Trump just obliterated several multi-billion-dollar Indian staffing companies.

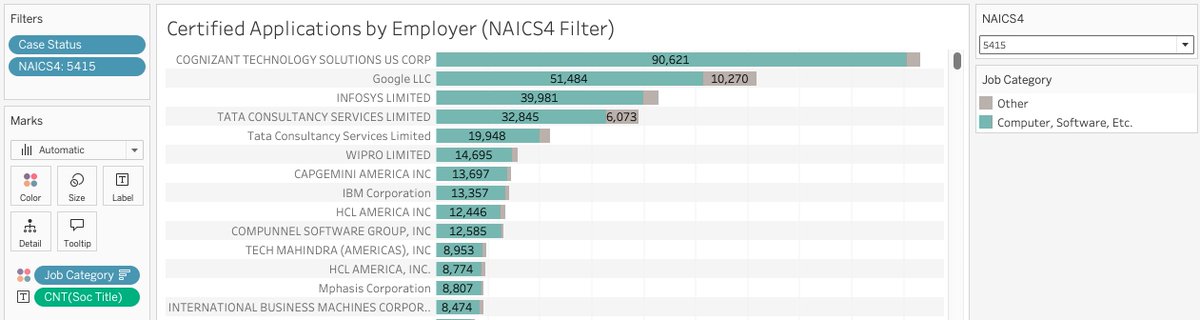

Many H-1B workers are hired via IT consulting and contracting companies, not directly by businesses. And these companies have big market caps:

Cognizant: $34B

Infosys: $70B

Tata Consultancy: $130B

Wipro: $30B

HCL: $45B

Tech Mahindra: $15B

For companies like this, $100k annual fees simply don’t work. Most of these workers are paid $90-110k (I’ll post the data and link to my previous thread in the next post), so the $100k fee doubles the cost of the worker and destroys the staffing companies margins.

Seeing the market respond on Monday is going to be really interesting. Yesterday probably would have been a great time to take out short positions.

Many H-1B workers are hired via IT consulting and contracting companies, not directly by businesses. And these companies have big market caps:

Cognizant: $34B

Infosys: $70B

Tata Consultancy: $130B

Wipro: $30B

HCL: $45B

Tech Mahindra: $15B

For companies like this, $100k annual fees simply don’t work. Most of these workers are paid $90-110k (I’ll post the data and link to my previous thread in the next post), so the $100k fee doubles the cost of the worker and destroys the staffing companies margins.

Seeing the market respond on Monday is going to be really interesting. Yesterday probably would have been a great time to take out short positions.

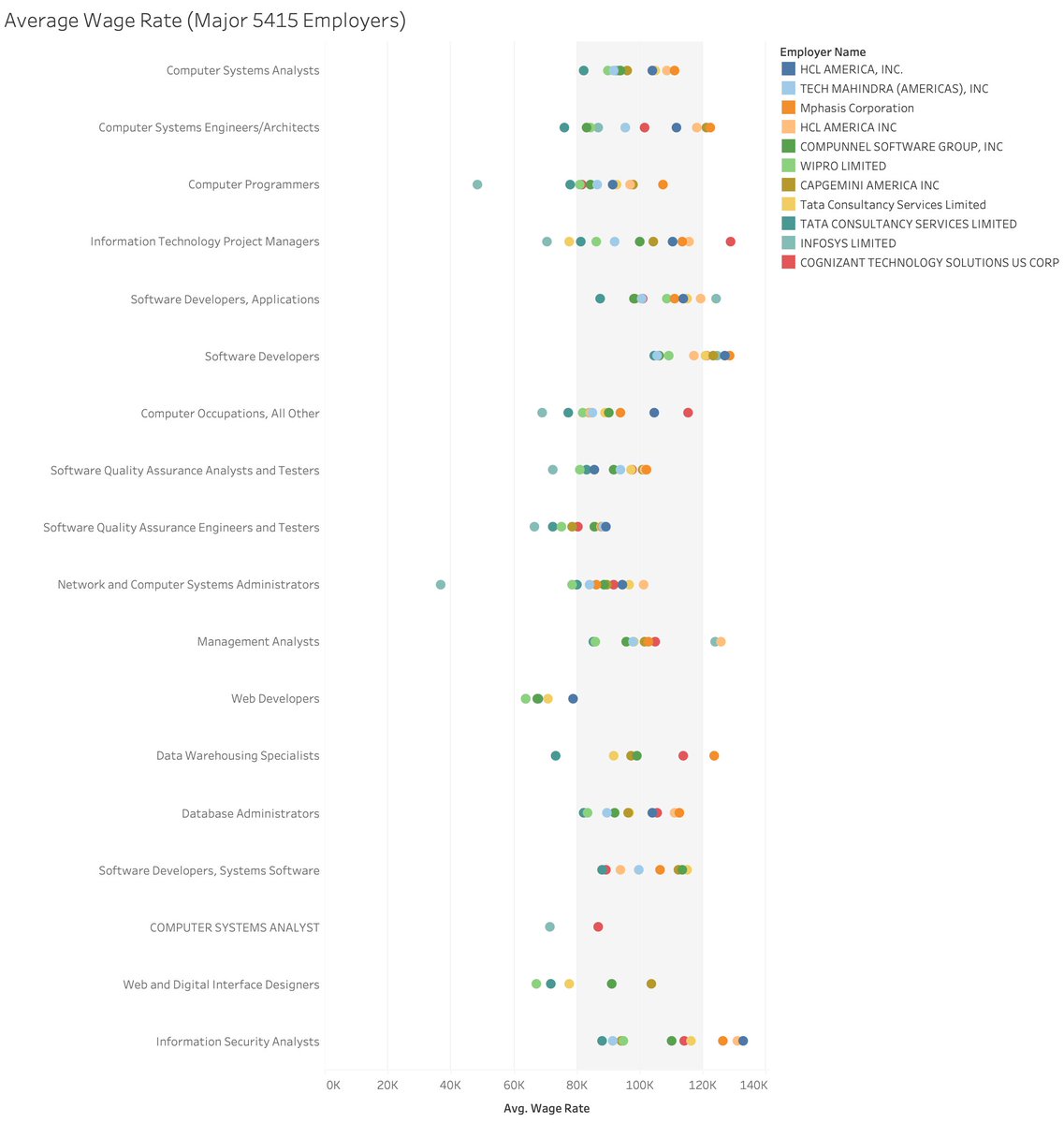

Here's the salary data for these roles. You can see that the average salaries for each role and each company are generally in the shaded $80-120k band.

Here's my thread from December providing a more extensive breakdown of H-1B applications:

https://x.com/RobertMSterling/status/1873174358535110953

• • •

Missing some Tweet in this thread? You can try to

force a refresh