🚨🏦🪖The NATO Military Bank: The Globalists' War Fund is Here

The globalists are building their final piece of financial infrastructure for perpetual war. Forget the World Bank. Forget the IMF. Meet the "NATO Bank", the Defense, Security and Resilience Bank.

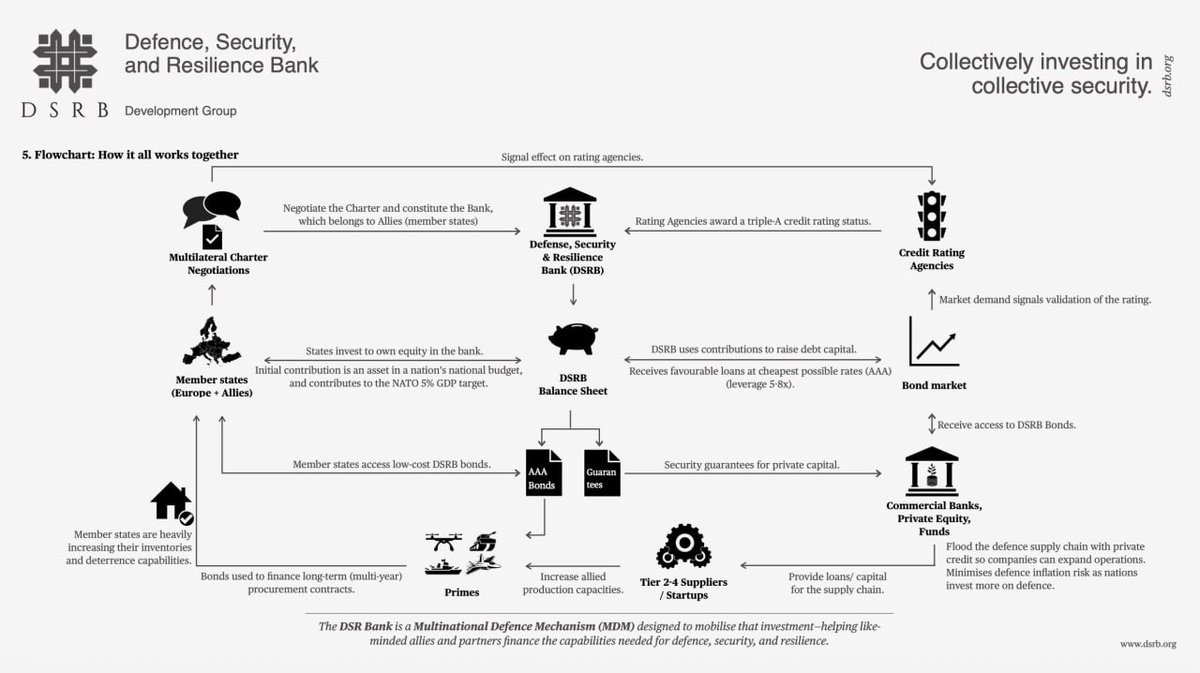

Here's how it works🧵

The globalists are building their final piece of financial infrastructure for perpetual war. Forget the World Bank. Forget the IMF. Meet the "NATO Bank", the Defense, Security and Resilience Bank.

Here's how it works🧵

Core Function 1 - Sovereign Lending:

This mechanism will not alleviate debt but enshrine it. It creates a perpetual debt trap for smaller NATO states, locking their national security into loan repayments to a financial entity they do not control, eroding fiscal sovereignty.

This mechanism will not alleviate debt but enshrine it. It creates a perpetual debt trap for smaller NATO states, locking their national security into loan repayments to a financial entity they do not control, eroding fiscal sovereignty.

Core Function 2 - Risk Mitigation:

Socializing the risk for private arms manufacturers is a disastrous moral hazard.

It guarantees profits for the Military-Industrial Complex (MIC) regardless of performance, using public funds to underwrite private gain, eliminating any market incentive for efficiency or cost-control.

Socializing the risk for private arms manufacturers is a disastrous moral hazard.

It guarantees profits for the Military-Industrial Complex (MIC) regardless of performance, using public funds to underwrite private gain, eliminating any market incentive for efficiency or cost-control.

Strategic Objective - Forced Interoperability:

In practice, this will mean the standardization of procurement around primarily US and UK systems.

It is a financial tool to crush what remains of Europe's independent defense industry, creating dependency, not alliance cohesion.

In practice, this will mean the standardization of procurement around primarily US and UK systems.

It is a financial tool to crush what remains of Europe's independent defense industry, creating dependency, not alliance cohesion.

Economic Objective - Countering Inflation:

The idea that a massive, centralized influx of capital into a supply-constrained sector will lower prices is economically naive. It is far more likely to overheat the industry, creating bottlenecks and inflating costs further, making the problem worse.

The idea that a massive, centralized influx of capital into a supply-constrained sector will lower prices is economically naive. It is far more likely to overheat the industry, creating bottlenecks and inflating costs further, making the problem worse.

Architects & Governance:

The initiative is not led by current NATO officials but by a network of former high-ranking alliance military & intelligence figures (e.g., Murray, Peach, Geoană).

This suggests a hybrid model: officially multilateral but heavily influenced by a specific policy bloc.

The initiative is not led by current NATO officials but by a network of former high-ranking alliance military & intelligence figures (e.g., Murray, Peach, Geoană).

This suggests a hybrid model: officially multilateral but heavily influenced by a specific policy bloc.

Lobbying & Integration:

Its swift inclusion in EU policy documents is not a sign of merit, but of the overwhelming power of the militarist lobby.

Critical debate is being bypassed in a panic-driven rush to fund a new Cold War, with no exit strategy.

Its swift inclusion in EU policy documents is not a sign of merit, but of the overwhelming power of the militarist lobby.

Critical debate is being bypassed in a panic-driven rush to fund a new Cold War, with no exit strategy.

The "City of London" Nexus

Basing it in the world's premier capital of financialization is a telling choice. It signals that the primary output of this project will not be security, but complex financial instruments, securitized debt, and derivatives tied to conflict—a grim prospect.

Basing it in the world's premier capital of financialization is a telling choice. It signals that the primary output of this project will not be security, but complex financial instruments, securitized debt, and derivatives tied to conflict—a grim prospect.

World Bank for War

This is an admission of failure. The World Bank's model is plagued by corruption, mission creep, and often crippling debt for recipient nations. Applying this flawed model to war preparation is a recipe for a vast, unaccountable black hole of spending.

This is an admission of failure. The World Bank's model is plagued by corruption, mission creep, and often crippling debt for recipient nations. Applying this flawed model to war preparation is a recipe for a vast, unaccountable black hole of spending.

Implication - Financialization of Security:

This is the most dystopian outcome. It permanently hardwires the profit motive into the architecture of collective security. The financial and military elite now have a vested, monetary interest in perpetual tension, not in peace.

This is the most dystopian outcome. It permanently hardwires the profit motive into the architecture of collective security. The financial and military elite now have a vested, monetary interest in perpetual tension, not in peace.

• • •

Missing some Tweet in this thread? You can try to

force a refresh