$DLO is a best-in-class fintech set to 5x

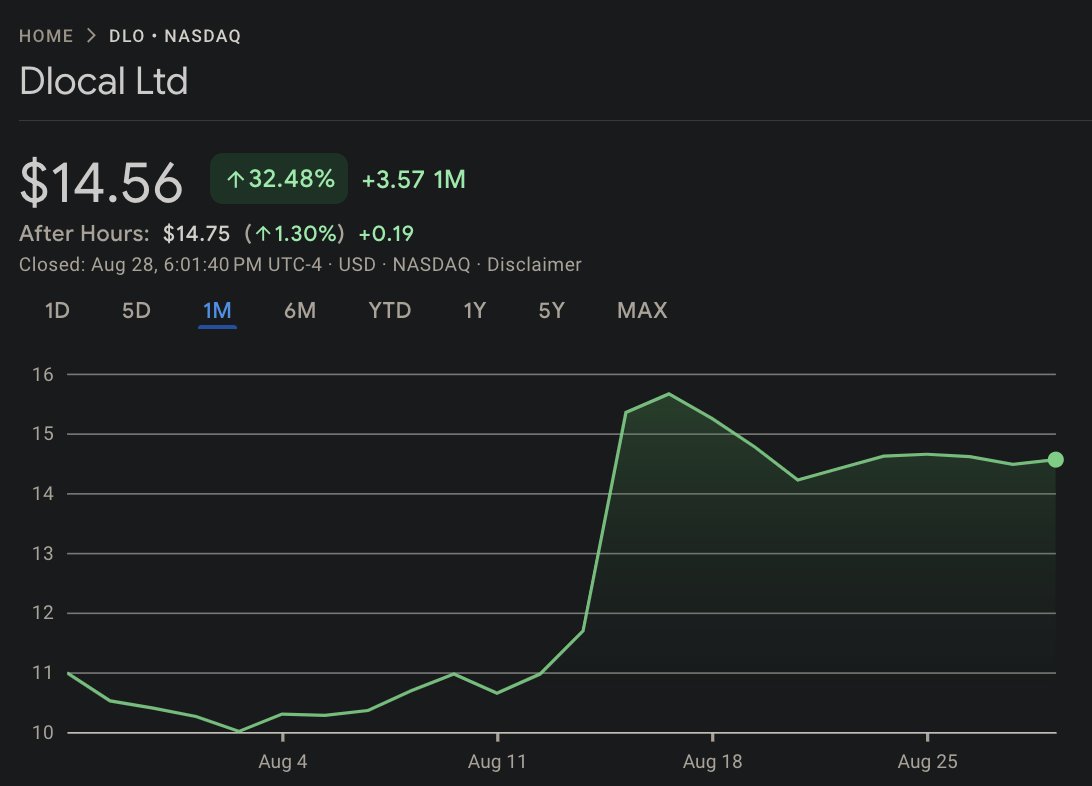

Stock is up 40% since the earnings 🚀

Payment volumes are exploding, revenue growth is accelerating, and profits are at record highs.

Here is my $DLO Investment Thesis:🧵

Stock is up 40% since the earnings 🚀

Payment volumes are exploding, revenue growth is accelerating, and profits are at record highs.

Here is my $DLO Investment Thesis:🧵

1/ A+++ CEO

$DLO is led by Pedro Arnt, who for 12 years was the CFO of $MELI.

During his tenure, Mercado Libre transitioned from a small e-commerce company with revenues of $20M into an e-commerce, logistics, and fintech behemoth with revenues of $20B and payment volume of $120B.

There is possibly no one better in the world DLocal could have picked as their leader to scale them into a similar-sized payments company!

$DLO is led by Pedro Arnt, who for 12 years was the CFO of $MELI.

During his tenure, Mercado Libre transitioned from a small e-commerce company with revenues of $20M into an e-commerce, logistics, and fintech behemoth with revenues of $20B and payment volume of $120B.

There is possibly no one better in the world DLocal could have picked as their leader to scale them into a similar-sized payments company!

2/ $DLO is a payment processor akin to $ADYEN and Stripe.

How are they different?

$DLO focuses exclusively on emerging markets!

These are countries in Africa, South America, and Asia with large populations, fast economic growth, but low digital penetration.

How are they different?

$DLO focuses exclusively on emerging markets!

These are countries in Africa, South America, and Asia with large populations, fast economic growth, but low digital penetration.

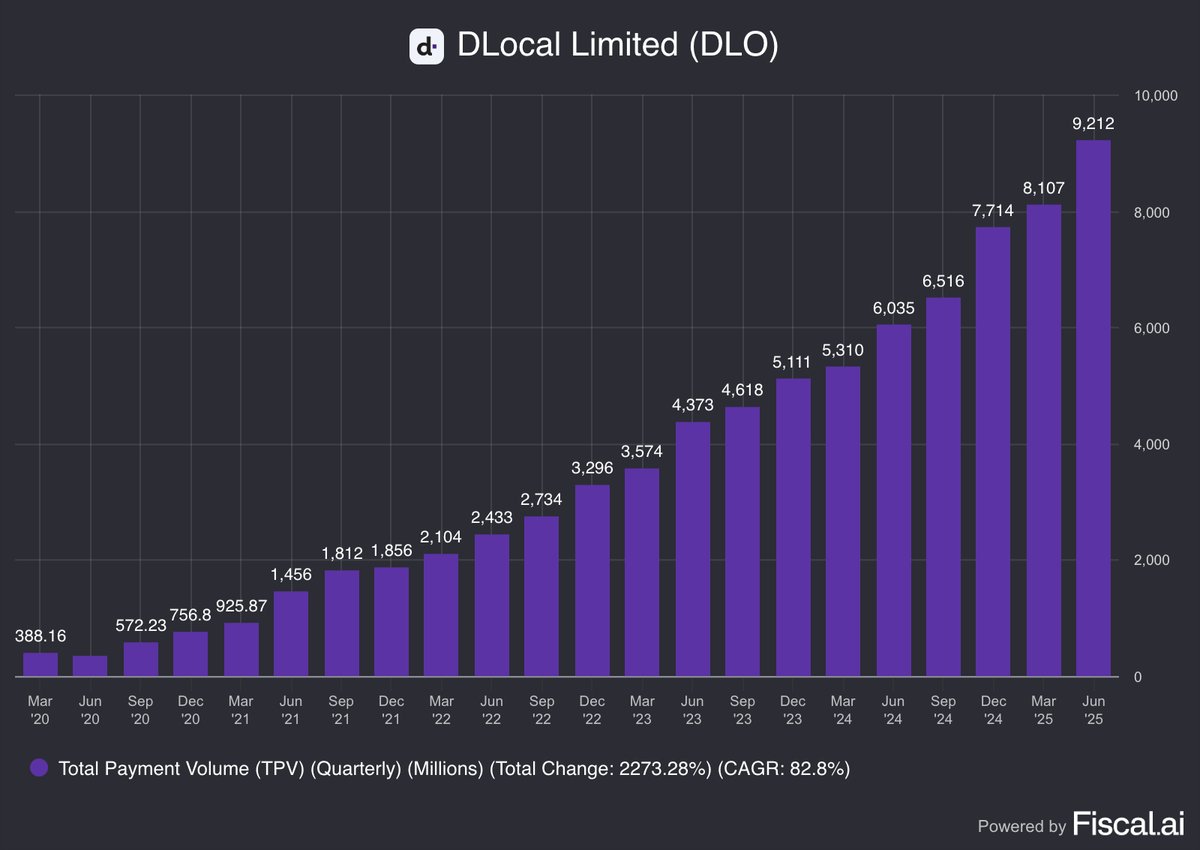

3/ Focusing exclusively on emerging markets has allowed $DLO to turbocharge its business!

Payment volumes have grown over 20x

From $388M in Q1 2020 to $9.1B in Q1 2025

Payment volumes have grown over 20x

From $388M in Q1 2020 to $9.1B in Q1 2025

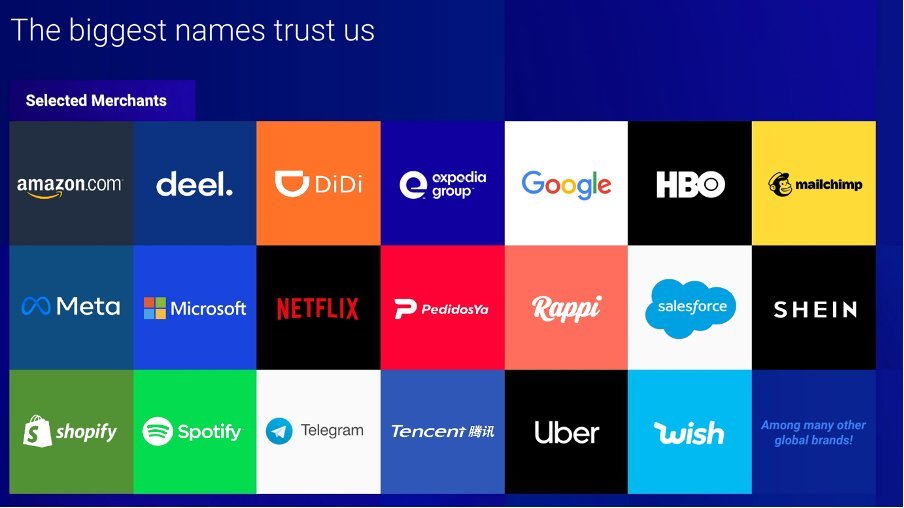

4/ The GREATEST clients one could ask for

🇧🇷 $DLO works with $AMZN in Brazil

🇳🇬 $SPOT in Nigeria

🇲🇽 $UBER in Mexico

🇪🇬 $NFLX in Egypt

🇰🇪 $GOOGL in Kenya

These companies are the most demanding in the world, they wouldn't work with $DLO if their services weren't the BEST!

🇧🇷 $DLO works with $AMZN in Brazil

🇳🇬 $SPOT in Nigeria

🇲🇽 $UBER in Mexico

🇪🇬 $NFLX in Egypt

🇰🇪 $GOOGL in Kenya

These companies are the most demanding in the world, they wouldn't work with $DLO if their services weren't the BEST!

5/ The Opportunity is STRATOSPHERIC

Why would $DLO work just in these "poor" countries, is there money to be made, you ask? A big YES.

By 2028, the digital payments volumes in emerging markets will reach $3.7T!

Today, $DLO processes not even 1% of that!

The path for growth is clear:

Why would $DLO work just in these "poor" countries, is there money to be made, you ask? A big YES.

By 2028, the digital payments volumes in emerging markets will reach $3.7T!

Today, $DLO processes not even 1% of that!

The path for growth is clear:

6/ New Regions

$DLO operates in around 40 countries.

While indeed impressive, the World Bank classifies 150 countries as developing and emerging.

There is potential to still expand in Africa, Eastern Europe, and Central Asia.

$DLO operates in around 40 countries.

While indeed impressive, the World Bank classifies 150 countries as developing and emerging.

There is potential to still expand in Africa, Eastern Europe, and Central Asia.

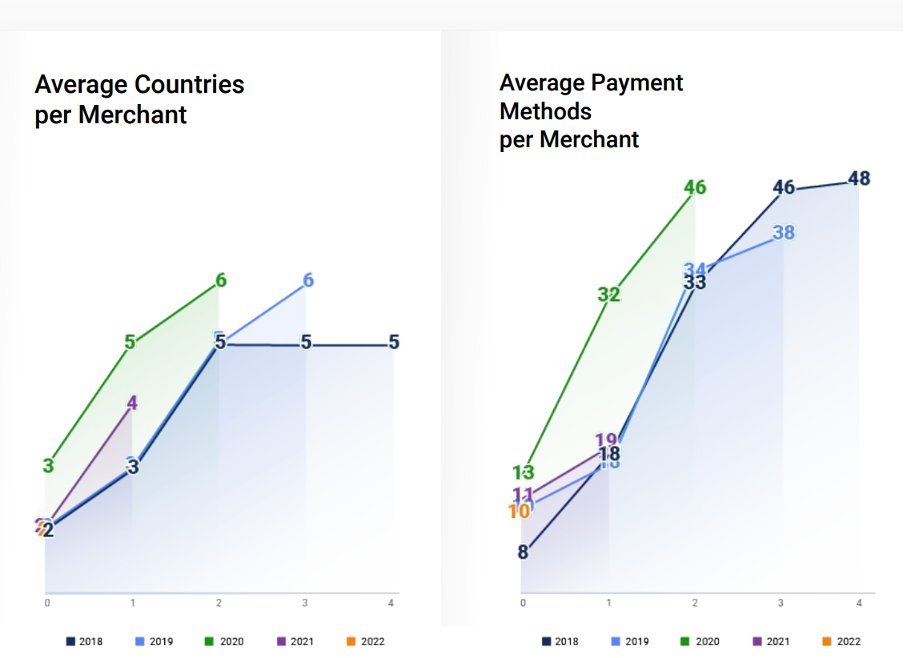

7/ Increasing Transaction Volumes with current clients

An average client uses $DLO in 5 countries and for over 40 payment methods.

$Meta in 2024 made over $50B from South America, Africa, and Asia. Meanwhile, $GOOGL earned close to $80B in South America and Asia.

Let’s remember that DLocal’s entire TPV is just $28B, around 40% of Meta’s business in its target markets. And this is just one of their customers.

The opportunity to capture a larger slice of their business is immense!

An average client uses $DLO in 5 countries and for over 40 payment methods.

$Meta in 2024 made over $50B from South America, Africa, and Asia. Meanwhile, $GOOGL earned close to $80B in South America and Asia.

Let’s remember that DLocal’s entire TPV is just $28B, around 40% of Meta’s business in its target markets. And this is just one of their customers.

The opportunity to capture a larger slice of their business is immense!

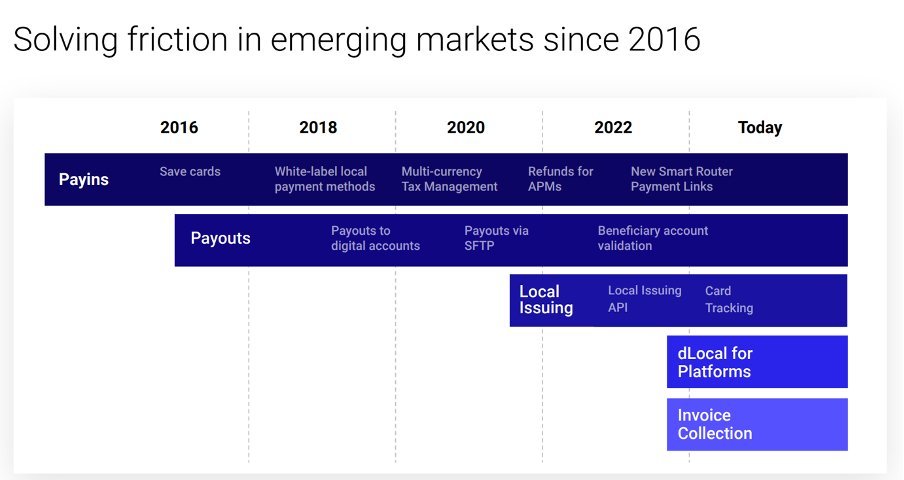

8/ New Products

$DLO started in 2016 in a single country with a single product, but has since developed many innovative products to solve the payment complexity in emerging markets.

They combine on-the-ground local expertise with regional and global technology experts to fully grasp merchant needs and how to better serve them.

While their offering is already broad, there is potential to develop it further, and I am sure they are working diligently to release new products.

$DLO started in 2016 in a single country with a single product, but has since developed many innovative products to solve the payment complexity in emerging markets.

They combine on-the-ground local expertise with regional and global technology experts to fully grasp merchant needs and how to better serve them.

While their offering is already broad, there is potential to develop it further, and I am sure they are working diligently to release new products.

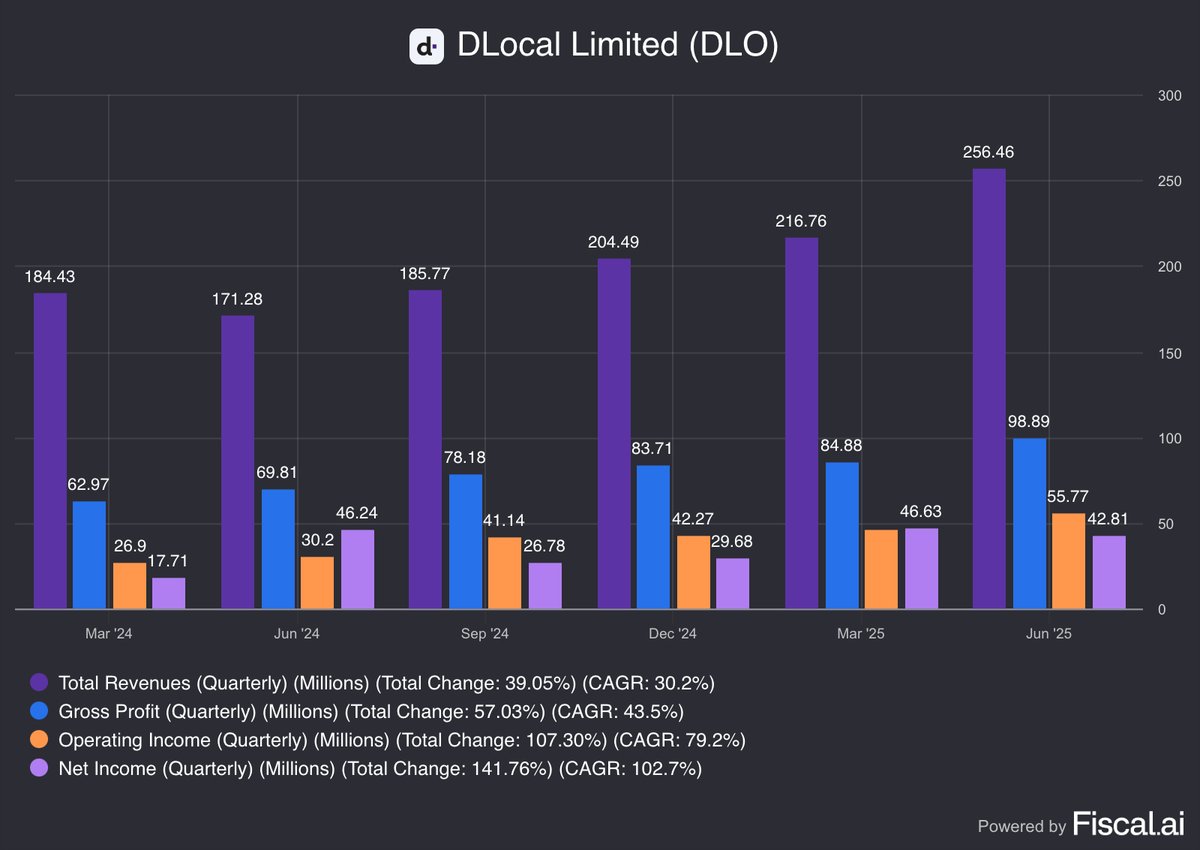

9/ Growth is reaccelerating

In Q1 2025, $DLO growth rates accelerated from 2024.

Revenue: $217M +49.7% Y/Y (14.7% in 2024)

Gross Profit: $85M +41.7% Y/Y (6.4% in 2024)

Operating Income: $46M +84.7% Y/Y (-21.7% in 2024)

Net Income: $47M -7.4% Y/Y *FX (-19.1% in 2024)

In Q1 2025, $DLO growth rates accelerated from 2024.

Revenue: $217M +49.7% Y/Y (14.7% in 2024)

Gross Profit: $85M +41.7% Y/Y (6.4% in 2024)

Operating Income: $46M +84.7% Y/Y (-21.7% in 2024)

Net Income: $47M -7.4% Y/Y *FX (-19.1% in 2024)

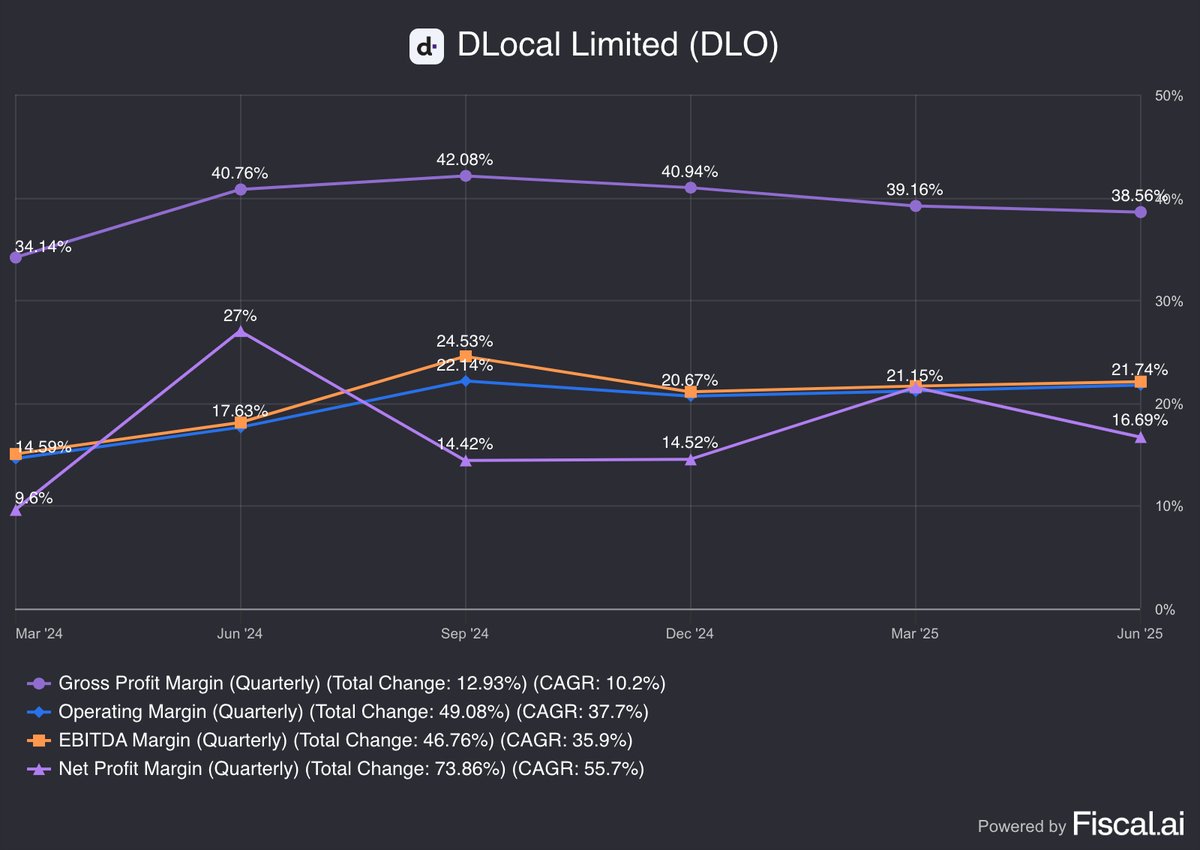

10/ Margins are improving

In Q2 2025, $DLO margins jumped

Gross Margin: from 34% to 39%

Operating: 14.6% to 21.2%

EBITDA: 15% to 22%

Net Income: 9.6% to 17%

In Q2 2025, $DLO margins jumped

Gross Margin: from 34% to 39%

Operating: 14.6% to 21.2%

EBITDA: 15% to 22%

Net Income: 9.6% to 17%

11/ Valuation is affordable

Despite $DLO rising 32% in the past month, the company still trades at a reasonable P/E of 30.

Analysts expect that by 2027, the company will grow sales by 76% and earnings by 83%.

Meaning 2027 P/E is 16

Despite $DLO rising 32% in the past month, the company still trades at a reasonable P/E of 30.

Analysts expect that by 2027, the company will grow sales by 76% and earnings by 83%.

Meaning 2027 P/E is 16

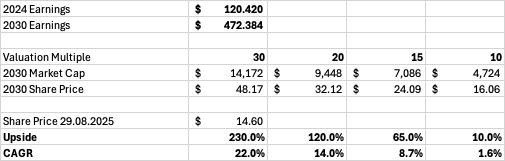

12/ 2030 Share Price

If $DLO grows earnings with a 26% CAGR from 2024 to 2030, they could generate $472M in Net Income.

A P/E of 30 would result in a market cap of $14.2B

That is an upside of over 230% from today's level.

3X return in 5 years is a CAGR of 27%.

5X return if earnings grow with a 35% CAGR.

If $DLO grows earnings with a 26% CAGR from 2024 to 2030, they could generate $472M in Net Income.

A P/E of 30 would result in a market cap of $14.2B

That is an upside of over 230% from today's level.

3X return in 5 years is a CAGR of 27%.

5X return if earnings grow with a 35% CAGR.

Why are you not investing in $DLO? Let me know!

• • •

Missing some Tweet in this thread? You can try to

force a refresh