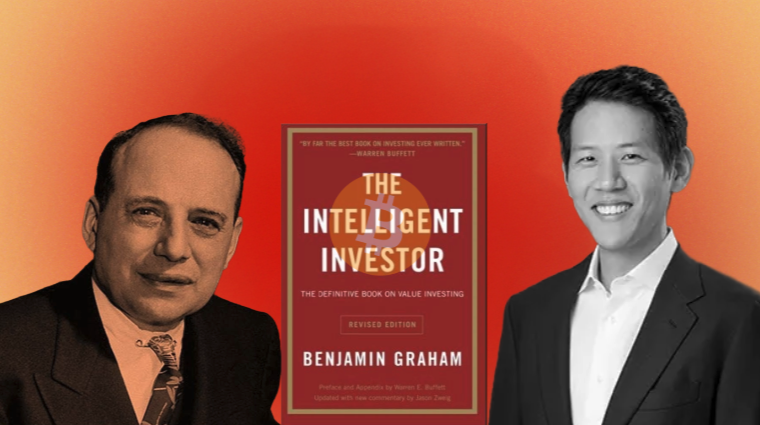

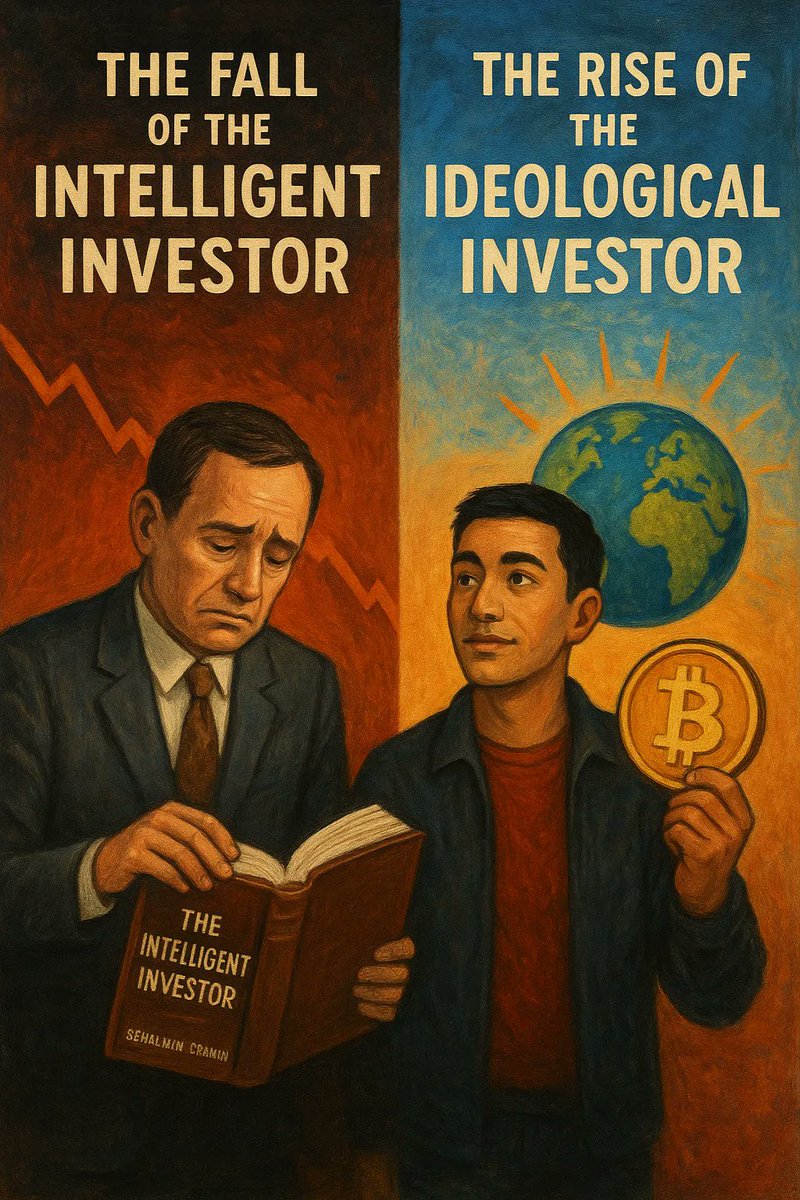

Most investors are still using Benjamin Graham's 1949 investing playbook in 2025.

But traditional value investing just died.

The "Ideological Investor" is here.

And if you don't understand these 3 key shifts, you're investing with a BLINDFOLD🧵

But traditional value investing just died.

The "Ideological Investor" is here.

And if you don't understand these 3 key shifts, you're investing with a BLINDFOLD🧵

Think about it:

Quants blamed "anomalies" for underperformance in 2016 (Trump) and 2020 (COVID).

They missed the signal:

Anomalies aren't exceptions anymore.

They ARE the environment.

Quants blamed "anomalies" for underperformance in 2016 (Trump) and 2020 (COVID).

They missed the signal:

Anomalies aren't exceptions anymore.

They ARE the environment.

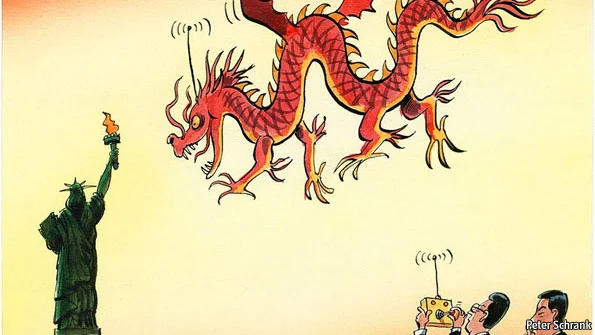

The Washington Consensus that built modern finance?

• Fiscal restraint

• Free markets

• Stable exchange rates

• Privatization

Dead. All dead.

The Beijing Consensus won:

State-led, sovereignty-first principles now rule.

• Fiscal restraint

• Free markets

• Stable exchange rates

• Privatization

Dead. All dead.

The Beijing Consensus won:

State-led, sovereignty-first principles now rule.

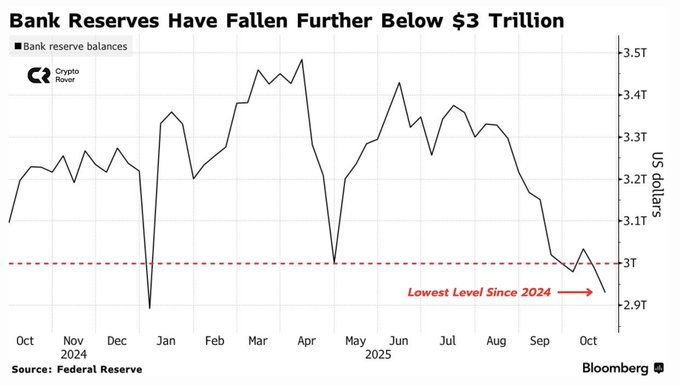

February 2022 changed everything.

When the West seized Russia's reserves, we crossed the Rubicon.

History will remember this as the 1971 Nixon moment...

but in reverse.

The "neutral" reserve currency?

A murdered myth.

When the West seized Russia's reserves, we crossed the Rubicon.

History will remember this as the 1971 Nixon moment...

but in reverse.

The "neutral" reserve currency?

A murdered myth.

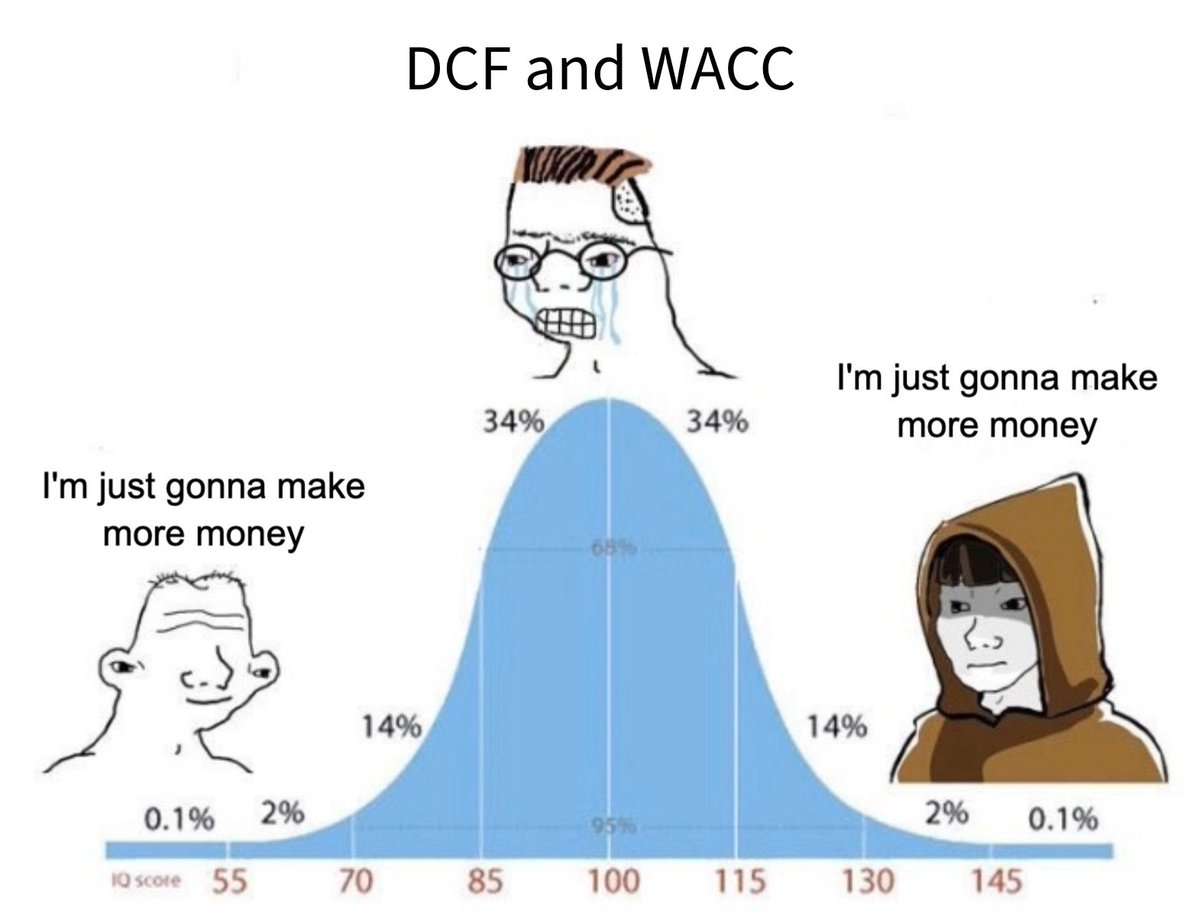

Your DCF models assume political neutrality.

Meanwhile:

• US government takes 10% of Intel (market rallies)

• Japan's monetary policy becomes a financial weapon

• Nvidia moves purely on China policy news

Politics IS the new fundamentals.

Meanwhile:

• US government takes 10% of Intel (market rallies)

• Japan's monetary policy becomes a financial weapon

• Nvidia moves purely on China policy news

Politics IS the new fundamentals.

We're entering 3 ideological fault lines that determine EVERYTHING:

GEOPOLITICS: Sanctions and tariffs matter more than cash flows

AI: It's reshaping how capital itself works

CULTURE: One wrong brand campaign can crater your stock

GEOPOLITICS: Sanctions and tariffs matter more than cash flows

AI: It's reshaping how capital itself works

CULTURE: One wrong brand campaign can crater your stock

Remember Carrie Wheeler at Opendoor?

Stellar CEO.

Navigated housing correction brilliantly.

Fired in DAYS after missing earnings.

Why?

She didn't frame the story around AI.

Markets have zero tolerance for cultural blindness now.

Stellar CEO.

Navigated housing correction brilliantly.

Fired in DAYS after missing earnings.

Why?

She didn't frame the story around AI.

Markets have zero tolerance for cultural blindness now.

Meanwhile, Alex Karp at Palantir...

Cash-burning enigma for years.

Terrible fundamentals.

Stock explodes.

Why?

He positioned Palantir as THE AI defense play.

Cultural fluency beats cash flow.

Cash-burning enigma for years.

Terrible fundamentals.

Stock explodes.

Why?

He positioned Palantir as THE AI defense play.

Cultural fluency beats cash flow.

Nike and Kaepernick.

Gillette's "Best Men Can Be."

Levi's and Sydney Sweeney.

Cracker Barrel's rebrand disaster.

Culture wars aren't "sentiment" anymore.

They determine your cost of capital.

Gillette's "Best Men Can Be."

Levi's and Sydney Sweeney.

Cracker Barrel's rebrand disaster.

Culture wars aren't "sentiment" anymore.

They determine your cost of capital.

The old investor: "What's the P/E ratio?"

The Ideological Investor:

"What's the geopolitical risk?"

"Which AI camp are they in?"

"What cultural tribe do they serve?"

Different game. Different rules.

The Ideological Investor:

"What's the geopolitical risk?"

"Which AI camp are they in?"

"What cultural tribe do they serve?"

Different game. Different rules.

Bitcoin.

It's the ONLY asset that:

• Escapes geopolitics (sovereignless)

• Accelerates AI

• Unites a global culture

Bitcoin isn't an investment.

It's an ideological fortress.

It's the ONLY asset that:

• Escapes geopolitics (sovereignless)

• Accelerates AI

• Unites a global culture

Bitcoin isn't an investment.

It's an ideological fortress.

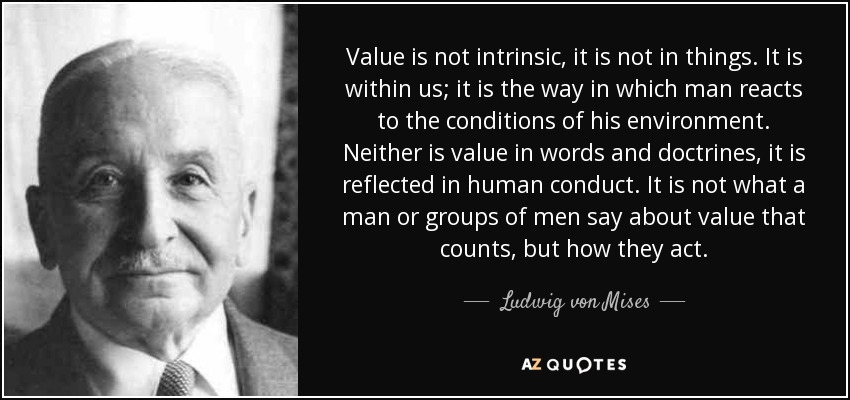

Jeff Park nails it:

"Value is not determined by cash flows or cost of capital, but by the frameworks through which societies allocate trust and power."

Translation: Motif beats tradfi math now.

"Value is not determined by cash flows or cost of capital, but by the frameworks through which societies allocate trust and power."

Translation: Motif beats tradfi math now.

The Newtonian Investor is obsolete.

The Ideological Investor thrives.

Stop calculating. Start interpreting.

Your edge isn't in spreadsheets.

It's in understanding which ideologies survive crises, regime changes, and paradigm shifts.

The Ideological Investor thrives.

Stop calculating. Start interpreting.

Your edge isn't in spreadsheets.

It's in understanding which ideologies survive crises, regime changes, and paradigm shifts.

Bottom line:

Graham's "Intelligent Investor" assumed stable rules.

Those rules are gone.

In the age of fat tails and ideological warfare, only one question matters:

What do you believe in?

Because in the end, Bitcoin is value.

And value is belief.

Graham's "Intelligent Investor" assumed stable rules.

Those rules are gone.

In the age of fat tails and ideological warfare, only one question matters:

What do you believe in?

Because in the end, Bitcoin is value.

And value is belief.

h/t @dgt10011

https://x.com/dgt10011/status/1962962925825527874

@dgt10011 I help investors build generational wealth and destroy taxes through Bitcoin mining.

Inflation is a problem for everyone.

Bitcoin is a solution for everyone.

Check out my investor letter, The Bitcoin Mining Investor: thebitcoinmininginvestor.com

Inflation is a problem for everyone.

Bitcoin is a solution for everyone.

Check out my investor letter, The Bitcoin Mining Investor: thebitcoinmininginvestor.com

@dgt10011 And if you found this post helpful/valuable, consider reposting to support my work and reach others like yourself:

https://x.com/BillyBoone32/status/1963045957073019243

• • •

Missing some Tweet in this thread? You can try to

force a refresh