If you think house prices will keep going up,

you are missing something CRITICAL

A house is a monetary battery.

And a storm is coming to drain 90% of the stored wealth...

Here's why you should be wary of investing in real estate🧵

you are missing something CRITICAL

A house is a monetary battery.

And a storm is coming to drain 90% of the stored wealth...

Here's why you should be wary of investing in real estate🧵

A house hasn't always been an "investment class"

1950 (and 1971) is where it started.

What is responsible for the growth in real house prices since?

It's shocking:

1950 (and 1971) is where it started.

What is responsible for the growth in real house prices since?

It's shocking:

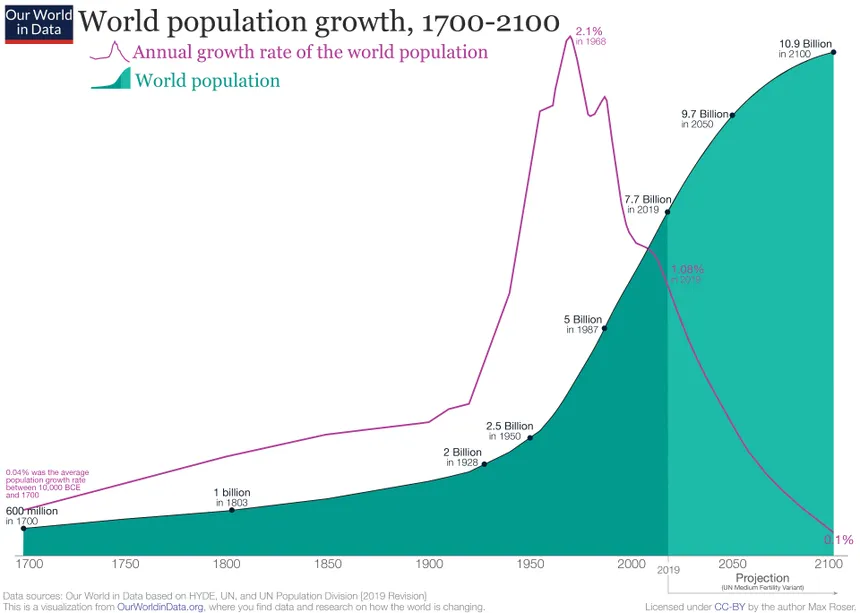

The demand for a house has skyrocketed the last 50 years.

Supply has been unable to keep up.

But everything is about to change:

Supply has been unable to keep up.

But everything is about to change:

Demand is a factor.

You could have very well lived during the maximum number of humans that will ever exist on the planet.

It's all downhill from here (for now)

You could have very well lived during the maximum number of humans that will ever exist on the planet.

It's all downhill from here (for now)

But demand is slowing.

Drastically.

We are now below replacement rate.

Fewer people = less demand for housing.

Drastically.

We are now below replacement rate.

Fewer people = less demand for housing.

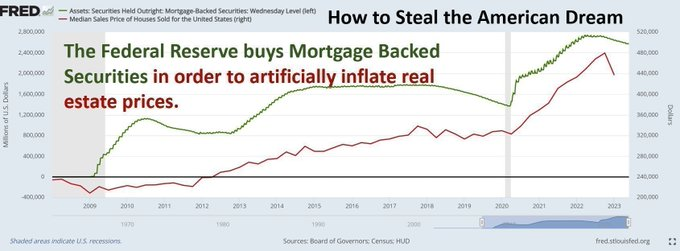

Since 1971 (end of gold standard), houses became the middle class's inflation hedge.

We stopped saving dollars.

Started "investing" in homes.

Houses went from shelter to money.

We stopped saving dollars.

Started "investing" in homes.

Houses went from shelter to money.

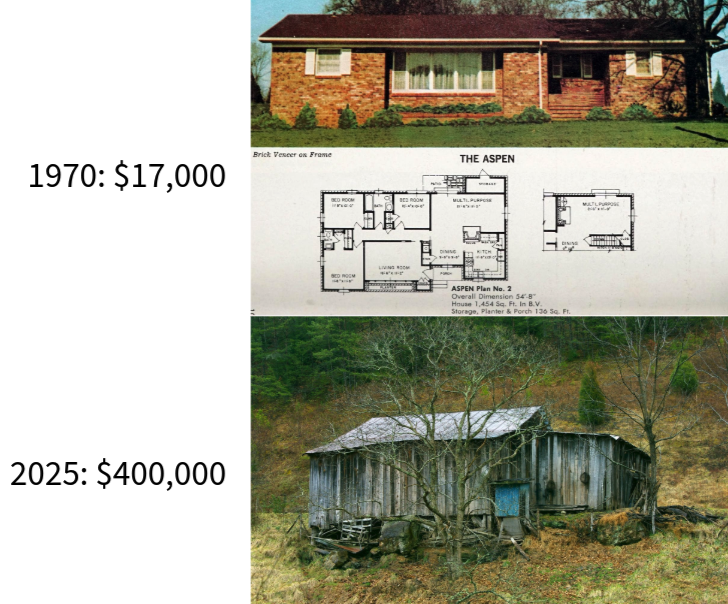

1970:

Average yearly wage: $9,870

Average house price: $17,000

House cost about 1.72 times your annual (single income) salary.

2025:

Average US yearly wage: $66,000

Average house price: $442,000

House cost about 7 times your annual salary.

Average yearly wage: $9,870

Average house price: $17,000

House cost about 1.72 times your annual (single income) salary.

2025:

Average US yearly wage: $66,000

Average house price: $442,000

House cost about 7 times your annual salary.

Translation:

1970 man works for 1 year to buy a house.

2025 man works for 7 years to buy a house.

Rent in 70's average was 108$ a month.

That's about 13% of a person's annual salary back then.

Rent now is $2,000.

That's 30% of a person's annual income.

1970 man works for 1 year to buy a house.

2025 man works for 7 years to buy a house.

Rent in 70's average was 108$ a month.

That's about 13% of a person's annual salary back then.

Rent now is $2,000.

That's 30% of a person's annual income.

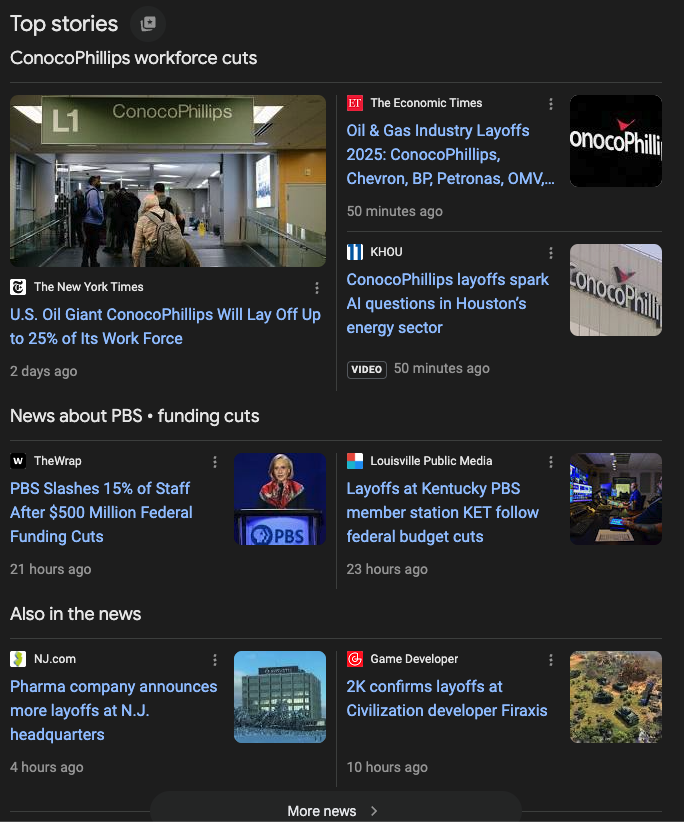

Without wage increases, demand for a house is wildly unsustainable.

This doesn't even factor in the decline in jobs available (ai is taking them)

This doesn't even factor in the decline in jobs available (ai is taking them)

5 forces driving the real estate bubble:

Population exploded (2.5B➡️8B people)

Everyone moved to cities (20%➡️90% urban)

Households shrink (5➡️2 people)

House size (800➡️2,500 sq ft)

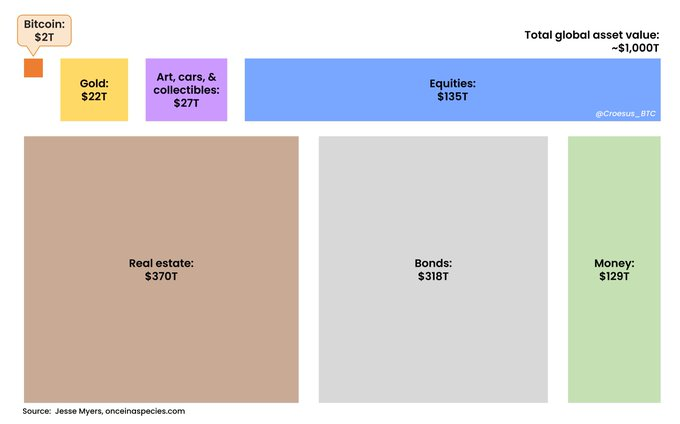

Financialization of real estate ($10T➡️$370T)

Perfect demand storm.

Population exploded (2.5B➡️8B people)

Everyone moved to cities (20%➡️90% urban)

Households shrink (5➡️2 people)

House size (800➡️2,500 sq ft)

Financialization of real estate ($10T➡️$370T)

Perfect demand storm.

The retail demand tailwind is turning into headwind with declining population growth and rising affordability crisis.

It's a Wall St game now.

It's a Wall St game now.

Meanwhile, supply constraints are cracking:

Starlink + solar = live anywhere

3D printing slashing construction costs

When everyone can work from anywhere, there is no local advantage.

Supply is UNLIMITED

Starlink + solar = live anywhere

3D printing slashing construction costs

When everyone can work from anywhere, there is no local advantage.

Supply is UNLIMITED

When people were required to be local to work, it created demand for local housing.

With the lowest transportation friction in HISTORY, and the lowest demand for in-person work in HISTORY,

pockets of supply are now expanded to global supply.

With the lowest transportation friction in HISTORY, and the lowest demand for in-person work in HISTORY,

pockets of supply are now expanded to global supply.

"But real estate always goes up!"

No.

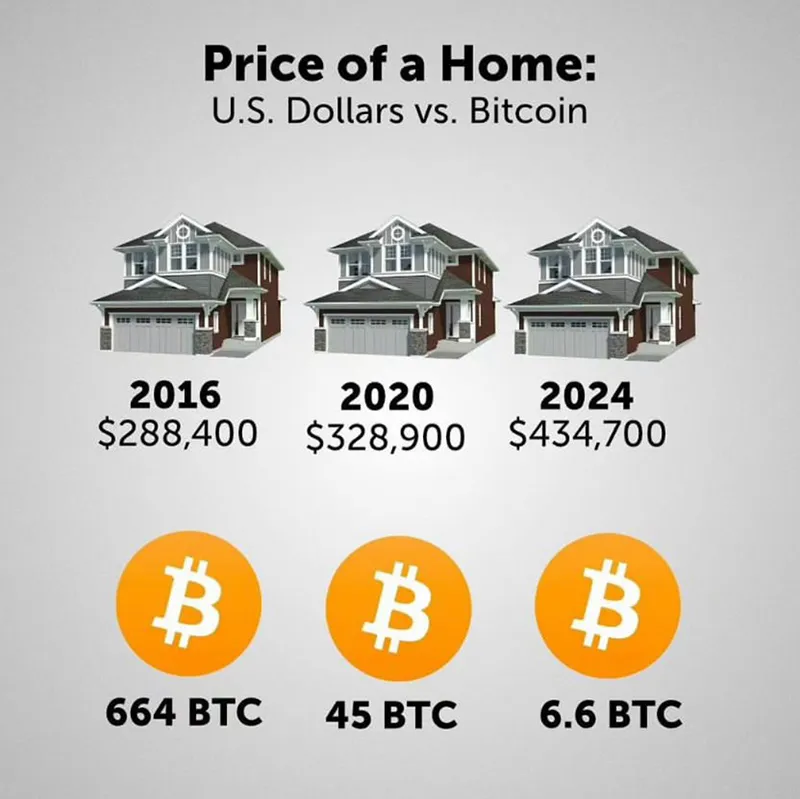

Monetary premiums always seek the hardest asset.

Gold → Real Estate → Bitcoin

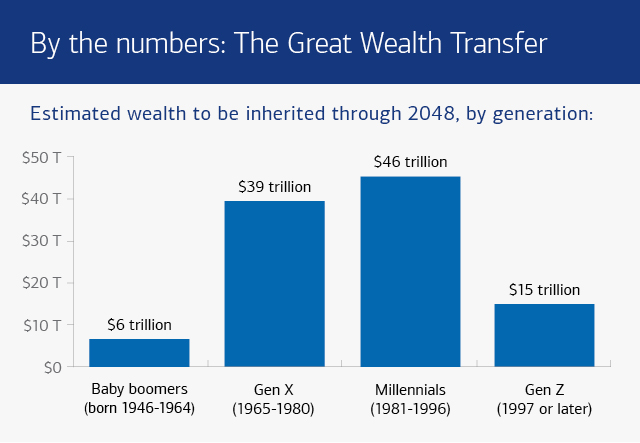

With decreased demand, wide open supply, and $75T in Boomer wealth changing hands,

The premium is getting flipped

No.

Monetary premiums always seek the hardest asset.

Gold → Real Estate → Bitcoin

With decreased demand, wide open supply, and $75T in Boomer wealth changing hands,

The premium is getting flipped

Bitcoin is superior money.

And it will reset the global monetary order.

And it will reset the global monetary order.

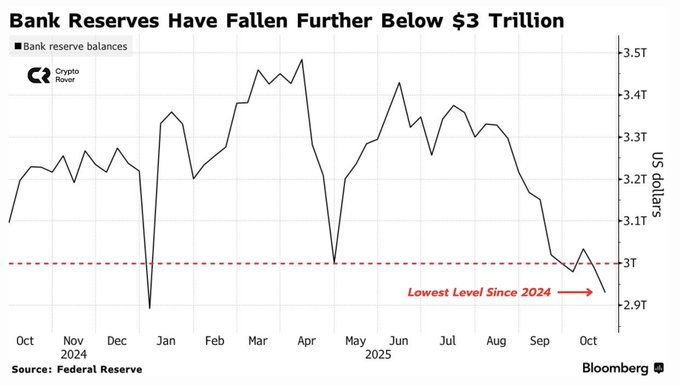

We're watching money EXIT real estate in real-time:

• Blackstone pausing redemptions

• Office buildings selling for 20% of 2019 prices

• China property sector imploding

Smart money sees what's coming.

• Blackstone pausing redemptions

• Office buildings selling for 20% of 2019 prices

• China property sector imploding

Smart money sees what's coming.

Your choice is simple:

Hold an overmonetized utility asset facing:

• Demographic collapse

• Supply expansion

• Expropriation + tax risk

Or

own the purest form of digital energy.

Hold an overmonetized utility asset facing:

• Demographic collapse

• Supply expansion

• Expropriation + tax risk

Or

own the purest form of digital energy.

And one day, Bitcoin will have a larger market cap than real estate.

Meaning a $20M coin is trading at $112,000...

Meaning a $20M coin is trading at $112,000...

I help investors understand Bitcoin mining and use it to build generational wealth.

Inflation is a problem for everyone.

Bitcoin is a solution for everyone.

Check out my investor letter:

DM me for a $100+ in hosted mining creditthebitcoinmininginvestor.com

Inflation is a problem for everyone.

Bitcoin is a solution for everyone.

Check out my investor letter:

DM me for a $100+ in hosted mining creditthebitcoinmininginvestor.com

And if you found this post helpful/valuable, consider reposting to reach others like yourself:

https://x.com/BillyBoone32/status/1964052253754491094

• • •

Missing some Tweet in this thread? You can try to

force a refresh