Lots of chatter out there about how there is a GLOBAL long-dated bond selloff afoot and how that is weird. (This is a 🧵).

I am sympa to that view as I've called President Trump a "Human Steepener" and was SHORT DURATION due to his campaign from September 2024 to January 2025.

I am sympa to that view as I've called President Trump a "Human Steepener" and was SHORT DURATION due to his campaign from September 2024 to January 2025.

But then something strange happened: the GOP in the House REVOLTED against President Trump's campaign promises and the One Big Beautiful Bill (once we combine it with the TAX increase that is the tariffs) came out far less profligate. As a result, I ended my short duration position in January 2025, due to that revolt. Since then, the 10-year has been well behaved and even has dropped below 4.2% today.

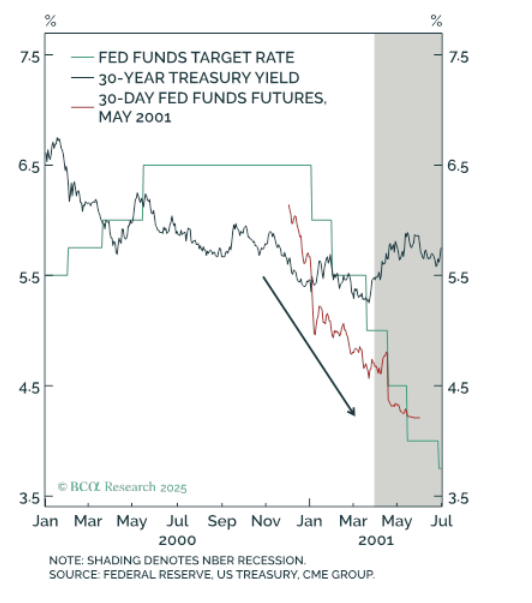

But this chart has become popular on FinTwit. It shows how the 30-year yield is not reacting to the upcoming Fed rate cuts and how this is somehow "weird" and a sign of a fiscal crisis.

To prove that this is "weird," we are shown this chart, from 2020. Note how the 30 year yield fell along with the fed funds futures and the target rate. BOOM. There it is. Evidence of an imminent fiscal crisis this time around.

Actually, both in 2001 and 2009, long-dated yields kind of went HIGHER.

And think about it, this makes sense. Why should long-dated yields go down because of something that is happening over the next 12-18 months? A recession comes and goes.

And think about it, this makes sense. Why should long-dated yields go down because of something that is happening over the next 12-18 months? A recession comes and goes.

Which brings me to the 2020 recession. Folks need to stop referring to it. People lost their goddamn minds! How many of you thought it would produce a deflationary depression? I know who you are. (Mostly tech bros!). YOU know who you are.

Of course the 30-year rallied hard. The median investor thought that they'd be watching their grandkids doing Zoom school from a bunker. That proved wildly incorrect.

The point is that there is no sign that the 30-year is blowing out because of a fiscal crisis. This narrative is overstated. Ultimately, the 10-year yield should be rising if bonds were selling off due to fiscal policy. And yet, following the passage of OBBBA, yields have FALLEN.

Now, what could upset the cart here is the Supreme Court case on tariffs. We are in an upside-down world where yields are likely to rise if SCOTUS strikes down tariffs, which is BEARISH for equities.

As such, the bulls find themselves in a weird situation of having to cheer on for Trump's tariffs in order to remain long equities!

And it is that irony and paradox that makes me absolutely LOVE my job!

As such, the bulls find themselves in a weird situation of having to cheer on for Trump's tariffs in order to remain long equities!

And it is that irony and paradox that makes me absolutely LOVE my job!

• • •

Missing some Tweet in this thread? You can try to

force a refresh