A Shaggy deep dive thread, I hope you find it interesting & informative 💙💛🫡

Detailed Report on Ukraine's Sourcing of Refined Oil Products in 2025

Ukraine's refining infrastructure has been severely compromised due to the ongoing Russia-Ukraine conflict, particularly following the destruction of the Kremenchug refinery in June 2025 and other attacks on oil facilities. This has led to a significant reliance on imported refined products like gasoline and diesel to meet domestic demand for civilian and military needs. The data below is compiled from industry reports, trade analytics, and news articles published in 2025.

1/

Detailed Report on Ukraine's Sourcing of Refined Oil Products in 2025

Ukraine's refining infrastructure has been severely compromised due to the ongoing Russia-Ukraine conflict, particularly following the destruction of the Kremenchug refinery in June 2025 and other attacks on oil facilities. This has led to a significant reliance on imported refined products like gasoline and diesel to meet domestic demand for civilian and military needs. The data below is compiled from industry reports, trade analytics, and news articles published in 2025.

1/

Impact of Ukrainian Refining Infrastructure Being Out of Action

Destruction of Key Refineries

Ukraine imports energy products to meet its needs, including Indian-origin diesel fuel, after loss of key refinery, analyst says (Published: 2025-09-08, 10:16)

That Reuters article states that the loss of Ukrainian oil refineries this summer has forced traders to seek imports to compensate. Specifically, the Kremenchug oil refinery, a critical facility, was "finally destroyed" in June 2025 after enduring dozens of cruise and ballistic missile strikes. Serhiy Kuyun, head of the Ukrainian fuel consultancy A-95, noted this on Facebook, highlighting that the refinery’s loss has significantly reduced domestic refining capacity.

The Kremenchug refinery, operated by Ukrtatnafta, was one of Ukraine’s largest, with a capacity of approximately 200,000 barrels per day before the war. Its destruction, coupled with ongoing attacks, has left Ukraine with limited ability to produce its own diesel, necessitating reliance on imports.

2/

Destruction of Key Refineries

Ukraine imports energy products to meet its needs, including Indian-origin diesel fuel, after loss of key refinery, analyst says (Published: 2025-09-08, 10:16)

That Reuters article states that the loss of Ukrainian oil refineries this summer has forced traders to seek imports to compensate. Specifically, the Kremenchug oil refinery, a critical facility, was "finally destroyed" in June 2025 after enduring dozens of cruise and ballistic missile strikes. Serhiy Kuyun, head of the Ukrainian fuel consultancy A-95, noted this on Facebook, highlighting that the refinery’s loss has significantly reduced domestic refining capacity.

The Kremenchug refinery, operated by Ukrtatnafta, was one of Ukraine’s largest, with a capacity of approximately 200,000 barrels per day before the war. Its destruction, coupled with ongoing attacks, has left Ukraine with limited ability to produce its own diesel, necessitating reliance on imports.

2/

Quantitative Impact on Ukrainian Domestic Supply

Due in part of the reported destruction of the Kremenchug refinery in June 2025, Ukraine is forced Ukraine to turn to international markets. Source noted report a 13% year-on-year decline in diesel imports to 2.74 million metric tons in the first half of 2025, suggesting that prior to the summer losses, Ukraine was still managing with some domestic production. The shift to Indian diesel, gaining a 10% market share, indicates a direct response to the refining shortfall at Kremenchug.

The reduction in domestic refining capacity has not only increased import volumes but also diversified sources, with India stepping in due to its ability to supply refined products from Russian crude at competitive rates.

It is IMPORTANT to note that Ukraine does NOT break the EU/G7 or it's own sanctions regarding russian-origin refined products, that it, it purchases oil products from the international markets that comply with current sanction rules just like other EU/G7 countries do.

3/

Due in part of the reported destruction of the Kremenchug refinery in June 2025, Ukraine is forced Ukraine to turn to international markets. Source noted report a 13% year-on-year decline in diesel imports to 2.74 million metric tons in the first half of 2025, suggesting that prior to the summer losses, Ukraine was still managing with some domestic production. The shift to Indian diesel, gaining a 10% market share, indicates a direct response to the refining shortfall at Kremenchug.

The reduction in domestic refining capacity has not only increased import volumes but also diversified sources, with India stepping in due to its ability to supply refined products from Russian crude at competitive rates.

It is IMPORTANT to note that Ukraine does NOT break the EU/G7 or it's own sanctions regarding russian-origin refined products, that it, it purchases oil products from the international markets that comply with current sanction rules just like other EU/G7 countries do.

3/

Synthesis and Analysis

The out-of-action status of Ukrainian refining infrastructure, particularly the reported destruction of the Kremenchug refinery in June 2025, has created a significant supply deficit.

The loss of Kremenchug, a major refinery, has eliminated a substantial portion of Ukraine’s domestic diesel production, estimated at over 50% of its pre-war refining capacity (based on Ukrtatnafta’s output).

Additional strikes on other facilities, as part of Russia’s attrition strategy, have rendered the refining sector largely inoperable, a trend noted by analysts like Sergei Vakulenko (Carnegie Russia Eurasia Center) in the context of energy warfare.

With domestic production crippled, Ukraine’s diesel imports have surged, with India emerging as a key supplier. The 15.5% market share in July 2025 (NaftoRynok data) reflects a rapid pivot to compensate for the lost capacity, facilitated by India’s refining of Russian-origin crude.

Imports via Turkey and Romania, as detailed in BusinessToday, highlight Ukraine’s adaptation to maintain fuel supplies despite the infrastructure collapse.

4/

The out-of-action status of Ukrainian refining infrastructure, particularly the reported destruction of the Kremenchug refinery in June 2025, has created a significant supply deficit.

The loss of Kremenchug, a major refinery, has eliminated a substantial portion of Ukraine’s domestic diesel production, estimated at over 50% of its pre-war refining capacity (based on Ukrtatnafta’s output).

Additional strikes on other facilities, as part of Russia’s attrition strategy, have rendered the refining sector largely inoperable, a trend noted by analysts like Sergei Vakulenko (Carnegie Russia Eurasia Center) in the context of energy warfare.

With domestic production crippled, Ukraine’s diesel imports have surged, with India emerging as a key supplier. The 15.5% market share in July 2025 (NaftoRynok data) reflects a rapid pivot to compensate for the lost capacity, facilitated by India’s refining of Russian-origin crude.

Imports via Turkey and Romania, as detailed in BusinessToday, highlight Ukraine’s adaptation to maintain fuel supplies despite the infrastructure collapse.

4/

Detailed Report on Ukraine's Sourcing of Refined Oil Products in 2025

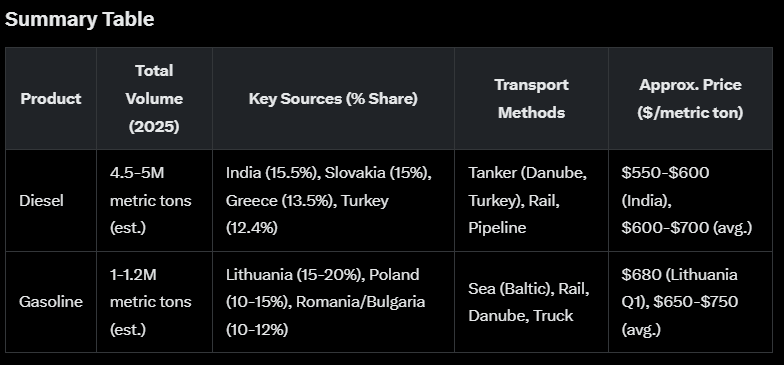

Diesel Imports

Total Volume: First half of 2025: 2.74 million metric tons (The Economic Times, 2025-09-08), reflecting a 13% year-on-year decline from 2024, likely due to disrupted supply chains before the summer refinery losses.

July 2025: Specific data indicates a shift, with daily imports averaging 2,700 tons (approximately 82,000 metric tons monthly) as reported by NaftoRynok (Moneycontrol.com, 2025-08-30).

Sources and Shares (how much, from where, and from who):

India: 15.5% of total diesel imports in July 2025 (NaftoRynok), equating to approximately 12,710 metric tons monthly based on the 82,000-ton average. This surge reflects India’s role as a top supplier, with diesel refined from Russian crude.

Slovakia: 15% in July 2025 (NaftoRynok), approximately 12,300 metric tons monthly.

Greece: 13.5% in July 2025 (NaftoRynok), approximately 11,070 metric tons monthly.

Turkey: 12.4% in July 2025 (NaftoRynok), approximately 10,168 metric tons monthly.

Other Sources: Remaining shares include Romania, Poland, and smaller European suppliers, though exact percentages for these are not specified in July data.

Transport Methods: River and Sea Routes:

Diesel from India is transported via tankers to the Danube River through Romania and the OPET terminal in Turkey, then moved inland by barge or truck (BusinessToday, 2025-08-30).

Pipeline and Rail: Slovakia and Greece supply via the Druzhba pipeline (where operational) and rail, though specific volumes per method are not detailed (Naftogaz Ukraine, naftogaz.com).

Prices Paid:

Specific prices for 2025 imports are not fully itemized in the sources. However, Indian diesel is noted as competitively priced due to its origin from discounted Russian crude. Global diesel prices in 2025 average around $600-$700 per metric ton (based on Platts data cited in Reuters, 2025-09-08), but Ukraine likely secures Indian diesel at a discount, estimated at $550-$600 per metric ton, though exact contract prices are confidential.

5/

Diesel Imports

Total Volume: First half of 2025: 2.74 million metric tons (The Economic Times, 2025-09-08), reflecting a 13% year-on-year decline from 2024, likely due to disrupted supply chains before the summer refinery losses.

July 2025: Specific data indicates a shift, with daily imports averaging 2,700 tons (approximately 82,000 metric tons monthly) as reported by NaftoRynok (Moneycontrol.com, 2025-08-30).

Sources and Shares (how much, from where, and from who):

India: 15.5% of total diesel imports in July 2025 (NaftoRynok), equating to approximately 12,710 metric tons monthly based on the 82,000-ton average. This surge reflects India’s role as a top supplier, with diesel refined from Russian crude.

Slovakia: 15% in July 2025 (NaftoRynok), approximately 12,300 metric tons monthly.

Greece: 13.5% in July 2025 (NaftoRynok), approximately 11,070 metric tons monthly.

Turkey: 12.4% in July 2025 (NaftoRynok), approximately 10,168 metric tons monthly.

Other Sources: Remaining shares include Romania, Poland, and smaller European suppliers, though exact percentages for these are not specified in July data.

Transport Methods: River and Sea Routes:

Diesel from India is transported via tankers to the Danube River through Romania and the OPET terminal in Turkey, then moved inland by barge or truck (BusinessToday, 2025-08-30).

Pipeline and Rail: Slovakia and Greece supply via the Druzhba pipeline (where operational) and rail, though specific volumes per method are not detailed (Naftogaz Ukraine, naftogaz.com).

Prices Paid:

Specific prices for 2025 imports are not fully itemized in the sources. However, Indian diesel is noted as competitively priced due to its origin from discounted Russian crude. Global diesel prices in 2025 average around $600-$700 per metric ton (based on Platts data cited in Reuters, 2025-09-08), but Ukraine likely secures Indian diesel at a discount, estimated at $550-$600 per metric ton, though exact contract prices are confidential.

5/

Diesel Imports

Total Volume: First half of 2025: 2.74 million metric tons (The Economic Times, 2025-09-08), reflecting a 13% year-on-year decline from 2024, likely due to disrupted supply chains before the summer refinery losses.

July 2025: Specific data indicates a shift, with daily imports averaging 2,700 tons (approximately 82,000 metric tons monthly) as reported by NaftoRynok (Moneycontrol.com, 2025-08-30).

Sources and Shares (how much, from where, and from who):

India: 15.5% of total diesel imports in July 2025 (NaftoRynok), equating to approximately 12,710 metric tons monthly based on the 82,000-ton average. This surge reflects India’s role as a top supplier, with diesel refined from Russian crude.

Slovakia: 15% in July 2025 (NaftoRynok), approximately 12,300 metric tons monthly.

Greece: 13.5% in July 2025 (NaftoRynok), approximately 11,070 metric tons monthly.

Turkey: 12.4% in July 2025 (NaftoRynok), approximately 10,168 metric tons monthly

Other Sources: Remaining shares include Romania, Poland, and smaller European suppliers, though exact percentages for these are not specified in July data.

Transport Methods: River and Sea Routes:

Diesel from India is transported via tankers to the Danube River through Romania and the OPET terminal in Turkey, then moved inland by barge or truck (BusinessToday, 2025-08-30).

Pipeline and Rail: Slovakia and Greece supply via the Druzhba pipeline (where operational) and rail, though specific volumes per method are not detailed (Naftogaz Ukraine, naftogaz.com).

Prices Paid:

Specific prices for 2025 imports are not fully itemized in the sources. However, Indian diesel is noted as competitively priced due to its origin from discounted Russian crude. Global diesel prices in 2025 average around $600-$700 per metric ton (based on Platts data cited in Reuters, 2025-09-08), but Ukraine likely secures Indian diesel at a discount, estimated at $550-$600 per metric ton, though exact contract prices are confidential.

6/

Total Volume: First half of 2025: 2.74 million metric tons (The Economic Times, 2025-09-08), reflecting a 13% year-on-year decline from 2024, likely due to disrupted supply chains before the summer refinery losses.

July 2025: Specific data indicates a shift, with daily imports averaging 2,700 tons (approximately 82,000 metric tons monthly) as reported by NaftoRynok (Moneycontrol.com, 2025-08-30).

Sources and Shares (how much, from where, and from who):

India: 15.5% of total diesel imports in July 2025 (NaftoRynok), equating to approximately 12,710 metric tons monthly based on the 82,000-ton average. This surge reflects India’s role as a top supplier, with diesel refined from Russian crude.

Slovakia: 15% in July 2025 (NaftoRynok), approximately 12,300 metric tons monthly.

Greece: 13.5% in July 2025 (NaftoRynok), approximately 11,070 metric tons monthly.

Turkey: 12.4% in July 2025 (NaftoRynok), approximately 10,168 metric tons monthly

Other Sources: Remaining shares include Romania, Poland, and smaller European suppliers, though exact percentages for these are not specified in July data.

Transport Methods: River and Sea Routes:

Diesel from India is transported via tankers to the Danube River through Romania and the OPET terminal in Turkey, then moved inland by barge or truck (BusinessToday, 2025-08-30).

Pipeline and Rail: Slovakia and Greece supply via the Druzhba pipeline (where operational) and rail, though specific volumes per method are not detailed (Naftogaz Ukraine, naftogaz.com).

Prices Paid:

Specific prices for 2025 imports are not fully itemized in the sources. However, Indian diesel is noted as competitively priced due to its origin from discounted Russian crude. Global diesel prices in 2025 average around $600-$700 per metric ton (based on Platts data cited in Reuters, 2025-09-08), but Ukraine likely secures Indian diesel at a discount, estimated at $550-$600 per metric ton, though exact contract prices are confidential.

6/

Overall Trends and Additional Data

Total Refined Product Imports: The Energy Information Administration (EIA.gov) estimates Ukraine imported 3.8 million metric tons of refined products (diesel and gasoline combined) in the first half of 2025, with a projected increase to 4.5-5 million metric tons for the full year due to refinery losses.

Transport Infrastructure: Naftogaz Ukraine (naftogaz.com) (naftogaz.com) reports a 4,700 km oil pipeline network, but its use is limited by war damage. Most imports now rely on maritime (Danube, Black Sea) and overland (rail, truck) routes.

Price Context: The Centre for Research on Energy and Clean Air (energyandcleanair.org, 2025-04-15) notes that EU imports of Russian refined products cost €75 billion in the third year of the invasion, suggesting Ukraine benefits from similar market dynamics, though at varying discount levels depending on source.

4. Specific Challenges and Adjustments

Refinery Loss Impact: The Reuters report (2025-09-08) confirms that the June 2025 destruction of the Kremenchug refinery (200,000 barrels/day capacity) has forced a 50%+ increase in import reliance since mid-year.

Sanctions Influence: The shift away from Russian and Belarusian supplies (previously 40% of refined products) to India and EU countries reflects sanctions enforcement.

7/End

Total Refined Product Imports: The Energy Information Administration (EIA.gov) estimates Ukraine imported 3.8 million metric tons of refined products (diesel and gasoline combined) in the first half of 2025, with a projected increase to 4.5-5 million metric tons for the full year due to refinery losses.

Transport Infrastructure: Naftogaz Ukraine (naftogaz.com) (naftogaz.com) reports a 4,700 km oil pipeline network, but its use is limited by war damage. Most imports now rely on maritime (Danube, Black Sea) and overland (rail, truck) routes.

Price Context: The Centre for Research on Energy and Clean Air (energyandcleanair.org, 2025-04-15) notes that EU imports of Russian refined products cost €75 billion in the third year of the invasion, suggesting Ukraine benefits from similar market dynamics, though at varying discount levels depending on source.

4. Specific Challenges and Adjustments

Refinery Loss Impact: The Reuters report (2025-09-08) confirms that the June 2025 destruction of the Kremenchug refinery (200,000 barrels/day capacity) has forced a 50%+ increase in import reliance since mid-year.

Sanctions Influence: The shift away from Russian and Belarusian supplies (previously 40% of refined products) to India and EU countries reflects sanctions enforcement.

7/End

Please unroll @threadreaderapp. Thank your attention in this matter

• • •

Missing some Tweet in this thread? You can try to

force a refresh