🧵Why It's Easy to Retire on Bitcoin

Opening your 401(k) statement feels like eating gas-station sushi.

Today we spice the bland 4 % Rule with Bitcoin rocket fuel.

Grab a helmet, the buffet just caught fire. 👇

Opening your 401(k) statement feels like eating gas-station sushi.

Today we spice the bland 4 % Rule with Bitcoin rocket fuel.

Grab a helmet, the buffet just caught fire. 👇

Quick refresher:

The 4 % Rule says withdraw 4 % of your starting balance each year, then raise that payout with inflation.

Historically it keeps you solvent for 30 years.

Example: $1 M → $40 K first year, inflation bumps later.

Simple, boring, fine.

The 4 % Rule says withdraw 4 % of your starting balance each year, then raise that payout with inflation.

Historically it keeps you solvent for 30 years.

Example: $1 M → $40 K first year, inflation bumps later.

Simple, boring, fine.

What happens if you trusted the S&P 500 from 2015-2024?

You posted roughly 243 % total return, ~13 % per year.

$1 M ballooned to $3.43 M.

Nice, but it still buys the economy-class cruise that serves lukewarm shrimp.

You posted roughly 243 % total return, ~13 % per year.

$1 M ballooned to $3.43 M.

Nice, but it still buys the economy-class cruise that serves lukewarm shrimp.

Same decade, same starting pile, 100 % Bitcoin.

Return: 41 536 % (yes, three commas).

$1 M → $416 M.

The withdrawal check is $16.6 M per year, indexed to inflation.

That covers shrimp, cruise ship, and the ocean.

Return: 41 536 % (yes, three commas).

$1 M → $416 M.

The withdrawal check is $16.6 M per year, indexed to inflation.

That covers shrimp, cruise ship, and the ocean.

Blended magic:

• 80 % S&P, 20 % BTC → $86 M

• Withdrawal: $3.44 M per year

You kept four-fifths in polite index funds yet nuked mediocrity 25×.

• 80 % S&P, 20 % BTC → $86 M

• Withdrawal: $3.44 M per year

You kept four-fifths in polite index funds yet nuked mediocrity 25×.

Why? Bitcoin is asymmetry in a bottle.

Downside capped at what you invest, upside basically open season on fiat.

A teaspoon of orange powder turns oatmeal into nitroglycerin pancakes.

Downside capped at what you invest, upside basically open season on fiat.

A teaspoon of orange powder turns oatmeal into nitroglycerin pancakes.

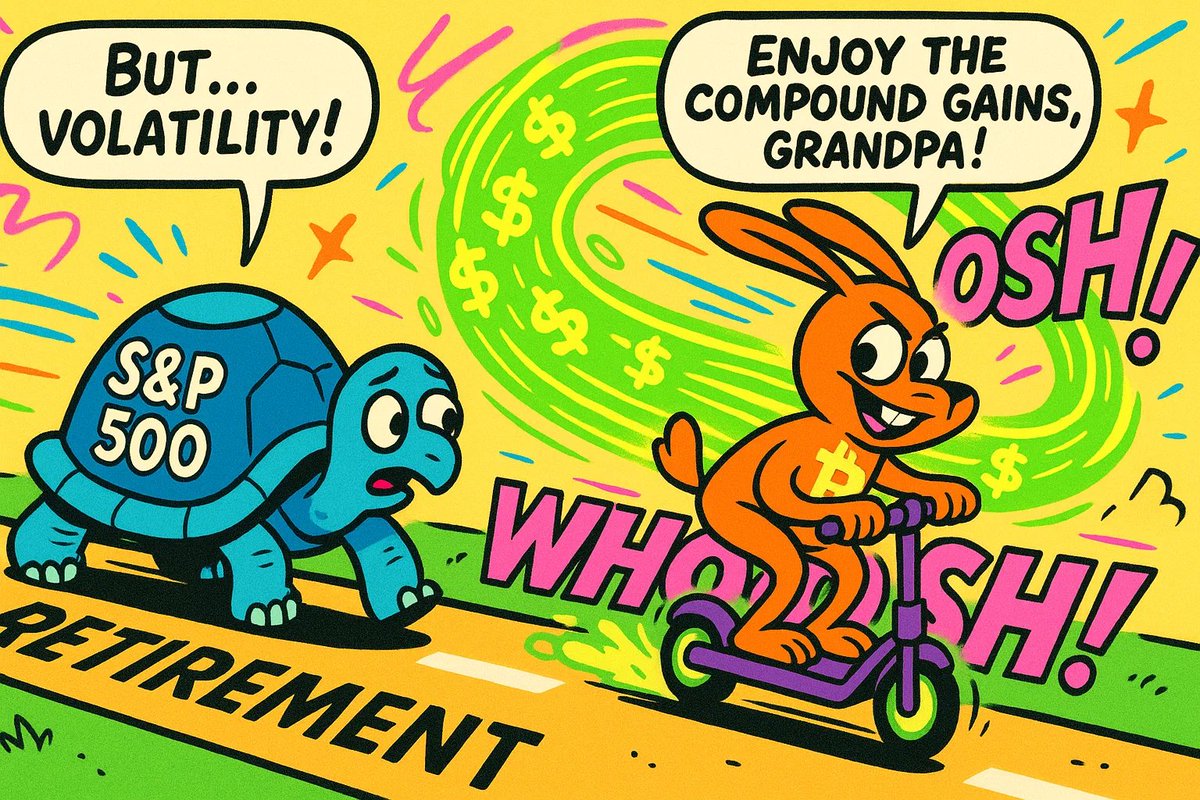

Yes, volatility is real.

Bitcoin once face-planted 73 %.

The 80/20 portfolio saw a worst-year drawdown near 29 %. Ugly, but that drawdown later bought yachts.

Cold cash buffer = sanity serum for people not totally sold on Bitcoin yet.

Bitcoin once face-planted 73 %.

The 80/20 portfolio saw a worst-year drawdown near 29 %. Ugly, but that drawdown later bought yachts.

Cold cash buffer = sanity serum for people not totally sold on Bitcoin yet.

Implementation cheat code:

(aka life-changing advice for someone not even a full BTC maxi yet):

1️⃣ Pick a 10-20 % BTC slice.

2️⃣ DCA weekly, sleep better.

3️⃣ Rebalance annually.

4️⃣ Cold storage wallet, multi-sig, zero excuses.

5️⃣ Keep 3-5 years expenses in T-Bills or cash.

(aka life-changing advice for someone not even a full BTC maxi yet):

1️⃣ Pick a 10-20 % BTC slice.

2️⃣ DCA weekly, sleep better.

3️⃣ Rebalance annually.

4️⃣ Cold storage wallet, multi-sig, zero excuses.

5️⃣ Keep 3-5 years expenses in T-Bills or cash.

I ran 10,000 Monte Carlo simulations.

Classic S&P survives ~90 % of timelines. (30 yrs retirement)

The 80/20 blend survives 96 %, even with back-to-back Bitcoin crashes.

Trim withdrawals by 10 % in disasters and the plan turns into a cockroach with diamond armor.

Classic S&P survives ~90 % of timelines. (30 yrs retirement)

The 80/20 blend survives 96 %, even with back-to-back Bitcoin crashes.

Trim withdrawals by 10 % in disasters and the plan turns into a cockroach with diamond armor.

The old 4 % Rule paid the bills.

Add Bitcoin, your bills pay themselves while you hunt for a tax haven with beach views.

Time to press the orange button, automate the buys, and invite your financial advisor to the victory parade.

Add Bitcoin, your bills pay themselves while you hunt for a tax haven with beach views.

Time to press the orange button, automate the buys, and invite your financial advisor to the victory parade.

If you'd like this thread in video form where I break down the power of Bitcoin for retirement, here you go!

• • •

Missing some Tweet in this thread? You can try to

force a refresh