HOW TO RIDE THE TREND EFFECTIVELY📈📈

I'm going to teach you how to identify strong trends, make sure the pullbacks are not reversals, and enter responsibly

🧵👇

I'm going to teach you how to identify strong trends, make sure the pullbacks are not reversals, and enter responsibly

🧵👇

The Process

1) Find a strong trend (using volume)

2) Wait for a pullback

3) Make sure the pullback isn't a reversal

4) Enter using a responsible strategy

This thread will explain these 4 steps and give you some extra tips to help you make money💰

1) Find a strong trend (using volume)

2) Wait for a pullback

3) Make sure the pullback isn't a reversal

4) Enter using a responsible strategy

This thread will explain these 4 steps and give you some extra tips to help you make money💰

Before we start...

MAKE SURE YOU SHOW THIS THREAD SOME LOVE

I created this thread for you guys & now I'm posting it for FREE. Go ❤️ the top post

MAKE SURE YOU SHOW THIS THREAD SOME LOVE

I created this thread for you guys & now I'm posting it for FREE. Go ❤️ the top post

What Timeframe??

This strategy works on all timeframes. I use it to day trade, swing trade, futures trade, options trade, etc

1 min, 5 min, 10 min, hourly, daily, weekly, etc

This strategy works on all timeframes. I use it to day trade, swing trade, futures trade, options trade, etc

1 min, 5 min, 10 min, hourly, daily, weekly, etc

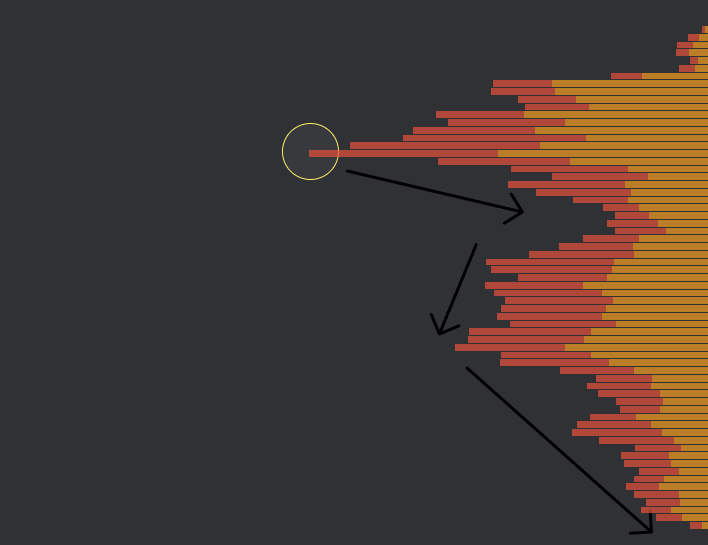

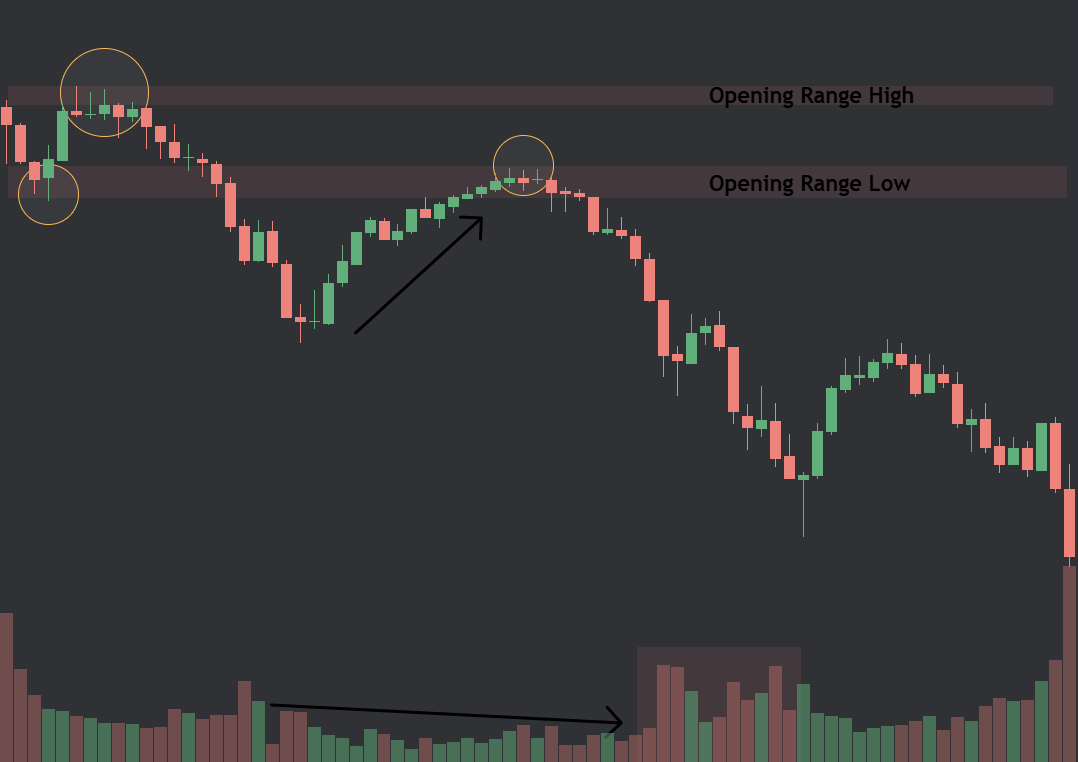

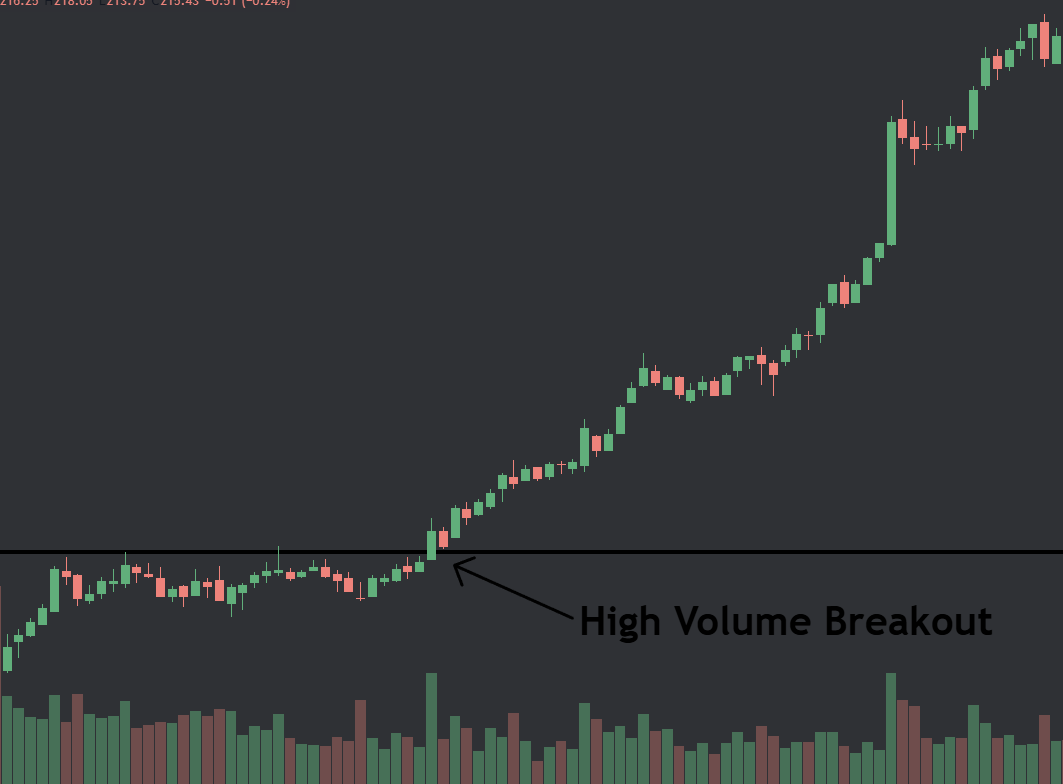

Finding Strong Trends

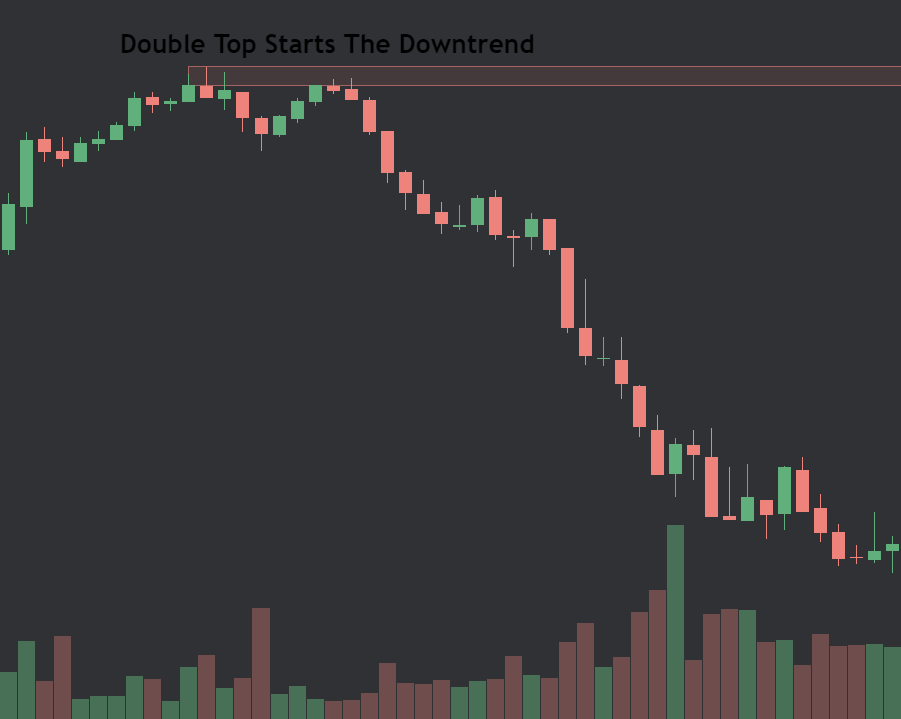

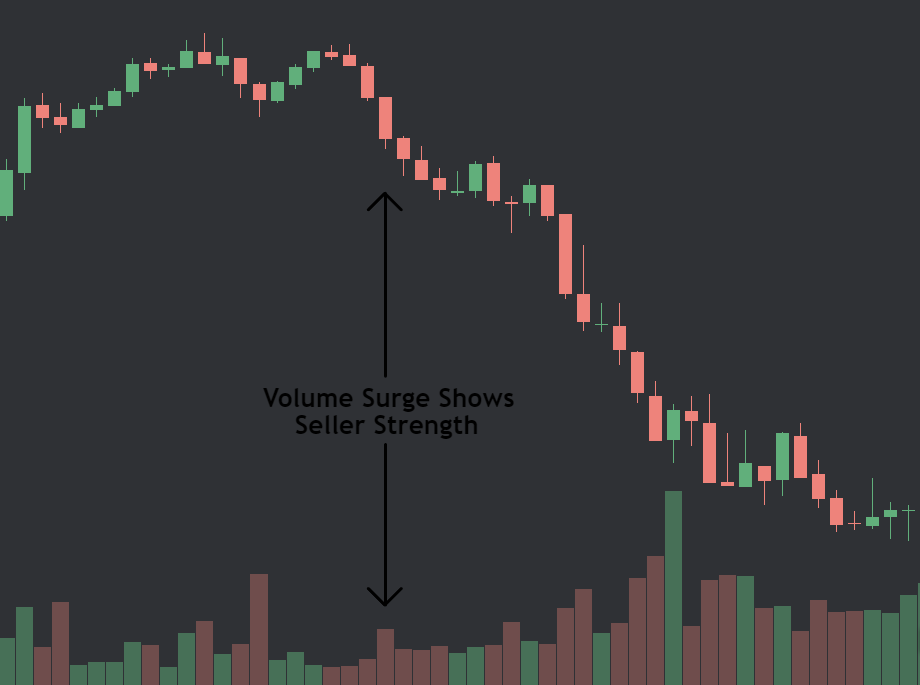

Our trend needs a setup that STARTS the trend & volume support

In this example, our downtrend starts with a double top and shows seller strength with a volume surge + strong red candle

Our trend needs a setup that STARTS the trend & volume support

In this example, our downtrend starts with a double top and shows seller strength with a volume surge + strong red candle

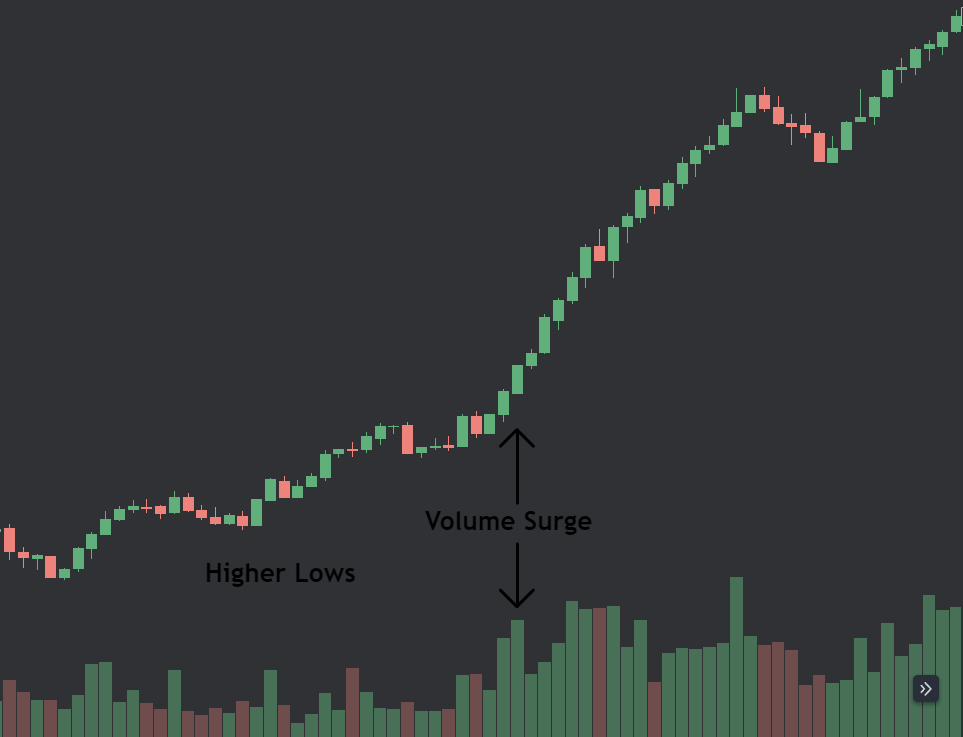

Strong Trend Examples

Notice how both of these examples start with a setup and are confirmed using volume

Notice how both of these examples start with a setup and are confirmed using volume

Wait For A Pullback

This part is simple. Don't mess it up. Chasing a trend without a pullback is dumb. Don't be dumb

WAIT FOR A FUCKING PULLBACK

This part is simple. Don't mess it up. Chasing a trend without a pullback is dumb. Don't be dumb

WAIT FOR A FUCKING PULLBACK

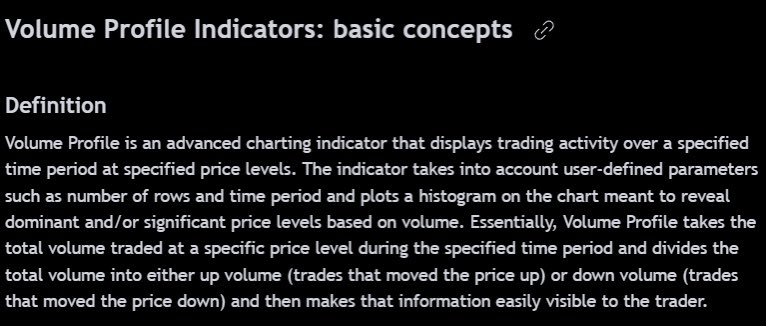

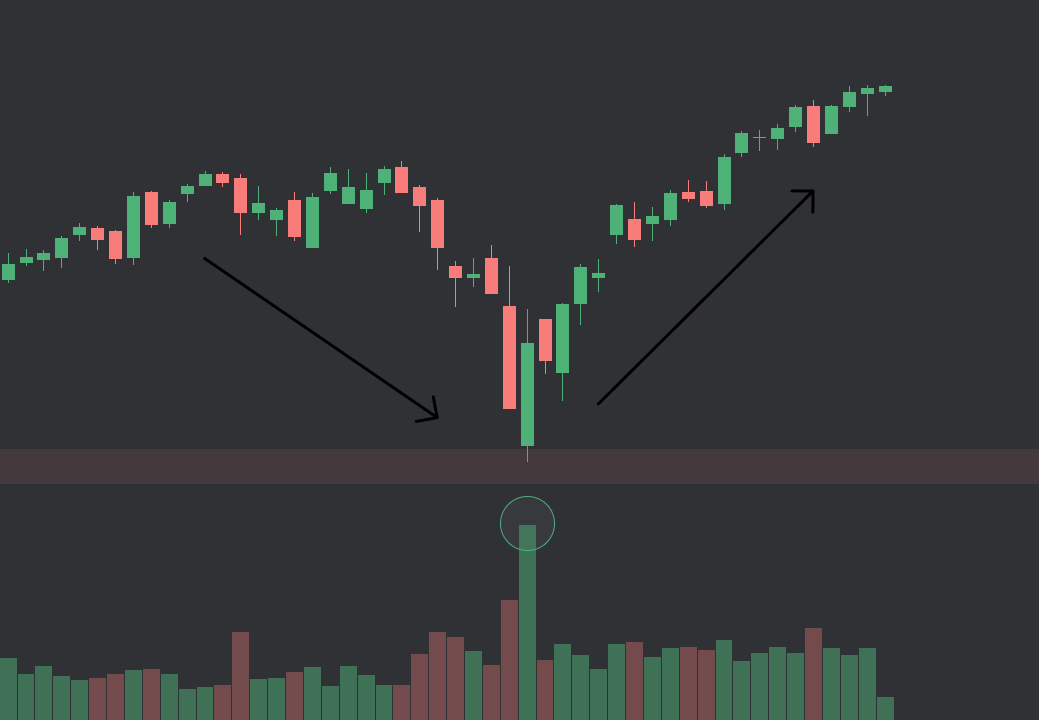

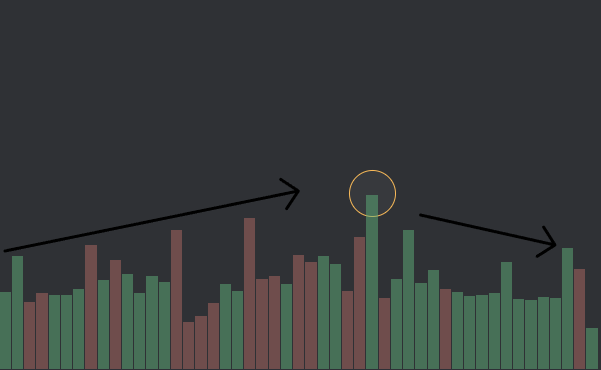

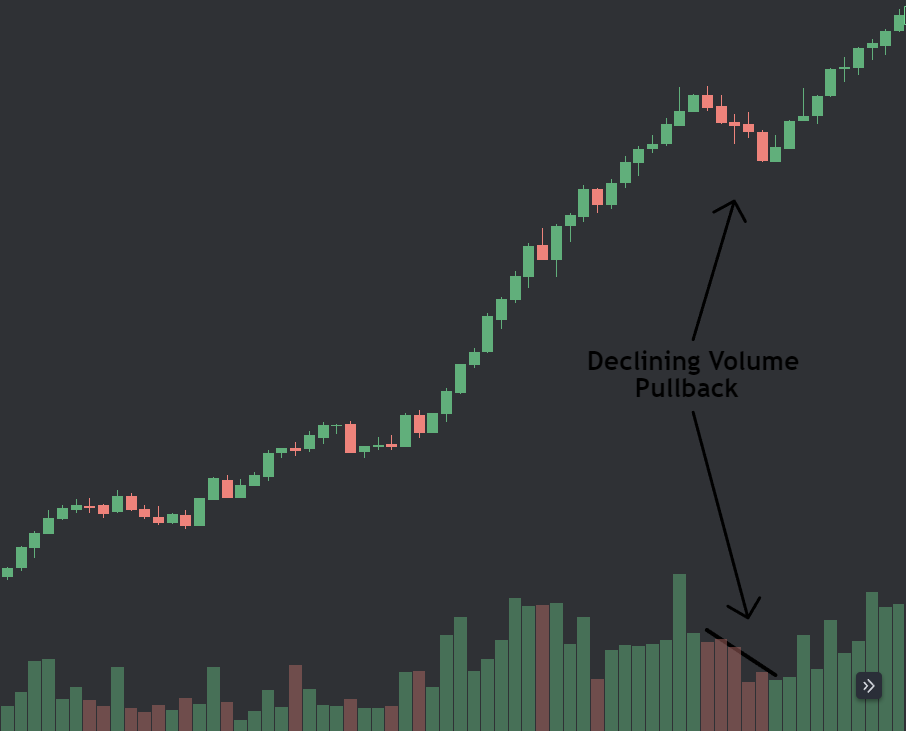

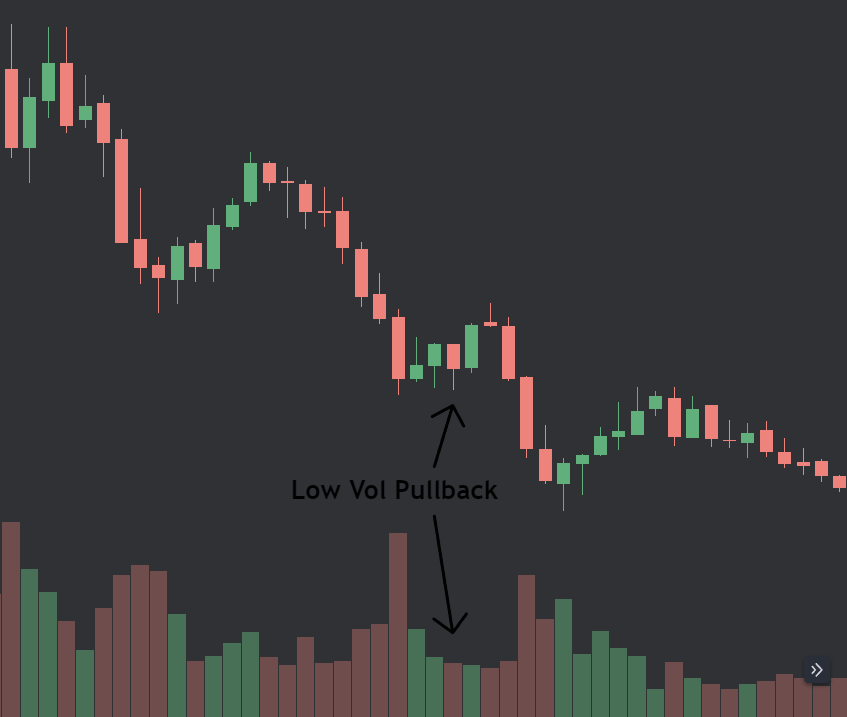

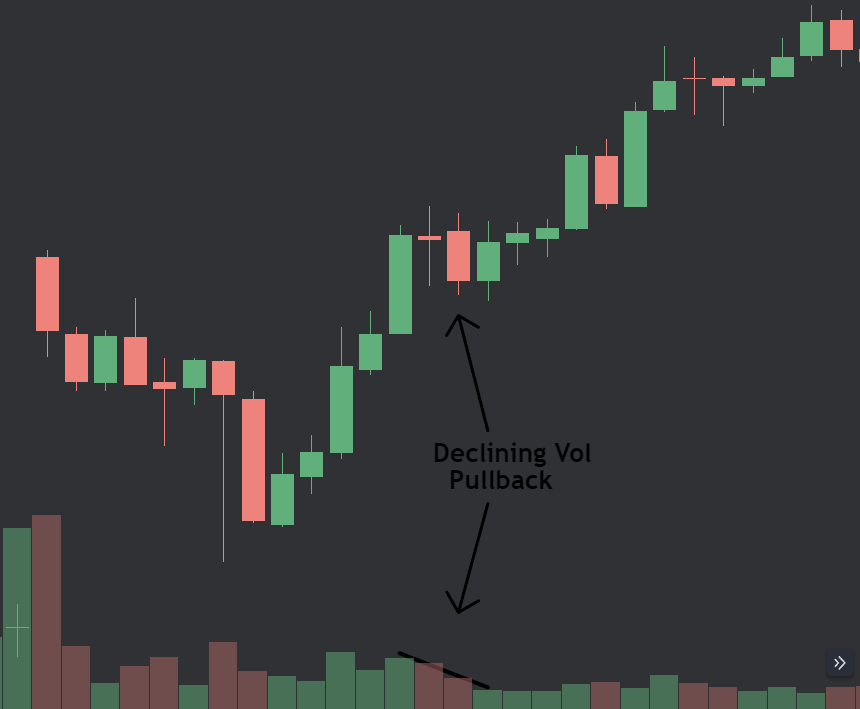

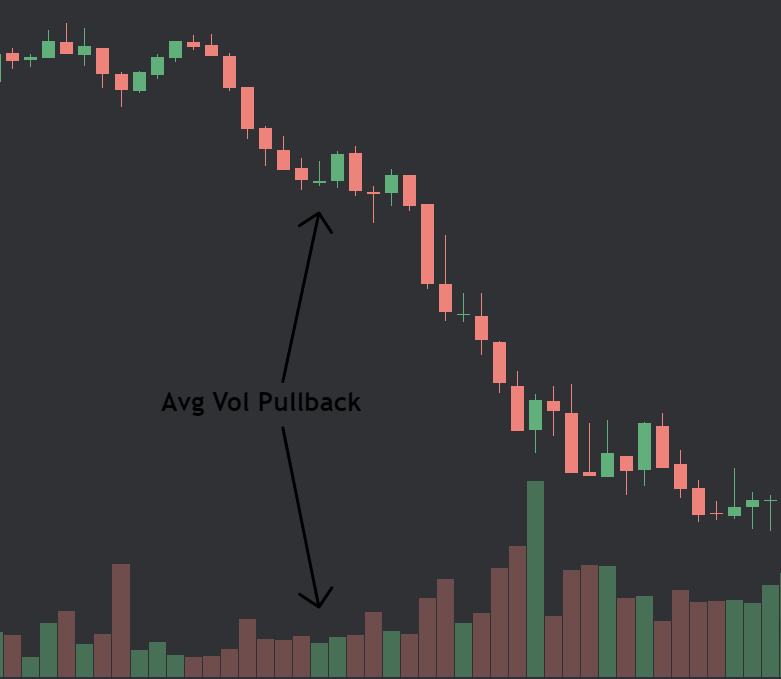

Analyzing The Pullback

I prefer my pullbacks to be LOWER VOLUME than the trend. The trend should show strength, the pullback should show weakness

High volume 'pullbacks' are often reversals. It signals strength AGAINST our trend, which we don't want to see

I prefer my pullbacks to be LOWER VOLUME than the trend. The trend should show strength, the pullback should show weakness

High volume 'pullbacks' are often reversals. It signals strength AGAINST our trend, which we don't want to see

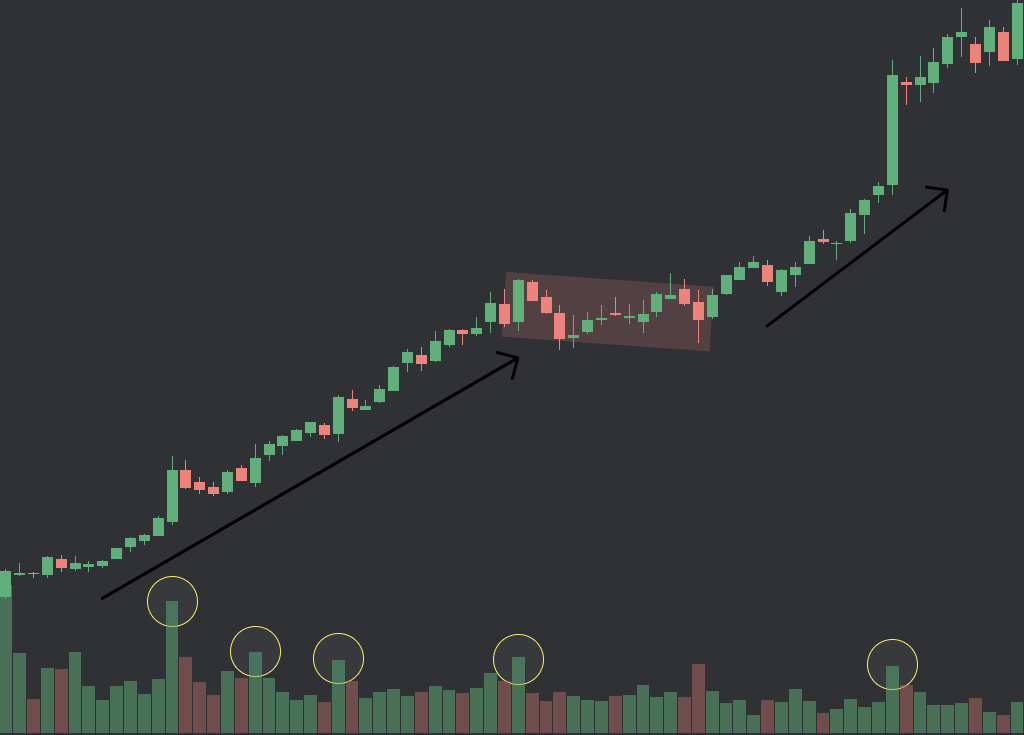

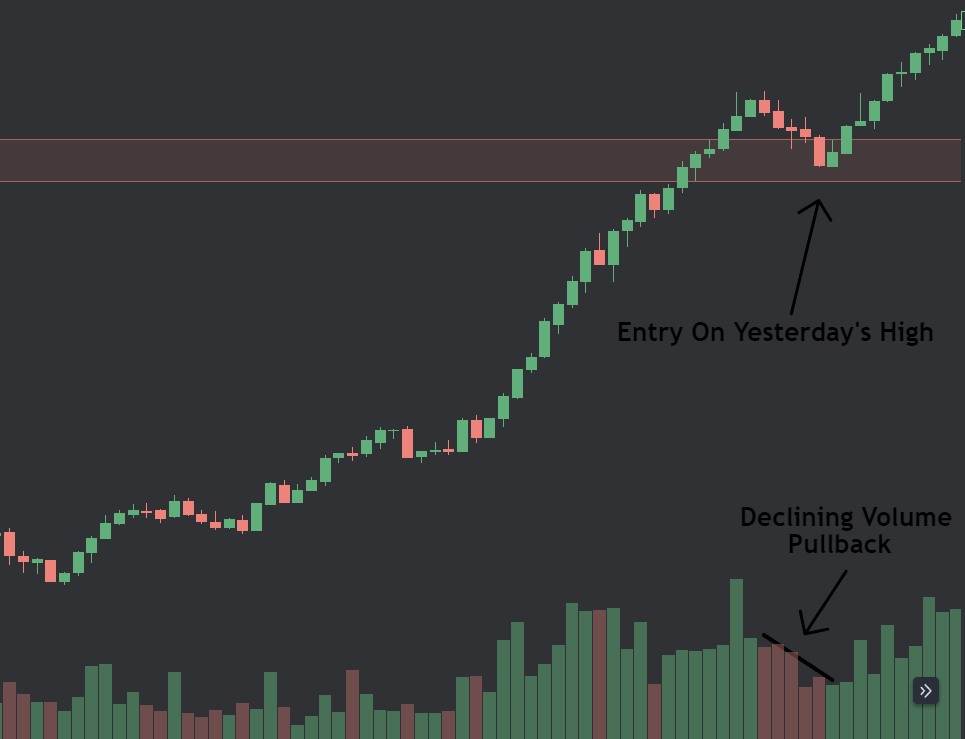

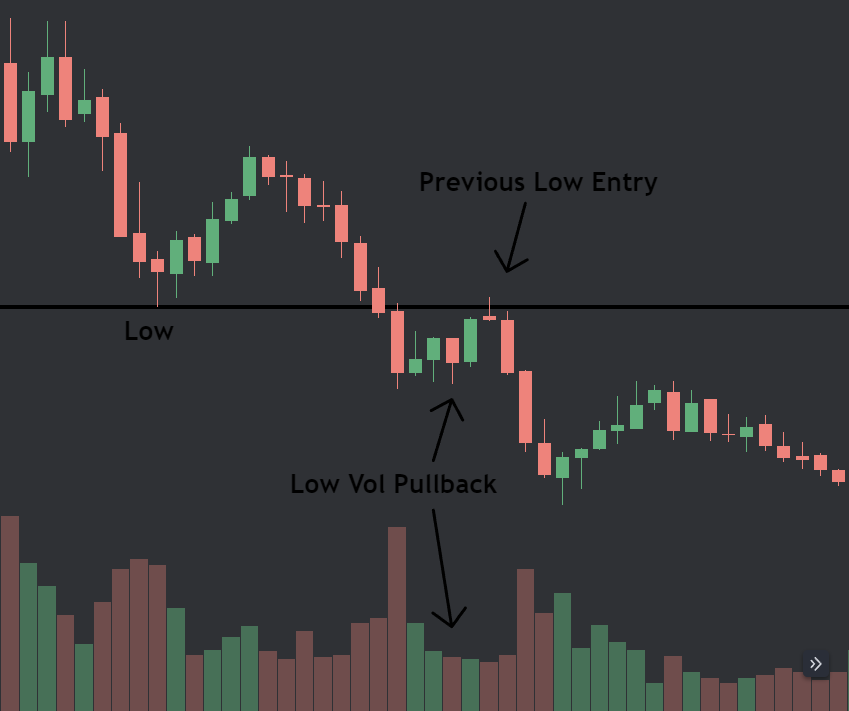

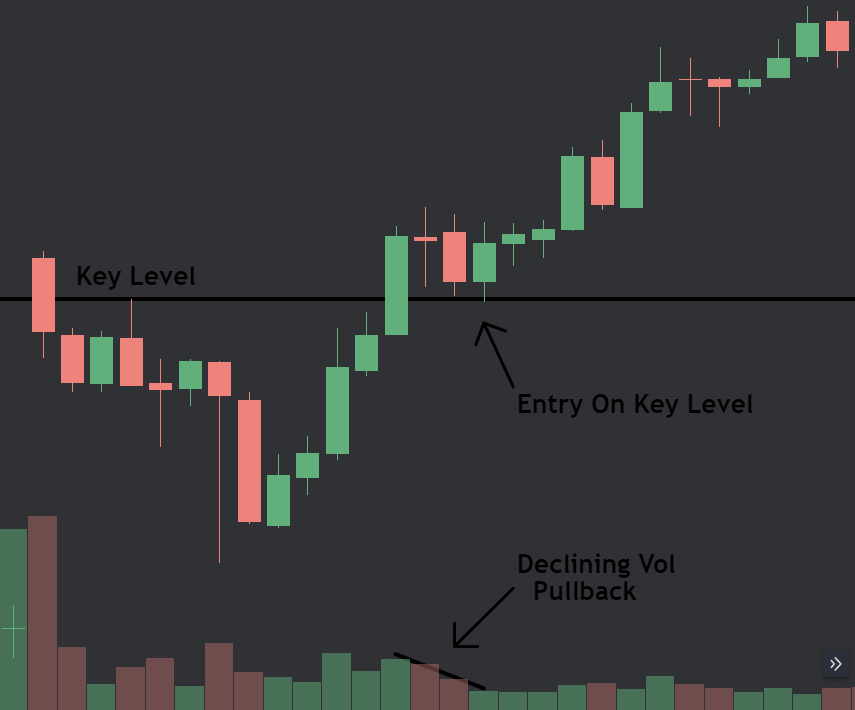

Pullback Examples

Notice how NONE of these pullbacks show any sort of strength. They are all avg volume or less. These are GOOD pullbacks to enter on

Notice how NONE of these pullbacks show any sort of strength. They are all avg volume or less. These are GOOD pullbacks to enter on

Enter Using A Responsible Strategy

9ema, key levels, previous high/low, 200ma etc

Strong trend + low volume pullback + entry using another indicator

9ema, key levels, previous high/low, 200ma etc

Strong trend + low volume pullback + entry using another indicator

Average/low volume pullbacks are the entry

Average/low volume pullbacks are the entry

Average/low volume pullbacks are the entry

Average/low volume pullbacks are the entry

Average/low volume pullbacks are the entry

1) Strong trend supported by volume

2) Average/Lower volume pullback

3) Pullback touches key level/indicator

4) Enter

No setup will work every time, but this one works a lot more than it fails

2) Average/Lower volume pullback

3) Pullback touches key level/indicator

4) Enter

No setup will work every time, but this one works a lot more than it fails

Final thoughts

-Strong trends won't happen every day

-Be patient & wait for the pullback

-Use your favorite indicator/strategy to help with entry

-Strong trend & weak pullback

-Don't overcomplicate it

-Strong trends won't happen every day

-Be patient & wait for the pullback

-Use your favorite indicator/strategy to help with entry

-Strong trend & weak pullback

-Don't overcomplicate it

LISTEN THE F*** UP

I post scalp setups, options swing setups, and other good stuff for my subs here on X

Hit the pink button in my bio & join the gang

I post scalp setups, options swing setups, and other good stuff for my subs here on X

Hit the pink button in my bio & join the gang

GREAT JOB READING THIS ENTIRE THREAD

Now go ride some trends and change your life

Now go ride some trends and change your life

• • •

Missing some Tweet in this thread? You can try to

force a refresh