🚀📌 L.T. Elevator Ltd IPO – SME Complete Review

Elevators & Escalators 🏙️ | Infra Growth 🚇 | AMC Revenues 🔄

An elevator & escalator solutions provider is coming to Dalal Street via BSE SME listing. Let’s decode this ₹39 Cr issue 👇🧵

@manishlalwani9 @Tanmay_31_

@sachprat07 @rohiitian

Elevators & Escalators 🏙️ | Infra Growth 🚇 | AMC Revenues 🔄

An elevator & escalator solutions provider is coming to Dalal Street via BSE SME listing. Let’s decode this ₹39 Cr issue 👇🧵

@manishlalwani9 @Tanmay_31_

@sachprat07 @rohiitian

Company Overview

🔹 Incorporated: 2012

🔹 Sector: Industrial Products – Elevators & Escalators

🔹 Business Activities:

• Manufacturing elevators & escalators

• Installation & modernization projects

• Maintenance & service contracts (AMC)

🔹 Clients: Real estate developers, commercial projects, residential complexes

🔹 Markets: Primarily India-focused (Tier-I & Tier-II cities)

👉 Business model offers a mix of one-time project revenue + recurring AMC income

🔹 Incorporated: 2012

🔹 Sector: Industrial Products – Elevators & Escalators

🔹 Business Activities:

• Manufacturing elevators & escalators

• Installation & modernization projects

• Maintenance & service contracts (AMC)

🔹 Clients: Real estate developers, commercial projects, residential complexes

🔹 Markets: Primarily India-focused (Tier-I & Tier-II cities)

👉 Business model offers a mix of one-time project revenue + recurring AMC income

Key Differentiators

📌 Full stack service provider – Design → Manufacturing → Installation → Service

📌 Focused on cost-efficient products for Indian market vs global MNCs

📌 Growing footprint in Tier-II cities where demand is rising

📌 Long-term service contracts ensure stable recurring revenues

📌 Full stack service provider – Design → Manufacturing → Installation → Service

📌 Focused on cost-efficient products for Indian market vs global MNCs

📌 Growing footprint in Tier-II cities where demand is rising

📌 Long-term service contracts ensure stable recurring revenues

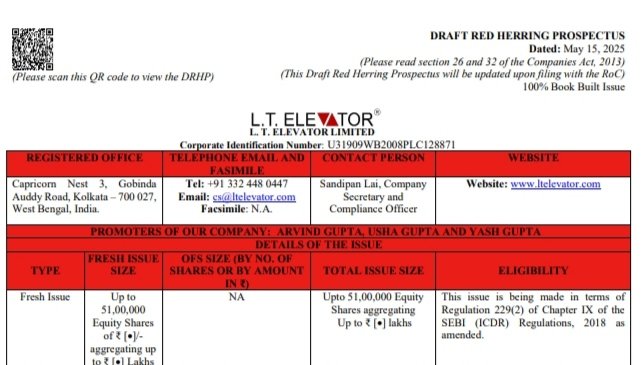

IPO Details

📌 IPO Type: Book Build Issue

📌 Price Band: ₹76 – ₹78/share

📌 Face Value: ₹10/share

📌 Total Issue Size: ₹39.37 Cr

• Fresh Issue: ₹37.40 Cr

• OFS: Nil

📌 Open/Close: Sept 12 – Sept 16, 2025

📌 Listing: BSE SME

📌 Market Maker Reservation: ₹1.97 Cr

📌 Promoter Holding (Pre): 85.14%

📌 IPO Type: Book Build Issue

📌 Price Band: ₹76 – ₹78/share

📌 Face Value: ₹10/share

📌 Total Issue Size: ₹39.37 Cr

• Fresh Issue: ₹37.40 Cr

• OFS: Nil

📌 Open/Close: Sept 12 – Sept 16, 2025

📌 Listing: BSE SME

📌 Market Maker Reservation: ₹1.97 Cr

📌 Promoter Holding (Pre): 85.14%

Retail Participation

🛑 Lot Size: 1600 shares

🛑 Min Application: 2 lots = 3200 shares

🛑 Investment: ₹2,49,600

⚠️ High ticket size → restricts small retail investors. Likely participation from HNI & well-funded SME investors.

🛑 Lot Size: 1600 shares

🛑 Min Application: 2 lots = 3200 shares

🛑 Investment: ₹2,49,600

⚠️ High ticket size → restricts small retail investors. Likely participation from HNI & well-funded SME investors.

Objects of the Issue

Funds will be used for 👇

1️⃣ Expansion of manufacturing capacity

2️⃣ Working capital requirements

3️⃣ Repayment of borrowings

4️⃣ General corporate purposes

👉 The IPO proceeds are growth-oriented, not just debt reduction.

Funds will be used for 👇

1️⃣ Expansion of manufacturing capacity

2️⃣ Working capital requirements

3️⃣ Repayment of borrowings

4️⃣ General corporate purposes

👉 The IPO proceeds are growth-oriented, not just debt reduction.

Industry Outlook

📈 Indian Elevator & Escalator Market: Growing at 8–10% CAGR

🏙️ Demand Drivers:

• Rapid urbanization & infra projects

• High-rise residential demand

• Metro & commercial complexes

• Govt infra push (Smart Cities, Housing for All)

⚔️ Competition: Global MNCs (Kone, Otis, Schindler, Mitsubishi) + local/regional players (Johnson Lifts, Escon, etc.)

👉 L.T. Elevator positions itself as a mid-segment, value-driven player.

📈 Indian Elevator & Escalator Market: Growing at 8–10% CAGR

🏙️ Demand Drivers:

• Rapid urbanization & infra projects

• High-rise residential demand

• Metro & commercial complexes

• Govt infra push (Smart Cities, Housing for All)

⚔️ Competition: Global MNCs (Kone, Otis, Schindler, Mitsubishi) + local/regional players (Johnson Lifts, Escon, etc.)

👉 L.T. Elevator positions itself as a mid-segment, value-driven player.

Market Positioning

🔹 Competes in mid-market segment → between premium MNCs & unorganized small players

🔹 Service/maintenance contracts (AMC) provide long-term visibility

🔹 Focused on affordable, customized solutions for Indian conditions

🔹 Strong play on Tier-II city demand growth

🔹 Competes in mid-market segment → between premium MNCs & unorganized small players

🔹 Service/maintenance contracts (AMC) provide long-term visibility

🔹 Focused on affordable, customized solutions for Indian conditions

🔹 Strong play on Tier-II city demand growth

Financial Performance (from RHP)

📊 Growth Indicators (last 3 yrs trend):

• Revenue rising with infra & housing push

• EBITDA & PAT margins stabilizing as AMC share grows

• Borrowings under control (debt-light model post IPO)

⚠️ Exact FY23–FY25 numbers limited in RHP preview but trend shows steady growth.

📊 Growth Indicators (last 3 yrs trend):

• Revenue rising with infra & housing push

• EBITDA & PAT margins stabilizing as AMC share grows

• Borrowings under control (debt-light model post IPO)

⚠️ Exact FY23–FY25 numbers limited in RHP preview but trend shows steady growth.

Strengths (Positives)

✅ End-to-end service provider (Design → Service)

✅ Growing recurring AMC revenue base

✅ Promoter experience & domain knowledge

✅ Strong demand drivers from infra & real estate

✅ IPO funds directed toward expansion → growth visibility

✅ End-to-end service provider (Design → Service)

✅ Growing recurring AMC revenue base

✅ Promoter experience & domain knowledge

✅ Strong demand drivers from infra & real estate

✅ IPO funds directed toward expansion → growth visibility

Risks (Negatives)

⚠️ High entry ticket size (₹2.49L) – retail participation will be low

⚠️ Strong competition from global majors (Kone, Otis)

⚠️ Working capital intensive – infra projects often face delayed payments

⚠️ SME listing – lower liquidity, higher volatility

⚠️ Limited geographic presence vs national/global peers

⚠️ High entry ticket size (₹2.49L) – retail participation will be low

⚠️ Strong competition from global majors (Kone, Otis)

⚠️ Working capital intensive – infra projects often face delayed payments

⚠️ SME listing – lower liquidity, higher volatility

⚠️ Limited geographic presence vs national/global peers

Valuation & Peers

💰 Price Band: ₹76–78/share

At upper band, valuations expected in ~20–22x P/E range

Peers:

• Johnson Lifts (unlisted large domestic peer) trades at premium

• MNCs (Otis, Kone, Schindler) command higher multiples globally

👉 L.T. Elevator appears reasonably priced within SME space.

💰 Price Band: ₹76–78/share

At upper band, valuations expected in ~20–22x P/E range

Peers:

• Johnson Lifts (unlisted large domestic peer) trades at premium

• MNCs (Otis, Kone, Schindler) command higher multiples globally

👉 L.T. Elevator appears reasonably priced within SME space.

Promoter Holding & Post IPO Structure

• Pre-IPO Promoter Holding: 85.14%

• Post IPO Holding: [Expected to dilute moderately]

• Strong skin-in-the-game indicates long-term promoter commitment

• Pre-IPO Promoter Holding: 85.14%

• Post IPO Holding: [Expected to dilute moderately]

• Strong skin-in-the-game indicates long-term promoter commitment

Final Takeaway

📌 L.T. Elevator = Urban Infra + Housing Growth + AMC Stability

✅ Industry tailwinds + steady financials

✅ Reasonable valuations vs peers

⚠️ High ticket size & SME risks remain

Verdict:

👍 Good for Listing Gains

✅ Selective Long-term Play if you believe in India’s infra & housing boom

What’s your view on this IPO? 👇

@vishan_khadke

@Paryan_Sharma @adeshjainj @india_ipo @Anvith_ @thebigbulldeals @bansalabhishek5 @Abhishek25glt @AshishMeher7

@Vismaya9999

📌 L.T. Elevator = Urban Infra + Housing Growth + AMC Stability

✅ Industry tailwinds + steady financials

✅ Reasonable valuations vs peers

⚠️ High ticket size & SME risks remain

Verdict:

👍 Good for Listing Gains

✅ Selective Long-term Play if you believe in India’s infra & housing boom

What’s your view on this IPO? 👇

@vishan_khadke

@Paryan_Sharma @adeshjainj @india_ipo @Anvith_ @thebigbulldeals @bansalabhishek5 @Abhishek25glt @AshishMeher7

@Vismaya9999

👉Follow @megharaj_g_k

👉Follow my whatsapp channel

whatsapp.com/channel/0029Vb…

For more content

🔕 Disclaimer :

x.com/megharaj_g_k/s…

👉Follow my whatsapp channel

whatsapp.com/channel/0029Vb…

For more content

🔕 Disclaimer :

x.com/megharaj_g_k/s…

@UnrollHelper

• • •

Missing some Tweet in this thread? You can try to

force a refresh