The reason you were red today is because you were looking at the wrong time frame

Lets unlearn your bad habit and make you profitable, tonight 🧵

Lets unlearn your bad habit and make you profitable, tonight 🧵

1/ A lot of people (including you) got bagged today

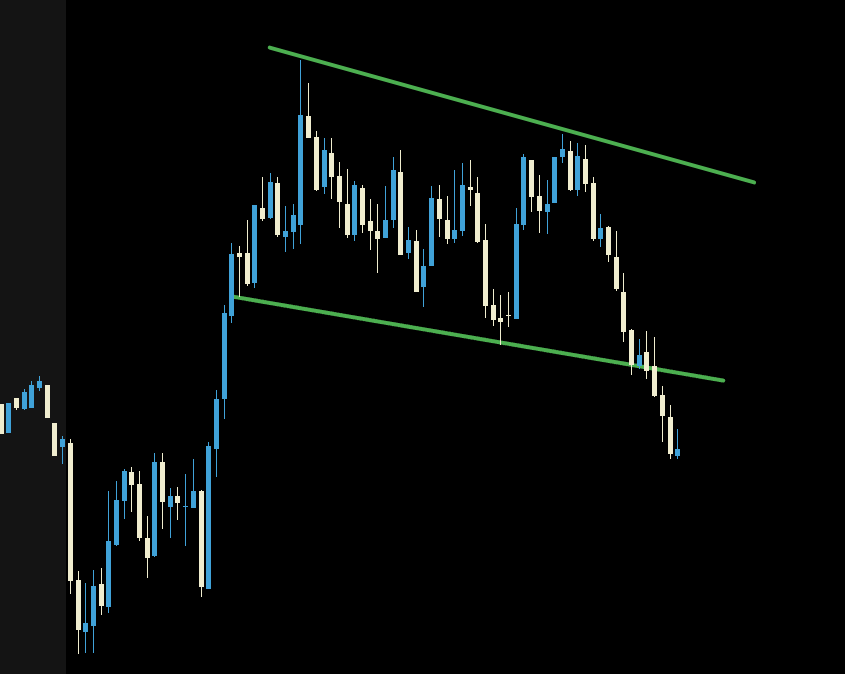

You saw the massive gap down and saw a picture perfect flag forming. You thought to yourself "I am about to catch the bottom and get paid!." You loaded up calls expecting to be yacht shopping after lunch. The market said, "Nope!" You and your local FURU got bagged.

You saw the massive gap down and saw a picture perfect flag forming. You thought to yourself "I am about to catch the bottom and get paid!." You loaded up calls expecting to be yacht shopping after lunch. The market said, "Nope!" You and your local FURU got bagged.

2/ Let me play mind reader for a minute

"I studied bull flags for weeks, this is exactly what they talked about in the videos! This is my chance to hit a good trade!" So you loaded up a bunch of calls because every FURU taught you that bull flag = free money.

"I studied bull flags for weeks, this is exactly what they talked about in the videos! This is my chance to hit a good trade!" So you loaded up a bunch of calls because every FURU taught you that bull flag = free money.

3/ I know your REAL problem

You're on the wrong time frame. You started watching some YouTube videos and you see all these traders using the 1m chart. You think to yourself this is where the real money is, so you focus on the 1m. You think all these traders are hyper scalping the small time frames.

You're on the wrong time frame. You started watching some YouTube videos and you see all these traders using the 1m chart. You think to yourself this is where the real money is, so you focus on the 1m. You think all these traders are hyper scalping the small time frames.

4/ Reality hits

That textbook Youtube setup didn't break higher. It broke lower. Your calls went from green to red faster than your ex blocked your number after a night out at Applebee's crushing dollar long islands (don't ask how I know this.) You're drunk off emotion, "How did such a beautiful setup cause me to be red?"

That textbook Youtube setup didn't break higher. It broke lower. Your calls went from green to red faster than your ex blocked your number after a night out at Applebee's crushing dollar long islands (don't ask how I know this.) You're drunk off emotion, "How did such a beautiful setup cause me to be red?"

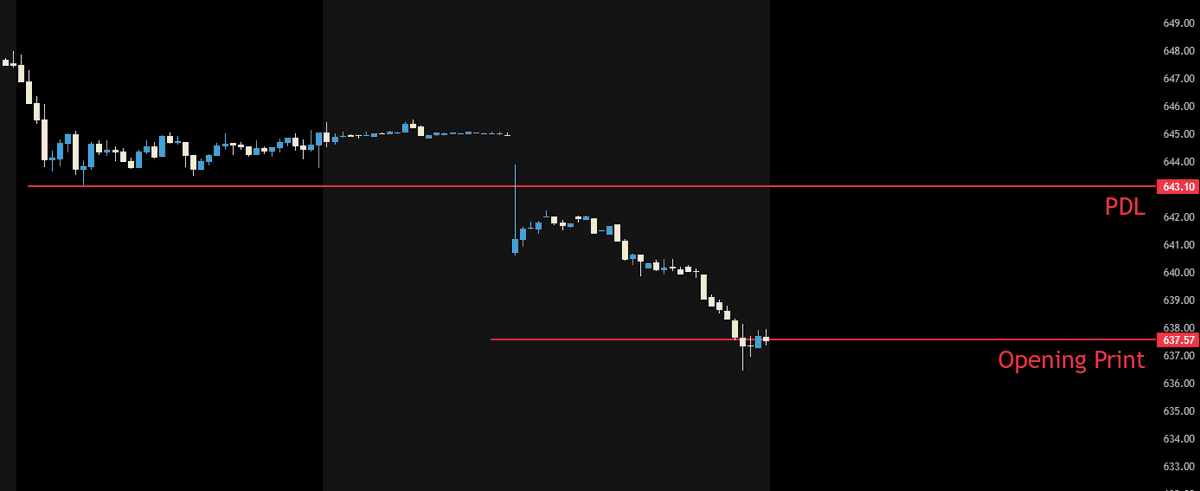

5/ Here is what you missed

The market was gapping down forming and outside day. This means price opened below the PDL indicating that the market was bearish. A bearish outside day means all pops will get sold because the daily trend is BEARISH. Below is a picture of how price looked during this "bull flag."

The market was gapping down forming and outside day. This means price opened below the PDL indicating that the market was bearish. A bearish outside day means all pops will get sold because the daily trend is BEARISH. Below is a picture of how price looked during this "bull flag."

6/ A simpler way to avoid the red day

If we add a 🟣line to your chart, lets call it the 8ema. Now lets look at $SPY with a deep breathe aka the big picture view. $SPY was down 1.5% to start the morning. In this market that's a sizeable gap down. Use common sense do we realistically think it will keep selling off? Or does it need a bounce?

If we add a 🟣line to your chart, lets call it the 8ema. Now lets look at $SPY with a deep breathe aka the big picture view. $SPY was down 1.5% to start the morning. In this market that's a sizeable gap down. Use common sense do we realistically think it will keep selling off? Or does it need a bounce?

7/ Common sense says, bounce

Off the open you have short covering and other hedge fund games until the real moves at 10am. Based on the 🟣 rules below lets plan a trade:

Candle below 🟣 = calls

Candle above 🟣 = puts

but on what time frame?

Off the open you have short covering and other hedge fund games until the real moves at 10am. Based on the 🟣 rules below lets plan a trade:

Candle below 🟣 = calls

Candle above 🟣 = puts

but on what time frame?

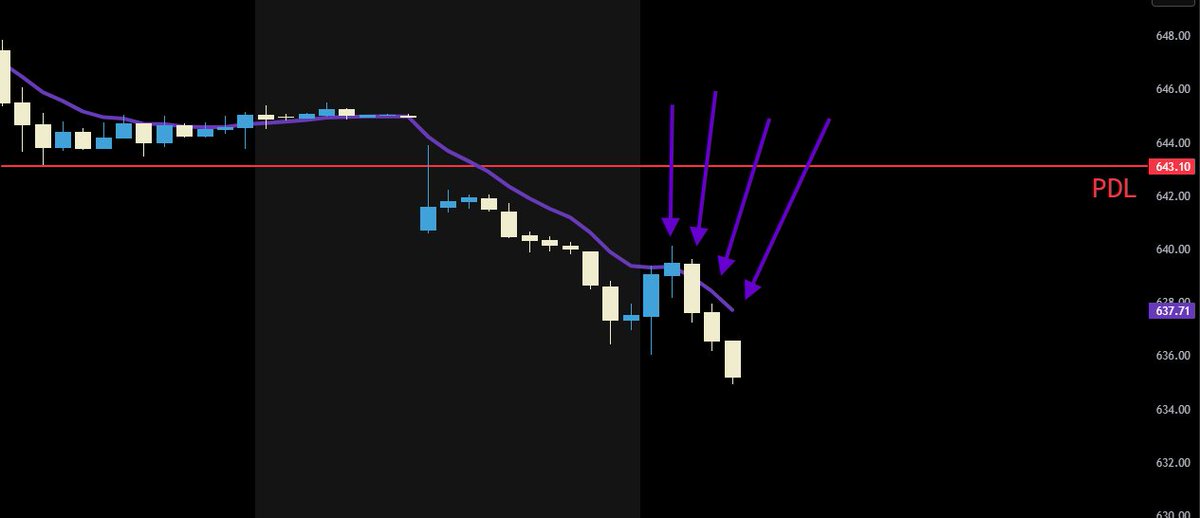

8/ We can't use the 10m

The market gapped down 1.5% the smaller time frames are printing FALSE signals using the 🟣 line rules. We have to use a higher time frame like the 30m. We can see there is an extension fill brewing off the open, perfect for shorts to cover and for us to short.

The market gapped down 1.5% the smaller time frames are printing FALSE signals using the 🟣 line rules. We have to use a higher time frame like the 30m. We can see there is an extension fill brewing off the open, perfect for shorts to cover and for us to short.

9/ What happens at 10am?

We reject perfectly off the 30m 🟣 line to the penny. The rules state that this is a short if you followed the rules you just got paid. This was a 30m extension fill, NOT a 1m bullflag.

We reject perfectly off the 30m 🟣 line to the penny. The rules state that this is a short if you followed the rules you just got paid. This was a 30m extension fill, NOT a 1m bullflag.

10/ Single time frame trading is why you're not profitable

You can have the most gorgeous setup, but if the higher time frame (30m) does not agree you are going to lose money. That is your secret to profitability.

You can have the most gorgeous setup, but if the higher time frame (30m) does not agree you are going to lose money. That is your secret to profitability.

11/ I teach this exact concepts for free

I invested something call the Time Frame Tango, to help new traders like yourself avoid these massive mistakes like this. I teach how to use the higher time frame (which btw is perfect if you work a full time job.) You can find this video here:

I invested something call the Time Frame Tango, to help new traders like yourself avoid these massive mistakes like this. I teach how to use the higher time frame (which btw is perfect if you work a full time job.) You can find this video here:

12/ How to pros saw this setup differently

I saw a massive gap down with an 8ema extension. My plan was to wait for the extension to fill, aka we tap the 30m 8ema and take puts. I knew the new traders would be get washed out on this setup, because I used to be that new trader, until I understood the 30m chart.

I saw a massive gap down with an 8ema extension. My plan was to wait for the extension to fill, aka we tap the 30m 8ema and take puts. I knew the new traders would be get washed out on this setup, because I used to be that new trader, until I understood the 30m chart.

13/ The sad reality

This type of setup happens almost every single day. Retail traders fall for the same trap over and over. They see some micro time frame setup and ignore everything about the higher time frame. Then they wonder why they keep losing money.

This type of setup happens almost every single day. Retail traders fall for the same trap over and over. They see some micro time frame setup and ignore everything about the higher time frame. Then they wonder why they keep losing money.

14/ The solution is embarrassingly simple

Learn the Time Frame Tango. The 10m and the 30m chart have to agree before you push a single button. When the 30m says no, you don't take the trade. This will cut out 65% of your losses over night.

Learn the Time Frame Tango. The 10m and the 30m chart have to agree before you push a single button. When the 30m says no, you don't take the trade. This will cut out 65% of your losses over night.

15/ At the end of the day there is one question you need to answer

Does what I'm doing make sense to me?

Does the P03 ICT Model X IFVG makes sense? Great.

but if the purple line is above the candle on the 30m you buy puts makes more sense... than welcome.

Does what I'm doing make sense to me?

Does the P03 ICT Model X IFVG makes sense? Great.

but if the purple line is above the candle on the 30m you buy puts makes more sense... than welcome.

16/ Summary

If this thread makes you feel better about a silly mistake than drop a like and RT to help out a new trader.

If this thread makes you feel better about a silly mistake than drop a like and RT to help out a new trader.

https://x.com/EllyDtrades/status/1963056128587087938

• • •

Missing some Tweet in this thread? You can try to

force a refresh