Hospital occupancy rates in India are ~65%

Yet reports show how patients are being turned away from hospitals because there are "NO BEDS AVAILABLE"

That's got to be bad for business!

But despite that, Apollo, Fortis, Medanta, etc have posted record profits!

Here's how

1/10

Yet reports show how patients are being turned away from hospitals because there are "NO BEDS AVAILABLE"

That's got to be bad for business!

But despite that, Apollo, Fortis, Medanta, etc have posted record profits!

Here's how

1/10

To understand what's happening, you need to first understand a metric common in the healthcare sector, Average Revenue Per Occupied Bed or ARPOB

Here's a simple analogy

Like hotels track revenue per occupied room, hospitals track revenue per occupied bed

2/10

Here's a simple analogy

Like hotels track revenue per occupied room, hospitals track revenue per occupied bed

2/10

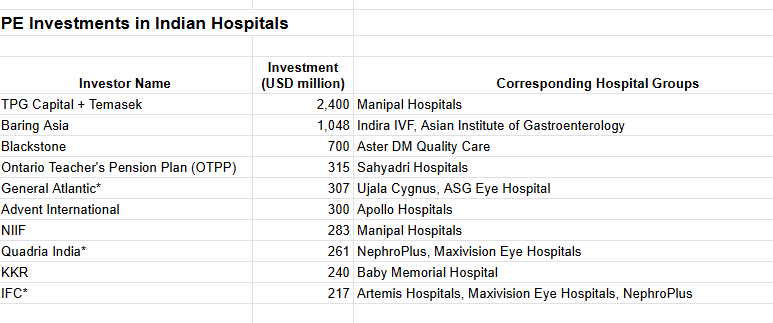

And ARPOB across major hospital chains is near all time high!

Max Hospital is making ~Rs 78,000/day/bed

Fortis is making ~Rs 73,000/day/bed

Medanta is making ~Rs 67,000/day/bed

Apollo is making ~Rs 62,000/day/bed

Attaching a list below with estimate figures

3/10

Max Hospital is making ~Rs 78,000/day/bed

Fortis is making ~Rs 73,000/day/bed

Medanta is making ~Rs 67,000/day/bed

Apollo is making ~Rs 62,000/day/bed

Attaching a list below with estimate figures

3/10

But then if occupancy rates are still around 65%, how are hospitals making such record profits

Well, it has something to do with the clinical mix

Clinical mix is the proportion of different types of medical procedures and patients a hospital treats

Let me break this down

4/10

Well, it has something to do with the clinical mix

Clinical mix is the proportion of different types of medical procedures and patients a hospital treats

Let me break this down

4/10

In healthcare there is a hierarchy of procedures

-Primary procedures are general consultation, regular checkups, basically outpatient care

-Secondary procedures are simple surgeries requiring short hospitalization like fracture treatment, cataract surgery, etc

5/10

-Primary procedures are general consultation, regular checkups, basically outpatient care

-Secondary procedures are simple surgeries requiring short hospitalization like fracture treatment, cataract surgery, etc

5/10

-Tertiary procedures require specialists and advanced equipment (dialysis, cancer treatment)

-Quaternary procedures are highly specialized, only few hospitals can perform (organ transplants, complex neurosurgery, etc)

Prices of procedures increase up the hierarchy

6/10

-Quaternary procedures are highly specialized, only few hospitals can perform (organ transplants, complex neurosurgery, etc)

Prices of procedures increase up the hierarchy

6/10

This means, the more complex the procedure, the more revenue per bed for the hospital

A primary care patient generates Rs 5,000- 15,000 per day

Whereas a quaternary care patient generates anywhere between Rs 1,50,000- Rs 5,00,000 per day!

7/10

A primary care patient generates Rs 5,000- 15,000 per day

Whereas a quaternary care patient generates anywhere between Rs 1,50,000- Rs 5,00,000 per day!

7/10

Currently, Indian hospitals are following a clinical mix focussed more on tertiary and quaternary procedures because they bring in the big bucks

Even though occupancy rates are no where near full, hospitals are still able to make bank through this strategy

8/10

Even though occupancy rates are no where near full, hospitals are still able to make bank through this strategy

8/10

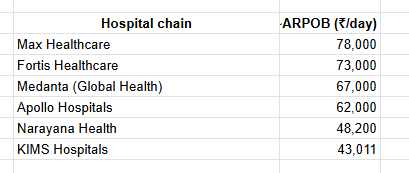

I am not making this up, hospital management has been quite vocal about this in their recent earning calls

Attaching a few quotes below

So, what does it mean for you and me?

9/10

Attaching a few quotes below

So, what does it mean for you and me?

9/10

When hospitals optimise for ARPOB, whether you will be treated or not is evaluated solely on how much money you can make for the hospital

And that is an awful place to be at, and it seems like there is no way back (more about that later)

10/10

And that is an awful place to be at, and it seems like there is no way back (more about that later)

10/10

• • •

Missing some Tweet in this thread? You can try to

force a refresh