XRP could benefit tremendously if tokenization claims 10% of the global GDP by 2030 and the XRPL captures a considerable chunk of the market.

Notably, Ripple recently highlighted that tokenization will be immensely important in the future of finance. In a recent report on digital assets custody, the company emphasized that custody deals more on trust.

Notably, Ripple recently highlighted that tokenization will be immensely important in the future of finance. In a recent report on digital assets custody, the company emphasized that custody deals more on trust.

Ripple explained that as tokenization trends continue to grow, institutions entering the space will need the same level of security, trading access, and risk management they rely on with traditional assets.

Interestingly, what caught most investors’ attention was Ripple’s mention of a Boston Consulting Group forecast that by 2030, tokenized assets could account for 10% of global GDP.

For context, in 2020, the global economy was worth $86.116 trillion, according to the Federal Reserve Bank of St. Louis. It grew to $98.365 trillion in 2021, $102.434 trillion in 2022, and $106.970 trillion in 2023. By 2024, estimates put the global GDP at a whopping $111.236 trillion.

This indicates that since 2020, the world economy has grown at an average annual rate of 6.69%. If this pace continues, global GDP could reach $164 trillion by 2030. Meanwhile, should 10% of that total become tokenized, the tokenization market would be worth about $16.4 trillion by 2030.

Interestingly, what caught most investors’ attention was Ripple’s mention of a Boston Consulting Group forecast that by 2030, tokenized assets could account for 10% of global GDP.

For context, in 2020, the global economy was worth $86.116 trillion, according to the Federal Reserve Bank of St. Louis. It grew to $98.365 trillion in 2021, $102.434 trillion in 2022, and $106.970 trillion in 2023. By 2024, estimates put the global GDP at a whopping $111.236 trillion.

This indicates that since 2020, the world economy has grown at an average annual rate of 6.69%. If this pace continues, global GDP could reach $164 trillion by 2030. Meanwhile, should 10% of that total become tokenized, the tokenization market would be worth about $16.4 trillion by 2030.

This massive opportunity leads to questions about which networks could capture the lion’s share of tokenization. Many analysts highlight the XRP Ledger as a strong candidate. For instance, Bitwise has pointed to XRP as one of the cleanest ways to invest in tokenization. Also, Ripple’s CTO, David Schwartz, confirmed two years ago that the ledger was pivoting toward this area.

Amid this growing conversation, how much of the market could the XRPL realistically capture? If the ledger secures just 15% of tokenized assets, it would represent $2.46 trillion in value. However, it remains uncertain how this could impact the XRP price.

To have an assessment, we asked OpenAI’s chatbot ChatGPT. According to ChatGPT, in a bullish scenario where reserves on XRPL fully back tokenized assets, XRP’s market cap would equal $2.46 trillion. With 59.48 billion tokens in circulation, that would push the price to around $41.

However, this would likely not be the case, as tokenization value does not translate to market valuation. For instance, today, the XRPL houses around $306.8 million in tokenized assets, but XRP has a market cap of $168 billion.

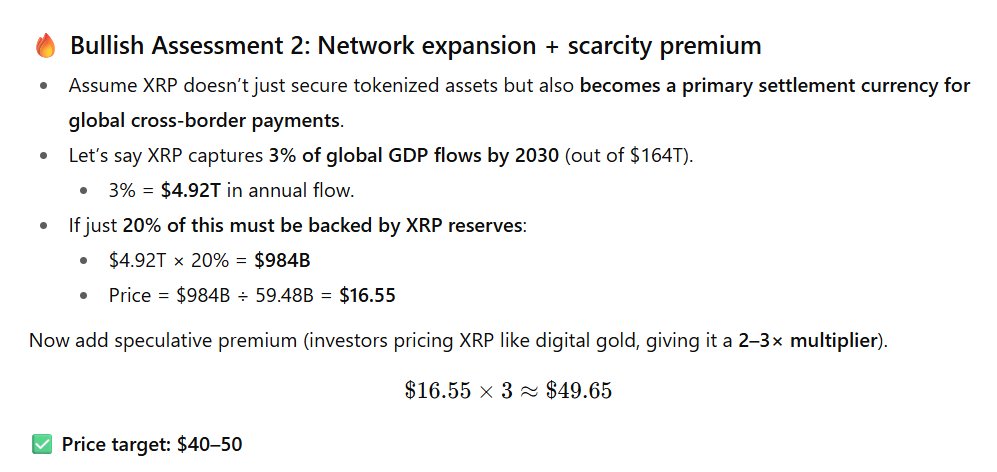

Meanwhile, ChatGPT also considered another case where XRP expands beyond tokenization and becomes a major settlement currency for cross-border payments. If XRP handles 3% of global GDP flows, roughly $4.92 trillion in 2030, and 20% of that flow requires XRP reserves, the total would come to $984 billion.

Specifically, this directly translates to $16.55 per token. However, factoring in speculative premiums, ChatGPT placed the price range between $40 and $50.

Meanwhile, in a more ambitious “moonshot” scenario, ChatGPT suggested that if XRP captures a share of both tokenized assets and cross-border payments, its value could break past $100.

Amid this growing conversation, how much of the market could the XRPL realistically capture? If the ledger secures just 15% of tokenized assets, it would represent $2.46 trillion in value. However, it remains uncertain how this could impact the XRP price.

To have an assessment, we asked OpenAI’s chatbot ChatGPT. According to ChatGPT, in a bullish scenario where reserves on XRPL fully back tokenized assets, XRP’s market cap would equal $2.46 trillion. With 59.48 billion tokens in circulation, that would push the price to around $41.

However, this would likely not be the case, as tokenization value does not translate to market valuation. For instance, today, the XRPL houses around $306.8 million in tokenized assets, but XRP has a market cap of $168 billion.

Meanwhile, ChatGPT also considered another case where XRP expands beyond tokenization and becomes a major settlement currency for cross-border payments. If XRP handles 3% of global GDP flows, roughly $4.92 trillion in 2030, and 20% of that flow requires XRP reserves, the total would come to $984 billion.

Specifically, this directly translates to $16.55 per token. However, factoring in speculative premiums, ChatGPT placed the price range between $40 and $50.

Meanwhile, in a more ambitious “moonshot” scenario, ChatGPT suggested that if XRP captures a share of both tokenized assets and cross-border payments, its value could break past $100.

• • •

Missing some Tweet in this thread? You can try to

force a refresh