Fear & Greed Index dropped 20 points in 4 days

Short-term holders panic selling at a loss

I analyzed 16 years of on-chain data and spotted a pattern

Here’s what it means for crypto and what’s next 👇🧵

Short-term holders panic selling at a loss

I analyzed 16 years of on-chain data and spotted a pattern

Here’s what it means for crypto and what’s next 👇🧵

✦ Before we dive in :

✦ Smash that Follow, Like, and Retweet button

✦I’ve put a lot of effort into this thread, and your support would mean a lot.

✦ Let’s spread the value!

✦ Smash that Follow, Like, and Retweet button

✦I’ve put a lot of effort into this thread, and your support would mean a lot.

✦ Let’s spread the value!

1/

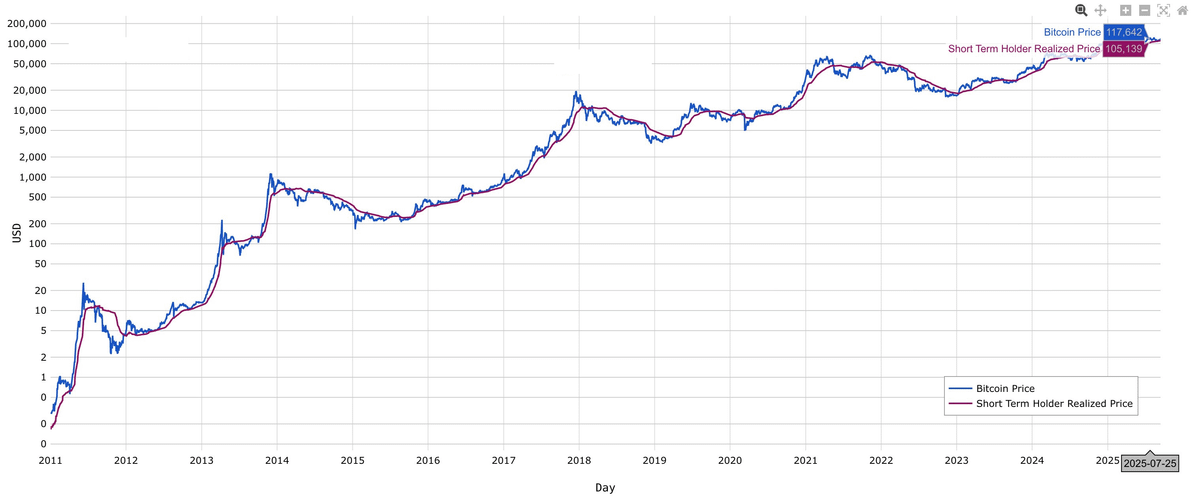

✦ The weak hands are blinking first

✦ Short-term holders the under-155 day crowd are back to dumping at a loss after months of holding

✦ They’re the first to crack when momentum fades

✦ This shift marks the start of a bigger rotation beneath the surface

✦ The weak hands are blinking first

✦ Short-term holders the under-155 day crowd are back to dumping at a loss after months of holding

✦ They’re the first to crack when momentum fades

✦ This shift marks the start of a bigger rotation beneath the surface

2/

✦ Flash selling by STHs isn’t random it’s the fear trade

✦ Quick-profit wallets get trapped in chop, then rush for exits

✦ That supply gets scooped up by bigger players who plan to hold

✦ Every panic unload is someone else’s cheap entry

✦ Flash selling by STHs isn’t random it’s the fear trade

✦ Quick-profit wallets get trapped in chop, then rush for exits

✦ That supply gets scooped up by bigger players who plan to hold

✦ Every panic unload is someone else’s cheap entry

3/

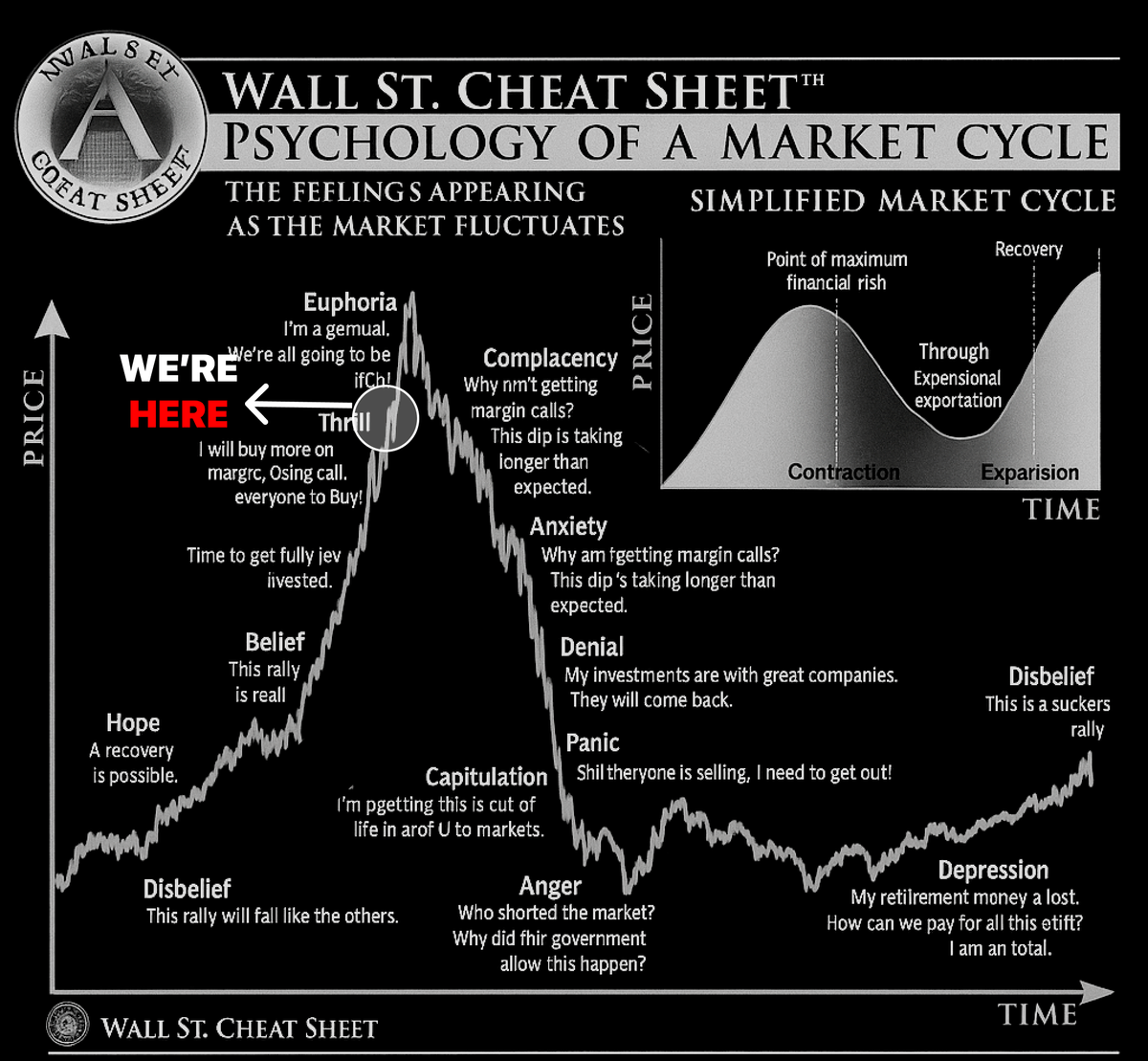

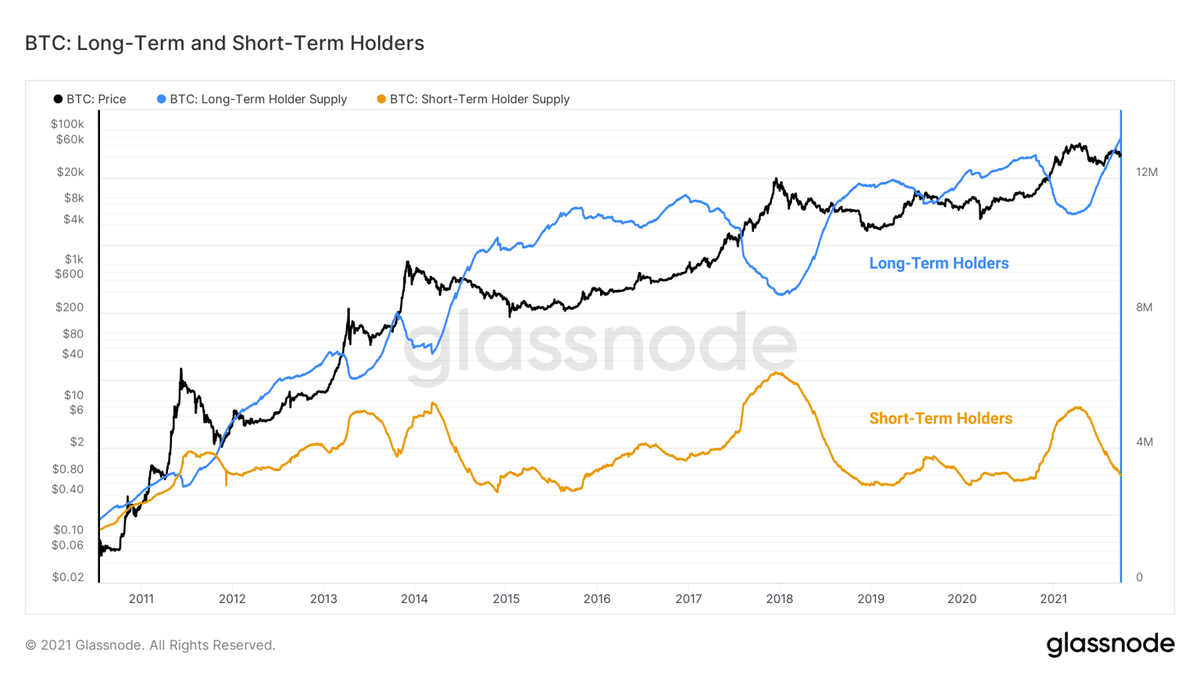

✦ Each cycle repeats the same rinse

✦ STH capitulation → LTH accumulation → base gets stronger

✦ When weak hands puke, strong hands reload quietly

✦ These flows build the launchpad for the next leg up

✦ Each cycle repeats the same rinse

✦ STH capitulation → LTH accumulation → base gets stronger

✦ When weak hands puke, strong hands reload quietly

✦ These flows build the launchpad for the next leg up

4/

✦ Right now coins bought at the highs are flooding spot markets

✦ CT screams bearish, but long-term holders aren’t budging

✦ That split between panic and patience is your real signal

✦ Under the noise, structural demand is still there

✦ Right now coins bought at the highs are flooding spot markets

✦ CT screams bearish, but long-term holders aren’t budging

✦ That split between panic and patience is your real signal

✦ Under the noise, structural demand is still there

5/

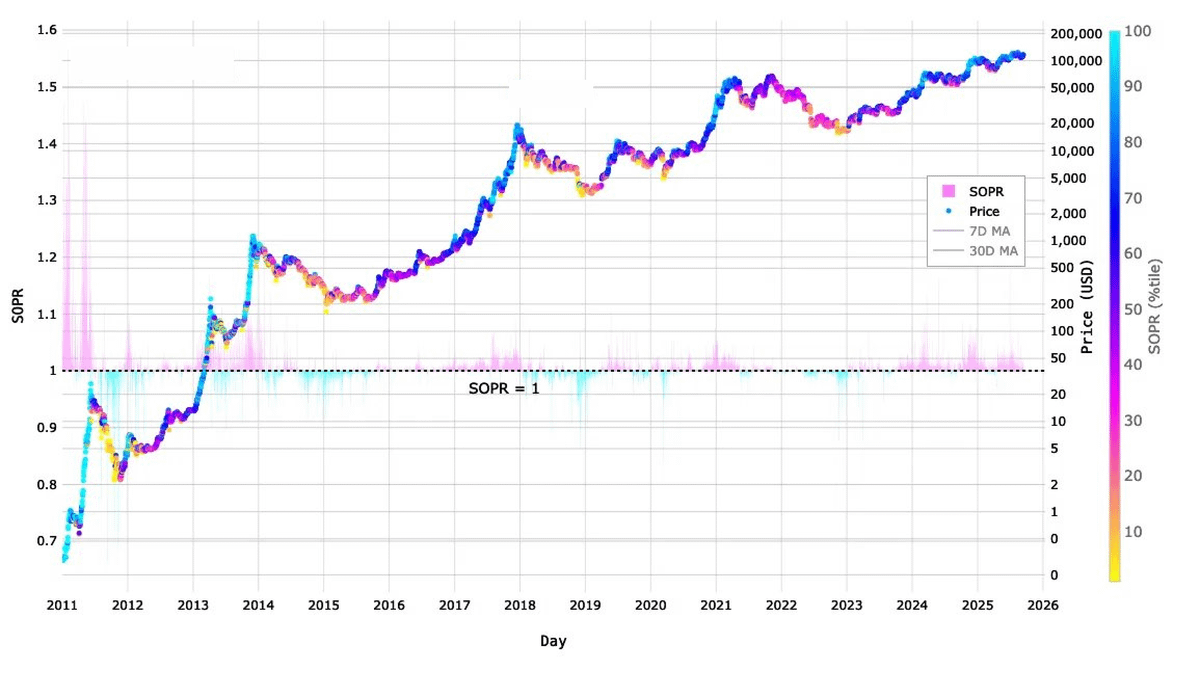

✦ Derivatives have already started their reset

✦ Funding drops, open interest wipes, leverage unwinds

✦ It’s ugly short-term but clears the runway for a clean rally

✦ Bitcoin always self-flushes before it takes off again

✦ Derivatives have already started their reset

✦ Funding drops, open interest wipes, leverage unwinds

✦ It’s ugly short-term but clears the runway for a clean rally

✦ Bitcoin always self-flushes before it takes off again

6/

✦ Panic ≠ the start of a crash

✦ Short-term holders are dumping at a loss classic late-stage fear

✦ This is when the herd thinks the top is in

✦ Smart money uses this exact window to buy quietly

✦ Panic ≠ the start of a crash

✦ Short-term holders are dumping at a loss classic late-stage fear

✦ This is when the herd thinks the top is in

✦ Smart money uses this exact window to buy quietly

7/

✦ Macro still matters: delayed rate cuts, dollar strength, liquidity drain all risk accelerators

✦ If long-term holders hold firm while short-term players fold, downside stays capped

✦ Watch conviction, not the headlines

✦ Macro still matters: delayed rate cuts, dollar strength, liquidity drain all risk accelerators

✦ If long-term holders hold firm while short-term players fold, downside stays capped

✦ Watch conviction, not the headlines

8/

✦ For traders, the edge is simple: don’t chase panic

✦ Tighten risk if you’re long, but don’t dump at local bottoms

✦ If you’re short, know you’re riding weak hands when they run out, shorts get trapped

✦ For traders, the edge is simple: don’t chase panic

✦ Tighten risk if you’re long, but don’t dump at local bottoms

✦ If you’re short, know you’re riding weak hands when they run out, shorts get trapped

9/

✦ Strategic moves right now:

-Track SOPR, exchange inflows, derivatives

-Watch for stabilization after liquidations

-Look for quiet LTH accumulation during sell-offs

✦ These signals front-run the next major move

✦ Strategic moves right now:

-Track SOPR, exchange inflows, derivatives

-Watch for stabilization after liquidations

-Look for quiet LTH accumulation during sell-offs

✦ These signals front-run the next major move

10/

✦ This phase = a healthy flush, not a cycle-ending collapse

✦ Capitulation clears leverage and refreshes momentum

✦ Treat it as a reset before the next leg higher

✦ Long-term trend still leans bullish with conviction in strong hands

✦ This phase = a healthy flush, not a cycle-ending collapse

✦ Capitulation clears leverage and refreshes momentum

✦ Treat it as a reset before the next leg higher

✦ Long-term trend still leans bullish with conviction in strong hands

✦ If you found this useful, please like, retweet, and save the tweet below!

✦ Drop your thoughts in the comments, and don’t forget to follow

@philarekt for more content like this! 👇

✦ Drop your thoughts in the comments, and don’t forget to follow

@philarekt for more content like this! 👇

https://x.com/philarekt/status/1967241277025726680

• • •

Missing some Tweet in this thread? You can try to

force a refresh