🧵Why Bitcoin-Backed Lending Will Change EVERYTHING

The dam is breaking.

As you read this, the global monetary system is IMPLODING.

Bitcoin-backed lending is the neutron bomb that VAPORIZES 500 years of central banking.

This is how digital scarcity is being WEAPONIZED👇

The dam is breaking.

As you read this, the global monetary system is IMPLODING.

Bitcoin-backed lending is the neutron bomb that VAPORIZES 500 years of central banking.

This is how digital scarcity is being WEAPONIZED👇

💡 THE GENIUS REVEALED

Here's the devastating simplicity:

Borrow melting fiat against appreciating Bitcoin.

Never sell your sats, just mortgage them.

Repay loans with currency that loses 15-20% purchasing power annually while your collateral doubles every 3-4 years.

It's like borrowing Monopoly money against Fort Knox gold, except the gold multiplies and the Monopoly money catches fire.

Here's the devastating simplicity:

Borrow melting fiat against appreciating Bitcoin.

Never sell your sats, just mortgage them.

Repay loans with currency that loses 15-20% purchasing power annually while your collateral doubles every 3-4 years.

It's like borrowing Monopoly money against Fort Knox gold, except the gold multiplies and the Monopoly money catches fire.

⚔️ SPECULATIVE WARFARE EVOLVED

Traditional speculative attacks required massive capital to short weak currencies.

This time, every individual becomes George Soros.

Lock your Bitcoin, mint dollars, buy more Bitcoin, repeat.

You're not just betting against fiat... you're actively draining its lifeblood while building an impenetrable fortress of digital scarcity.

Traditional speculative attacks required massive capital to short weak currencies.

This time, every individual becomes George Soros.

Lock your Bitcoin, mint dollars, buy more Bitcoin, repeat.

You're not just betting against fiat... you're actively draining its lifeblood while building an impenetrable fortress of digital scarcity.

📊 THE MATHEMATICS OF MONETARY MURDER

The numbers are apocalyptic:

Only 2% of Bitcoin supply locked = 420,000 BTC vanishes from markets

At 40% LTV = $25+ billion in fresh fiat demand

Result: Synthetic supply shock equivalent to THREE Bitcoin halvings happening simultaneously

Market depth evaporates, single buyers can move prices 10-20% because there's literally nothing left to sell.

The numbers are apocalyptic:

Only 2% of Bitcoin supply locked = 420,000 BTC vanishes from markets

At 40% LTV = $25+ billion in fresh fiat demand

Result: Synthetic supply shock equivalent to THREE Bitcoin halvings happening simultaneously

Market depth evaporates, single buyers can move prices 10-20% because there's literally nothing left to sell.

🔥 SUPPLY SHOCK MECHANICS

Every Bitcoin locked in lending protocols is a bullet removed from the chamber pointed at the price.

When Strategy buys $1 billion worth, they compete for dwindling supply.

When 500,000 Bitcoiners simultaneously lock collateral, they CREATE the scarcity that makes Strategy's purchases go parabolic.

You're not just holding, folks.

You will be SUFFOCATING the market.

Every Bitcoin locked in lending protocols is a bullet removed from the chamber pointed at the price.

When Strategy buys $1 billion worth, they compete for dwindling supply.

When 500,000 Bitcoiners simultaneously lock collateral, they CREATE the scarcity that makes Strategy's purchases go parabolic.

You're not just holding, folks.

You will be SUFFOCATING the market.

💸 THE REFLEXIVITY DEATH SPIRAL

This is EXPONENTIAL:

Lock Bitcoin → Price rises from reduced supply

Rising price → Borrow more fiat against higher collateral value

Use fiat → Buy more Bitcoin

Repeat until fiat dies

Each cycle amplifies the next.

Your Bitcoin collateral becomes a money-printing machine that funds its own acquisition spree.

This is EXPONENTIAL:

Lock Bitcoin → Price rises from reduced supply

Rising price → Borrow more fiat against higher collateral value

Use fiat → Buy more Bitcoin

Repeat until fiat dies

Each cycle amplifies the next.

Your Bitcoin collateral becomes a money-printing machine that funds its own acquisition spree.

🏛️ TREASURIES ARE DEAD MONEY WALKING

For 80 years, U.S. Treasuries were the "risk-free" collateral backing the global repo market.

Now watch pension funds, banks, and sovereign wealth funds discover that "risk-free" bonds lose 25% real value while Bitcoin 4x's.

When repo desks demand orange collateral instead of government IOUs, the Fed loses control of interest rates forever.

For 80 years, U.S. Treasuries were the "risk-free" collateral backing the global repo market.

Now watch pension funds, banks, and sovereign wealth funds discover that "risk-free" bonds lose 25% real value while Bitcoin 4x's.

When repo desks demand orange collateral instead of government IOUs, the Fed loses control of interest rates forever.

💰 THE TAX ARMAGEDDON MULTIPLIER

This is where it gets vicious:

Sell Bitcoin = 20-37% immediate tax hit to fund government spending

Borrow against Bitcoin = Zero taxes, infinite deferral

Repay with depreciating dollars = Your effective tax rate goes NEGATIVE

The government bleeds revenue precisely when inflation forces massive spending.

Fiscal death spiral accelerates.

Political pressure for money printing becomes irresistible.

This is where it gets vicious:

Sell Bitcoin = 20-37% immediate tax hit to fund government spending

Borrow against Bitcoin = Zero taxes, infinite deferral

Repay with depreciating dollars = Your effective tax rate goes NEGATIVE

The government bleeds revenue precisely when inflation forces massive spending.

Fiscal death spiral accelerates.

Political pressure for money printing becomes irresistible.

🌍 GLOBAL CAPITAL CONTROLS OBLITERATED

Entrepreneurs in Argentina, Turkey, Nigeria:

Lock your Bitcoin in Miami, mint USDC, buy equipment in Germany, repay loans with hyperinflating pesos/lira/naira.

You just executed a cross-border carry trade without touching the traditional banking system.

The IMF and capital controls become as relevant as medieval guilds.

Entrepreneurs in Argentina, Turkey, Nigeria:

Lock your Bitcoin in Miami, mint USDC, buy equipment in Germany, repay loans with hyperinflating pesos/lira/naira.

You just executed a cross-border carry trade without touching the traditional banking system.

The IMF and capital controls become as relevant as medieval guilds.

📈 INSTITUTIONAL CAPITULATION EVENT

The yield chase is starting:

Bitcoin-backed notes paying SOFR + 600-800 basis points

Pension funds desperate for returns in zero-rate world

Insurance companies needing to match long-term liabilities

Sovereign wealth funds realizing their "diversification" into bonds was wealth destruction

When Teachers' Retirement System of Texas allocates to Bitcoin-backed lending, the game is over.

The yield chase is starting:

Bitcoin-backed notes paying SOFR + 600-800 basis points

Pension funds desperate for returns in zero-rate world

Insurance companies needing to match long-term liabilities

Sovereign wealth funds realizing their "diversification" into bonds was wealth destruction

When Teachers' Retirement System of Texas allocates to Bitcoin-backed lending, the game is over.

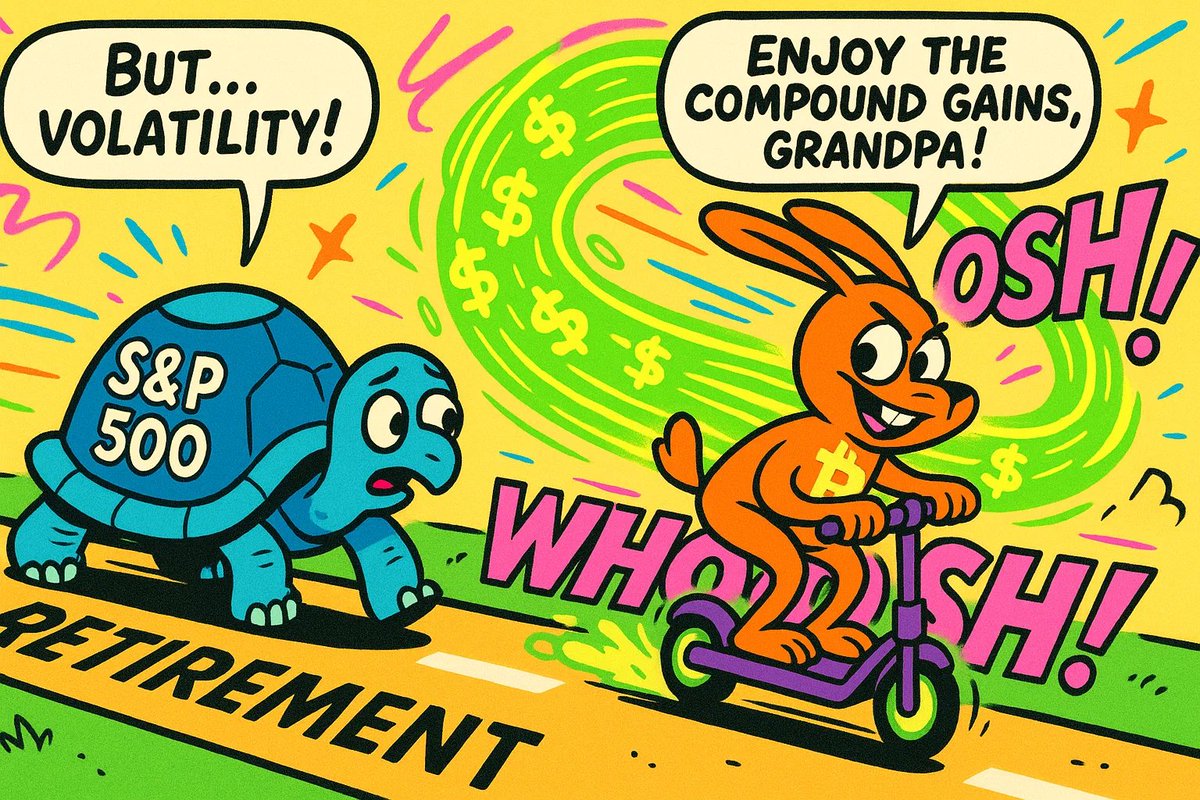

⚡ VOLATILITY: THE FALSE OBJECTION DESTROYED

"But Bitcoin is volatile!" WRONG.

Conservative 35% LTV survives 65% Bitcoin crashes

Instant liquidation prevents cascading losses

Real estate takes 6+ months to foreclose

Bonds gap down 20% overnight on credit downgrades

Stocks can lose 90% and stay worthless for decades

Bitcoin collateral is MORE stable than traditional assets because the liquidation is mathematical, not emotional.

"But Bitcoin is volatile!" WRONG.

Conservative 35% LTV survives 65% Bitcoin crashes

Instant liquidation prevents cascading losses

Real estate takes 6+ months to foreclose

Bonds gap down 20% overnight on credit downgrades

Stocks can lose 90% and stay worthless for decades

Bitcoin collateral is MORE stable than traditional assets because the liquidation is mathematical, not emotional.

🧠 THE UNIT OF ACCOUNT REVOLUTION

Once your mortgage, salary, and business contracts price in satoshis, fiat becomes the volatile currency.

People will think: "That coffee costs 500 sats, but I can borrow dollars at 8% to buy it and repay the loan when those dollars are worth 400 sats next year."

Mental accounting shifts to Bitcoin. Game over.

Once your mortgage, salary, and business contracts price in satoshis, fiat becomes the volatile currency.

People will think: "That coffee costs 500 sats, but I can borrow dollars at 8% to buy it and repay the loan when those dollars are worth 400 sats next year."

Mental accounting shifts to Bitcoin. Game over.

🏦 WALL STREET'S FINAL SURRENDER

Coming soon to Bloomberg Terminal:

Bitcoin Collateralized Loan Obligations (BCLOs)

Synthetic CDOs backed by sat-denominated debt

Credit default swaps on fiat currencies vs. Bitcoin

Pension fund mandates requiring "digital asset diversification"

Every financial product will eventually reference Bitcoin duration.

The traditional system becomes a derivative of Bitcoin markets.

Coming soon to Bloomberg Terminal:

Bitcoin Collateralized Loan Obligations (BCLOs)

Synthetic CDOs backed by sat-denominated debt

Credit default swaps on fiat currencies vs. Bitcoin

Pension fund mandates requiring "digital asset diversification"

Every financial product will eventually reference Bitcoin duration.

The traditional system becomes a derivative of Bitcoin markets.

🚀 THE CENTRAL BANK CHECKMATE

By 2028: Federal Reserve balance sheet includes Bitcoin reserves.

Not by choice... by necessity.

When repo markets demand orange collateral, central banks become price takers in Bitcoin auctions.

They cannot print satoshis to calm markets.

They must BUY them, bidding against each other in a global auction that never ends.

By 2028: Federal Reserve balance sheet includes Bitcoin reserves.

Not by choice... by necessity.

When repo markets demand orange collateral, central banks become price takers in Bitcoin auctions.

They cannot print satoshis to calm markets.

They must BUY them, bidding against each other in a global auction that never ends.

💎 THE CORPORATE BALANCE SHEET REVOLUTION

Microsoft's 2026 earnings call:

"We generated $50 billion in cash flow, which we immediately deployed into Bitcoin-backed lending protocols.

Rather than holding depreciating cash reserves, we now earn 12% yields while maintaining liquid access to operating capital. Our Bitcoin treasury has grown 340% this year."

Every S&P 500 CFO will copy this playbook or get fired.

Microsoft's 2026 earnings call:

"We generated $50 billion in cash flow, which we immediately deployed into Bitcoin-backed lending protocols.

Rather than holding depreciating cash reserves, we now earn 12% yields while maintaining liquid access to operating capital. Our Bitcoin treasury has grown 340% this year."

Every S&P 500 CFO will copy this playbook or get fired.

🌪️ THE VELOCITY ACCELERATION PHASE

As Bitcoin-backed lending scales, fiat velocity explodes.

Why hold dollars when you can hold Bitcoin and borrow dollars?

Hot potato economics:

Everyone rushes to exchange fiat for real assets, Bitcoin collateral multiplies, more fiat gets borrowed, velocity increases, prices rise, repeat unto infinity.

As Bitcoin-backed lending scales, fiat velocity explodes.

Why hold dollars when you can hold Bitcoin and borrow dollars?

Hot potato economics:

Everyone rushes to exchange fiat for real assets, Bitcoin collateral multiplies, more fiat gets borrowed, velocity increases, prices rise, repeat unto infinity.

⛓️ THE REHYPOTHECATION APOCALYPSE

Traditional finance rehypothecates the same collateral 10-50 times.

Bitcoin's cryptographic proof makes this impossible.

When $10 trillion in global repo markets must find REAL collateral instead of synthetic derivatives, the scramble for authentic Bitcoin creates a supply crisis that makes the 2008 housing shortage look like a minor inconvenience.

Traditional finance rehypothecates the same collateral 10-50 times.

Bitcoin's cryptographic proof makes this impossible.

When $10 trillion in global repo markets must find REAL collateral instead of synthetic derivatives, the scramble for authentic Bitcoin creates a supply crisis that makes the 2008 housing shortage look like a minor inconvenience.

🎯 THE GENERATIONAL WEALTH TRANSFER

Millennials and Gen Z intuitively understand:

Borrow against your Bitcoin, buy real estate/stocks/businesses with the proceeds, let inflation eat the debt while your collateral moons.

Meanwhile, Boomers holding bonds and cash watch their life savings evaporate in real terms.

The largest wealth transfer in history, powered by superior monetary technology.

Millennials and Gen Z intuitively understand:

Borrow against your Bitcoin, buy real estate/stocks/businesses with the proceeds, let inflation eat the debt while your collateral moons.

Meanwhile, Boomers holding bonds and cash watch their life savings evaporate in real terms.

The largest wealth transfer in history, powered by superior monetary technology.

🌊 THE LIQUIDITY PREFERENCE INVERSION

Keynes said people prefer liquid assets during uncertainty.

But when liquid assets (dollars, bonds) guarantee purchasing power loss while illiquid assets (Bitcoin collateral) guarantee purchasing power gain, liquidity preference inverts.

Everyone wants to be as illiquid as possible in fiat terms.

Keynes said people prefer liquid assets during uncertainty.

But when liquid assets (dollars, bonds) guarantee purchasing power loss while illiquid assets (Bitcoin collateral) guarantee purchasing power gain, liquidity preference inverts.

Everyone wants to be as illiquid as possible in fiat terms.

⚖️ LEGAL TENDER LAWS BECOME IRRELEVANT

"This note is legal tender for all debts, public and private" - printed on worthless paper while debts get priced in Bitcoin terms and settled with borrowed fiat.

Legal tender laws become as enforceable as sumptuary laws.

Economic reality trumps legal fiction.

"This note is legal tender for all debts, public and private" - printed on worthless paper while debts get priced in Bitcoin terms and settled with borrowed fiat.

Legal tender laws become as enforceable as sumptuary laws.

Economic reality trumps legal fiction.

🔬 THE GAME THEORY ENDGAME

Nash Equilibrium Analysis:

If you don't use Bitcoin-backed lending: Your purchasing power erodes

If you do use it: You accelerate fiat collapse, but preserve wealth

Individual rational behavior (protect yourself) creates collective outcome (system collapse)

There is no stable equilibrium where fiat survives

Mathematics, not ideology, drives this transition.

Nash Equilibrium Analysis:

If you don't use Bitcoin-backed lending: Your purchasing power erodes

If you do use it: You accelerate fiat collapse, but preserve wealth

Individual rational behavior (protect yourself) creates collective outcome (system collapse)

There is no stable equilibrium where fiat survives

Mathematics, not ideology, drives this transition.

💥 THE MAGNITUDE OF THIS MOMENT

You're not just witnessing financial innovation.

You're living through the controlled demolition of the global monetary system.

Bitcoin-backed lending is the shaped charge placed at the foundation of central banking.

When it detonates, the blast radius includes every government, every bank, every pension fund that bet against mathematical scarcity.

You're not just witnessing financial innovation.

You're living through the controlled demolition of the global monetary system.

Bitcoin-backed lending is the shaped charge placed at the foundation of central banking.

When it detonates, the blast radius includes every government, every bank, every pension fund that bet against mathematical scarcity.

🏰 THE FINAL TRUTH

This isn't coming. It's here.

Platforms are live, billions already locked

Institutions are allocating, governments are studying

Early adopters are compounding wealth exponentially

The network effects are becoming unstoppable

You have a choice: Build your vault in the new system, or watch your wealth evaporate in the old one.

The Bitcoin-backed lending revolution isn't just changing money... it's changing power itself.

Stack. Vault. Borrow. Win.

This isn't coming. It's here.

Platforms are live, billions already locked

Institutions are allocating, governments are studying

Early adopters are compounding wealth exponentially

The network effects are becoming unstoppable

You have a choice: Build your vault in the new system, or watch your wealth evaporate in the old one.

The Bitcoin-backed lending revolution isn't just changing money... it's changing power itself.

Stack. Vault. Borrow. Win.

Click here if you'd like to see me break down this incredible revolution in video form:

• • •

Missing some Tweet in this thread? You can try to

force a refresh