Gold just hit all-time highs. Silver nearly touched $40.

Creators everywhere are saying precious metals will become "unobtainable."

But what if I told you they're preparing you for the wrong future?

Here's what our team revealed about what's really coming 🧵

Creators everywhere are saying precious metals will become "unobtainable."

But what if I told you they're preparing you for the wrong future?

Here's what our team revealed about what's really coming 🧵

Right now, the precious metals community is euphoric:

"Silver to $100!"

"Gold will be unobtainable!"

"Stack now before it's too late!"

"Physical metals are the only real money!"

But they're missing something critical about WHY this is happening

"Silver to $100!"

"Gold will be unobtainable!"

"Stack now before it's too late!"

"Physical metals are the only real money!"

But they're missing something critical about WHY this is happening

Yes, gold and silver are surging. The charts look incredible.

But here's the question no one's asking:

Why are central banks suddenly dumping US treasuries for gold at the exact same time they're building digital currency infrastructure?

The timing isn't coincidental.

But here's the question no one's asking:

Why are central banks suddenly dumping US treasuries for gold at the exact same time they're building digital currency infrastructure?

The timing isn't coincidental.

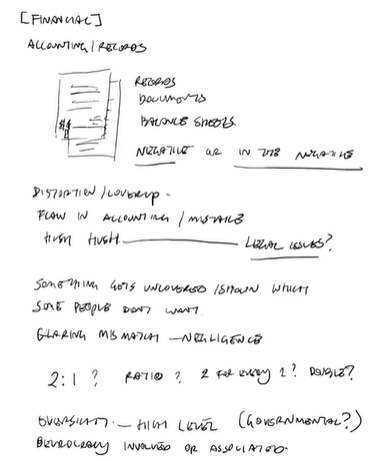

Our remote viewing team was tasked to look at the future of gold and silver.

What they saw wasn't endless price appreciation.

They saw scandal. Accounting mismanagement. Missing gold reserves. And a system-wide collapse that changes everything.

What they saw wasn't endless price appreciation.

They saw scandal. Accounting mismanagement. Missing gold reserves. And a system-wide collapse that changes everything.

From our sessions:

"Something gets uncovered that people don't want revealed"

"Glaring mismatch in accounting"

"Missing money and counterfeits"

"The gold that's supposed to be there... isn't"

Fort Knox audit, anyone?

"Something gets uncovered that people don't want revealed"

"Glaring mismatch in accounting"

"Missing money and counterfeits"

"The gold that's supposed to be there... isn't"

Fort Knox audit, anyone?

But here's the disturbing part:

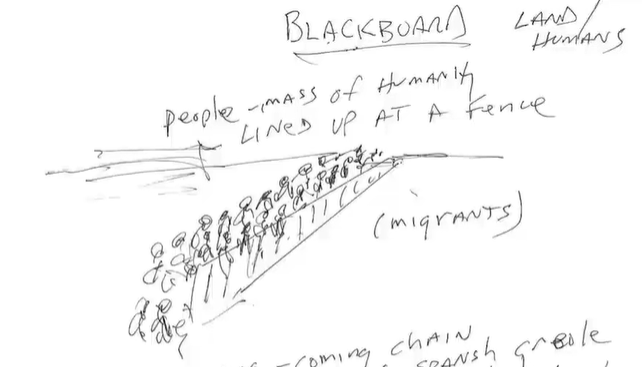

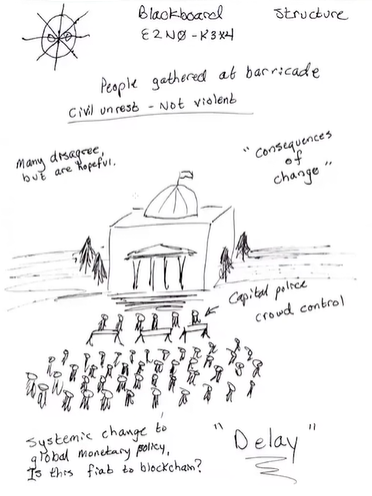

The viewers saw massive civil unrest when people discover the truth about gold reserves.

Demonstrations. Angry crowds. A "shocking decline" that affects everyone who thought physical metals were their safety net.

The viewers saw massive civil unrest when people discover the truth about gold reserves.

Demonstrations. Angry crowds. A "shocking decline" that affects everyone who thought physical metals were their safety net.

One viewer saw it clearly:

"People falling out of windows like bankers used to do" "Trusted institutions in decline"

"A newsworthy scandal about missing money"

The precious metals surge isn't leading to security - it's leading to revelation and chaos.

"People falling out of windows like bankers used to do" "Trusted institutions in decline"

"A newsworthy scandal about missing money"

The precious metals surge isn't leading to security - it's leading to revelation and chaos.

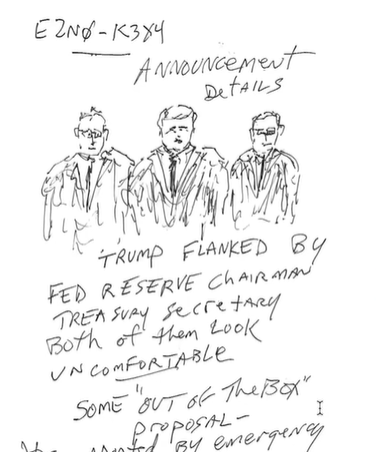

Meanwhile, they saw something else:

"New bonds backed by assets and tokenized"

"Blockchain distributed ledger technology"

"Digital infrastructure" replacing the old system

The future isn't physical metals. It's digital assets backed by real value.

"New bonds backed by assets and tokenized"

"Blockchain distributed ledger technology"

"Digital infrastructure" replacing the old system

The future isn't physical metals. It's digital assets backed by real value.

Think about the practical reality our viewers saw:

Massive population movements. Infrastructure collapse. Supply chain breakdowns.

In that world, can you really carry 50 pounds of silver across state lines while fleeing civil unrest?

Massive population movements. Infrastructure collapse. Supply chain breakdowns.

In that world, can you really carry 50 pounds of silver across state lines while fleeing civil unrest?

Here's what the remote viewing data suggests:

The gold/silver surge is the final pump before the revelation.

When people discover what's really in (or NOT in) the vaults, physical metals become a liability, not an asset.

The gold/silver surge is the final pump before the revelation.

When people discover what's really in (or NOT in) the vaults, physical metals become a liability, not an asset.

The viewers saw the transition clearly:

From physical to digital. From vaults to blockchain. From carrying metals to moving assets instantly across borders.

Everything goes digital not just for control - but for survival in the chaos that's coming.

From physical to digital. From vaults to blockchain. From carrying metals to moving assets instantly across borders.

Everything goes digital not just for control - but for survival in the chaos that's coming.

The metals surge is real. But it's not the endgame most think it is.

It's the setup for the biggest revelation in monetary history.

We explore the complete remote viewing sessions - and what they mean for your wealth - in our private community: ffgrv.com

It's the setup for the biggest revelation in monetary history.

We explore the complete remote viewing sessions - and what they mean for your wealth - in our private community: ffgrv.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh