Day 5/30 of mastering the market and dropping value ‼ 🔥

Understanding the key concept of liquidity 💰📈📉

(The fuel that moves the market)

A thread 🧵

Understanding the key concept of liquidity 💰📈📉

(The fuel that moves the market)

A thread 🧵

Before we proceed kindly follow, repost, like and comment so others can benefit from it.

And join my Telegram for more insight ⬇️

t.me/The_kingsmantr…

And join my Telegram for more insight ⬇️

t.me/The_kingsmantr…

Liquidity 💰💸

Introduction

Liquidity is the engine that powers the financial market. Without liquidity, price cannot move. Every buy order requires a sell order, and every sell order requires a buy order. Liquidity provides that connection.

Introduction

Liquidity is the engine that powers the financial market. Without liquidity, price cannot move. Every buy order requires a sell order, and every sell order requires a buy order. Liquidity provides that connection.

What is Liquidity?

It’s simply where buy & sell orders are resting.

Think of it as pools of money that the market hunts.

Every highs and lows in the market are liquidity.

it is where the orders are resting, waiting to be taken. These orders (stop-loss, entries, limits).

It’s simply where buy & sell orders are resting.

Think of it as pools of money that the market hunts.

Every highs and lows in the market are liquidity.

it is where the orders are resting, waiting to be taken. These orders (stop-loss, entries, limits).

Types of liquidity.

There are different types of liquidities and they all have their unique forms and can be traded strategically using different approach.

Structural liquidity.

Transactional liquidity

Equal highs and lows

Trendline liquidity

Buy and sell side

Inducement

There are different types of liquidities and they all have their unique forms and can be traded strategically using different approach.

Structural liquidity.

Transactional liquidity

Equal highs and lows

Trendline liquidity

Buy and sell side

Inducement

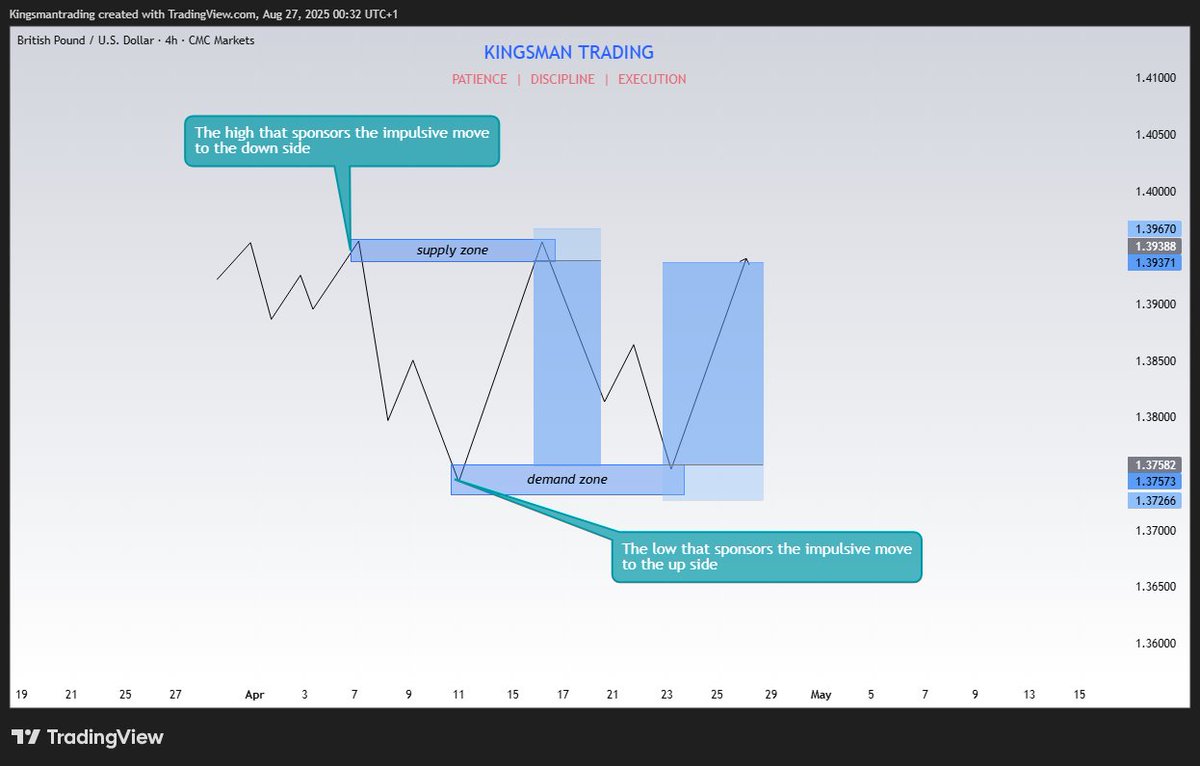

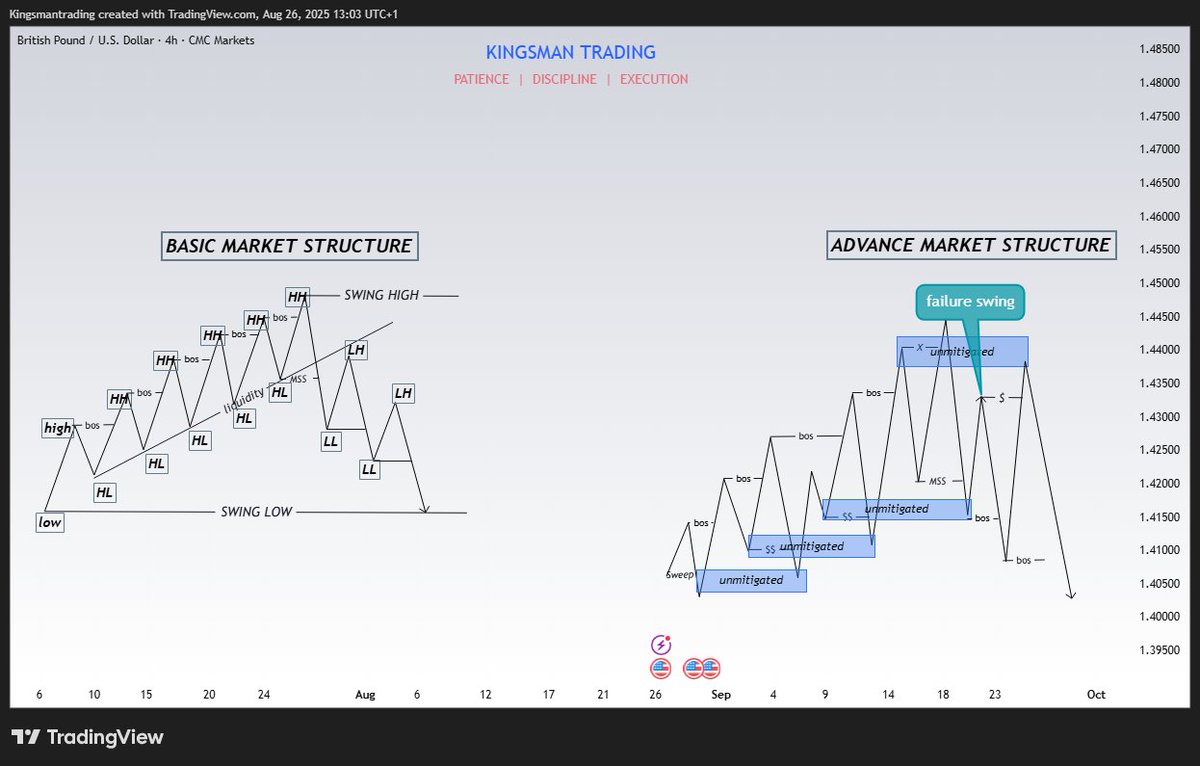

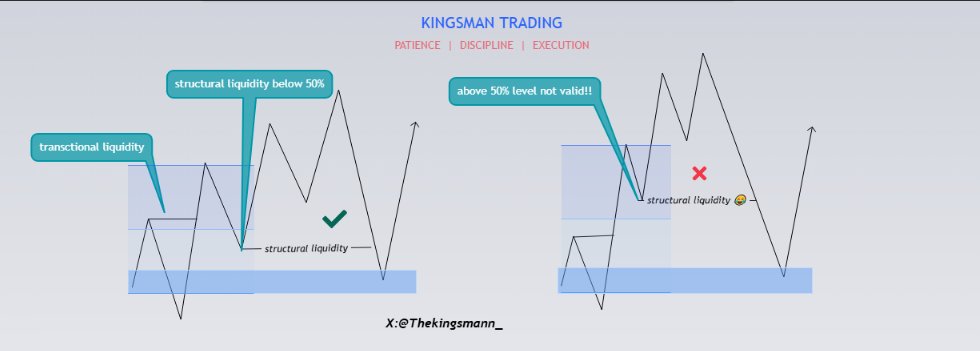

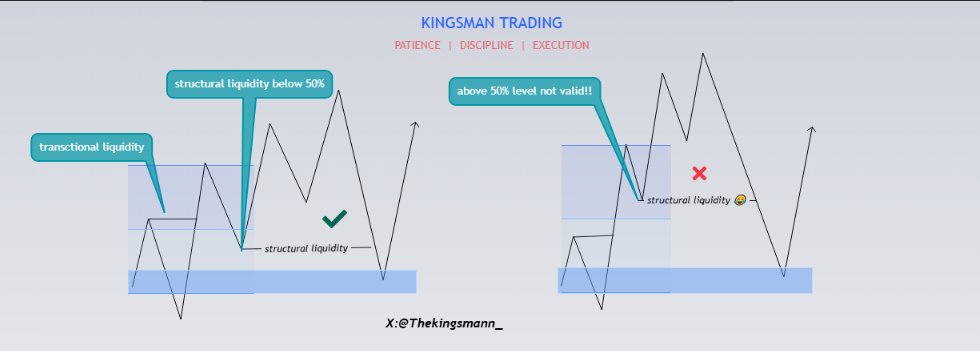

1. Structural liquidity: This liquidity is mainly used for continuation, for a valid structural liquidity there must be a protected level, price must sweep the previous high or low depending on the direction before the major move, structural liquidity must always be taken out.

2. Transactional liquidity (TLQ): Transactional liquidity is used for correction in market trend. The retracement after a transactional liquidity is usually your structural liquidity.

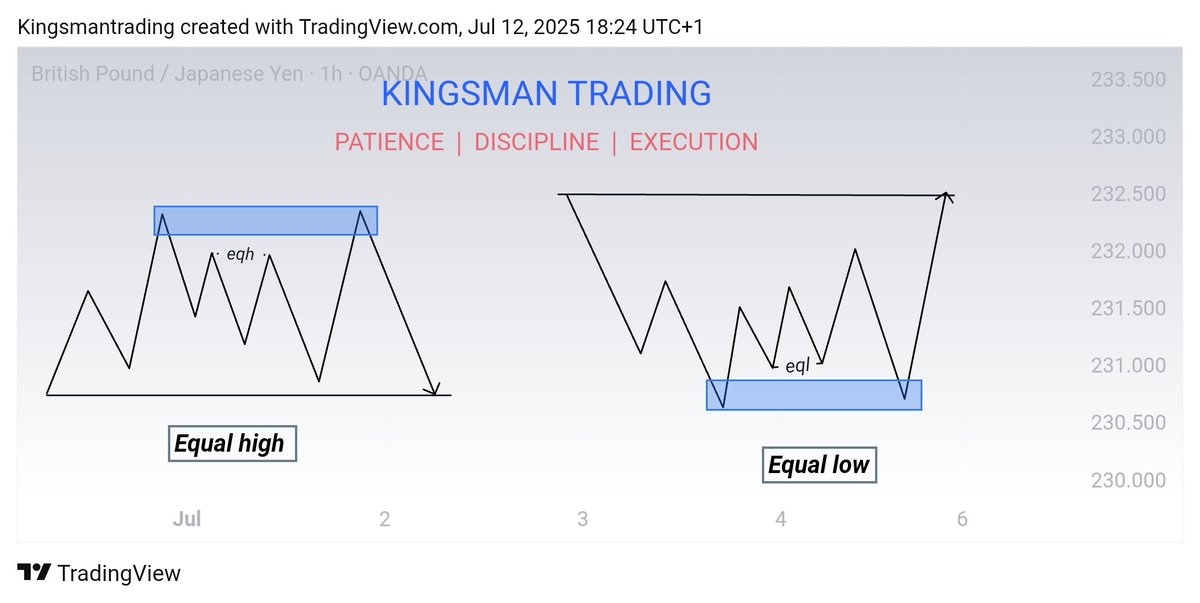

3. Equal highs and lows: As the name implies “equal highs and lows” this is when price fails to break a certain level and instead it creates a high and low that are relatively equal. Hence making liquidity to pile in that area.

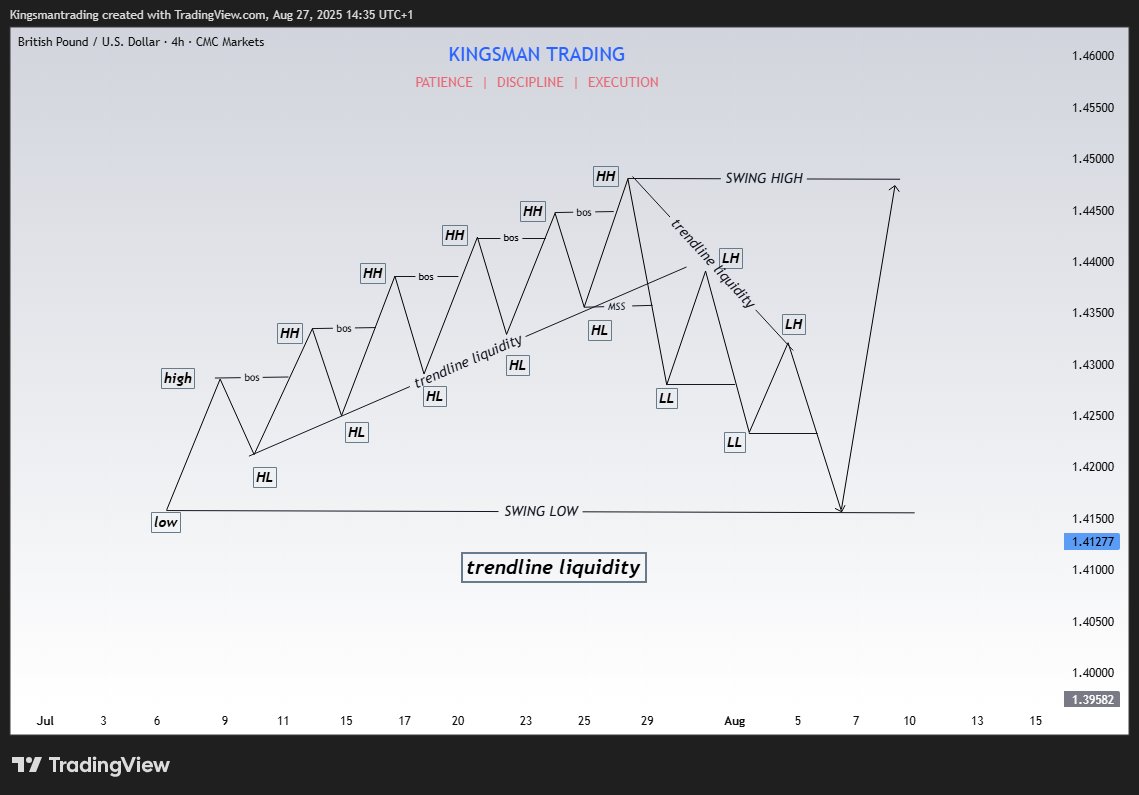

4. Trendline liquidity: This are liquidity that are clustered along trendlines in a trending market(e.g. connecting higher lows in an uptrend, or lower highs in a downtrend).

That creates a liquidity pool around the trendline that price will take out and then reverses.

That creates a liquidity pool around the trendline that price will take out and then reverses.

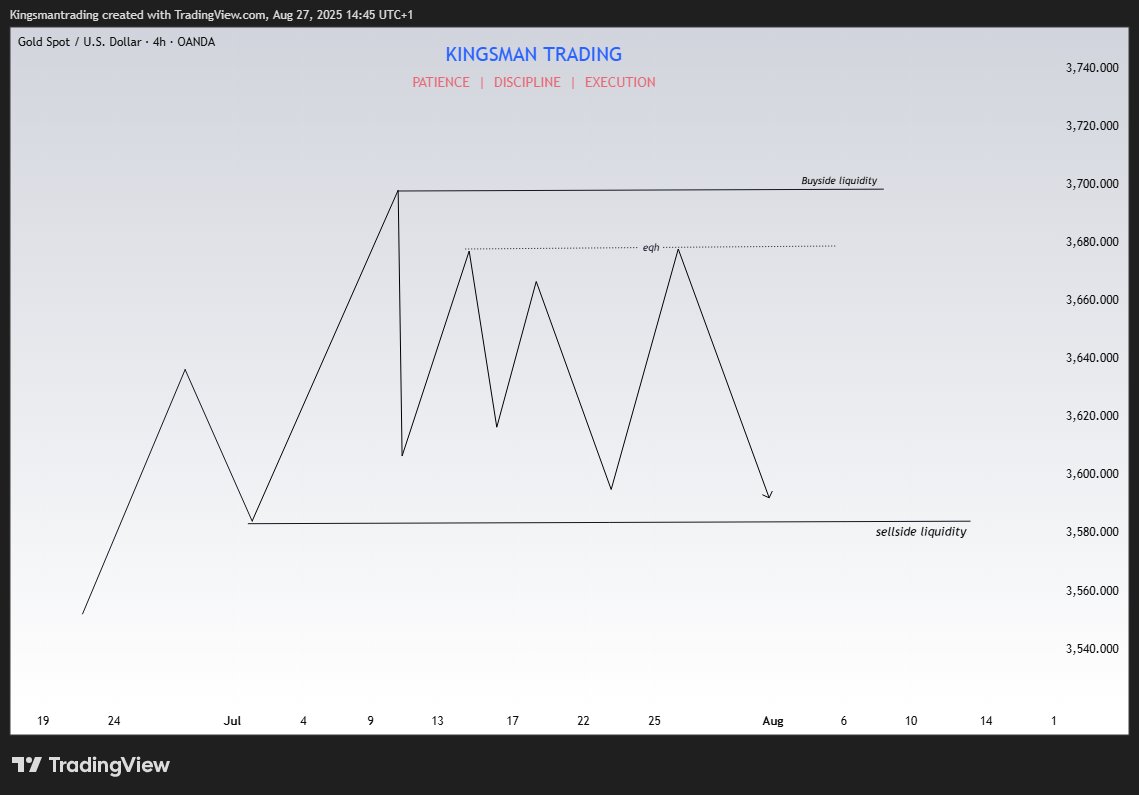

5. Buy and sell side liquidity: these are mainly liquidities that rest above highs and lows, market constantly shift to hunt buyside and sell side. After buy side is taken out then price will hunt for the sellside.

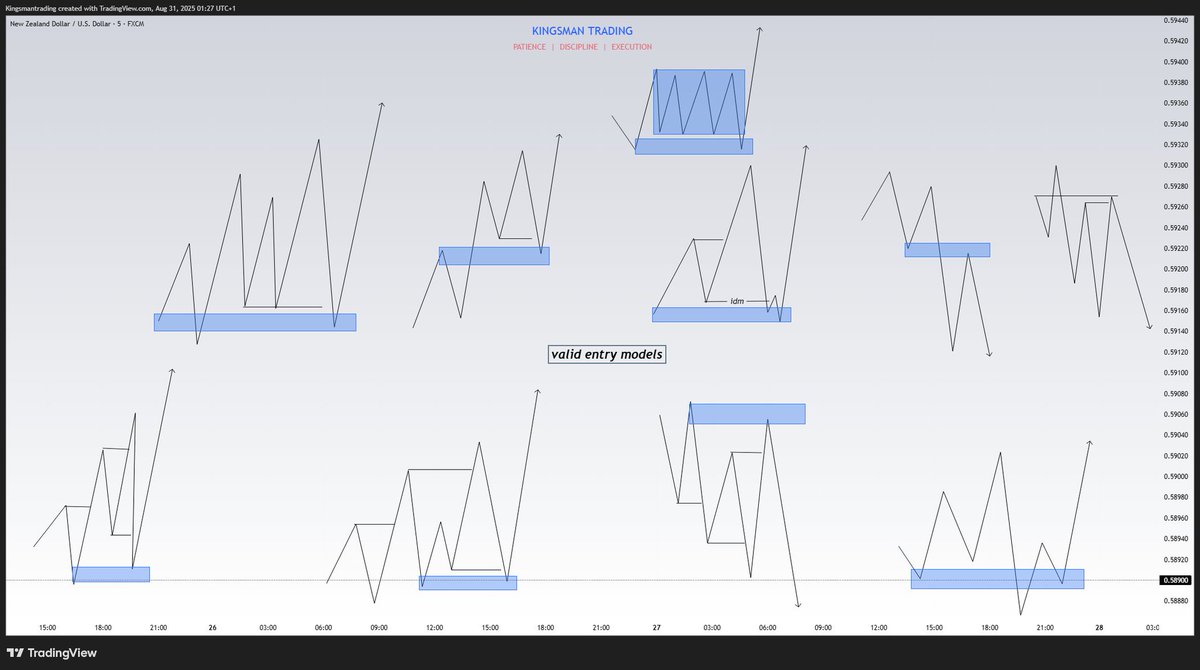

6. Inducement

Market tempts traders into positions right before the real move.

Example: Price creates a support zone, bounces a bit, luring buyers to go long.

But that support is just a trap,the market goes lower to grab their stops (creating liquidity) before moving.

Market tempts traders into positions right before the real move.

Example: Price creates a support zone, bounces a bit, luring buyers to go long.

But that support is just a trap,the market goes lower to grab their stops (creating liquidity) before moving.

Thanks for being here to the end 🙏 don't forget to follow and repost 😭😭

• • •

Missing some Tweet in this thread? You can try to

force a refresh