Eppeltone Engineers :

A case where execution is the key !!

With an order book of 484 cr and smart meters being need of the hour and a huge TAM ahead , Eppeltone seems to be in a sweet spot .

Few notes below 👇

#eppeltone #SmartMeter #grid

A case where execution is the key !!

With an order book of 484 cr and smart meters being need of the hour and a huge TAM ahead , Eppeltone seems to be in a sweet spot .

Few notes below 👇

#eppeltone #SmartMeter #grid

Introduction :

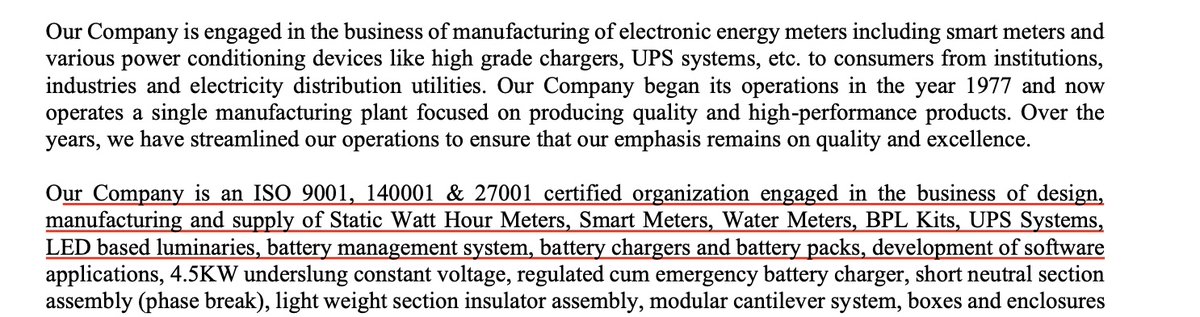

Eppeltone established in 1997 is primary into the business of manufacturing electronic energy meters along with high grade charges , UPS systems and others .

Eppeltone established in 1997 is primary into the business of manufacturing electronic energy meters along with high grade charges , UPS systems and others .

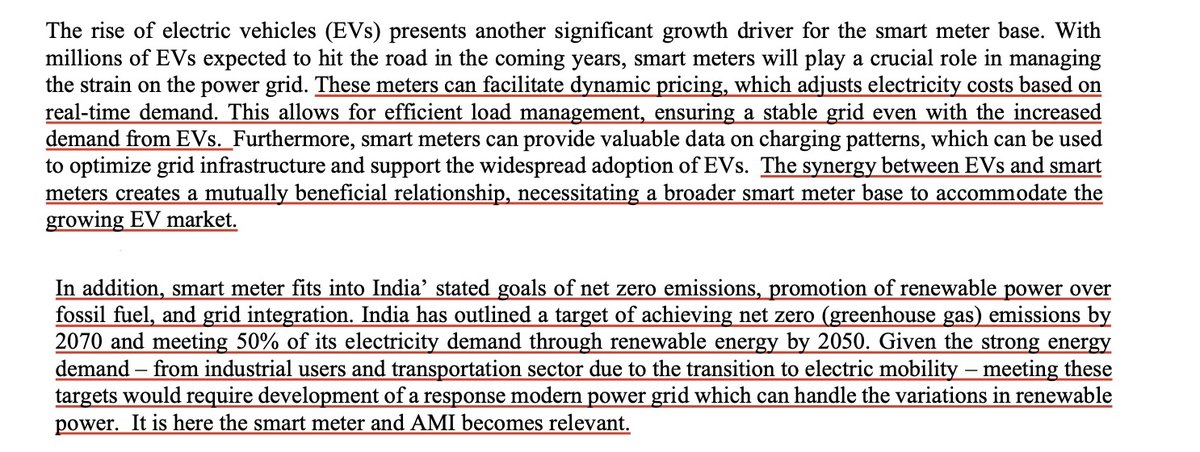

Smart Meters and why they are important :

They provide real-time energy usage data, leading to increased energy efficiency, cost savings for consumers .

For utilities, they enable better grid management, quicker fault detection and easier integration of renewable energy sources, supporting the transition to a sustainable energy future.

#GRID

They provide real-time energy usage data, leading to increased energy efficiency, cost savings for consumers .

For utilities, they enable better grid management, quicker fault detection and easier integration of renewable energy sources, supporting the transition to a sustainable energy future.

#GRID

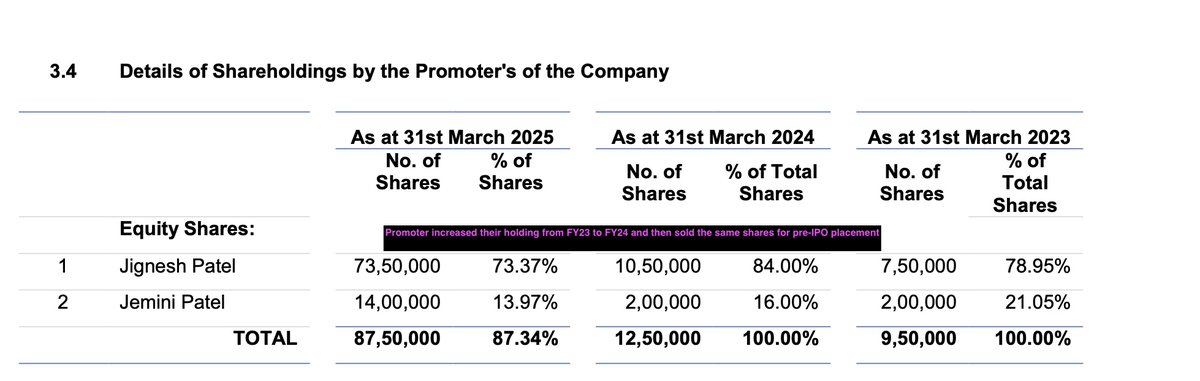

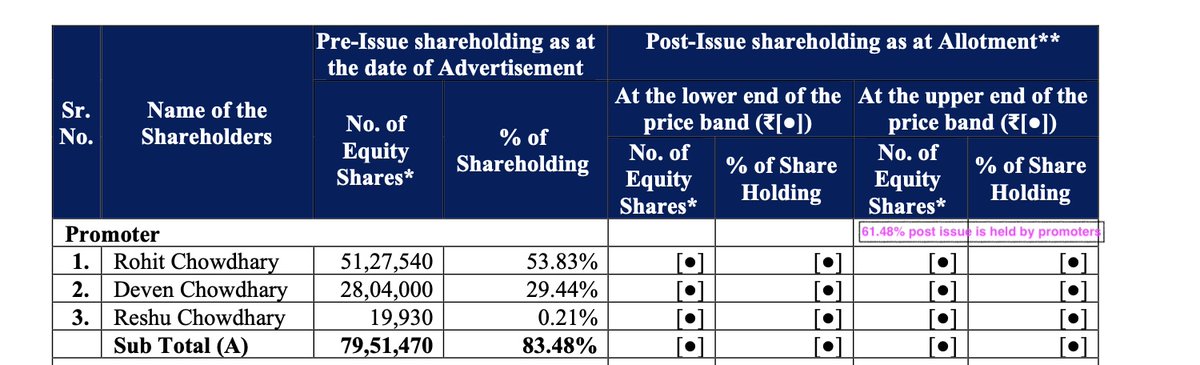

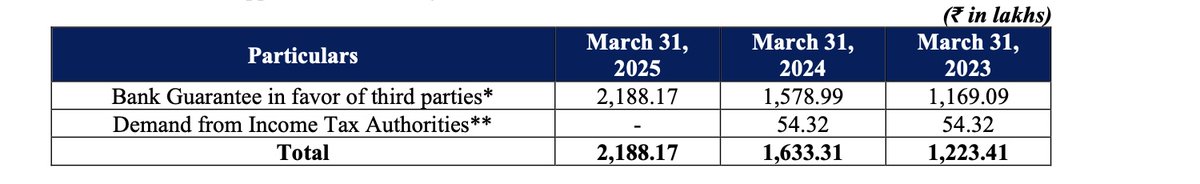

Promoters / Contingent Liability / RPTS :

Company is promoted by Rohit Chowdhary and Deven Chowdhary who is a well know personality in the electronic meter segment .

Promoters held 84% pre issue and 61% post issue

Negligible tax and litigation cases against the company .

Contingent liability only in the form of bank guarantee. Salary of promoter at 96 lakhs each for FY25.

No major related party transaction except with Amit exports which is a company of the third brother.

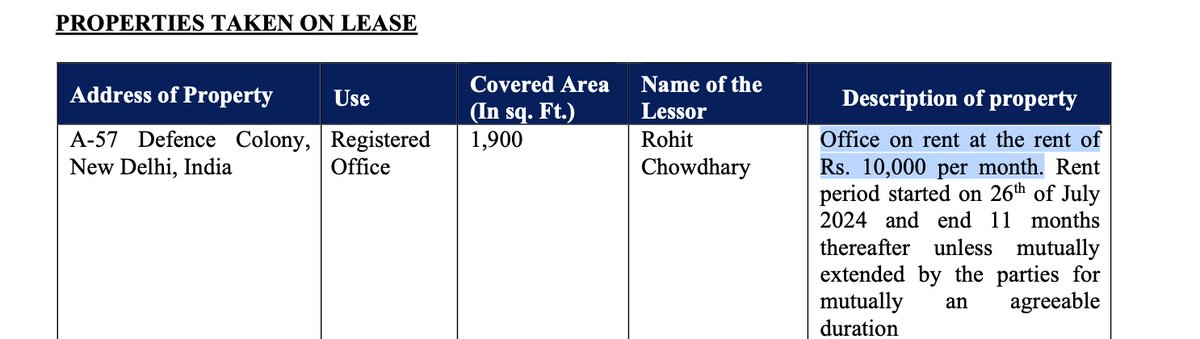

Property taken in lease from the promoter at just Rs 10k rent

Company is promoted by Rohit Chowdhary and Deven Chowdhary who is a well know personality in the electronic meter segment .

Promoters held 84% pre issue and 61% post issue

Negligible tax and litigation cases against the company .

Contingent liability only in the form of bank guarantee. Salary of promoter at 96 lakhs each for FY25.

No major related party transaction except with Amit exports which is a company of the third brother.

Property taken in lease from the promoter at just Rs 10k rent

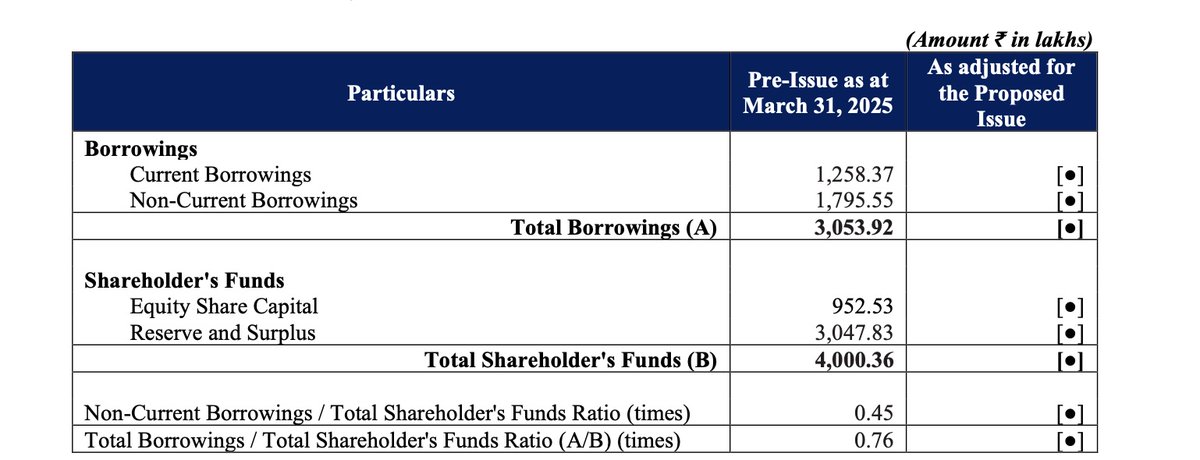

IPO Issue :

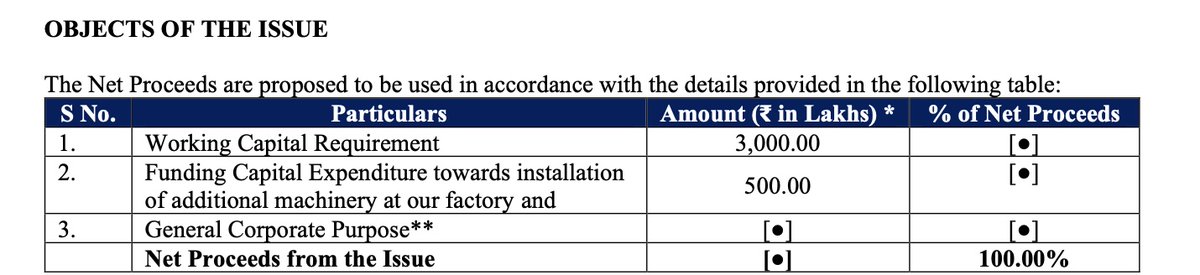

Company raised 44 cr in its IPO issue of which 30 cr were for working capital , 5 cr for additional machinery as capex.

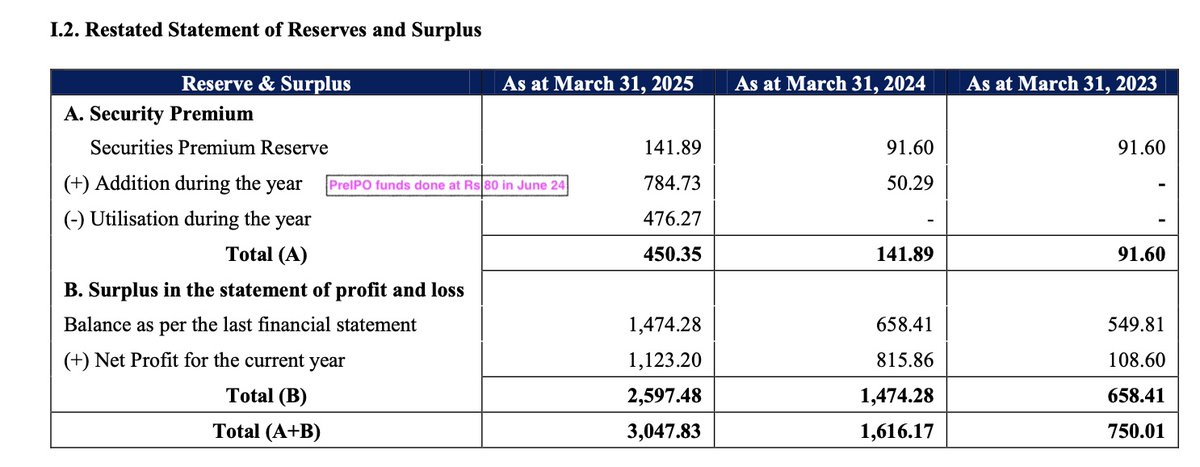

Company has raised money at 80 rs in pre-IPO round for working capital needs

Company raised 44 cr in its IPO issue of which 30 cr were for working capital , 5 cr for additional machinery as capex.

Company has raised money at 80 rs in pre-IPO round for working capital needs

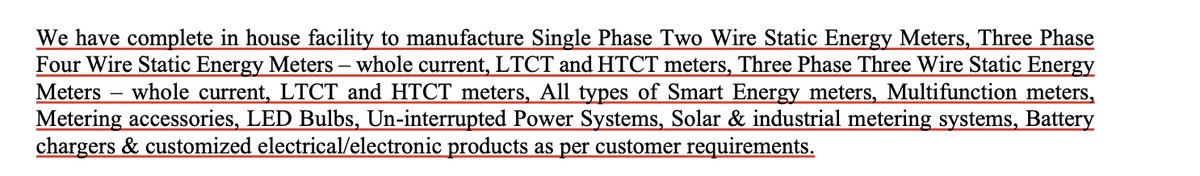

Products and Business : Complete in house facility for the following products .

Business is B2B supplying products to institutional, non-institutional, electricity distribution utilities, AMISP and turnkey contractors

Business is B2B supplying products to institutional, non-institutional, electricity distribution utilities, AMISP and turnkey contractors

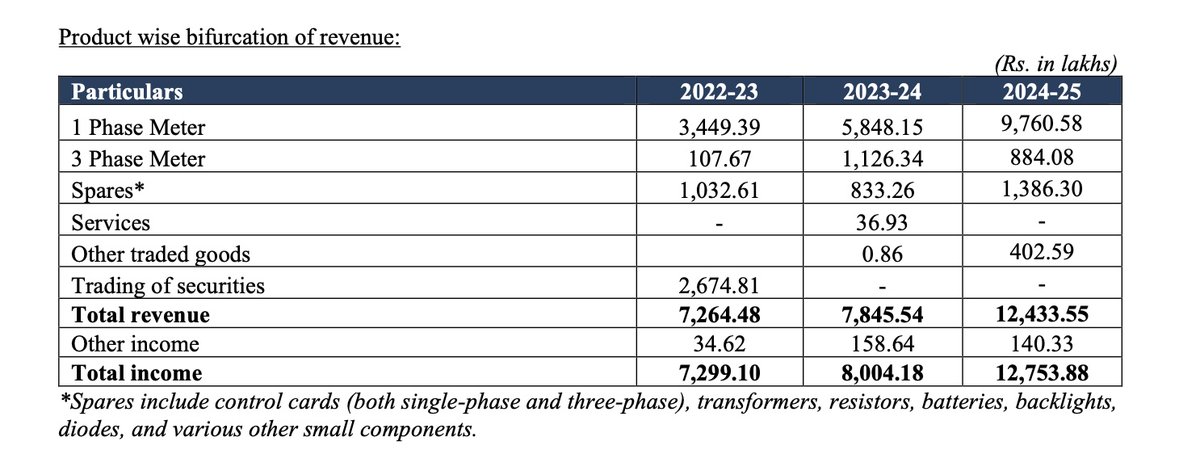

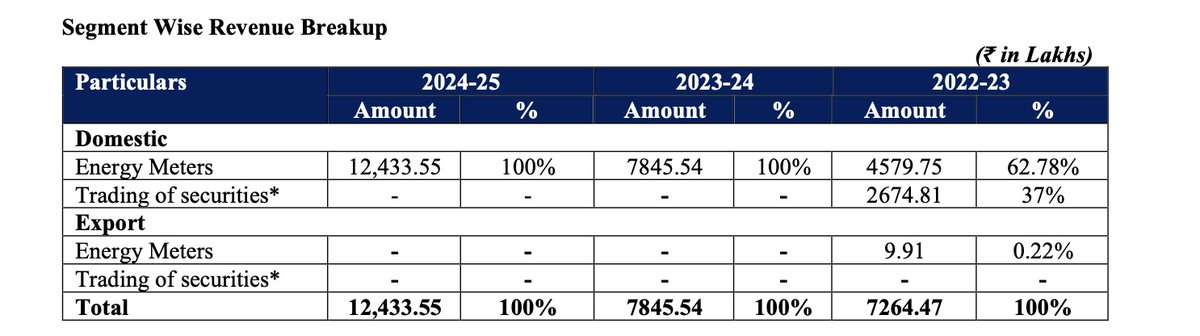

Product Wise Bifurcation and Segment Wise Revenues

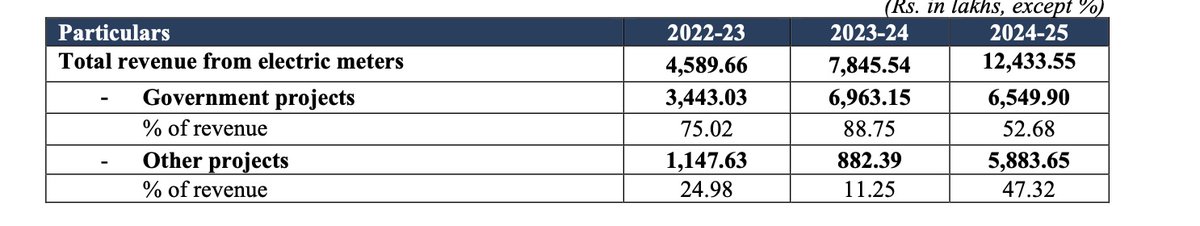

There is hardly any trading income and majorly of the revenues are from single phase energy meters.

There is hardly any trading income and majorly of the revenues are from single phase energy meters.

Business Points :

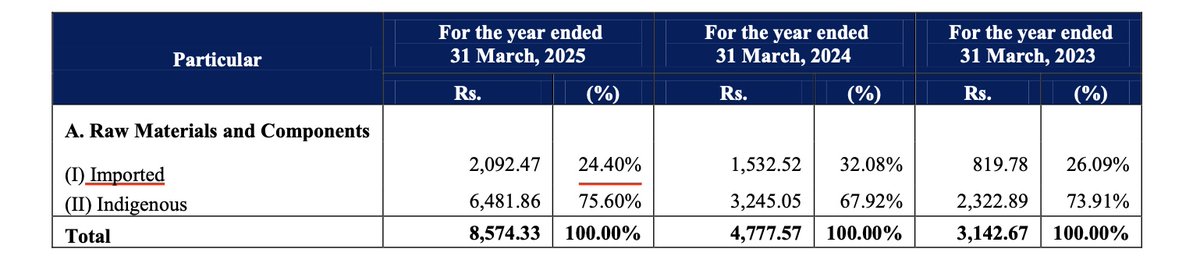

23% of the Raw Material is imported.

Top 5 customer constituents 65% of the business

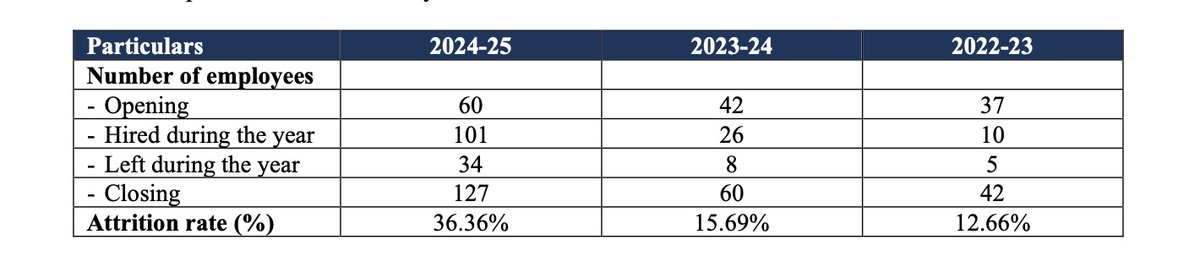

Has 164 employees on roll as on March 31st.

Company has total 36000 sq ft aggregate manufacturing plant in Greater Noida with NABL accredited R&D Testing unit.

23% of the Raw Material is imported.

Top 5 customer constituents 65% of the business

Has 164 employees on roll as on March 31st.

Company has total 36000 sq ft aggregate manufacturing plant in Greater Noida with NABL accredited R&D Testing unit.

Government dependency :

Eppeltone has had major dependence on govt projects which has reduced to nearly 52% in FY25.

90% of the revenues was from govt energy meter segment in previous years .

Eppeltone has had major dependence on govt projects which has reduced to nearly 52% in FY25.

90% of the revenues was from govt energy meter segment in previous years .

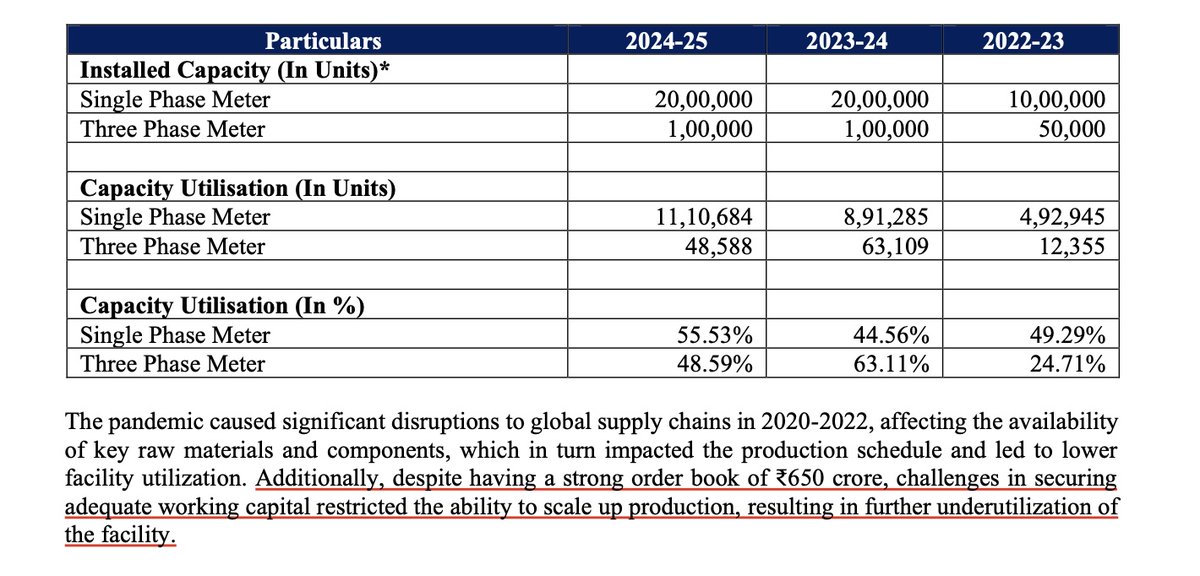

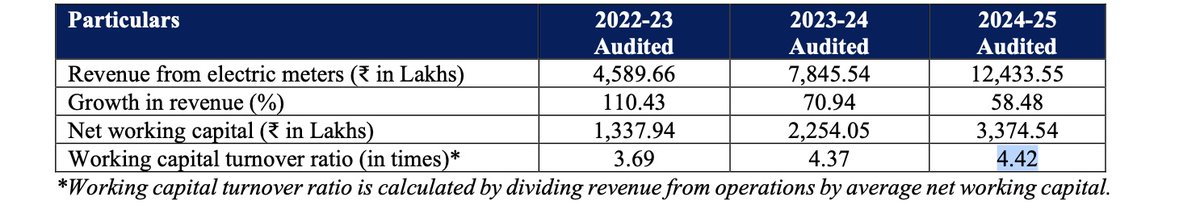

Order Book and capacity Utilization :

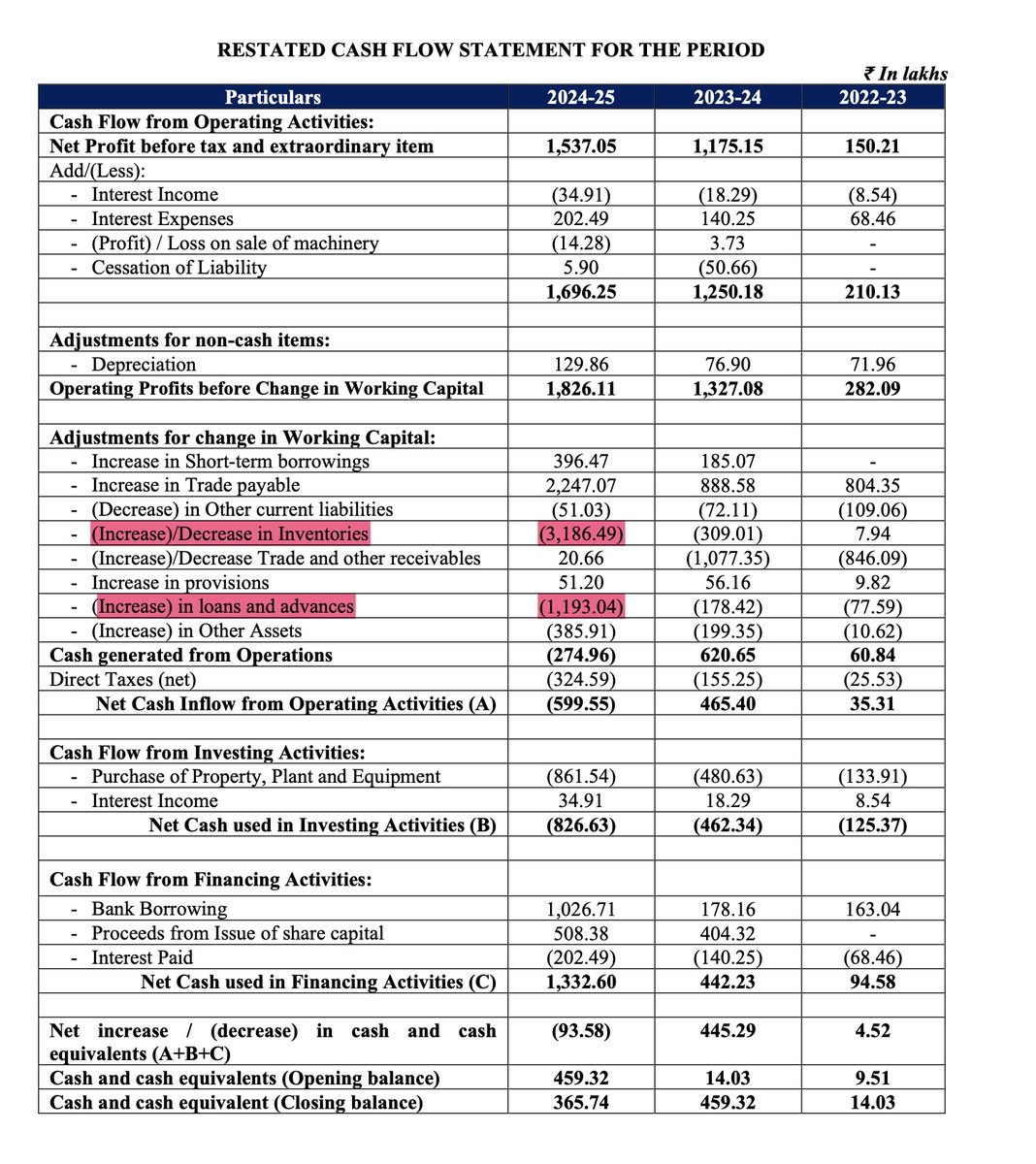

Though the company has capacity and order book of 484 cr , working capital shortage was the main reason that capacity could not be utilised as stated in RHP. Read below .

#orderbook

Though the company has capacity and order book of 484 cr , working capital shortage was the main reason that capacity could not be utilised as stated in RHP. Read below .

#orderbook

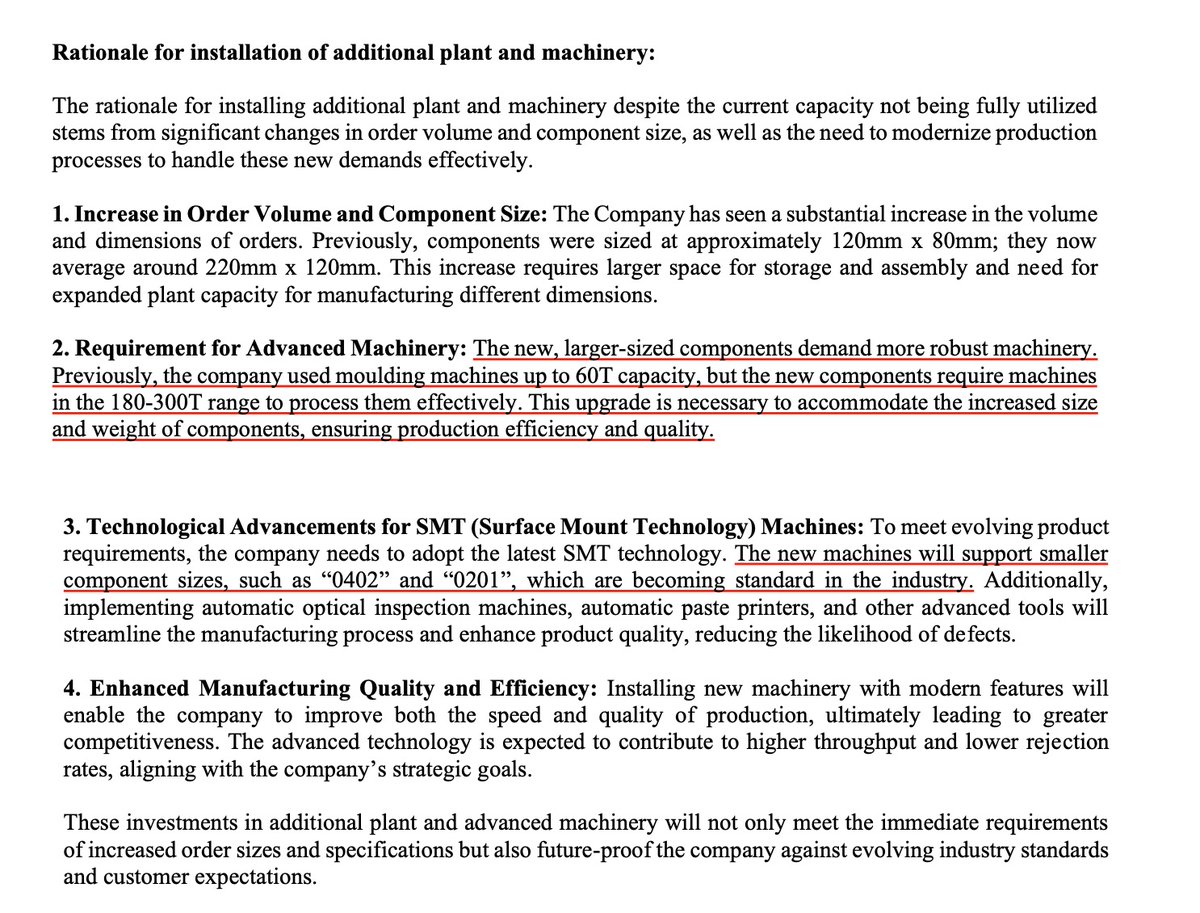

Important Part :

Installation of new machinery and how this would accelerate the order book completion .

The new capex of 5cr with help in delivering the demand products as stated as the new meters are bigger in dimension .

Installation of new machinery and how this would accelerate the order book completion .

The new capex of 5cr with help in delivering the demand products as stated as the new meters are bigger in dimension .

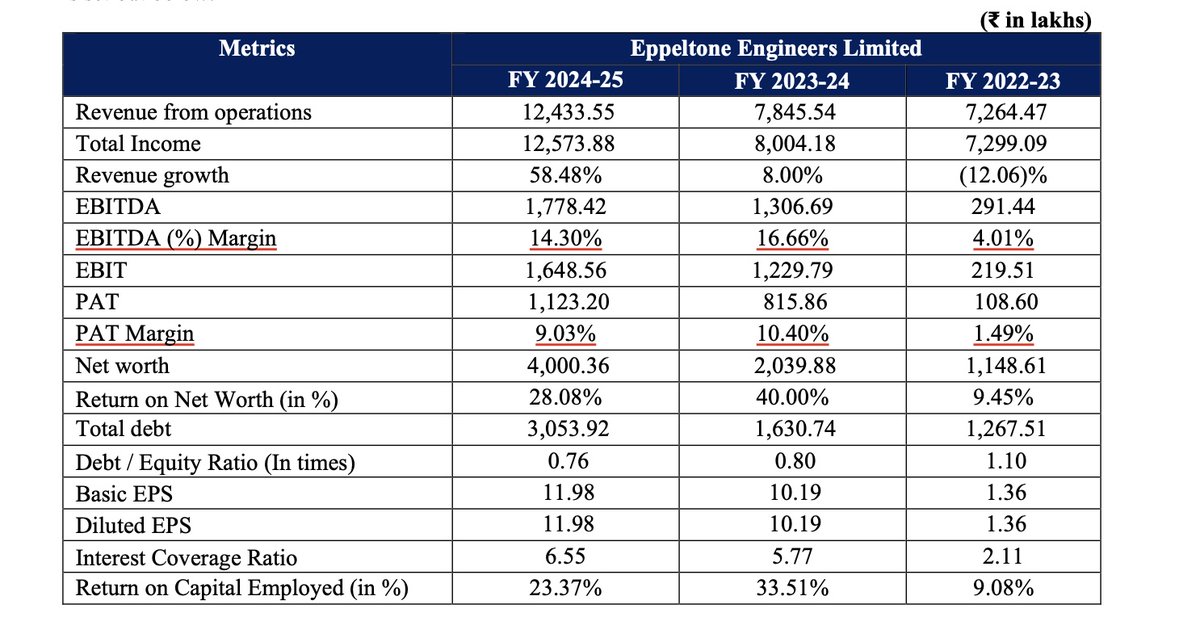

Financials :

In FY 24 EPPL has done a topline of 78 cr with PAT of 8 cr while in FY 25 it did a topline of 124 cr with PAT of 11.2 cr (9%) .

In FY 24 EPPL has done a topline of 78 cr with PAT of 8 cr while in FY 25 it did a topline of 124 cr with PAT of 11.2 cr (9%) .

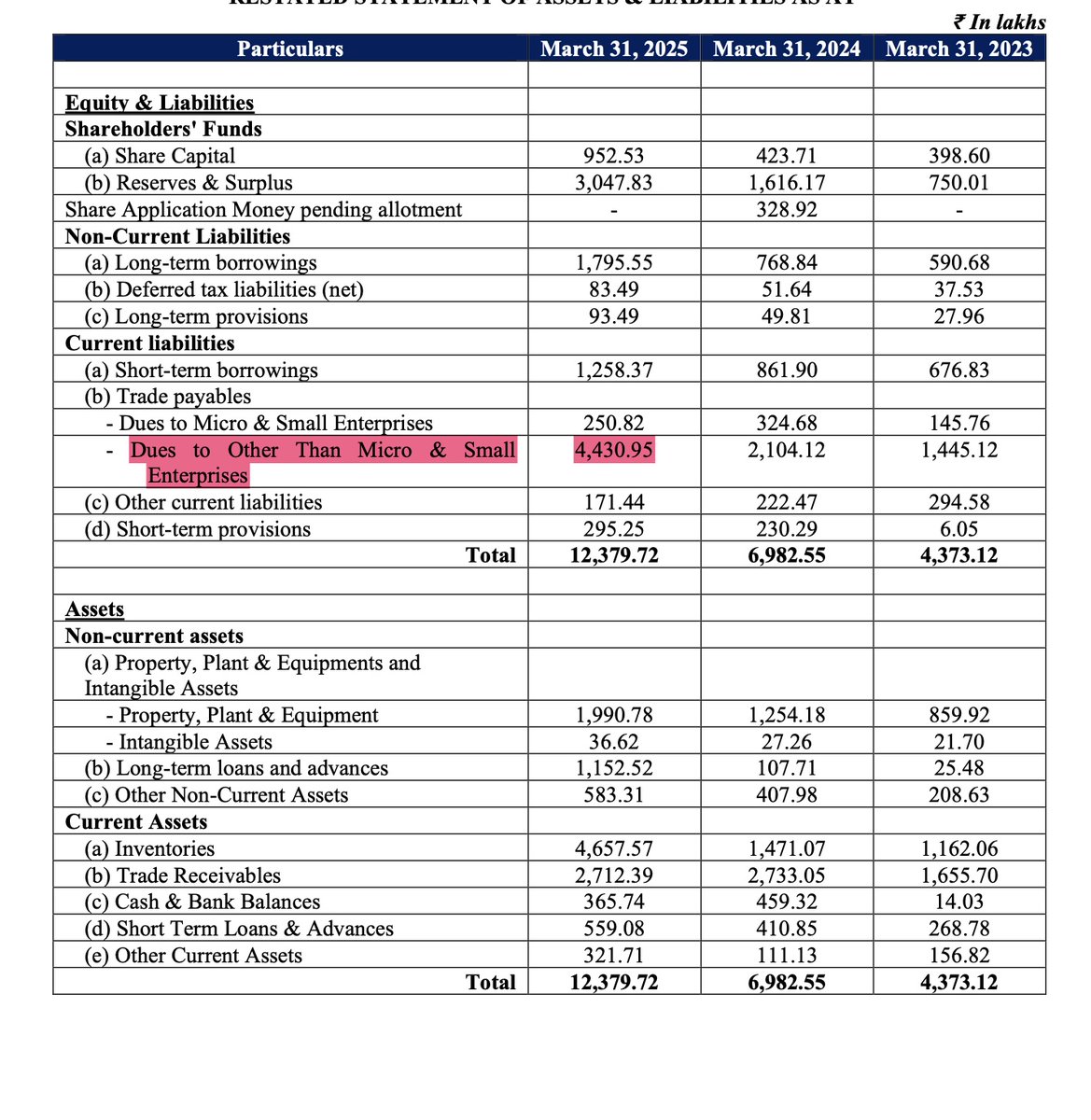

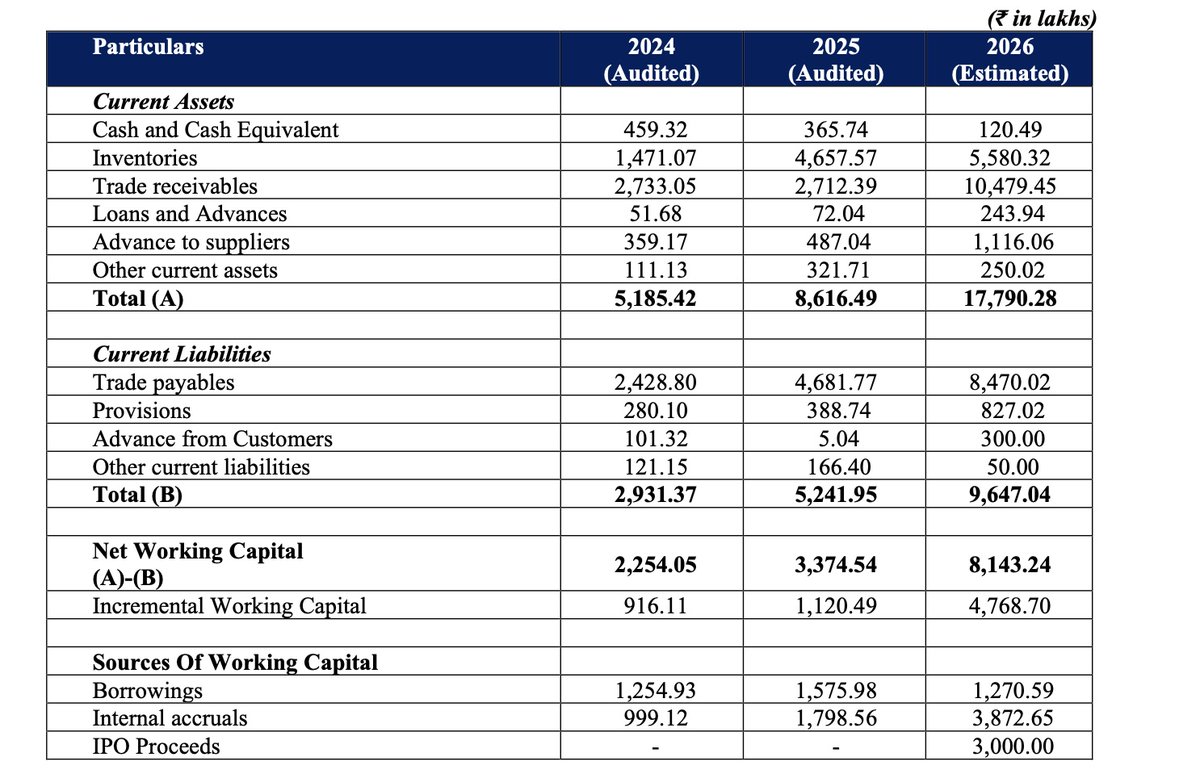

Working Capital and Borrowing :

Long term at 18 cr and short term at 12.5cr . Trades payable at 44 cr while trades receivables at 27 cr.

Working capital estimates as given below for FY 26 .

EPPL estimates working capital requirements to double in FY26

Long term at 18 cr and short term at 12.5cr . Trades payable at 44 cr while trades receivables at 27 cr.

Working capital estimates as given below for FY 26 .

EPPL estimates working capital requirements to double in FY26

Capex :

Manufacturing plant expansion has already started in Greater Noida to increase capacity by 50% .

Plans to increase capacity utilization from 50% to 75% in order to execute the pending order book.

Manufacturing plant expansion has already started in Greater Noida to increase capacity by 50% .

Plans to increase capacity utilization from 50% to 75% in order to execute the pending order book.

Way Ahead : Execution of pending order book is more a function of working capital . With IPO funds of 30 cr used for WC , company should be able to execute the order book and utilise capacity more efficiently . Expected to be trading at 12x FY 26.

Disclaimer : Notes are for educational purposes only and doesn't constitute a buy or a sell call. #DISCLAIMER

Disclaimer : Notes are for educational purposes only and doesn't constitute a buy or a sell call. #DISCLAIMER

• • •

Missing some Tweet in this thread? You can try to

force a refresh