I’m going to return to the subject of the Good Law Project and, like my previous thread, there’s going to be some technical stuff about governing documents and the like to wade through before I get to the punchline…

…and, boy, do I have a punchline. /1

…and, boy, do I have a punchline. /1

So, following on from yesterday’s deep dive into the current governance set-up of Jolyon Maugham’s personal fiefdom, the Good Law Project (GLP), I’ve been taking a look at how the legal structures underneath it has evolved over time.

GLP was originally registered as a company limited by guarantee in January 2017 with the initial object of conducting itself as a general commercial business.

In August 2018, a revised set of Articles of Association were filed with Companies House which specify that the object(s) of the company are ‘as expressed in the Memorandum of Association’. There’s no Memorandum of Association attached to this filing and the one filed on incorporation does not state the object(s) of the company, it just names the original subscriber as Jolyon Toby Dennis Moore./2

GLP was originally registered as a company limited by guarantee in January 2017 with the initial object of conducting itself as a general commercial business.

In August 2018, a revised set of Articles of Association were filed with Companies House which specify that the object(s) of the company are ‘as expressed in the Memorandum of Association’. There’s no Memorandum of Association attached to this filing and the one filed on incorporation does not state the object(s) of the company, it just names the original subscriber as Jolyon Toby Dennis Moore./2

Moving ahead to March 2019 and we have yet another revised set of Articles of Association filed at Companies House.

This time around there is a clear statement that “the company is not established or conducted for private gain, any surplus or assets are used principally for the benefit of the community” and it also includes an asset lock clause that’s clearly been cribbed from the model Articles for Community Interest Companies published by the CIC regulator. This even includes a named potential recipient for the GLP’s assets, should it be wound up, a registered charity called the Public Law Project.

However, there are still no clauses that place express restrictions on private/member benefits. /3

This time around there is a clear statement that “the company is not established or conducted for private gain, any surplus or assets are used principally for the benefit of the community” and it also includes an asset lock clause that’s clearly been cribbed from the model Articles for Community Interest Companies published by the CIC regulator. This even includes a named potential recipient for the GLP’s assets, should it be wound up, a registered charity called the Public Law Project.

However, there are still no clauses that place express restrictions on private/member benefits. /3

The overall impression created to this point is that of someone with very limited knowledge of the non-profit sector inexpertly blundering around while trying to draft a workable set of governing documents while not being entirely sure that they're aiming for or how to get there. /4

Finally, we come to December 2021 and another completely revised set of Articles of Association which – praise Cthulhu – have actually been drafted by a large law firm albeit that most of the drafting involves butchering the Model CIC articles to remove anything that might impede Maugham’s absolute command of his personal fiefdom.

The asset lock clause remains in situ, although the named proposed recipient has gone, and there is even a set of clauses dealing with restrictions on private and member benefits and we finally have the addition of a comprehensive objects clause which runs to eight separate line items, all of which are most likely cribbed from the governing documents of actual registered charities, because no one actually drafts objects clauses from scratch./5

The asset lock clause remains in situ, although the named proposed recipient has gone, and there is even a set of clauses dealing with restrictions on private and member benefits and we finally have the addition of a comprehensive objects clause which runs to eight separate line items, all of which are most likely cribbed from the governing documents of actual registered charities, because no one actually drafts objects clauses from scratch./5

At no point in this process, or indeed since, has the Good Law Project become a registered charity, and for good reason.

Now, according to the GLP itself, this reason is that –

“Charities in the UK are bound by regulations to make sure they focus on the public benefit. These rules are often flouted, but they’re very strictly drawn around political campaigning.

Good Law Project fights to resist hate and bring hope – which is a political project. We’re set up as a non-profit company and not a charity, so we can punch up at power without one hand tied behind our back.”

And it’s certainly true that charities are tightly constrained in their involvement in political campaigning. It has to be within the scope of the charity’s objects, it cannot be the sole purpose of the charity and charities are required to stress their independence, take a balanced approach to their involvement with political parties and not allow themselves to be used as a vehicle for expression of the personal or party political views of an individual trustee or staff member. [No Comment!] /6

Now, according to the GLP itself, this reason is that –

“Charities in the UK are bound by regulations to make sure they focus on the public benefit. These rules are often flouted, but they’re very strictly drawn around political campaigning.

Good Law Project fights to resist hate and bring hope – which is a political project. We’re set up as a non-profit company and not a charity, so we can punch up at power without one hand tied behind our back.”

And it’s certainly true that charities are tightly constrained in their involvement in political campaigning. It has to be within the scope of the charity’s objects, it cannot be the sole purpose of the charity and charities are required to stress their independence, take a balanced approach to their involvement with political parties and not allow themselves to be used as a vehicle for expression of the personal or party political views of an individual trustee or staff member. [No Comment!] /6

It’s also the case that charities are closely regulated in regards to expending charitable fund on litigation. There are certain types of litigation – charity proceedings – which can only be entered into with the express permission of the Charity Commission and while charities can, and do, engage in strategic litigation in furtherance of their objects there are stringent rules in terms of due diligence and evaluations of value for money/impact that charity trustees are required to follow.

A common criticism levelled at many of GLP crowdfunding campaigns is that donations are being solicited from the general public on the back of sketchy information about the nature and purpose of the proposes litigation and without giving any kind of independent appraisal of the probability of success. Take that approach as a charity engaging in strategic litigation and trustees risk regulatory action by the Charity Commission that, in the worst case scenarios, could result in disqualification as a trustee and personal liability for the costs incurred by the charity./7

A common criticism levelled at many of GLP crowdfunding campaigns is that donations are being solicited from the general public on the back of sketchy information about the nature and purpose of the proposes litigation and without giving any kind of independent appraisal of the probability of success. Take that approach as a charity engaging in strategic litigation and trustees risk regulatory action by the Charity Commission that, in the worst case scenarios, could result in disqualification as a trustee and personal liability for the costs incurred by the charity./7

However, these are actually side issues because the key reasons that GLP has not registered as charity are that there is no prospect, whatsoever, of the Charity Commission approving an application based on its current (or past) governing documents and its governance structure, nor – to the best of my knowledge - is there any precedent for the acceptance of the pursuit of strategic litigation as a legitimate charitable object or primary charitable purpose.

In fact, I think it highly unlikely that the Charity Commission would ever accepted GLPs business model as being charitable within the law to the extent that even with Maugham operating as El Presidente, GLP is currently unregisterable under Charity Law. /8

In fact, I think it highly unlikely that the Charity Commission would ever accepted GLPs business model as being charitable within the law to the extent that even with Maugham operating as El Presidente, GLP is currently unregisterable under Charity Law. /8

And this raises another very interesting question – tax, specifically corporation tax.

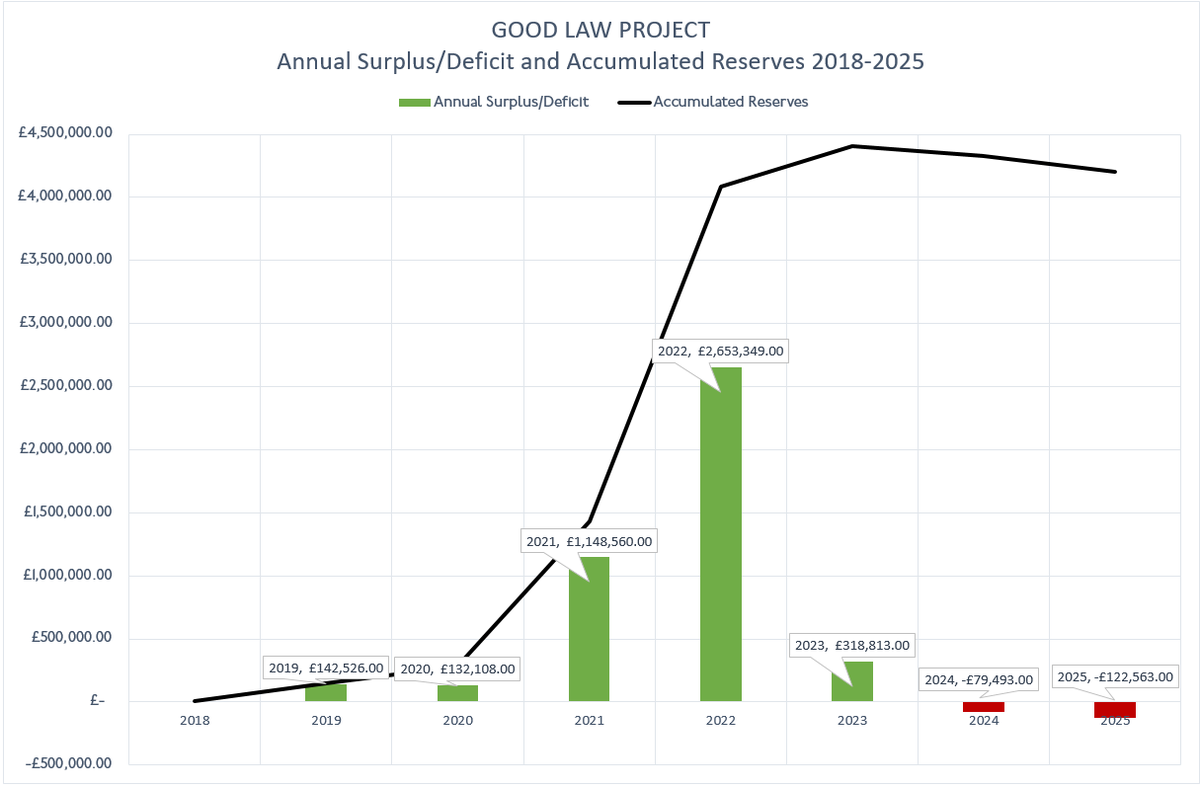

Time for a quick graph – this shows how GLP’s financial reserves have grown over its lifetime from under £10,000 in its first year of operation to over £4million by January 2022, display both its annual surpluses/deficits and accumulated reserves.

What you are looking at here is the profit generated by GLP from, for the most part, its crowdfunding campaigns and general public donations, income which – today – runs at over £4millon per year. /9

Time for a quick graph – this shows how GLP’s financial reserves have grown over its lifetime from under £10,000 in its first year of operation to over £4million by January 2022, display both its annual surpluses/deficits and accumulated reserves.

What you are looking at here is the profit generated by GLP from, for the most part, its crowdfunding campaigns and general public donations, income which – today – runs at over £4millon per year. /9

Now, as a matter of general tax law in the UK, donations made to charities and other non-profit organisations without anything being given in return are VAT exempt and do not have to be declared to HMRC if the charity/non-profit’s turnover exceeds the threshold for VAT registration.

However, this does not apply to Corporation Tax, where an exemption on retained surpluses (profits) is applied only to registered charities.

Other types of non-profit organisations, such as Community Interest Companies, remain liable for corporation tax on any surpluses generated that are not written off via the application of various tax reliefs, none of which would come close to adding up to the - for example - £2.65millon surplus generated by GLP in the year to January 2022. /10

However, this does not apply to Corporation Tax, where an exemption on retained surpluses (profits) is applied only to registered charities.

Other types of non-profit organisations, such as Community Interest Companies, remain liable for corporation tax on any surpluses generated that are not written off via the application of various tax reliefs, none of which would come close to adding up to the - for example - £2.65millon surplus generated by GLP in the year to January 2022. /10

So how is taxation addressed in GLP’s published accounts at Companies House.

Well, in the accounts filed from 2018-2020 there is no reference to taxation whatsoever.

In the 2021 and 2022 accounts, item 1.8 of the notes to the financial statement states:

“1.8 Taxation

The company is exempt from corporation tax, it being a company not carrying on a business for the purpose of making a profit.”

But, not having the purpose of making a profit does not automatically confer an exemption to corporation tax on a business. Unless it’s a registered charity then a company engaged in any kind of business is liable for corporation tax on its profits/surpluses.

From 2023 onwards, the statement in the accounts dealing with taxation reads as follows:

“1.9 Taxation

The company is exempt from corporation tax as it is not carrying on a trade or venture in the nature of a trade. Tax is payable on any income interest received only.”

Huh? /11

Well, in the accounts filed from 2018-2020 there is no reference to taxation whatsoever.

In the 2021 and 2022 accounts, item 1.8 of the notes to the financial statement states:

“1.8 Taxation

The company is exempt from corporation tax, it being a company not carrying on a business for the purpose of making a profit.”

But, not having the purpose of making a profit does not automatically confer an exemption to corporation tax on a business. Unless it’s a registered charity then a company engaged in any kind of business is liable for corporation tax on its profits/surpluses.

From 2023 onwards, the statement in the accounts dealing with taxation reads as follows:

“1.9 Taxation

The company is exempt from corporation tax as it is not carrying on a trade or venture in the nature of a trade. Tax is payable on any income interest received only.”

Huh? /11

I’m not a tax lawyer – obviously – so I could be mistaken in my interpretation here but, I’ll try to explain what I think is going on here.

For corporation tax purposes, a trade is defined is statute as ‘including any venture in the nature of trade’ which is both tautological and unhelpful, hence there is apparently scads of case law dealing with the ‘badge of trade’ which are used to determine whether something is or isn’t, in fact, trade.

Most of this case law appears to relate to the provision of goods, which doesn’t help us at all but I did find an article in Tax Advisor magazine which offers this information in relation to CICs – taxadvisermagazine.com/article/not-pr…

“...in most cases, a CIC will be entering into a contract with an independent party to provide goods or, more commonly, services, it is difficult to see the contract as anything other than a commercial arrangement freely entered into. This leaves the question of whether the services are provided for reward or, perhaps more meaningfully, with a view to profit. The crucial issue is whether any surplus for the year is attributable to the customer or the CIC. If a surplus must contractually be rolled forward and applied to providing services under the contract in future years, or alternatively be refunded, it will be attributable to the customer and no profit can arise to the CIC (BBC v Johns [1964] 1 All ER 923).

A CIC is, of course, required under its articles of association to apply any profits for the benefit of the community. However, this not-for-profit motive does not affect the corporation tax position on earning profits; it merely directs how those profits are to be applied. A CIC’s not-for-profit motive does not, therefore, affect its corporation tax status.” /12

For corporation tax purposes, a trade is defined is statute as ‘including any venture in the nature of trade’ which is both tautological and unhelpful, hence there is apparently scads of case law dealing with the ‘badge of trade’ which are used to determine whether something is or isn’t, in fact, trade.

Most of this case law appears to relate to the provision of goods, which doesn’t help us at all but I did find an article in Tax Advisor magazine which offers this information in relation to CICs – taxadvisermagazine.com/article/not-pr…

“...in most cases, a CIC will be entering into a contract with an independent party to provide goods or, more commonly, services, it is difficult to see the contract as anything other than a commercial arrangement freely entered into. This leaves the question of whether the services are provided for reward or, perhaps more meaningfully, with a view to profit. The crucial issue is whether any surplus for the year is attributable to the customer or the CIC. If a surplus must contractually be rolled forward and applied to providing services under the contract in future years, or alternatively be refunded, it will be attributable to the customer and no profit can arise to the CIC (BBC v Johns [1964] 1 All ER 923).

A CIC is, of course, required under its articles of association to apply any profits for the benefit of the community. However, this not-for-profit motive does not affect the corporation tax position on earning profits; it merely directs how those profits are to be applied. A CIC’s not-for-profit motive does not, therefore, affect its corporation tax status.” /12

So it seems a key question is whether any or all of the surpluses generated by GLP in providing its services are locked in, and must be either carried forward to subsequent years and used only to fulfill the terms of the contract or be refunded if not used.

That seems applicable, in principle, to the crowdfunding of specific cases or activities where there can be said to be a contract is between each individual donor and GLP that their donation will be used solely for the purpose set out in the crowdfunder with any surplus remaining after the case or activity is concluded being returned, pro rata, to the donors.

It also seems applicable, in principle, to any grant funding GLP receives on condition that this is treated as restricted funding from which any underspend at the conclusion of the funding period is returnable to the grant making body. /13

That seems applicable, in principle, to the crowdfunding of specific cases or activities where there can be said to be a contract is between each individual donor and GLP that their donation will be used solely for the purpose set out in the crowdfunder with any surplus remaining after the case or activity is concluded being returned, pro rata, to the donors.

It also seems applicable, in principle, to any grant funding GLP receives on condition that this is treated as restricted funding from which any underspend at the conclusion of the funding period is returnable to the grant making body. /13

But what about GLP’s tithe?

The 10% it states that it takes from each of its crowdfunding appeals to cover running costs?

I took a look at one fairly recent crowdfunding appeal and it includes this statement in the ‘small print’:

“10% of the funds raised will be a contribution to the general running costs of Good Law Project. It is our policy only to raise sums that we reasonably anticipate could be spent on the work we are crowdfunding for. But if there is a surplus it will go to develop and support further work we do to fight for a fairer, greener future for all.”

Elsewhere – actually in GLP’s accounts, there’s this note:

“Surpluses generated will be spent on future cases, on developing the company and building its financial sustainability, on supporting other initiatives and organisations which are aligned with our purpose and aims, and on meeting future potential liabilities as they arise, including the contingent liabilities listed at note 10 to the accounts.”

Not only does GLP take its tithe, but it appears that any surpluses on its crowdfunded campaigns go into the organisation’s general funds, meaning that they are no longer locked in to a ‘contract’ with the donors under which they are to be used only for a specified purpose, nor are they being returned to donors once they’ve been drawn down by GLP – although my understanding is that donations to appeals that don’t meet their basic fundraising target are refunded in full. /14

The 10% it states that it takes from each of its crowdfunding appeals to cover running costs?

I took a look at one fairly recent crowdfunding appeal and it includes this statement in the ‘small print’:

“10% of the funds raised will be a contribution to the general running costs of Good Law Project. It is our policy only to raise sums that we reasonably anticipate could be spent on the work we are crowdfunding for. But if there is a surplus it will go to develop and support further work we do to fight for a fairer, greener future for all.”

Elsewhere – actually in GLP’s accounts, there’s this note:

“Surpluses generated will be spent on future cases, on developing the company and building its financial sustainability, on supporting other initiatives and organisations which are aligned with our purpose and aims, and on meeting future potential liabilities as they arise, including the contingent liabilities listed at note 10 to the accounts.”

Not only does GLP take its tithe, but it appears that any surpluses on its crowdfunded campaigns go into the organisation’s general funds, meaning that they are no longer locked in to a ‘contract’ with the donors under which they are to be used only for a specified purpose, nor are they being returned to donors once they’ve been drawn down by GLP – although my understanding is that donations to appeals that don’t meet their basic fundraising target are refunded in full. /14

And then there’s the £3.5-4 million in general donations that GLP has solicited each year as unrestricted general funds with no specific purpose and no provision for a refund to donors in the case of an underspend. Is that trading or not trading – it’s by no means clear?

As I’ve said, I’m not a tax lawyer but it does seem to me that, based on what I’m reading, if a non-profit organisation solicits donations or provides services in return for remuneration with a view to generating a surplus during the year with the intention of this being retained as a reserves of cover general running costs and other activities in subsequent years then this seems likely to meet the definition of trading for corporation tax purposes.

Does that make sense?

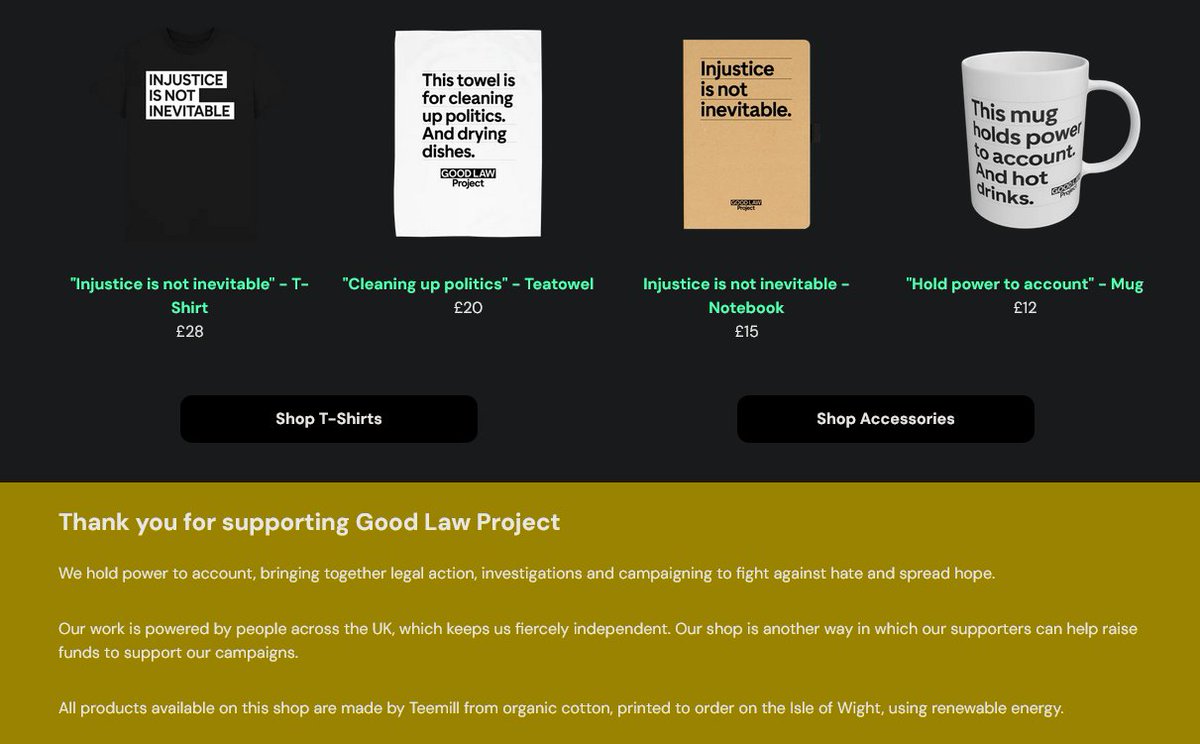

Oh – and if GLP is not carrying on a trade at all then what about the GLP merch shop on Teemill, which they link to from their own website?

It might only be loose change compared to their donations but it sure looks like trade to me./15

As I’ve said, I’m not a tax lawyer but it does seem to me that, based on what I’m reading, if a non-profit organisation solicits donations or provides services in return for remuneration with a view to generating a surplus during the year with the intention of this being retained as a reserves of cover general running costs and other activities in subsequent years then this seems likely to meet the definition of trading for corporation tax purposes.

Does that make sense?

Oh – and if GLP is not carrying on a trade at all then what about the GLP merch shop on Teemill, which they link to from their own website?

It might only be loose change compared to their donations but it sure looks like trade to me./15

Of course, it’s entirely possible that GLP has run all this past HMRC in advance and they’re entirely happy that they are not carrying on a trade for corporation tax purposes or that there's some arcane bit of case law that sets a precedent for this kind of thing that I'm simply unaware of but, from the outside looking in, I’ve not seen anything like this before in the not-for-profit sector - and, in a previous working life, I used to draw up the paperwork for 30+ new charities and community groups a year, including drafting their governing documents - and while it seems that some of GLPs activities and fundraising practices may be capable of be classed as not carrying out trade, it’s far from certain that this applies to everything they do.

If it is possible to write off most, if not all of your service-based activities as not carrying on a trade then there is likely to be a few CICs that will be interested in understanding exactly how you pull that off and whether it can be applied to their own activities and tax liabilities.

I’m sceptical but, in the interests of transparency, GLP wish to confirm that their tax exempt status has been approved by HMRC then I’ll be more than happy to publicise or link to any public statement to that effect and clarify and correct any misunderstandings this thread contains as to the correct operation of corporation tax law and the meaning of 'trade'.

Like I said, I’m not a tax lawyer, just an ordinary Joe with an interest in transparency and accountability. /end

If it is possible to write off most, if not all of your service-based activities as not carrying on a trade then there is likely to be a few CICs that will be interested in understanding exactly how you pull that off and whether it can be applied to their own activities and tax liabilities.

I’m sceptical but, in the interests of transparency, GLP wish to confirm that their tax exempt status has been approved by HMRC then I’ll be more than happy to publicise or link to any public statement to that effect and clarify and correct any misunderstandings this thread contains as to the correct operation of corporation tax law and the meaning of 'trade'.

Like I said, I’m not a tax lawyer, just an ordinary Joe with an interest in transparency and accountability. /end

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh