Speaking of $ETH beta plays… Many are still sleeping on $EIGEN

$19B TVL. 29 AVSs live. 160+ more coming and every new AVS = more tokens locked, less supply on market.

Fade it if you want… but here’s my breakdown on @eigenlayer : 🧵👇

$19B TVL. 29 AVSs live. 160+ more coming and every new AVS = more tokens locked, less supply on market.

Fade it if you want… but here’s my breakdown on @eigenlayer : 🧵👇

2/

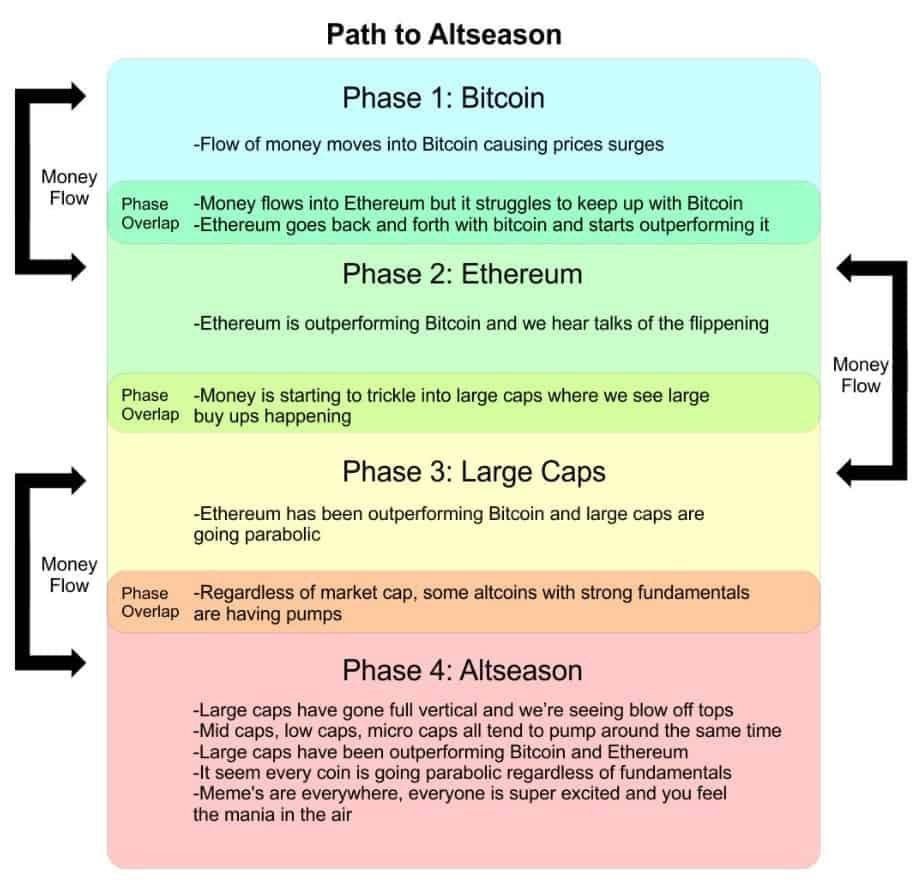

You might know that when an L1 pumps, its ecosystem tokens pump too.

We saw that with $ENA and $ETH, $PUMP and $SOL and now $EIGEN and $ETH could be the next.

For those who have been following me know that i have been bullish on $EIGEN since its airdrop

You might know that when an L1 pumps, its ecosystem tokens pump too.

We saw that with $ENA and $ETH, $PUMP and $SOL and now $EIGEN and $ETH could be the next.

For those who have been following me know that i have been bullish on $EIGEN since its airdrop

3/

It's a bit different than my other holdings like $PUMP and $ENA, which has large token buybacks.

Today I'll outline a few reasons on why $EIGEN could be a good runner in 2025. and why im holding a fat bag of it..

So let's start.

It's a bit different than my other holdings like $PUMP and $ENA, which has large token buybacks.

Today I'll outline a few reasons on why $EIGEN could be a good runner in 2025. and why im holding a fat bag of it..

So let's start.

4/

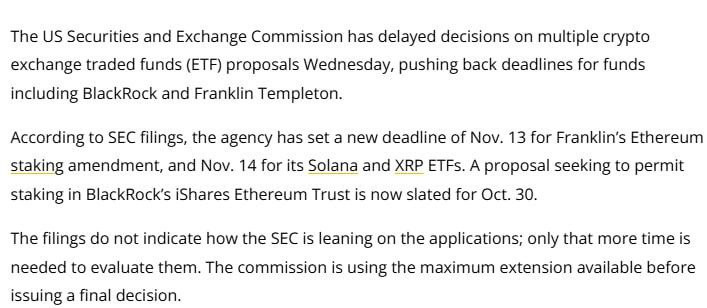

1) Staking approval

I know we have been waiting for ETH ETFs approval, but now it's only a matter of time.

BlackRock's ETH staking approval next deadline is in October and I think the approval will most likely happen.

But how is it bullish for $EIGEN?

1) Staking approval

I know we have been waiting for ETH ETFs approval, but now it's only a matter of time.

BlackRock's ETH staking approval next deadline is in October and I think the approval will most likely happen.

But how is it bullish for $EIGEN?

5/

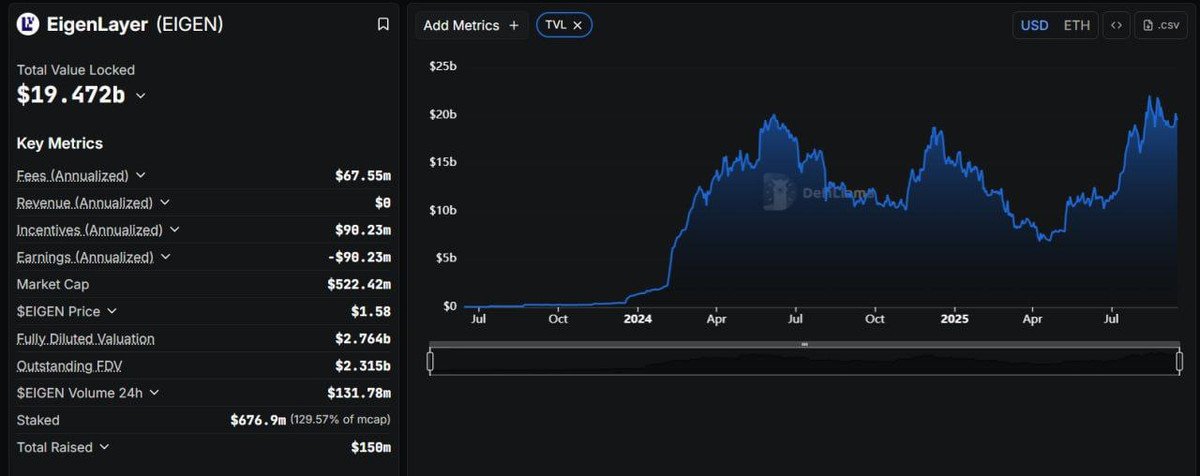

First of all, Eigenlayer is the largest restaking protocol on Ethereum with $19.44B in TVL

With ETH ETFs staking approval, there'll be huge narrative around staking and restaking too.

And there's a reason for it.

First of all, Eigenlayer is the largest restaking protocol on Ethereum with $19.44B in TVL

With ETH ETFs staking approval, there'll be huge narrative around staking and restaking too.

And there's a reason for it.

6/

Right now, APR for staking $ETH is 3-3.2% but if you restake it with Eigen, net APR goes above 5%.

This 2% extra yield makes a huge difference if you have a large size.

Just like stablecoin narrative resulted in $ENA rally, staking narrative will pump $EIGEN.

Right now, APR for staking $ETH is 3-3.2% but if you restake it with Eigen, net APR goes above 5%.

This 2% extra yield makes a huge difference if you have a large size.

Just like stablecoin narrative resulted in $ENA rally, staking narrative will pump $EIGEN.

7/

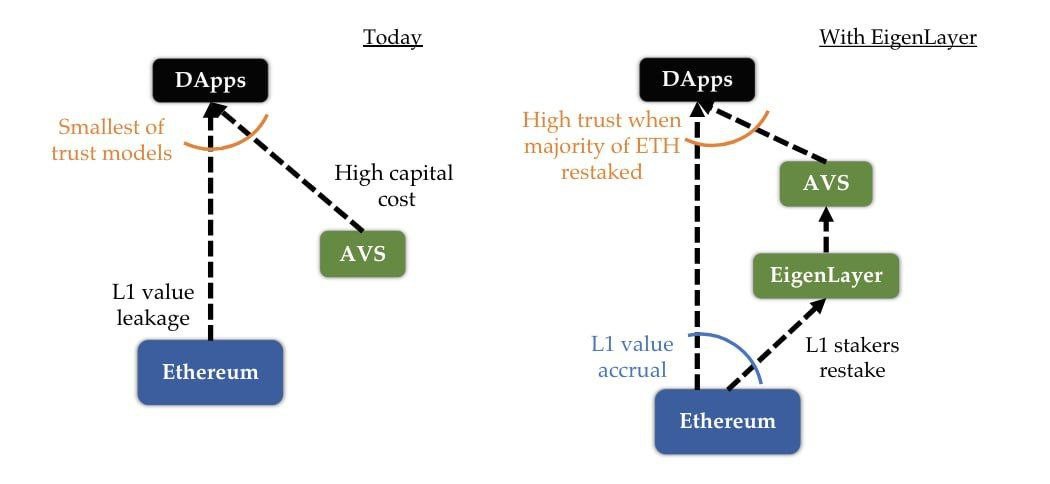

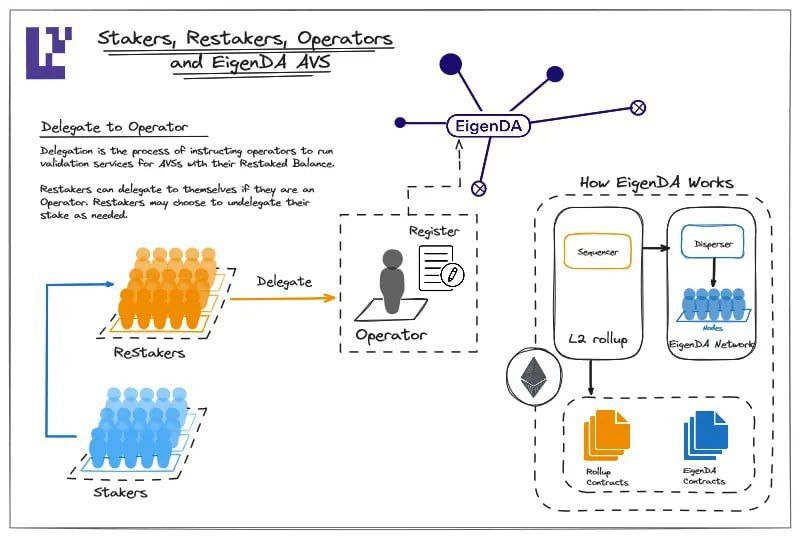

2) Actively Validated Services

Eigen’s biggest innovation is securing Actively Validated Services (AVSs).

These are services that Ethereum alone cannot fully secure.. things like data storage, cross-chain messaging, or faster rollups.

To join these services, operators must stake EIGEN, not just ETH.

2) Actively Validated Services

Eigen’s biggest innovation is securing Actively Validated Services (AVSs).

These are services that Ethereum alone cannot fully secure.. things like data storage, cross-chain messaging, or faster rollups.

To join these services, operators must stake EIGEN, not just ETH.

8/

That means every time a new AVS launches, it directly pulls more EIGEN off the market and locks it.

Today around 29 AVSs are live, and over 160+ are in the development.

So the bigger Eigen’s AVS ecosystem gets, the stronger the demand for $EIGEN.

That means every time a new AVS launches, it directly pulls more EIGEN off the market and locks it.

Today around 29 AVSs are live, and over 160+ are in the development.

So the bigger Eigen’s AVS ecosystem gets, the stronger the demand for $EIGEN.

9/

Here are some major AVSs powered by Eigen:

EigenDA → a “data availability” service. Think of it like decentralized Google Drive for blockchains.

Omni Network → connects blockchains together with secure interoperability.

AltLayer → provides high-speed rollups for scaling apps.

Here are some major AVSs powered by Eigen:

EigenDA → a “data availability” service. Think of it like decentralized Google Drive for blockchains.

Omni Network → connects blockchains together with secure interoperability.

AltLayer → provides high-speed rollups for scaling apps.

10/

3) EigenDA

EigenDA is the most important AVS right now.

It lets apps store and verify huge amounts of data cheaply and securely.

Apps pay fees to use EigenDA and those fees are redistributed to EIGEN stakers.

3) EigenDA

EigenDA is the most important AVS right now.

It lets apps store and verify huge amounts of data cheaply and securely.

Apps pay fees to use EigenDA and those fees are redistributed to EIGEN stakers.

11/

So the more apps rely on EigenDA (AI models, RWA apps, gaming, DeFi protocols), the more money flows back into the hands of token holders.

This creates a natural loop: more usage → more fees → more rewards for stakers → more demand for EIGEN.

That's why $676 million in EIGEN tokens have been staked which is almost 130% of the circulating supply.

So the more apps rely on EigenDA (AI models, RWA apps, gaming, DeFi protocols), the more money flows back into the hands of token holders.

This creates a natural loop: more usage → more fees → more rewards for stakers → more demand for EIGEN.

That's why $676 million in EIGEN tokens have been staked which is almost 130% of the circulating supply.

12/

As more tokens get staked, it'll create a supply crunch for EIGEN.

And what happens during supply crunch and increased demand?

Token prices go up.

As more tokens get staked, it'll create a supply crunch for EIGEN.

And what happens during supply crunch and increased demand?

Token prices go up.

13/

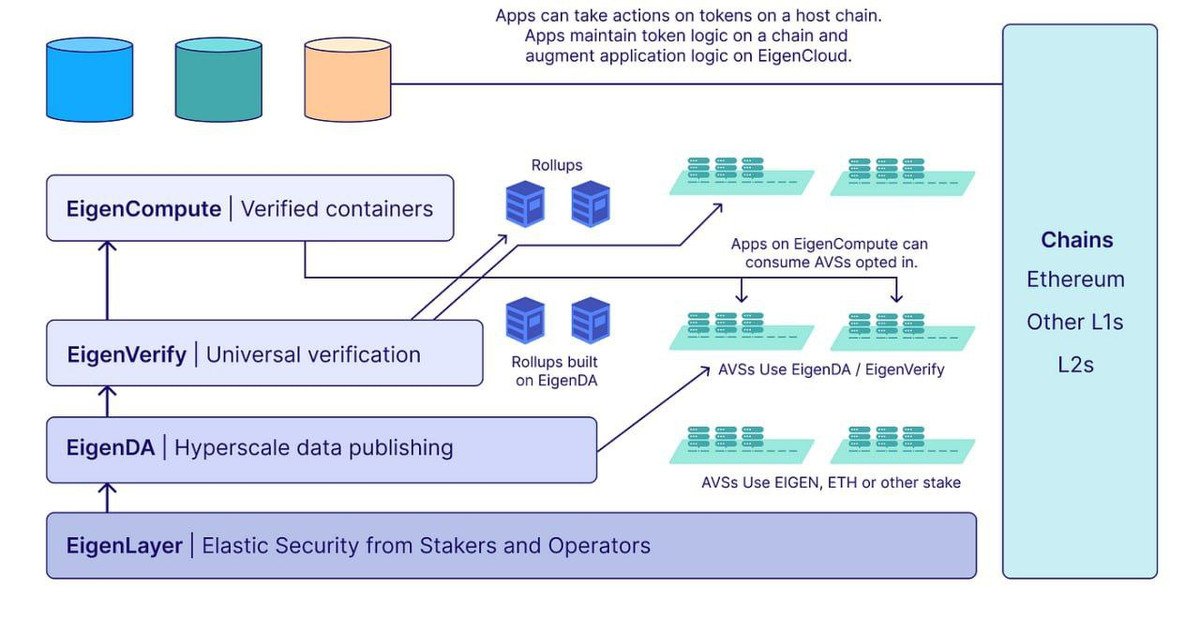

4) Eigen Cloud

Think of EigenCloud as Amazon Web Services (AWS) for Web3 which is secured through EigenLayer.

Developers can build apps that need high throughput, AI, storage, or real-world data directly on EigenCloud.

4) Eigen Cloud

Think of EigenCloud as Amazon Web Services (AWS) for Web3 which is secured through EigenLayer.

Developers can build apps that need high throughput, AI, storage, or real-world data directly on EigenCloud.

14/

Every EigenCloud Service Needs Security and it require stakers to post EIGEN as collateral.

More services = more EIGEN locked = less supply in circulation, which is good for $EIGEN price.

Also, apps using EigenCloud (AI training, storage, RWA platforms) will pay fees for compute, bandwidth, and verification.

Every EigenCloud Service Needs Security and it require stakers to post EIGEN as collateral.

More services = more EIGEN locked = less supply in circulation, which is good for $EIGEN price.

Also, apps using EigenCloud (AI training, storage, RWA platforms) will pay fees for compute, bandwidth, and verification.

15/

Those fees flow back to EIGEN stakers, turning the token into a revenue-sharing asset.

As bigger institutions will use EigenCloud for regulated apps (finance, AI, RWAs), billions in demand for cloud-grade infrastructure will flow.

That liquidity will then indirectly flows into $EIGEN because security guarantees require staking the token.

Those fees flow back to EIGEN stakers, turning the token into a revenue-sharing asset.

As bigger institutions will use EigenCloud for regulated apps (finance, AI, RWAs), billions in demand for cloud-grade infrastructure will flow.

That liquidity will then indirectly flows into $EIGEN because security guarantees require staking the token.

16/

$EIGEN demand dynamics

As I said before, $EIGEN doesn't have a buyback mechanism.

Instead it has a value accrual for EIGEN holders via staking rewards which comes from protocol revenue and not inflation.

But there's one concern and that's inflation.

$EIGEN demand dynamics

As I said before, $EIGEN doesn't have a buyback mechanism.

Instead it has a value accrual for EIGEN holders via staking rewards which comes from protocol revenue and not inflation.

But there's one concern and that's inflation.

17/

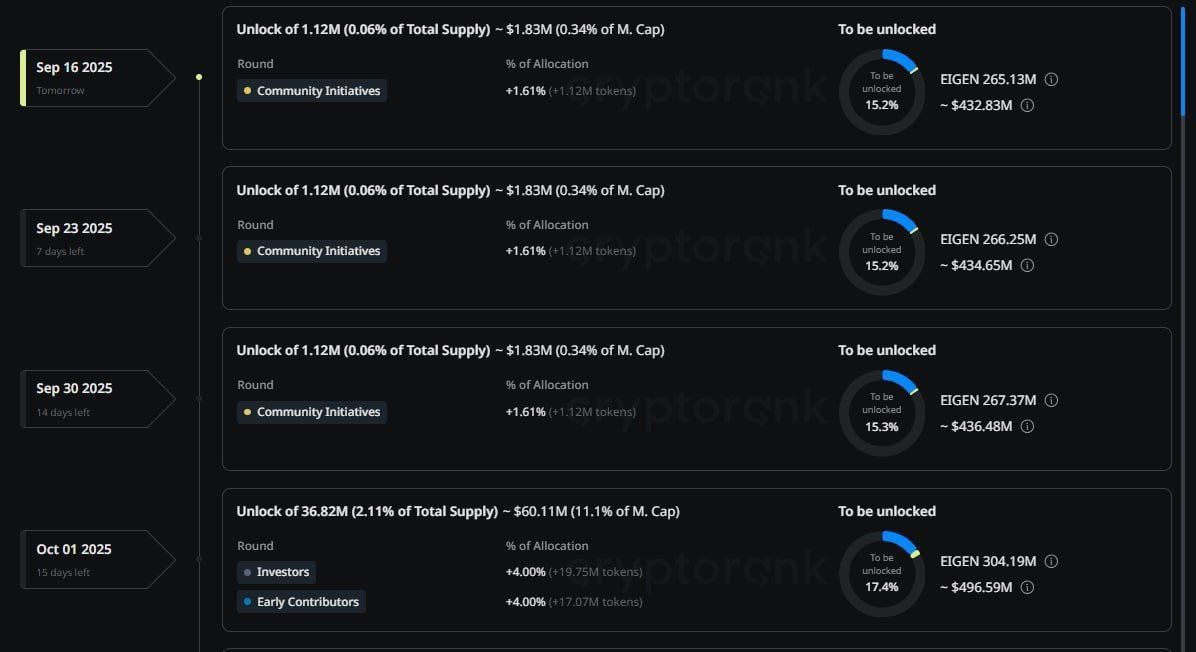

EIGEN has $60M in monthly unlocks which is almost 11% of its circulating market cap.

100% of the unlocks go to early contributors and investors which are up 5x-10x.

This definitely incentivize them to sell and this could impact prices during market downtrend.

EIGEN has $60M in monthly unlocks which is almost 11% of its circulating market cap.

100% of the unlocks go to early contributors and investors which are up 5x-10x.

This definitely incentivize them to sell and this could impact prices during market downtrend.

18/

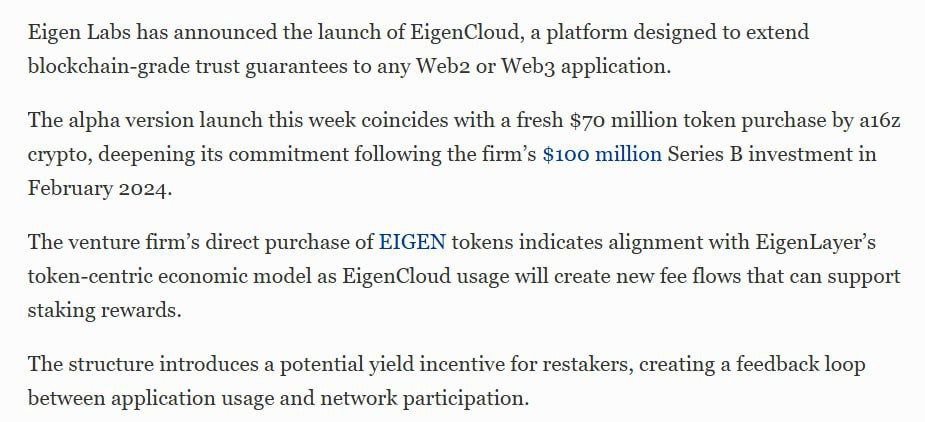

Another bullish thing is a16z $70M purchase in $EIGEN tokens last quarter which shows high conviction.

Also there are a few other bullish hopiums which hasn't happened yet but could happen.

One of them is enabling token buyback mechanism and another one will a DAT focused on EIGEN.

If you'll look at the VCs backing EIGEN, the 2nd one seems more likely to happen in 2025.

Another bullish thing is a16z $70M purchase in $EIGEN tokens last quarter which shows high conviction.

Also there are a few other bullish hopiums which hasn't happened yet but could happen.

One of them is enabling token buyback mechanism and another one will a DAT focused on EIGEN.

If you'll look at the VCs backing EIGEN, the 2nd one seems more likely to happen in 2025.

19/

Conclusion:

I don't care what other says, $EIGEN looks undervalued to me at current prices.

If you'll look at top 20 and top 30 projects, there are a lot of vapourware projects trading at $5B-$10B valuation.

I think $EIGEN has a good chance of becoming top 50 project this cycle if we are talking about it based on utility.

Conclusion:

I don't care what other says, $EIGEN looks undervalued to me at current prices.

If you'll look at top 20 and top 30 projects, there are a lot of vapourware projects trading at $5B-$10B valuation.

I think $EIGEN has a good chance of becoming top 50 project this cycle if we are talking about it based on utility.

That’s a wrap!

Got any questions about this thread? Drop them in the comments, and I’ll be happy to help.

Stay updated by joining my Telegram:

And if you found this useful, I’d really appreciate a follow: @Axel_bitblaze69

Thanks for reading! 😉t.me/Alpha_Updates

Got any questions about this thread? Drop them in the comments, and I’ll be happy to help.

Stay updated by joining my Telegram:

And if you found this useful, I’d really appreciate a follow: @Axel_bitblaze69

Thanks for reading! 😉t.me/Alpha_Updates

I hope this thread brought you some value!

Make sure to follow @Axel_bitblaze69 for:

• More valuable crypto insights

• Real-time alpha & airdrop updates

If you found this helpful, feel free to like/retweet the first tweet below!👇

Make sure to follow @Axel_bitblaze69 for:

• More valuable crypto insights

• Real-time alpha & airdrop updates

If you found this helpful, feel free to like/retweet the first tweet below!👇

https://twitter.com/axel_bitblaze69/status/1967953209512837350

• • •

Missing some Tweet in this thread? You can try to

force a refresh