Gm ☕️

Monday–Tuesday: Positioning ahead of the Fed. Light data flow. Crypto majors look primed, with selective strength in alts and multiple clean setups on the board.

Wednesday: FOMC meeting, expected rate cuts. The event of the week. Volatility likely to spike.

Thursday: Post-Fed follow-through. Market digestion, USD reaction, and potential liquidity rotation into altcoins.

Friday: U.S. data (PMIs, jobless claims) could inject another layer of volatility heading into weekend trading.

Have a profitable week.

Monday–Tuesday: Positioning ahead of the Fed. Light data flow. Crypto majors look primed, with selective strength in alts and multiple clean setups on the board.

Wednesday: FOMC meeting, expected rate cuts. The event of the week. Volatility likely to spike.

Thursday: Post-Fed follow-through. Market digestion, USD reaction, and potential liquidity rotation into altcoins.

Friday: U.S. data (PMIs, jobless claims) could inject another layer of volatility heading into weekend trading.

Have a profitable week.

This is the HTF setup, perfectly aligned with rate cuts and price discovery. The chart continues to trend with bullish momentum, no reason to flip bias this week on gut-feel posts.

#TOTAL2

#TOTAL2

$SOL neckline around 260$, expect resistance

$ETH 5k+ next

Will $PUMP do a $UNI or $JUP, no overtrading, good risk management

$JUP heavy downtrend resistance, do it

$ETH 5k+ next

Will $PUMP do a $UNI or $JUP, no overtrading, good risk management

$JUP heavy downtrend resistance, do it

The $SEI setup is golden, do a $SUI or better do a $SOL

Without my own bias, $LTC downtrend

$AAVE is just one gigantic cup and handle chart, break this multi years downtrend for a neckline pump (400$)

$LINK the world, the easiest long term core port hold besides SOL

Without my own bias, $LTC downtrend

$AAVE is just one gigantic cup and handle chart, break this multi years downtrend for a neckline pump (400$)

$LINK the world, the easiest long term core port hold besides SOL

Wen $WEN?

You know that I know that you know that $TAO will go to 750$ from here

Idk this is $HYPE, 10x or zero who knows

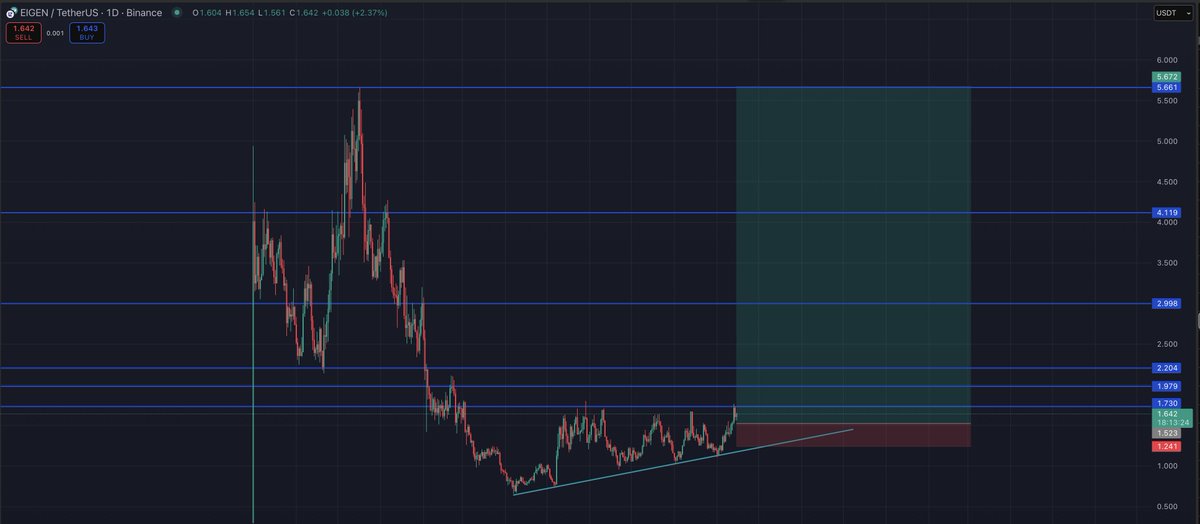

$EIGEN ascending triangle

You know that I know that you know that $TAO will go to 750$ from here

Idk this is $HYPE, 10x or zero who knows

$EIGEN ascending triangle

Can the bundlers ansem and co finally push $NIL from here pls? Thanks.

$PENGU is just PENGU, everyone is up big, just vibing

Cabal front ran my third TP on $BONK, crypto is a scam

100% BO pump, initials out and forget about $PEAQ for now

$PENGU is just PENGU, everyone is up big, just vibing

Cabal front ran my third TP on $BONK, crypto is a scam

100% BO pump, initials out and forget about $PEAQ for now

$ENA will go higher, look at this LTF bull flag + buy backs

145% BO pump, flagging now $WLD

Max ROI in DeFi potential: $PENDLE

Was i drunk? More horizontals than capital $W

145% BO pump, flagging now $WLD

Max ROI in DeFi potential: $PENDLE

Was i drunk? More horizontals than capital $W

$AVAX monthly downtrend BO, if u in congrats

$ARB gud trade, go for TP4 next

BO and retest done, higher $SUI

Same for $ONDO

$ARB gud trade, go for TP4 next

BO and retest done, higher $SUI

Same for $ONDO

You can build more potential setups around $RENDER $GRT $AR and $METIS

Tight SL, if you are unsure, you could wait for rate cut decision first.

Tight SL, if you are unsure, you could wait for rate cut decision first.

No magic tools, no gimmick lines, the HTF setups are clean. You just have to look.

If you’re trading, start with the 1W and 1D. Build your view from patterns (maybe a bottom is in?) and momentum.

Then drop to the LTFs (4h–12h) to structure the setup you want to trade over the next 3 months.

Rinse and repeat.

If you’re trading, start with the 1W and 1D. Build your view from patterns (maybe a bottom is in?) and momentum.

Then drop to the LTFs (4h–12h) to structure the setup you want to trade over the next 3 months.

Rinse and repeat.

Most alts are vaporware. They don’t need a token priced in dollars, and few have a sustainable business model or any revenue at all. Trade them, never marry them.

Never forget: nobody really knows anything. We’re all just guessing off blue lines and a guy who says ‘good afternoon’ a few times a year. The ones pretending to know what’s next are exactly the ones you shouldn’t follow.

“Nobody knows if a stock is going to go up, down, sideways or in fucking circles, least of all stockbrokers, right? It’s all a fugayzi, you know what a fugayzi is?”

“Fugayzi. It’s fake.”

"Fugayzi, fugazi. It's a whazy. It's a woozie. It's fairy dust. It doesn't exist. It's never landed. It is no matter. It's not on the elemental chart. It's not fucking real.”

“Nobody knows if a stock is going to go up, down, sideways or in fucking circles, least of all stockbrokers, right? It’s all a fugayzi, you know what a fugayzi is?”

“Fugayzi. It’s fake.”

"Fugayzi, fugazi. It's a whazy. It's a woozie. It's fairy dust. It doesn't exist. It's never landed. It is no matter. It's not on the elemental chart. It's not fucking real.”

Trade level by level, based on momentum and relative strength. Focus on what’s hot right now, the charts that line up, the ones showing potential to trade higher.

If you’re experienced enough, you take those trades on smaller timeframes, 2 to 3 months per coin. Move it higher on your watchlist, trade it through on relative strength, then already start scanning further down your list: what’s next? How do the chart patterns look? What’s the broader market dynamic?

Don’t fall into the mindset of thinking in bull vs. bear markets. ‘The bull market must end soon… the top is in… the bottom is in…’ None of that matters. Just trade level by level. Focus on the charts. Start with the HTF setup, then zoom down into the LTF for the next 2–3 months of trades. Build your watchlist properly.

Stop obsessing over whether the top is in or not. Trade with more calm, more composure. Let the dynamics play out, instead of stressing about what might be the exact top.

If you’re experienced enough, you take those trades on smaller timeframes, 2 to 3 months per coin. Move it higher on your watchlist, trade it through on relative strength, then already start scanning further down your list: what’s next? How do the chart patterns look? What’s the broader market dynamic?

Don’t fall into the mindset of thinking in bull vs. bear markets. ‘The bull market must end soon… the top is in… the bottom is in…’ None of that matters. Just trade level by level. Focus on the charts. Start with the HTF setup, then zoom down into the LTF for the next 2–3 months of trades. Build your watchlist properly.

Stop obsessing over whether the top is in or not. Trade with more calm, more composure. Let the dynamics play out, instead of stressing about what might be the exact top.

If your market read, fading momentum, or chart patterns hitting resistance tell you it’s time to rotate out, even fully into stables or cash, and the market still pushes higher, that’s fine. You simply didn’t catch that level.

Keep watching, look for the next setup. But never FOMO into a green candle. Missing a move is okay, chasing without a plan is not.

The focus should always be on positioning early, with defined setups and stop losses, not jumping in when the move has already started. If you’re in, great, ride the momentum. If you’re out, don’t FOMO. Instead, ask: where’s the next level? Where’s the next setup? Where’s the proper entry?

Sometimes the candle runs higher and forms a long bull flag. That’s when you wait and look to accumulate as close to the bottom of that flag as possible, based on the setup, so you’re positioned for the next leg up.

It’s okay to be wrong sometimes. What’s not okay is revenge trading or chasing green candles. That’s the discipline.

Keep watching, look for the next setup. But never FOMO into a green candle. Missing a move is okay, chasing without a plan is not.

The focus should always be on positioning early, with defined setups and stop losses, not jumping in when the move has already started. If you’re in, great, ride the momentum. If you’re out, don’t FOMO. Instead, ask: where’s the next level? Where’s the next setup? Where’s the proper entry?

Sometimes the candle runs higher and forms a long bull flag. That’s when you wait and look to accumulate as close to the bottom of that flag as possible, based on the setup, so you’re positioned for the next leg up.

It’s okay to be wrong sometimes. What’s not okay is revenge trading or chasing green candles. That’s the discipline.

It’s not the market that’s wrong or the enemy you’re fighting, it’s you. Every trade and investment decision comes down to your own mindset, and often that’s what you’re battling against.

Your mindset and your decisions must align. You need to think clearly and with discipline, so you don’t deceive yourself, and so you can admit mistakes when they happen. That’s how you grow.

Your mindset and your decisions must align. You need to think clearly and with discipline, so you don’t deceive yourself, and so you can admit mistakes when they happen. That’s how you grow.

• • •

Missing some Tweet in this thread? You can try to

force a refresh