🚨🇺🇸🇷🇺The US Is Repeating the Soviet Union's Final Fatal Mistake

Massive government spending is overpowering the Federal Reserve, threatening the dollar's stability. The US is on the same path that led to the USSR's currency collapse.

Here’s how🧵

Massive government spending is overpowering the Federal Reserve, threatening the dollar's stability. The US is on the same path that led to the USSR's currency collapse.

Here’s how🧵

The Mechanism: Flooding the System with Liquidity

🇺🇸: M2 money supply is growing at +4.8% YoY, with a record $22.1T in circulation. This is driven by massive Treasury issuance to fund deficits, not direct Fed printing.

USSR: The state printed rubles directly to cover yawning budget deficits from failed economic programs and military spending.

The source differs (bond markets vs. printing press) but the effect is identical: a massive, artificial increase in the money supply that devalues each unit of currency.

🇺🇸: M2 money supply is growing at +4.8% YoY, with a record $22.1T in circulation. This is driven by massive Treasury issuance to fund deficits, not direct Fed printing.

USSR: The state printed rubles directly to cover yawning budget deficits from failed economic programs and military spending.

The source differs (bond markets vs. printing press) but the effect is identical: a massive, artificial increase in the money supply that devalues each unit of currency.

The Problem:

🔸US Debt Explosion: Federal debt held by the public has nearly tripled in the last 15 years, soaring from $10 trillion in 2010 to over $28 trillion today.

🔸Soviet Debt Explosion: In its final years, the USSR's budget deficit exploded to over 10% of GDP, and its foreign hard currency debt more than doubled between 1985 and 1991.

In both cases, the central bank lost control, becoming an enabler of unsustainable spending rather than an independent guardian of the economy.

🔸US Debt Explosion: Federal debt held by the public has nearly tripled in the last 15 years, soaring from $10 trillion in 2010 to over $28 trillion today.

🔸Soviet Debt Explosion: In its final years, the USSR's budget deficit exploded to over 10% of GDP, and its foreign hard currency debt more than doubled between 1985 and 1991.

In both cases, the central bank lost control, becoming an enabler of unsustainable spending rather than an independent guardian of the economy.

The Lag Effect: The Calm Before the Storm

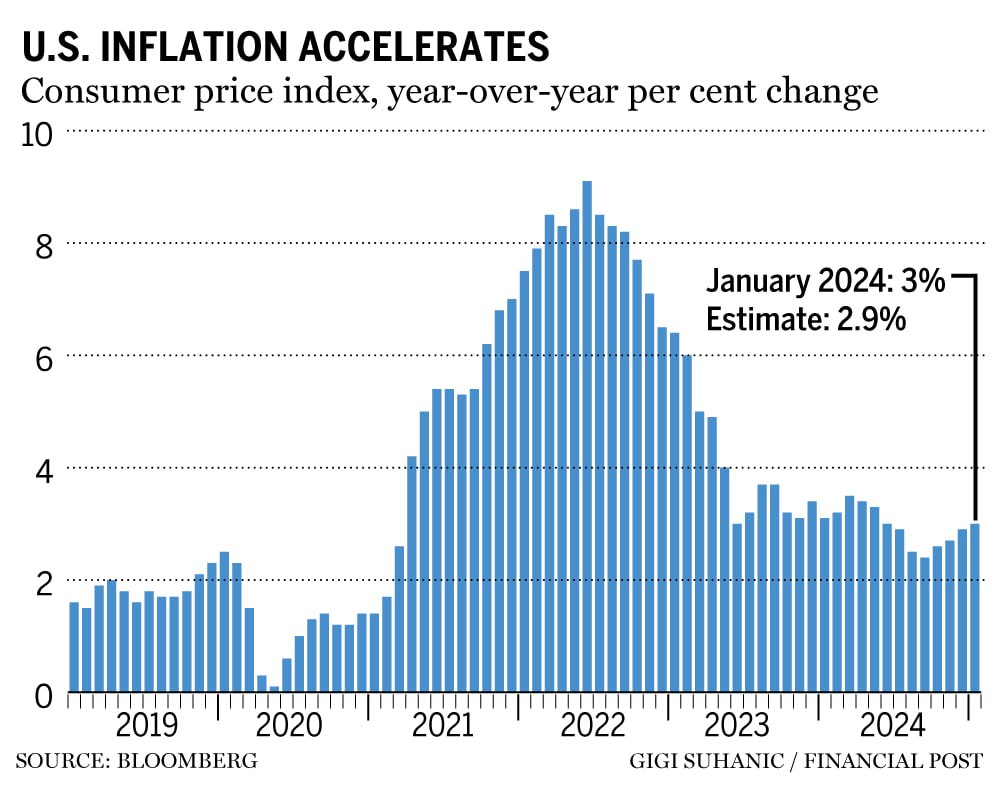

🇺🇸: In 2020, M2 exploded but inflation didn't surge until 2021 when velocity (spending) picked up. We are seeing the same setup now: money supply growing before demand fully accelerates.

USSR: Similarly, the inflation from their money printing lagged. The official economy showed low inflation while imbalances built up in the shadows for years.

Inflation is not instantaneous. It is a monetary phenomenon with a long and variable lag. Both cases show that a growing money supply is a lit fuse, even if the bomb hasn't exploded yet.

🇺🇸: In 2020, M2 exploded but inflation didn't surge until 2021 when velocity (spending) picked up. We are seeing the same setup now: money supply growing before demand fully accelerates.

USSR: Similarly, the inflation from their money printing lagged. The official economy showed low inflation while imbalances built up in the shadows for years.

Inflation is not instantaneous. It is a monetary phenomenon with a long and variable lag. Both cases show that a growing money supply is a lit fuse, even if the bomb hasn't exploded yet.

The Official Deception: Manipulating the Narrative

USSR: The officially published inflation rate for 1990 was 5.3%, though independent analyses estimated the actual rate to be closer to 20%. This significant discrepancy suggests that the published figures may not have fully reflected the economic reality and were likely used to project an image of stability.

🇺🇸: The method is more subtle but effective. Official statistics are often massaged (e.g., hedonic adjustments, substitution in CPI). Crucially, initial economic data is frequently revised downward after the positive headlines have been absorbed by the public, systematically painting a rosier picture after the fact.

USSR: The officially published inflation rate for 1990 was 5.3%, though independent analyses estimated the actual rate to be closer to 20%. This significant discrepancy suggests that the published figures may not have fully reflected the economic reality and were likely used to project an image of stability.

🇺🇸: The method is more subtle but effective. Official statistics are often massaged (e.g., hedonic adjustments, substitution in CPI). Crucially, initial economic data is frequently revised downward after the positive headlines have been absorbed by the public, systematically painting a rosier picture after the fact.

The Underlying Cause: Funding Political Imperatives

USSR: Money printing was used to fund unsustainable subsidies, prop up loss-making state industries, and finance the war in Afghanistan—all to maintain political control and ideological pretenses.

🇺🇸: The spending surge funds entitlements, political priorities, and industrial policy. The unstated goal is to maintain social stability and avoid economic pain, kicking the can down the road.

In both cases, the root cause is political. The currency is sacrificed to avoid short-term political pain or to fund overarching government objectives, ignoring long-term economic reality.

USSR: Money printing was used to fund unsustainable subsidies, prop up loss-making state industries, and finance the war in Afghanistan—all to maintain political control and ideological pretenses.

🇺🇸: The spending surge funds entitlements, political priorities, and industrial policy. The unstated goal is to maintain social stability and avoid economic pain, kicking the can down the road.

In both cases, the root cause is political. The currency is sacrificed to avoid short-term political pain or to fund overarching government objectives, ignoring long-term economic reality.

The Endgame: Currency Crisis and Loss of Faith

USSR: The final result was hyperinflation (>2,300% in 1992) and the complete obliteration of the ruble's value, wiping out savings and destroying faith in the state itself.

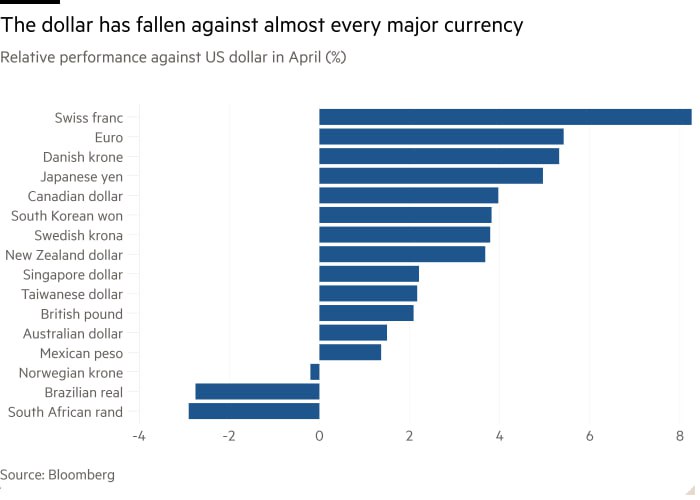

🇺🇸: The USD is the world's reserve currency, providing a buffer. However, the endgame of fiscal dominance is still the same: an inflationary crisis that destroys purchasing power and can lead to a loss of faith in the government's financial credibility.

USSR: The final result was hyperinflation (>2,300% in 1992) and the complete obliteration of the ruble's value, wiping out savings and destroying faith in the state itself.

🇺🇸: The USD is the world's reserve currency, providing a buffer. However, the endgame of fiscal dominance is still the same: an inflationary crisis that destroys purchasing power and can lead to a loss of faith in the government's financial credibility.

The dollar's privileged status is a defensive shield, not a promise of eternal dominance. This privilege is actively eroding because:

🔸Weaponization via sanctions pushes nations to develop alternatives.

🔸Structural shifts like the BRICS+ system deliberately bypass dollar dominance.

🔸The Triffin Dilemma makes the US the world's debtor, inherently devaluing its currency.

The very tools that enforce dollar power are what will ultimately break it.

🔸Weaponization via sanctions pushes nations to develop alternatives.

🔸Structural shifts like the BRICS+ system deliberately bypass dollar dominance.

🔸The Triffin Dilemma makes the US the world's debtor, inherently devaluing its currency.

The very tools that enforce dollar power are what will ultimately break it.

The lesson is brutal but simple: You cannot print your way to prosperity. A government that consistently spends beyond its means and funds it by debasing its currency is playing with fire.

The USSR is the historical case study. The US is writing its own chapter.

The USSR is the historical case study. The US is writing its own chapter.

• • •

Missing some Tweet in this thread? You can try to

force a refresh