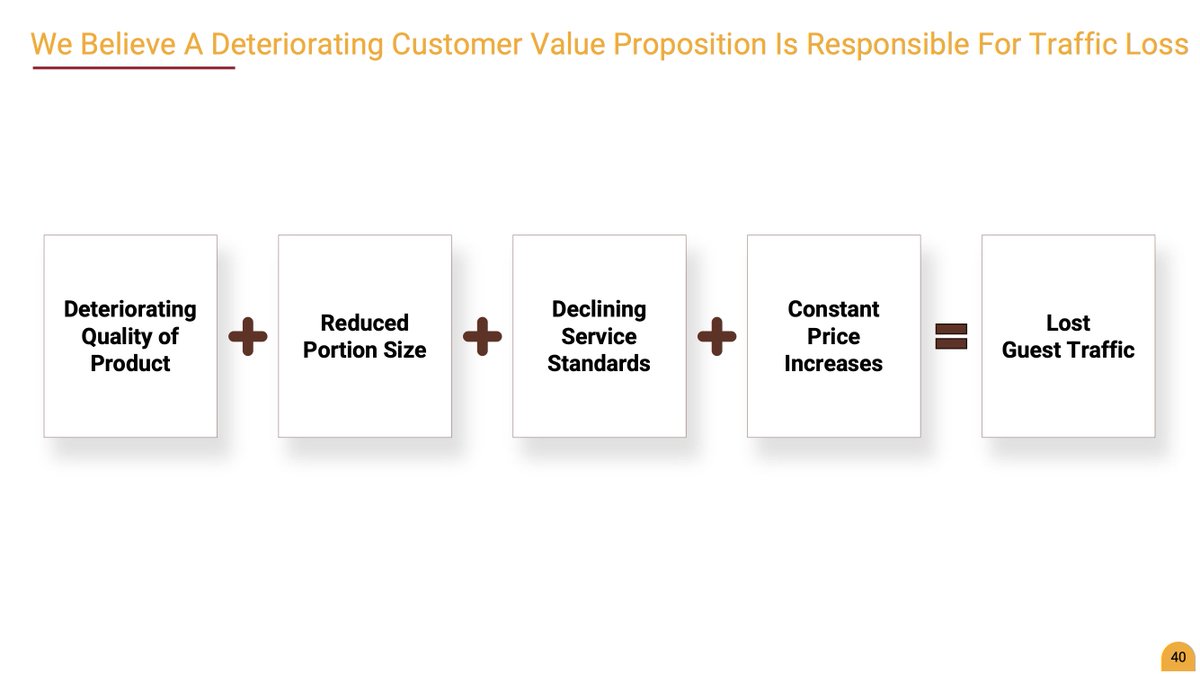

Formula for erosion of traffic:

Deteriorating product quality

Reduced portion sizes

Declining service

Price increases

Again, hard to manage that dynamic when consumers are price sensitive, ingredient prices are rising, and labor is short.

Deteriorating product quality

Reduced portion sizes

Declining service

Price increases

Again, hard to manage that dynamic when consumers are price sensitive, ingredient prices are rising, and labor is short.

Cracker Barrel has spent $853M on capex since FY19.

For comparison, operating income over the period was $754M. The company is spending more on growth (which isn't leading to new revenue) than it's generating in EBIT.

For comparison, operating income over the period was $754M. The company is spending more on growth (which isn't leading to new revenue) than it's generating in EBIT.

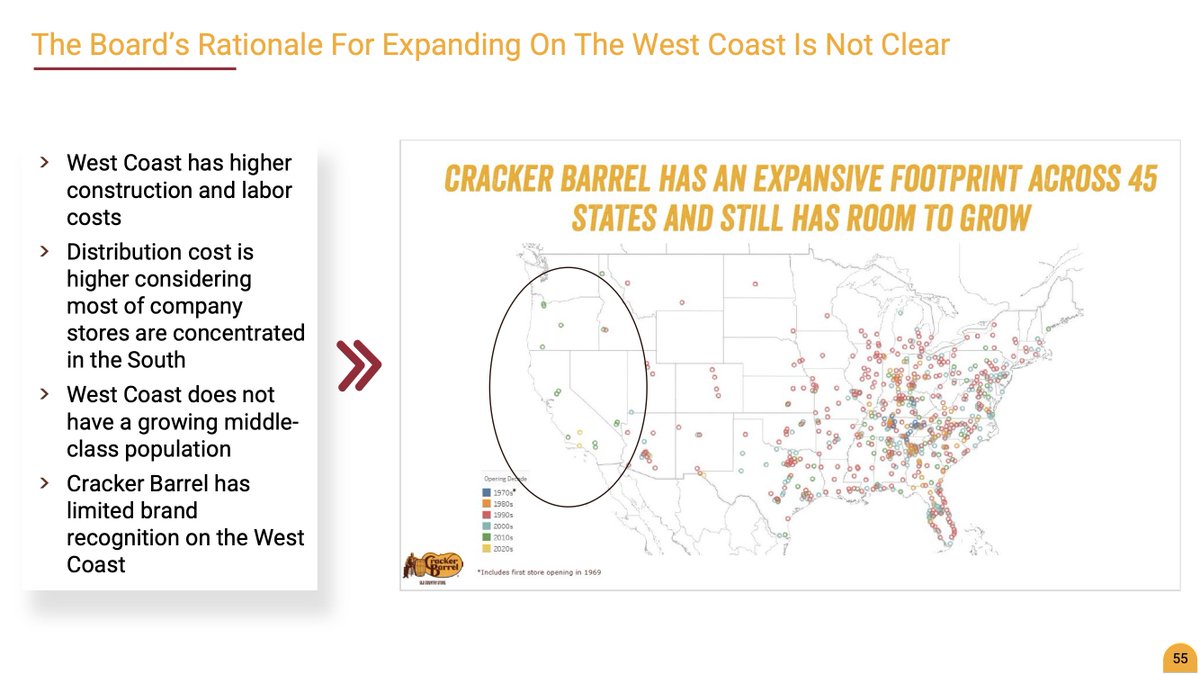

West Coast expansion won't save the company—costs are higher and brand recognition is lower.

The company has already had to close nearly 60% of is locations in California and Oregon.

The company has already had to close nearly 60% of is locations in California and Oregon.

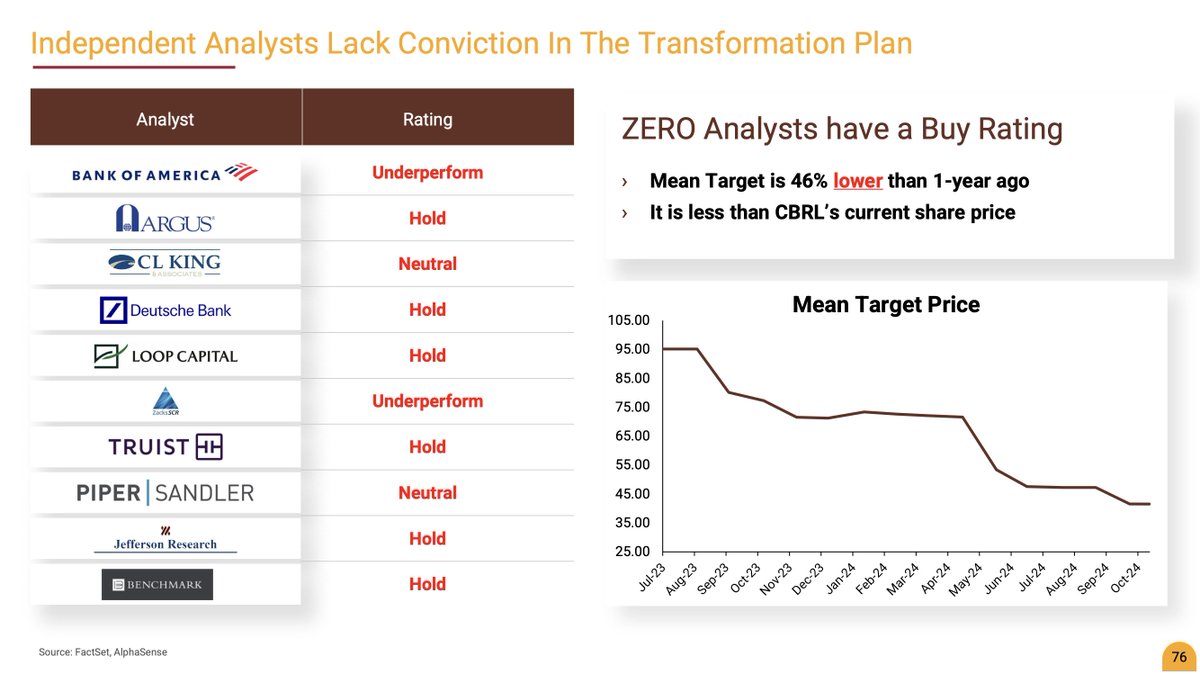

Wall Street equity research analysts have no confidence in management's turnaround plan.

Zero analysts have a buy rating on the stock.

Zero analysts have a buy rating on the stock.

Activist investor Starboard (remember their viral deck about Darden back in the day?) warned that restraurant remodels are an easy way to incinerate cash and destroy shareholder value.

When it comes to remodels, ROIC is almost always below WACC.

When it comes to remodels, ROIC is almost always below WACC.

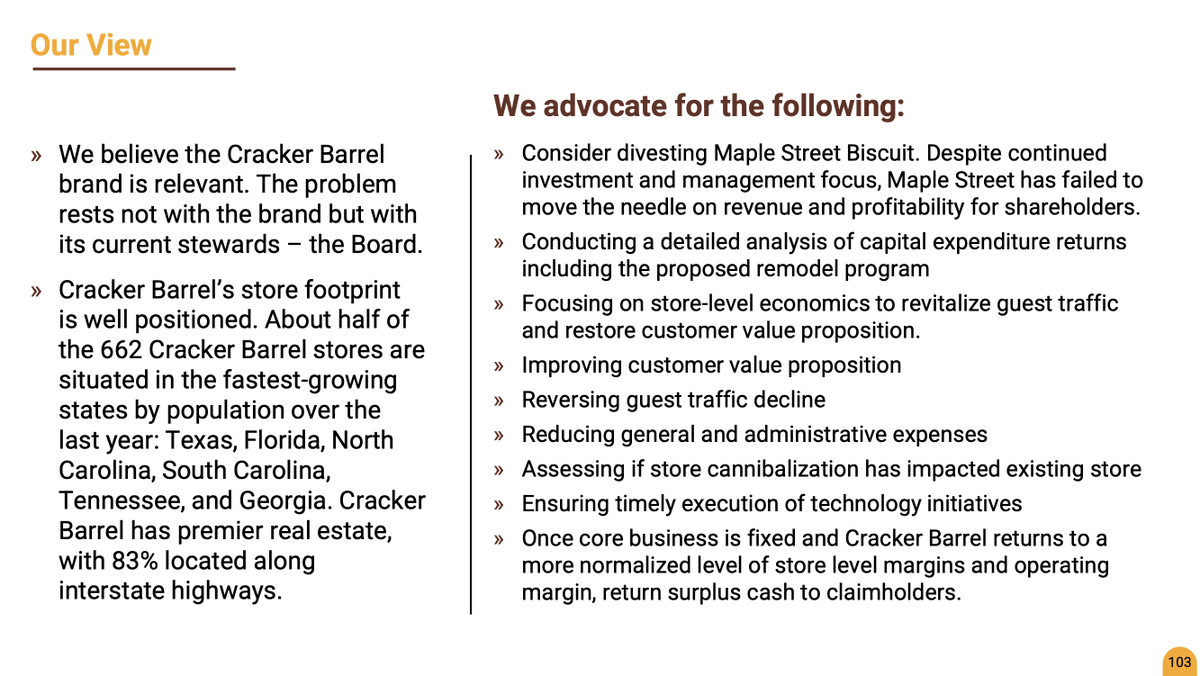

Conclusion:

- Divest Maple Street Biscuit

- Make sure capex generates acceptable ROIC

- Fix the customer value prop

- Reverse the decline in store traffic

- Leverage good footprint (662 locations, many in high-growth areas) to return cash to shareholders once margins improve

- Divest Maple Street Biscuit

- Make sure capex generates acceptable ROIC

- Fix the customer value prop

- Reverse the decline in store traffic

- Leverage good footprint (662 locations, many in high-growth areas) to return cash to shareholders once margins improve

• • •

Missing some Tweet in this thread? You can try to

force a refresh