Speaker 1: Samit Vartak, Founder SageOne Investment Managers @SamitVartak @sageone

Equity market cycles and current small cap cycle: landmine or goldmine?

In the last few years even 25% returns seems to be disappointing for most, yet one has to realise such returns don't come without risk. Risk can be of timing, valuations or just things not working out. Right now expectations are high - so highly probable you'll get disappointed.

Some context..

Equity market cycles and current small cap cycle: landmine or goldmine?

In the last few years even 25% returns seems to be disappointing for most, yet one has to realise such returns don't come without risk. Risk can be of timing, valuations or just things not working out. Right now expectations are high - so highly probable you'll get disappointed.

Some context..

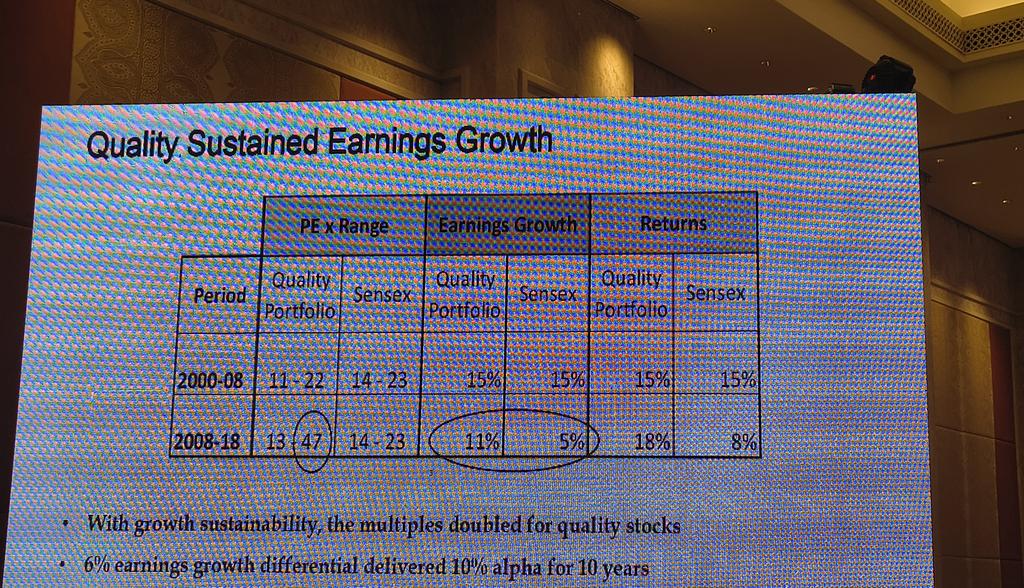

Take 2 buckets - quality portfolio and the Sensex.

A quality stock is one which sustains high ROCE over a long time.

In 2000-08, quality portfolio vs sensex had similar PE, earnings and returns.

In 2008-18, quality portfolio PE jumped, sensex remained the same. However earnings growth for quality portfolio was 2x sensex. That's why quality PF got 18% returns vs 8% for sensex.

Why did this happen?

• Migration to growth because overall growth slowed down

A quality stock is one which sustains high ROCE over a long time.

In 2000-08, quality portfolio vs sensex had similar PE, earnings and returns.

In 2008-18, quality portfolio PE jumped, sensex remained the same. However earnings growth for quality portfolio was 2x sensex. That's why quality PF got 18% returns vs 8% for sensex.

Why did this happen?

• Migration to growth because overall growth slowed down

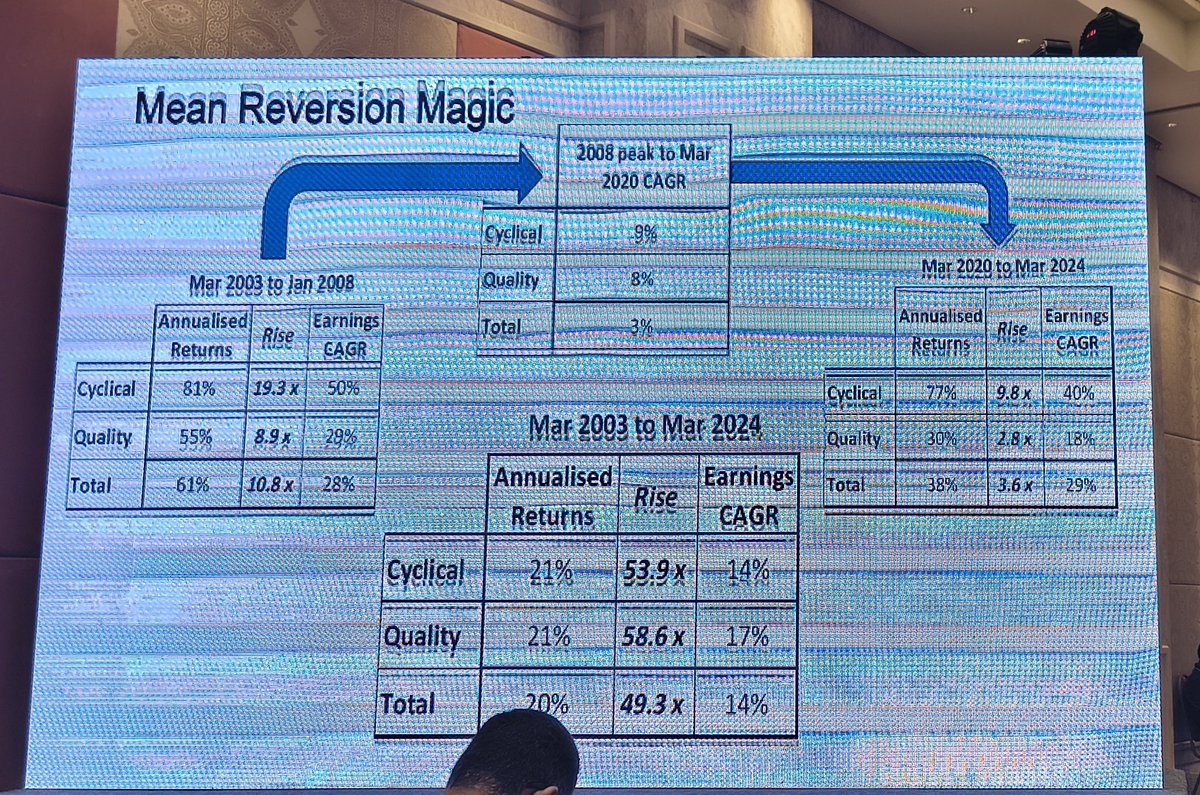

In each bull and bear market cycle, there is a difference in quality vs cyclicals. In one phase, cyclicals outperformed, in others quality outperformed. In the last 4 years, cyclicals are up 10x vs 3x for quality.

Yet they revert to the mean over the long run.

The issue is, the average investor isn't ahead of the trend and is jumping around.. sometimes he gets caught up at the wrong time.

Yet they revert to the mean over the long run.

The issue is, the average investor isn't ahead of the trend and is jumping around.. sometimes he gets caught up at the wrong time.

Nifty Small 100 follows a boom and bust cycle. Past cycles have seen a 25-40% fall. Are you prepared to see such a fall today?

Generally the fall is triggered at the economy, banking and market level.

Last few falls has not been as bad as the 2008 and 2020 fall. The difference in fall between nifty and small cap has also been lower.

Generally cycles are for 32 months - 12 months downcycle (42% drop) for a 20 month upcycle (2.5x average uprise).

It's scary because to recover a 40% fall, you need to rise by 70%.

Generally the fall is triggered at the economy, banking and market level.

Last few falls has not been as bad as the 2008 and 2020 fall. The difference in fall between nifty and small cap has also been lower.

Generally cycles are for 32 months - 12 months downcycle (42% drop) for a 20 month upcycle (2.5x average uprise).

It's scary because to recover a 40% fall, you need to rise by 70%.

Last 3 years, small caps have done better than sensex - 2021 to 2025 - extraordinary.

However from 2005 to 2020, sensex outperformed the BSE Mid and Small index in 11 out of 15 years on a rolling basis. Even those 4 years has a marginal outperformance by Mid and Small Index.

Only in 2021 to 2025 has the MidSmall Index done far better than Sensex.

We must tone down our return expectations.

However from 2005 to 2020, sensex outperformed the BSE Mid and Small index in 11 out of 15 years on a rolling basis. Even those 4 years has a marginal outperformance by Mid and Small Index.

Only in 2021 to 2025 has the MidSmall Index done far better than Sensex.

We must tone down our return expectations.

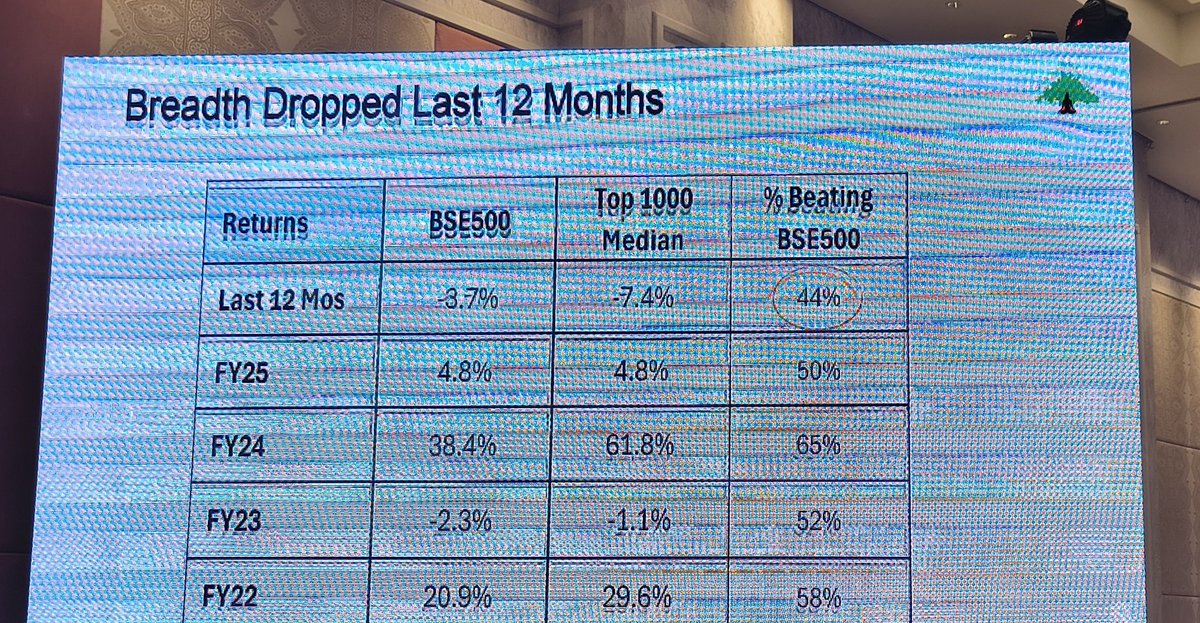

Breadth of successes has dropped in the last 12 months.

% of stocks beating the sensex has been dropping. It was above 50% from 2021 to 2025. In the last 12 months, it's 44%.

Surely the momentum that lasted in 5 years, we can't expect it to continue.

% of stocks beating the sensex has been dropping. It was above 50% from 2021 to 2025. In the last 12 months, it's 44%.

Surely the momentum that lasted in 5 years, we can't expect it to continue.

Small cap valuations have caught up with large caps. There is valuation discomfort hence

Large cap has 3 buckets - PSU, Banking and rest of the universe.

PSU make up for 35% profits of the large caps. Trade at 7-9x multiple.

Banking makes 17%. Trade at 15x.

Smallcaps don't have both these buckets, so ideally we must compare non banking non PSU of large and small caps. In this context, the difference between large and small caps still remain.

Large cap has 3 buckets - PSU, Banking and rest of the universe.

PSU make up for 35% profits of the large caps. Trade at 7-9x multiple.

Banking makes 17%. Trade at 15x.

Smallcaps don't have both these buckets, so ideally we must compare non banking non PSU of large and small caps. In this context, the difference between large and small caps still remain.

You may ask, why have small caps not corrected yet? Is there a structural shift?

Median debt to equity ratio i.e leverage in small caps has vanished. It was 0.62 in 2008 - 0.26 in 2018 - 0.13 in September 2025.

So the cashflow growth in mid and small cap space has been great - the working capital days is lowest ever and the leverage is an indication of that.

If we see the EV / CFO, it was 26x in 2008, 22x in 2018 and 22x today. The interest rates are 6.5% today and cash flow yields are 4.4%, so a 2% difference.

Median debt to equity ratio i.e leverage in small caps has vanished. It was 0.62 in 2008 - 0.26 in 2018 - 0.13 in September 2025.

So the cashflow growth in mid and small cap space has been great - the working capital days is lowest ever and the leverage is an indication of that.

If we see the EV / CFO, it was 26x in 2008, 22x in 2018 and 22x today. The interest rates are 6.5% today and cash flow yields are 4.4%, so a 2% difference.

There is a structural reason for small caps doing well. There is a huge change in the quality of balance sheets for small caps.

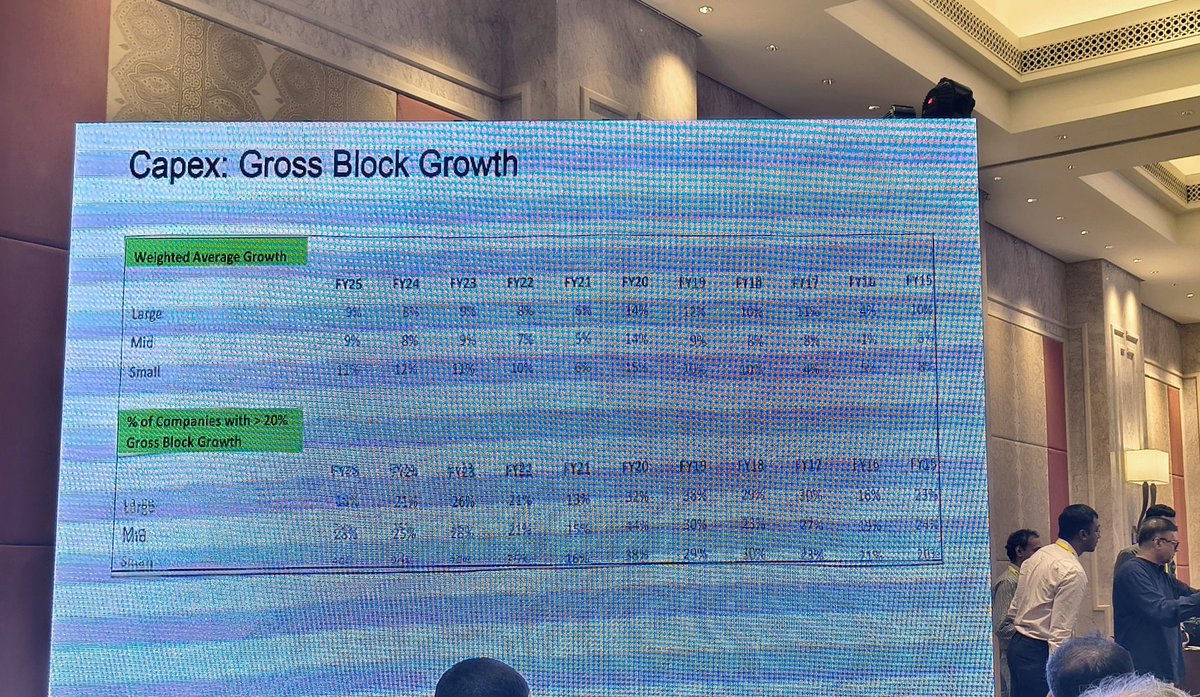

The best companies are those growing gross block by 20%+ - these will deliver growth. So % of companies growing gross block > 20%, large caps is lowest at 18%. So only 18% of large cap companies are growing gross block by 20%. 30% of small caps are growing gross block by 20%.

At macro levels, we don't see much of a difference between large caps have larger weight in headline numbers.

But there are hundreds of small companies doubling gross block.

The best companies are those growing gross block by 20%+ - these will deliver growth. So % of companies growing gross block > 20%, large caps is lowest at 18%. So only 18% of large cap companies are growing gross block by 20%. 30% of small caps are growing gross block by 20%.

At macro levels, we don't see much of a difference between large caps have larger weight in headline numbers.

But there are hundreds of small companies doubling gross block.

Stillness vs Speed

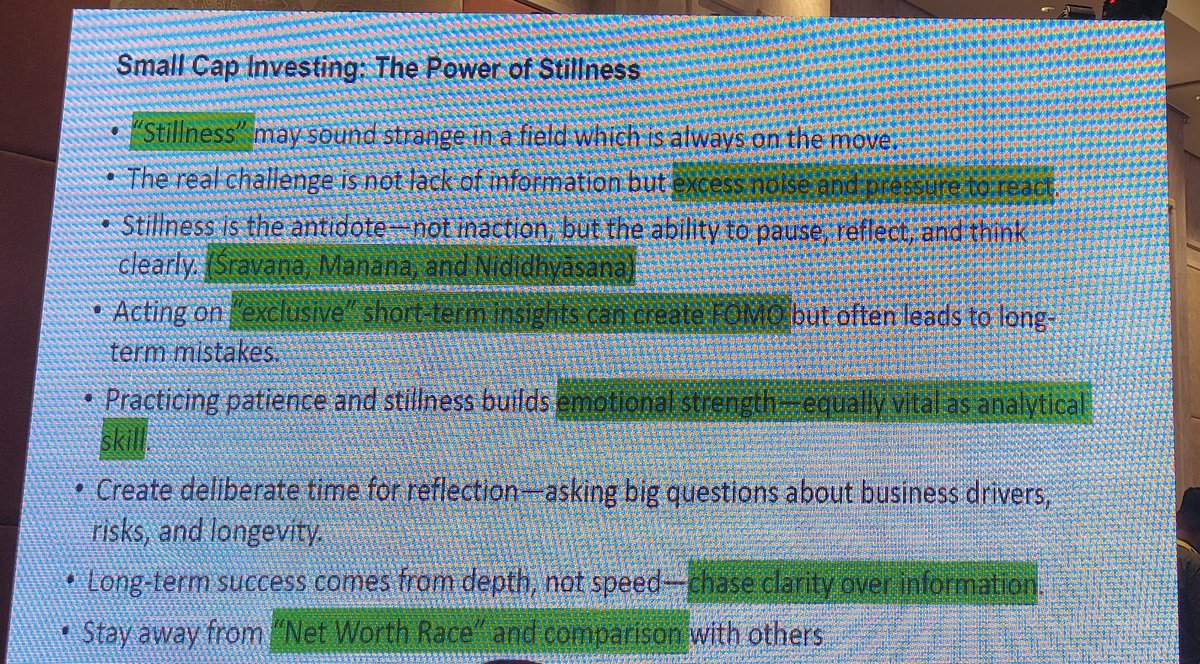

As a fund manager, small caps are stressful.

The level of data available is much lower for small caps.

So one needs to be careful of operators, manipulators, FOMO.

Mistake is to think smallcap requires fast action. The small cap universe is made for you to act fast. But that's a trap.

As a fund manager, small caps are stressful.

The level of data available is much lower for small caps.

So one needs to be careful of operators, manipulators, FOMO.

Mistake is to think smallcap requires fast action. The small cap universe is made for you to act fast. But that's a trap.

In small caps - most of the time as soon as you act fast based on fomo or borrowed conviction, the stock becomes a dud in your portfolio.

You need to act slow. Reflect on it.

Sravana - gathering knowledge / data. Here the right data is also important: there is data overload.

Manana - reflect on it; question the claims

Nidhidhyasana - maintaining your portfolio.

If you jump from Sravana to Nidhidhyasana without Manana, then it is terminal.

This pattern is common in bull markets.

You need to act slow. Reflect on it.

Sravana - gathering knowledge / data. Here the right data is also important: there is data overload.

Manana - reflect on it; question the claims

Nidhidhyasana - maintaining your portfolio.

If you jump from Sravana to Nidhidhyasana without Manana, then it is terminal.

This pattern is common in bull markets.

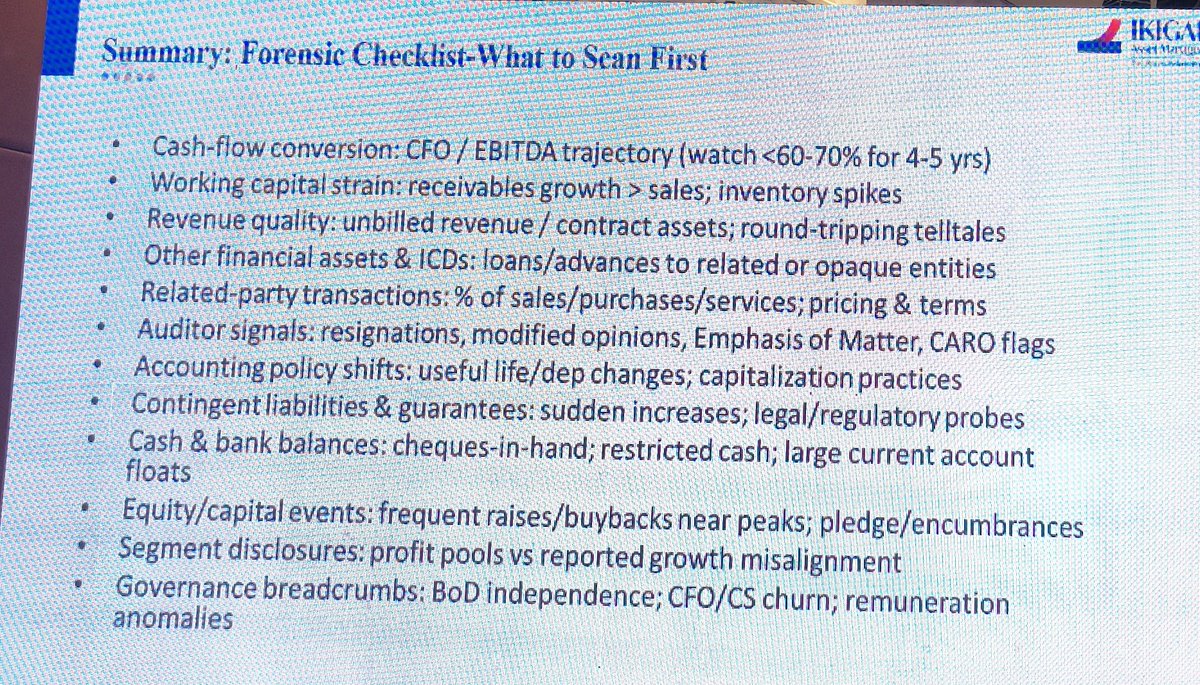

Speaker 2: Pankaj Tibrewal @pankajtibre @Ikigai_fund

Practitioners Insights: Forensic Accounting

3 years back, I was at this forum. At that time we discussed that over the last 24 years, broader markets - how to choose companies to compound your wealth?

Today we'll see how not to choose.

We're at a sideways market and people are starting to get frustrated. This is the time the skeletons usually get out.

Practitioners Insights: Forensic Accounting

3 years back, I was at this forum. At that time we discussed that over the last 24 years, broader markets - how to choose companies to compound your wealth?

Today we'll see how not to choose.

We're at a sideways market and people are starting to get frustrated. This is the time the skeletons usually get out.

There was a time, where I was under pressure for filtering companies having accounting, forensic issues..

2017, skeletons started coming out.. ILFS DHFL etc.

Teji mai paisa banata hai, mandi me fund manager ijjat banata hai.

I see a similar phase today.

2017, skeletons started coming out.. ILFS DHFL etc.

Teji mai paisa banata hai, mandi me fund manager ijjat banata hai.

I see a similar phase today.

@pankajtibre @Ikigai_fund If you can get the beauty of the balance sheet - that is every debit has a credit, you can ask better questions.

For every inflated profit, you'll see inflated assets soon.

For every inflated profit, you'll see inflated assets soon.

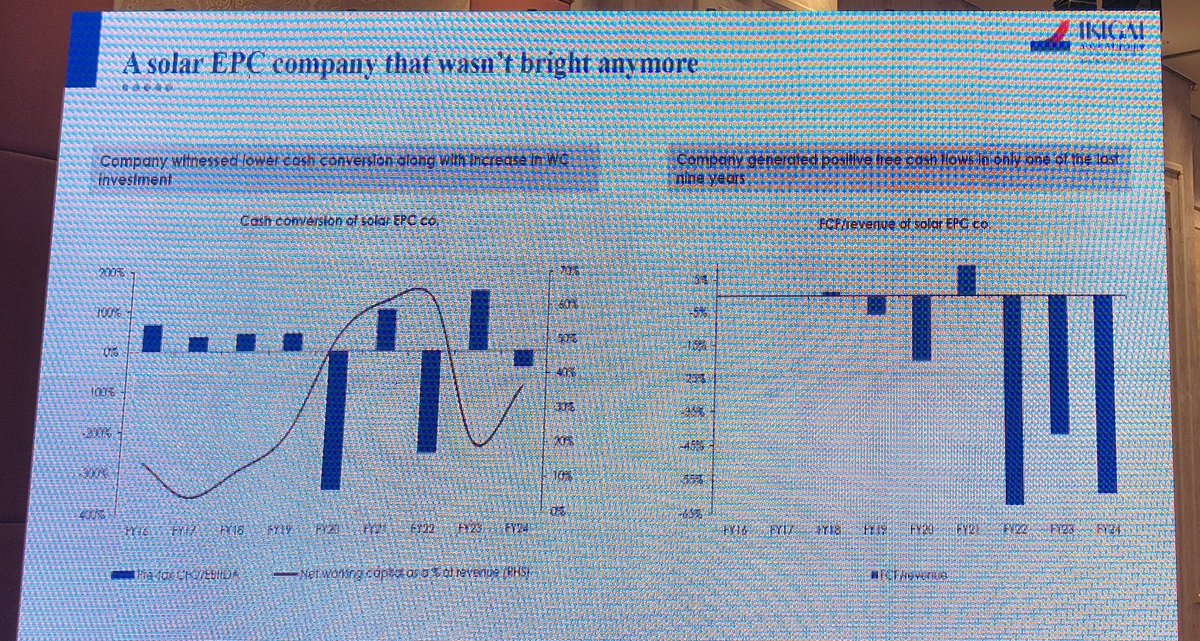

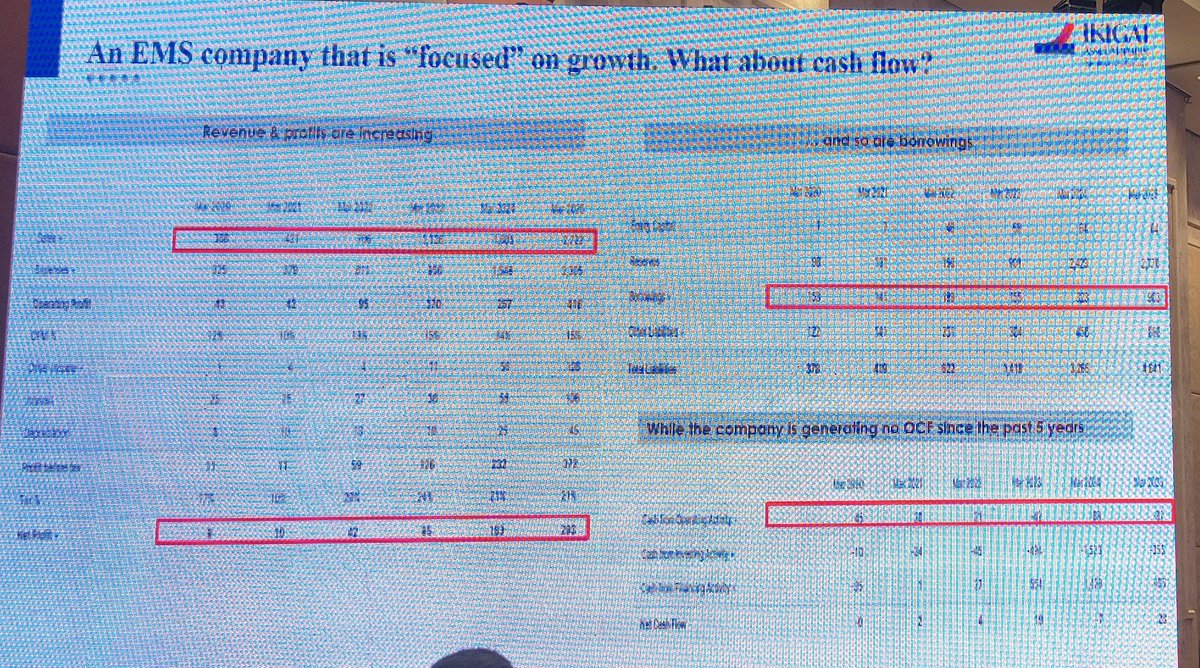

@pankajtibre @Ikigai_fund Create boundaries for yourself - define which metrics your companies have to pass on.

For ikigai, cash flow is king. We want 60-70% ebitda to cashflow conversion.

For ikigai, cash flow is king. We want 60-70% ebitda to cashflow conversion.

Aggressive accounting and pilferage

Today's environment is of IPOs.

Data points show that profits are rising before the IPO, but cash flow suffers. After listing, revenues and profits fall, but cash flow improves. Yet people get disappointed because what was promised in the roadshow..

Today, 1/3rd of upcoming IPOs don't have cash conversion of even 40%.

Sales are being pushed to show profits.

Today's environment is of IPOs.

Data points show that profits are rising before the IPO, but cash flow suffers. After listing, revenues and profits fall, but cash flow improves. Yet people get disappointed because what was promised in the roadshow..

Today, 1/3rd of upcoming IPOs don't have cash conversion of even 40%.

Sales are being pushed to show profits.

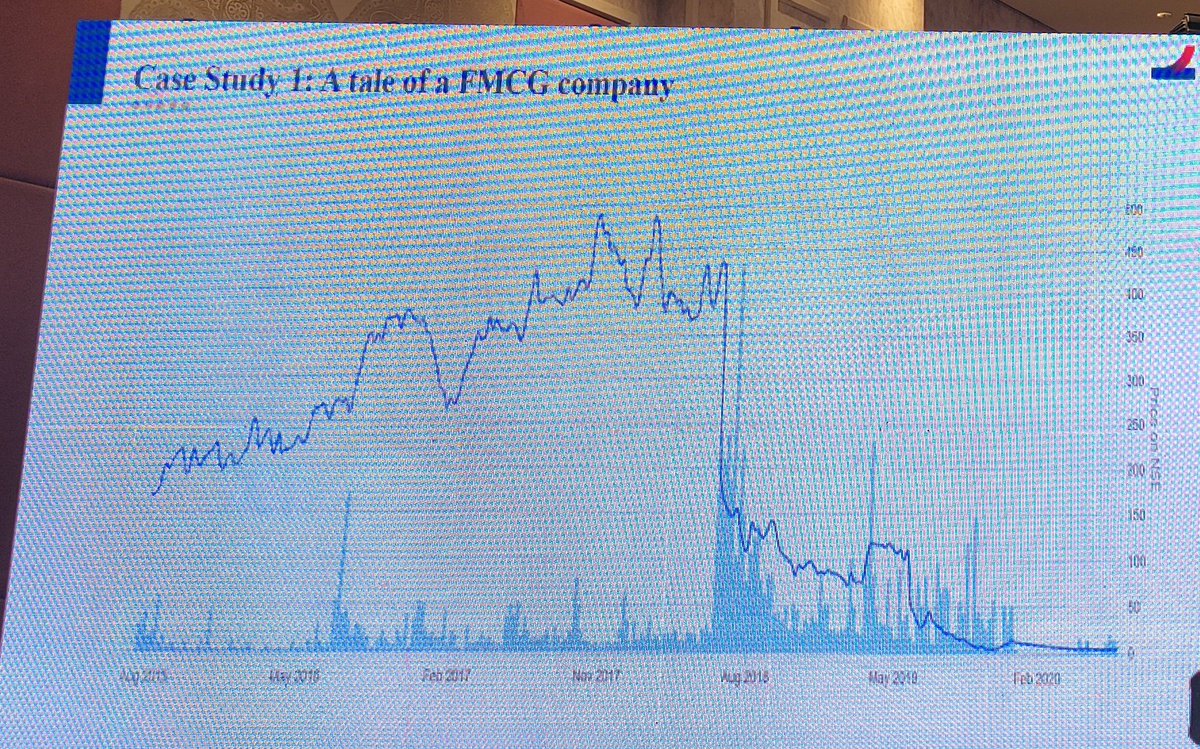

Case study: FMCG co

Was called Coca Cola of India.

Lot of investors went behind this stock.

Profit grew from 6 crores to 100 crores.

But cashflow conversion was just 36% over 7 years.

Another metric was net sales to gross block was falling from 2.8 in 2014 to 0.7 in 2019.

We did channel checks and found fake invoices. In 2019, ILFS and Yes Bank happened, liquidity dried up and the company suffered..

Was called Coca Cola of India.

Lot of investors went behind this stock.

Profit grew from 6 crores to 100 crores.

But cashflow conversion was just 36% over 7 years.

Another metric was net sales to gross block was falling from 2.8 in 2014 to 0.7 in 2019.

We did channel checks and found fake invoices. In 2019, ILFS and Yes Bank happened, liquidity dried up and the company suffered..

Case study: FMCG co

Was called Coca Cola of India.

Lot of investors went behind this stock.

Profit grew from 6 crores to 100 crores.

But cashflow conversion was just 36% over 7 years.

Another metric was net sales to gross block was falling from 2.8 in 2014 to 0.7 in 2019.

We did channel checks and found fake invoices. In 2019, ILFS and Yes Bank happened, liquidity dried up and the company suffered..

Was called Coca Cola of India.

Lot of investors went behind this stock.

Profit grew from 6 crores to 100 crores.

But cashflow conversion was just 36% over 7 years.

Another metric was net sales to gross block was falling from 2.8 in 2014 to 0.7 in 2019.

We did channel checks and found fake invoices. In 2019, ILFS and Yes Bank happened, liquidity dried up and the company suffered..

Case study 2: Digital Company

Darlings from Rs. 10 to Rs. 900. Smart investors bought in.

But when we looked again the same issue.

Profit went from 3.5 crores to 200 crores.

But cash flow conversion was pathetic over many years.

Approx 11-12% of expenses were unclassified.

Working capital days were more than peers.

In many cases, there is a difference between BSE reporting and investor presentation!

Darlings from Rs. 10 to Rs. 900. Smart investors bought in.

But when we looked again the same issue.

Profit went from 3.5 crores to 200 crores.

But cash flow conversion was pathetic over many years.

Approx 11-12% of expenses were unclassified.

Working capital days were more than peers.

In many cases, there is a difference between BSE reporting and investor presentation!

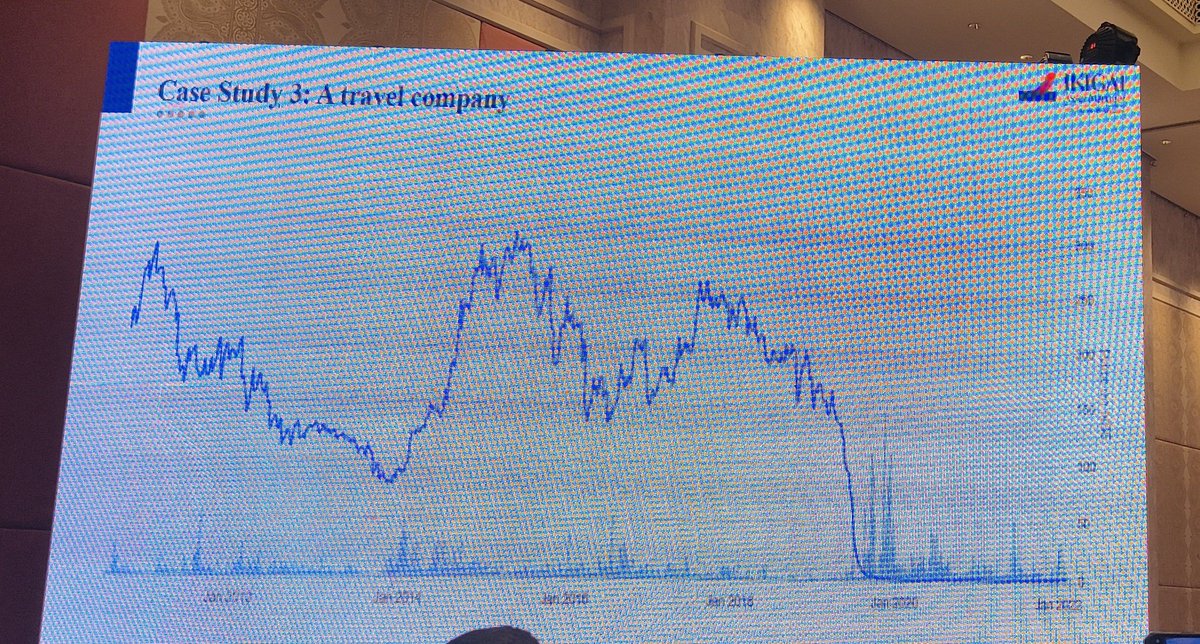

@pankajtibre @Ikigai_fund Case 3: Travel Company

Revenue and profits jumped over 10 years.

Cash flow conversion was just 20%. They were growing at the expense of working capital.

Almost all incremental sales went into receivables.

Slowdown happened, capital became scarce and result: co went into NCLT.

Revenue and profits jumped over 10 years.

Cash flow conversion was just 20%. They were growing at the expense of working capital.

Almost all incremental sales went into receivables.

Slowdown happened, capital became scarce and result: co went into NCLT.

@pankajtibre @Ikigai_fund Case 4: Jewelry company

Working capital as a % of net revenues went to 65%+.

When such things happen, you have to ask stern questions.

Identifying such problems early on helps to get out of the train early.

Working capital as a % of net revenues went to 65%+.

When such things happen, you have to ask stern questions.

Identifying such problems early on helps to get out of the train early.

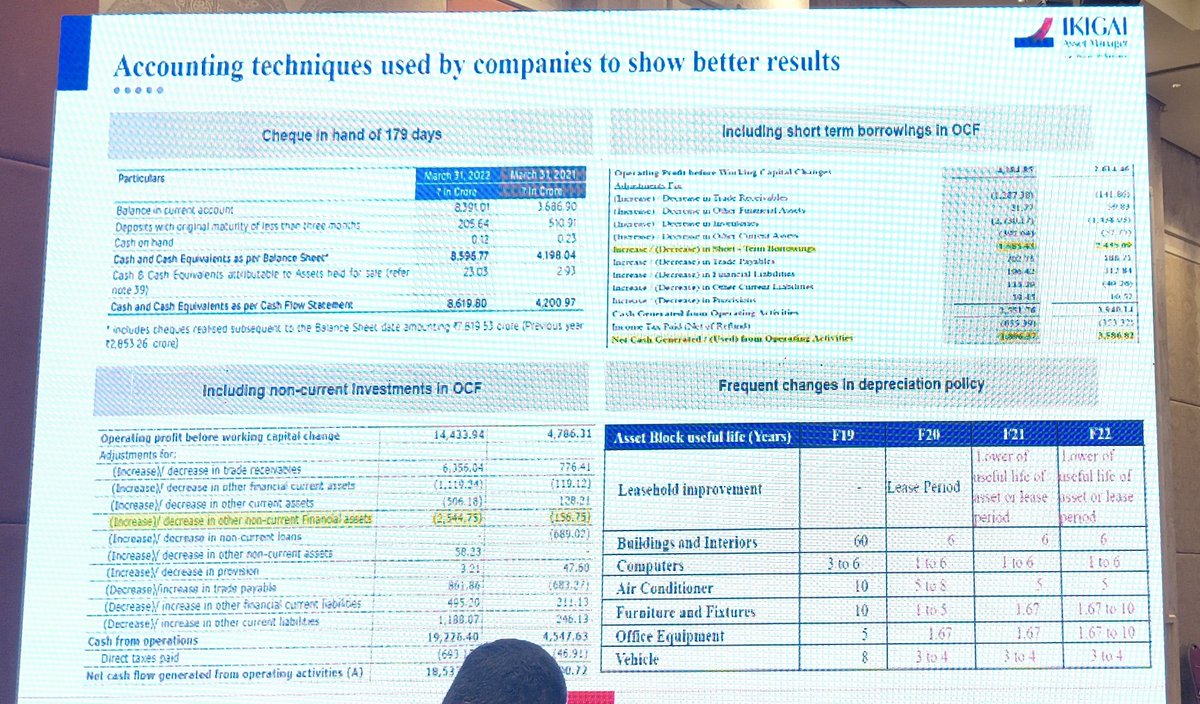

Companies are also becoming smart.

They know investors open screener and see cashflow from operations.

See this co, it has balance in current account of 8000+ crores and it is majorly cheques realised in next period!

Many companies show increase in short term borrowings in CFO.

Another company had 80% of service revenue was unbilled.

They know investors open screener and see cashflow from operations.

See this co, it has balance in current account of 8000+ crores and it is majorly cheques realised in next period!

Many companies show increase in short term borrowings in CFO.

Another company had 80% of service revenue was unbilled.

@pankajtibre @Ikigai_fund In IT cos, look at revenue recognition and see how much of revenue is unbilled.

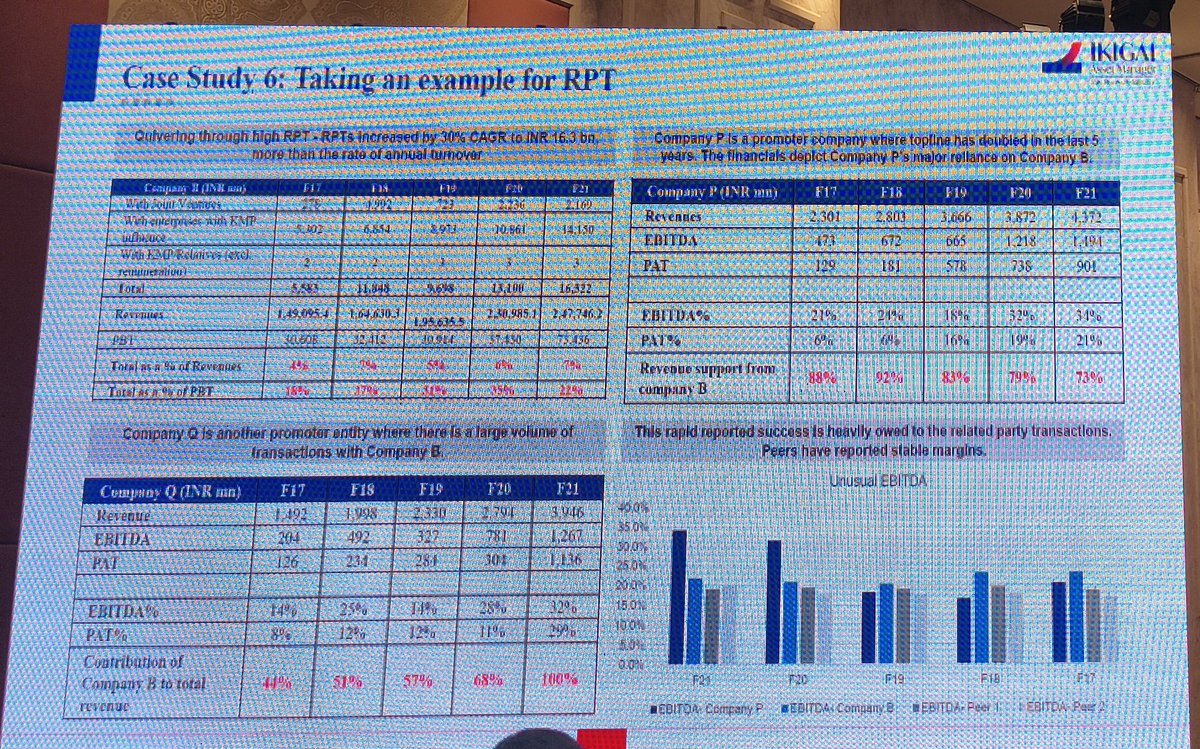

With JVs and KMPs, RPTs as a % of revenues is small but as a % of profits is 20%+.

1000s of crores of business is routed via promoter entities.

With JVs and KMPs, RPTs as a % of revenues is small but as a % of profits is 20%+.

1000s of crores of business is routed via promoter entities.

To get excess valuations, companies window dress before IPOs.

Environment of excess capital motivates different accounting gimmicks.

For example: 2 years back everyone was gung ho on DI Pipes because of Jal Jeevan Mission. DI pipe went from 30 per kg to 70 per kg.

Suddenly last year govt slowed down on Jal Jeevan, a lot of DI pipe cos got stuck. Realisations have halved back to Rs. 40.

Environment of excess capital motivates different accounting gimmicks.

For example: 2 years back everyone was gung ho on DI Pipes because of Jal Jeevan Mission. DI pipe went from 30 per kg to 70 per kg.

Suddenly last year govt slowed down on Jal Jeevan, a lot of DI pipe cos got stuck. Realisations have halved back to Rs. 40.

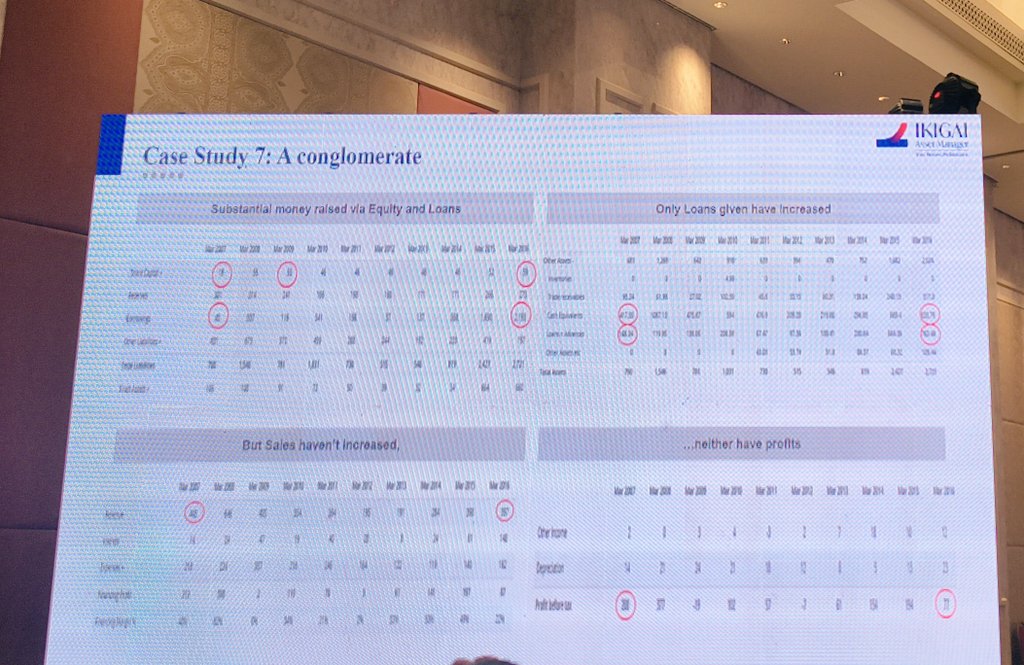

Triangulate between equity raise, sales, profits and cash flow.

Many case studies of equity dilution and borrowing not flowing into sales growth and profits.

When you look at these over a period of 5-7 years, you see a trend emerging...

Hence investing is a art and science over the long term.

Many case studies of equity dilution and borrowing not flowing into sales growth and profits.

When you look at these over a period of 5-7 years, you see a trend emerging...

Hence investing is a art and science over the long term.

Triangulate between equity raise, sales, profits and cash flow.

Many case studies of equity dilution and borrowing not flowing into sales growth and profits.

When you look at these over a period of 5-7 years, you see a trend emerging...

Hence investing is a art and science over the long term.

Many case studies of equity dilution and borrowing not flowing into sales growth and profits.

When you look at these over a period of 5-7 years, you see a trend emerging...

Hence investing is a art and science over the long term.

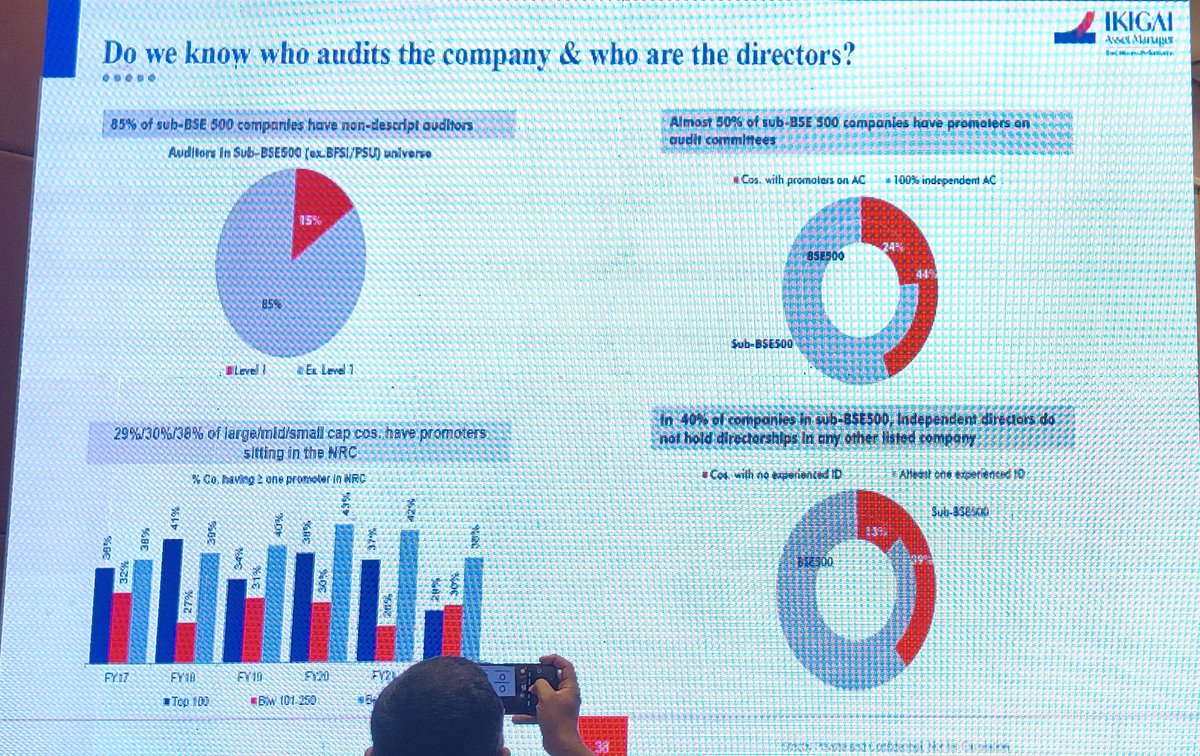

In Bullet Proof investing, the process of elimination is more important than the process of selection.

Every bull cycle - the theme changes, the name changes but the characteristic of the promoter remains.

Always ask this question - is the promoter part of the audit committee? Are the independent directors also holding positions in other boards?

Every bull cycle - the theme changes, the name changes but the characteristic of the promoter remains.

Always ask this question - is the promoter part of the audit committee? Are the independent directors also holding positions in other boards?

• Why long term matters?

• What are rare breeds and how do you find them?

• Lessons from the journey.

• What are rare breeds and how do you find them?

• Lessons from the journey.

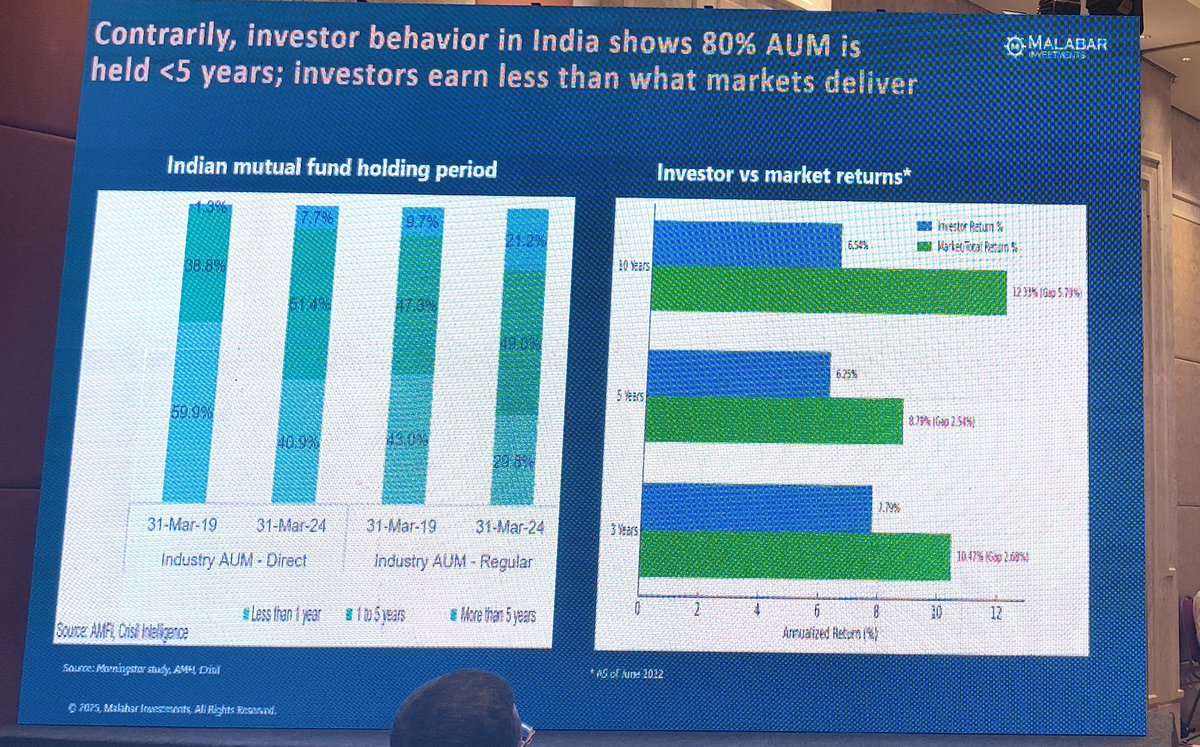

Greatness comes from nurturing, patience and time.

Think trees, diamonds or raising a child. It takes years of hard work before you see greatness.

However in India, investors do not exhibit this patient behavior.

Even now only 21% of investors hold for 5 years. We're not giving enough time to let investments work.

A fund can have a phenomenal track record but the investors entering and exiting the wrong time will not make the same returns.

Think trees, diamonds or raising a child. It takes years of hard work before you see greatness.

However in India, investors do not exhibit this patient behavior.

Even now only 21% of investors hold for 5 years. We're not giving enough time to let investments work.

A fund can have a phenomenal track record but the investors entering and exiting the wrong time will not make the same returns.

Rare breeds

Power law says a small number of inputs cause a disproportionately large share of outcomes.

For example - take a Redwood forest - thousands of saplings, but a handful become trees - these trees take most of the sunlight and grow taller.

Power law says a small number of inputs cause a disproportionately large share of outcomes.

For example - take a Redwood forest - thousands of saplings, but a handful become trees - these trees take most of the sunlight and grow taller.

Similarly in business,

• 10% of UPI customers account for 60% of the transactions

• 5% or zomato customers drive high frequency orders

• 10% of sick people account for 64% of US healthcare costs

In VC investments, 6% of deals where 5% of capital was deployed delivered 60% of the returns.

• 10% of UPI customers account for 60% of the transactions

• 5% or zomato customers drive high frequency orders

• 10% of sick people account for 64% of US healthcare costs

In VC investments, 6% of deals where 5% of capital was deployed delivered 60% of the returns.

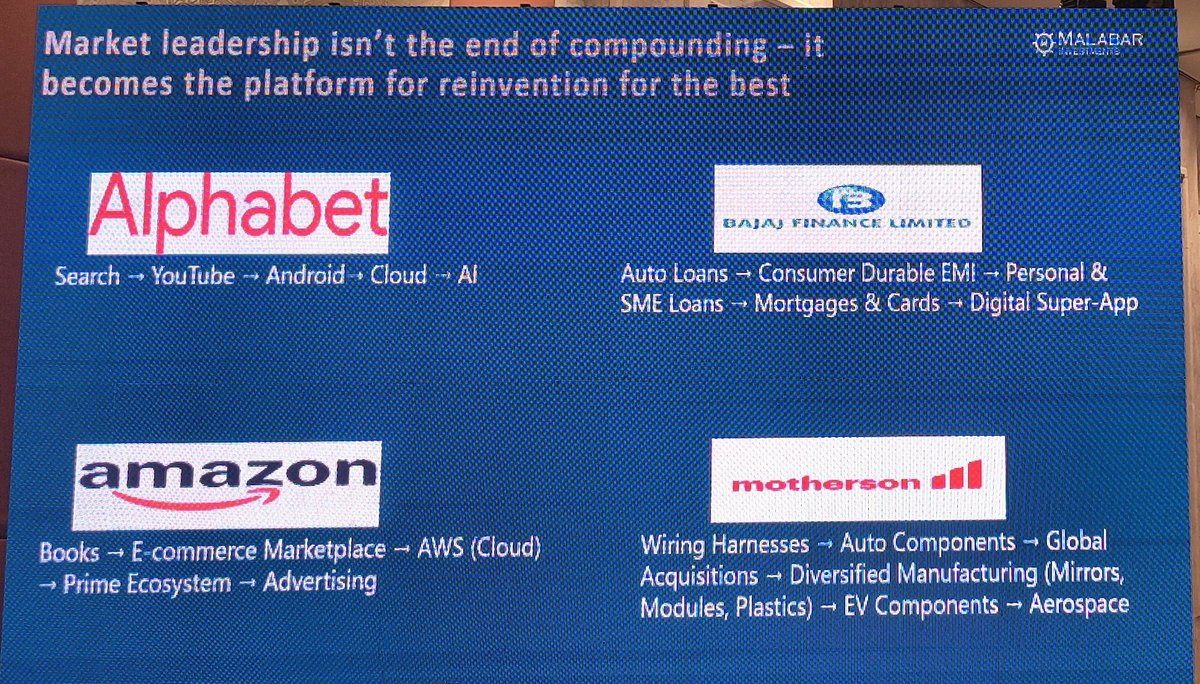

Great managements like Apple, Saregama, Titan can continue to keep the engine going by adapting to newer adjacencies.

For example, Hindustan Foods started with contract manufacturing. CEO kept spotting adjacencies and transformed into largest FMCG enabler.

Affle started in the SMS era and keeps surprising with new growth vectors every year.

Disclaimer: not a stock reco

For example, Hindustan Foods started with contract manufacturing. CEO kept spotting adjacencies and transformed into largest FMCG enabler.

Affle started in the SMS era and keeps surprising with new growth vectors every year.

Disclaimer: not a stock reco

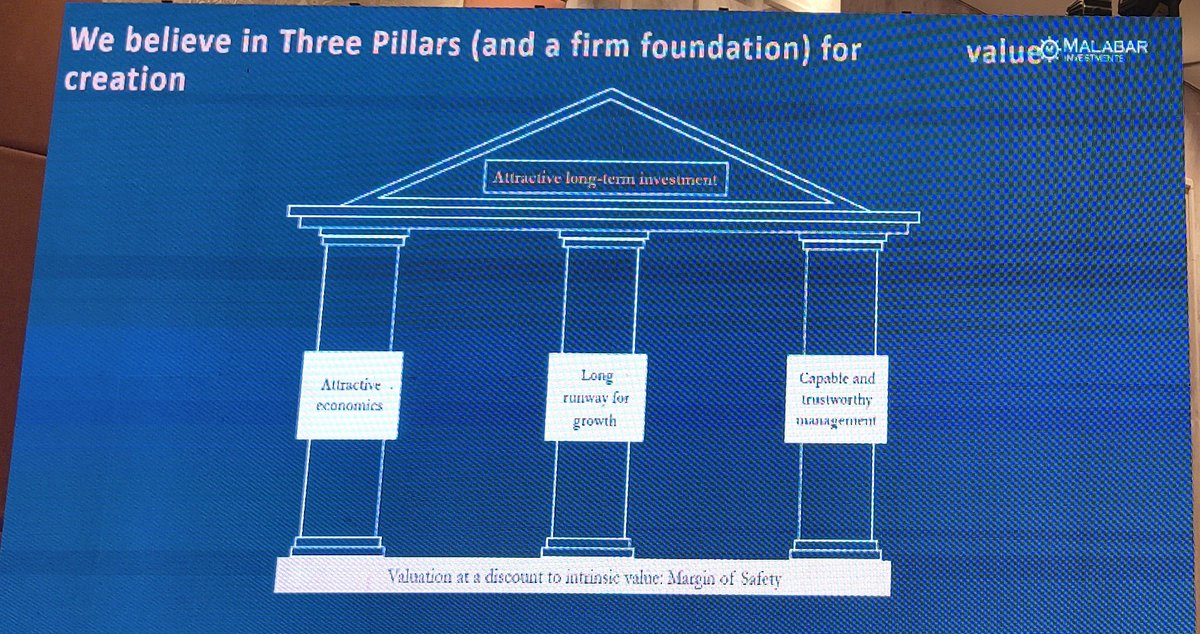

Making a portfolio with companies with better earnings growth vs the index can bring a big difference to the end portfolio.

Image is Malabar's portfolio:

If a company can do 35% CAGR, that's 20x over a decade - can withstand 50% multiple correction and still deliver 26% IRR.

Image is Malabar's portfolio:

If a company can do 35% CAGR, that's 20x over a decade - can withstand 50% multiple correction and still deliver 26% IRR.

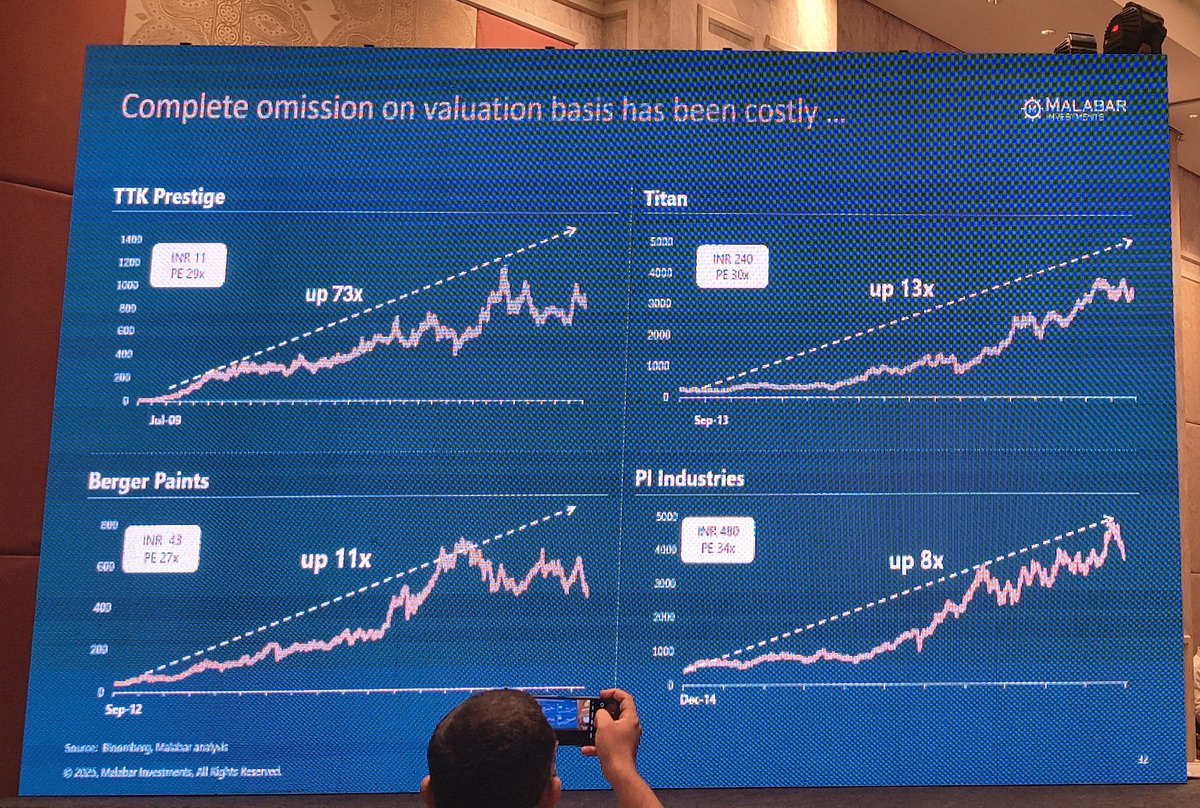

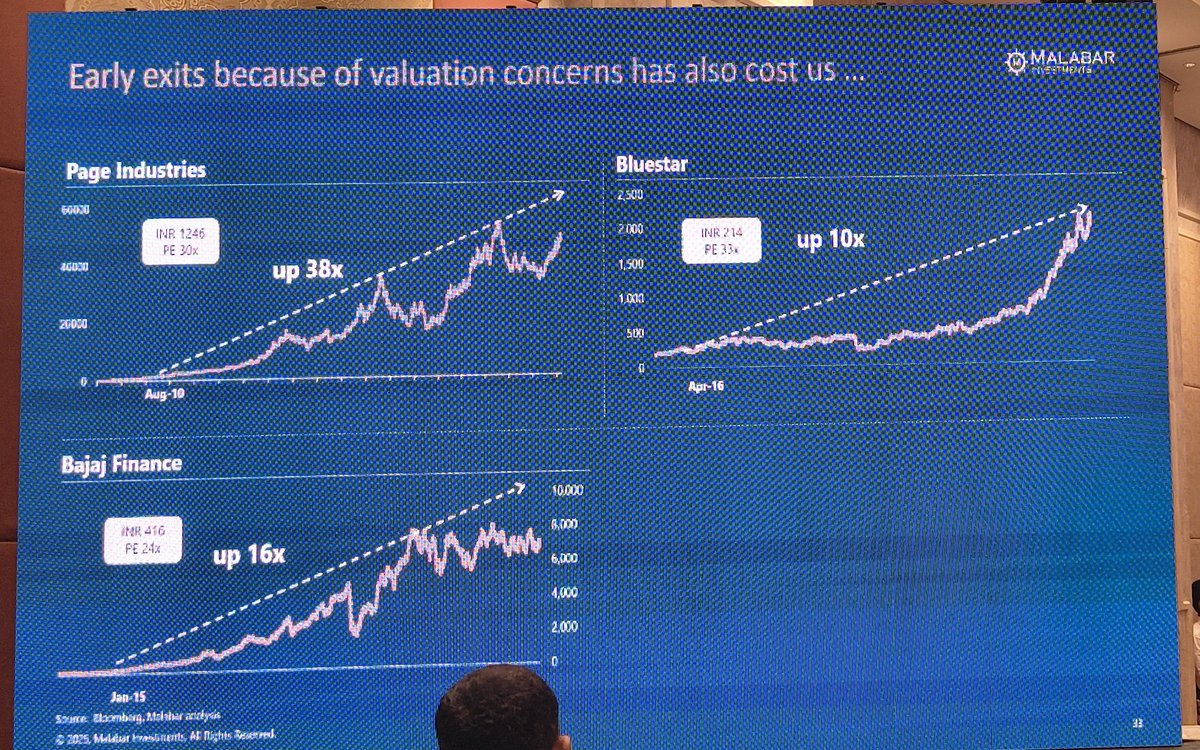

Learning is to never sell early on valuations if the fundamentals are still intact.

• Only a few exceptional companies that make most of the wealth

• Great investments have common traits: long runway, strong economics, capable management and bought at reasonable valuations.

• Concentrated, long term ownership delivers the best results.

• Time is the ultimate multiplier. Let it work!

• Only a few exceptional companies that make most of the wealth

• Great investments have common traits: long runway, strong economics, capable management and bought at reasonable valuations.

• Concentrated, long term ownership delivers the best results.

• Time is the ultimate multiplier. Let it work!

Speaker 4: Chirag Setalvad, CIO at HDFC Mutual Fund @hdfcmf @chiragsetalvad

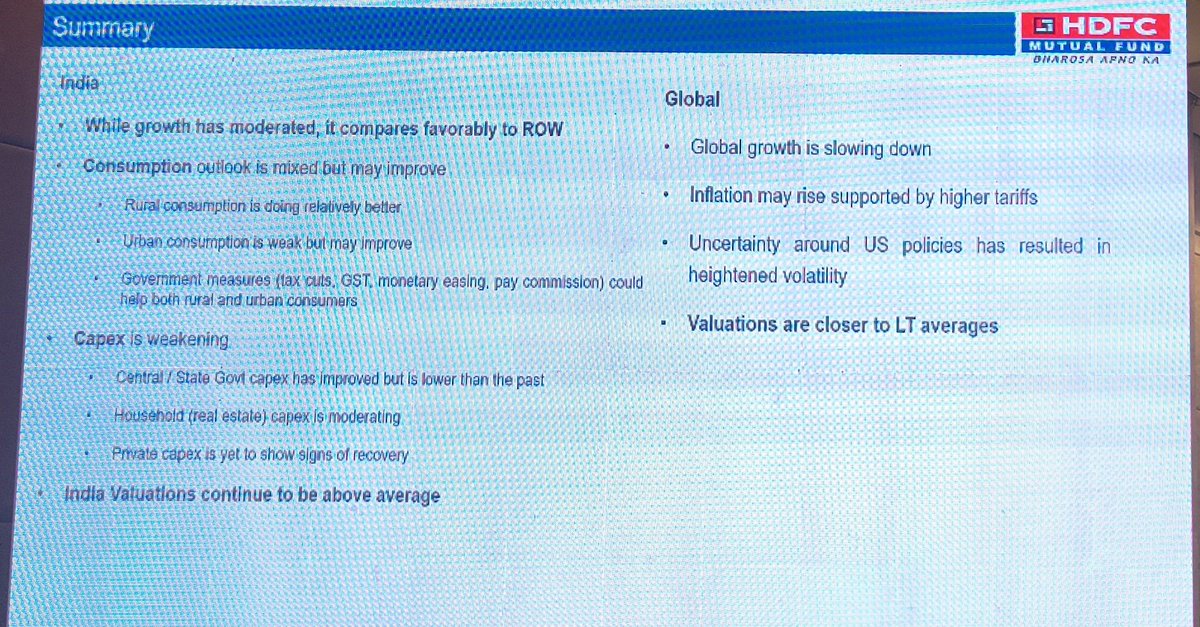

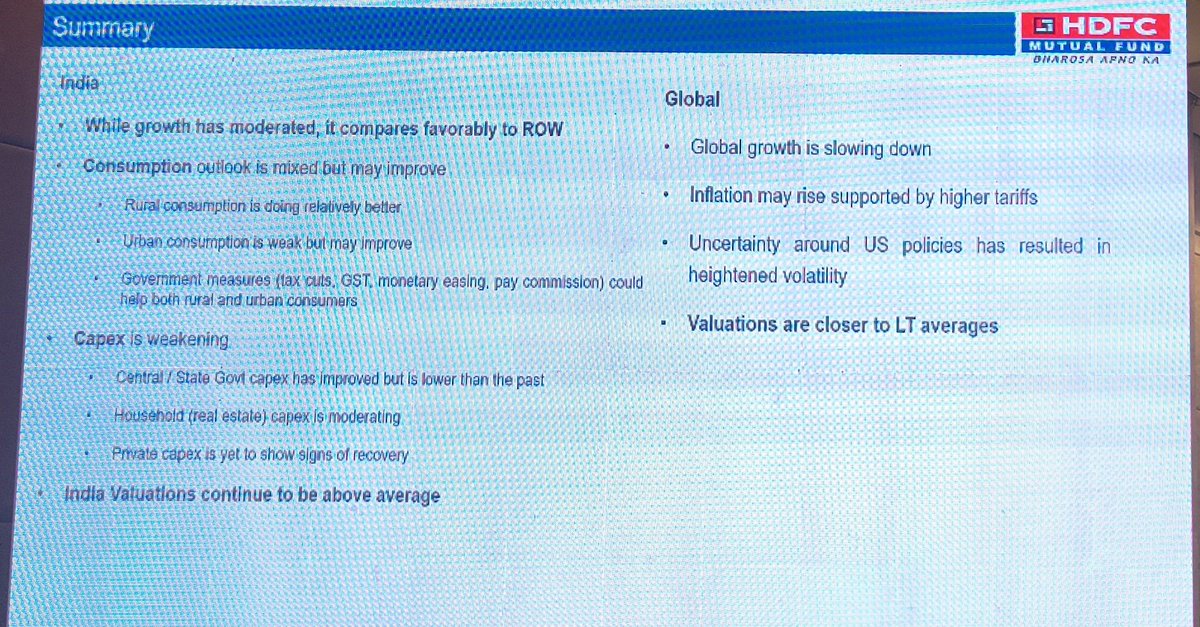

Economy and Equity Market Outlook.

India's long term economy has grown steadily despite several challenges.

Consumption is roughly 2/3rd of GDP and investment is 1/3rd.

Economy and Equity Market Outlook.

India's long term economy has grown steadily despite several challenges.

Consumption is roughly 2/3rd of GDP and investment is 1/3rd.

Consumption - let's split into urban and rural

Urban - weak.

• We've seen salary slowdown. Also a slowdown in retail credit.

• However there's a possibility of improvement - thanks to tax cuts, GST reductions and upcoming pay commission revision - so a lot of stimulus towards the consumer.

Rural - steady.

So consumption looks positive going ahead..

Urban - weak.

• We've seen salary slowdown. Also a slowdown in retail credit.

• However there's a possibility of improvement - thanks to tax cuts, GST reductions and upcoming pay commission revision - so a lot of stimulus towards the consumer.

Rural - steady.

So consumption looks positive going ahead..

Investments side

3 components

Government spending, corporate capex and household capex

• Government capex is slowing down

• Household capex is slowing down - an impact from rising RE prices and stagnant stock markets

• Corporate capex - weak for many years, tariffs may keep it subdued.

3 components

Government spending, corporate capex and household capex

• Government capex is slowing down

• Household capex is slowing down - an impact from rising RE prices and stagnant stock markets

• Corporate capex - weak for many years, tariffs may keep it subdued.

@hdfcmf @chiragsetalvad Global economy has uncertainty.

US - growth is tapering from 2-2.5 to 1.5%

China - continues to remain weak

Eurozone - remains muted

India is itself slowing down but we're still doing well. Situation outside India is even more challenging.

US - growth is tapering from 2-2.5 to 1.5%

China - continues to remain weak

Eurozone - remains muted

India is itself slowing down but we're still doing well. Situation outside India is even more challenging.

Stock markets aren't reflecting any of this concern - neither in India nor globally.

We need to simplify this understanding - we're currently not in a deep value market obviously.

Large caps in India continue to be better priced however.

In small and mid caps we are entering the extreme phase of excesses in valuations. There is way too much excitement in small caps.

We need to simplify this understanding - we're currently not in a deep value market obviously.

Large caps in India continue to be better priced however.

In small and mid caps we are entering the extreme phase of excesses in valuations. There is way too much excitement in small caps.

Small caps are no more small. Even a 25k crore company is a small cap.

Mid cap total size and small cap's total size are same.

While small caps are great alpha creators for 20 years, over the next few years large caps would be the place to hide.

Mid cap total size and small cap's total size are same.

While small caps are great alpha creators for 20 years, over the next few years large caps would be the place to hide.

The challenge is all assets have done well and no asset class looks interesting.

So it's time to take a pause.

The argument that markets won't fall because of SIP numbers is... - are we saying SIP numbers can only go up and not go down?

The argument that cash in mutual funds is 7-8%, so it can absorb any fall - normally any MF has 3-4%, so incremental cash levels are 3%, not too much.

So excesses can correct anytime.

So it's time to take a pause.

The argument that markets won't fall because of SIP numbers is... - are we saying SIP numbers can only go up and not go down?

The argument that cash in mutual funds is 7-8%, so it can absorb any fall - normally any MF has 3-4%, so incremental cash levels are 3%, not too much.

So excesses can correct anytime.

Take the US - S&P has outperformed even the Nifty. Mag 7 has done 40% CAGR.

Periods of high returns are always always always followed by low returns.

If there's too much excitement about something, it leads to disappointment.

There's too much excitement today.

Periods of high returns are always always always followed by low returns.

If there's too much excitement about something, it leads to disappointment.

There's too much excitement today.

Summary. And a story.

In 2001, Sanjoy made me read One up on wall street - Peter Lynch writes about a fund manager and a dentist. As a young person it was enjoyable to read it.

A fund manager and dentist live in say.. Chennai. They go to the first party (have a common social circle). No one talks to the fund manager and everyone is talking to the dentist. Hence the stock market is cheap.

Next party - some are talking to dentist and some are talking to the fund manager. Market is reasonable.

Next party - everyone is talking to the fund manager. No one is talking to the dentist. The market is expensive.

Added a final layer to this story.

Final party - they don't invite the dentist. They invite the fund manager but they don't ask him, they advise him.. the market is nearing this phase.

In 2001, Sanjoy made me read One up on wall street - Peter Lynch writes about a fund manager and a dentist. As a young person it was enjoyable to read it.

A fund manager and dentist live in say.. Chennai. They go to the first party (have a common social circle). No one talks to the fund manager and everyone is talking to the dentist. Hence the stock market is cheap.

Next party - some are talking to dentist and some are talking to the fund manager. Market is reasonable.

Next party - everyone is talking to the fund manager. No one is talking to the dentist. The market is expensive.

Added a final layer to this story.

Final party - they don't invite the dentist. They invite the fund manager but they don't ask him, they advise him.. the market is nearing this phase.

Summary. And a story.

In 2001, Sanjoy made me read One up on wall street - Peter Lynch writes about a fund manager and a dentist. As a young person it was enjoyable to read it.

A fund manager and dentist live in say.. Chennai. They go to the first party (have a common social circle). No one talks to the fund manager and everyone is talking to the dentist. Hence the stock market is cheap.

Next party - some are talking to dentist and some are talking to the fund manager. Market is reasonable.

Next party - everyone is talking to the fund manager. No one is talking to the dentist. The market is expensive.

Added a final layer to this story.

Final party - they don't invite the dentist. They invite the fund manager but they don't ask him, they advise him.. the market is nearing this phase.

In 2001, Sanjoy made me read One up on wall street - Peter Lynch writes about a fund manager and a dentist. As a young person it was enjoyable to read it.

A fund manager and dentist live in say.. Chennai. They go to the first party (have a common social circle). No one talks to the fund manager and everyone is talking to the dentist. Hence the stock market is cheap.

Next party - some are talking to dentist and some are talking to the fund manager. Market is reasonable.

Next party - everyone is talking to the fund manager. No one is talking to the dentist. The market is expensive.

Added a final layer to this story.

Final party - they don't invite the dentist. They invite the fund manager but they don't ask him, they advise him.. the market is nearing this phase.

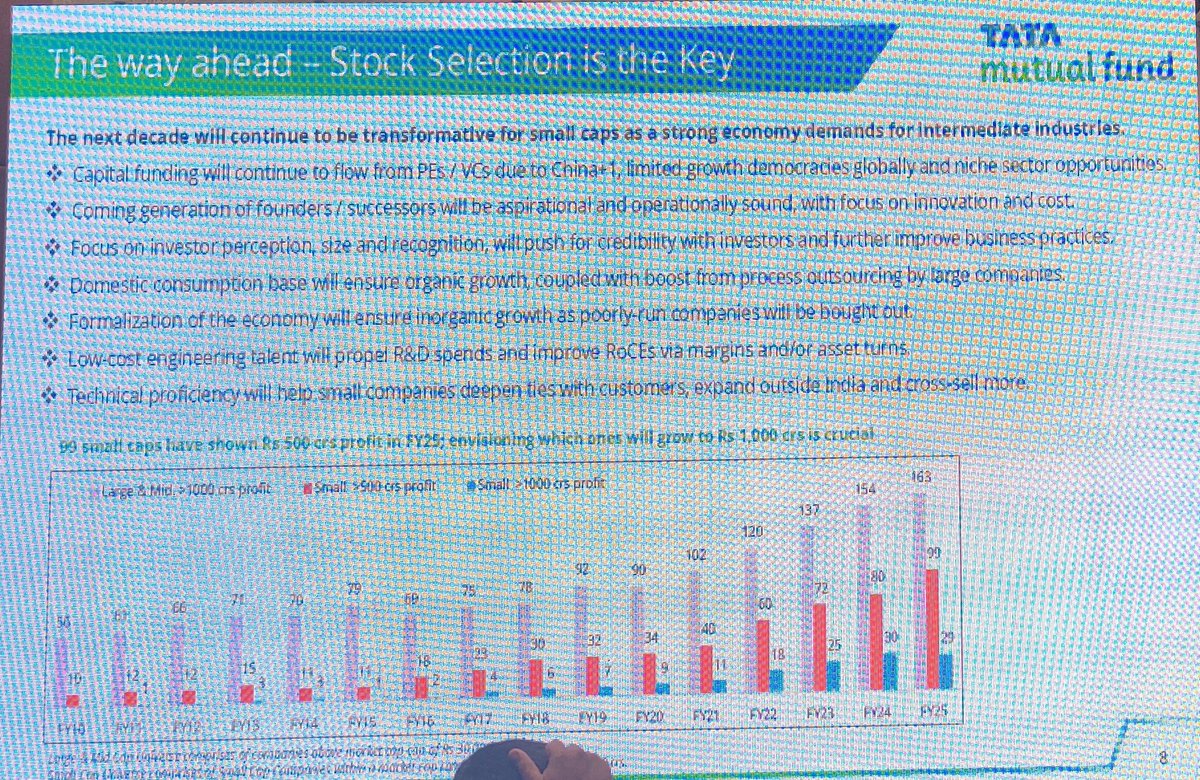

Speaker 5: Chandraprakash Padiyar of Tata MF

India Small Caps

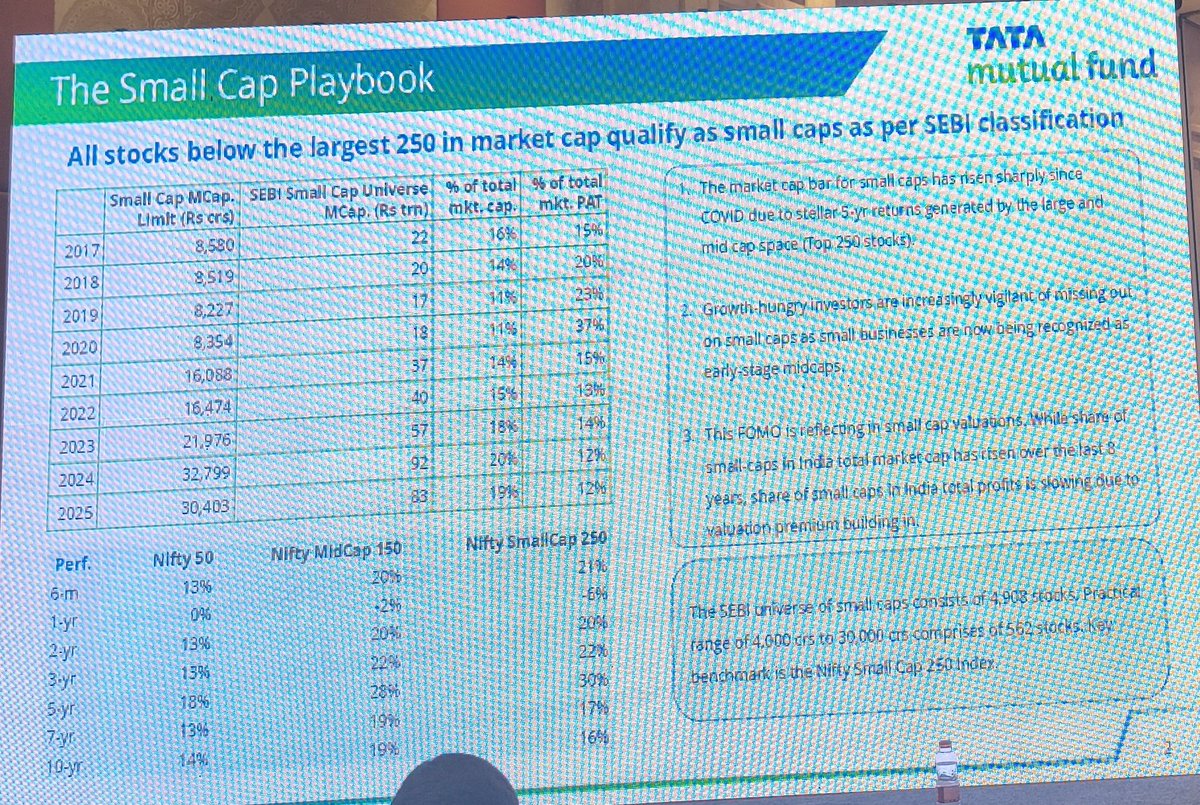

SEBI classifies all companies below top 250 as small caps.

So the market cap universe has moved from 22L crore to 80L crore. Their share of total market cap has moved from 16% to 20%.

But their share of total market PAT is now at the lowest in many years. From 15% to begin, peaking at 37% to now back to 12% of total market PAT.

Tata MF chooses companies from 4000 crores to 30000 crores.

India Small Caps

SEBI classifies all companies below top 250 as small caps.

So the market cap universe has moved from 22L crore to 80L crore. Their share of total market cap has moved from 16% to 20%.

But their share of total market PAT is now at the lowest in many years. From 15% to begin, peaking at 37% to now back to 12% of total market PAT.

Tata MF chooses companies from 4000 crores to 30000 crores.

From a coverage POV, Tata MF prides itself on covering 250+ small cap companies out of 5000+ companies. For other MFs, the coverage universe is even lower.

This means a large part of the small cap universe will still be under covered and under researched.

This means a large part of the small cap universe will still be under covered and under researched.

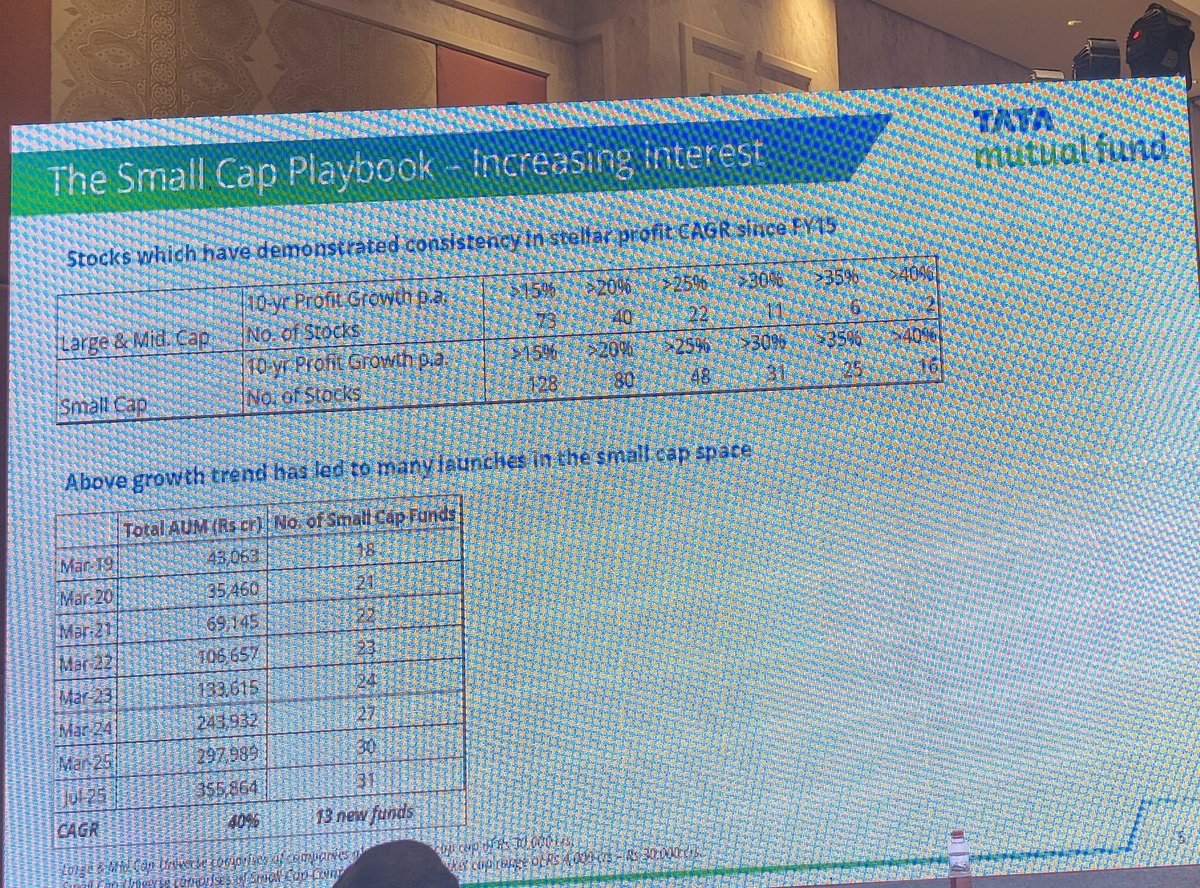

2 large caps have grown profits > 40% a year.

16 small caps have grown profits > 40% a year.

That's why more and more small cap funds are being launched.

In 2018, there were 18 small cap funds with 43k crore AUM. Today it's at 3L crore AUM with 31 funds.

Investors have pressurised us by putting more money based on past returns.

16 small caps have grown profits > 40% a year.

That's why more and more small cap funds are being launched.

In 2018, there were 18 small cap funds with 43k crore AUM. Today it's at 3L crore AUM with 31 funds.

Investors have pressurised us by putting more money based on past returns.

44% of Tata Small Cap's AUM is in cos with > 3% ownership.

So with small cap MFs the hit rate is critical - if you get it wrong, it's a liquidity trap and if you win, you'll make big.

Between 4k to 15k crore mcap - there is an under researched space in this range significantly. This is the segment.

Most peers and benchmark names are in the 15k - 30k crore segment with over

research and significant valuation discomfort.

So with small cap MFs the hit rate is critical - if you get it wrong, it's a liquidity trap and if you win, you'll make big.

Between 4k to 15k crore mcap - there is an under researched space in this range significantly. This is the segment.

Most peers and benchmark names are in the 15k - 30k crore segment with over

research and significant valuation discomfort.

Many examples of small companies with strong moats.

Steel wire ropes player coming out of a bad time

Pharma / biotech player entering an early stage of an earnings upcycle

Interesting times for us, we are finding entrepreneurs whose aspirations are higher. We do find businesses which we think can scale over a period of time which makes us optimistic over the long term.

Short term of course valuations are high, if you do invest in small caps, be extra cautious - take a long term view.

Steel wire ropes player coming out of a bad time

Pharma / biotech player entering an early stage of an earnings upcycle

Interesting times for us, we are finding entrepreneurs whose aspirations are higher. We do find businesses which we think can scale over a period of time which makes us optimistic over the long term.

Short term of course valuations are high, if you do invest in small caps, be extra cautious - take a long term view.

Speaker 6: Nilesh Shah @NileshShah68, MD at Kotak Mutual Fund @KotakMF

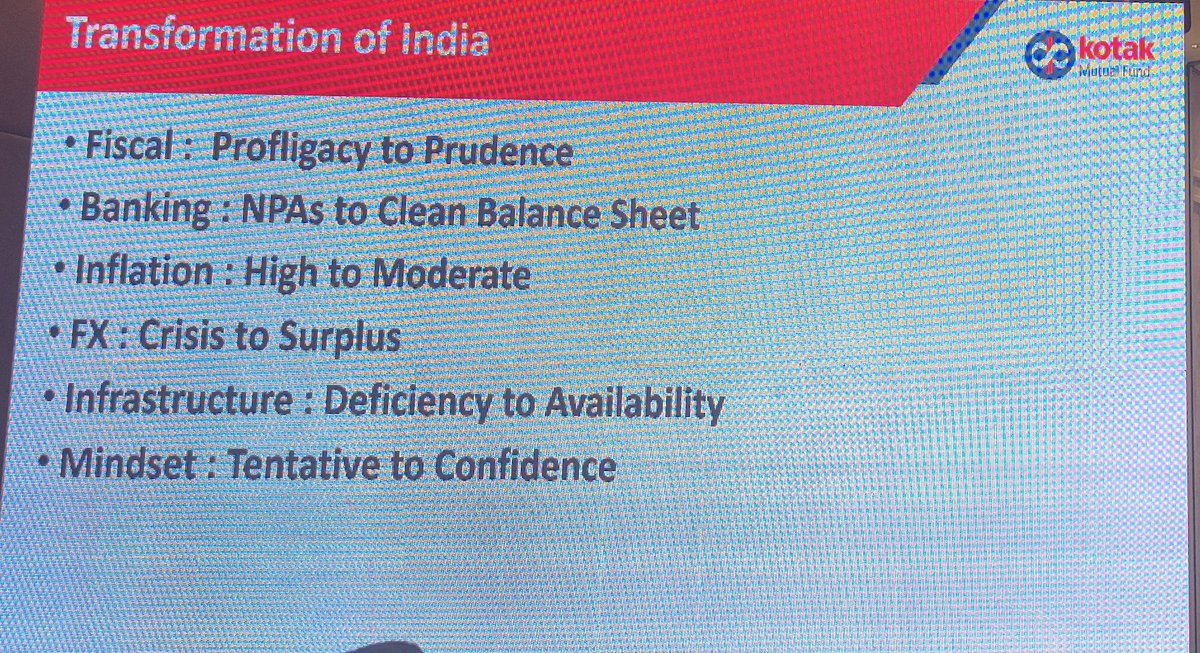

What India & India Inc must do to sustain premium valuation?

The worry about investors is not whether Indian profits will grow, but whether it will maintain the PE.

India today undoubtedly trades at a premium to other emerging markets.

India is the only major economy whose debt to GDP has come down since the subprime crisis. No other major economy can claim this status.

What India & India Inc must do to sustain premium valuation?

The worry about investors is not whether Indian profits will grow, but whether it will maintain the PE.

India today undoubtedly trades at a premium to other emerging markets.

India is the only major economy whose debt to GDP has come down since the subprime crisis. No other major economy can claim this status.

@NileshShah68 @KotakMF Our banking system has become so robust that when Americas 16th largest bank Silicon Valley Bank went down, a Mumbai based Shamrao Vithal CoOp bank had to announce that it's not us.

We've come a long way from times of shortage to a fast growing major economy.

We've come a long way from times of shortage to a fast growing major economy.

Are we misleading investors and giving easy exit to FPIs?

Will they have the last laugh?

In this case both buyer and seller believe that earnings are bound to rise.

What is the main question is - will we maintain valuations?

There is no scope to expand valuations as we are on Mt Everest.

Unfortunately it is easy to climb everest but difficult to stay. Even Edmund Hillary had to come down.

Will they have the last laugh?

In this case both buyer and seller believe that earnings are bound to rise.

What is the main question is - will we maintain valuations?

There is no scope to expand valuations as we are on Mt Everest.

Unfortunately it is easy to climb everest but difficult to stay. Even Edmund Hillary had to come down.

@NileshShah68 @KotakMF Even blue chips can de rate.

Even China went through de rating and de rating.

So what can we as investors do?

Warren Buffett mentions that stocks are slave of earnings. So focus on growth, governance and green - the 3Gs.

Even China went through de rating and de rating.

So what can we as investors do?

Warren Buffett mentions that stocks are slave of earnings. So focus on growth, governance and green - the 3Gs.

But just earnings isn't enough, we as citizens also have a role to play if we want premium valuations.

Do we as citizens have the right civics sense? We all know the answer.

As a society we have to appreciate our talent.

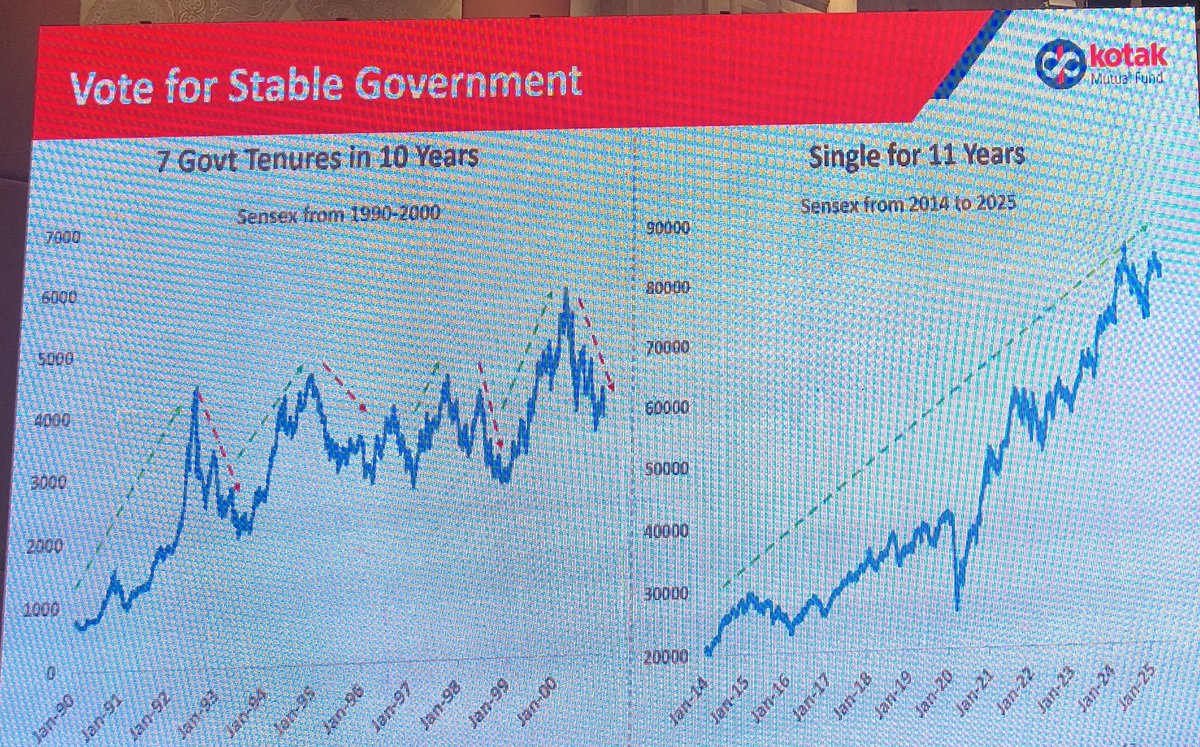

We should also vote for a stable government - 2 years back we spoke of Bangladesh overtaking us. Today no one talks about Bangladesh. Importance of a stable government.

To sustain valuations we also need rule of law.

Do we as citizens have the right civics sense? We all know the answer.

As a society we have to appreciate our talent.

We should also vote for a stable government - 2 years back we spoke of Bangladesh overtaking us. Today no one talks about Bangladesh. Importance of a stable government.

To sustain valuations we also need rule of law.

Another aspect is whether we as a country can take decisions based on our needs.

Our government should focus on future and divest from the past.

Our govt runs Ashoka hotels shouldn't they be investing in bio tech?

Coal steel plants vs Rare Earth?

Telecom vs energy?

Trading vs AI/ML Cyber Security?

Unfortunately, in India divestment is a taboo. Voters think they are selling family jewels where they are family junk.

For MTNL users govt has put 2L crores. Shouldn't this money go into futuristic investment?

We need a government that can fight for national interest.

Our government should focus on future and divest from the past.

Our govt runs Ashoka hotels shouldn't they be investing in bio tech?

Coal steel plants vs Rare Earth?

Telecom vs energy?

Trading vs AI/ML Cyber Security?

Unfortunately, in India divestment is a taboo. Voters think they are selling family jewels where they are family junk.

For MTNL users govt has put 2L crores. Shouldn't this money go into futuristic investment?

We need a government that can fight for national interest.

IT and GCC's are paying 1/3rd of salaries, and now are at the risk of AI.

We've missed the bus of LLMs but can we do something ahead?

One thing our government should enable is to back our companies to go global. Suzlon failed to do tech transfer from RE Power.

Look at China - they acquired KUKA Robotics from Germany, did tech transfer and now China rules robotics industry.

RE Power vs Kuka is the difference between India and China.

We've missed the bus of LLMs but can we do something ahead?

One thing our government should enable is to back our companies to go global. Suzlon failed to do tech transfer from RE Power.

Look at China - they acquired KUKA Robotics from Germany, did tech transfer and now China rules robotics industry.

RE Power vs Kuka is the difference between India and China.

We need to manage our perception.

Even Indians in Singapore think Operation Sindoor is a drawn match.

When we meet global investors, we say India is an expensive market. We don't have the courage to say India is the cheapest emerging market from a 5 year horizon.

The day fund managers have the guts to say this our perception can change. Anyway which foreign investor comes with a 1 year horizon?

Even Indians in Singapore think Operation Sindoor is a drawn match.

When we meet global investors, we say India is an expensive market. We don't have the courage to say India is the cheapest emerging market from a 5 year horizon.

The day fund managers have the guts to say this our perception can change. Anyway which foreign investor comes with a 1 year horizon?

@NileshShah68 @KotakMF Our exports require competitiveness. No country has grown without exports.

But our industries are used to subsidise others.

Industries pay a higher power and freight cost to cross subsidise agriculture and household industries.

But our industries are used to subsidise others.

Industries pay a higher power and freight cost to cross subsidise agriculture and household industries.

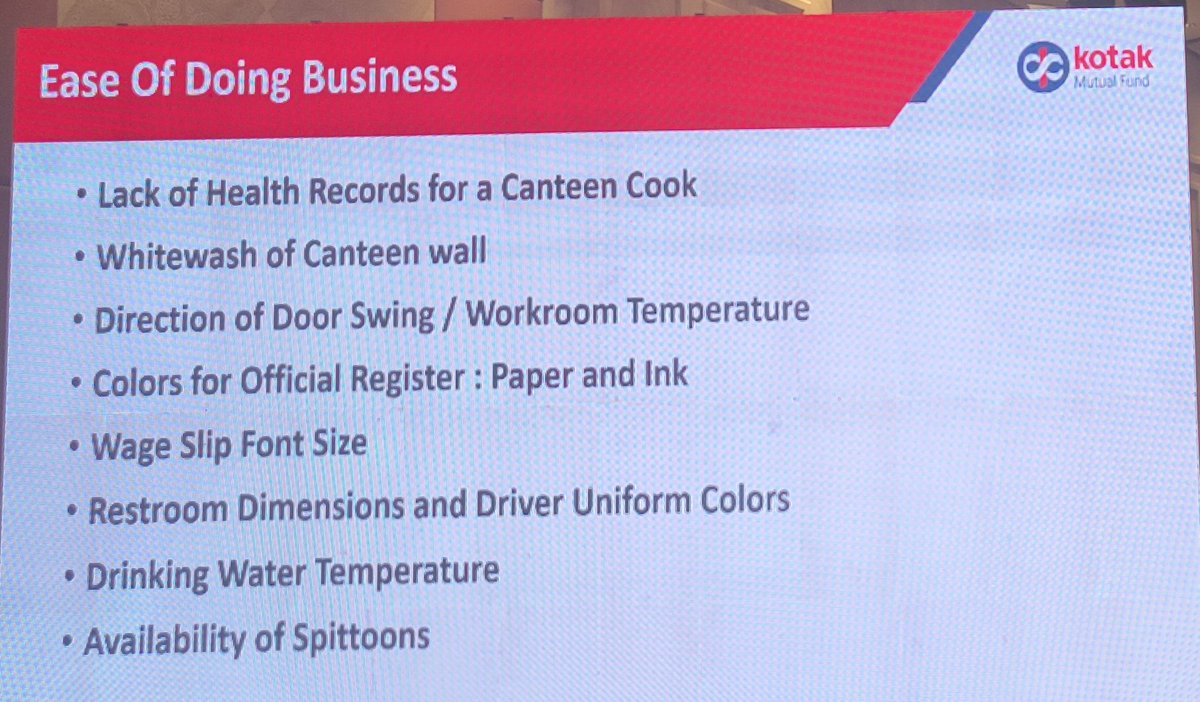

@NileshShah68 @KotakMF Indians arent just fighting Kauravs, but they're also fighting Pandavs.

We need a National Commission of Ease of Doing Business with a 007 bond style license to deregulate.

We need a National Commission of Ease of Doing Business with a 007 bond style license to deregulate.

Our ranking on R&D is very low. Some may say we can do R&D at low cost (like ISRO).

Even adjusting for that, we are at the bottom.

Indians are filing parents in the US in cutting edge fields. But do we appreciate such talent here?

With H1B, this is the best time to get talent back.

Even adjusting for that, we are at the bottom.

Indians are filing parents in the US in cutting edge fields. But do we appreciate such talent here?

With H1B, this is the best time to get talent back.

@NileshShah68 @KotakMF The right quadrant are actions highly likely to be done and have the highest impact.

@NileshShah68 @KotakMF Finally we need India Inc to also step up.

Not to always obsess over quarterly ROEs but to invest for the future.

Not to always obsess over quarterly ROEs but to invest for the future.

India's journey will be no different from our journey.

We all came form middle class backgrounds but thanks to prudent investing we are financially secure. We all walked Agnipath to reach here. One more generation has to walk Agnipath for the future.

Will that happen? My answer is Yes.

Take Bansilal Peth in Telangana, neglected until 2000. Today it is a tourist attraction.

In 2047, when we all meet, we will remember the Agnipath of today for a Viksit Bharat.

We all came form middle class backgrounds but thanks to prudent investing we are financially secure. We all walked Agnipath to reach here. One more generation has to walk Agnipath for the future.

Will that happen? My answer is Yes.

Take Bansilal Peth in Telangana, neglected until 2000. Today it is a tourist attraction.

In 2047, when we all meet, we will remember the Agnipath of today for a Viksit Bharat.

@NileshShah68 @KotakMF Speaker 7: Kuntal Shah @Kuntalhshah from Oaklane Capital.

Library of Mistakes in Investing

Unlike a roll of dice some snakes of the investing game can be avoided.

1. Many myths prevail in the investing community

2. Errors of Commission

3. Errors of Omission

Library of Mistakes in Investing

Unlike a roll of dice some snakes of the investing game can be avoided.

1. Many myths prevail in the investing community

2. Errors of Commission

3. Errors of Omission

Myths:

1. Bubbles and Crashes are because of monetary printing.

Reality: human psychology and our responses are root causes of overvaluation and undervaluations

2. Markets are efficient

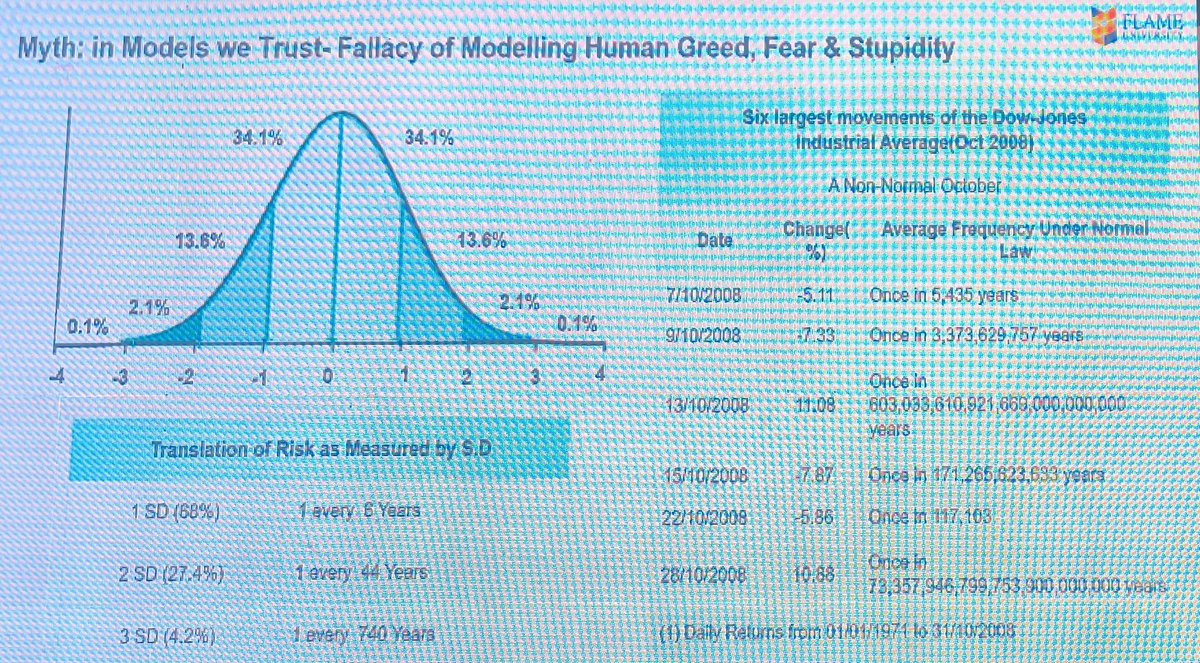

Reality: EMH is of zero value. No mathematical equation can model asset prices because they're driven by human behaviour.

Many of the market movements shouldn't have happened if we go by the bell curve.

1. Bubbles and Crashes are because of monetary printing.

Reality: human psychology and our responses are root causes of overvaluation and undervaluations

2. Markets are efficient

Reality: EMH is of zero value. No mathematical equation can model asset prices because they're driven by human behaviour.

Many of the market movements shouldn't have happened if we go by the bell curve.

@NileshShah68 @KotakMF @Kuntalhshah 3. Everything that counts can be counted

Reality: LTCM, JMW, JM Advisors - all 3 funds of John Merriweather went bankrupt.

Reality: LTCM, JMW, JM Advisors - all 3 funds of John Merriweather went bankrupt.

@NileshShah68 @KotakMF @Kuntalhshah 4. Intelligence guarantees investment success

Reality: Charles Mckay, author of books lost a fortune by investing in railway stocks.

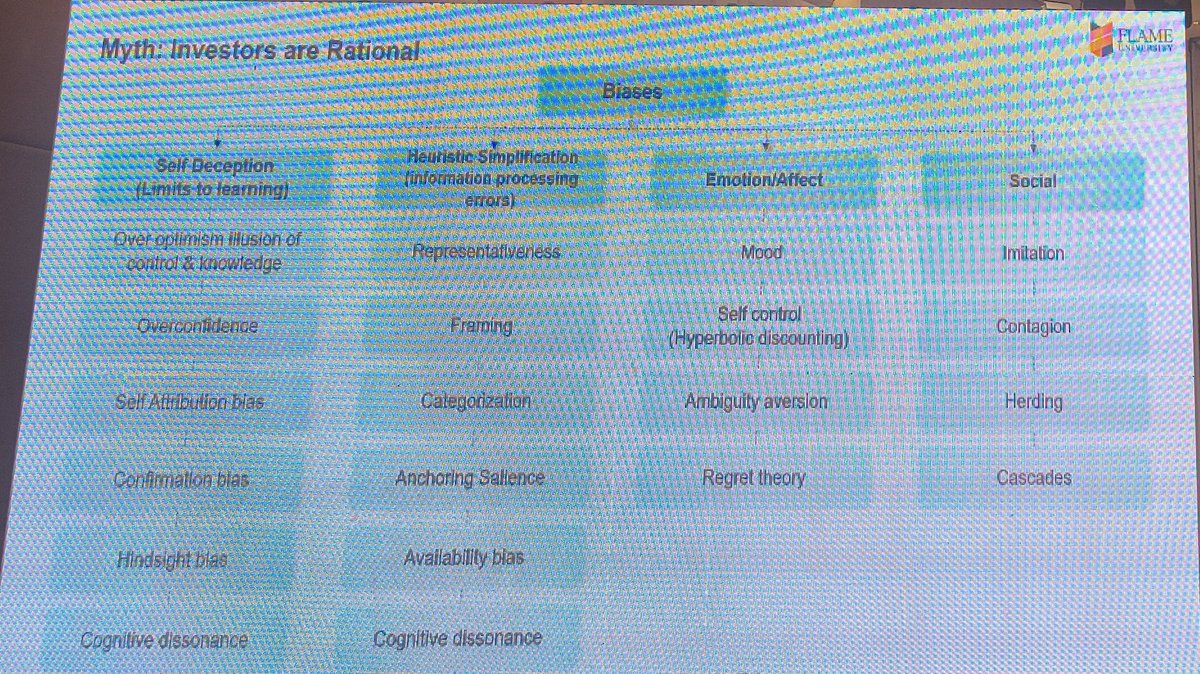

5. Investors are rational

Reality: Investors have biases.

• Self Deception

• Heuristic Simplification

• Emotion / Affect

• Social

Reality: Charles Mckay, author of books lost a fortune by investing in railway stocks.

5. Investors are rational

Reality: Investors have biases.

• Self Deception

• Heuristic Simplification

• Emotion / Affect

• Social

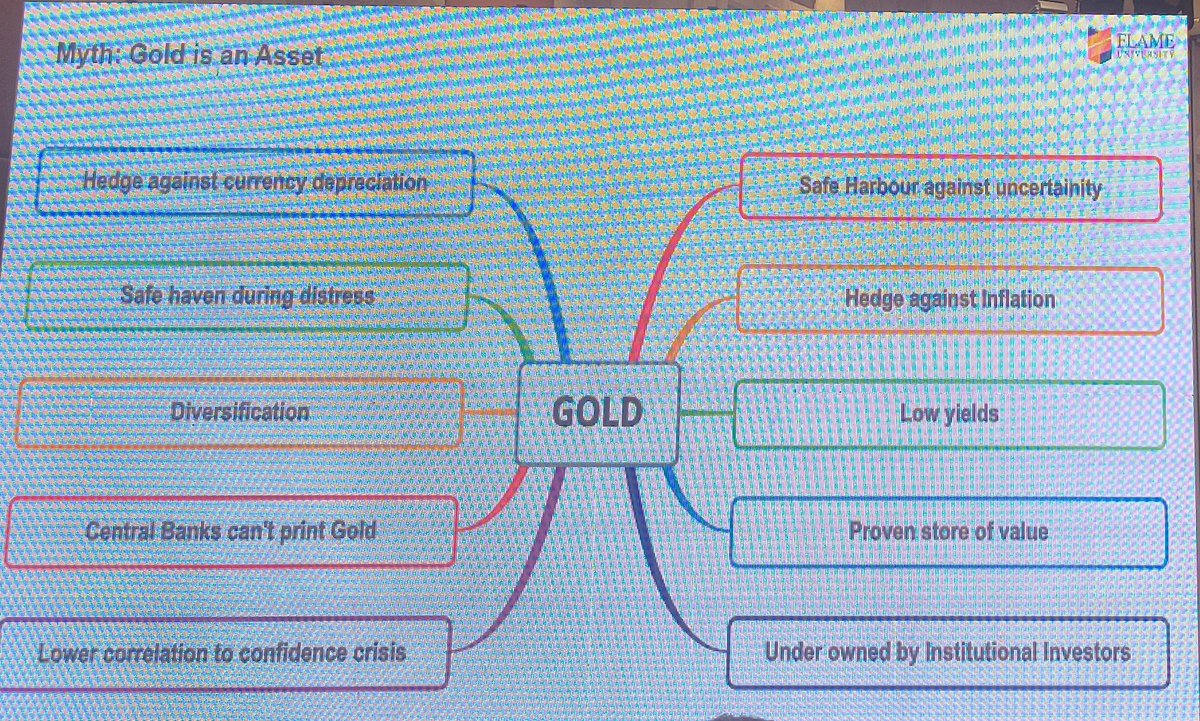

@NileshShah68 @KotakMF @Kuntalhshah 6. Gold is an asset

Reality: Gold is a currency

7. Diversified uncorrelated portfolios do well

Reality: Correlation between assets go to 1 during times of crisis.

Reality: Gold is a currency

7. Diversified uncorrelated portfolios do well

Reality: Correlation between assets go to 1 during times of crisis.

@NileshShah68 @KotakMF @Kuntalhshah 8. Equities are risky

Reality: We can formulate any hypothesis if we can change the starting date.

What is more important is the rolling return. During all periods, equities outperform.

Reality: We can formulate any hypothesis if we can change the starting date.

What is more important is the rolling return. During all periods, equities outperform.

The only risk is short term volatility.

If this fundamental is clear to you, then you will not sell at the wrong part of the time and you'll have fruits of long term compounding.

9. Bottom-up investing suffice

Reality: The only way to outperform is timing the asset allocation.

Asset allocation is the biggest and most neglected decision at the investor level. Especially if you invest through a fund manager like mutual funds.

Asset allocation is investors call, not fund managers.

If this fundamental is clear to you, then you will not sell at the wrong part of the time and you'll have fruits of long term compounding.

9. Bottom-up investing suffice

Reality: The only way to outperform is timing the asset allocation.

Asset allocation is the biggest and most neglected decision at the investor level. Especially if you invest through a fund manager like mutual funds.

Asset allocation is investors call, not fund managers.

@NileshShah68 @KotakMF @Kuntalhshah 10. Illiquid investments generate higher returns than liquid investments

Reality: it worked when nobody was doing it. Today they're so illiquid that the only way to liquidate is to borrow against it.

Reality: it worked when nobody was doing it. Today they're so illiquid that the only way to liquidate is to borrow against it.

11. All growth is good

Reality: Certain growth can also be cancerous. Don't treat all growth as equal.

12. Higher risk leads to higher return

Reality: One of the best investments was a company called Burrows Welcome, subsidiary of GSK. At 165, UTI sold 10% and we bought it in a fund. The idea was this co was going to merge with Glaxo at a 1.8:1 ratio and Glaxo was at 800 at that time!

Reality: Certain growth can also be cancerous. Don't treat all growth as equal.

12. Higher risk leads to higher return

Reality: One of the best investments was a company called Burrows Welcome, subsidiary of GSK. At 165, UTI sold 10% and we bought it in a fund. The idea was this co was going to merge with Glaxo at a 1.8:1 ratio and Glaxo was at 800 at that time!

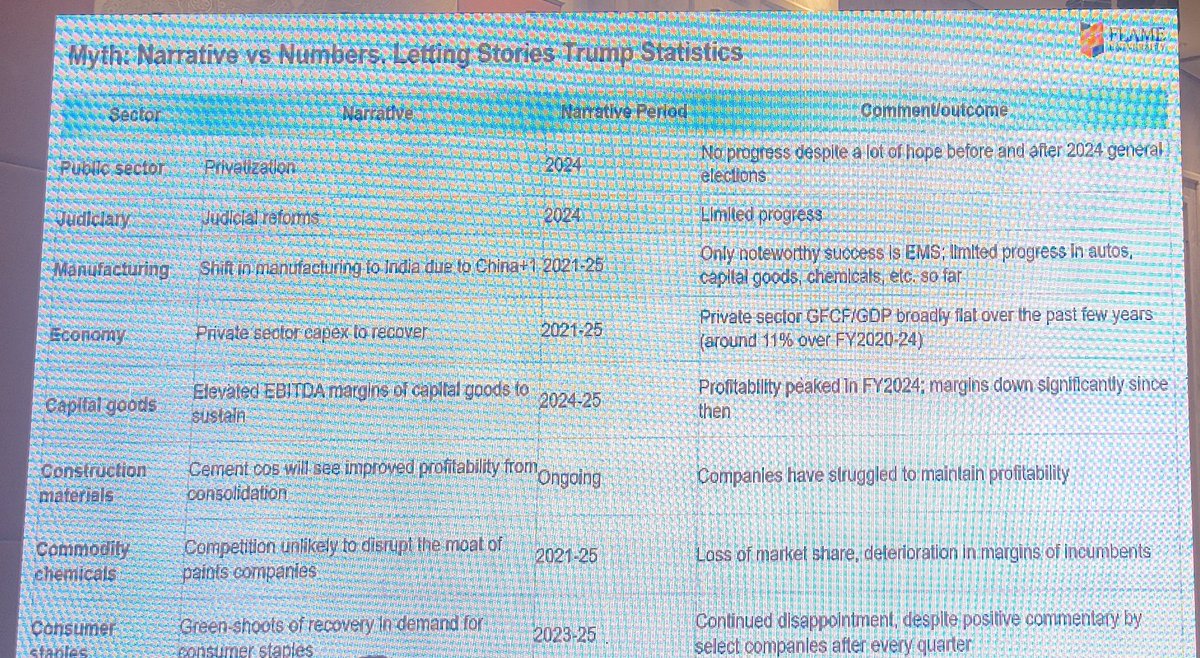

13. Narratives vs Numbers

Reality: Every narrative can be translated to a number. Similarly every number needs a narrative to forecast.

Not all narratives play out. You need a microscope but you also need to see the bigger picture.

Sometimes hug the trees to see if it's infected but sometimes also take the helicopter to see how vast the Amazon forest is.

Reality: Every narrative can be translated to a number. Similarly every number needs a narrative to forecast.

Not all narratives play out. You need a microscope but you also need to see the bigger picture.

Sometimes hug the trees to see if it's infected but sometimes also take the helicopter to see how vast the Amazon forest is.

Errors of Commission

1. Ignore history

Investors don't pay attention to what has happened in the past.

What we learn from history is that we don't learn from history.

2. Taking financial cues from people playing a different game than you are

Reality: You can borrow ideas but you can't borrow conviction.

3. Cloning without context

Reality: WB says airlines and tech are bad, but he owned them. He said diversification is overrated but...

60% of his investments were held for less than one year.

What WB says and does will be different because he knows he is in a position of respect.

1. Ignore history

Investors don't pay attention to what has happened in the past.

What we learn from history is that we don't learn from history.

2. Taking financial cues from people playing a different game than you are

Reality: You can borrow ideas but you can't borrow conviction.

3. Cloning without context

Reality: WB says airlines and tech are bad, but he owned them. He said diversification is overrated but...

60% of his investments were held for less than one year.

What WB says and does will be different because he knows he is in a position of respect.

4. Timing the market

Reality: all FMs say your returns are better if you invested in the best times.

No FM has ever said what happens to your PF if you added in the worst times.

5. Analysis Paralysis

Reality: only a few moving parts of a business that matter, not all.

6. Closet indexing

Reality: Indexing in ETFs is at low cost

But why are a lot of MFs indexing at their fee structure?

Reality: all FMs say your returns are better if you invested in the best times.

No FM has ever said what happens to your PF if you added in the worst times.

5. Analysis Paralysis

Reality: only a few moving parts of a business that matter, not all.

6. Closet indexing

Reality: Indexing in ETFs is at low cost

But why are a lot of MFs indexing at their fee structure?

@NileshShah68 @KotakMF @Kuntalhshah 7. Diversification and dilution of returns

Reality: Is your demat statement a warehouse or a curated museum?

8. Diversification

Reality: It's a double edged sword. The ideal sweet spot is 16-17 investments with different characteristics.

Reality: Is your demat statement a warehouse or a curated museum?

8. Diversification

Reality: It's a double edged sword. The ideal sweet spot is 16-17 investments with different characteristics.

@NileshShah68 @KotakMF @Kuntalhshah 8 is concentration* not diversification

@NileshShah68 @KotakMF @Kuntalhshah 9. Buy and Hold

Reality: MSCI China has delivered a 0% return since inception.

10. Selling multibaggers early

Reality: Biggest mistakes are in selling multibaggers early.

Reality: MSCI China has delivered a 0% return since inception.

10. Selling multibaggers early

Reality: Biggest mistakes are in selling multibaggers early.

Errors of Omission

1. Ignoring macro

Reality: India market fell more than US market during US sub prime crisis. Macro sometimes drives micro

2. Not planning your exit

Reality: you can only play offense if your defense permits you to. Hence you have to take periodic cash positions.

3. Role of cycles and mean reversion

Reality: You'll have to wait for next Kumbh Mela to sell.

4. Failure to question the narrative

Reality: Buyer of the security should beware. For example almost all frauds had top 4 auditors. Don't outsource research.

1. Ignoring macro

Reality: India market fell more than US market during US sub prime crisis. Macro sometimes drives micro

2. Not planning your exit

Reality: you can only play offense if your defense permits you to. Hence you have to take periodic cash positions.

3. Role of cycles and mean reversion

Reality: You'll have to wait for next Kumbh Mela to sell.

4. Failure to question the narrative

Reality: Buyer of the security should beware. For example almost all frauds had top 4 auditors. Don't outsource research.

5. Ignoring accounting fine print

Promoters, CAs, Lawyers etc all know what you want to hear. They can manipulate any metric.

6. Importance of stop loss

Consider stop loss, time loss and tax loss.

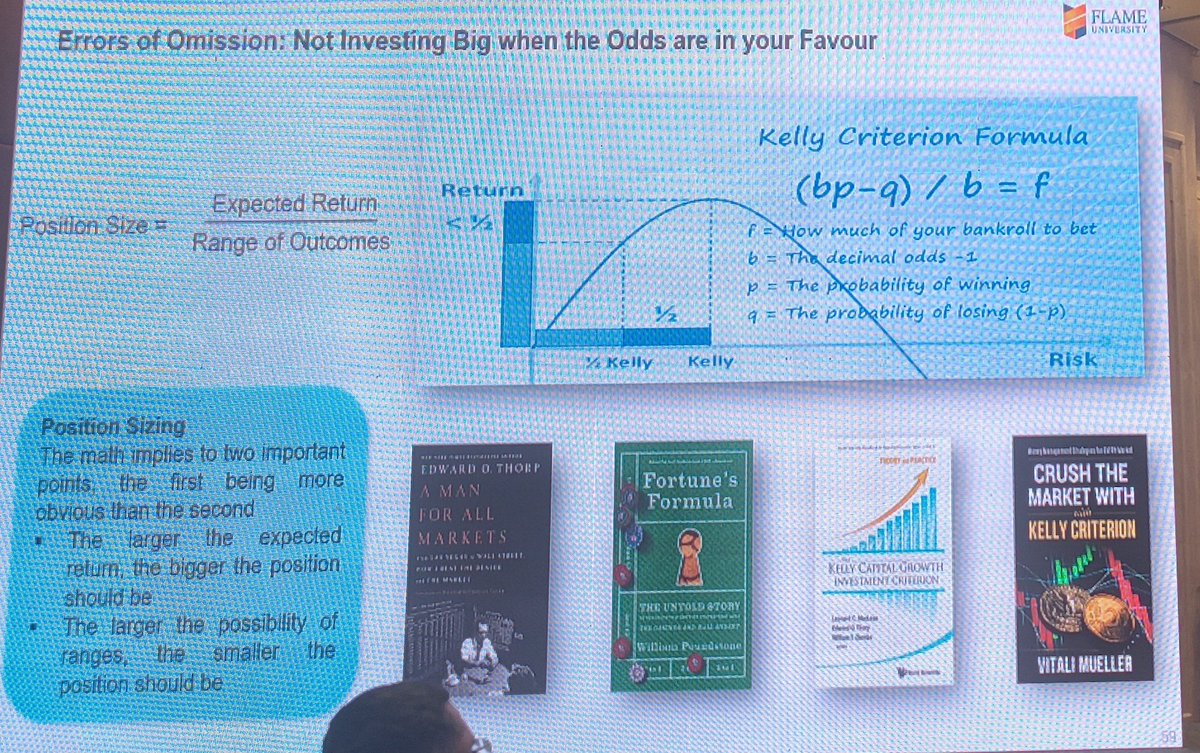

7. Not investing big when the odds are in your favor

Position size = Expected return / range of outcomes

Promoters, CAs, Lawyers etc all know what you want to hear. They can manipulate any metric.

6. Importance of stop loss

Consider stop loss, time loss and tax loss.

7. Not investing big when the odds are in your favor

Position size = Expected return / range of outcomes

@NileshShah68 @KotakMF @Kuntalhshah Everything is a cycle. From buying sizing trimming and selling.

Don't worry about these errors - every investor has made errors - the idea is to recognise and trim them early on.

Don't worry about these errors - every investor has made errors - the idea is to recognise and trim them early on.

Closing remarks: Shyam Sekhar

At the end of 20-20, people usually worry about which of the names to buy.

But in Bullet Proof, it leaves you think from a larger lens.

Last year Naren spoke against small caps.

In today's event, two of the country's best smallcap managers spoke to you today.

One of the fund managers said that I'm bullish for the next 5/10 years, but I'd be cautious for the next 1 year.

Actually, what Naren said is also similar but articulated differently.

A lot of money is flowing into mid and small cap space driven by recency bias.

At the end of 20-20, people usually worry about which of the names to buy.

But in Bullet Proof, it leaves you think from a larger lens.

Last year Naren spoke against small caps.

In today's event, two of the country's best smallcap managers spoke to you today.

One of the fund managers said that I'm bullish for the next 5/10 years, but I'd be cautious for the next 1 year.

Actually, what Naren said is also similar but articulated differently.

A lot of money is flowing into mid and small cap space driven by recency bias.

@shyamsek from @ithoughtmfd

While valuations are elevated today but when valuations come into comfort zone, as individual investors, we must have the courage to buy when the largest institutions sell.

Reason is simple: the question isn't to invest in equity or not. The questions isn't to invest now or later.

The question is in valuations.

Reason is simple: the question isn't to invest in equity or not. The questions isn't to invest now or later.

The question is in valuations.

@shyamsek @ithoughtmfd Today, the investment fraternity justifies higher valuations by giving 2 year forecasts and saying FY28 is cheap.

Principally, if you get a company at attractive valuations in FY27, you're in a safe zone. FY28 or FY29 is a sell side tactic.

Principally, if you get a company at attractive valuations in FY27, you're in a safe zone. FY28 or FY29 is a sell side tactic.

I used to take a week to buy a stock, today I take 2-3 years to build a position.

In the coming years we'll see a valuation as well as an allocation reset.

Allocation reset is where the MF industry will get assets - the direction of the inflows will alter your portfolios direction - it may go down even in a rising market.

In the coming years we'll see a valuation as well as an allocation reset.

Allocation reset is where the MF industry will get assets - the direction of the inflows will alter your portfolios direction - it may go down even in a rising market.

Over 2-3 years, capital will move from the wrong place to the right place.

So what should you do?

• Accept that we're crowding capital in the wrong place

• Inverted market structure where people are only betting on the small companies; will turn very fast.

• Given all these, equities will still be the best asset class.

We have to recalibrate our portfolios.

So what should you do?

• Accept that we're crowding capital in the wrong place

• Inverted market structure where people are only betting on the small companies; will turn very fast.

• Given all these, equities will still be the best asset class.

We have to recalibrate our portfolios.

• • •

Missing some Tweet in this thread? You can try to

force a refresh