Proposal: Fix Legacy Contracts by Core Upgrade

What does it mean for Terra Classic and why does it matter?

Let’s break it down

What does it mean for Terra Classic and why does it matter?

Let’s break it down

In 2022, the v2.1.0 upgrade broke many legacy CosmWasm contracts.

This affected pools that relied on querying tax rates or oracle exchange rates.

As a result, liquidity was locked and traders couldn’t fully use these pools.

This affected pools that relied on querying tax rates or oracle exchange rates.

As a result, liquidity was locked and traders couldn’t fully use these pools.

The new proposal introduces a small patch (~30–50 lines of code).

This would re-enable contract execution and restore access to:

1. Astroport pools

2. Some Terraswap pools

3. Many legacy tax-handling contracts

This would re-enable contract execution and restore access to:

1. Astroport pools

2. Some Terraswap pools

3. Many legacy tax-handling contracts

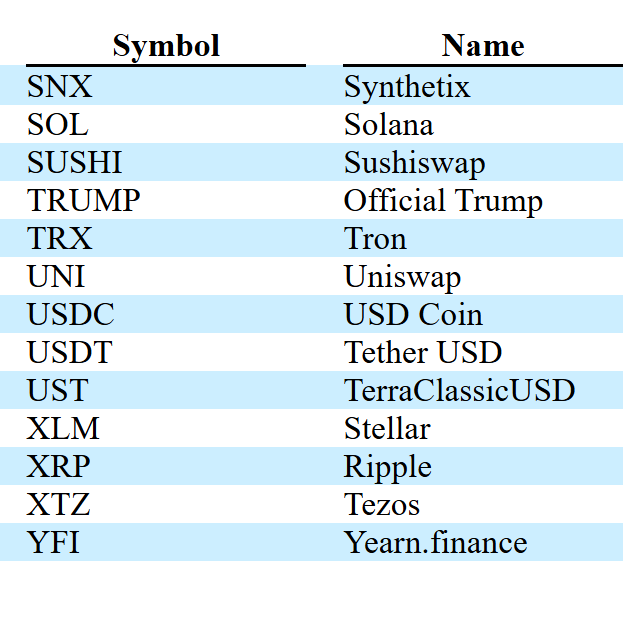

Example of locked liquidity today:

LUNC/USTC: ~700M LUNC, ~6M USTC

bLUNA/LUNC: ~150M LUNC

MIR/USTC: ~6M USTC

ASTRO/USTC: ~3.9M USTC

kUST/USTC: ~2.9M USTC

Across 465 Astroport contracts: ~959M LUNC + ~27.4M USTC

LUNC/USTC: ~700M LUNC, ~6M USTC

bLUNA/LUNC: ~150M LUNC

MIR/USTC: ~6M USTC

ASTRO/USTC: ~3.9M USTC

kUST/USTC: ~2.9M USTC

Across 465 Astroport contracts: ~959M LUNC + ~27.4M USTC

Positive impact if passed:

Liquidity returns to the chain

Tokens become usable again

Contracts work without migration

Liquidity returns to the chain

Tokens become usable again

Contracts work without migration

Risks:

Pools are imbalanced, bots will quickly arbitrage.

The LUNC/USTC pool trades at ~2× fair value.

Could cause sharp short-term swings in LUNC and USTC prices.

Pools are imbalanced, bots will quickly arbitrage.

The LUNC/USTC pool trades at ~2× fair value.

Could cause sharp short-term swings in LUNC and USTC prices.

Other concerns:

Arbitrage profits go to bots, not long-term holders.

Public perception: seen as “unlocking” supply, even though it was always meant to be accessible.

Liquidity providers can’t exit early before patch.

Arbitrage profits go to bots, not long-term holders.

Public perception: seen as “unlocking” supply, even though it was always meant to be accessible.

Liquidity providers can’t exit early before patch.

Why not just refund LPs directly?

Technically unfeasible.

Would require thousands of transactions during upgrade.

Risky, complex, and could miss funds.

Technically unfeasible.

Would require thousands of transactions during upgrade.

Risky, complex, and could miss funds.

So what are the options?

1. Fix contracts by core upgrade

2. Leave everything as is

3. Migrate each contract manually

1. Fix contracts by core upgrade

2. Leave everything as is

3. Migrate each contract manually

The proposal argues the patch is the cleanest fix.

Yes, bots may capture early gains, but this will rebalance pools and restore normal trading.

Yes, bots may capture early gains, but this will rebalance pools and restore normal trading.

Bottom line:

This isn’t about creating new liquidity.

It’s about restoring access to nearly 1B LUNC and millions of USTC locked since 2022.

This isn’t about creating new liquidity.

It’s about restoring access to nearly 1B LUNC and millions of USTC locked since 2022.

Proposal: Fix Legacy Contracts by Core Upgrade

What do you think, should Terra Classic pass this?

What do you think, should Terra Classic pass this?

Read : luncdaily.com/terra-classic-…

Support Our Work

Delegate with us: station.terra.money/validator/terr…

Purchase $MIOFF: vyntrex.io/market/terra1l…

Stay Updated

Join our community: t.me/lunc_daily

Latest News: t.me/orbitwire

Support Our Work

Delegate with us: station.terra.money/validator/terr…

Purchase $MIOFF: vyntrex.io/market/terra1l…

Stay Updated

Join our community: t.me/lunc_daily

Latest News: t.me/orbitwire

• • •

Missing some Tweet in this thread? You can try to

force a refresh