🧵 1/ Alright, folks, let's talk markets. We're standing at the cusp of what could be the start of a fresh bull trend across risk assets. Why? Multiple signals are aligning: small caps via $IWM are breaking out, altcoins are starting to surge higher signaling a risk-on vibe, and gold looks like it might be peaking, paving the way for liquidity to rotate into equities and crypto. Buckle up—this could be the rotation we've been waiting for. Let's break it down.

2/ First up: $IWM, the iShares Russell 2000 ETF tracking small-cap stocks. This bad boy has been consolidating for years, but recent action screams breakout. After underperforming for much of 2025, it's now holding above key levels like the 88.6% Fib retracement around $233.20, with eyes on $245 and beyond. The Fed's hints at rate cuts are turbocharging this—lower rates mean easier capital for speculative small caps, which make up the bulk of the Russell 2000.

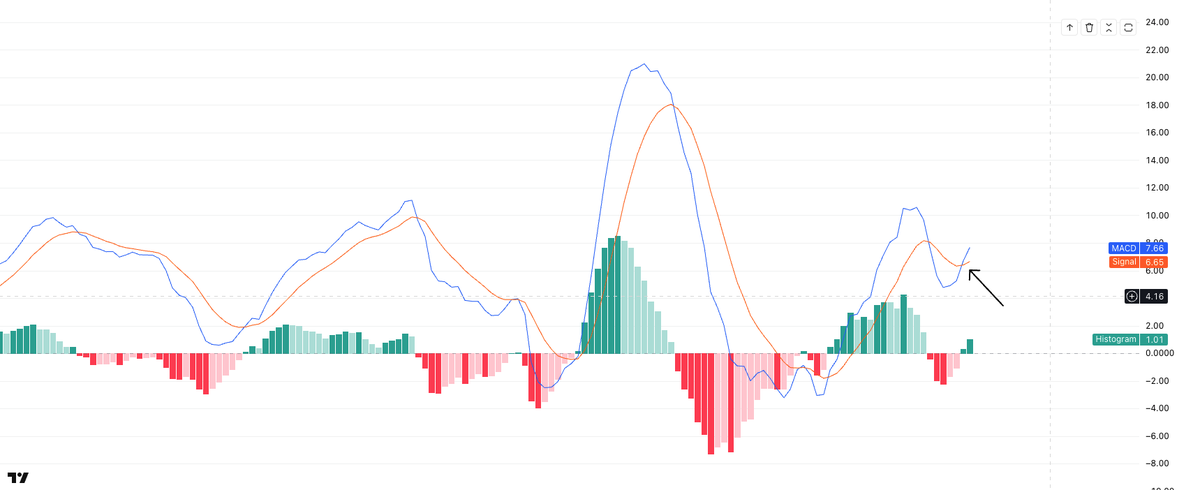

3/ Remember, $IWM hasn't made a true new high since 2021, building a massive base. Short positioning by hedge funds is at all-time highs, setting up for a potential squeeze. We've seen a bull MACD cross on the monthly chart (even though I rarely focus on MACD) for the first time since Dec 2023, and it's up nearly 4% in a single day post-Powell comments. This isn't just noise; it's the kind of strength that ignores lower-timeframe bear divs and points to underlying momentum.

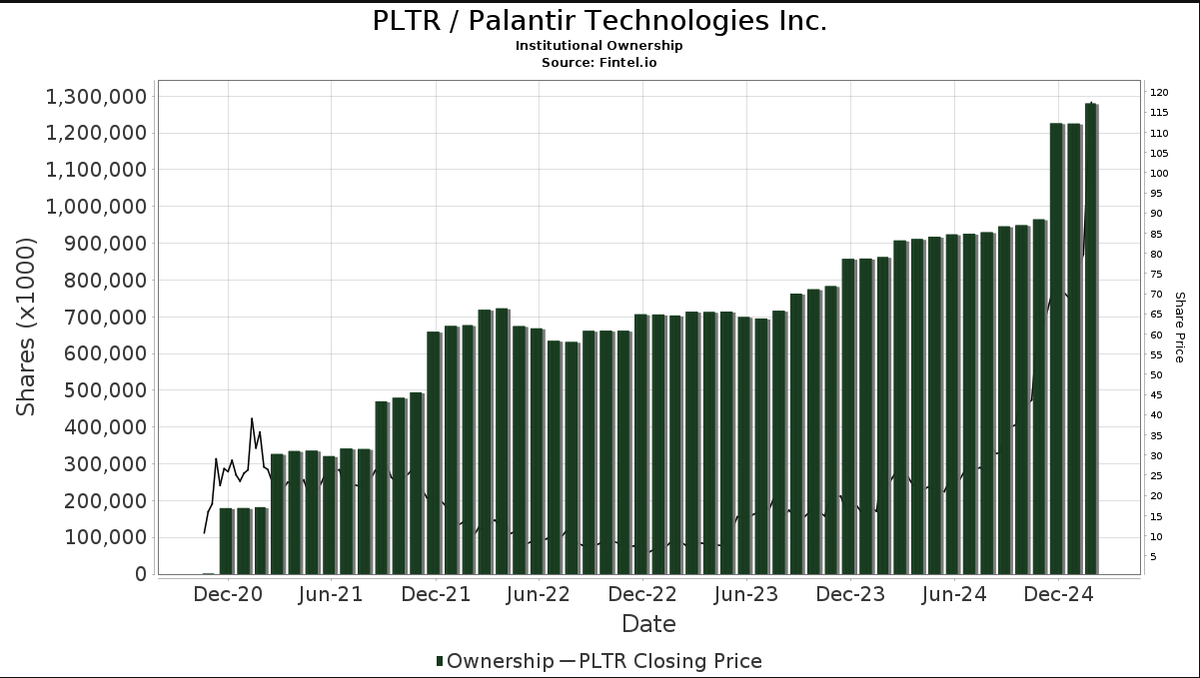

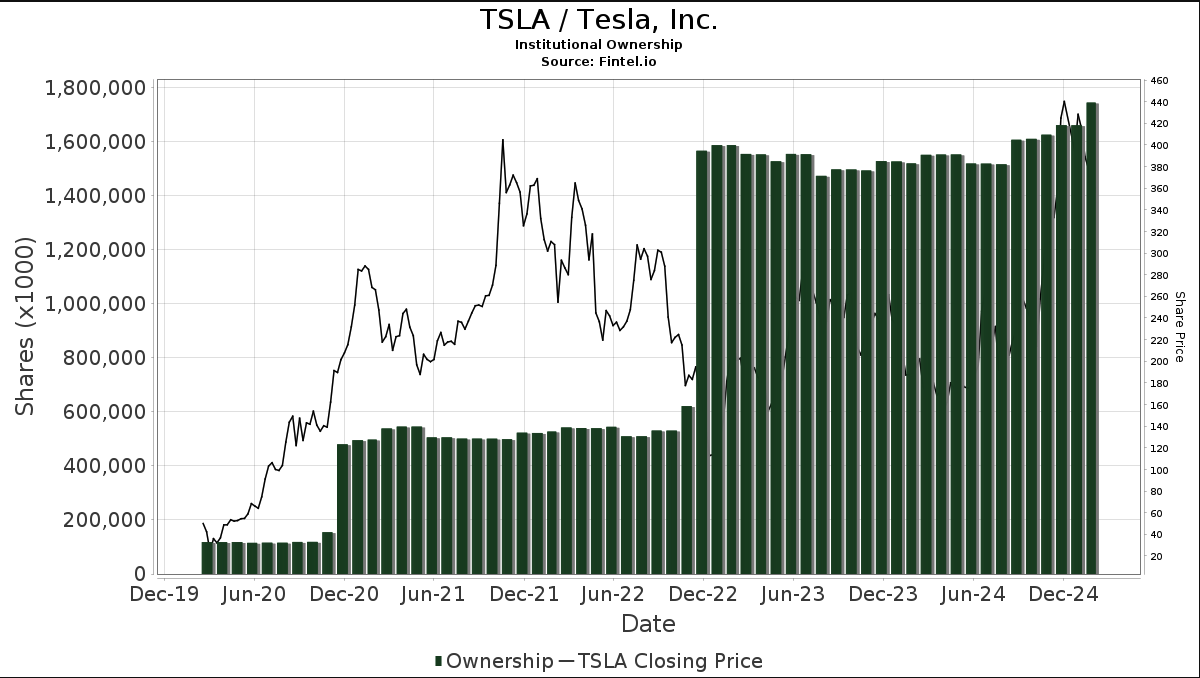

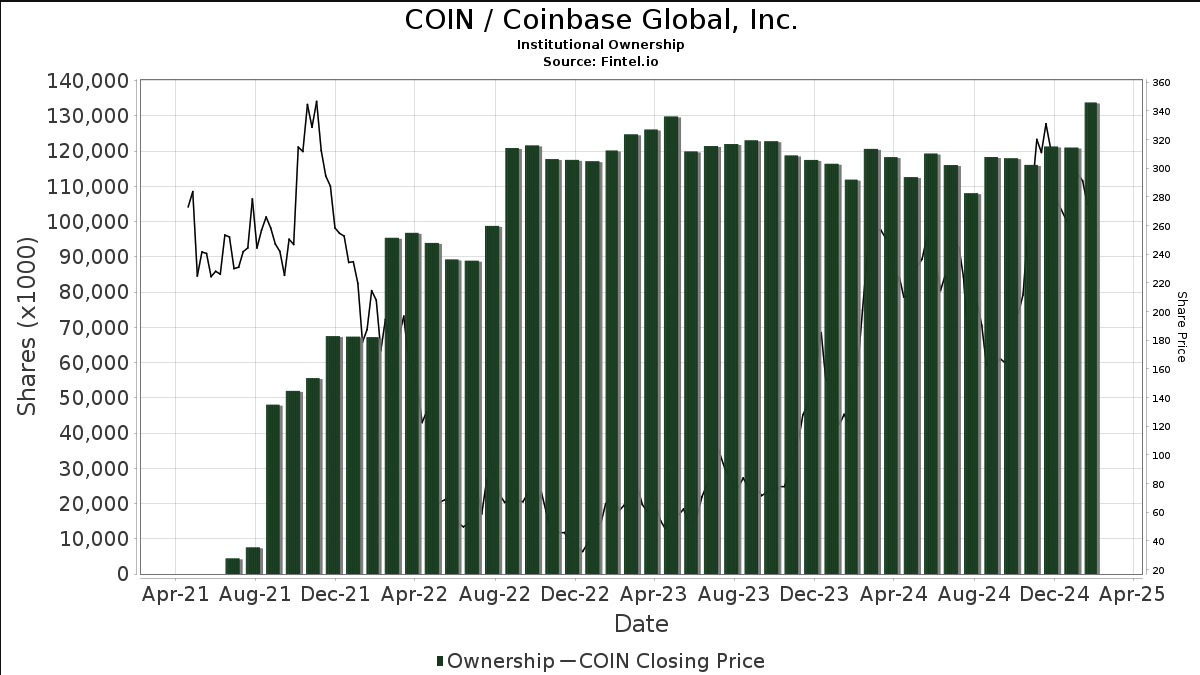

4/ Shifting to crypto: Altcoins are starting to break higher, a classic risk-on indicator. We're seeing spikes in futures open interest, heavy leverage rotating in, and predictions of explosive gains. $OTHERS is also almost ready to break through the weekly cloud

5/ Even #TOTAL3 (excluding $BTC and $ETH) is set to break into all time highs and head towards the fib extensions above

6/ Now, the wildcard: Gold. It's been on a tear, hitting record highs above $3,500/oz, up 30% YTD as a hedge against uncertainty. But here's the twist—gold often lags as the "last asset" for capital allocation. With crypto going mainstream, liquidity is shifting out of gold (see outflows in GDX/J despite ATH prices) toward Bitcoin and alts.

YTD $GDX has net outflows in excess of 3.1 billion

YTD $GDX has net outflows in excess of 3.1 billion

7/ Forecasts see gold pushing to $4,000 by year-end, but ratios like Nasdaq ( $IXIC) priced in #GOLD are rejecting at the 200day MA, hinting at a top and rotation back to stocks. Platinum and palladium are already breaking out vs. SPX, signaling a broader metals shift—but for gold, this could mean peaking as investors rotate to higher-growth assets. Tokenized gold on chains like XRPL, Stellar, and XDC adds on-chain diversification, but the real play is liquidity flowing elsewhere.

8/ #GOLD also hit the full extension today of the 2020 high and 2022 low. Hitting the full extension of the 4.236 is definitely a zone to be cautious in

9/ Put it together: $IWM's breakout fuels small-cap momentum, altcoins' higher breaks scream risk-on, and gold's potential top (post-ATH exhaustion) frees up capital for rotation into equities and crypto. Lower rates, neglected assets waking up, and historical patterns all align. This isn't the end of the bull—it's the reload for the next leg up.

• • •

Missing some Tweet in this thread? You can try to

force a refresh