The reason you haven't quit your 9-5 is because you don't understand this copy paste strategy

This is your full guide on Purple Profits 🧵

This is your full guide on Purple Profits 🧵

1/ Most traders love complication

You're out here studying 85 setups, following 15 YouTube FURUs, lurking in 58 discords and still can't figure out if you should buy calls or puts. Meanwhile I'm hitting consistent winners with one simple purple line.

You're out here studying 85 setups, following 15 YouTube FURUs, lurking in 58 discords and still can't figure out if you should buy calls or puts. Meanwhile I'm hitting consistent winners with one simple purple line.

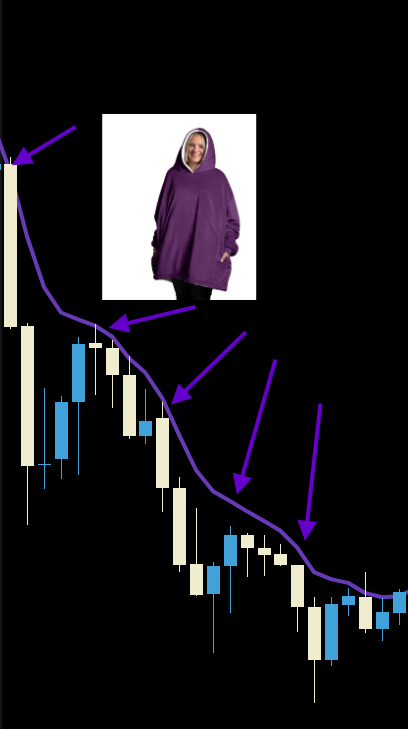

2/ Meet your new best friend - the 8ema

If you have been following me for a while you know I reference something called the magical 🟣 line. This line is the 8ema. It is a purple line that helps me and many others profits. This is how I got the term "Purple Profits." I know its super creative, but now it is time to teach your the Magic.

If you have been following me for a while you know I reference something called the magical 🟣 line. This line is the 8ema. It is a purple line that helps me and many others profits. This is how I got the term "Purple Profits." I know its super creative, but now it is time to teach your the Magic.

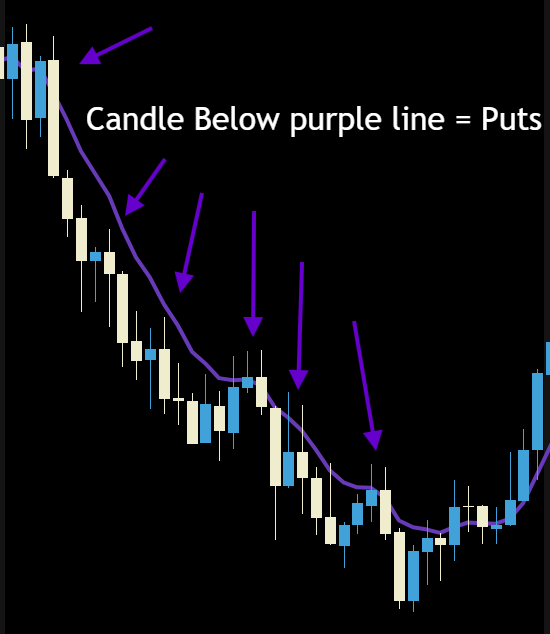

3/ You just have to follow the rules

Do you want to make money or do you want to be an outlaw? If you like making $$$ just follow these 2 rules.

Candles above the purple line = Calls ONLY

Candle below the purple line = Puts ONLY

Do you want to make money or do you want to be an outlaw? If you like making $$$ just follow these 2 rules.

Candles above the purple line = Calls ONLY

Candle below the purple line = Puts ONLY

4/ It can't be that simple

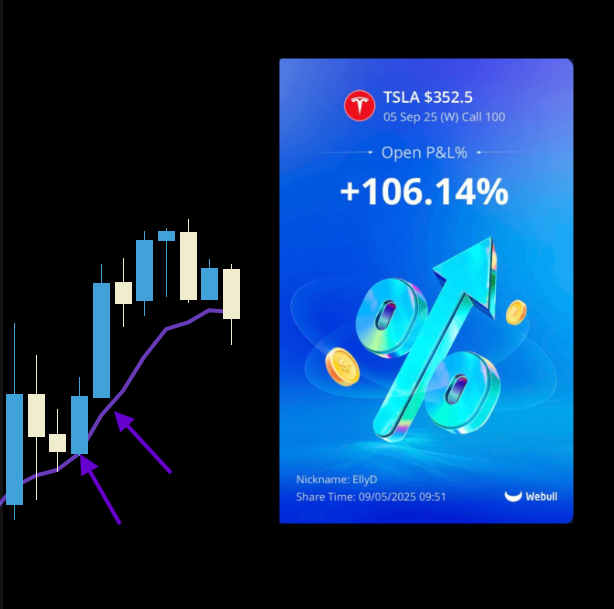

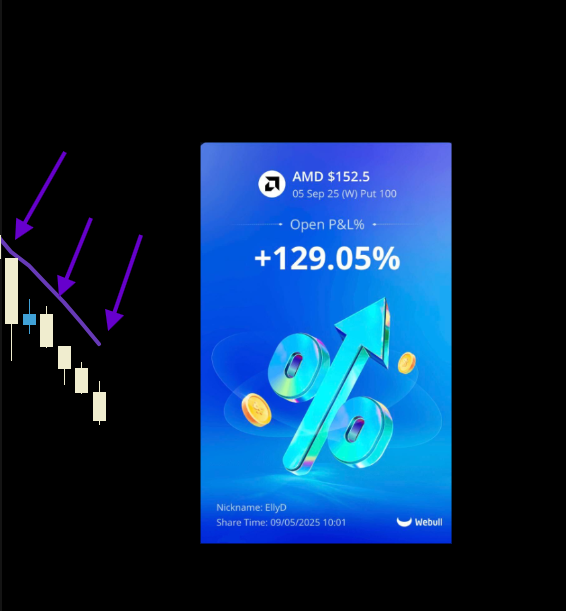

See that's the problem you have been brainwashed to believe that trading requires a PHD and insider information. If it doesn't work then how did I hit 2 100%ers on Friday both long and short? I must have had a insider information.

See that's the problem you have been brainwashed to believe that trading requires a PHD and insider information. If it doesn't work then how did I hit 2 100%ers on Friday both long and short? I must have had a insider information.

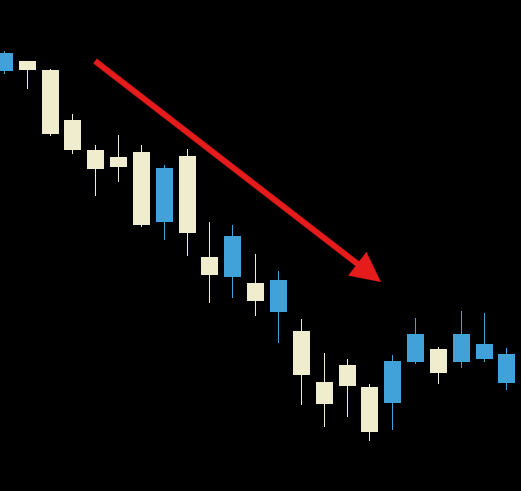

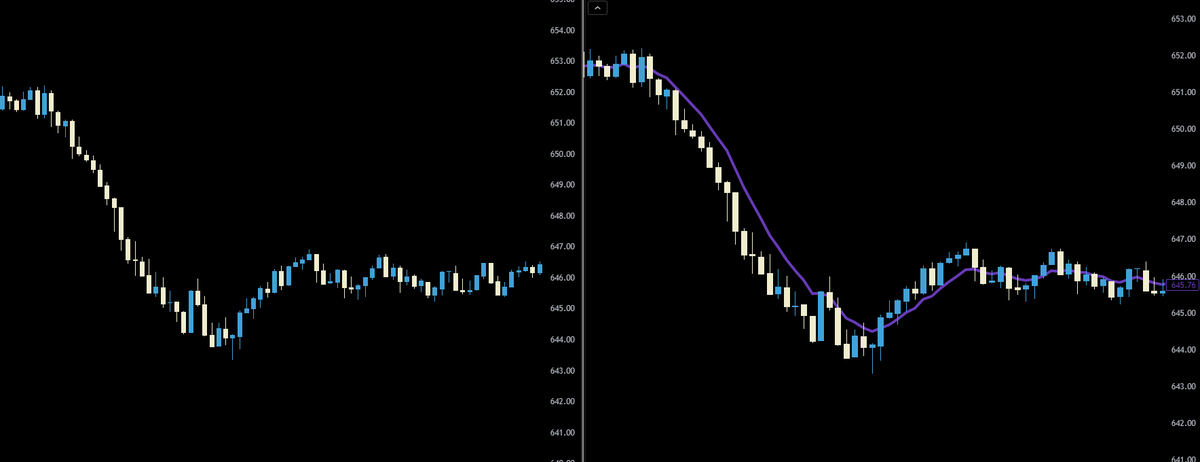

5/ Why EMAs work

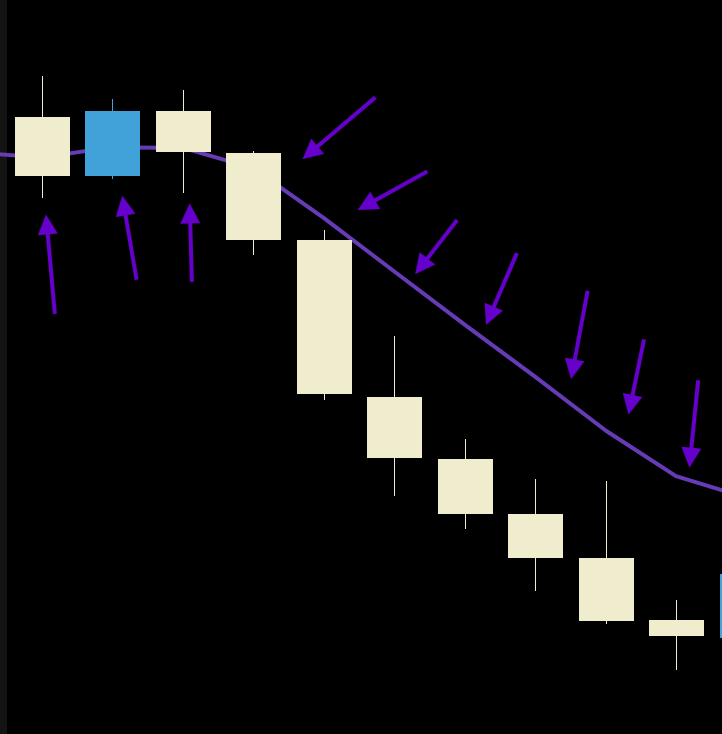

I often get the comment "EMAs don't work because they're lagging!" Fun fact every single indicator is lagging. Below is a chart that is breaking down to the lows. Tell me where is the best place for an entry. Its free falling into the gulag with no retest. What do you do? One chart is naked the other has the purple line.

I often get the comment "EMAs don't work because they're lagging!" Fun fact every single indicator is lagging. Below is a chart that is breaking down to the lows. Tell me where is the best place for an entry. Its free falling into the gulag with no retest. What do you do? One chart is naked the other has the purple line.

6/ EMAs give trader's comfort

I like to think of EMAs as a soft purple snuggie on a cold snow winter day. It snuggles price keeping me warm and cozy while the market looks like WW3 just started. It gives you a VISUAL of where price could go and reject or bounce when there is nothing else to go off of.

I like to think of EMAs as a soft purple snuggie on a cold snow winter day. It snuggles price keeping me warm and cozy while the market looks like WW3 just started. It gives you a VISUAL of where price could go and reject or bounce when there is nothing else to go off of.

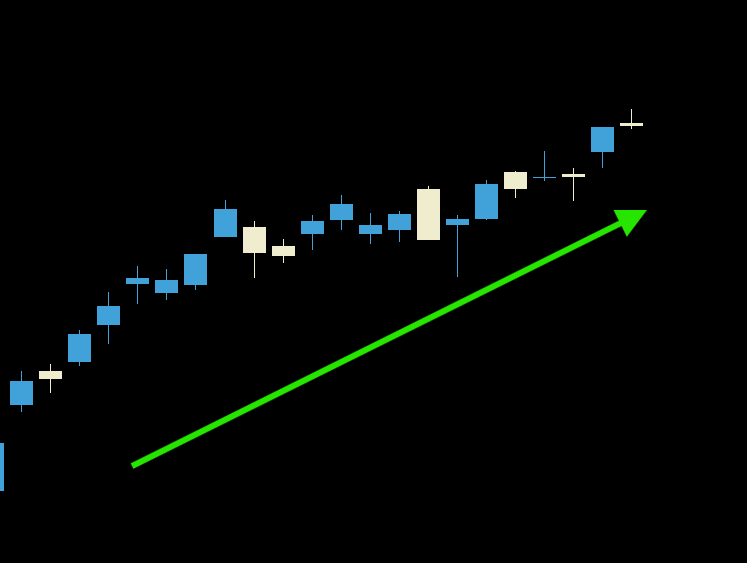

7/ The reason your not profitable

Everyday I see people fading the trend and wondering why they haven't quit their 9-5 yet. The reason is simple the trend is your friend. Following the trend will double your win rate.

Above 🟣= Bullish trend (calls)

Below 🟣 = Bearish trend (puts)

Everyday I see people fading the trend and wondering why they haven't quit their 9-5 yet. The reason is simple the trend is your friend. Following the trend will double your win rate.

Above 🟣= Bullish trend (calls)

Below 🟣 = Bearish trend (puts)

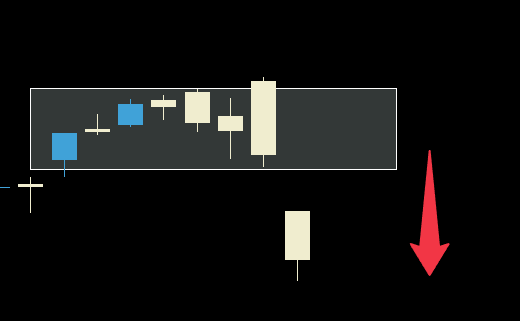

8/ But Elly what about reversals!

The best thing about the purple line is will literally scream at us when there is a reversal. We don't have to guess. Below we can see price was above the 🟣 line so it was bullish, then broke below and flushed out to the lows. Purple Profits once again told us to go short! Magic

The best thing about the purple line is will literally scream at us when there is a reversal. We don't have to guess. Below we can see price was above the 🟣 line so it was bullish, then broke below and flushed out to the lows. Purple Profits once again told us to go short! Magic

9/ The copy paste strategy

Every morning ask yourself one question "Are we above or below the purple line?" That determined your trading plan for the day. No more guessing or figuring out the trend once the setup already left without you. This will reduce your trading stress and get you in trades faster.

Every morning ask yourself one question "Are we above or below the purple line?" That determined your trading plan for the day. No more guessing or figuring out the trend once the setup already left without you. This will reduce your trading stress and get you in trades faster.

10/ Most traders ignore this

You think this is too simple. You think you need to understand Japanese bond yields at 4am and how the Congo's copper prices will affect your $TSLA weeklies. Meanwhile I just buy calls when it is above the purple line. The best strategies are the simplest ones, that you understand in detail.

You think this is too simple. You think you need to understand Japanese bond yields at 4am and how the Congo's copper prices will affect your $TSLA weeklies. Meanwhile I just buy calls when it is above the purple line. The best strategies are the simplest ones, that you understand in detail.

11/ Why I used this system (real talk)

Every strategy I use is designed from pain. Pain from losing money everyday and blowing accounts. I simply needed something to protect me from me. These strategies are born out of necessity I needed to save my trading career before I had nothing left.

Every strategy I use is designed from pain. Pain from losing money everyday and blowing accounts. I simply needed something to protect me from me. These strategies are born out of necessity I needed to save my trading career before I had nothing left.

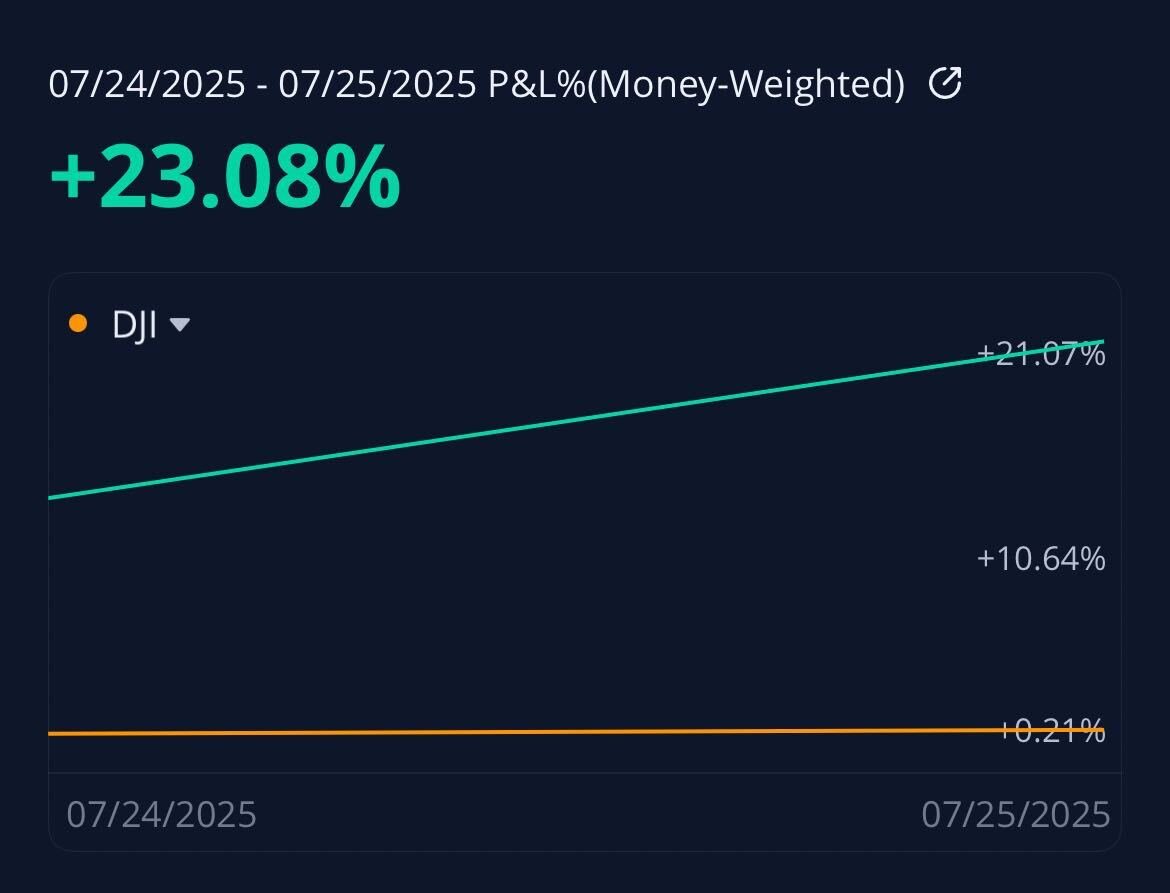

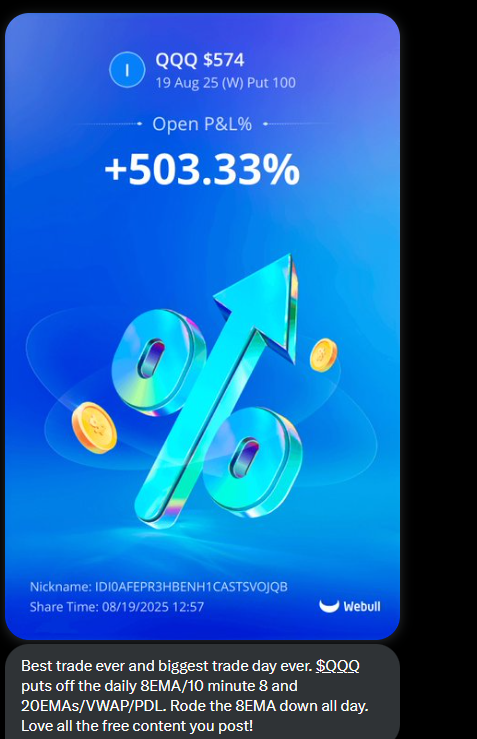

12/ Real Trader Results

Almost every I get tagged in my followers hitting 100% gains. They scrubbed their minds of terrible trading advice and started to keep things simple. If they can do it, why can't you?

Almost every I get tagged in my followers hitting 100% gains. They scrubbed their minds of terrible trading advice and started to keep things simple. If they can do it, why can't you?

13/ Your 9-5 escape plan

Master Purple Profits prove to yourself and your family you can be consistent. Then send your boss your 2 weeks. The only conversations we have around the water cooler is multibaggers.

Master Purple Profits prove to yourself and your family you can be consistent. Then send your boss your 2 weeks. The only conversations we have around the water cooler is multibaggers.

14/ From now until April is hunting season

The summer is over, volatility is back.. I make 80% of my money between now and April. I thrive in this time of year. We get huge moves and news all which benefits those using purple profits. Are you going to sit on the sidelines forever?

The summer is over, volatility is back.. I make 80% of my money between now and April. I thrive in this time of year. We get huge moves and news all which benefits those using purple profits. Are you going to sit on the sidelines forever?

15/ Your Homework

You're going to click this link and watch this video where I explain the entire Purple Profits strategy in detail for free, then send me a DM this week telling me how much money you made this week:

You're going to click this link and watch this video where I explain the entire Purple Profits strategy in detail for free, then send me a DM this week telling me how much money you made this week:

16/ Summary

I am committed to providing free value for the trading community. The only thing I ask if you like and RT. Your RT could change someone's trading journey.

I am committed to providing free value for the trading community. The only thing I ask if you like and RT. Your RT could change someone's trading journey.

https://x.com/EllyDtrades/status/1965205019826819193

• • •

Missing some Tweet in this thread? You can try to

force a refresh