1/ 🚨 “Banks don't want to hold XRP, so it’ll never be used.”

That FUD confuses balance sheets with payments design. In ODL (Ripple’s On-Demand Liquidity), banks don’t warehouse XRP. Liquidity is sourced via exchanges/market makers. A bank/PSP consumes a quote, funds fiat, the system buys XRP, moves it across XRPL in ~3-5s, sells into destination fiat, and pays out locally. It’s all API-orchestrated. No balance-sheet headache required.

Keep reading for a full explanation 👇🧵

That FUD confuses balance sheets with payments design. In ODL (Ripple’s On-Demand Liquidity), banks don’t warehouse XRP. Liquidity is sourced via exchanges/market makers. A bank/PSP consumes a quote, funds fiat, the system buys XRP, moves it across XRPL in ~3-5s, sells into destination fiat, and pays out locally. It’s all API-orchestrated. No balance-sheet headache required.

Keep reading for a full explanation 👇🧵

2/ 💡 The legacy problem

Global payments today = trapped trillions in nostro/vostro pre-funding, multi-hop correspondent chains, opaque fees, slow settlement, capital inefficiency, and FX risk. BIS/G20 have made real-time atomic settlement a priority. XRP solves the plumbing problem: unlocking trapped capital while collapsing settlement risk.

Global payments today = trapped trillions in nostro/vostro pre-funding, multi-hop correspondent chains, opaque fees, slow settlement, capital inefficiency, and FX risk. BIS/G20 have made real-time atomic settlement a priority. XRP solves the plumbing problem: unlocking trapped capital while collapsing settlement risk.

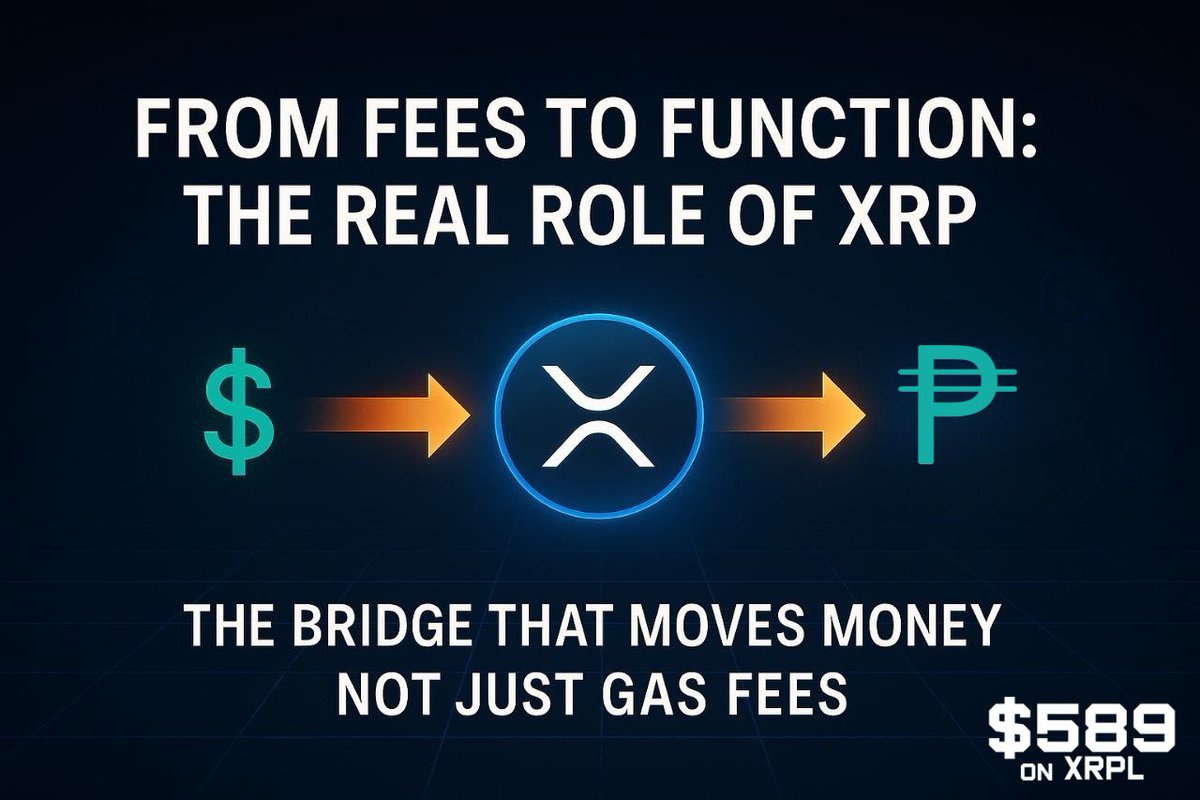

3/ ⚙️ How ODL actually works

1. Payment request → multiple LPs/exchanges return quotes.

2. Best quote is accepted → locks price/fees until expiry.

3. Source fiat → XRP (seconds).

4. XRP moves on XRPL (~3-5s).

5. XRP sold for destination fiat.

6. Local payout rail (ACH, InstaPay, FPS, SEPA) delivers funds.

Banks don’t “hold crypto.” Exchanges/LPs hold inventory. Exposure is seconds.

1. Payment request → multiple LPs/exchanges return quotes.

2. Best quote is accepted → locks price/fees until expiry.

3. Source fiat → XRP (seconds).

4. XRP moves on XRPL (~3-5s).

5. XRP sold for destination fiat.

6. Local payout rail (ACH, InstaPay, FPS, SEPA) delivers funds.

Banks don’t “hold crypto.” Exchanges/LPs hold inventory. Exposure is seconds.

4/ 📊 Balance sheet, Basel, and accounting

• GAAP (2024 update): crypto measured at fair value through earnings - no more impairment games.

• Basel III: unbacked crypto (XRP) is Group 2 → high capital charges, 2% Tier 1 cap.

→ This is why ODL design avoids banks warehousing XRP. Exchanges/LPs carry the inventory, banks just move fiat in/out. “Accounting nightmare” FUD ignores this structure.

• GAAP (2024 update): crypto measured at fair value through earnings - no more impairment games.

• Basel III: unbacked crypto (XRP) is Group 2 → high capital charges, 2% Tier 1 cap.

→ This is why ODL design avoids banks warehousing XRP. Exchanges/LPs carry the inventory, banks just move fiat in/out. “Accounting nightmare” FUD ignores this structure.

5/ ⏱️ Risk + volatility engineered away

• Locked quotes prevent slippage.

• XRP exposure window = ~seconds.

• Pre-funded fiat exchange accounts add stability.

• Retry/fallback flows if a leg fails.

This is FX execution, not speculation. Think “atomic FX swap,” not “crypto gamble.”

• Locked quotes prevent slippage.

• XRP exposure window = ~seconds.

• Pre-funded fiat exchange accounts add stability.

• Retry/fallback flows if a leg fails.

This is FX execution, not speculation. Think “atomic FX swap,” not “crypto gamble.”

6/ 🧠 The XRPL edge

• Native DEX with auto-bridging: routes via XRP when it’s cheaper than direct FX.

• AMM + CLOB integration: deeper liquidity, tighter spreads, smarter routing.

• 3-5s finality, negligible fees, 10+ years battle-tested.

This makes XRP uniquely suited as a bridge asset for small-duration FX.

• Native DEX with auto-bridging: routes via XRP when it’s cheaper than direct FX.

• AMM + CLOB integration: deeper liquidity, tighter spreads, smarter routing.

• 3-5s finality, negligible fees, 10+ years battle-tested.

This makes XRP uniquely suited as a bridge asset for small-duration FX.

7/ 🌍 Proof it works (live corridors)

• SBI Remit (Japan→Philippines): Uses XRP as a bridge via SBI VC Trade + Tranglo. Removes pre-funding, faster credit, lower cost. SBI itself doesn’t warehouse XRP.

• Pyypl (Middle East/Africa): Uses ODL with explicit corridor design so no XRP is held in the UAE. Compliance baked in.

→ Real companies, real customers, real FX corridors today.

• SBI Remit (Japan→Philippines): Uses XRP as a bridge via SBI VC Trade + Tranglo. Removes pre-funding, faster credit, lower cost. SBI itself doesn’t warehouse XRP.

• Pyypl (Middle East/Africa): Uses ODL with explicit corridor design so no XRP is held in the UAE. Compliance baked in.

→ Real companies, real customers, real FX corridors today.

8/ ✅ Compliance + treasury controls

RippleNet enforces a Rulebook: KYC/AML, sanctions, standardized data, SLAs.

Treasury controls include:

• Quote windows, orchestrated flows

• Pre-funded fiat accounts at exchanges

• Per-tx & corridor caps

• Auto-retries, fallbacks

This is payments engineering, not “ape into crypto.” Built to slot into banking stacks.

RippleNet enforces a Rulebook: KYC/AML, sanctions, standardized data, SLAs.

Treasury controls include:

• Quote windows, orchestrated flows

• Pre-funded fiat accounts at exchanges

• Per-tx & corridor caps

• Auto-retries, fallbacks

This is payments engineering, not “ape into crypto.” Built to slot into banking stacks.

9/ 💵 Why banks/PSPs care (economics)

• Pre-funding replaced by just-in-time liquidity → frees trapped capital.

• Aggregated liquidity + pathfinding → tighter FX spreads.

• PvP-like atomic settlement eliminates Herstatt risk.

• All-in cost = FX spread + exchange fees + payout rail - avoided nostro costs & float.

In many EM corridors, ODL beats correspondent FX economics - especially at consumer/SME ticket sizes.

• Pre-funding replaced by just-in-time liquidity → frees trapped capital.

• Aggregated liquidity + pathfinding → tighter FX spreads.

• PvP-like atomic settlement eliminates Herstatt risk.

• All-in cost = FX spread + exchange fees + payout rail - avoided nostro costs & float.

In many EM corridors, ODL beats correspondent FX economics - especially at consumer/SME ticket sizes.

10/ 🤡 It’s funny how BTC maxis always cite “banking insiders”

… yet those insiders clearly don’t even understand how their own industry works - or how XRP actually solves its pain points. The truth? They don’t like XRP, so they go hunting for opinions that confirm their bias. If they understood the tech, they’d be onboard, because XRP fixes a trillion-dollar problem in cross-border payments. Instead, they push FUD.

Bookmark + share this thread next time you see that narrative - most people, even "banking insiders" 😂, clearly don’t understand how this system really works.

… yet those insiders clearly don’t even understand how their own industry works - or how XRP actually solves its pain points. The truth? They don’t like XRP, so they go hunting for opinions that confirm their bias. If they understood the tech, they’d be onboard, because XRP fixes a trillion-dollar problem in cross-border payments. Instead, they push FUD.

Bookmark + share this thread next time you see that narrative - most people, even "banking insiders" 😂, clearly don’t understand how this system really works.

11/ 🚀 Bottom line

XRP isn’t about banks “holding bags.” It’s a just-in-time bridge that enables real-time FX, eliminates pre-funding, compresses spreads, and settles in seconds. Compliance + capital rules are built into the design.

Know what you hold. Follow @589CTO for clarity in the chaos.

XRP isn’t about banks “holding bags.” It’s a just-in-time bridge that enables real-time FX, eliminates pre-funding, compresses spreads, and settles in seconds. Compliance + capital rules are built into the design.

Know what you hold. Follow @589CTO for clarity in the chaos.

• • •

Missing some Tweet in this thread? You can try to

force a refresh