Oil made Rockefeller rich.

Steel made Carnegie wealthy.

Now, Wall Street has chosen its next industry to monopolize:

WATER.

Here’s how they’re turning the most essential resource into their next monopoly and the alternative no one talks about: 🧵

Steel made Carnegie wealthy.

Now, Wall Street has chosen its next industry to monopolize:

WATER.

Here’s how they’re turning the most essential resource into their next monopoly and the alternative no one talks about: 🧵

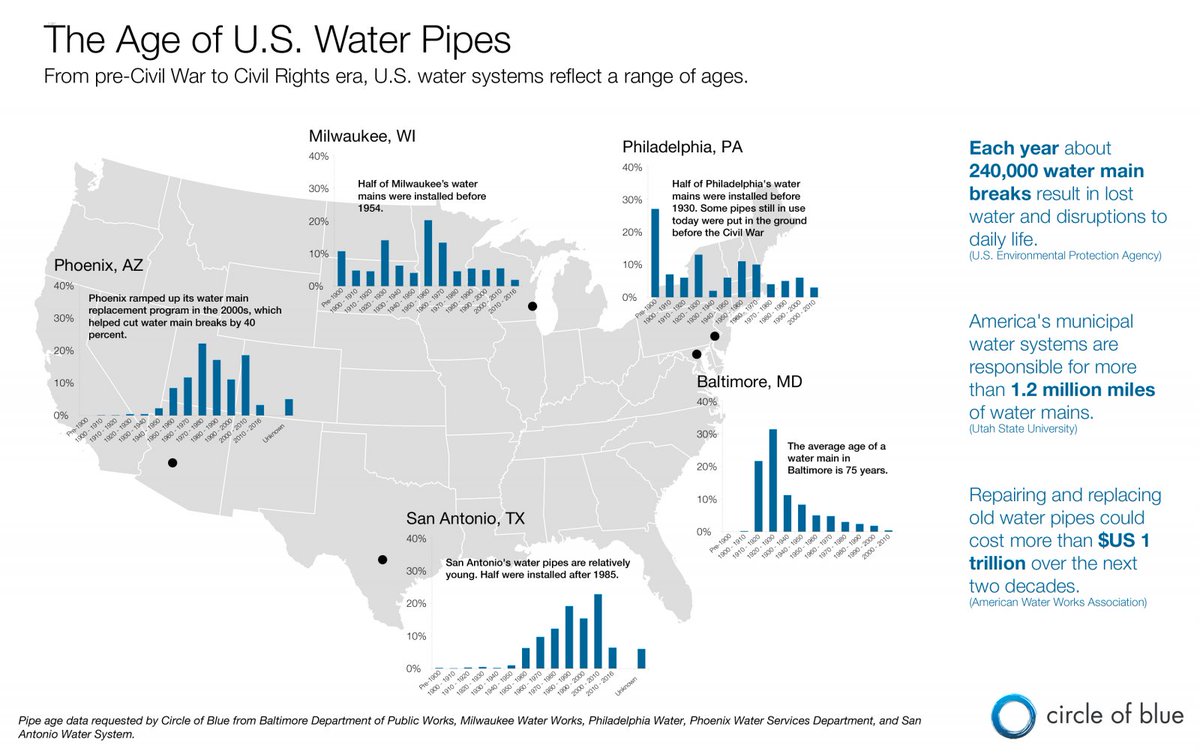

First, context:

Across America, pipes are failing.

Every 2 minutes, a main bursts.

6 billion gallons of treated water vanish daily.

Meanwhile, droughts and climate shocks are draining reservoirs.

Water scarcity is the new normal.

Across America, pipes are failing.

Every 2 minutes, a main bursts.

6 billion gallons of treated water vanish daily.

Meanwhile, droughts and climate shocks are draining reservoirs.

Water scarcity is the new normal.

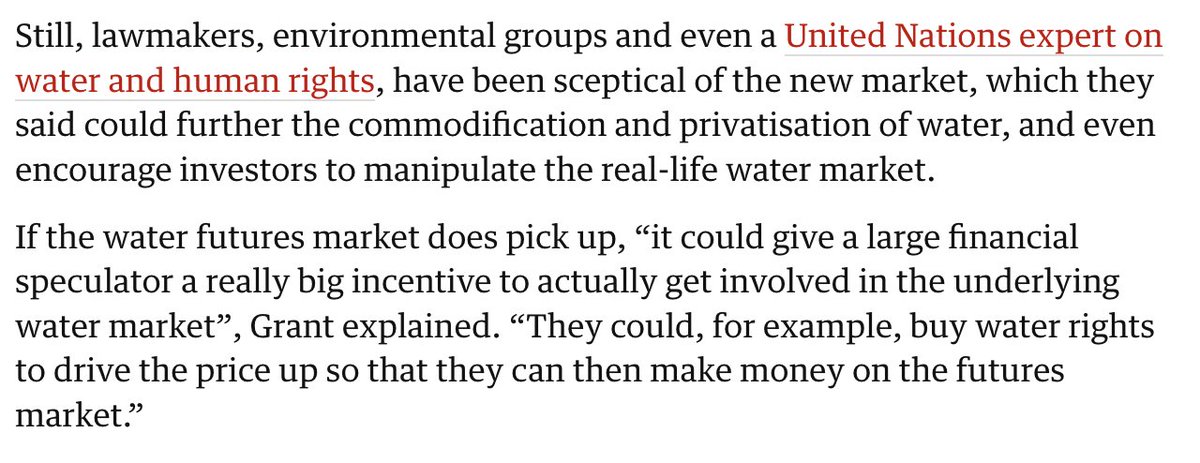

Wall Street smelled blood.

In 2020, California launched the world’s first water futures market.

For the first time, investors could bet on water like oil.

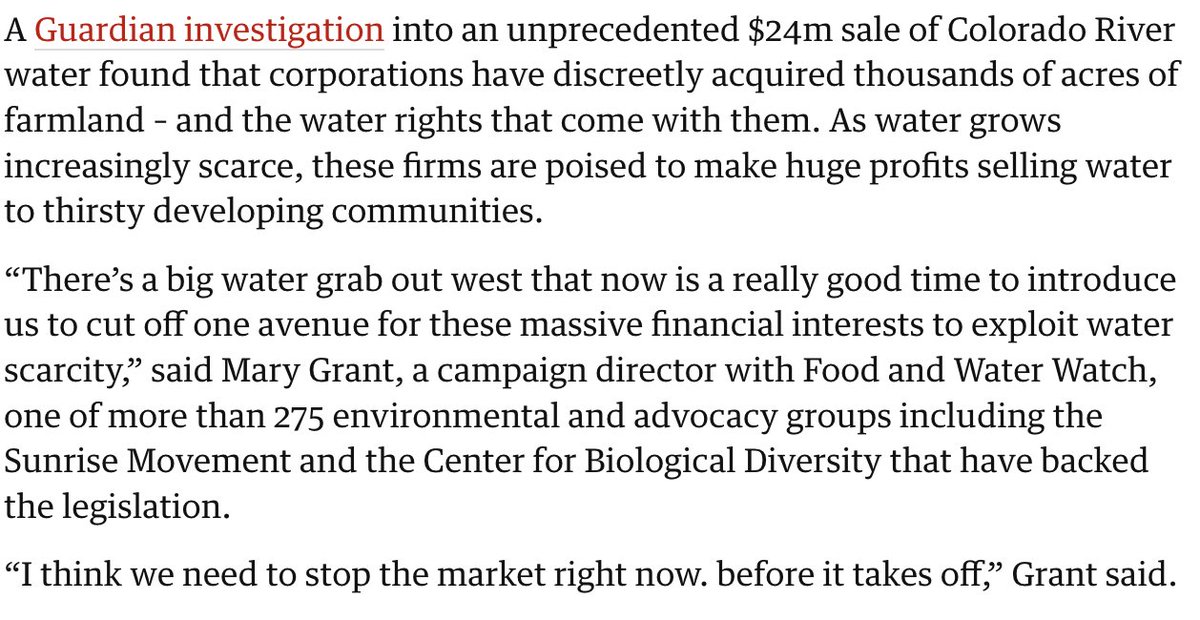

The Guardian warned: “Private speculation on water scarcity is here.”

In 2020, California launched the world’s first water futures market.

For the first time, investors could bet on water like oil.

The Guardian warned: “Private speculation on water scarcity is here.”

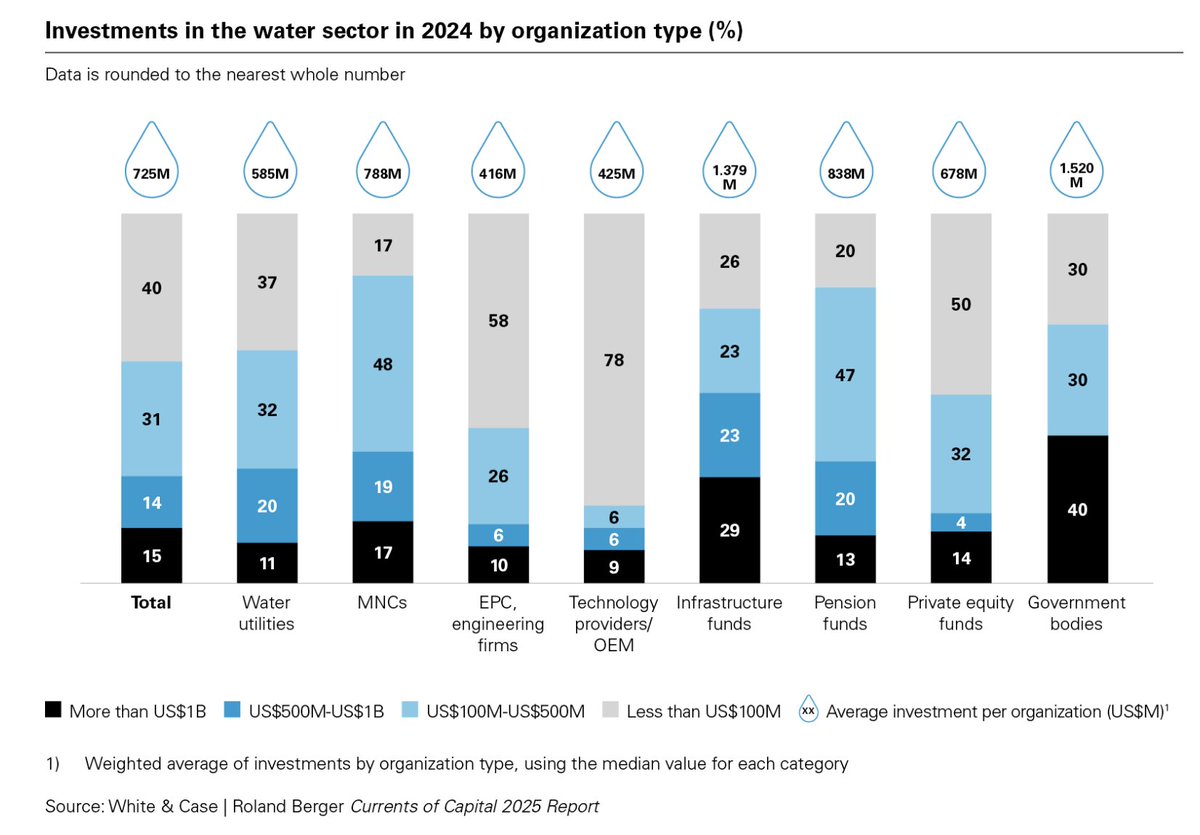

Private equity piled in.

They buy utilities and water rights.

“Fair market value” laws let them outbid cities, forcing sales.

Once Wall Street owns the pipes, families are trapped.

Cancel Netflix? Sure.

Cancel water? Impossible.

They buy utilities and water rights.

“Fair market value” laws let them outbid cities, forcing sales.

Once Wall Street owns the pipes, families are trapped.

Cancel Netflix? Sure.

Cancel water? Impossible.

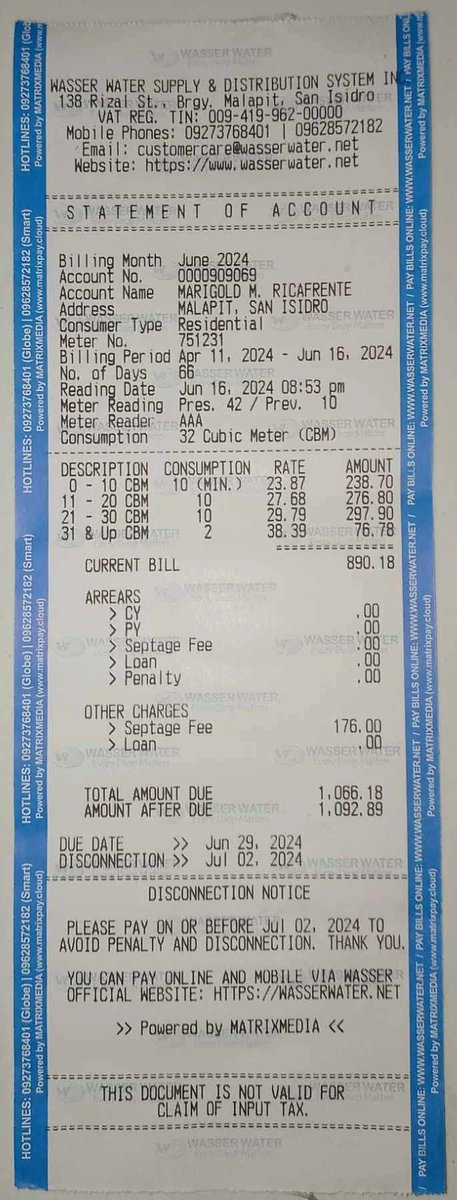

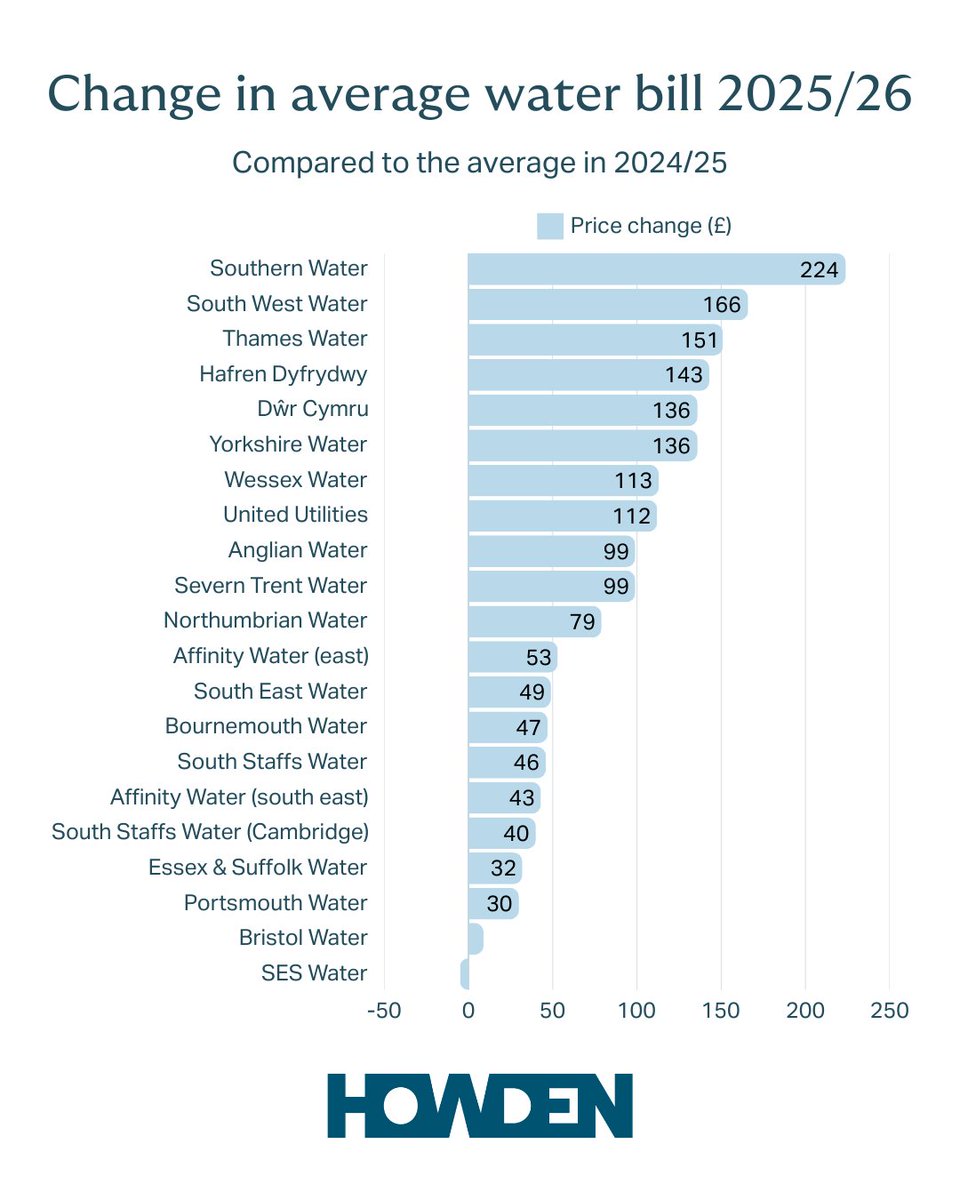

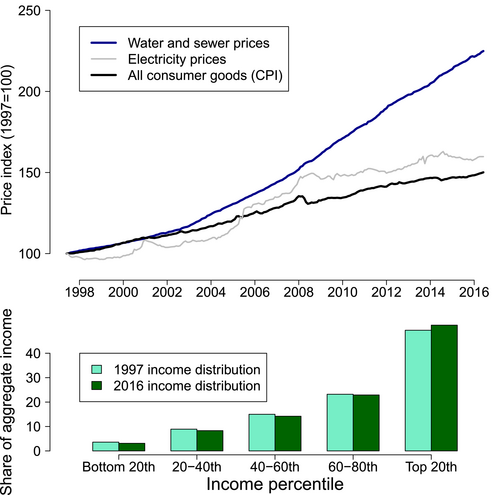

The result?

MIT found nearly 1 in 3 U.S. households already struggles to pay water bills.

That’s 40 million Americans on the brink of “water poverty.”

And unlike fuel or streaming, you can’t cut water.

You pay, or your tap runs dry.

MIT found nearly 1 in 3 U.S. households already struggles to pay water bills.

That’s 40 million Americans on the brink of “water poverty.”

And unlike fuel or streaming, you can’t cut water.

You pay, or your tap runs dry.

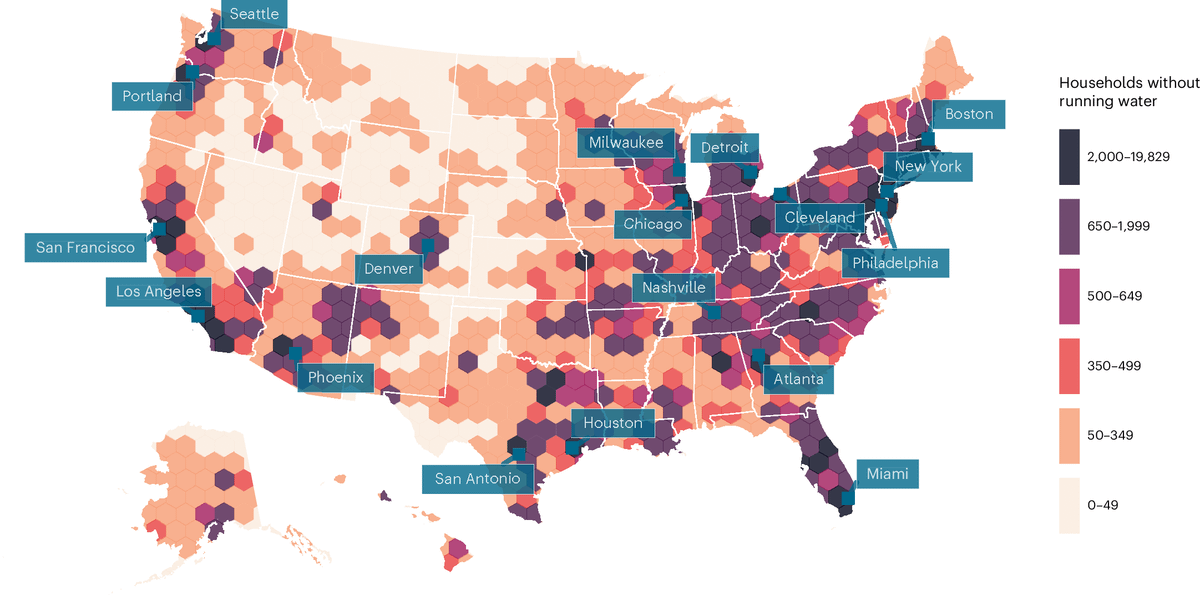

This isn’t economics, it’s water poverty.

2M Americans lack running water, while the poorest towns pay the most.

The fix? Flip the model.

Do the OPPOSITE of a monopoly:

Investors profit from treating wastewater, not billing families.Done right, Wall Street becomes the solution.

2M Americans lack running water, while the poorest towns pay the most.

The fix? Flip the model.

Do the OPPOSITE of a monopoly:

Investors profit from treating wastewater, not billing families.Done right, Wall Street becomes the solution.

Why? Because unlike tech, water has no substitute.

When Wall Street controls the pipes, they control life itself.

That’s the ultimate “non-substitutable asset.”

When Wall Street controls the pipes, they control life itself.

That’s the ultimate “non-substitutable asset.”

But here’s the misconception.

Privatization ≠ selling water sources.

That’s a disaster, think Nestlé hoarding aquifers.

Utilities should deliver fresh water.

Businesses must treat wastewater, the true burden crushing cities.

Privatization ≠ selling water sources.

That’s a disaster, think Nestlé hoarding aquifers.

Utilities should deliver fresh water.

Businesses must treat wastewater, the true burden crushing cities.

That’s where Water On Demand flips the model.

We put micro-utilities at industrial + farm sites.

Polluters pay to clean what they use.

Cities get relief.

Families avoid exploitation.

We put micro-utilities at industrial + farm sites.

Polluters pay to clean what they use.

Cities get relief.

Families avoid exploitation.

The U.S. faces a $1.26T water gap in 20 years.

40M Americans risk water poverty.

Wall Street profits from scarcity.

But there’s another path, one that protects families while creating real assets for investors.

40M Americans risk water poverty.

Wall Street profits from scarcity.

But there’s another path, one that protects families while creating real assets for investors.

Our model at @waterondemand is simple.

- Investors fund the equipment

- We build decentralized water systems

- 20.3% projected annual returns with debt leverage & 100% bonus depreciation

Secured. Inflation-protected. Real. Like oil wells, but with water.

- Investors fund the equipment

- We build decentralized water systems

- 20.3% projected annual returns with debt leverage & 100% bonus depreciation

Secured. Inflation-protected. Real. Like oil wells, but with water.

Every $100000 invested can restore 1.4 million gallons of water EVERY YEAR.

With projected IRRs better than oil and gas, real estate, and solar.

The future runs on water!

With projected IRRs better than oil and gas, real estate, and solar.

The future runs on water!

I’ve secured early access, before institutional capital floods in.

The first $20M of accredited investors also receive founder’s shares in Water On Demand Inc.

This is infrastructure for the people.

DM me “WATER” to learn more about working with us.

x.com/messages/compo…

The first $20M of accredited investors also receive founder’s shares in Water On Demand Inc.

This is infrastructure for the people.

DM me “WATER” to learn more about working with us.

x.com/messages/compo…

Hi, I'm Ken Berenger.

I've spent 35 years as an entrepreneur, elite sales trainer, and risk-taker who's had to rebuild from nothing—twice.

My mission on X is to share the formula for asymmetric wealth that cost me years, so you don't need to make the same mistakes.

I've spent 35 years as an entrepreneur, elite sales trainer, and risk-taker who's had to rebuild from nothing—twice.

My mission on X is to share the formula for asymmetric wealth that cost me years, so you don't need to make the same mistakes.

My mission is to share wisdom from the greatest wealth builders and spotlight once-in-a-lifetime opportunities that everyday people can access.

Follow me @kenberenger and let's debunk the secrets of wealth.

RT the tweet below to spread the word:

Follow me @kenberenger and let's debunk the secrets of wealth.

RT the tweet below to spread the word:

https://twitter.com/1519010190061887488/status/1963965988577378501

• • •

Missing some Tweet in this thread? You can try to

force a refresh