ICAI Recommends Key Suggestions On Practical Issues in GST

The Institute of Chartered Accountants of India (ICAI) has submitted a detailed set of recommendations aimed at resolving persistent compliance and procedural challenges under the GST.

The Institute of Chartered Accountants of India (ICAI) has submitted a detailed set of recommendations aimed at resolving persistent compliance and procedural challenges under the GST.

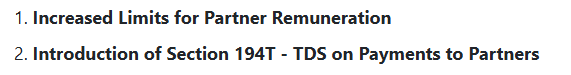

The suggestions, compiled by the GST & Indirect Taxes Committee, cover critical areas such as adjudication, input tax credit (ITC), registration, refunds, returns, and e-way bills.

As GST completes eight years of implementation, ICAI highlighted that many taxpayers continue to face operational bottlenecks, despite several reforms. Among the key recommendations are:

🟠 Defined Timelines for Notices: Taxpayers should be given at least seven working days to respond to Form DRC-01A intimations, ensuring fairness and adequate preparation time.

🟠 Virtual Hearings Compliance: Authorities should strictly follow CBIC's instruction to allow online hearings unless physical hearings are specifically requested.

🟠 Dual Service of Notices: Both electronic and physical delivery of notices should be mandatory to avoid ex-parte orders, especially for small traders and rural taxpayers.

To know more in details, click here 👇

caclubindia.com/news/icai-reco…

caclubindia.com/news/icai-reco…

Bookmark and 🔃 Now. Follow @CAclubindia for more such informative articles, news and updates!

• • •

Missing some Tweet in this thread? You can try to

force a refresh