🚨🇨🇳🇺🇸Checkmate in the Pacific: How China's Missiles Have Made US Power Projection Obsolete

A sobering analysis confirms the US military is fundamentally outmatched. China's precision-strike complex can decimate American air forces on day one.

Here's how 🧵

A sobering analysis confirms the US military is fundamentally outmatched. China's precision-strike complex can decimate American air forces on day one.

Here's how 🧵

Let's be blunt: the US military is no longer the dominant power in the Western Pacific.

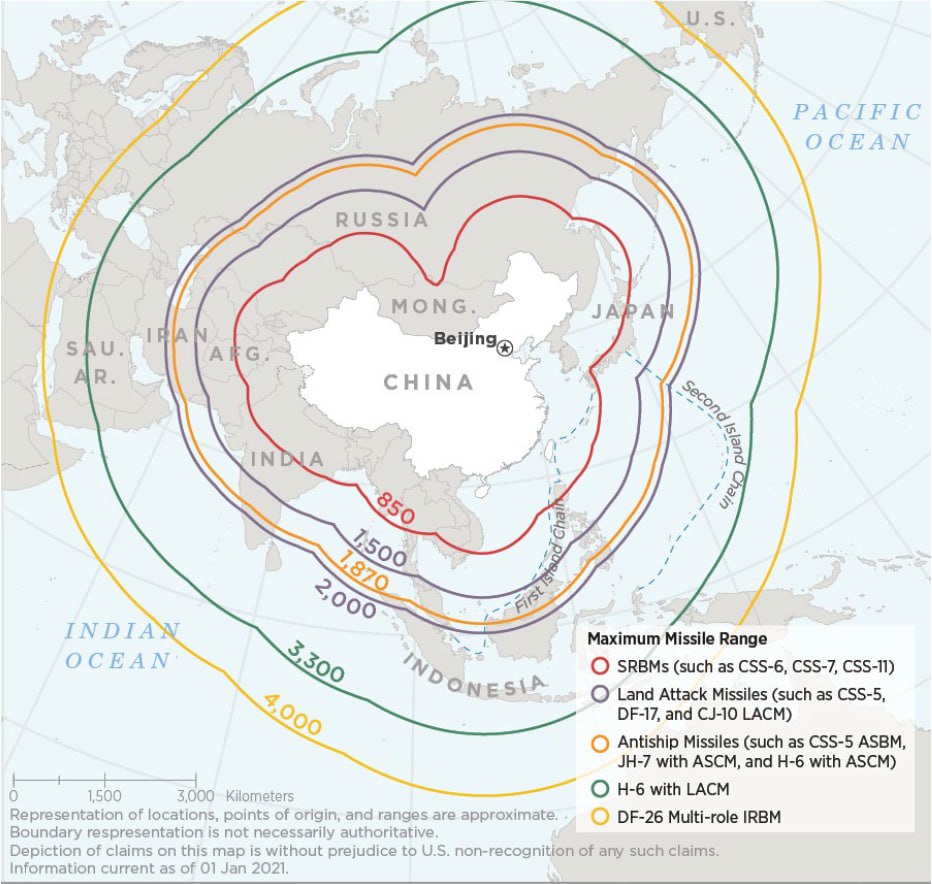

China's vast arsenal of precision missiles and satellites has created a kill zone where US bases and carriers are not shields, but giant, vulnerable targets.

China's vast arsenal of precision missiles and satellites has created a kill zone where US bases and carriers are not shields, but giant, vulnerable targets.

The US strategy hinges on airpower, but this is now its greatest vulnerability. The simulations show that no matter where the US flies from—large bases, small fields, near or far—China can saturate them with barrages of accurate ballistic and cruise missiles.

The losses are not just bad; they are catastrophic and war-ending.

The US would likely lose 200-400 aircraft in the opening weeks—primarily destroyed on the tarmac.

This isn't a setback; it's a defeat from which the USAF couldn't recover.

The US would likely lose 200-400 aircraft in the opening weeks—primarily destroyed on the tarmac.

This isn't a setback; it's a defeat from which the USAF couldn't recover.

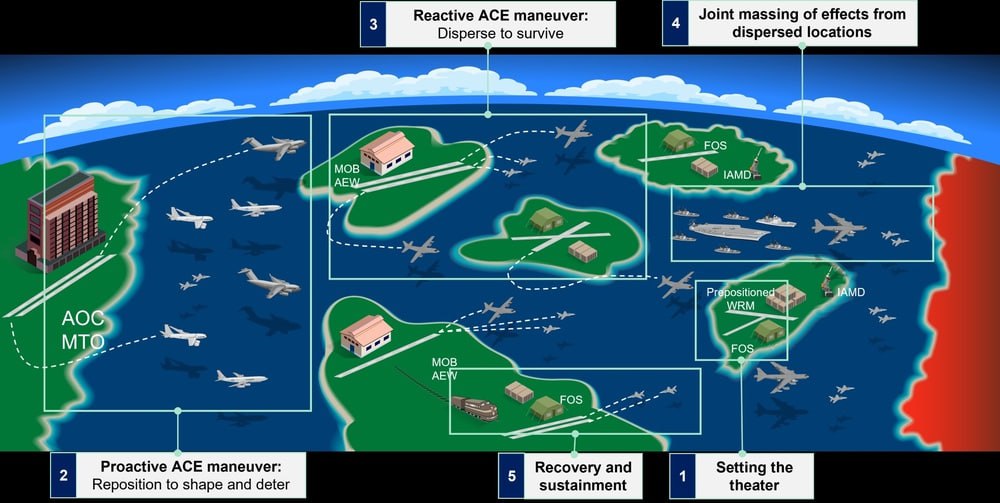

The Pentagon's plan to "get agile" (Agile Combat Employment) is a fantasy. Dispersing to smaller, austere airfields doesn't save planes; it just puts them on bases with fewer defenses and no shelters, making them even easier targets.

This flawed doctrine forces a horrific choice:

🔸Either accept the annihilation of your air force

🔸Or, in a crisis, immediately launch escalatory attacks to blind Chinese satellites.

There is no middle ground. Deterrence is now a dangerous bluff.

🔸Either accept the annihilation of your air force

🔸Or, in a crisis, immediately launch escalatory attacks to blind Chinese satellites.

There is no middle ground. Deterrence is now a dangerous bluff.

The only potential solution—hardening bases with hundreds of shelters—is a monumental task the US hasn't even started. Meanwhile, China has already built over 800 shelters for its own air force.

US is years behind in the defense that desperately need.

US is years behind in the defense that desperately need.

Even if US built them, it's an arms race that might not win. China's missile production dwarfs the West's. The grim math suggests they can produce missiles faster and cheaper than US can build shelters to protect against them.

US allies cannot save them

While South Korea's 700+ hardened shelters are a tantalizing lifeline, Seoul has shown zero appetite for being drawn into a US-China war over Taiwan. Counting on them is a dangerous gamble.

While South Korea's 700+ hardened shelters are a tantalizing lifeline, Seoul has shown zero appetite for being drawn into a US-China war over Taiwan. Counting on them is a dangerous gamble.

The uncomfortable truth:

The US is on a trajectory to lose a war with China US have three bad options:

🔸Spend trillions playing catch-up

🔸Retreat to a less vulnerable but less influential force

🔸Reconsider US geopolitical commitments in Asia

The era of US primacy is over

The US is on a trajectory to lose a war with China US have three bad options:

🔸Spend trillions playing catch-up

🔸Retreat to a less vulnerable but less influential force

🔸Reconsider US geopolitical commitments in Asia

The era of US primacy is over

• • •

Missing some Tweet in this thread? You can try to

force a refresh